Score

NCE

Seychelles|5-10 years|

Seychelles|5-10 years| https://xnce.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Netherlands

NetherlandsContact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

NCE SC Limited

NCE

Seychelles

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The Seychelles FSA regulation with license number: SD112 is an offshore regulation. Please be aware of the risk!

NCE Joins in Wiki Finance Expo Hong Kong 2024

In this era featuring rapid digitalization, the financial market is thriving, and investors are becoming increasingly selective in their choice of brokers. Against this backdrop, NCE has quickly emerged as the preferred choice for many investors, thanks to its ultra-low costs, efficient services, and diverse range of trading products.

Hong Kong

Hong Kong EXPO

EXPONCE at Wiki Finance EXPO Singapore 2023

NCE is a high-tech dealer known for financial innovation. • NCE takes the core purpose of "Low cost, Fast execution, and Fast deposit/withdrawal" as the basis for serving our clients.

Singapore

Singapore EXPO

EXPOWiki Finance EXPO HongKong 2022

NCE is a high-tech dealer known for financial innovation. We take the core purpose of "Low cost, Fast execution and Fast deposit / withdrawal" as the basis for serving our clients.

Hong Kong

Hong Kong EXPO

EXPONCEat Wiki Finance EXPO Dubai 2022

NCE is a high-tech dealer known for financial innovation.

United Arab Emirates

United Arab Emirates EXPO

EXPONCE Joins in Wiki Finance Expo Hong Kong 2024

In this era featuring rapid digitalization, the financial market is thriving, and investors are becoming increasingly selective in their choice of brokers. Against this backdrop, NCE has quickly emerged as the preferred choice for many investors, thanks to its ultra-low costs, efficient services, and diverse range of trading products.

Hong Kong

Hong Kong EXPO

EXPONCE at Wiki Finance EXPO Singapore 2023

NCE is a high-tech dealer known for financial innovation. • NCE takes the core purpose of "Low cost, Fast execution, and Fast deposit/withdrawal" as the basis for serving our clients.

Singapore

Singapore EXPO

EXPOWiki Finance EXPO HongKong 2022

NCE is a high-tech dealer known for financial innovation. We take the core purpose of "Low cost, Fast execution and Fast deposit / withdrawal" as the basis for serving our clients.

Hong Kong

Hong Kong EXPO

EXPONCEat Wiki Finance EXPO Dubai 2022

NCE is a high-tech dealer known for financial innovation.

United Arab Emirates

United Arab Emirates EXPO

EXPOWikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1 : 1000 |

| Minimum Deposit | 200 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (2+) ETH |

| Withdrawal Method | (2+) ETH |

| Commission | from $3.8/lot |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1 : 1000 |

| Minimum Deposit | 200 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (2+) ETH |

| Withdrawal Method | (2+) ETH |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed NCE also viewed..

XM

IC Markets Global

HFM

IUX

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

Taipei

Taipei- 560***

- GBPUSD

- 07-31 05:00:32

BeiJing

BeiJing- 829***

- GBPUSD

- 07-31 05:45:13

London

London- 215***

- GBPUSD

- 07-31 03:27:34

Stop Out

2.69%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

NCE · Company Summary

| NCE Review Summary | |

| Founde | 2007 |

| Registered Country | Seychelles |

| Regulation | Offshore regulated by FSA |

| Market Instruments | Forex, commodities, indices, shares, cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | Floating from 0 pips |

| Trading Platform | MT5 |

| Minimum Deposit | $200 |

| Customer Support | Emai: support@xnce.com; live chat; contact form |

| Regional Restrictions | Iran, North Korea, Syria, Sudan, Gambia, Bangladesh, Bolivia, Ecuador, Kyrgyzstan, the United States, Japan and Hong Kong |

NCE Information

NCE operates under the trading name NCE SC Limited, focusing on forex, commodities, indices, shares, and cryptos trading. However, its status as FSA (The Seychelles Financial Services Authority) offshore raises significant credibility concerns for traders. Caution is advised due to regulatory flags that can impact reliability and investor protection.

Pros & Cons

| Pros | Cons |

| Wide range of instruments | FSA offshore regulation |

| MetaTrader 5(MT5) platform support | Restricted areas |

| Demo account | High minimum deposit |

| Fund segregation | |

| No deposit/withdrawal fees |

Is NCE Legit?

When considering the safety of a brokerage like NCEor any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: NCE operates under the Seychelles Financial Services Authority (FSA) offshore with license number SD112.

| Regulated Country | Regulator | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles Financial Services Authority (FSA) | Offshore Regulated | NCE SC Limited | Retail Forex License | SD112 |

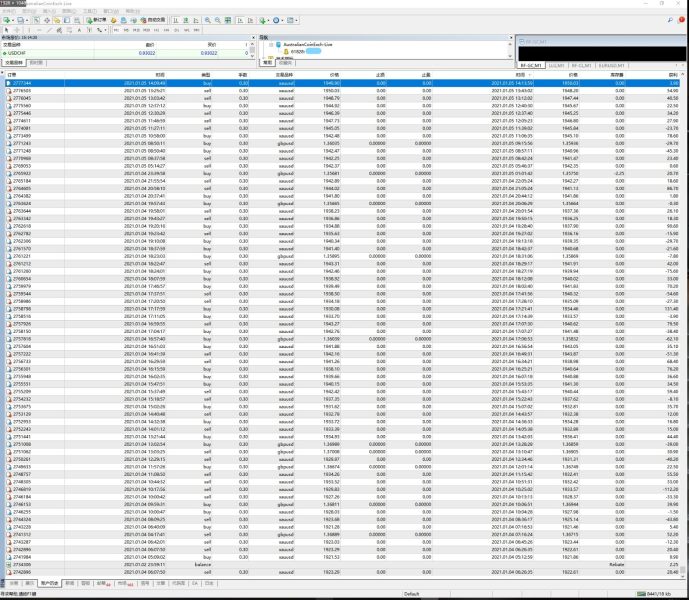

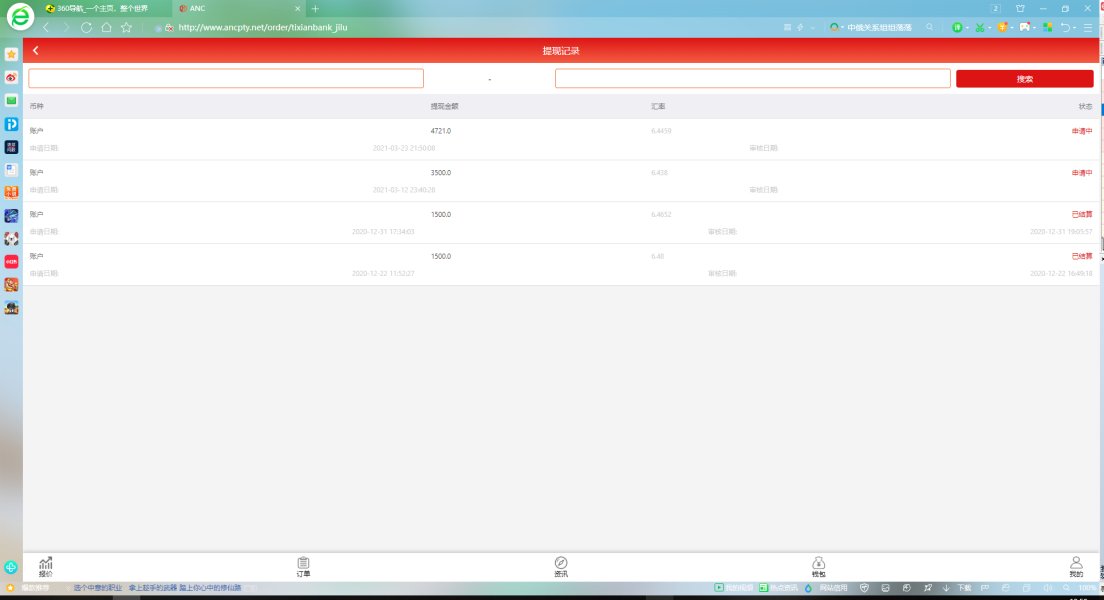

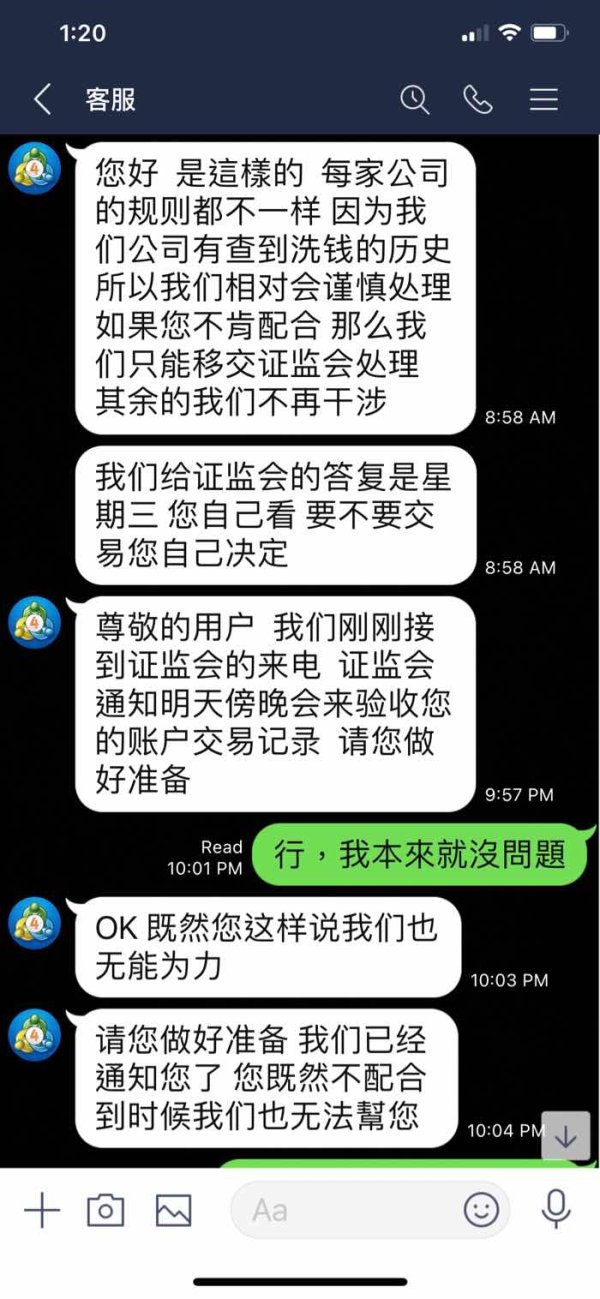

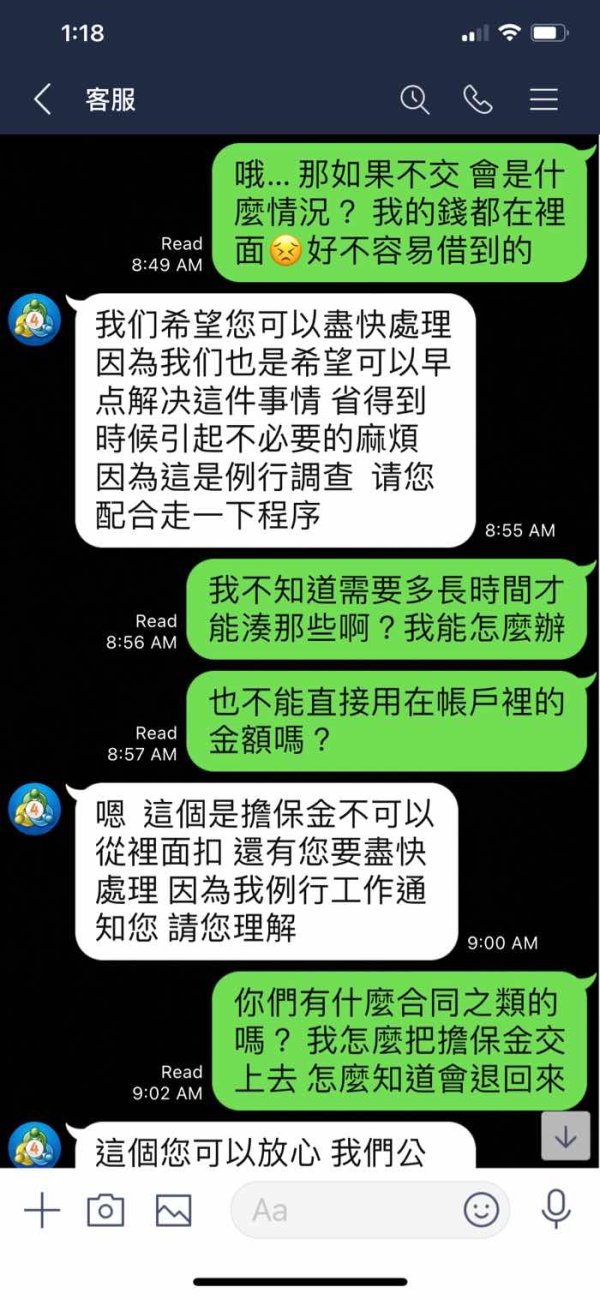

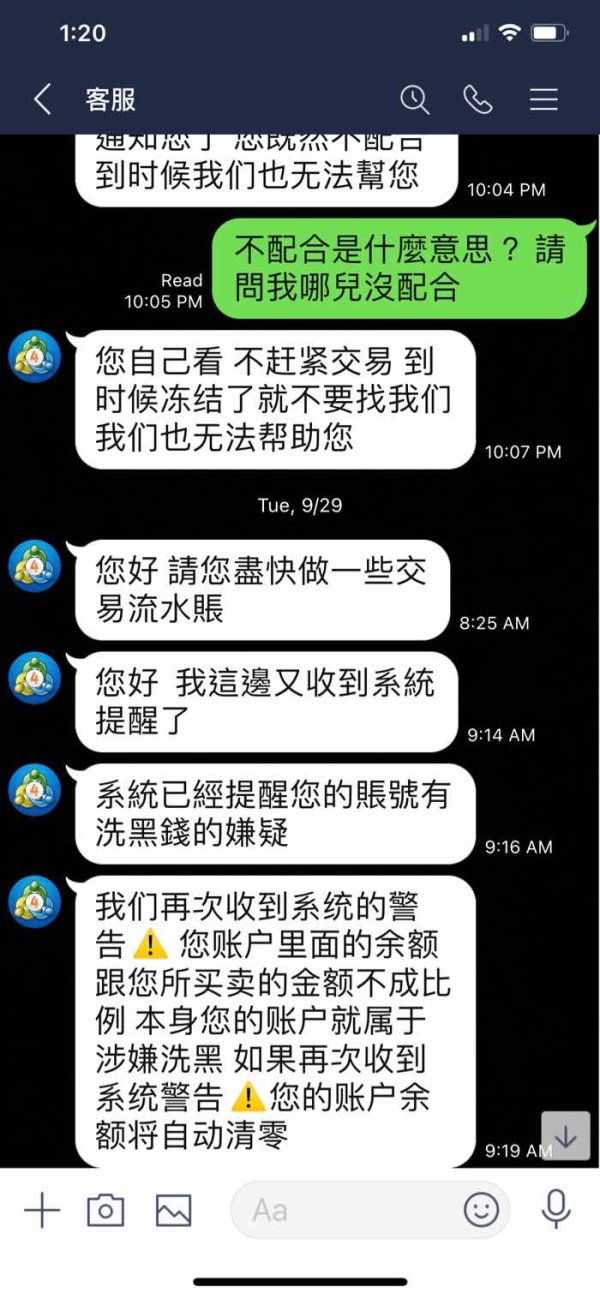

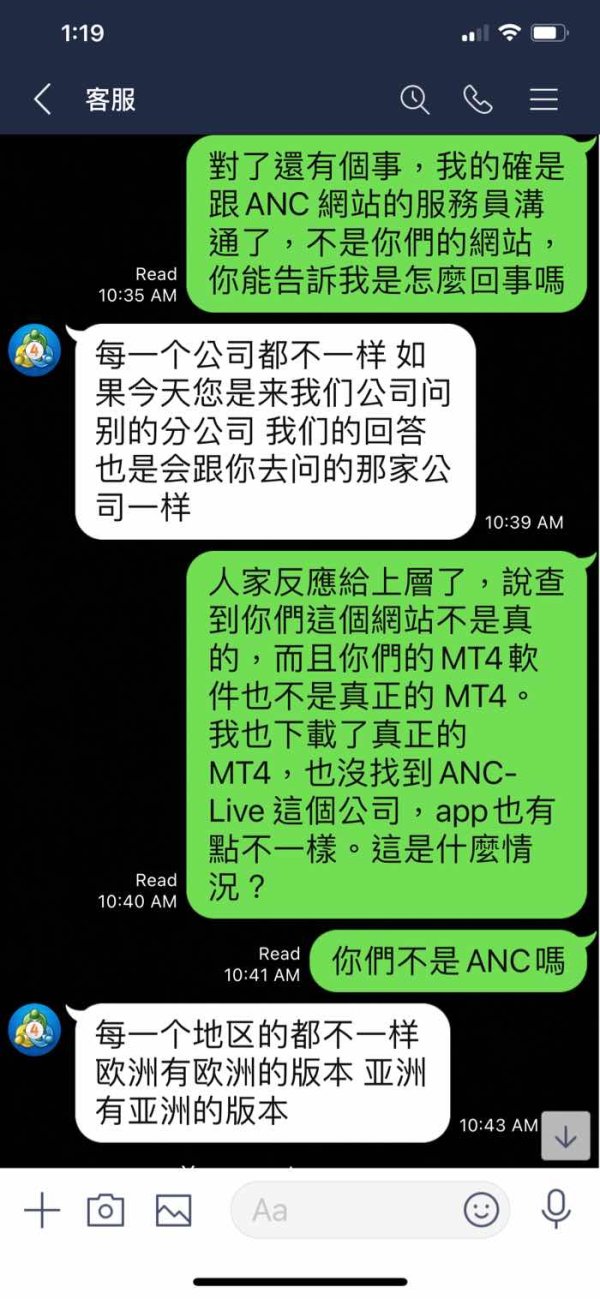

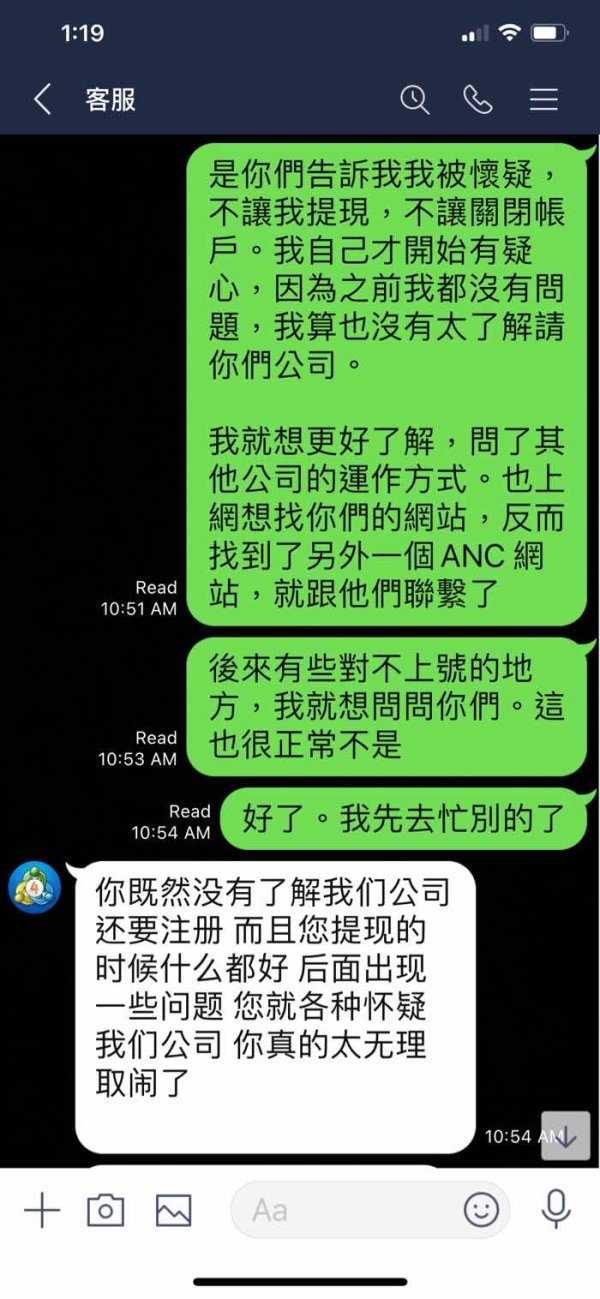

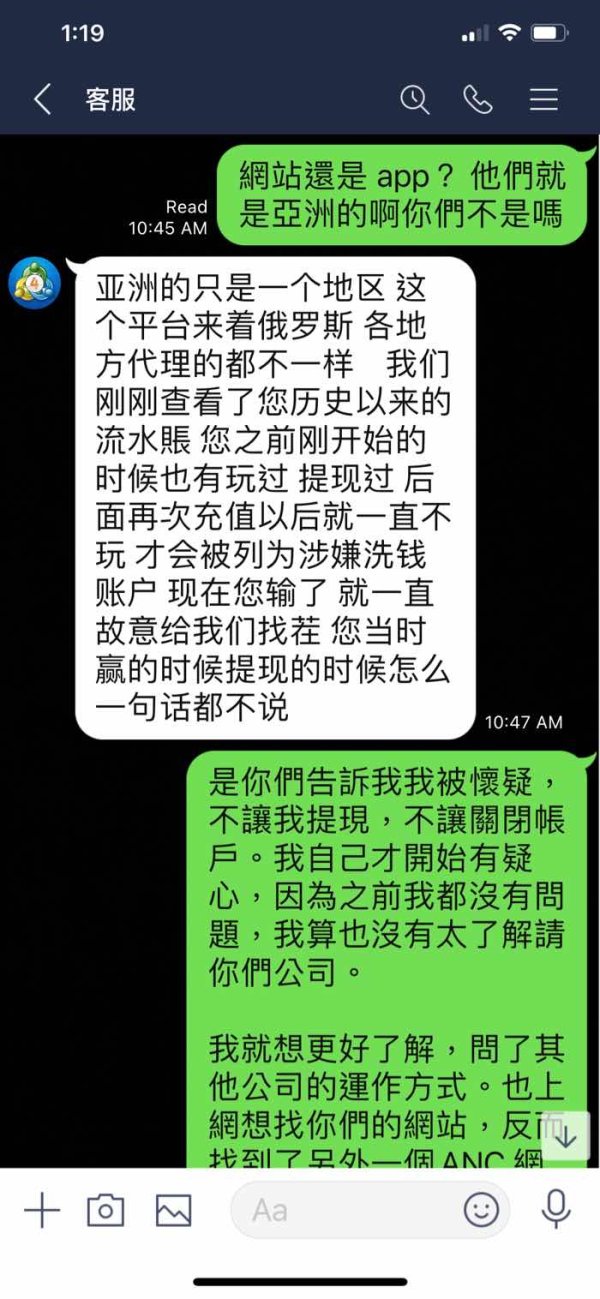

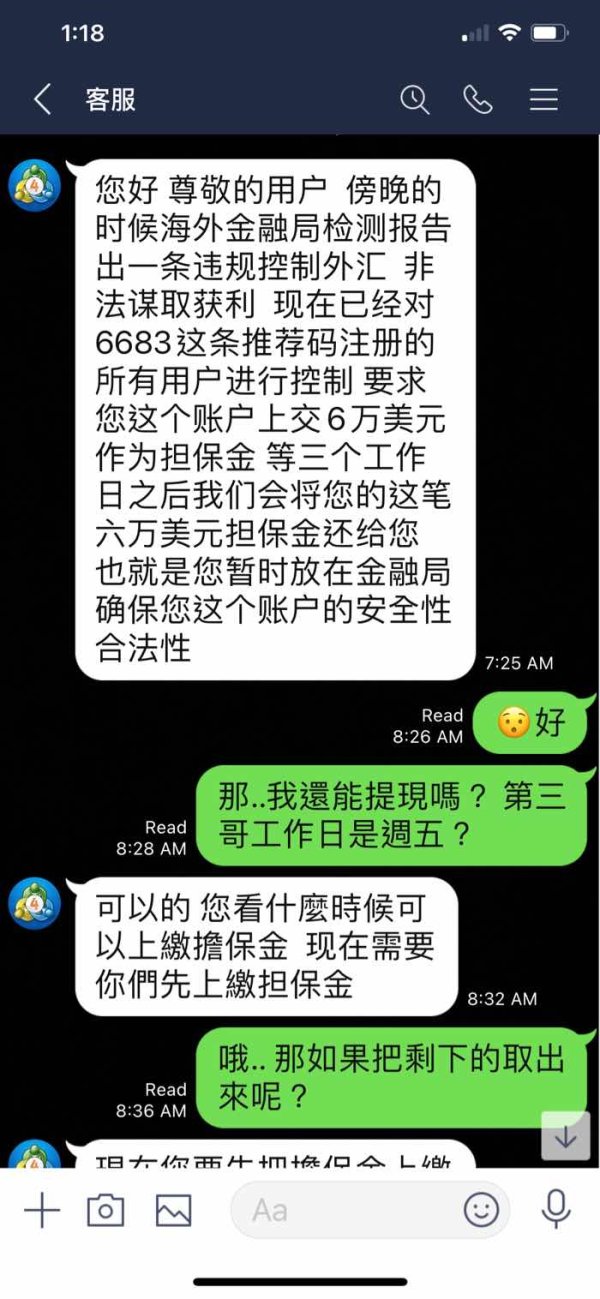

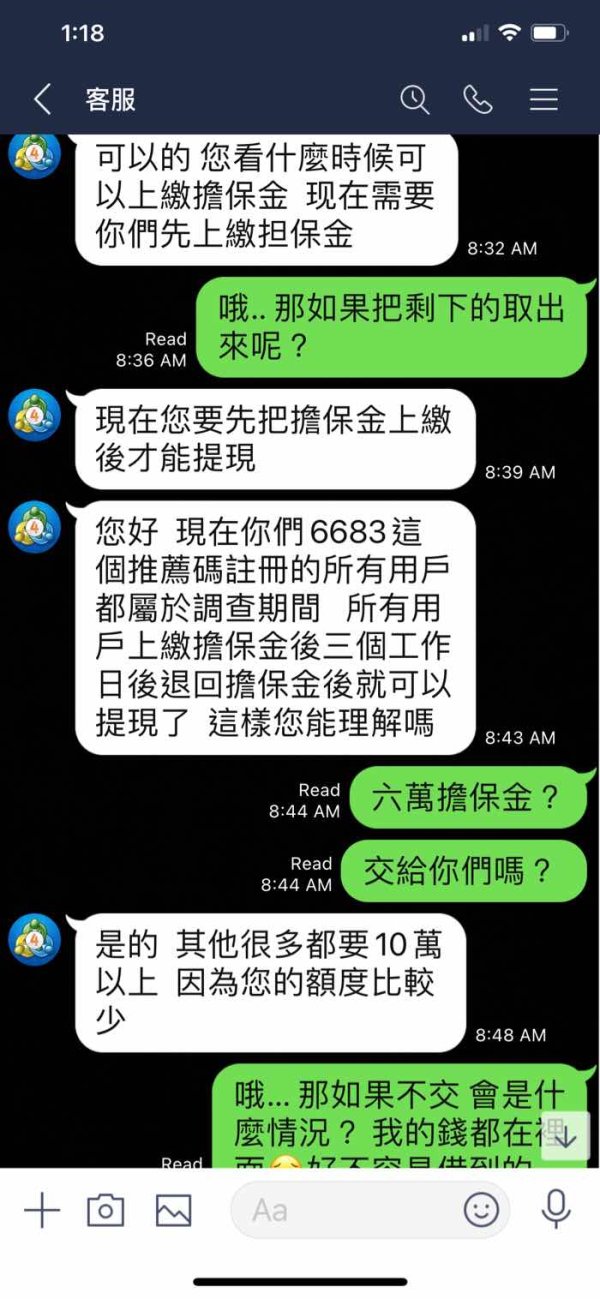

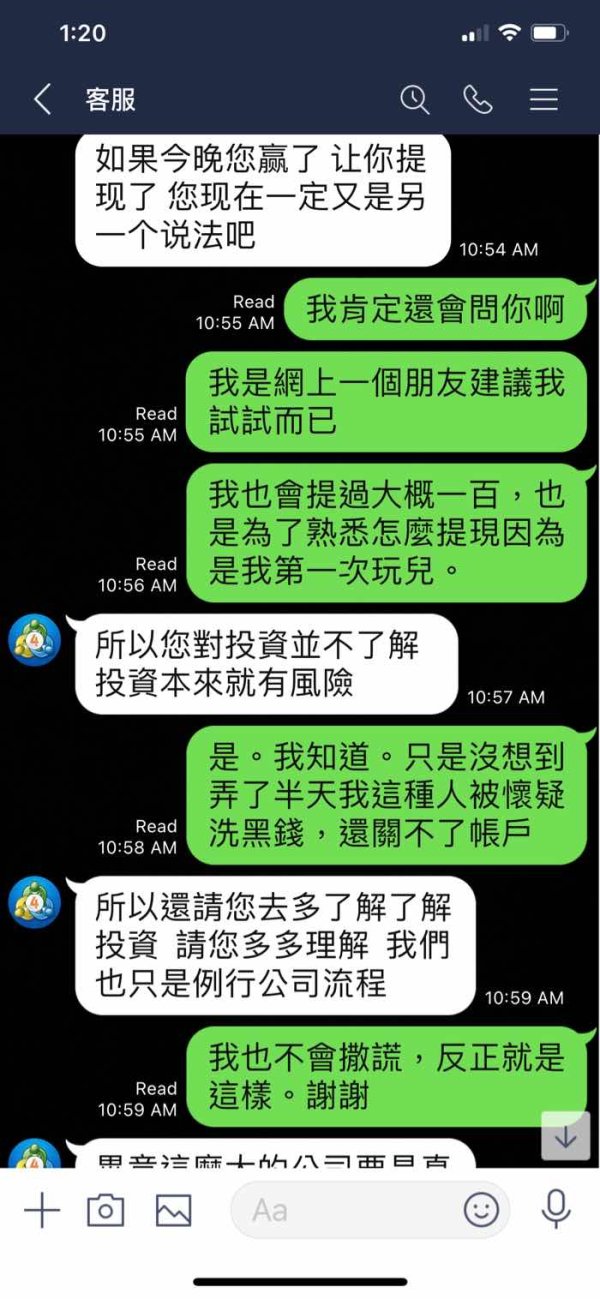

- User feedback: NCE has been flagged for withdrawal issues in an exposures on WikiFX, questioning the broker's reliability. This serves as a warning for anyone considering their services, urging utmost caution due to potential issues with fund withdrawals.

- Security measures: At NCE, client funds are securely segregated from company assets, held in accounts with globally recognized financial institutions.

In the end, choosing whether or not to engage in trading with NCEis an individual decision. We advise you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

NCE offers a comprehensive selection of over 80 financial instruments across various asset categories.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

The Metals category allows investors to trade in precious metals like gold and silver, benefiting from their unique market dynamics and safe-haven appeal during economic uncertainties.

The Energies market encompasses commodities such as oil and natural gas, providing strategic avenues for investment in vital energy resources.

Indices offer a window into global economic performance through stock indices, allowing traders to capture the pulse of major economies and diversify their portfolios accordingly.

Investing in the Shares market enables participation in leading global companies, facilitating portfolio growth through equity investments.

Furthermore, NCE supports trading in cryptocurrencies, unlocking opportunities in the volatile yet promising digital asset market, where innovative technologies and market trends drive investor interest and potential returns.

Account Types

- Demo Account

NCE provides a demo account that allows you to try out the financial markets without the risk of losing money.

- Live Account

NCE offers a total of 3 account types: Standard Accountm Raw Spread Account and VIP Account. The minimum deposit to open the Raw Spread Account and the Standard Account is $200. The threshold to open the VIP Account is $5000.

| Account Type | Minimum Deposit |

| Raw Spread | $200 |

| Standard | $200 |

| VIP | $5,000 |

Leverage

When it comes to leverage, NCE enables its clients to use the maximum trading leverage up to 1:1000, which is greater than the levels regarded appropriate by any regulators, with the maximum leverage for major currencies up to 1:30 in Europe and Australia, and 1:50 in the United States and Canada.

The company offers leverage ranges from 1000:1 for account equities between 0 to $999.99, gradually reducing to 100:1 for balances exceeding $20,000 for Forex, Metals, and Oil trading.

| Account Equity Range | Leverage Limit |

| $0 - $999.99 | 1000:1 |

| $1000 - $4999.99 | 800:1 |

| $5000 - $9999.99 | 500:1 |

| $10000 - $20000 | 200:1 |

| $20000 and above | 100:1 |

Cryptocurrency trading maintains fixed leverage ratios, with major pairs like BTCUSD and ETHUSD offering leverage up to 100:1, while smaller altcoins like MANAUSD and MATICUSD are leveraged at 10:1.

| Symbols | Fixed Leverage |

| BTCUSD, ETHUSD, LTCUSD | 100:1 |

| BCHUSD, XRPUSD, ADAUSD, EOSUSD, DOTUSD, DOGEUSD, LINKUSD | 20:1 |

| MANAUSD, SANDUSD, MATICUSD, AXSUSD | 10:1 |

Indices such as US30 and UK100 provide leverage up to 100:1, reflecting global market volatility and investor demand.

| Symbols | Fixed Leverage |

| US30, US100, US500, UK100, China50, HongKong50, AU200, Japan225 | 100:1 |

Shares trading offers a conservative approach with a fixed leverage of 20:1 across all listed stocks, ensuring stability and risk management in equity investments.

| Symbols | Fixed Leverage |

| All Shares | 20:1 |

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size, no more than a 1:10.

Spreads & Commissions

NCE offers competitive trading conditions with flexible spread and commission options across its account types:

| Account Type | Spread | Commission |

| Raw Spread | Floating from 0 pips | $3.8/lot |

| Standard | Floating, not specified | ❌ |

| VIP | $2/lot |

In the Raw Spread Account, traders benefit from floating spreads starting as low as 0 pips, providing tight pricing on Forex, metals, and other assets. Additionally, this account type charges a commission of $3.8 per lot traded, which is cost-effective for more active traders.

For the Standard Account, no commission is applied, making it ideal for traders looking to avoid additional transaction costs while still benefiting from floating spreads designed to optimize trading profitability.

On the other hand, the VIP Account offers enhanced trading conditions with a commission of $2 per lot, paired with floating spreads.

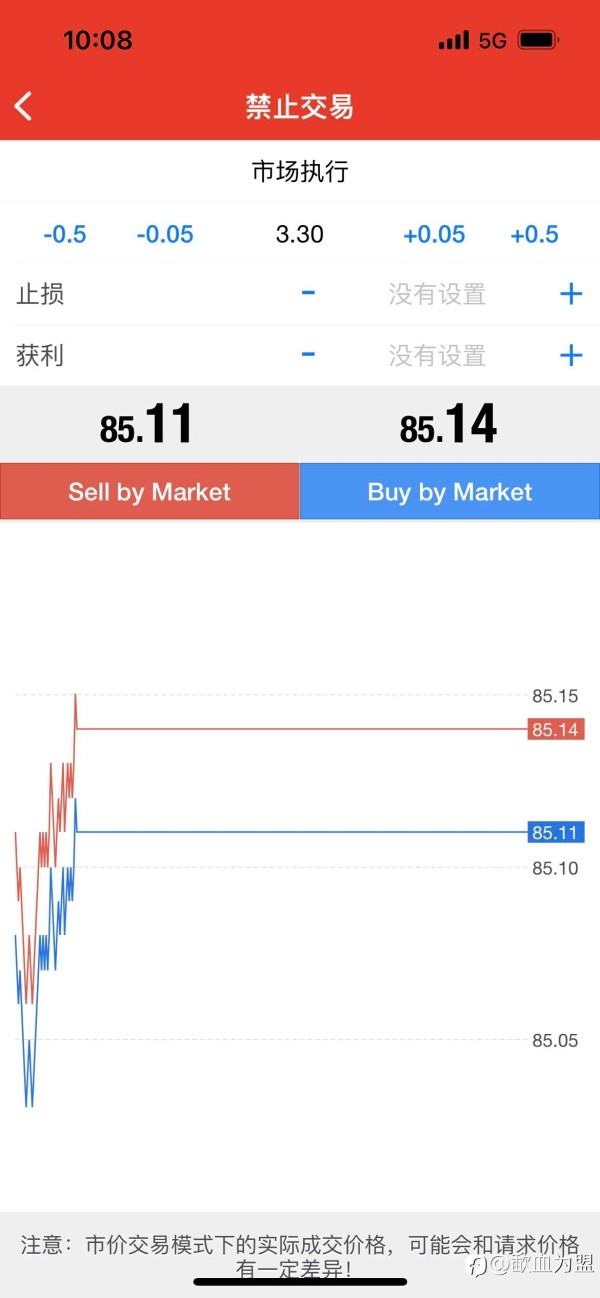

Trading Platform

NCE provides traders with the popular MetaTrader 5 (MT5) trading platform which is avaialbel on desktop, web and mobile devices. MT5 is a popular and widely recognized trading platform known for its user-friendly interface and robust features. It provides traders with access to a range of financial instruments, including Forex, indices, commodities, and more. MT5 offers advanced charting capabilities, technical analysis tools, customizable indicators, and the ability to automate trading strategies using Expert Advisors (EAs). Traders can also execute trades, manage orders, and monitor market conditions in real-time using MT5.

FIX API

NCE's FIX API offers tailored trading solutions across the market spectrum. It provides customized options for individual traders, enhances efficiency for asset managers and hedge funds, and enables automatic exchange and currency hedging for brokers and companies. With competitive pricing for institutional partners, this versatile API caters to diverse trading needs, from personalized strategies to large-scale operations.

Trading Tools

At NCE, traders benefit from access to a comprehensive Economic Calendar that highlights crucial economic events and indicators affecting global financial markets. This tool enables traders to stay informed about key announcements such as central bank decisions, economic data releases (like GDP reports and employment figures), and geopolitical events that can influence market sentiment and asset prices.

Social Trading

At NCE, social trading serves as a dynamic platform that bridges the gap between experienced investors (managers) and less seasoned traders, fostering a collaborative environment for learning and profit. This innovative feature allows novice traders to follow and emulate the strategies of successful investors, gaining insights into their trading decisions and techniques. Users can observe real-time trading activities, access performance metrics, and directly interact with managers to understand market trends and refine their own strategies.

Beyond individual learning, NCE's social trading enhances community engagement by creating a supportive network where traders can share insights, discuss market developments, and collaborate on investment ideas. This interactive approach not only democratizes access to trading expertise but also encourages knowledge-sharing and mutual growth among participants.

Deposits & Withdrawals

NCE supports two main payment methods: UnionPay and bank transfers in USD, EUR, GBP, and PLN.

These methods ensure flexibility for traders to fund their accounts and withdraw funds efficiently. The platform requires a minimum deposit of $100, with no commissions charged on deposits or withdrawals.

Deposits are processed instantly, while withdrawals are typically completed within 1 working day.

Customer Service

NCE provides customer service primarily through email: support@ncemarkets.com, live chat, and a contact form.

Q&A

Is NCE regulated?

NCE is currently offshore regulated by the Seychelles Financial Services Authority (FSA) with license no.SD112.

Is NCE a good broker for beginners?

Yes, NCE offers a a user-friendly platform and social trading function. Beginners can open a risk-free demo account first to test.

Does NCE offer industry-leading MT4 & MT5?

Yes, NCE provides access to MetaTrader 5 (MT5) on web, Windows and mobile devices.

What is the minimum deposit NCE requires?

The minimum deposit required by NCE is $100, but a minimum deposit to open an account is $200.

Does NCE offer demo accounts?

Yes.

Are there any restricted areas for NCE's services?

Yes, NCE SC Limited does not offer services to residents of certain jurisdictions including Iran, North Korea, Syria, Sudan, Gambia, Bangladesh, Bolivia, Ecuador, Kyrgyzstan, the United States, Japan, and Hong Kong.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

News

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now