Score

Brisk Liquidity

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://cn.briskliquidity.nz/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Brisk Group Limited

Brisk Liquidity

United Kingdom

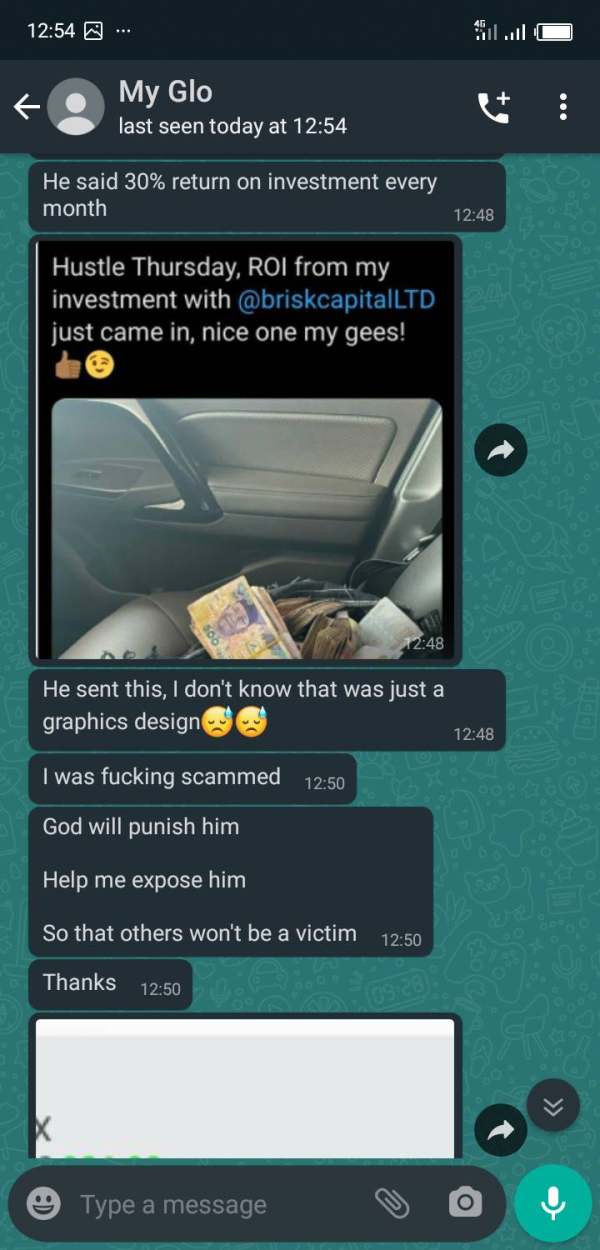

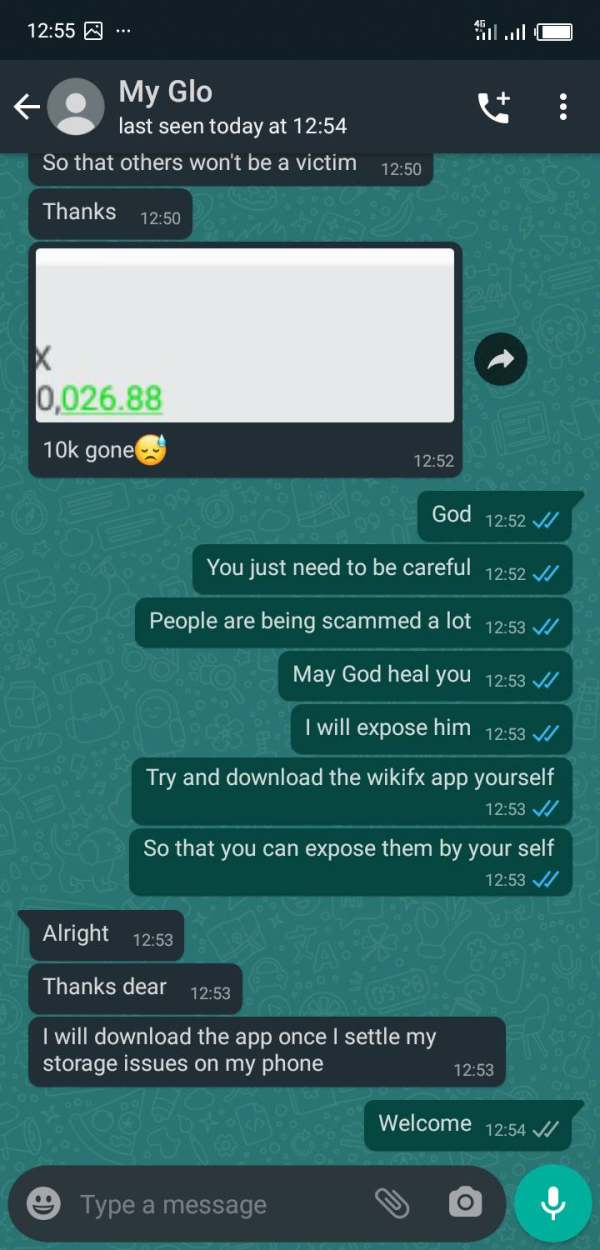

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- United KingdomFCA (license number: 785997) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

WikiFX Verification

Users who viewed Brisk Liquidity also viewed..

XM

IUX

FP Markets

AUS GLOBAL

Brisk Liquidity · Company Summary

| Company Name | Brisk Liquidity |

| Headquarters | New Zealand, UK |

| Regulations | No License |

| Account Types | Standard and Active Trader |

| Leverage | 1:500 for Standard Account1:200 for Active Trader |

| Spread | 0.5 pips for Standard Account |

| Minimum Deposit | $200 AUD for Standard Account |

| Deposit/Withdraw Methods | Bank Wire, Credit/Debit cards, Skrill, Local Bank Deposit, Neteller, Bpay, Union Pay |

| Trading Platforms | MetaTrader 4 |

| Customer Support | info@briskliquidity.nz, info@briskgr.com |

Overview of Brisk Liquidity

Brisk Liquidity, a forex brokerage firm, is primarily based in New Zealand, with an additional presence in the UK. Striving to cater to a wide array of trading needs and preferences, the broker offers a range of market instruments for its clients. This selection likely encompasses a variety of foreign exchange pairs along with other potential financial instruments, which may appeal to traders interested in diverse asset classes.

To ensure user-friendly and efficient trading, Brisk Liquidity turns to the power of the highly esteemed MetaTrader 4 platform. MT4 is recognized across the forex industry for its advanced trading tools, automated trading systems, technical analysis indicators, and customizable features, making it a popular choice among both novice and experienced traders. As such, traders opting for Brisk Liquidity can expect a well-equipped trading environment.

Is Brisk Liquidity legit or a scam?

Brisk Liquidity's operation is under the purview of Brisk Liquidity Limited, a company that has its registration in New Zealand. While registration represents the company's legitimacy as a corporate entity, it doesn't necessarily equate to operational credibility within the Forex market, which requires specific financial regulations. It's also significant to point out that Brisk Liquidity is part of the larger Brisk Group, a factor that might lend the firm some weight in terms of reputation.

However, when it comes to regulatory oversight, the conversation takes a different turn. Brisk Liquidity seems to be operating without formal regulation. The absence of regulatory scrutiny often raises concerns about the safety of client funds, the firm's adherence to fair trading practices, pricing transparency, and overall accountable conduct. For many traders, regulation by a reputable financial authority stands as a mark of trust. Therefore, potential clients need to carefully take into account the lack of regulatory oversight when considering investing with Brisk Liquidity.

Pros and Cons

In terms of the advantages of Brisk Liquidity, several features stand out. Beyond a doubt, the most significant is the availability of the well-reputed MetaTrader 4 platform which offers an extensive array of trading tools and user-friendly interaction. Another beneficial factor is the range of payment methods offered. From standard bank wire to e-wallets, Brisk Liquidity caters to various individual preferences. Furthermore, the diverse account types available serve an expansive range of trader types and needs. A key advantage is the relatively low minimum deposit requirement, making this platform accessible to a wide range of traders whether novice or experienced. In addition, they offer a fairly high degree of leverage, potentially offering higher returns for adept traders.

However, there are areas where this broker could improve. The lack of specific regulation may raise some eyebrows and could be a potential red flag. Furthermore, the information on trading conditions appears to be controversial, which may cause confusion for its clients. A clear drawback is the lack of educational resources which can be seen as a limitation for beginner or less-informed traders looking to improve their trading skills and knowledge. There is also perceived lack of transparency which may affect the trust relationship between the broker and its clients. Lastly, while high leverage can be advantageous, it also introduces the potential for higher risk if the trades don't perform as expected.

| Pros | Cons |

| Availability of MetaTrader 4 | Lack of Regulation |

| Many Payment Methods Supported | Controversial Information on Trading Conditions |

| Diverse Account Types | Lack of Educational Resources |

| Relatively Low Minimum Deposit Requirement | Perceived Lack of Transparency |

| High Degree of Leverage | Potential for High Risk with High Leverage |

Account Types

Brisk Liquidity caters to various trading preferences by offering two primary account types, aiming to meet the requirements of both beginner and expert traders. One of these is the Standard account, which is considered a highly attractive option for novice traders or those with moderate trading volumes. This account type is commission-free, allowing traders to operate without worrying about additional charges on their trades, thereby ensuring a cost-effective trading environment.

Furthermore, Brisk Liquidity provides an Active Trader account geared towards seasoned and professional traders who engage in high-volume trading. For this account type, while spreads start from 0.0 pips, a commission is charged. In addition to these, Brisk Liquidity also extends MAM and PAMM services for money managers and offers Islamic (swap-free) accounts, ensuring they cater to a diverse array of traders with various trading needs and preferences.

How to open an account in Brisk Liquidity?

Opening an account with Brisk Liquidity is a fairly straightforward process which can be done online. These simple steps provide prospective clients with an easy-to-follow pathway to get started on their trading journey with this broker. Here's a step-by-step guide that outlines how you can go about setting up your own trading account:

First, navigate to the Brisk Liquidity website.

Once there, find and click on the 'Open Account' button.

Fill in the registration form with the requested personal information.

Upon completion, submit the form to initiate the verification process.

Once your account is verified, you will be required to deposit funds. Choose your preferred payment method and follow the instructions provided.

After depositing the funds, your trading account will be activated and ready for use.

Spread and Commission Fees

Brisk Liquidity offers competitive spreads and commission structure for its trading accounts. For Standard account holders, they can enjoy trading with spreads starting from as low as 0.5 pips. This provides traders with cost-effective access to the markets, conducive to a wide range of trading strategies.

On the other hand, Brisk Liquidity offers a unique advantage for Active Trader account holders who engage in high-volume trading. Spreads for these account holders can start from 0.0 pips, offering extremely tight and competitive trading costs. In addition to the spreads, a commission is charged on trades, further details of which can be found in the broker's terms and conditions or through direct contact with Brisk Liquidity. Such a structure allows for a more transparent and competitive trading environment for professional traders.

Leverage

Brisk Liquidity is competitive in providing high leverage to its traders, catering to their varying trading needs and risk tolerance. For Standard account holders, the broker offers an impressive maximum leverage of 1:500. This high degree of leverage can potentially enhance profitability for traders who can handle the associated risks effectively.

On the other hand, for Active Trader account holders who typically engage in high-volume trades, the firm provides a lower maximum leverage of 1:200. This reflects a balanced and risk-responsive approach, suitable for more experienced traders who engage in substantial trading volumes. Consequently, Brisk Liquidity's leverage structure serves to meet the diverse requirements of both beginner and professional traders.

Trading Platform

Brisk Liquidity provides their clients with a number of unique and sophisticated services. They offer a MetaTrader 4 platform, which is a commonly used Forex trading platform known for its ability to analyse financial markets and use Expert Advisor. It is a comprehensive platform, incorporating mobile trading, trading signals, and markets. Through MetaTrader 4, traders gain access to tools that can significantly enhance their Forex trading experience, thereby assisting them in achieving their trading goals efficiently.

In addition to its trading platform, Brisk Liquidity offers a plethora of trading tools. They provide traders with the opportunity to engage in simulated trading, which offers individuals a risk-free environment to hone their trading skills before entering live markets. In order to facilitate easy and seamless trading, they also offer a Copy Trade service. Traders also have access to Expert Advisor, signals, and custom charts.

Minimum Deposit

Brisk Liquidity offers a standard account type with a minimum deposit threshold of $200 AUD. This relatively modest minimum deposit requirement makes the broker accessible to a wide variety of traders, both beginners and experienced traders alike. The rate allows newcomers to the forex trading world to start trading with a lower financial commitment, while also providing a lower-entry barrier for experienced traders interested in exploring Brisk Liquidity's platform and services.

Deposit & Withdrawal Methods

Brisk Liquidity provides a wide array of payment methods, making both deposits and withdrawals easy and efficient for its clients. For those preferring traditional methods, Bank Wire transfers and Credit/Debit card transactions are feasible options. The firm's links with various banks ensure a seamless transfer of funds. Acceptance of credit and debit cards further accommodates clients who value ease and speed. These tried-and-true modes of payment are known for their robustness, security, and worldwide accessibility, making them a suitable choice for most traders.

In addition to traditional methods, Brisk Liquidity is also adept with contemporary digital payment platforms. They accept deposits via Skrill and Neteller, which are popular e-wallet services known for their quick processing times and user-friendly interfaces. For clients in certain locations, they provide the convenience of Local Bank Deposits. For customers who prefer using specific systems, Brisk Liquidity accepts payments via Bpay and Union Pay, adding to the list of its comprehensive payment methods.

Customer Support

Brisk Liquidity appears committed to offering its clients the necessary support through direct communication lines. Their customer support service seems readily available to address any queries or technical issues traders might have. Two primary contact emails are provided for this purpose: info@briskliquidity.nz and info@briskgr.com. This provision of multiple email addresses suggests a potentially fast response time and easy accessibility to assist customers, though the actual quality of the assistance can vary.

Conclusion

Brisk Liquidity, a forex brokerage operating in New Zealand and the UK under the Brisk Group, utilizes the popular MetaTrader 4 platform, catering to traders of varying experience levels. Offering a diverse range of market instruments, multiple payment options, a relatively low minimum deposit, and high leverage, it appeals to a wide client base. However, concerns arise due to the lack of specific regulation, leading to uncertainty regarding the firm's credibility. The transparency of trading conditions and the availability of educational resources are areas that require scrutiny.

In considering Brisk Liquidity as a potential broker, traders should weigh the advantages of accessibility and leverage against the drawbacks of regulatory uncertainty, limited transparency, and educational resources. Careful evaluation is essential before engaging in trading activities with this brokerage.

FAQ

Q: What is the regulatory status of Brisk Liquidity?

A: Brisk Liquidity is currently unregulated.

Q: What is the minimum deposit required for a standard account?

A: The minimum deposit for a standard account at Brisk Liquidity is $200 AUD.

Q: How can I reach customer support if needed?

A: You can reach customer support for Brisk Liquidity by emailing at info@briskliquidity.nz or info@briskgr.com.

Q: What trading platform does Brisk Liquidity use?

A: Brisk Liquidity utilises the MetaTrader 4 trading platform, renowned for its user-friendly interface, advanced trading tools, and customizable features.

Q: Is Union Pay supported by Brisk Liquidity?

A: yes, Union Pay supported by Brisk Liquidity.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now