Score

Allaria

Spain|5-10 years|

Spain|5-10 years| https://www.allaria.com.ar/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Argentina 8.41

Argentina 8.41Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Spain

SpainUsers who viewed Allaria also viewed..

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

allaria.com.ar

Server Location

Argentina

Website Domain Name

allaria.com.ar

Server IP

200.69.16.2

Company Summary

| Aspect | Information |

| Company Name | Allaria |

| Registered Country/Area | Spain |

| Founded year | 1995 |

| Regulation | Unregulated |

| Market Instruments | Stocks, Bonds, Derivatives, Mutual Funds |

| Account Types | Personal, Company |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Commissions | Ranging up to 1.50% plus VAT for stocks and public or private fixed income, with minimum charges of $20 ARS plus VAT for local stocks and USD 10 plus VAT for foreign stocks, and up to 2.50% plus VAT for options trading |

| Trading Platforms | N/A |

| Customer Support | +54 (11) 5555-6000 |

| Deposit & Withdrawal | N/A |

| Educational Resources | Research reports, daily market analysis, company insights |

Overview of Allaria

Founded in Spain in 1995, Allaria is a financial services provider offering a wide range of trading assets, including stocks, bonds, derivatives, and mutual funds.

Its advantages lie in its comprehensive market analysis, robust research resources, and accessible customer support, facilitating informed investment decisions.

However, high commission fees, limited international market access, and a lack of regulatory oversight are notable drawbacks.

Is Allaria Legit or a Scam?

Allaria operates without regulatory oversight. This absence may foster unchecked practices, potentially risking investor protection, market stability, and financial transparency.

It could encourage fraudulent activities, manipulation, and systemic risks. Without oversight, Allaria's operations lack accountability and standardization, hindering trust and confidence in its financial activities. Investors face heightened uncertainty and vulnerability due to the absence of regulatory safeguards, potentially exposing them to greater financial losses and exploitation.

Pros and Cons

| Pros | Cons |

| Various asset options including stocks, bonds, derivatives, and mutual funds | High commission fees |

| Robust research resources | Unregulated |

| Accessible customer support | Limited international market access |

| Comprehensive market analysis | Services for Spanish users only |

| Limited trading platform features |

Pros:

Various Asset Options:

Robust Research Resources:

Accessible Customer Support:

Comprehensive Market Analysis:

Allaria offers a wide range of investment options, including stocks, bonds, derivatives, and mutual funds. This diversity allows investors to build a well-rounded portfolio tailored to their risk tolerance and investment goals.

The platform provides comprehensive research resources, including daily reports and latest market insights. These resources help investors stay informed about market trends, make educated investment decisions, and potentially maximize returns on investment.

Allaria offers accessible customer support channels, ensuring users can easily reach out for assistance or clarification regarding their accounts, trades, or any other inquiries. This availability of support fosters trust and confidence among users.

Users benefit from comprehensive market analysis provided by Allaria, including insights into companies, fixed income, foreign exchange markets, and macroeconomics. This analysis assists investors in understanding market dynamics and identifying potential investment opportunities.

Cons:

High Commission Fees:

Unregulated:

Limited International Market Access:

Services for Spanish Users Only:

Limited Trading Platform Features:

One downside of Allaria is its high commission fees, which can significantly impact investors' overall returns. These fees may deter some investors or reduce the profitability of trades, particularly for those engaging in frequent or high-volume transactions.

Allaria operates without regulatory oversight, which may raise risks regarding investor protection and financial transparency. The lack of regulation could expose investors to higher risks, including potential fraudulent activities or market manipulation.

The platform may have limited access to international markets, restricting investors' ability to diversify their portfolios globally. This limitation could hinder opportunities for international investments and potentially limit overall portfolio growth.

Allaria's services may be exclusively available to Spanish-speaking users, potentially excluding investors who prefer other languages or limiting accessibility for international users who are not proficient in Spanish.

The trading platform offered by Allaria may have limited features compared to other platforms in the market. This limitation could restrict users' ability to execute complex trading strategies or access advanced tools for portfolio management.

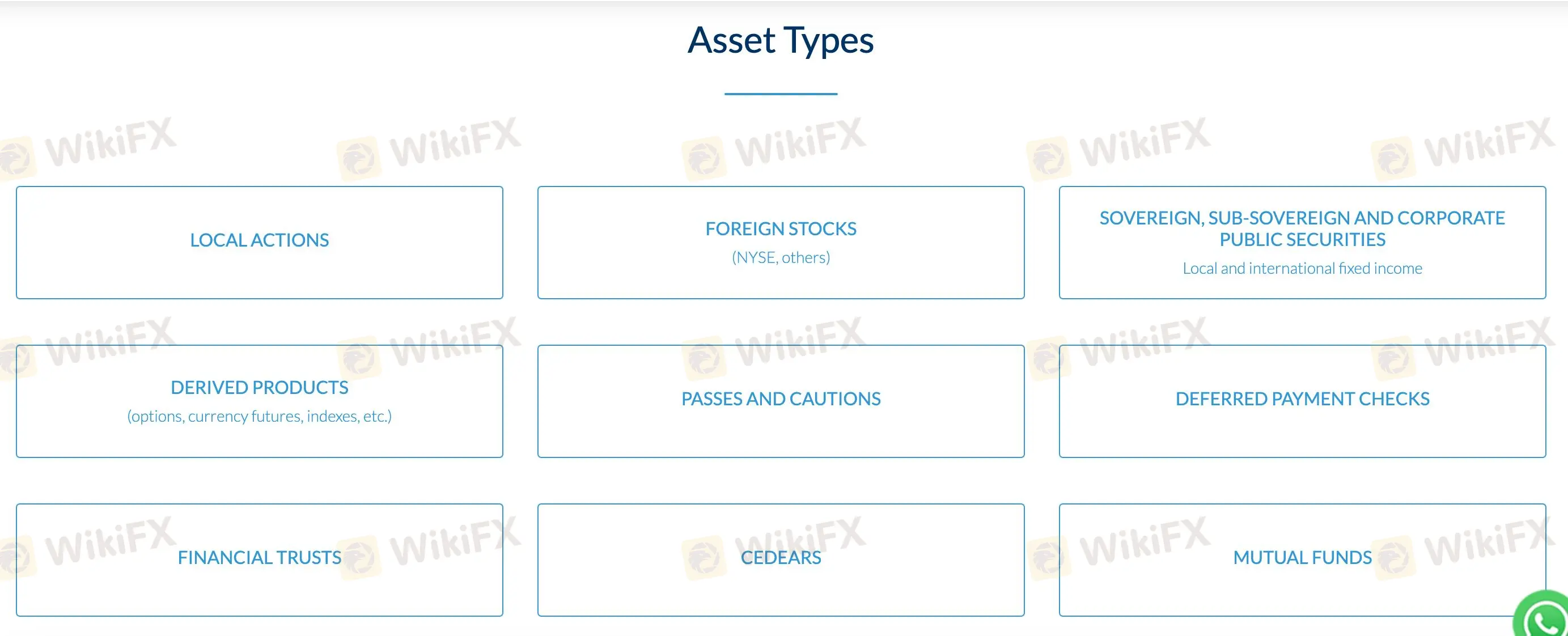

Market Instruments

Allaria offers a wide array of trading assets, providing investors with a broad spectrum of opportunities for portfolio diversification and investment strategies.

Local Actions form a fundamental component, encompassing stocks traded within the domestic market.

Complementing this, the platform facilitates trading in Foreign Stocks listed on various exchanges such as the NYSE, broadening access to international markets.

It also deals in Sovereign, Sub-sovereign, and Corporate Public Securities, reflecting a commitment to both government and corporate bonds across different jurisdictions.

Furthermore, Allaria engages in trading Local and International Fixed Income products.

Derived Products like options, currency futures, and indexes offer avenues for sophisticated trading strategies and risk management techniques.

Additionally, the platform handles Deferred Payment Checks, Financial Trusts, CEDERs, and Mutual Funds, further expanding the range of investment vehicles available to users.

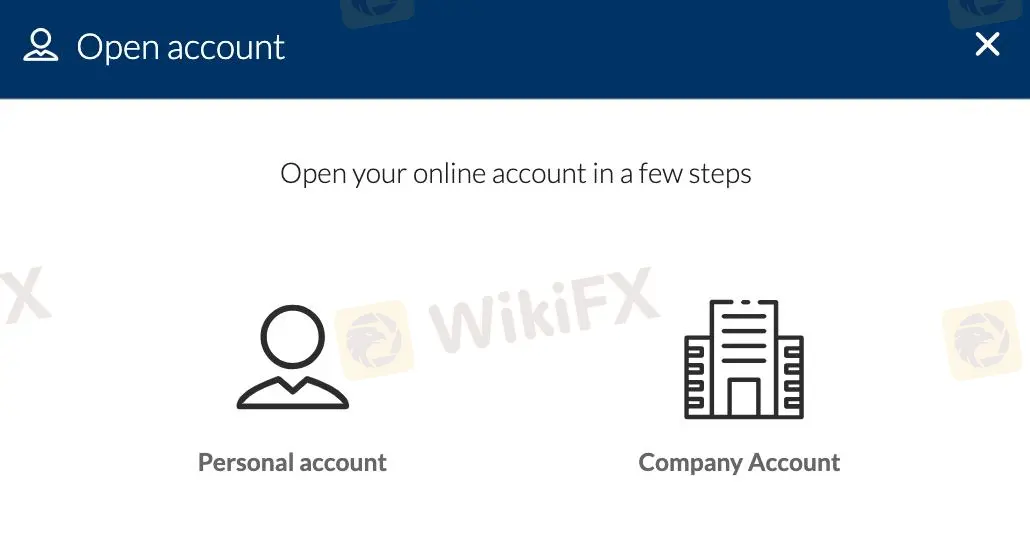

Account Types

Allaria offers two main account types: personal accounts and company accounts.

Personal Accounts: These accounts are tailored for individual investors looking to manage their personal investments. Personal accounts typically require users to provide personal identification details such as full name, date of birth, address, and contact information.

They are suitable for individuals who wish to invest their personal funds in various financial instruments offered by Allaria, including stocks, bonds, derivatives, and mutual funds. Personal accounts provide a platform for users to execute trades, monitor their portfolio performance, and access research and market analysis tools to make informed investment decisions.

Company Accounts: Company accounts are designed for businesses and corporate entities seeking to manage their investments and financial assets. To open a company account, users need to provide relevant business documentation such as the company's registration details, legal structure, address, and contact information.

These accounts are suitable for organizations looking to invest surplus funds, manage corporate assets, or conduct financial transactions in the capital markets. Company accounts offer features tailored to corporate needs, such as access to specialized investment products, corporate finance services, and reporting tools for tracking financial performance.

How to Open an Account?

Opening an account with Allaria involves several clear steps:

Choose Account Type:

Provide Information:

Submit Documentation:

Verification and Approval:

Decide whether to open a personal or company account based on your needs and entity type.

For a personal account, input personal details such as your full name, date of birth, address, and contact information.

For a company account, submit business information including company name, registration details, address, and contact information.

Upload required identification documents, such as government-issued ID (passport, driver's license) for personal accounts, and legal documentation for company accounts (certificate of incorporation, business license).

Additional documentation may be necessary based on regulatory requirements.

Allaria reviews the provided information and documents.

Once verified, your account is approved, and you'll receive confirmation along with login credentials to access your online account.

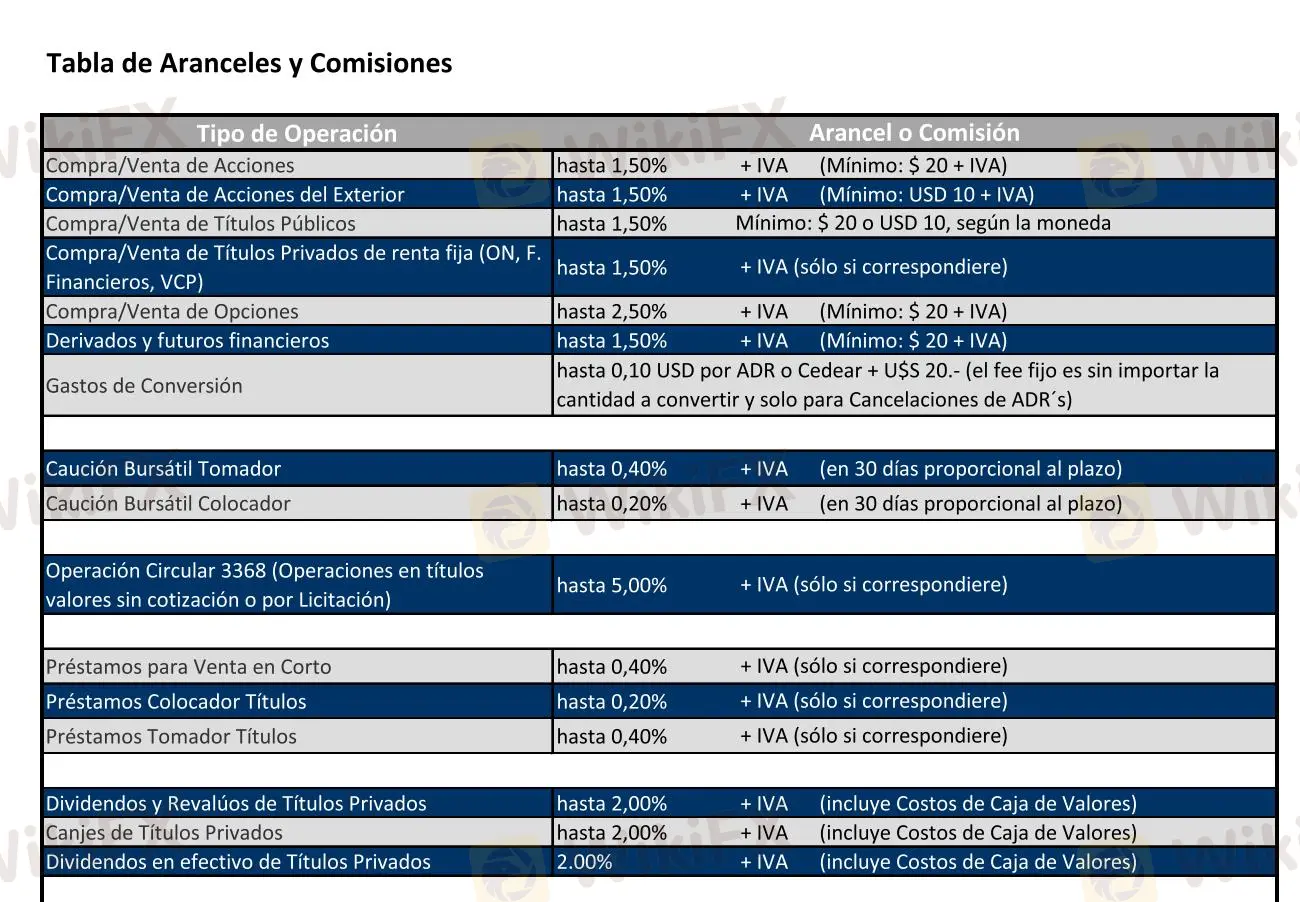

Spreads & Commissions

Allaria's commissions and fees structure varies based on the type of operation and asset being traded.

For buying and selling stocks and public or private fixed income, clients are subject to a commission of up to 1.50%, plus VAT, with a minimum charge of $20 ARS + VAT for local stocks and USD 10 + VAT for foreign stocks, irrespective of the trade value. Similarly, options trading incurs a commission of up to 2.50%, with a minimum charge of $20 ARS + VAT.

Derivatives and futures transactions are subject to a commission of up to 1.50%, plus VAT, with the same minimum charge.

Additional fees include conversion fees, margin borrowing fees for takers and providers, and other charges such as fees for specific operations, dividends, revaluations, custody fees, internal transfers, and overseas transfers, among others.

These fees contribute to the overall cost structure for clients engaging in various trading activities through Allaria's platform.

Customer Support

Allaria's customer support offers straightforward assistance.

Users can submit their queries via a form, leaving their name, email, and reason for consultation. A representative promptly responds to address risks.

For direct contact, individuals can visit their office at May 25 359, 12th floor, or call +54 (11) 5555-6000. This accessible support system ensures users receive timely help.

Educational Resources

Allaria provides robust educational resources to meet investors' needs.

Their research section offers daily reports, providing insights into market trends, trading volumes, and asset performance, aiding in informed decision-making. Additionally, latest reports delve into various market segments, from companies to macroeconomics, aiding in portfolio analysis.

The availability of expert research teams further enhances users' understanding of market dynamics and investment opportunities.

Conclusion

In conclusion, Allaria, founded in Spain in 1995, offers a wide array of market instruments for investors.

While it provides comprehensive market analysis and accessible customer support, its unregulated status poses a significant disadvantage, potentially raising risks about investor protection and financial transparency.

Additionally, the lack of specified details regarding minimum deposit, maximum leverage, spreads, and trading platforms might limit users' ability to make informed decisions.

Nevertheless, its robust research resources and varied account types accommodate the needs of investors, underscoring its commitment to providing tailored investment solutions within the Spanish financial landscape.

FAQs

Q: What market instruments does Allaria offer?

A: Allaria provides access to a wide range of market instruments, including stocks, bonds, derivatives, and mutual funds.

Q: Is Allaria regulated?

A: No, Allaria operates without regulatory oversight.

Q: How can I contact Allaria's customer support?

A: You can reach Allaria's customer support via phone or by visiting their office.

Q: What are the account types available at Allaria?

A: Allaria offers both personal and company accounts.

Q: What educational resources does Allaria provide?

A: Allaria offers research reports, daily market analysis, and insights into various market segments to assist investors in making informed decisions.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now