Score

Glactic

Saint Kitts and Nevis|2-5 years|

Saint Kitts and Nevis|2-5 years| https://glactico.online

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Kitts and Nevis

Saint Kitts and NevisUsers who viewed Glactic also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

glactico.online

Server Location

United States

Website Domain Name

glactico.online

Server IP

67.220.184.146

Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Kitts and Nevis (lack of regulation) |

| Company Name | Galactic |

| Regulation | Not regulated by financial authorities |

| Minimum Deposit | Information not provided |

| Maximum Leverage | Up to 1:300 |

| Spreads | Vary from 0.9 pips to 2.4 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| Account Types | Standard and Demo accounts |

| Demo Account | Available for practice trading |

| Customer Support | Slow response times, lack of expertise |

| Payment Methods | Neteller, Skrill, Cryptocurrencies (e.g., Bitcoin, Ethereum) |

| Educational Tools | Lack of educational resources |

Overview

Galactic, a company based in Saint Kitts and Nevis with no financial regulation, offers a trading environment that has its share of drawbacks. The lack of essential information such as the minimum deposit requirement and the company's founding year adds an element of uncertainty for potential traders. While a high maximum leverage of up to 1:300 can be enticing, the absence of educational resources is a glaring deficiency. Additionally, the platform's slow customer support responses and their apparent lack of expertise leave users in a state of frustration and dissatisfaction. To compound these issues, the company's website intermittently goes down, raising concerns about reliability. These combined factors paint a rather unappealing picture for those considering Galactic as their trading platform of choice.

Regulation

Galactic is not regulated as a broker, meaning it operates without oversight from financial regulatory authorities. This lack of regulation can pose potential risks for investors, as there may be limited consumer protection measures in place. It's essential for individuals engaging with Galactic or any similar financial service to exercise caution, conduct thorough research, and consider the potential consequences of dealing with unregulated entities. Seek guidance from reputable financial institutions or consult with financial professionals before making any investment decisions.

Pros and Cons

Galactic, as a trading platform, presents a range of advantages and disadvantages. While it offers a diverse selection of market instruments, including Forex, commodities, shares, indices, and cryptocurrencies, which provides traders with ample trading options, the lack of regulation raises concerns about investor protection. The maximum trading leverage of up to 1:300 can amplify both profits and losses, necessitating careful risk management. Low spreads and the absence of commissions can be advantageous, but the absence of educational resources is a notable drawback. Moreover, customer support's delayed responses and the website's occasional downtime contribute to an overall mixed user experience.

| Pros | Cons |

|

|

|

|

|

|

|

|

Market Instruments

Galactic offers a range of market instruments, allowing users to trade in various financial markets. Here's a brief description of each instrument:

Forex: Galactic provides access to the foreign exchange market (Forex), where users can trade currency pairs. Forex trading involves speculating on the price movements of one currency relative to another. Traders can take advantage of fluctuations in exchange rates to profit from their trades.

Commodities: Galactic enables users to trade commodities, which can include agricultural products (such as wheat or corn), energy resources (like oil or natural gas), and precious metals (such as gold and silver). Trading commodities can be a way to diversify an investment portfolio.

Shares: Galactic offers the opportunity to trade shares of publicly traded companies. These shares represent ownership in a company, and traders can speculate on the price movements of these stocks. It's a common way to invest in individual companies and participate in their financial performance.

Indices: Users can trade stock market indices through Galactic. Indices are benchmarks that track the performance of a group of stocks representing a specific sector or region. Trading indices allows traders to speculate on the overall market's direction rather than individual stocks.

Cryptocurrencies: Galactic also supports cryptocurrency trading. Cryptocurrencies are digital or virtual currencies that use cryptography for security. Popular options include Bitcoin, Ethereum, and many others. Cryptocurrency trading is known for its volatility and potential for substantial gains or losses.

These market instruments provide a diverse set of opportunities for traders and investors, each with its unique characteristics and risk profiles. Traders should carefully consider their financial goals, risk tolerance, and market knowledge when participating in these markets via Galactic or any similar platform. Additionally, it's important to stay informed about market developments and trends to make informed trading decisions.

Account Types

Here are the two account types offered by Glactic:

Standard Account:

Designed for live trading with real money in various financial markets.

Requires traders to deposit their own funds for actual trading, including Forex, commodities, shares, indices, and cryptocurrencies.

Offers live market access, exposing traders to actual market conditions, risks, and rewards.

Involves the potential for both profits and losses, necessitating risk management.

May provide leverage options, but traders should be cautious of potential amplified losses.

Incur fees and commissions, which vary based on the broker.

Demo Account:

A practice tool for both novice and experienced traders.

Funded with virtual money for risk-free experimentation and learning.

Simulates a real trading environment with access to live market data.

Allows traders to test strategies and refine skills without financial risk.

No fees or commissions associated with demo trading.

Ideal for becoming familiar with the trading platform without cost.

Leverage

The broker offers a maximum trading leverage of up to 1:300. This means that for every $1 of your own capital, you can control a trading position worth up to $300 in the financial markets. Leverage can amplify both potential profits and losses, making it important for traders to use it carefully and consider their risk management strategies when trading with such high leverage.

Spreads and Commissions

The spreads and commissions offered by this broker vary depending on the specific trading accounts. Spreads typically range from as low as 0.9 pips to a maximum of 2.4 pips. Spreads represent the difference between the buying (ask) and selling (bid) prices of a financial instrument and are a cost that traders need to consider.

The noteworthy aspect is that this broker does not charge commissions. Instead, they primarily generate revenue through the spreads, making it important for traders to select an account type that aligns with their trading preferences. The choice between lower spreads with no commissions or potentially higher spreads with no added fees depends on the individual trader's trading strategy and objectives.

It's essential for traders to assess these cost factors when selecting a trading account, as they can significantly impact the overall profitability of their trading activities.

Deposit & Withdrawal

The broker accepts the following methods for deposit and withdrawal:

Neteller: Traders can deposit and withdraw funds using Neteller, an e-wallet service that allows for secure online transactions. Neteller is a popular choice among traders for its convenience and speed in moving funds in and out of trading accounts.

Skrill: Skrill is another e-wallet service that the broker accepts for deposits and withdrawals. Like Neteller, Skrill offers a secure and efficient way to manage funds, making it a convenient option for traders.

Crypto: The broker also supports cryptocurrency deposits and withdrawals. This means that traders can use various cryptocurrencies, such as Bitcoin or Ethereum, to fund their trading accounts or withdraw their profits. Crypto transactions are known for their speed and security, making them an increasingly popular choice in the financial industry.

It's important to note that the availability of these deposit and withdrawal methods may vary depending on the broker's policies and the specific trading accounts or regions. Traders should check with the broker for the most up-to-date and accurate information regarding deposit and withdrawal options and any associated fees or processing times.

Trading Platforms

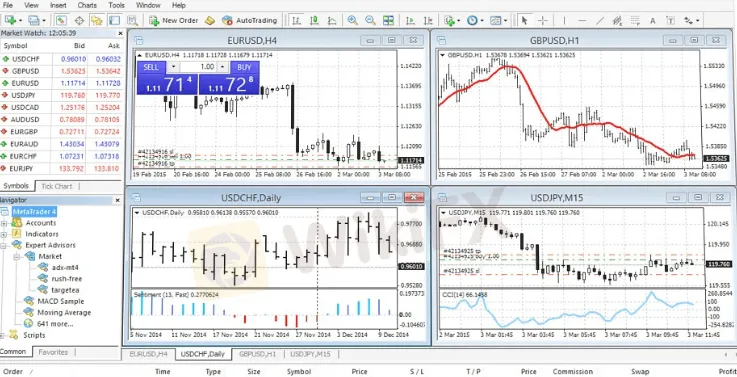

Glactic offers its clients the MetaTrader 4 (MT4) platform, renowned for its user-friendliness and robust features. Key highlights include:

User-Friendly Interface: MT4's intuitive design suits traders of all levels.

Advanced Charting: Access to extensive charting tools and technical indicators for in-depth analysis.

Automated Trading: Create, test, and deploy automated strategies with Expert Advisors.

Multiple Asset Classes: Trade Forex, commodities, shares, indices, and cryptocurrencies.

Real-Time Data: Stay updated with live market data, news, and economic calendars.

Security: MT4 prioritizes security, ensuring the safety of client data.

Mobile Trading: Access accounts and trade on iOS and Android devices.

One-Click Trading: Execute trades with precision using one-click trading.

With these features, Glactic's MT4 platform provides a comprehensive and versatile trading solution for traders of varying styles and preferences.

Customer Support

Customer support at contact@glactico.online is marred by sluggish response times, often delivering inadequate and unhelpful information. The team's lack of expertise and limited support channels compounds the problem, leaving customers feeling frustrated and underserved, and creating a significant disconnect between their expectations and the actual support provided.

Educational Resources

The lack of educational resources on the platform is a significant drawback, depriving users of valuable tools and materials for enhancing their trading knowledge and skills. Without access to educational content such as tutorials, webinars, or articles, users may struggle to make informed decisions in the complex world of financial markets. This deficiency may hinder their ability to develop effective trading strategies and ultimately impact their overall trading experience negatively.

Summary

Galactic presents a concerning picture for potential traders. The lack of regulation raises red flags for investor protection, leaving individuals vulnerable to risks. Moreover, their customer support is notably inadequate, with delayed responses and unhelpful information, fostering an environment of frustration and discontent. A severe downside is the absence of educational resources, hindering traders from improving their skills and knowledge. Furthermore, the current website outage adds to the overall negative experience, highlighting issues with reliability. These shortcomings collectively create an unfavorable impression of Galactic as a trading platform.

FAQs

Q1: Is Galactic a regulated broker?

A1: No, Galactic is not regulated by any financial authority. This lack of oversight can pose potential risks for traders, as there may be limited consumer protection measures in place.

Q2: What is the maximum trading leverage offered by Galactic?

A2: Galactic offers a maximum trading leverage of up to 1:300, allowing traders to control a larger position with a smaller initial investment. However, it's crucial to exercise caution due to the potential for amplified losses.

Q3: Does Galactic charge commissions for trading?

A3: No, Galactic primarily generates revenue through spreads, and they do not charge commissions. Traders can choose between account types with different spread levels to align with their trading preferences.

Q4: What deposit and withdrawal methods does Galactic support?

A4: Galactic accepts deposits and withdrawals via methods such as Neteller, Skrill, and cryptocurrencies like Bitcoin and Ethereum. These options provide flexibility for users to manage their funds.

Q5: What educational resources are available on Galactic's platform?

A5: Unfortunately, Galactic lacks educational resources on its platform, such as tutorials, webinars, or articles. This absence may hinder traders in enhancing their trading knowledge and skills.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now