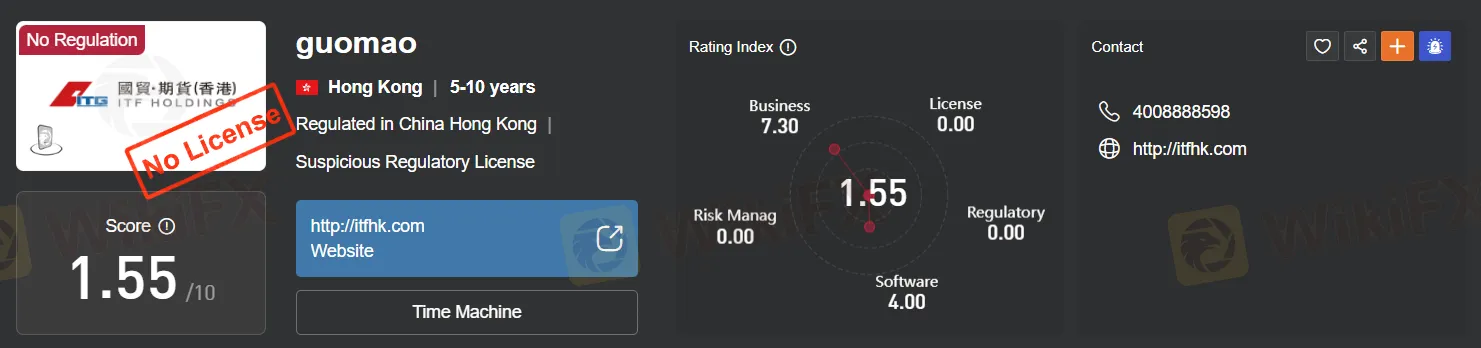

Score

guomao

Hong Kong|5-10 years|

Hong Kong|5-10 years| http://itfhk.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:ITF Holdings Co., Limited

License No.:BID804

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed guomao also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

itfhk.com

Server Location

Hong Kong

Website Domain Name

itfhk.com

Website

GRS-WHOIS.HICHINA.COM

Company

ALIBABA CLOUD COMPUTING (BEIJING) CO., LTD.

Domain Effective Date

2016-05-31

Server IP

103.229.144.59

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Company Name | Guomao |

| Regulation | Unregulated |

| Minimum Deposit | $2,000 |

| Maximum Leverage | 1:400 |

| Spreads | Relatively high (exact values not given) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Stocks, Commodities |

| Account Types | Standard, Demo |

| Demo Account | Available |

| Customer Support | Negative feedback reported |

| Payment Methods | Credit/Debit cards, Wire Transfers, e-wallets (specific details not confirmed) |

| Educational Tools | Lack of educational resources |

Overview

Guomao, based in Hong Kong, operates as an unregulated broker, raising significant concerns about its legitimacy and safety. Traders are required to make a substantial minimum deposit of $2,000 and can utilize a maximum leverage of 1:400, although the exact spreads are not specified, they are reported to be relatively high. The broker offers the MetaTrader 4 (MT4) trading platform, providing access to Forex, stocks, and commodities trading. While there are Standard and Demo account options, caution is advised as Guomao has been reported as a scam, and its website is down. Customer support has garnered negative feedback, and educational resources are notably lacking. Traders should exercise extreme caution and consider reputable and regulated alternatives for their trading needs to ensure the safety of their investments and trading activities.

Regulation

Guomao operates as an unregulated broker, which raises significant concerns about its legitimacy and safety. Unregulated brokers like Guomao function without any oversight or supervision from financial authorities, leading to potential risks such as the absence of regulatory oversight, making it possible for Guomao to engage in unfair practices without consequences. Additionally, unregulated brokers, including Guomao, are more susceptible to engaging in fraudulent activities, putting traders at an increased risk of falling victim to scams. Clients who choose unregulated brokers like Guomao have limited protection, lacking the safety nets provided by regulatory mechanisms such as compensation funds. Moreover, Guomao and similar unregulated brokers may lack transparency in their operations, leaving traders in the dark about their practices and financial stability. Overall, trading with an unregulated broker like Guomao inherently carries more significant risks due to the absence of safeguards to protect traders' interests.

Pros and Cons

Guomao presents both advantages and disadvantages for traders. While it offers a variety of market instruments and access to the MetaTrader 4 platform, there are significant concerns, including allegations of being involved in fraudulent activities. Traders should exercise caution when considering Guomao as their broker of choice.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Guomao offers a range of market instruments and access to the user-friendly MetaTrader 4 platform. Traders can enjoy a high maximum leverage of 1:400 and choose between Standard and Demo accounts. However, caution is advised as there have been allegations of Guomao being involved in fraudulent activities, including being described as a scam. The broker imposes relatively high spreads on currency pairs, and a significant minimum deposit of $2000 is required. Furthermore, Guomao lacks educational resources and offers limited customer support options. Traders should exercise discretion when considering this broker and opt for reputable and regulated alternatives for their trading needs.

Market Instruments

Guomao offers a variety of market instruments for trading, including:

Forex (Foreign Exchange): Guomao allows traders to participate in the Forex market, involving the trading of currency pairs like EUR/USD, EUR/GBP, USD/CHF, EUR/JPY, GBP/USD, and USD/JPY. However, it's important to note that the minimal spread for the EUR/USD pair is mentioned as 1.4 pips, which is relatively high compared to regulated brokers. High spreads can impact trading costs and profitability.

Stocks: Guomao provides access to stock trading as one of its trading instruments, although specific details about the available stocks are not provided.

Commodities: Guomao may offer commodities for trading, although the review does not provide detailed information about the specific commodities available.

It's crucial to reiterate that Guomao has been described as an exposed scam scheme in a review, making it highly advisable to exercise extreme caution and avoid any engagement with this broker. Prioritize reputable and regulated brokers to ensure the safety of your investments and trading activities.

Account Types

Guomao offers two types of trading accounts:

Standard Account: The primary account type for real-money trading with Guomao. Traders can access various financial instruments, including forex, stocks, and commodities, through this account. The minimum deposit requirement for a standard account is $2000.

Demo Account: Guomao also provides a Demo Account, which is used for practice and learning purposes. It is funded with virtual money, allowing traders to simulate real market conditions and practice trading strategies without risking real funds.

Please note that Guomao has been described as a scam in the review, so it is strongly advised to avoid this broker and consider reputable and regulated brokers for your trading needs.

Leverage

Guomao offers a maximum trading leverage of 1:400. This means that for every $1 in your trading account, you can control a position of up to $400 in the market. Leverage can magnify both profits and losses in trading, so it's important for traders to use it with caution and have a good understanding of how it works. While higher leverage can potentially lead to higher returns, it also increases the risk of significant losses, especially in volatile markets. Traders should always consider their risk tolerance and use leverage judiciously to manage their positions effectively.

Spreads and Commissions

Guomao offers spreads and commissions that can vary depending on the type of trading accounts they offer. Here's a description of the spreads and commissions:

Spreads: Guomao offers spreads, which are effectively the price difference between buying (Ask) and selling (Bid) a financial instrument. The specific spread values for different currency pairs, such as EUR/USD, EUR/GBP, USD/CHF, EUR/JPY, GBP/USD, and USD/JPY, are not extensively detailed in the review. However, it does note that the EUR/USD spread on a standard account is mentioned as 1.4 pips. This spread value is relatively high when compared to regulated brokers, where spreads are often closer to 1 pip or even lower.

Commissions: Commissions are additional fees that some brokers may impose on trades, especially in certain trading conditions or account types. Since the specific commission rates or structures are not provided, it's unclear whether Guomao charges commissions in addition to spreads.

Deposit & Withdrawal

When dealing with Guomao, there are specific considerations regarding deposits and withdrawals:

Minimum Deposit: Guomao mandates a minimum deposit of $2000 for traders looking to open an account.

Deposit Methods: Available deposit methods may include Credit/Debit cards, Wire Transfers, and e-wallets. However, the review does not provide specific details about these options.

Deposit Fees: Guomao might impose deposit fees, with varying fee structures depending on the chosen method. These fees could take the form of a percentage fee for bank card deposits, a fixed fee for wire transfers, or a percentage fee for e-wallet deposits.

Minimum Withdrawal: The broker sets a minimum withdrawal amount of $50.

Withdrawal Processing Time: Withdrawal requests may undergo a processing period lasting up to 3-5 days.

It's important to note that while the review does not mention withdrawal fees explicitly, it suggests that the broker charges deposit fees, although there is some contradiction in the information provided.

Trading Platforms

Guomao offers access to the popular MetaTrader 4 (MT4) trading platform, widely recognized in the industry for its user-friendly interface and robust features. Key highlights of MT4 include advanced charting tools, automated trading via Expert Advisors (EAs), real-time market news and analysis, a user-friendly interface suitable for traders of all experience levels, and mobile trading capabilities for on-the-go management of positions.

Customer Support

The phone number provided for the company's customer support, 4008888598, reflects a customer support service that has been described in a negative tone. Customers have reported frustrating experiences, including long wait times, unhelpful responses, and difficulty in reaching a knowledgeable representative. This subpar level of customer support can leave clients feeling unsatisfied and underserved, which is a significant concern when dealing with financial services like trading.

Educational Resources

Guomao's scarcity of educational resources represents a notable drawback for traders. The lack of tutorials, courses, and informative content leaves traders without the means to improve their skills and gain a better grasp of the market. Consequently, this shortfall can lead to uninformed trading decisions, increased risk exposure, and a potential disadvantage when compared to brokers offering comprehensive educational materials.

Summary

Guomao operates as an unregulated broker, raising significant concerns about its legitimacy and safety. Unregulated brokers like Guomao lack oversight, allowing them to potentially engage in unfair practices without consequences, including fraudulent activities that put traders at risk of scams. Clients who choose unregulated brokers have limited protection and face the possibility of opaque operations and financial instability. Trading with Guomao inherently carries more significant risks due to the absence of safeguards. Additionally, Guomao has been linked to allegations of fraudulent activities, including being described as a scam, making it a highly questionable choice for traders. The broker imposes relatively high spreads, a substantial minimum deposit requirement, lacks educational resources, offers limited customer support options, and its website is reportedly down. In summary, exercising extreme caution and avoiding Guomao in favor of reputable and regulated brokers is strongly recommended to ensure the safety of investments and trading activities.

FAQs

Q1: Is Guomao a regulated broker?

A1: No, Guomao operates as an unregulated broker, which raises concerns about its legitimacy and safety.

Q2: What is the minimum deposit required to open an account with Guomao?

A2: Guomao requires a minimum deposit of $2000 for traders to open a Standard Account.

Q3: Does Guomao offer educational resources for traders?

A3: No, Guomao lacks educational materials, leaving traders without opportunities for skill development and market understanding.

Q4: What is the maximum trading leverage offered by Guomao?

A4: Guomao offers a maximum trading leverage of 1:400, which can amplify both profits and losses.

Q5: How is Guomao's customer support?

A5: Guomao's customer support has received negative feedback, with reports of long wait times, unhelpful responses, and difficulty in reaching knowledgeable representatives, contributing to overall dissatisfaction among clients.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Hong Kong Dealing in futures contracts Revoked

- High potential risk

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now