Score

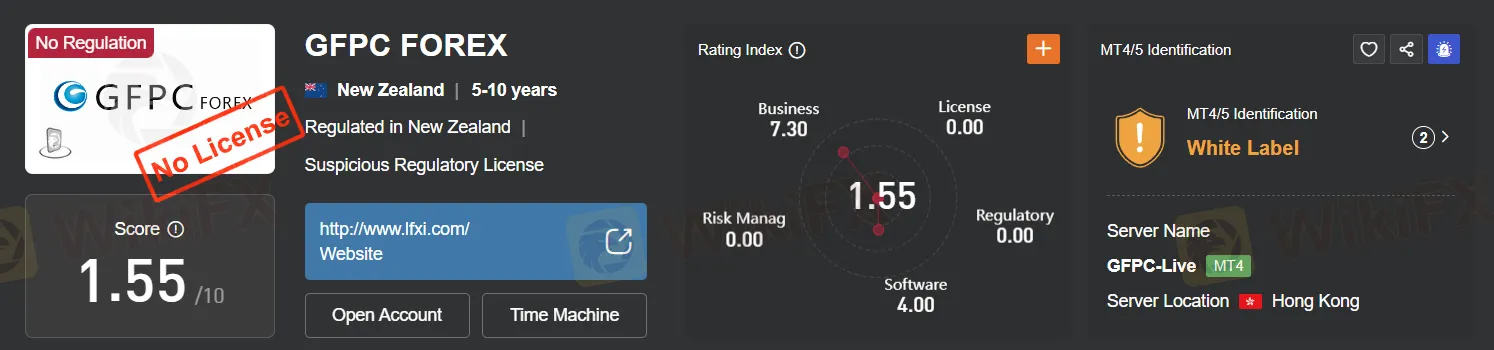

GFPC FOREX

New Zealand|5-10 years|

New Zealand|5-10 years| http://www.lfxi.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:GFPC LIMITED

License No.:432946

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

New Zealand

New ZealandA Visit to GFPC FOREX in New Zealand-Unfound

It was confirmed after the surveyor’s inspection that the real address of GFPC FOREX in New Zealand was different from its regulation address. Since the broker’s financial service company license (RN:432946) issued by FSPR has been cancelled.

New Zealand

New ZealandA Visit to GFPC FOREX in New Zealand-Unfound

It was confirmed after the surveyor’s inspection that the real address of GFPC FOREX in New Zealand was different from its regulation address. Since the broker’s financial service company license (RN:432946) issued by FSPR has been cancelled.

New Zealand

New ZealandUsers who viewed GFPC FOREX also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

BlackBull

- 5-10 years |

- Regulated in New Zealand |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

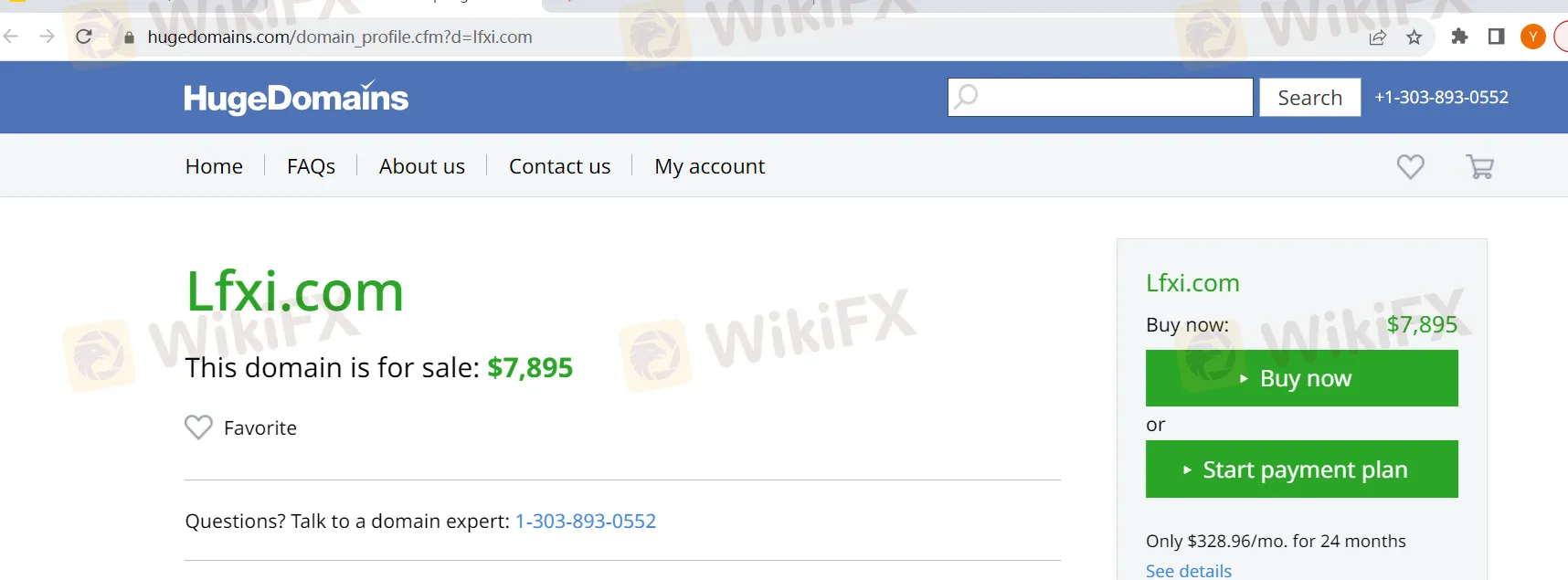

lfxi.com

Server Location

United States

Website Domain Name

lfxi.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

104.37.245.142

Company Summary

| Aspect | Information |

| Registered Country/Area | New Zealand |

| Founded Year | 2017 |

| Company Name | GFPC FOREX |

| Regulation | Lacks valid regulation, New Zealand FSPR license revoked |

| Minimum Deposit | $500 (Basic Account) |

| Maximum Leverage | Up to 1:500 |

| Spreads | Basic Account: Fixed 2 pips on major currency pairs; Variable starting from 1.5 pips on major pairs; Advanced Account: Variable starting from 0.5 pips on major pairs;VIP Account: Ultra-low starting from 0.1 pips on major pairs; |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Primarily Forex instruments |

| Account Types | Basic, Advanced, VIP |

| Customer Support | Limited contact options with a single phone line for Chinese (Simplified) customers and an email address (service-1@igfp.com) |

| Payment Methods | Bank wire, credit card |

| Educational Tools | Lack of educational resources |

| Website Status | Reported issues with a dysfunctional website, domain sale |

| Reputation (Scam or Not) | Clear indications of regulatory issues and potential scams, negative reviews, and lack of valid regulation |

Overview

GFPC FOREX, headquartered in New Zealand and founded in 2017, operates in a regulatory gray area, lacking valid regulation with its New Zealand FSPR license revoked. This raises significant concerns about its legitimacy and trustworthiness. The broker's minimum deposit of $500 for the Basic Account may seem accessible, but traders should proceed with caution given the clear indications of regulatory issues and potential scams. The maximum leverage of up to 1:500, while offering potential for high returns, also comes with elevated risk levels that could lead to substantial losses. The spread options vary, but even the “ultra-low” spreads in the VIP Account may not compensate for the regulatory uncertainties.

Traders are left with limited contact options, including just a single phone line for Chinese (Simplified) customers and an unimpressive email address (service-1@igfp.com) for customer support. Moreover, the absence of educational resources further disadvantages traders, hindering their ability to make informed decisions. Reports of a dysfunctional website and a domain sale add to the concerns surrounding GFPC FOREX, making it a brokerage option that traders should approach with extreme caution, if at all. The negative reviews, coupled with the lack of valid regulation, cast a shadow of doubt over the broker's credibility and reputation in the trading community.

Regulation

The regulation status of GFPC FOREX is problematic and risky. They lack valid regulation, have received negative reviews, and their New Zealand FSPR license has been revoked. They also appear to operate beyond their regulated business scope. Traders and investors should exercise extreme caution when dealing with this broker, as there are clear indications of regulatory issues and potential scams. It is advisable to avoid doing business with them.

Pros and Cons

| Pros | Cons |

| Offers Forex trading instruments. | Lack of valid regulation raises concerns. |

| Multiple account types for diverse needs. | Limited information about other trading instruments. |

| Competitive leverage options. | Absence of educational resources hinders traders. |

| Range of spread and commission choices. | Questionable customer support with limited options. |

| User-friendly MT4 trading platform. | Reported issues with a dysfunctional website. |

| Allegations of fraudulent activities and domain sale. | |

| Negative reviews and regulatory issues highlight risks. |

GFPC FOREX presents a concerning profile marked by regulatory issues, limited educational resources, and questionable customer support. While it offers Forex trading and various account types, the absence of valid regulation and reports of fraudulent activities raise significant concerns. The broker's customer support options are limited, and the lack of educational materials can hinder traders' development. Additionally, the reported issues with the website's functionality and domain sale cast doubts on the broker's credibility. Traders are advised to exercise extreme caution when considering GFPC FOREX as a brokerage option and explore alternatives with better-regulated and supportive services.

Market Instruments

GFPC FOREX primarily offers Forex trading instruments. Forex, short for foreign exchange, is the market where currencies are traded. In this market, traders speculate on the exchange rates between different currency pairs. While the information provided does not specifically mention other types of trading instruments offered by GFPC FOREX, it emphasizes the broker's issues related to regulatory status. To create a detailed table about the market instruments offered, we would need additional information about the specific trading instruments beyond Forex that GFPC FOREX provides. If you have more details about the instruments offered, please provide them, and I'll be happy to help create a table for you.

Account Types

GFPC FOREX offers a range of account types to cater to the diverse needs of traders, each designed to provide a different level of service and features. The Basic Account is ideal for novice traders with a minimum initial deposit of $500. It offers leverage of up to 1:100, giving traders the ability to control larger positions with a relatively small capital outlay. Traders can choose between fixed or variable spreads and gain access to major currency pairs like EUR/USD and USD/JPY. Additionally, they benefit from daily market analysis, 24/5 customer support, and access to educational resources such as webinars and eBooks. The Basic Account operates with standard execution, making it a suitable starting point for those new to Forex trading.

For more experienced traders, GFPC FOREX offers the Advanced Account. This account type requires a minimum initial deposit of $5,000 and provides enhanced features. Traders enjoy leverage of up to 1:200 and tight variable spreads. They have access to a broader range of currency pairs, including minor and exotic pairs, offering greater diversification in their trading portfolio. Daily and weekly market analysis keeps them informed, and a dedicated account manager provides personalized support. Advanced trading tools like an economic calendar and trading signals assist in making informed trading decisions. Scalping and hedging are allowed, and traders benefit from priority withdrawals.

The VIP Account is the most exclusive offering from GFPC FOREX, designed for high-net-worth individuals and seasoned traders. To qualify for this account, a minimum initial deposit of $50,000 is required. The VIP Account provides leverage of up to 1:500 and ultra-low spreads, ensuring competitive trading conditions. Traders enjoy access to all currency pairs, allowing for maximum trading flexibility. Personalized trading strategy consultations are available, providing tailored guidance to optimize trading strategies. VIP members receive 24/7 customer support and invitations to exclusive events and seminars. Premium trading tools like auto-trading and algorithmic trading enhance trading capabilities, and there are no requotes. Customized trading conditions are tailored to meet the specific needs of VIP traders.

GFPC FOREX understands that traders have varying levels of experience and capital, and their account types reflect this diversity. These offerings provide a range of choices, from a solid starting point for beginners to comprehensive services for advanced and VIP traders. Each account type comes with its unique features and benefits, making it essential for traders to select the one that aligns with their trading goals and preferences. Transparency and adherence to regulatory requirements are key principles in GFPC FOREX's account offerings.

Leverage

GFPC FOREX offers a maximum trading leverage of up to 1:500. Leverage is a fundamental aspect of Forex trading that allows traders to control a larger position size with a relatively smaller amount of capital. In this case, a leverage of 1:500 means that for every $1 in the trader's account, they can control a position size of up to $500 in the Forex market.

While high leverage can amplify potential profits, it also significantly increases the level of risk. Traders should exercise caution when using high leverage, as it can lead to substantial losses if the market moves against their position. It's important for traders to have a solid risk management strategy in place and to use leverage wisely, taking into account their trading experience, risk tolerance, and overall financial situation. Additionally, regulatory authorities often impose restrictions on leverage to protect traders, so it's crucial to be aware of and comply with these regulations when trading with a broker.

Spreads and Commissions

GFPC FOREX provides a range of spread options across its account types to accommodate traders with varying preferences and experience levels:

Basic Account: Designed for novice traders, the Basic Account offers both fixed and variable spreads. The fixed spread is set at 2 pips on major currency pairs (e.g., EUR/USD, USD/JPY), providing predictability in trading costs. Alternatively, traders can opt for variable spreads starting from 1.5 pips on major currency pairs, offering flexibility in pricing.

Advanced Account: Geared towards more experienced traders, the Advanced Account features tighter variable spreads. These spreads start from just 0.5 pips on major currency pairs, enhancing competitiveness and pricing quality.

VIP Account: Catering to high-net-worth individuals and seasoned traders, the VIP Account provides the tightest spreads in the range. With ultra-low spreads starting from 0.1 pips on major currency pairs, it offers traders exceptional pricing conditions.

Commissions:

Commissions, where applicable, are transparently structured to ensure fair trading costs:

Basic Account: The Basic Account does not entail any additional commissions. This straightforward fee structure is designed to make trading accessible and predictable for novice traders, with no hidden costs.

Advanced Account: Similar to the Basic Account, the Advanced Account does not have extra commissions. Traders can enjoy the benefits of tighter spreads without the complexity of additional fees, ensuring transparency in trading costs.

VIP Account: The VIP Account introduces a modest commission of $5 per lot traded (round trip). This commission is applied to offset the cost of the ultra-low spreads offered, maintaining a reasonable and competitive fee structure for high-net-worth and experienced traders.

In summary, GFPC FOREX's spread and commission structures are thoughtfully designed to cater to traders at different experience levels and trading preferences. The variety of spread options ensures that traders can choose pricing conditions that align with their specific needs, while transparent commission structures enhance clarity and trust in the trading environment. These pricing arrangements are developed in accordance with regulatory requirements to provide a secure and compliant trading experience for all clients.

Deposit & Withdrawal

Bank Wire:

Deposit:

Access GFPC FOREX banking details.

Initiate wire transfer from the bank.

Retain transaction receipt.

GFPC FOREX credits the trading account.

Withdrawal:

Submit withdrawal request.

GFPC FOREX processes the request.

Receive confirmation and funds in the bank account.

Credit Card:

Deposit:

Log in to the trading account.

Select credit card as the payment method.

Enter card details and deposit amount.

Receive instant credit to the trading account.

Withdrawal:

Request a withdrawal.

GFPC FOREX processes the withdrawal.

Funds are refunded to the credit card.

Receive confirmation and funds become available on the credit card.

Please note that processing times may vary and are subject to the broker's policies and regulatory requirements. Traders should refer to GFPC FOREX's specific guidelines for detailed information.

Trading Platforms

GFPC FOREX's MetaTrader 4 (MT4) platform is known for its user-friendly interface and versatility. Traders can access advanced charting tools with various timeframes and chart types, enhancing their technical analysis capabilities. The platform is customizable, allowing traders to tailor it to their preferences. With a wide range of technical indicators available, GFPC FOREX's MT4 is suitable for traders of all levels, from beginners to experienced professionals. Its intuitive design and powerful features make it a popular choice in the Forex and financial markets.

Customer Support

GFPC FOREX's customer support leaves much to be desired. While they provide a contact number for Chinese (Simplified) customers, the limited availability of a single phone line may lead to frustrating wait times and difficulty in reaching a representative. Additionally, relying solely on email as an alternative contact method can be problematic, as it lacks the immediacy of live support channels such as chat or phone. The provided email address, service-1@igfp.com, also lacks personalization and may not inspire confidence in customers seeking prompt assistance. Overall, the customer support options offered by GFPC FOREX appear to be lacking in terms of responsiveness and accessibility, which could potentially lead to frustration for traders in need of assistance.

Educational Resources

GFPC FOREX's lack of educational resources is a significant drawback for traders. Without access to educational materials such as webinars, tutorials, or educational content, customers are left at a disadvantage when it comes to improving their trading skills and understanding the financial markets. This absence of educational support can hinder traders' ability to make informed decisions and potentially lead to suboptimal trading outcomes. A brokerage that fails to provide educational resources may not adequately support its clients in their trading journey, and traders should carefully consider this when choosing a broker.

Summary

GFPC FOREX presents a concerning profile marked by regulatory issues, a limited array of market instruments, and a questionable customer support system. The absence of educational resources further compounds the problem, leaving traders ill-equipped to navigate the complex world of Forex trading. The platform's regulatory status is notably problematic, lacking valid regulation and raising concerns of potential scams. Additionally, the absence of an accessible and responsive customer support system, with limited contact options and an uninspiring email address, adds to the overall negative experience. The reported issues of a dysfunctional website, a domain sale, and allegations of fraudulent activities cast significant doubts on the integrity of GFPC FOREX as a broker, cautioning traders to exercise extreme vigilance and consider alternative options.

FAQs

Q1: Is GFPC FOREX a regulated broker?

A1: No, GFPC FOREX lacks valid regulation, and its New Zealand FSPR license has been revoked. Traders should be cautious as this raises concerns about the broker's legitimacy.

Q2: What account types does GFPC FOREX offer?

A2: GFPC FOREX provides Basic, Advanced, and VIP accounts, catering to traders with varying levels of experience and capital. These accounts offer different features and services to meet individual trading needs.

Q3: What is the maximum leverage offered by GFPC FOREX?

A3: GFPC FOREX offers a maximum trading leverage of up to 1:500. However, traders should exercise caution when using high leverage due to increased risk.

Q4: What deposit and withdrawal methods are available?

A4: GFPC FOREX supports bank wire and credit card transactions for deposits and withdrawals. Traders can initiate transfers or use credit cards for transactions.

Q5: Does GFPC FOREX offer educational resources?

A5: No, GFPC FOREX lacks educational resources, which can hinder traders' ability to improve their skills and market understanding. Traders should consider this limitation when choosing the broker.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- New Zealand Financial Service Corporate Revoked

- Suspicious Overrun

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now