简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Profit from a Directional Bias in the News

Abstract:Let's look at how to trade the news in a trading scenario with a directional bias. Let's return to our previous example of the unemployment rate in the United States.

Let's look at how to trade the news in a trading scenario with a directional bias.

Let's return to our previous example of the unemployment rate in the United States.

Scenario: Why did the USD continue to fall despite the fact that the US Unemployment Report showed improvement?

We have discussed what may happen if the unemployment number came in on par with forecasts, if not slightly better.

Let's imagine the unemployment rate DROPPED unexpectedly in this situation.

This is a good thing since it means more people have work now.

However, you notice that the dollar is FALLING on your graphs!

Isn't it true that if the unemployment rate falls, the dollar should rise?

Even though there are more people with jobs, the dollar could still decrease for a variety of reasons.

Reason #1: The economy's overall outlook remains bleak.

The first reason could be because the US economy's long-term and overall trajectory remains in a downward spiral.

Keep in mind that the strength or weakness of an economy is influenced by a number of fundamental elements.

Even if the unemployment rate fell, it may not be enough of a spark for big traders to change their minds about the dollar.

Reason #2: Employment Increases Are Only Temporary

Maybe it's right after Thanksgiving, in the midst of the Christmas rush.

To keep up with the flood of Christmas customers, many businesses hire seasonal labor at this time.

This rise in jobs may result in a short-term decline in the unemployment rate, but it has no bearing on the economy's long-term prospects.

Looking at the statistic from last year and comparing it to this year is a better method to gain a more realistic picture of the unemployment situation. This would help you to determine whether or not the job market has improved.

The most essential thing to keep in mind is to always take a step back and consider the big picture before making any snap decisions.

Now that you've memorized that knowledge, it's time to examine how we can use a directional bias to trade the news.

How to Profit from a Directional Bias in the News

To keep things simple, let's stick with our unemployment rate example.

The first thing you should do before reading the report is look at the unemployment rate's trend to see if it has been increasing or dropping.

You can prepare for what might happen in the future by looking at what has happened in the past.

Consider the case where the unemployment rate has been gradually rising.

It was at 1% six months ago, and it reached a high of 3% last month.

You may now declare with some certainty that jobs are disappearing and that the unemployment rate is likely to continue to climb.

You can start preparing to go short on the dollar now that you expect the unemployment rate to rise.

Your directional bias is this.

You think you could short USD/JPY in particular.

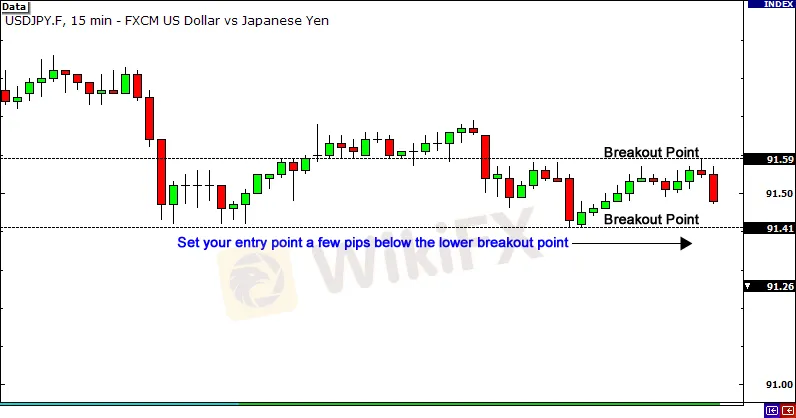

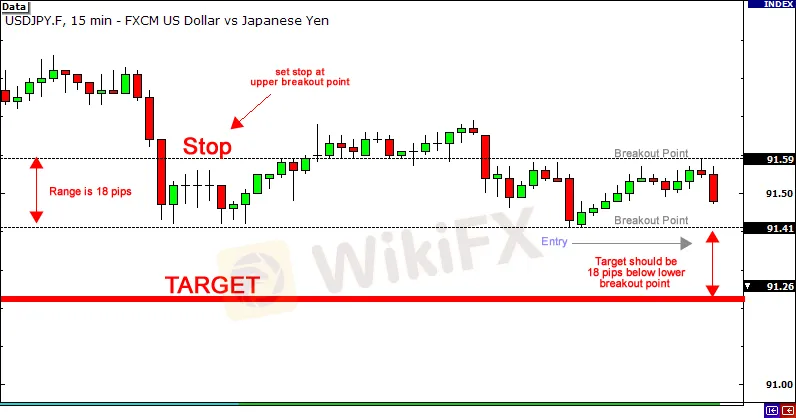

You can find the range of movement by looking at the price movement of USD/JPY at least 20 minutes before the unemployment rate is to be revealed.

Keep track of the highs and lows that are reached. These will be your pivotal points.

The smaller the range, the more likely a volatile move will occur!

You would pay special attention to the lower break out point of that range if you have a bearish perspective on the dollar (your directional bias).

Because you expect the dollar to fall, setting an entry point a few pips below that level is a good strategy.

Then, immediately above the upper breakout point, place a stop and set your limit for the same number of pips as thebreakout point range.

At this point, one of two things could happen.

The dollar may climb if the unemployment rate falls. As a result, the USD/JPY will likely climb, and your trade will most likely not trigger. There's no harm in trying!

Alternatively, if the news is as expected and the unemployment rate rises, the dollar may fall in value (assuming the entire fundamental outlook on the dollar is already bearish).

This is advantageous to you because you have already put up a bearish dollar trade, and all you have to do now is let it unfold.

Later on, you notice that your intended target has been hit. You've just snatched up a clutch of pips! Booyah!

The key to having a directional bias is to fully comprehend the concepts underlying the news story you intend to trade.

You could get caught up in some unfavorable settings if you don't grasp what influence it can have on specific currencies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator