简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The U.S. Dollar And Oil Relationship Is Changing

Abstract:Overall, there is an inverse correlation between the value of the dollar and commodities prices. The explanation for this relationship is based on two well-known conditions.

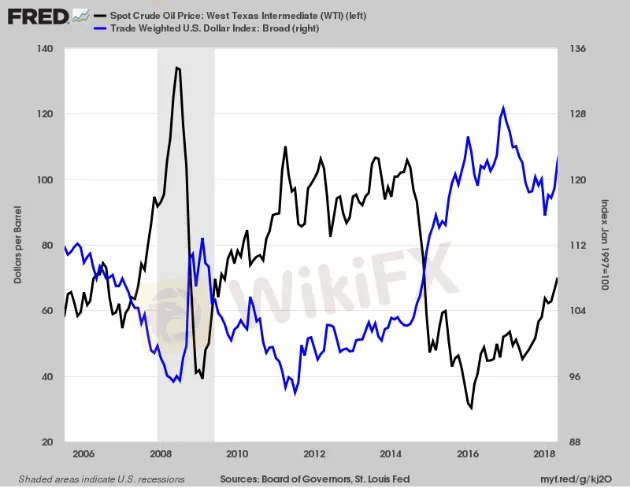

Overall, there is an inverse correlation between the value of the dollar and commodities prices. Historically, the prices of commodities have moved to drop when the dollar strengthens against other major currencies, and when the value of the dollar weakens against other major currencies, the prices of commodities generally goes higher.

The explanation for this relationship is based on two well-known conditions.

A barrel of oil is priced and rated in U.S. dollars across the world. When the U.S. dollar is strong, you need fewer U.S. dollars to buy a barrel of oil. When the U.S. dollar is weak, the price of oil is higher in dollar terms.

The United States has historically been a higher importer of oil. Rising oil prices cause the United States trade balance shortage to rise as more dollars are expected to be sent abroad.

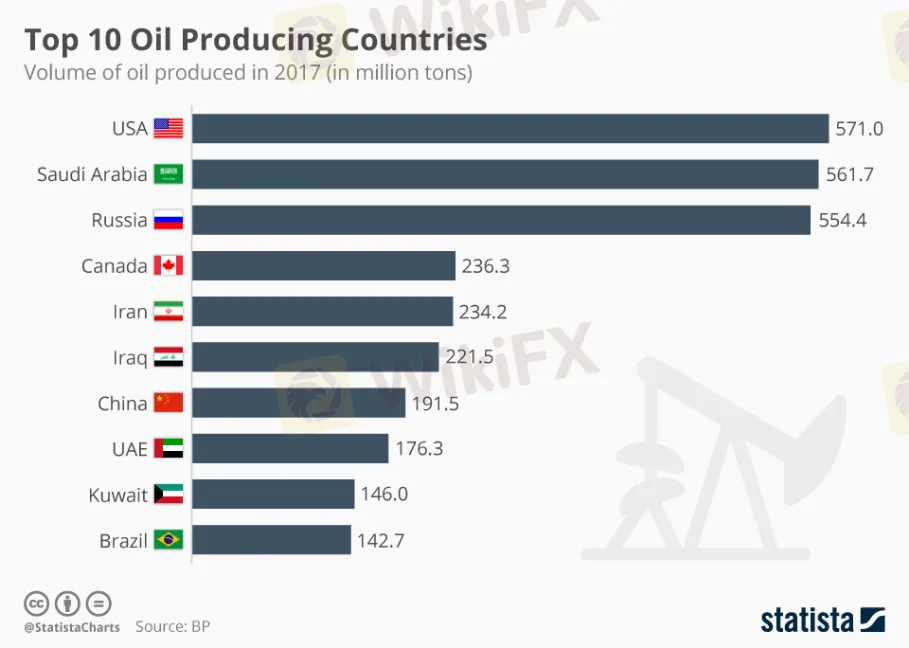

The U.S. shale revolution has dramatically increased domestic petroleum production. This is mainly to the success of horizontal drilling and fracking technology when the former continues to lock up true today, but the latter not so much. As a matter of fact, the United States became a high exporter of refined petroleum products in 2011, and thus overtaking Saudi Arabia and Russia.

And it has been proven According to the Energy Information and Administration (EIA), the United States is now about 90% self-sufficient in terms of total energy consumption.

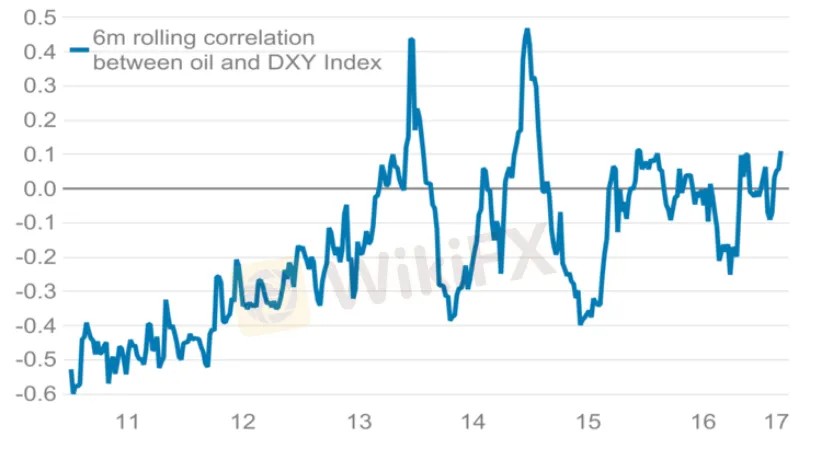

The technological progress of fracking has distracted the status quoted in the oil market, much like how Kylie Jenner‘s Lip Kits disrupted the status quo in the cosmetic industry. When the U.S. oil exports have increased, oil imports have decreased. And vice-versa which means that higher oil prices no longer play a role to a higher U.S. trade slippage, and actually helps to decrease it. As a result, we’ve seen the historically strong inverse and astonishing between oil prices and the U.S. dollar is becoming more unstable.

The rolling 6-month relationship coefficient was nearly negative over the past eight years but thats starting to change.

In view of the new dynamics of the global energy market, to see this historically negative relationship spend more time in positive regions. Wouldn't be amazing. The relationship between oil and the United States seems to be changing, reflecting the countrys growing role in the global oil industry.

Is the dollar becoming a petrocurrency? A term given to currencies of countries like Canada, Russia, and Norway that export so much oil, their economy gets busted as a results of that oil revenues. The United States has become the new swing producer of oil, meaning that its production levels hold the most influence over global oil prices. Before the shale revolution, it was Saudi Arabia.

The U.S. may possibly start to trade more like a petrocurrency in the next coming years. As the US continues to broader the share of oil exports over imports, revenue from oil will play a higher role in the U.S. economy, and the U.S. dollar may start behaving like a petrocurrency which means when oil prices goes up, so does the currency.

Comprehending why the dollar has historically traded in opposition to the price of oil and why the relationship has weakened recently can help traders make more announced trading resolutions as the global economy continues to evolve.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator