Score

宝盛微交易

China|5-10 years|

China|5-10 years| http://www.bswei.cc/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed 宝盛微交易 also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

bswei.cc

Server Location

Hong Kong

Website Domain Name

bswei.cc

Website

WHOIS.PAYCENTER.COM.CN

Company

XIN NET TECHNOLOGY CORPORATION

Domain Effective Date

2016-10-19

Server IP

103.74.193.200

Company Summary

| Company name | Julius Baer |

| Registered in | China |

| Regulated | Unregulated |

| Years of establishment | 2-5 years |

| Trading instruments | Stocks, forex, commodities, indices, cryptocurrencies |

| Account Types | Standard, Gold, VIP |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:500 |

| Minimum Spread | 1 pip |

| Trading platform | Web-based and mobile-friendly |

| Deposit and withdrawal method | Bank transfer, credit card, e-wallet |

Introduction

Julius Baer, based in China and unregulated, has been operational for 2-5 years. It offers trading opportunities in stocks, forex, commodities, indices, and cryptocurrencies. With three account types - Standard, Gold, and VIP - and a low minimum deposit of $10, the platform enables users to access leverage of up to 1:500.

Notably, the platform boasts competitive spreads as tight as 1 pip on popular currency pairs. Accessible via web and mobile, Julius Baer supports various deposit methods like bank transfers, credit cards, and e-wallets. However, its unregulated status raises concerns about investor protection and regulatory oversight.

Is Julius Baer legit or a scam?

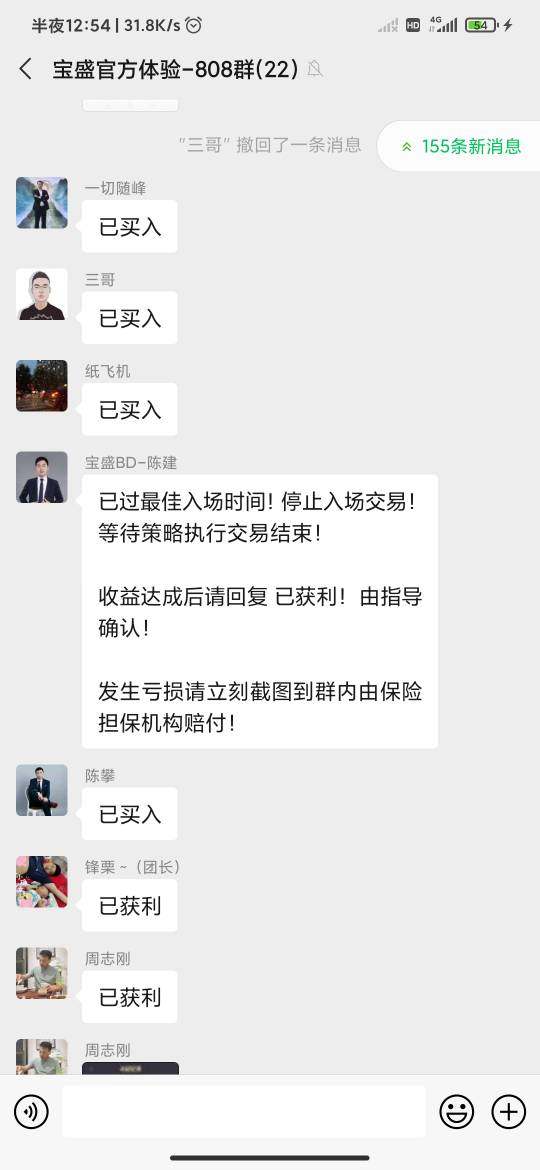

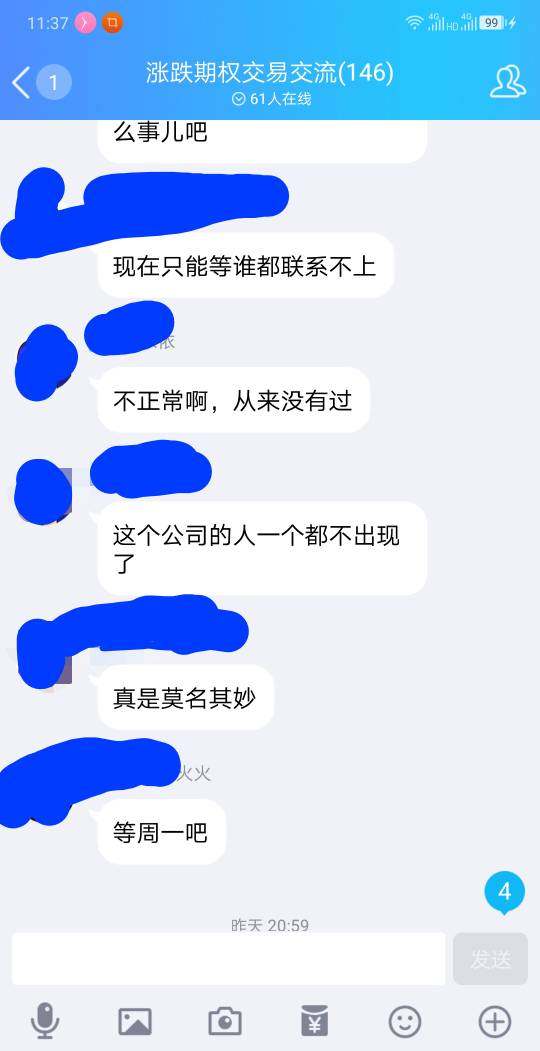

The legitimacy of Julius Baer remains a topic of debate within the trading community. One notable point of contention is the platform's lack of regulation by major financial authorities. This regulatory absence raises concerns about investor protection and oversight. Moreover, reports of users encountering difficulties when attempting to withdraw funds have cast a shadow over the platform's credibility.

Pros and Cons

Pros:

Diverse Range of Instruments: Julius Baer stands out for its extensive selection of tradable instruments, allowing users to explore different markets and diversify their portfolios.

User-Friendly Interface: The platform's user interface is designed to be intuitive and easy to navigate, making it accessible to traders of varying experience levels.

Low Minimum Deposits: The availability of accounts with low minimum deposit requirements can attract novice traders who want to start with a smaller investment.

Competitive Spreads: The platform's competitive spreads, such as the tight spread on the popular EUR/USD currency pair, can contribute to cost-effective trading.

Mobile App: With a dedicated mobile app, Julius Baer offers traders the flexibility to manage their positions and access market data on the go.

Cons:

Regulatory Uncertainty: The absence of regulation by prominent financial authorities raises concerns about transparency, investor protection, and accountability.

Withdrawal Challenges: Reports of users encountering difficulties when attempting to withdraw funds have fueled skepticism about the platform's reliability.

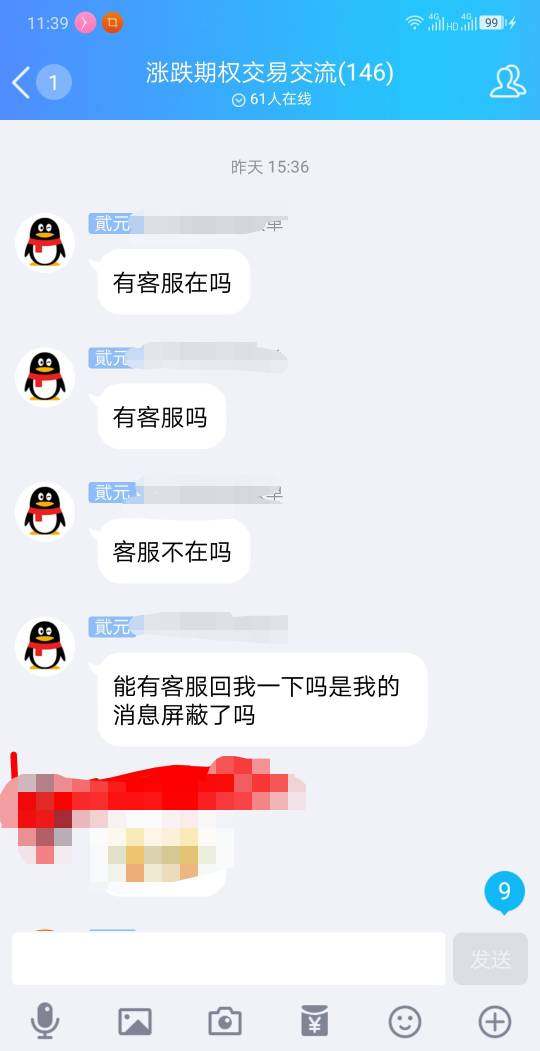

Customer Support: Some users have reported slow response times and inadequate support from Julius Baer's customer service.

| Pros | Cons |

| Wide range of financial instruments to trade | Not regulated by any major financial authority |

| Easy-to-use platform | Some users have experienced difficulties withdrawing funds |

| Low minimum deposit requirements | Customer support can be slow |

| Competitive spreads | |

| Mobile app available |

Market Instruments

Julius Baer stands out for its diverse array of market instruments, catering to traders with varied interests and strategies:

Stocks: Trading stocks allows investors to participate in the ownership of publicly listed companies. By buying and selling shares, traders can capitalize on changes in a company's value and market sentiment.

Forex: The platform's access to the foreign exchange market enables traders to engage in the world's largest and most liquid market. Currency pairs like EUR/USD and USD/JPY offer opportunities to speculate on exchange rate fluctuations.

Commodities: Commodities trading encompasses popular assets like gold, oil, and agricultural products. Traders can take advantage of price movements in these essential goods.

Indices: Indices represent a collection of stocks that track the performance of a specific market or sector. Trading indices allows investors to speculate on the overall health of markets.

Cryptocurrencies: In the ever-evolving realm of digital assets, Julius Baer provides an avenue to trade cryptocurrencies like Bitcoin and Ethereum. This volatile market offers potential for high returns, but comes with increased risk.

Account Types

Julius Baer tailors its account offerings to accommodate traders' preferences and needs:

Standard Account: Designed for beginners, the Standard account offers a low minimum deposit requirement, making it accessible to those new to trading. However, the trade-off includes lower leverage and potentially wider spreads.

Gold Account: Stepping up, the Gold account demands a higher minimum deposit. In return, traders enjoy improved leverage and tighter spreads compared to the Standard account.

VIP Account: The VIP account represents the premium tier, requiring the highest minimum deposit. In exchange, traders gain access to the most favorable trading conditions, including higher leverage and potentially even tighter spreads.

How to Open an Account?

Please note, currently the official website is not operational, these steps might not be applicable. If the official website is still functional, the account opening process for Julius Baer typically follows these steps:

Online Registration: Visit the official website and locate the “Open an Account” or similar section. Provide your full name, email address, phone number, date of birth, and country of residence. This initial step begins the registration process.

Documentation Submission: You will be prompted to upload scanned copies of your proof of identity (such as passport or driver's license) and proof of address documents (such as utility bills or bank statements).

Verification: The submitted documents will undergo verification by the Julius Baer team. This step ensures compliance with regulatory requirements and account security.

Agreement Acceptance: Review and accept the terms and conditions, as well as any agreements related to trading with Julius Baer.

Funding: Once your account is verified, you will receive instructions on how to fund your account. Different options such as bank transfers or online payment systems might be available.

Access Granted: After successful verification and funding, you will receive your account credentials. These credentials will allow you to log in to the trading platform and start trading.

Leverage

Julius Baer's provision of leverage up to 1:500 offers traders the opportunity to control positions exceeding their initial deposits. However, it's imperative to grasp the concept of leverage amplifying both profits and losses.

Spreads and Commissions

Competitive spreads are a notable feature of the platform. For instance, the EUR/USD pair often boasts a tight spread of approximately 1 pip. Furthermore, the absence of commissions on trades can make trading more cost-effective for users.

Trading Platform

The platform's user-friendly trading interface, accessible on web and mobile devices, provides a range of tools and features:

Real-time Market Data: Traders can access up-to-the-minute market information to make informed decisions.

Interactive Charts and Analysis: Visual tools assist traders in conducting technical analysis and identifying trends.

Efficient Order Execution: Timely and accurate order execution enhances trading efficiency.

Risk Management: Built-in utilities help traders manage and mitigate risk effectively.

