Score

CryptoGT

Marshall Islands|2-5 years|

Marshall Islands|2-5 years| https://cryptogt.com/en/website-home

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Japan 5.85

Japan 5.85Contact

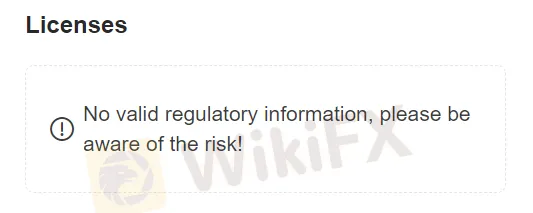

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Marshall Islands

Marshall IslandsAccount Information

Users who viewed CryptoGT also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

cryptogt.com

Server Location

United States

Website Domain Name

cryptogt.com

Server IP

172.67.199.250

Company Summary

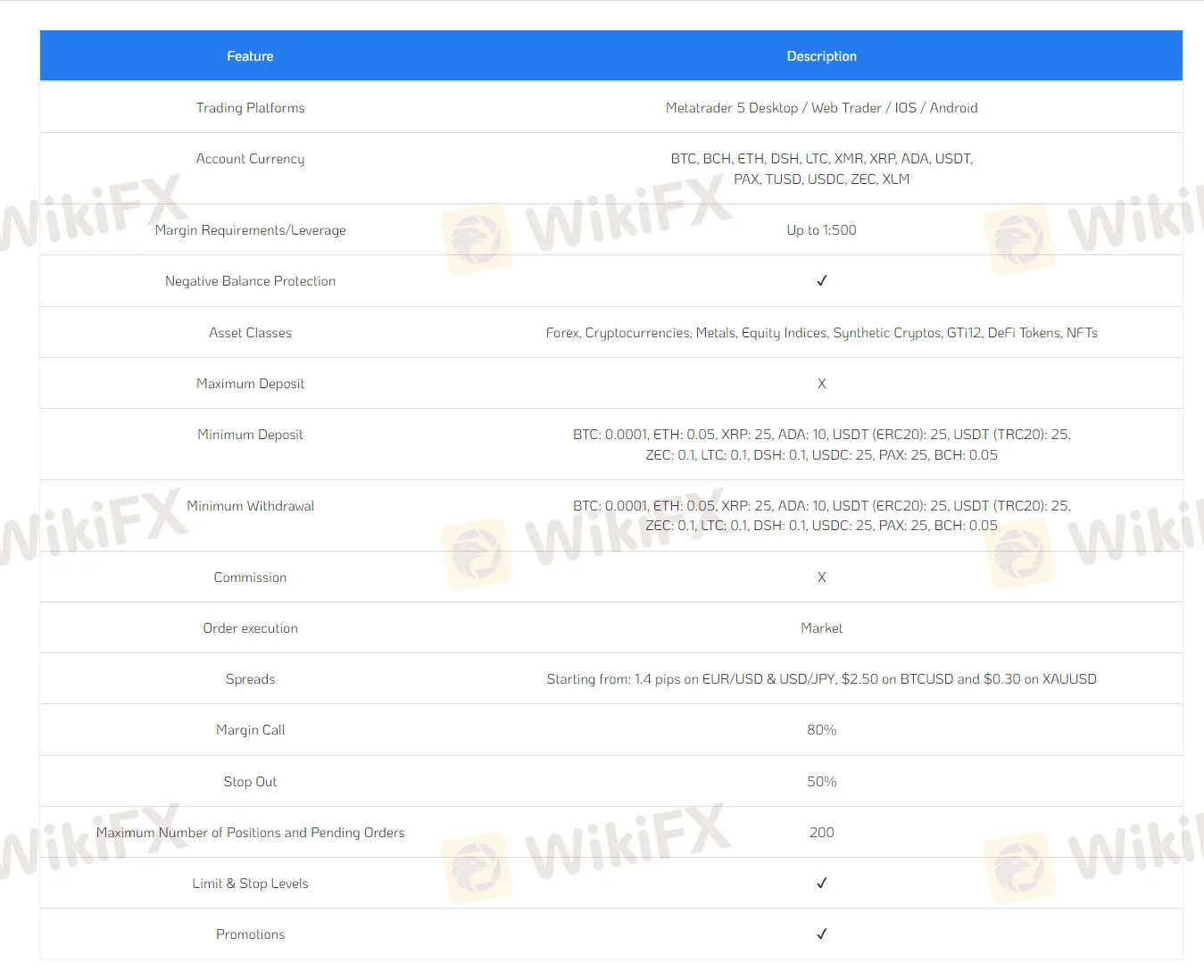

| CryptoGT Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Marshall Islands |

| Regulation | Non-regulated |

| Market Instruments | Forex, Cryptocurrencies, Metals, Equity Indices |

| Levearge | 1:500 |

| EUR/USD Spread | From 1.4 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | 0.0001 for BTC, 0.00105 for ETH, 5 for USDT, 0.0001 for ADA |

| Customer Support | Email: support@cryptogt.com; Live Chat; Contact Form |

What is CryptoGT?

CryptoGT is a trading platform that was launched in 2017 and is registered in the Marshall Islands. The platform allows operations across a range of market instruments including Forex/CFD operations, trading metals, indices, and notably, trading in cryptocurrencies. Unique to CryptoGT is their offering of synthetic pairs, which combines traditional CFD or Forex instruments with cryptocurrency, allowing for a unique trading experience.

Pros & Cons

| Pros | Cons |

|

|

|

Pros

Various Market Instruments: CryptoGT offers a diverse range of trading options that include Forex/CFD operations, trading in metals and indices, and crucially, cryptocurrencies. The unique offering of synthetic pairs combining traditional instruments with cryptocurrency adds an interesting dimension to the trading experience.

Cons

Non-regulated: CryptoGT is a non-regulated platform, with no details of regulatory oversight displayed on their website. This raises significant concerns about the security of funds and compliance with standard trading practices.

Delayed Customer Service Responses: Reports of delayed responses from the customer service team can be disadvantageous for traders who need immediate assistance or have urgent queries. These delays may affect trading decisions and consequently the potential profits for traders.

Is CryptoGT Safe or Scam?

CryptoGT is currently non-regulated, meaning it does not fall under the oversight of any recognized financial regulatory authority. The absence of regulation often raises concerns about the security of investors' funds and the company's compliance with standard trading practices. Despite being registered in the Marshall Islands, there is no publicly available information about CryptoGT's license or regulatory details on their website. Therefore, it is unclear what rules the company is following regarding financial transactions, dispute resolutions, and customer protection. Considering this, potential investors are advised to exercise caution with non-regulated platforms like CryptoGT as such platforms may entail a higher risk compared to those regulated by recognized financial institutions.

However, CryptoGT claims to provide several security measures, these include:

Strict capital ratio: CryptoGT maintains a capital-to-risk weighted exposure ratio of 40%, which is significantly higher than the typical requirement of 12%. This means that CryptoGT has a large amount of capital to back its liabilities, which makes it more financially stable and less likely to fail.

Tier 1 banking: CryptoGT holds its client funds in creditworthy, highly-rated financial institutions. This means that client funds are protected by the strong financial standing of these institutions.

Segregation of funds: CryptoGT keeps client funds segregated from its own funds. This means that client funds are not used to cover CryptoGT's own expenses or liabilities, and remain available to clients at all times.

Risk management: CryptoGT has implemented strong internal policies and procedures to identify and manage risks. This includes setting thresholds for various types of risks, and monitoring these thresholds closely.

Healthy revenue: CryptoGT has a strong standing in the market and is generating healthy revenue. This means that CryptoGT is financially sound and has the resources to invest in security and other areas of its business.

Market Instruments

The platform offers over 50 cryptocurrency pairs to trade along with other assets, providing a wide array of trading options, these include:

Forex Currency Pairs: Traditional forex trading is available, though the specific pairs are not mentioned.

Metals: Traders can take advantage of the typically high volatility of the metals market, which can include assets like gold, silver, and other precious metals.

Indices: Trading on indices allows traders to speculate on the price movements of some of the world's major stock markets.

Cryptocurrencies: A defining feature of CryptoGT, it facilitates trading in various cryptocurrencies, offering increased opportunities to profit from this high growth and volatile asset class.

Synthetic Pairs: CryptoGT offers unique trading pairs where traditional assets are traded against Bitcoin. These synthetic pairs include BTC/XAU (Bitcoin vs Gold), BTC/XAG (Bitcoin vs Silver), BTC/USO (Bitcoin vs Oil), BTC/SPX (Bitcoin vs S&P 500), BTC/FCB (Bitcoin vs Euro), and BTC/TWR. These options provide an opportunity for traders to benefit from the potential price movements in traditional markets relative to Bitcoin.

BTC/USD Trading: CryptoGT also offers trading in the BTC/USD pair with low-margin requirements, which means traders can take larger positions with a relatively smaller capital base.

Accounts

CryptoGT offers only one type of account, the Standard account. This account is available to both beginner and experienced traders, and offers a variety of features, including:

Access to a wide range of asset classes (See Market Instruments)

Competitive spreads and commissions

Negative balance protection

Access to the MetaTrader 5 trading platform

A variety of promotional offers

Minimum Deposit

CryptoGT has set minimum thresholds for deposits in various cryptocurrencies, making it accessible for users to participate using different digital currencies:

Bitcoin (BTC): The minimum deposit threshold is set at 0.0001 BTC.

Ethereum (ETH): For Ethereum, the minimum deposit is slightly higher at 0.00105 ETH.

Tether (USDT): For users preferring the stablecoin Tether, the threshold is set at 5 USDT.

Cardano (ADA): The Cardano minimum deposit is kept very low at 0.0001 ADA.

Leverage

CryptoGT offers a high leverage rate of up to 500x, which is relatively high compared to many other trading platforms. This level of leverage implies that traders have the potential to multiply their trading position by 500 times the amount of their original investment. For instance, a small deposit of 200 with a leverage of 500x could allow a trader to take control of positions worth up to 100,000 ($200 x 500).

However, it's vital to highlight that while trading on leverage can significantly amplify gains, it can also amplify losses. Leveraged trading essentially involves borrowing capital to open larger positions, which means potential losses can exceed the initial deposit. As such, traders should use leveraged trading judiciously and understand the risk it poses before engaging with it.

Spreads

CryptoGT caters to its users by offering some of the lowest spreads in the market. Spreads begin from as low as 1.4 pips for major Forex pairs such as EUR/USD and USD/JPY. For those interested in trading cryptocurrencies and commodities, the platform features very competitive spreads: $15 on Bitcoin (BTCUSD) and on gold (XAUUSD). This low-spread strategy could potentially help traders maximize their profits.

Trading Platforms

CryptoGT utilizes the popular MetaTrader 5 (MT5) trading platform, known for its advanced features, flexibility, and user-friendly interface. It supports a wide range of financial instruments and is especially noted for its support for cryptocurrencies, making it a fitting choice for CryptoGT.

One of the core strengths of MT5 is its customizability. Traders can personalize the platform to suit their trading preferences and strategies, setting up custom alerts, creating advanced charting setups, and more.

Moreover, MT5 supports multiple types of trading orders, which can help traders better manage their risk and maximize possible profits from each trade. These advanced order types can cater to a variety of trading strategies and help in effectively responding to market volatility.

Furthermore, MT5 is available across multiple platforms to ensure accessibility and convenience. Traders can use its desktop application for comprehensive features on Windows PCs, its web application for trading within a browser without any downloads, and its mobile applications (for both iOS and Android devices) for trading on the go.

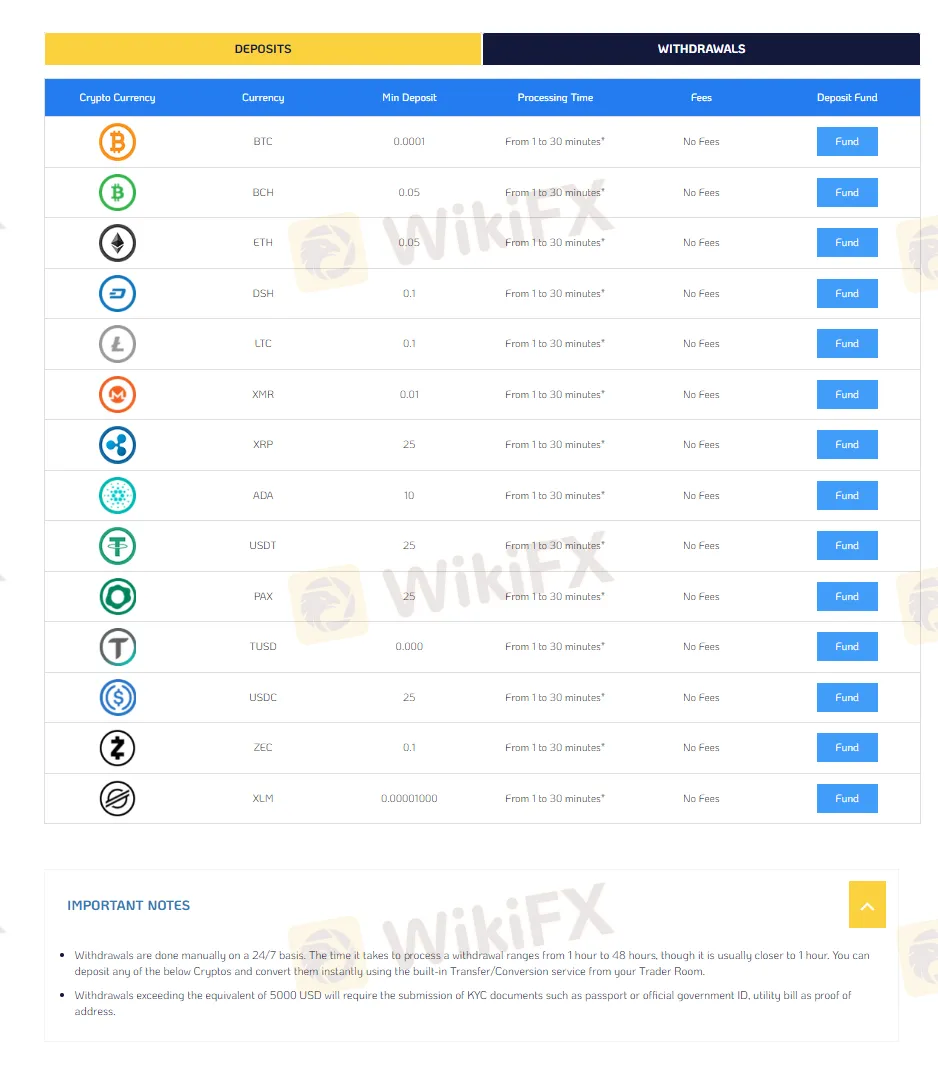

Deposit & Withdrawal

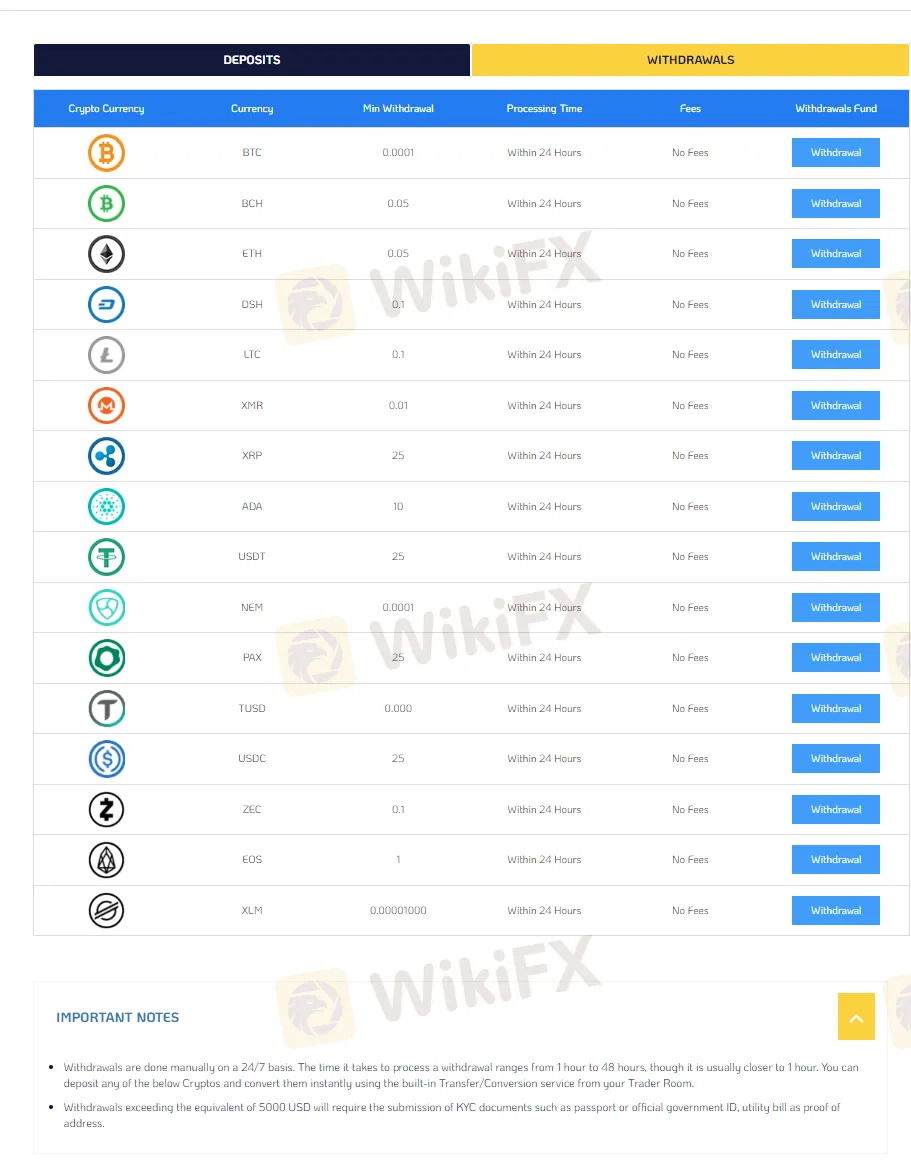

| Crypto Currency | Minimum Deposit | Deposit Processing Time | Deposit Fees | Minimum Withdrawal | Withdrawal Processing Time | Withdrawal Fees |

| BTC | 0.0001 | 1 to 30 Minutes | No Fees | 0.0001 | Within 24 Hours | No Fees |

| BCH | 0.05 | 0.05 | ||||

| ETH | ||||||

| DSH | 0.1 | 0.1 | ||||

| LTC | ||||||

| XMR | 0.01 | 0.01 | ||||

| XRP | 25 | 25 | ||||

| ADA | 10 | 10 | ||||

| USDT | 25 | 25 | ||||

| PAX | ||||||

| TUSD | 0 | 0 | ||||

| USDC | 25 | 25 | ||||

| ZEC | 0.1 | 0.1 | ||||

| XLM | 0.00001 | 0.00001 | ||||

| NEM | 0.0001 | Within 24 Hours | ||||

| EOS | 1 | |||||

Deposit and withdrawal information for cryptocurrencies varies depending on the cryptocurrency exchange or platform you are using, but there are some general trends.

Deposits typically have a minimum deposit amount, which varies by cryptocurrency. The deposit processing time also varies by cryptocurrency, but is typically within 30 minutes. There are usually no deposit fees.

Withdrawals also have a minimum withdrawal amount, which varies by cryptocurrency. The withdrawal processing time can range from 1 to 48 hours, but is typically closer to 1 hour. There are usually no withdrawal fees.

Important notes:

Withdrawals are typically processed manually on a 24/7 basis.

Withdrawals exceeding the equivalent of 5,000 USD will usually require the submission of KYC documents.

Inactive Fees

CryptoGT applies an inactivity fee to accounts that have been dormant or inactive for a period of one month. The inactivity fee amounts to $10. This means if you register an account with CryptoGT and do not perform any trading activity for a month, a fee will be deducted from your account balance. This practice is common among many brokers and trading platforms as a way to encourage regular trading activity. Therefore, it is advisable for users to ensure they are regularly using their accounts if they wish to avoid this fee. However, users should also consider the financial risk associated with continuous trading activity. It may be more beneficial to accept the inactivity fee rather than engage in unprofitable trades to avoid it.

Conclusion

CryptoGT is a cryptocurrency-focused trading platform, offering a range of market instruments like Forex currency pairs, metals, indices, and cryptocurrencies. With features like using MetaTrader 5 as its trading platform, offering high leverage up to 500x, and claiming to offer low spreads, it does bring several compelling advantages to the table. However, with its non-regulated status and reported concerns about customer support, it also carries associated risks. It's essential that traders meticulously weigh these pros and cons, and conduct due diligence before deciding to trade on CryptoGT.

Frequently Asked Questions (FAQs)

Q: Is CryptoGT regulated?

A: No, CryptoGT is a non-regulated platform. This status raises potential concerns about the security of investors' funds and the company's compliance with standard trading practices.

Q: What are the minimum deposits for different cryptocurrencies on CryptoGT?

A: The minimum deposit for Bitcoin is 0.0001 BTC, Ethereum is 0.00105 ETH, Tether is at the 5 USDT level, and for Cardano it's 0.0001 ADA.

Q: How can I deposit and withdraw on CryptoGT?

A: CryptoGT operates only with cryptocurrencies. Deposits and withdrawals can generally be managed via the user's account portal.

Q: What trading platform does CryptoGT use?

A: CryptoGT uses the MetaTrader 5 platform. It's customizable, supports numerous types of trading orders, and also has a desktop and mobile app.

Q: What's the maximum leverage allowed on CryptoGT?

A: CryptoGT provides a high leverage rate of up to 500x.

Q: Are there any fees for inactive accounts on CryptoGT?

A: Yes, CryptoGT charges an inactivity fee of $10 if no trading activity has occurred in an account for a period of one month.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now