简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Oversold in the Short-Term But Still in Trouble

Abstract:The Euro remains around 1.1200 to the US dollar after hitting the lowest level since June 2017 in Thursdays heavy sell-off. On the slate, US

EURUSD Price, Chart and US Non-Farm Payrolls:

The Euro remains under pressure after a dovish ECB meeting.

US non-farm payrolls will add end of week volatility.

Q1 2019 EUR Forecast and USD Top Trading Opportunitie

A bruised Euro remains around the 1.1200 against the US dollar after the ECB yesterday downgraded growth and inflation forecasts, pushed rate hikes back further and announced a fresh round of bank liquidity. The central banks action, while supportive for the economy, give further credence to a much lower Euro and multi-year lows remain insight.

EURUSD, EURJPY: Euro Drops as ECB Announces Fresh Round of TLTROs.

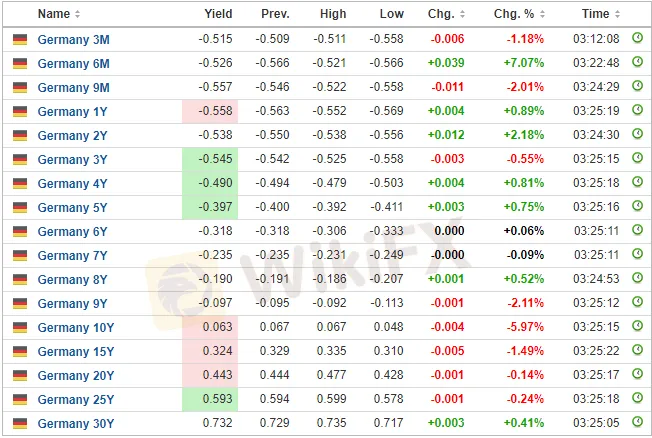

German government bond yields fell further – the curve is in negative territory all the way out to nine years – with the 10-year now yielding just six basis points and back to lows last seen in November 2016. This drop-in yield is in spite of the cessation of the QE program which has helped to drive bond yields lower over the past four years.

The latest German Factory Orders disappointed this morning with a m/m negative figure of 2.6% against predictions of 0.5% growth. The annual figure was also worse than expected at -3.9% against expectations of -3.1%.

DailyFX Economic Calendar.

The daily EURUSD chart looks oversold in the short-term, using the RSI indicator, and the pair may nudge higher ahead of the US labor report. Market expectations are for 180k jobs to be added in February with average hourly earnings pushing 0.3% higher m/m.

However, the Euro remains weak and any better-than-expected US data at 13:30 could see the pair re-testing Thursdays 21-month low at 1.1175.

EURUSD Technical Analysis: Sellers Try to Clear a Path Below 1.10.

EURUSD Daily Price Chart (August 2018 – March 8, 2019)

Retail traders are 70.6% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger bearish contrarian bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Today's analysis: USDJPY Set to Rise Amid Bank of Japan Policy Shift

USD/JPY (USD/JPY), an increase is expected as the Bank of Japan may reduce bond purchases and lay the groundwork for future rate hikes. Technical indicators show an ongoing uptrend with resistance around 157.8 to 160.

GemForex - weekly analysis

A Rat Race to the bottom in the rescue of the Dollar

GemForex - weekly analysis

Analysis for the week ahead: Markets remain worried by global recession fears

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

One article to understand the policy differences between Trump and Harris

How can the forex fix be manipulated?

CMC Markets and ASB Bank Form Strategic Partnership

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Currency Calculator