简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Beginner's Guide to Trading Forex News

Abstract:It's critical for forex traders to pay attention to big economic data releases, government statements, and geopolitical events. Because this information usually represents an economy's strength and can predict the future direction of a currency. Trade the news might be tough and not fit for everyone, but the resulting volatility can provide a plethora of trading chances.

It's critical for forex traders to pay attention to big economic data releases, government statements, and geopolitical events.

Why?

Because this information usually represents an economy's strength and can predict the future direction of a currency.

Trade the news might be tough and not fit for everyone, but the resulting volatility can provide a plethora of trading chances.

What's the point of trading news?

“To make more money!” is the easy response to that question.

In all seriousness, as we discussed in the last lesson, news is a critical component of the forex market because it has the ability to move the market!

When huge news breaks, especially crucial news that everyone is watching, you can almost guarantee that there will be significant movement.

Because you know the market will most certainly move in a certain direction, it's an opportunity worth considering.

As a news trader, your goal is to get on the right side of the move.

The Risks of Investing in News

There are always potential risks with any trading method that you should be aware of.

Here are a few of the threats:

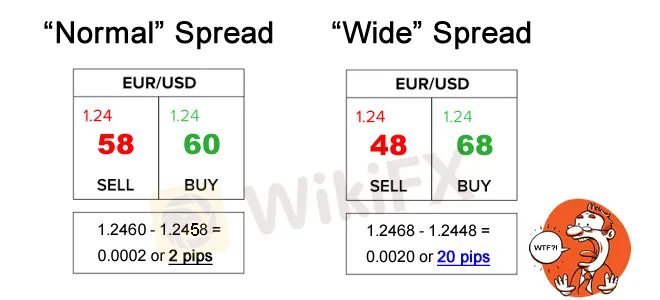

The spreads are getting wider.

Because the forex market is extremely volatile during major news events, several forex brokers WIDEN their spreads.

This raises trading costs and may have a negative impact on your bottom line.

You may potentially be “locked out,” which implies that your deal was executed correctly but did not appear on your trading platform for a few minutes.

This is problematic since you won't be able to modify your strategy if the trade goes against you!

Imagine thinking you weren't triggered and attempting to enter at market price... only to discover that your original order had been triggered!

You'd be putting your life in jeopardy TWICE as much now!

Price Changes

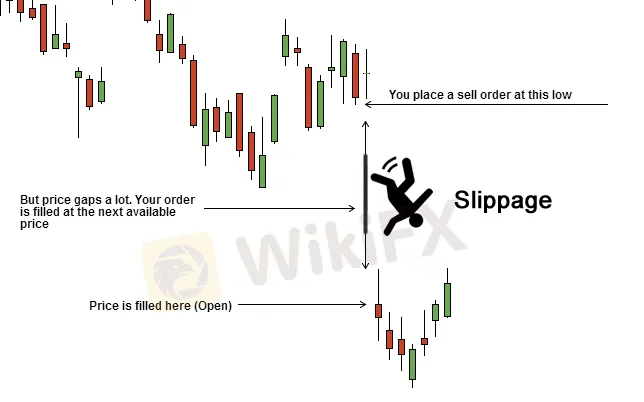

SLIPPAGE is another possibility.

Slippage occurs when you want to enter the market at a specific price, but the increased volatility during these events causes you to be filled at a far DIFFERENT price.

Large market swings triggered by news events rarely move in one way.

Frequently, the market will begin to move in one direction only to be whipsawed back in the opposite direction.

Trying to figure out where you're going can be a pain!

Trading the news, as profitable as it is, isn't as simple as beating some toddler in Fornite. It will necessitate a great deal of practice, practice, and more practice!

Above all, you must ALWAYS have a strategy in place.

We'll show you how to trade the news securely in the classes that follow.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator