Score

SCM

Cyprus|5-10 years|

Cyprus|5-10 years| http://www.spotcapitalmarkets.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

+357 25 030 480

Other ways of contact

Broker Information

More

SPOT CAPITAL MARKETS LTD

SCM

Cyprus

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- CyprusCYSEC (license number: 210/13) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

WikiFX Verification

Users who viewed SCM also viewed..

XM

FP Markets

GO MARKETS

VT Markets

SCM · Company Summary

| SCM | Basic Information |

| Company Name | SCM |

| Founded | 2013 |

| Headquarters | Cyprus |

| Regulations | Not regulated |

| Tradable Assets | Forex, CFDs, Stocks, Commodities, Indices, Cryptocurrencies |

| Account Types | Standard, Pro, VIP |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.2 pips |

| Commission | None |

| Deposit Methods | Bank wire, Credit/debit card, E-wallet, Cryptocurrency |

| Trading Platforms | MetaTrader 4 (MT4), cTrader |

| Customer Support | Phone: +357 25 030 480 |

| Education Resources | Video tutorials, Webinars, eBooks, Glossary |

| Bonus Offerings | None |

Overview of SCM

SCM, established in 2013 and headquartered in Cyprus, is a brokerage firm that provides traders with access to an extensive array of tradable assets, making it an enticing choice for those looking to diversify their investment portfolio. With a range of assets including Forex, CFDs, stocks, commodities, indices, and cryptocurrencies, SCM offers a comprehensive selection for traders with varying preferences.

SCM caters to traders of all experience levels by offering three distinct account types: Standard, Pro, and VIP. This flexibility ensures that both beginners and seasoned traders can find an account that suits their specific needs. The broker boasts competitive spreads starting from 0.2 pips and operates without charging commissions, making it an appealing option for cost-conscious traders.

It's important to note that SCM operates without a valid regulatory license, which may raise concerns among traders regarding fund security and dispute resolution. The absence of regulatory oversight underscores the need for thorough due diligence when considering SCM as a trading partner. Nonetheless, for traders looking to access a diverse range of assets and benefit from competitive trading conditions, SCM remains an option worth considering.

Is SCM Legit?

It has been verified that SCM does not possess a valid regulatory license from any established financial authority. Traders should be cautious when dealing with this broker, as the lack of regulatory oversight can pose potential risks and challenges, including concerns related to fund security and dispute resolution. Additionally, the abnormal or revoked regulatory status in the case of Cyprus CYSEC (license number: 210/13) further underscores the importance of thorough due diligence when choosing a broker.

Pros and Cons

SCM presents a range of advantages and disadvantages for traders. On the positive side, it offers a diverse selection of tradable assets and multiple account types to cater to various trading preferences. Additionally, the absence of commission charges on trades can be appealing. However, it's crucial to exercise caution due to the lack of regulatory oversight, which may raise concerns regarding fund security and dispute resolution. Furthermore, the limited availability of customer support channels is a notable drawback. Traders should carefully weigh these pros and cons when considering SCM as their trading platform.

| Pros | Cons |

| - Diverse range of tradable assets | - Absence of regulatory oversight |

| - Availability of multiple account types | - Regulatory status may raise risk concerns |

| - Spreads starting from 0.2 pips | - Limited customer support channels |

| - No commission charges on trades | |

| - Access to trading platforms |

Trading Instruments

SCM offers a variety of trading instruments for different investment preferences:

Forex: The Forex market is the world's largest and most liquid, where traders can engage in currency pair trading.

CFDs (Contracts for Difference): These financial derivatives enable traders to profit from the price movements of various assets like stocks, commodities, and indices without owning them directly.

Stocks: SCM provides the opportunity to trade stocks, allowing traders to benefit from changes in stock prices.

Commodities: Traders can participate in commodities trading, speculating on the price movements of resources like oil, gold, and wheat.

Indices: Indices represent market or sector performance and are tradable at SCM, providing a chance to profit from overall market trends.

Cryptocurrencies: Cryptocurrency trading allows traders to potentially profit from the price volatility of digital currencies like Bitcoin and Ethereum.

Here is a comparison table of trading instruments offered by different brokers:

| Product | SCM | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| Spread Betting | No | Yes | No | No |

| Stocks | Yes | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | Yes | No | Yes | No |

Account Types

SCM offers three account types: Standard, Pro, and VIP.

Standard Account: This is the most popular account type and is suitable for beginners and experienced traders alike. It offers no commissions, low spreads, and a wide range of trading instruments.

Pro Account: This account is designed for more experienced traders and offers lower spreads, more trading features, and a dedicated account manager.

VIP Account: This is the highest tier account type and offers the lowest spreads, dedicated account manager, and other exclusive benefits.

How to Open an Account

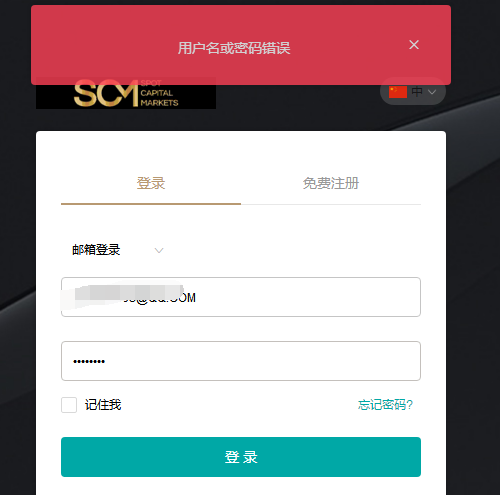

To open an account with SCM, follow these steps.

Visit the SCM website. Look for the “Sign up” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Leverage

SCM offers leverage on all of its trading instruments, except for cryptocurrencies. The amount of leverage available depends on the trading instrument and the account type.

For forex trading, the maximum leverage is 1:500 for the Standard Account, 1:200 for the Pro Account, and 1:100 for the VIP Account. This means that for every $100 you deposit, you can control a position of up to $50,000.

For CFD trading, the maximum leverage is 1:20 for the Standard Account, 1:10 for the Pro Account, and 1:5 for the VIP Account. This means that for every $100 you deposit, you can control a position of up to $2,000.

It is important to note that leverage is a double-edged sword. It can magnify your profits, but it can also magnify your losses. If you are not careful, you could lose more money than you deposited.

Spreads and Commissions (Trading Fees)

SCM charges spreads on all of its trading instruments, except for cryptocurrencies. The spreads are variable and depend on the trading instrument and the account type.

For forex trading, the spreads are typically around 1 pip for the Standard Account, 0.5 pips for the Pro Account, and 0.2 pips for the VIP Account. This means that if you buy 1 lot of EUR/USD, you will pay a spread of around $1.00 for the Standard Account, $0.50 for the Pro Account, and $0.20 for the VIP Account.

For CFD trading, the spreads are typically wider than for forex trading. The spreads for major indices are around 2 pips for the Standard Account, 1 pip for the Pro Account, and 0.5 pips for the VIP Account. The spreads for individual stocks can be much wider.

SCM does not charge commissions on any of its trading instruments. This means that the only cost you will incur when trading with SCM is the spread.

It is important to note that spreads can fluctuate, so the spreads that I have mentioned are just estimates. You should always check the current spreads before you make a trade.

Non-Trading Fees

SCM charges a few non-trading fees, including:

Inactivity fee: If your account balance is below a certain level for a certain period of time, you will be charged an inactivity fee. The inactivity fee is $10 per month.

Overnight financing fee: If you hold a position overnight, you will be charged an overnight financing fee. The overnight financing fee is calculated based on the interest rate of the underlying asset.

Margin call fee: If your margin level falls below a certain level, you will be charged a margin call fee. The margin call fee is $10.

Swap fee: If you hold a position in a currency pair that has different interest rates, you will be charged a swap fee. The swap fee is calculated based on the difference in interest rates.

Deposit & Withdraw Methods

SCM offers a variety of deposit and withdrawal methods, including:

Bank wire: This is the most popular deposit and withdrawal method. It is a secure and reliable method, but it can take a few days for the funds to be credited or debited from your account.

Credit/debit card: This is a quick and easy way to deposit funds into your account. However, there may be fees associated with using a credit or debit card.

E-wallet: This is a convenient way to deposit and withdraw funds. It is also a secure method, but there may be fees associated with using an e-wallet.

Cryptocurrency: This is a newer way to deposit and withdraw funds. It is a secure and fast method, but there may be fees associated with using cryptocurrency.

SCM has different minimum deposit requirements for different account types:

Standard Account: $100

Pro Account: $2,000

VIP Account: $50,000

Here is a comparison table of minimum deposit required by different brokers:

| Broker | SCM | Exnova | Tickmill | GO Markets |

| Minimum Deposit | $100 | $10 | $100 | $200 |

Trading Platforms

SCM offers traders access to two primary trading platforms:

MetaTrader 4 (MT4): MetaTrader 4 is a widely used trading platform known for its popularity and robust features. It provides traders with an array of tools, including advanced charting, analysis capabilities, and various trading tools. MT4 is favored by traders worldwide for its reliability and extensive functionality.

cTrader: cTrader is another trading platform available at SCM. It's gaining recognition among traders for its speed and user-friendly interface. cTrader offers features not found in MT4, such as hedging and support for algorithmic trading. This platform appeals to traders seeking a modern and intuitive trading experience.

Both platforms cater to different trading preferences, allowing traders to choose the one that best aligns with their needs and strategies.

Customer Support

SCM offers customer support to assist traders with their inquiries and concerns. You can reach the customer support team by calling the phone number +357 25 030 480. This direct contact method allows for real-time communication, enabling traders to receive prompt responses to their questions or assistance with any issues they may encounter while using the platform.

Educational Resources

SCM offers a variety of educational resources, including:

Video tutorials: SCM offers a library of video tutorials that cover a wide range of topics, from basic trading concepts to advanced trading strategies.

Webinars: SCM hosts regular webinars that are led by experienced traders and analysts.

eBooks: SCM offers a number of eBooks that cover a variety of topics, such as trading psychology and technical analysis.

Glossary: SCM provides a glossary of terms that are commonly used in trading.

Conclusion

In conclusion, SCM, a Cyprus-based brokerage founded in 2013, offers traders a diverse range of tradable assets and competitive spreads. It caters to traders of all experience levels with multiple account types and provides access to popular trading platforms like MetaTrader 4 (MT4) and cTrader. However, the absence of regulatory oversight is a significant drawback, raising concerns about fund security and dispute resolution. Additionally, limited customer support channels may pose challenges for traders seeking assistance. Traders considering SCM should carefully evaluate these factors before engaging with the platform.

FAQs

Q: Is SCM a regulated broker?

A: No, SCM does not possess a valid regulatory license from any established financial authority, which may raise concerns about its legitimacy and investor protection.

Q: What is the minimum deposit required to open an SCM account?

A: The minimum deposit for an SCM account varies depending on the account type: $100 for the Standard Account, $2,000 for the Pro Account, and $50,000 for the VIP Account.

Q: Does SCM charge commissions on trades?

A: No, SCM does not charge commissions on any of its trading instruments; instead, it generates revenue through spreads.

Q: Are there any non-trading fees associated with SCM?

A: Yes, SCM charges non-trading fees, including an inactivity fee, overnight financing fee, margin call fee, and swap fee, which traders should be aware of.

Q: What deposit and withdrawal methods does SCM offer?

A: SCM provides various deposit and withdrawal methods, including bank wire, credit/debit card, e-wallet, and cryptocurrency, offering flexibility for traders.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now