Score

CDEX

Guadeloupe|1-2 years|

Guadeloupe|1-2 years| https://vn.cd-ex.com/?lang=en

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:MAGIC COMPASS LTD

License No.:299/16

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Guadeloupe

GuadeloupeUsers who viewed CDEX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

cd-ex.com

Server Location

Hong Kong

Website Domain Name

cd-ex.com

Server IP

16.163.223.117

Company Summary

| CDEX | Basic Information |

| Company Name | CDEX |

| Headquarters | Unknown |

| Regulations | Suspicious Clone |

| Tradable Assets | Forex, commodities, cryptocurrencies, indices |

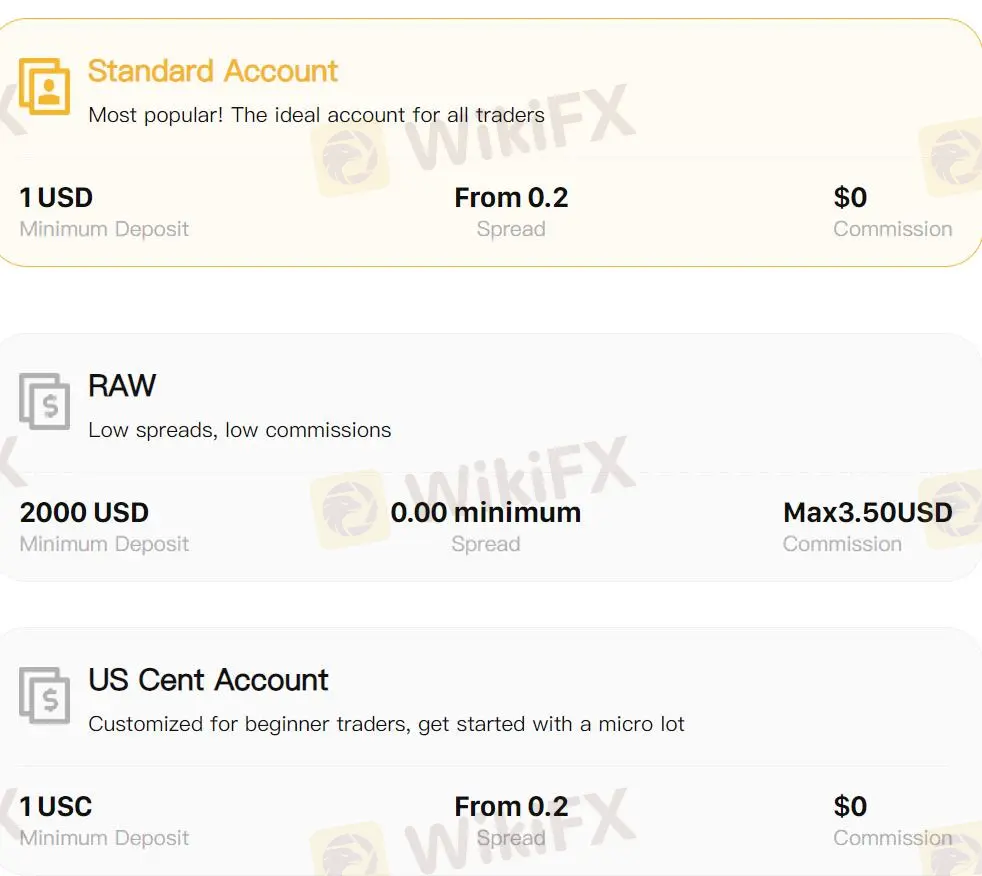

| Account Types | Standard, RAW, US Cent Account |

| Minimum Deposit | Standard: 1 USDRAW: 2000 USDUS Cent Account: 1 USC |

| Time to open account | Instant |

| Trading Platforms | MT5 platform |

| Customer Support | cs@cd-ex.com, X( formely Twitter), Youtube and Facebook |

Overview of CDEX

CDEX, based in Guadeloupe and established 1-2 years ago, offers four types of trading products and three account types, and supports the MT5 trading platform. However, its regulatory status is suspicious clone.

Is CDEX Legit?

CDEX is a suspicious clone, regulated by the Cyprus Securities and Exchange Commission. It holds a Market Making (MM) license with the number 299/16, issued to the licensed institution MAGIC COMPASS LTD.

| Regulatory Status | Suspicious clone |

| Regulated by | Cyprus Securities and Exchange Commission |

| Licensed Institution | MAGIC COMPASS LTD |

| Licensed Type | Market Making (MM) |

| Licensed Number | 299/16 |

Pros and Cons

| Pros | Cons |

| Provides four types of trading products | Suspicious clone |

| Offers three account types | |

| Supports MT5 trading platform |

Trading Instruments

CDEX offers four classes of trading instruments, including forex, commodities, cryptocurrencies, indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ✔ |

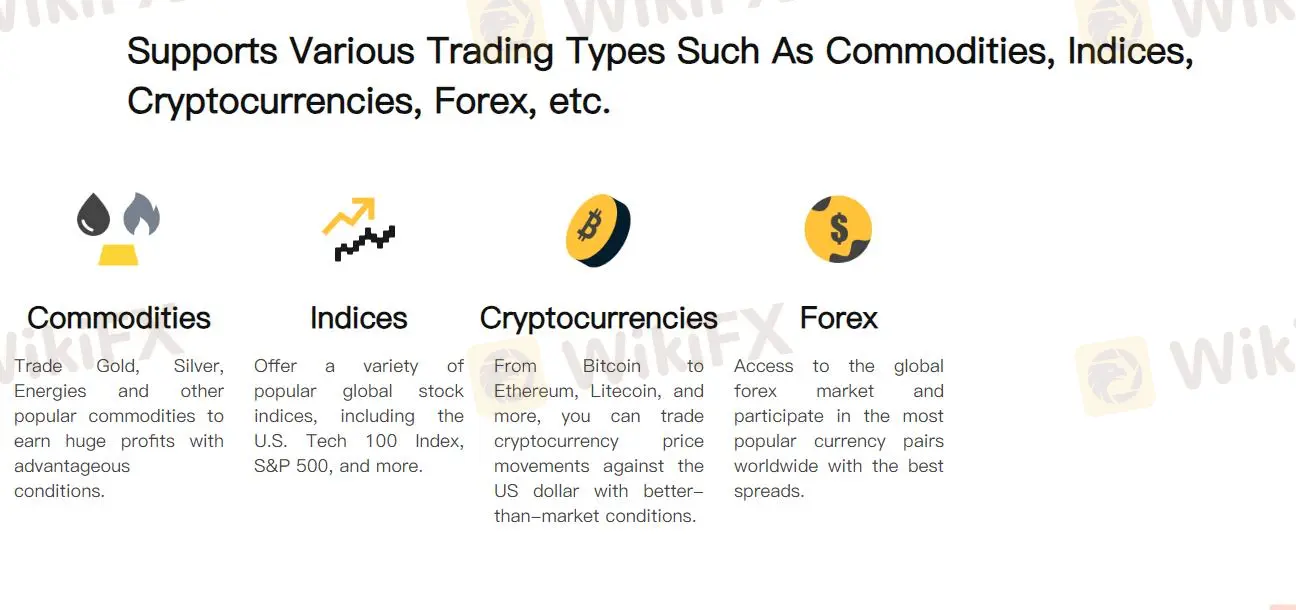

Account Types

Standard: This account type is accessible to all as it requires a minimal deposit of just 1USD. It features a low spread of 0.2 pips, which is the difference between the buying and selling price of an asset. The standout characteristic of this account type is its zero commission policy, making trading more profitable as there are no additional charges for transactions.

RAW: Suited for more significant investments, the RAW account necessitates a higher entry point with a minimum deposit requirement of 2000USD. Traders with this account enjoy zero pips spread, optimizing potential profitability. However, a commission of 3.50USD is charged for transactions, which should be factored into the trading strategy.

US Cent Account: This account caters to those looking to start with a smaller investment. It necessitates a minimum deposit of just 1USC (US Cent). Similar to the Standard Account, it offers a spread of 0.2 pipsand charges zero commission, making it an excellent choice for those new to trading or on a budget.

| Account Type | Minimum Deposit | Spread | Commission | Suitable For |

| Standard | 1 USD | 0.2 pips | Zero | All traders, especially beginners |

| RAW | 2000 USD | Zero pips | 3.50 USD | Traders with larger investments seeking low spread |

| US Cent Account | 1 USC (US Cent) | 0.2 pips | Zero | New traders or those on a budget |

CDEX Fees

CDEX offers three account types with varying spreads and commission structures.

The Standard and US Cent Account both feature a spread of 0.2 pips with zero commission, while the RAW account offers zero pips spread but charges a commission of 3.50 USD per transaction.

Trading Platforms

CDEX exclusively utilizes the MetaTrader 5 (MT5) trading platform across all its account types. MetaTrader 5 (MT5) is a mobile trading application that allows traders to connect to trading servers and control their trading operations using any Android based smartphone or tablet device.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Mobile and Desktop(Windows & macOS) | Experienced Trader |

| MT4 | ❌ | Mobile and Desktop(Windows & macOS) | Beginner |

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now