简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar May Rise Despite a Defensive Turn in Fed Guidance

Abstract:The US Dollar may rise despite a defensive turn in official Fed policy guidance as worries about slowing global growth stoke risk aversion and boost haven demand.

TALKING POINTS – US DOLLAR, FOMC, FED, YEN, AUSSIE DOLLAR

US Dollar may rise despite a defensive turn in Fed policy guidance

Markets rate hike outlook unlikely to be altered by FOMC update

Cautious rhetoric may stoke global slowdown fears, sour sentiment

The US Dollar narrowly outperformed in generally quiet Asia Pacific trade. The tepid rise probably reflects corrective flows after the prior sessions modest drawdown, speaking to traders desire to rebalance exposure toward neutral ahead of the much-anticipated FOMC monetary policy announcement.

Chair Powell and company are widely expected to keep the current policy mix unchanged. Meanwhile, the tenor of recent pronouncements from central bank officials suggests a downgrade of growth and inflation forecasts as well as a flattening of the projected rate hike path are almost certainly in the cards.

A DOVISH SURPRISE FROM THE FOMC IS UNLIKELY

That is probably not enough to sustain lasting directional development from financial markets. Investors priced-in view envisions no rate hikes in 2019. Even if the Fed were to erase the entire 50bps it envisioned in December – which seems improbably dramatic – that would still just meet existing expectations.

In practice, this means that a meaningfully market-moving dovish surprise will be very difficult to achieve unless the FOMC opts to formally introduce constraints on its $50 billion/month quantitative tightening (QT) program. That too seems unlikely given how little airtime has been used to set the stage for it.

On the other hand, the markets have found it entirely appropriate to operate in defiance of the Feds official forecasts since the beginning of the year. This implies that they may not rush to reprice a 2019 rate hike into what is the current conventional wisdom even if the Fed retains one increase in its game plan.

FED FORECAST UPDATE MAY SOUR MARKET MOOD

In all, that seems to lead to the conclusion that the announcement won‘t markedly alter the status quo for prevailing US monetary policy bets one way or the other. Officials’ more timid view might stoke already swirling global slowdown fears however, souring investors mood.

That may boost the US Dollaras de-risking puts a premium on liquidity while the unwinding of carry trades offers a lift to the Japanese Yen. At the other end of the G10 FX spectrum, the sentiment-geared Australian, Canadian and New Zealand Dollars might find themselves bearing the brunt of selling pressure.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

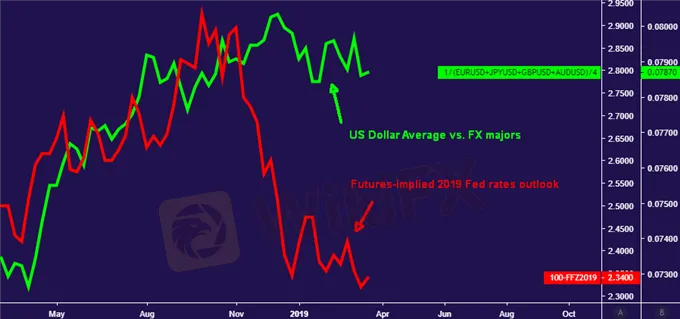

CHART OF THE DAY – US DOLLAR HOLDS UP DESPITE COLLAPSING RATE HIKE BETS

Conventional wisdom tells us that deteriorating rate hike bets ought to sink the relevant currency. In most cases, this is an entirely reasonable expectation. The Greenback has clearly shown a capacity to behave otherwise since late 2018. Collapsing Fed rate hike expectations seemed to cap gains but a parallel downturn has not followed. That seems to put USDs haven appeal on full display and make plain the possibility that with sufficient risk aversion, it can be well-supported even as policy support evaporates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CM Globals Raises Its Targets

CM Globals, a leading financial services firm, announced recently that it has raised its targets for the upcoming quarter.

CM Globals Supports Small Investors

CM Globals, a leading financial services firm, announced today that it is committed to supporting small investors by offering the lowest spreads and commissions in the market.

EUR/USD – Can it turn things around?

The euro is trading lower against the dollar again after a brief rebound late last month. But was the rebound brief or is there more to come?

EURUSD Price May Retest $1.1206 Level Before Bullish Reversal Commence

EURUSD is pulling back

WikiFX Broker

Latest News

Angel One is an Ideal choice for you ?

Canadian Watchdog Warns Against Capixtrade

StoneX Group Strengthens Indian Presence with Bullion Exchange Membership & New Offices

Indonesian Woman Lured into S$1.3 Million Forex Scam by Friend

6 Trading Platforms That May Put Your Money at Risk

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

Broker Review: Is Sure FX Reliable?

Be a part of SquaredFinancial Live Talk show on US Election

FOREX.com Partners with Kalshi for Event-Based Trading on US Election

ATTENTION! WARNING AGAINST FRAUD BROKERS

Currency Calculator