Score

Hmarl

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.hmcfds.com/simplified/

Website

Rating Index

Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Hmarl also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

hmcfds.com

Server Location

Singapore

Website Domain Name

hmcfds.com

Website

WHOIS.WEST263.COM

Company

CHENGDU WEST DIMENSION DIGITAL TECHNOLOGY CO., LTD.

Domain Effective Date

2018-08-10

Server IP

103.252.114.61

Company Summary

Note: Hmarl's official website: https://www.hmcfds.com/simplified/ is currently inaccessible normally.

Hmarl Information

Hmarl is an unregulated brokerage company registered in the United Kingdom. The broker's official website has been closed, so traders cannot obtain more security information.

Is Hmarl Legit?

Hmarl is authorized and regulated by the Financial Conduct Authority(FCA) and Australia Securities & Investment Commission(ASIC), while Suspicious Clone status will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with Hmarl.

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

Downsides of Hmarl

- Unavailable Website

Hmarl's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Hmarl does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

The FCA and ASIC regulate Hmarl. However, the Suspicious Clone status is less safe than a regulated one.

- Withdrawal Difficulty and Scams

According to a report on WikiFX, users encountered significant difficulties with fund withdrawals and scams. The issues remained unresolved despite the request being pending for a long time.

Negative Hmarl Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there were 6 pieces of Hmarl exposure.

Exposure. Cannot withdraw & scams

| Classification | Unable to Withdraw & Scams |

| Date | 2019-2023 |

| Post Country | Hong Kong, China |

The users said that they had problems with withdrawals and suspicion of brokerage scams, and it was still pending after a long time. You may visit: https://www.wikifx.com/en/comments/detail/202307044512966879.html https://www.wikifx.com/en/comments/detail/202006224702139730.html.

Conclusion

Hmarl Since the official website cannot be opened, traders cannot get more information about security services. In addition, the Suspicious Clone status and unregistered domain name indicate that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

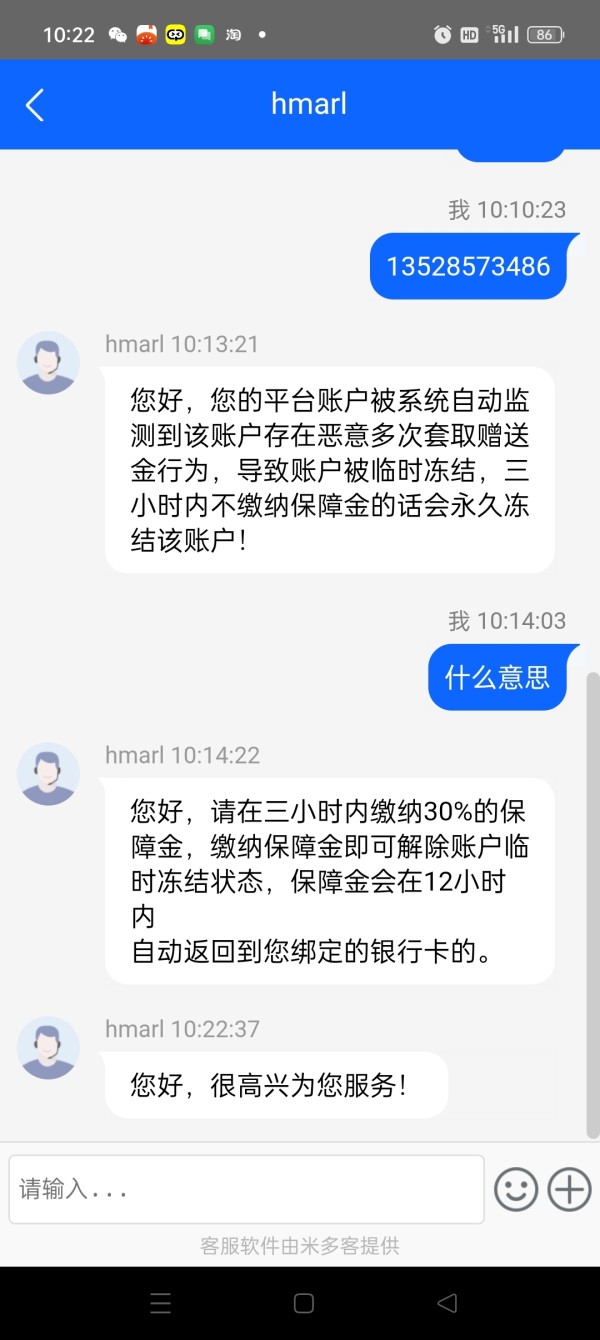

倒霉蛋

Hong Kong

The cash withdrawal did not arrive after transaction, account is locked, and it can only be unlocked by calling for a 30% security deposit.

