简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a Currency Carry Trade, and how does it work?

Abstract:Currency pairings are traded in the forex market (for example, if you buy USD/CHF, you are purchasing the US dollar and selling Swiss francs at the same time).

Currency pairings are traded in the forex market (for example, if you buy USD/CHF, you are purchasing the US dollar and selling Swiss francs at the same time).

You pay interest on the currency positions you SELL and earn interest on those you BUY.

The carry trade is unique in the spot forex market because interest is paid on a daily basis based on your position.

In the spot FX market, all positions are technically closed at the end of the day. If you hold a stance until the next day, you just don't see it happen.

Brokers shut and reopen your position, then debit or credit you for the difference in overnight interest rates.

This is the cost of “carrying” a position to the next day (also known as “rolling over”).

The carry trade has become quite popular in the forex market due to the level of leverage available from forex brokers.

The majority of forex trading is done on margin, which means you just have to put up a tiny portion of the trade and your broker will cover the rest. Many brokers will ask for as low as 1% or 2% of a position.

Example of a Currency Carry Trade

Let's look at a generic example to see how powerful this can be.

Joe the Newbie Forex Trader will be our model for this lesson.

Joe's birthday arrives, and his grandparents, being the kind and kind people they are, present him with a $10,000 gift. Schweeeet!

Rather of spending his birthday present on video games and posters of bubble gum pop idols, he decides to put it away for a rainy day.

“Joe, your savings account will pay 1% a year on your account balance,” the bank manager tells him when he goes to the local bank to open a savings account. Isn't that amazing?

Joe takes a breath and considers, “At 1%, my $10,000 will earn me $100 in a year.”

“That's awful!”

Joe, being the astute individual that he is, has studied School of Wikifx and has discovered a better way to invest his funds.

“Thank you sir,” Joe says politely to the bank manager, “but I believe I will invest my money elsewhere.”

Joe has been demo trading numerous methods (including the carry trade) for over a year and knows a lot about how FX trading works.

He creates a real account, deposits his $10,000 birthday gift, and executes his plan.

Joe finds a currency pair with a 5-percentage-point interest rate discrepancy and buys $100,000 worth of it.

They have $1,000 in margin because their broker just asks a 1% deposit of the position (100:1 leverage).

As a result, Joe now owns $100,000 worth of a currency pair that pays 5% interest every year.

What happens to Joe's account if he doesn't make any purchases for a year?

So, here are three options. Let's take a look at each one individually:

1. The value of a currency position depreciates.

The currency pair Joe purchases plummets in value. If the loss reduces the account balance to the amount set aside for margin, the trade is closed and just the margin – $1000 – remains.

2. At the conclusion of the year, the two currencies have the same exchange rate.

Joe did neither gain or lose any value on his investment in this scenario, but he did get a 5% interest on the $100,000 stake. That implies Joe made $5,000 on his $10,000 account just from interest. That's a 50 percent chance.

3. The value of a currency position increases. Joe's duo soars to new heights! Joe not only earns at least $5,000 in interest on his investment, but he also keeps any profits! That would make a great present for his next birthday!

Joe has the ability to make roughly 50% a year from his initial $10,000 thanks to the 100:1 leverage.

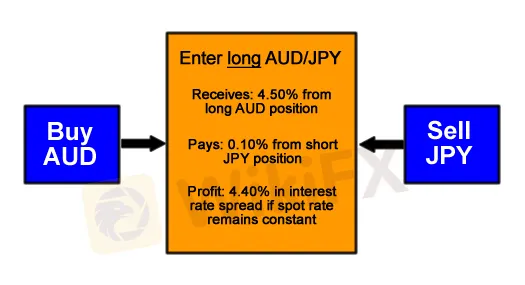

Based on September 2010 interest rates, here's an example of a currency pair that gives a 4.40 percent difference rate:

If you buy AUD/JPY and hold it for a year, you will gain +4.40 percent “positive carry.”

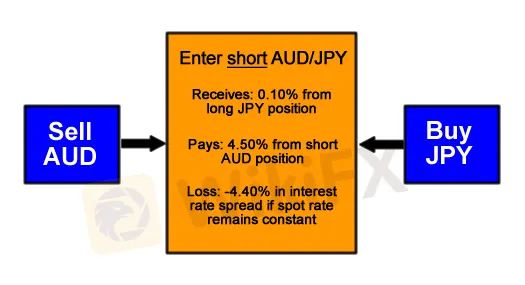

Of fact, selling AUD/JPY has the reverse effect:

You would earn a “negative carry” of -4.40 percent if you sold AUD/JPY and held it for a year.

This is just a general illustration of how the carry trade works.

Do you have any queries about the concept? No? We thought you'd pick it up quickly!

Now we'll get to the most crucial element of this lesson: carrying trade risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator