Score

TAIHONG FOREX

China|1-2 years|

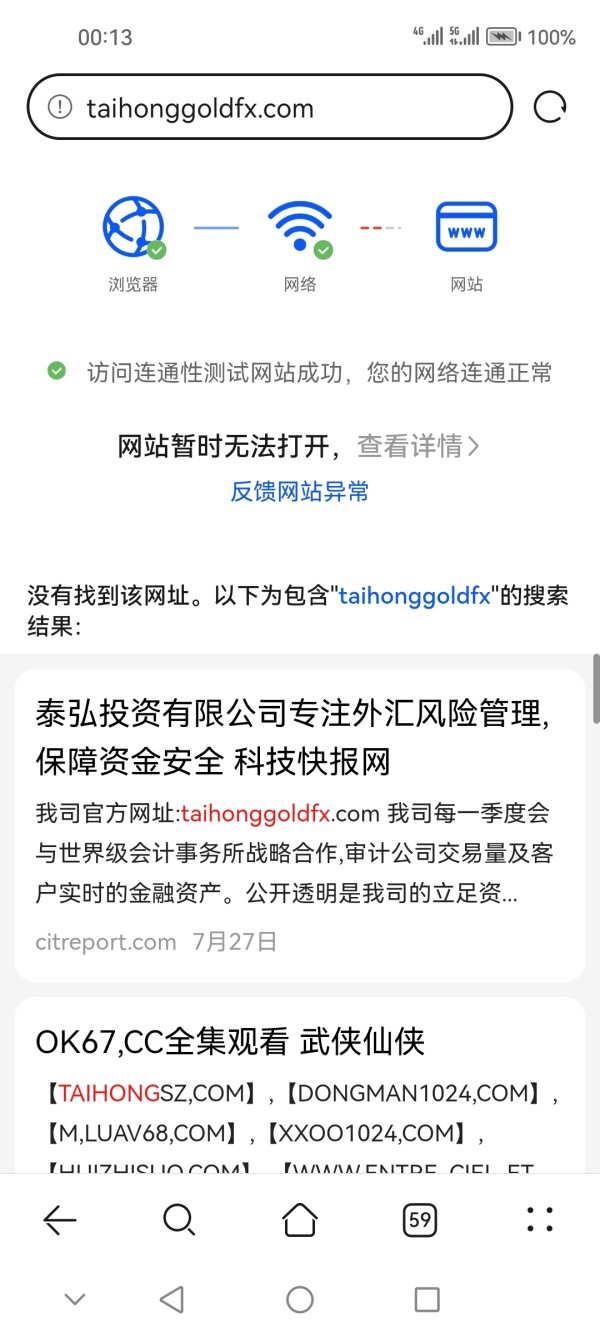

China|1-2 years| https://taihonggoldfx.com/eng/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed TAIHONG FOREX also viewed..

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

taihonggoldfx.com

Server Location

Singapore

Website Domain Name

taihonggoldfx.com

Server IP

27.124.41.238

Company Summary

| Aspect | Information |

| Company Name | TAIHONG FOREX |

| Registered Country/Area | China |

| Founded Year | 2021 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Spreads | low as 0 pips |

| Trading Platforms | MT4,MT5 |

| Tradable Assets | Forex,commodities |

| Account Types | personal account |

| Demo Account | Available |

| Customer Support | Phone, email |

| Deposit & Withdrawal | Debit card,bank transfer |

Overview of TAIHONG FOREX

TAIHONG FOREX, founded in 2021 and registered in China, is a financial trading platform that specializes in providing opportunities for trading Forex and commodities. Despite being unregulated, it seeks to attract traders with a relatively low minimum deposit set at 500 yuan and competitive spreads that can go as low as 0 pips.

The platform operates using the widely recognized MetaTrader 4 (MT4) trading platform, offering a singular personal account type for traders, though a demo account is available for those looking to practice their trading strategies without financial risk. Ensuring a level of convenience in managing finances, TAIHONG FOREX facilitates deposit and withdrawal processes through debit cards and bank transfers, and it also provides customer support via phone and email to assist users in their trading journey.

Nonetheless, potential clients should approach with caution due to the lack of regulatory oversight.

Is TAIHONG FOREX Legit or a Scam?

TAIHONG FOREX is unregulated.The lack of regulation for TAIHONG FOREX can be seen as a red flag in the financial trading industry, where regulation plays a pivotal role in ensuring transparency, reliability, and secure management of client funds.

The unregulated status implies that TAIHONG FOREX is not bound by specific regulatory standards or jurisdictions, potentially escalating the risk for users in the event of disputes or financial inconsistencies.

Therefore, traders contemplating utilizing TAIHONG FOREX should approach with vigilance and thoroughly assess the platform before deciding to invest, keeping in mind the elevated risk and the potential for loss without clear pathways for dispute resolution or recovery of funds.

Pros and Cons

Pros

Variety of MSG Assets:SCG provides a selection of tradable assets, such as Forex and commodities, offering traders multiple options and the ability to diversify their investment portfolio.

Accessible Trading Platform:Utilizing the MT4 trading platform, which is popular and well-regarded in the trading community, SCG enables its users to navigate a familiar and globally-accepted trading environment.

Low Minimum Deposit: With a low entry threshold of $100(500 yuan), SCG makes trading accessible to a wide range of investors, including those who prefer to start with a smaller investment.

Demo Account Availability:The availability of a demo account allows users to familiarize themselves with the platform and test trading strategies without risking real capital.

Various Payment Options:Offering multiple deposit and withdrawal options like debit card, credit card, and bank transfer, SCG provides flexibility and convenience in managing transactions.

Cons

Lack of Regulation:Currently unregulated, SCG does not offer the level of investor protection and adherence to certain operational standards that are typically provided by regulatory bodies.

Limited Account Types:Offering only personal accounts may limit the options for different kinds of traders, such as institutional investors or those looking for varying trading conditions and benefits.

Potential for Variable Spreads: With spreads ranging from 0.5% to 2%, traders might encounter fluctuating trading costs which can impact profitability, especially for those who engage in high-frequency trading.

Limited Information:The absence of comprehensive details about the companys trading conditions, policies, and operational aspects may make thorough assessment and decision-making challenging for potential clients.

Customer Support Channels: While SCG provides customer support via phone and email, the absence of live chat or 24/7 support might limit immediate assistance and could be a drawback for traders operating in different time zones or requiring instant help.

| pros | Cons |

| Variety of MSG Assets | Lack of Regulation |

| Accessible Trading Platform | Limited Account Types |

| Low Minimum Deposit | Potential for Variable Spreads |

| Demo Account Availability | Limited Information |

| Various Payment Options | Customer Support Channels |

Market Instruments

TAIHONG FOREX allows traders to engage with a selection of market instruments across various asset classes. Below is an overview of the market instruments accessible on the platform:

Forex (Foreign Exchange):

Major Pairs: Involves trading the world's most heavily traded currencies, typically paired with the US Dollar, like EUR/USD, GBP/USD, and USD/JPY.

Minor Pairs: Currency pairs that don't involve the US Dollar, such as EUR/AUD, GBP/JPY, etc.

Exotic Pairs: Involves one major currency paired with the currency of an emerging economy, e.g., USD/TRY, EUR/ZAR.

Commodities:

Precious Metals: Such as Gold, Silver, and possibly others, which are typically viewed as safe-haven assets.

Energy Commodities: Like Crude Oil and Natural Gas, which can be influenced by geopolitical and environmental factors.

Agricultural Commodities: Such as Wheat, Coffee, or Cotton, often impacted by weather conditions and global economic health.

These market instruments allow traders to potentially capitalize on market movements and offer diversification opportunities across different asset classes. Both Forex and commodities trading come with their own sets of risks and opportunities, thus, traders should be well-versed with the market dynamics, global economic indicators, and trading strategies pertinent to each instrument to navigate the market effectively. Additionally, considering that TAIHONG FOREX is unregulated, potential investors should approach with caution and be fully aware of the associated risks.

Account Types

TAIHONG FOREX promotes its Personal Account type, establishing a modest entrance to the trading world with a minimum deposit set at $100. Catering to traders across a spectrum of financial standings and experience levels, this account type grants access to a curated selection of market instruments, including Forex and commodities.

Utilizing the renowned MT4 trading platform, traders are afforded the comfort of maneuvering through diverse market conditions with a reliable and intuitively designed interface. While TAIHONG FOREX provides customer support via phone and email to guide users and resolve any arising queries, it‘s pivotal for prospective traders to be cognizant of the platform’s unregulated status.

This situation underscores the vital importance of thorough evaluation and prudent trading practices when interacting with TAIHONG FOREX‘s offerings, ensuring that traders’ actions are aligned with their individual risk appetite and investment goals.

How to Open an Account?

Heres a generalized 5-step guide in TAIHONG FOREX:

Visit the Website and Register:Navigate to TAIHONG FOREX's official website, find the “Sign Up” or “Open Account” button, typically located on the homepage, and provide the required personal details like name, email, and possibly a password during the initial registration process.

Verify Your Identity:Submit verification documents to adhere to potential Know Your Customer (KYC) protocols. This usually includes providing a government-issued ID and a document verifying your address, such as a recent utility bill.

Fund Your Account:Access the “Deposit” section in your newly created account. Choose a preferred payment method, ensuring you meet the minimum deposit requirement of $100, and follow the steps to add funds to your account.

Set Up Your Trading Platform:Choose between MT4 and MT5 trading platforms and establish your trading environment by downloading the necessary software or utilizing a web-based version, preparing your space for active trading.

Start Trading:Navigate through the trading platform to select your desired market instruments and initiate trading by executing buy or sell orders based on your analysis and trading strategy.

Spreads & Commissions

The overview of spreads and commissions for TAIHONG FOREX is as follows:

Spreads:

Low Spreads: TAIHONG FOREX boasts of providing low spreads, with figures going as low as 0 pips. This essentially means that under certain market conditions, the difference between the bid and ask price of a trading instrument can be extremely minimal, potentially facilitating cost-effective trading.

Commissions:

Theres no explicit commisions regarding the commission structure adopted by TAIHONG FOREX. Often, trading platforms could utilize a spread-only model, where the costs are embedded within the spread itself, or a commission per trade model, which might be applied alongside the spreads. Additionally, there might be variations in cost-structures for different tradable assets, or account types, if applicable, which traders should be mindful of.

Prospective traders are advised to delve into TAIHONG FOREXs terms and conditions during the course of trading.

Trading Platform

TAIHONG FOREX provides its traders with two prominent trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface, robust technical analysis tools, and automated trading capabilities via Expert Advisors.

Conversely, MT5 brings advanced functionalities, an expanded asset range, and improved charting tools to the table, along with enhanced strategic options through hedging capabilities.

Both platforms ensure accessibility across various devices and operating systems, offering traders flexibility and a range of tools to navigate financial markets.

When engaging with these platforms on TAIHONG FOREX, considering the broker's unregulated status and understanding the platforms functionalities through a demo account is crucial before venturing into live trading.

Deposit & Withdrawal

TAIHONG FOREX sets a minimum deposit requirement of $100, thereby creating a fairly accessible entry point for individuals aspiring to explore its trading offerings. Recognizing the fundamental channels for financial transactions, including debit cards and bank transfers, the finer details regarding TAIHONG FOREXs deposit and withdrawal methods and policies are not explicitly provided in the shared information.

Critically missing are insights into key aspects like transaction processing times, applicable fees, and possibly other alternative transaction methodologies. Ensuring efficient and transparent handling of financial transactions, particularly deposits and withdrawals, is vital in fostering a seamless and hassle-free trading experience, safeguarding traders from unexpected hurdles or complexities.

Therefore, potential traders eyeing TAIHONG FOREX should meticulously scrutinize the platform‘s financial transaction policies, potentially by examining their official platform thoroughly or engaging directly with their customer support, while acutely bearing in mind the platform’s unregulated status during their assessments and risk evaluations.

Customer Support

TAIHONG FOREX Limited, operating without a disclosed regulatory status, maintains a level of accessibility for existing and potential clients through a specified customer service email address: info@dlm505.com.

The companys website, available at https://taihonggoldfx.com/eng/, could serve as a primary source of information regarding its services and offerings.

While the designated email provides a direct line to the companys customer support, traders and interested parties should approach with due diligence,ensuring that they navigate through any engagements with caution and an informed perspective.

Conclusion

TAIHONG FOREX Limited presents itself as a trading platform, offering services via the widely-used MT4 platform with a minimum deposit requirement of $100 and low spreads. However, the discernible absence of regulatory oversight and limited transparency in several operational facets, especially in customer support and communication channels, necessitate that potential traders approach with heightened caution and conduct comprehensive due diligence to navigate through interactions and trading engagements safely and prudently.

FAQs

Q: Is TAIHONG FOREX regulated?

A: No, TAIHONG FOREX operates without regulatory oversight, according to the information provided.

Q: Which trading platform does TAIHONG FOREX utilize?

A: TAIHONG FOREX employs the MetaTrader 4 (MT4) trading platform for its users.

Q: What are the available financial instruments to trade on TAIHONG FOREX?

A: Traders can engage in trading Forex and commodities through TAIHONG FOREXs platform.

Q: How can I contact TAIHONG FOREX's customer support?

A: You can reach TAIHONG FOREX's customer support through email at info@dlm505.com. Also, you can use the chat directly in https://taihonggoldfx.com/eng/.

Q: Does TAIHONG FOREX provide a demo account for practice trading?

A: Yes, it offers a demo account.Users could make a visit to the official website or a query to customer support for more insights.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 14

Content you want to comment

Please enter...

Review 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

lalala340

Hong Kong

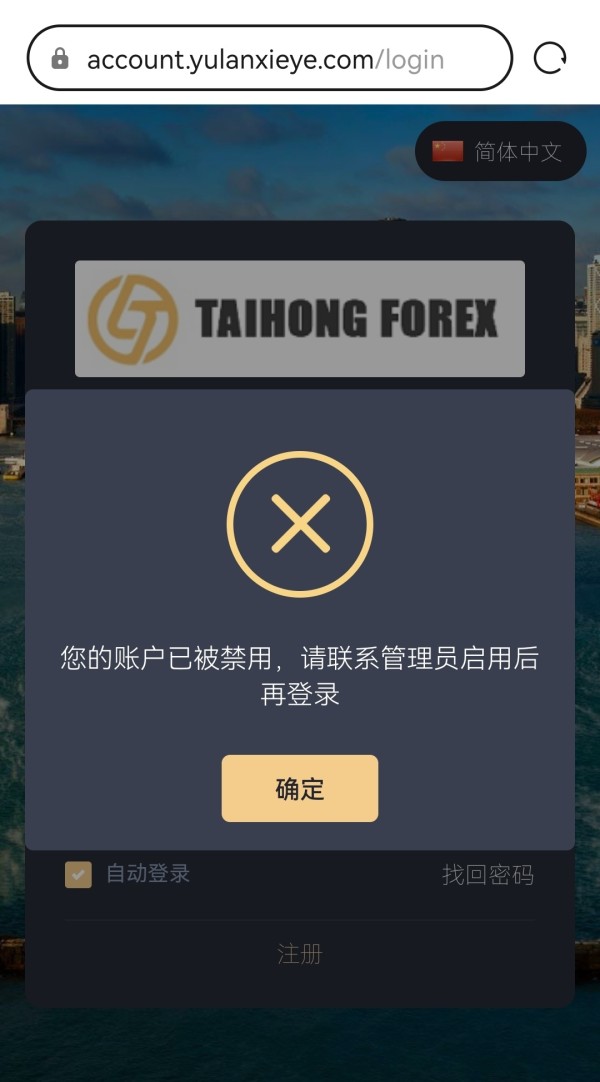

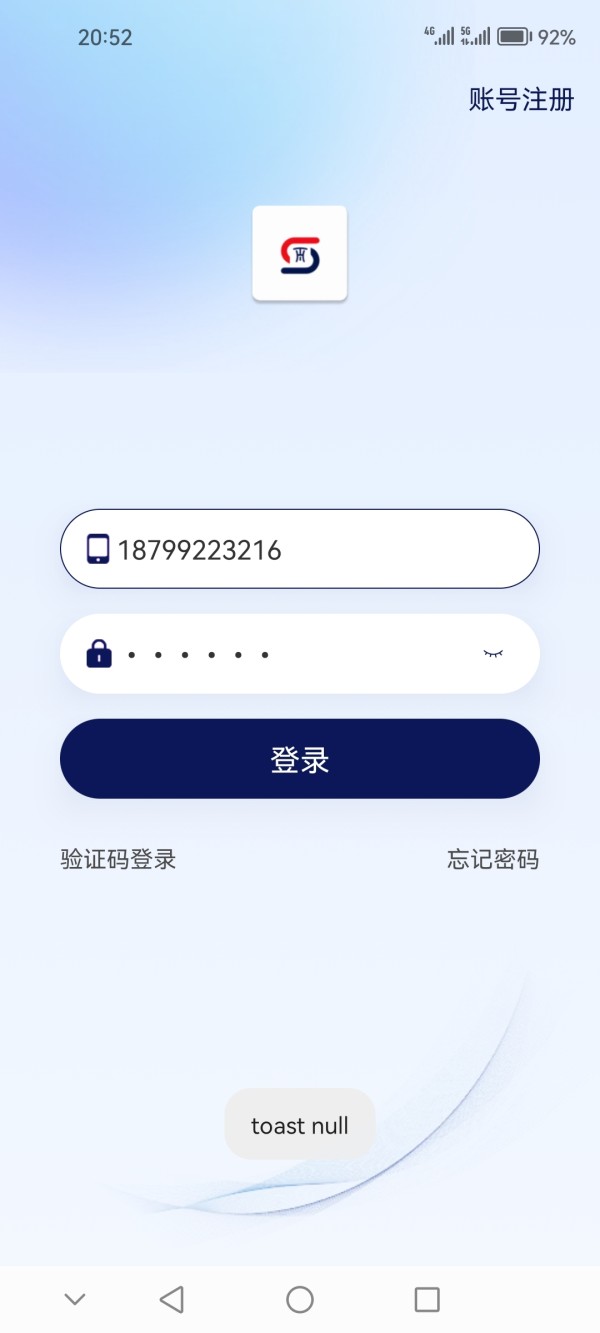

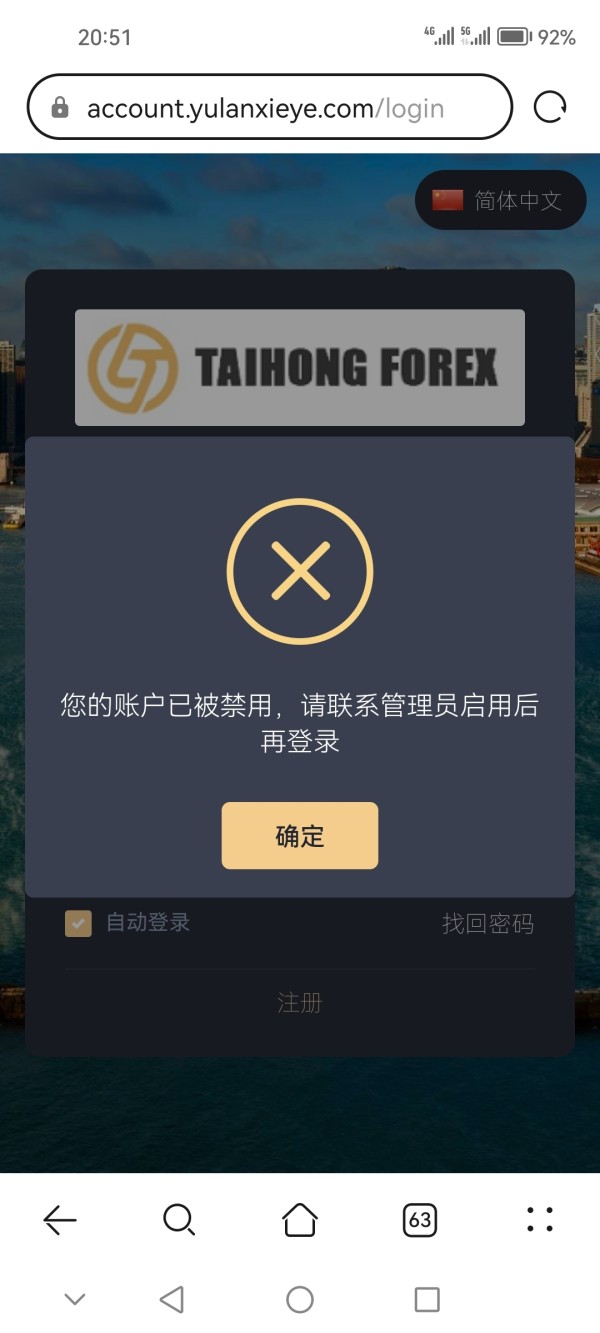

The platform ran away last night, and now the rest should be those of us who have been deceived. This platform asked beautiful lady to add you as friend, gain trust, and urge you to keep adding positions! Everyone should pay attention! ! !

Exposure

2023-09-15

蓝沙

Hong Kong

The company login interface account has been blocked! The company's official website is down, the server you rented is in Hong Kong, and the people in charge of marketing are just cannon fodder! It’s optional, it’s best not to go to Hong Kong! Are all the people in this group here just to be trusted? Or maybe I, a country bumpkin, don’t deserve to trade on this platform!

Exposure

2023-09-19

嘻嘻482

Hong Kong

I should have sent a message then! Maybe I am short-sighted. But this is too much!

Exposure

2023-09-14

天堂猎鹰

Hong Kong

The platform has probably run away with money, and now I can’t log in to my account.

Exposure

2023-09-14

嘻嘻482

Hong Kong

More than 3,000 US dollars cannot be withdrawn, it is an unscrupulous platform, be careful not to be deceived. All the people of the opposite sex who add you and play with you are scams, regardless of any reason! ! ! Does it apply to both men and women? The end result is the same as mine. I canceled your complaint, but you actually blocked my account!

Exposure

2023-09-15

防不胜防

Hong Kong

The supervision number is fake, the software interface is poor, and the software is deliberately lagging. Then it will compensate you unconditionally, and launch various recharge activity bonuses, and the recharge exchange rates are different. A lady will add you as a friend, get close to you, recommend a teacher to take orders. A sitter sends out large red pockets in the chat group, and provides various screenshots of making money, step by step to induce people to copy orders and add positions!

Exposure

2023-09-14

嘻嘻482

Hong Kong

Do all forex platforms need to recharge before withdrawing? What is the exchange rate on the regular platform for US dollars on the day? Is that so?

Exposure

2023-09-13

嘻嘻482

Hong Kong

There are millions of people on the Internet, half of them are scammers. Unable to withdraw money, let you continue to recharge. The platform probably wants to run away! ! ! Beware of being deceived! Suitable for both men and women! It cheated people through making friends.

Exposure

2023-09-15

蓝沙

Hong Kong

Exactly the same model, exactly the same deception. It can’t be the so called risk control, this reason is more likely to a scam.

Exposure

2023-09-11

3199325282

Hong Kong

I was just seduced by beauty. This lady pretended to be in love with you, then asked you to take lessons, register on the platform and transfer money, and kept urging you to add your position.

Exposure

2023-09-11

老翁

Hong Kong

HYTP5 is fake. Without supervision and not allowing withdrawals, it is suspected of fraud and illegal fund-raising.

Exposure

2023-09-11

930515435 来了 qq

Hong Kong

Unable to withdraw funds. Scam platform. A so-called "restore fee" needs to be paid. Don't believe it, everyone.

Exposure

2023-09-11

天堂猎鹰

Hong Kong

Unable to withdraw money, customer service said that you need to continue depositing money to restore the account credit.

Exposure

2023-09-11

心动 ing

Hong Kong

Can the platform cancel the customer service account without permission? Without any prior notice?

Exposure

2023-08-30