Exposure

2023-07-04

FX7565268352

Hong Kong

So if you go long in London Gold, you place the order at the price of 1900yuan/ounce, but the bid price will rise to 1905yuan/ounce. Sometimes the spread skyrockets and my worst experience was 500 pips, which is 10 to 20 times the spread of a normal platform. The platform disconnects at the very moment of your closing out, and when you log in the market has already fluctuated! They play the trick of "deposit $200 to get $300" but you must trade 20 lots in order to withdraw(the lowest spread is 70-80 pips at usual). That is to say, you should first surrender $1400-$1600 to the scam platform for commission. This trick is really deceptive.

Exposure

2020-10-04

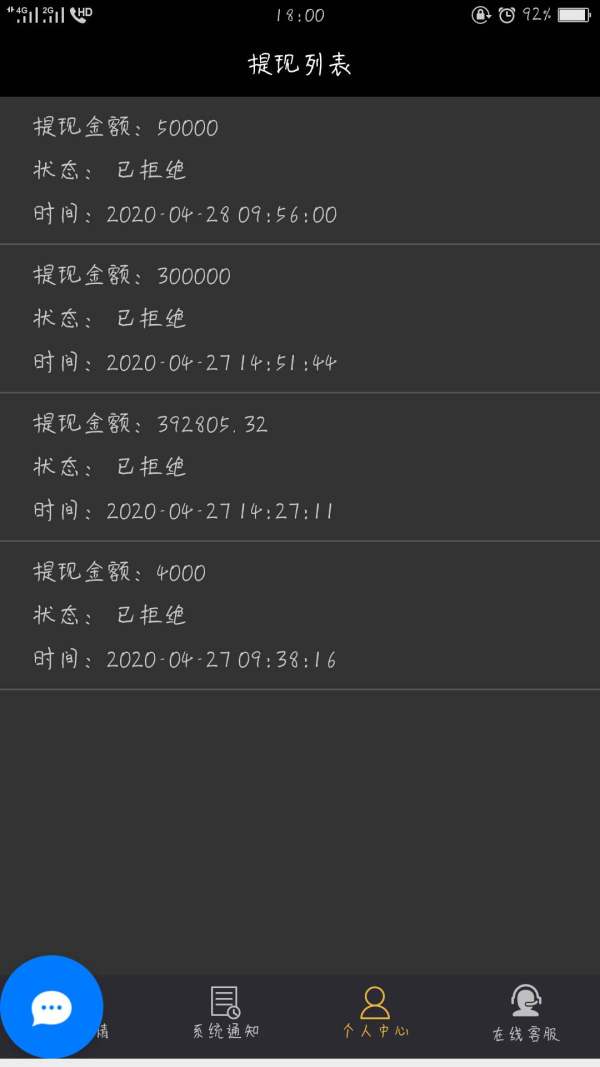

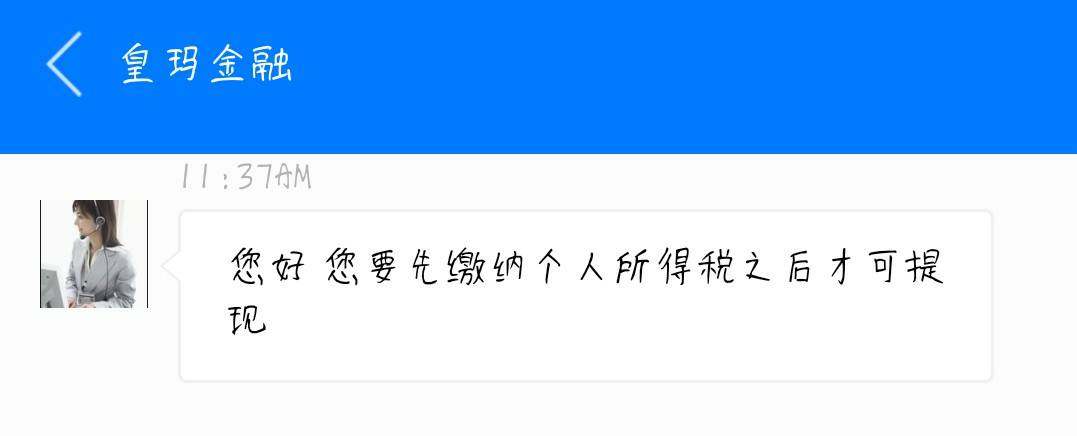

FX4101867522

Hong Kong

An individual tax, verification fee, overseas tax and margin were asked for before a withdrawal. The withdrawal was unavailable. It is simply a scam.

Exposure

2020-06-22

drs

Hong Kong

The platform didn’t give no access to withdrawal and even asked for individual tax! The so-called flexible deposit and withdrawal is nonsense.

Exposure

2020-04-30

drs

Hong Kong

The fraud broker gave no access to the withdrawal, asking me to pay the individual tax, and its staff even blackmailed me.

Exposure

2020-04-29

FX5629163734

Hong Kong

I couldn’t log in the mt5 today, so I logged in the website, only to find the 66 dollars which transferred from the mt5 to the platform were gone. The customer service personnel did not reply me. It is fortunate that I only deposited in 20 dollars. I have to thought the problem as a lesson.

Exposure

2019-06-25