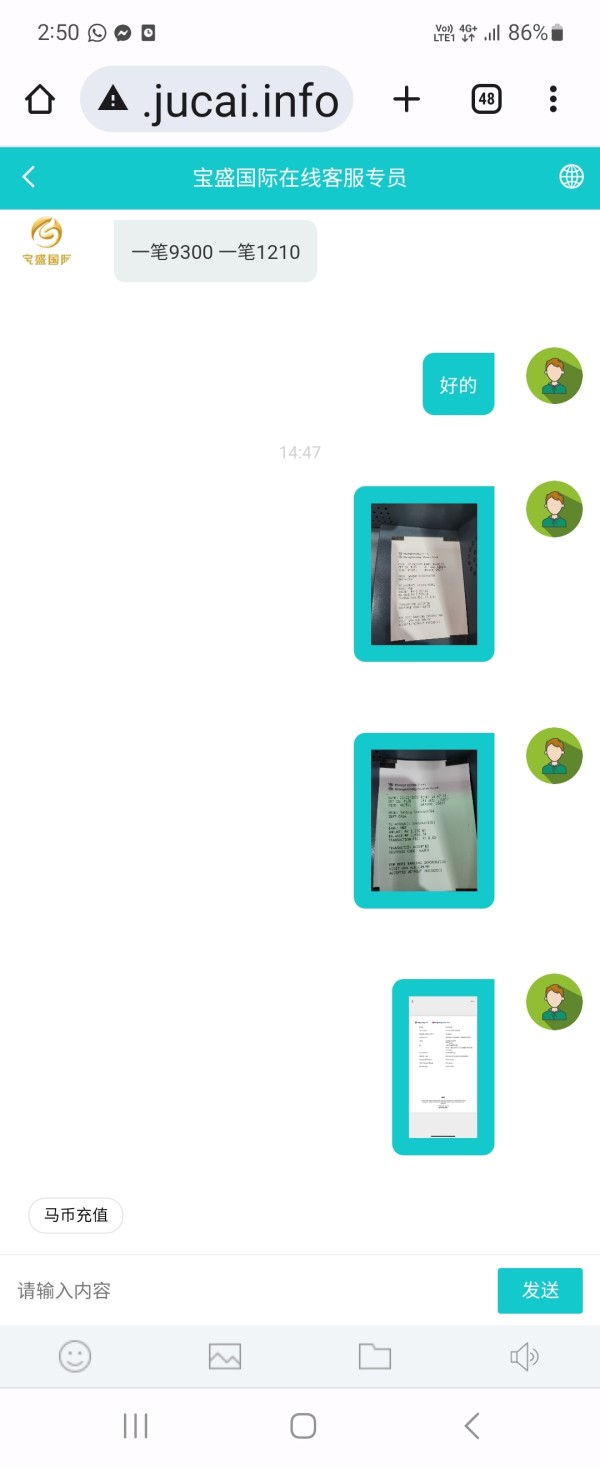

Deposit and Withdrawal

Julius Baer supports deposits in various currencies, including USD, EUR, and CNY. Funding options like bank transfers, credit cards, and e-wallets provide flexibility. Additionally, the platform claims to process withdrawals within 24 hours.But there are reports of users encountering difficulties when attempting to withdraw funds have fueled skepticism about the platform's reliability.

Risk Warning

Investors considering engaging with Julius Baer should be cautious due to several potential risks associated with the platform. While it offers a diverse range of financial instruments for trading, the absence of regulation by prominent financial authorities gives rise to apprehensions regarding the platform's transparency and the safeguards it provides to investors.

Additionally, reports of difficulties withdrawing funds and slow customer support indicate operational challenges that could impact traders' experiences. Furthermore, the fact that the official website is no longer active and negative feedback circulating online accentuates the need for thorough due diligence before considering any involvement with the platform. As such, prospective users should exercise prudence, thoroughly research the platform's credibility, and consider alternative, regulated trading platforms to mitigate potential risks.

Educational Resources

The platform's dedication to education enhances traders' knowledge and skills:

Comprehensive Trading Academy: A structured curriculum equips traders with fundamental and advanced trading concepts.

Informative Blog Posts: Regularly updated blogs provide insights into market trends, strategies, and analysis.

Interactive Forum: The forum fosters a community where traders can discuss ideas, seek advice, and share experiences.

Conclusion

Julius Baer's comprehensive micro-trading platform offers an extensive range of instruments and features to traders. While its diverse offerings and user-friendly interface present appealing opportunities, the absence of regulatory oversight and reported withdrawal challenges underscore the importance of informed decision-making. Aspiring users should conduct thorough research, understand the risks involved, and exercise caution to ensure a positive trading experience aligned with their individual goals and risk tolerance.

FAQs

Q1: Is Julius Baer regulated?

A1: No, it operates without major financial authority regulation.

Q2: How long has it been active?

A2: Approximately 2-5 years.

Q3: What instruments can I trade?

A3: Stocks, forex, commodities, indices, and cryptocurrencies.

Q4: What are the account types offered?

A4: Standard, Gold, and VIP accounts are available.

Q5: What is the minimum deposit required?

A5: The minimum deposit is $10.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now