Score

Primus

United States|2-5 years|

United States|2-5 years| https://primusltd.net/en/index.php

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 (0)20 7170 8200

Other ways of contact

Broker Information

More

Primus LTD

Primus

United States

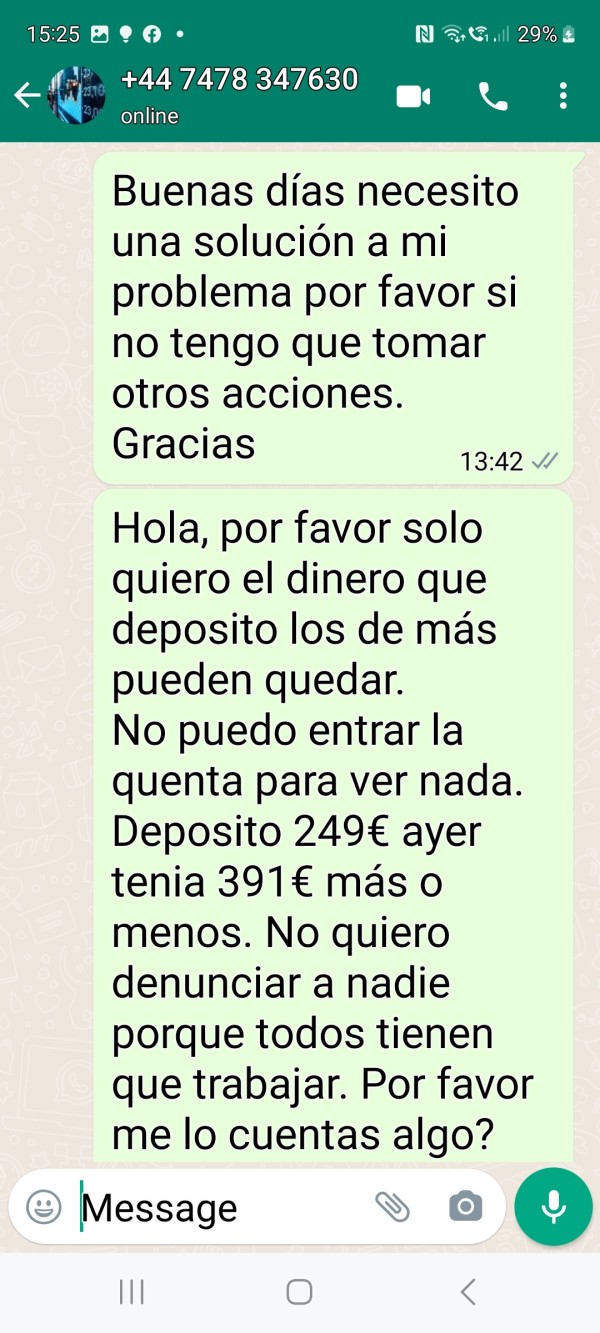

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed Primus also viewed..

XM

Vantage

VT Markets

STARTRADER

Primus · Company Summary

| Company name | Primus |

| Registered in | United Kingdom |

| Regulated | Unregulated |

| Years of establishment | Within 1 year |

| Trading instruments | Forex, indices, cryptocurrencies, commodities, shares, and treasuries |

| Account Types | New Trader Account and Experienced Trader Account |

| Maximum leverage | 1:30 for forex trading |

| Minimum spread | Varies depending on the instrument |

| Trading platform | Primus Next Generation |

| Deposit and withdrawal method | Credit/debit cards, bank transfers, and electronic payment options |

| Customer service | 24/5 phone support and email support |

Overview of Primus

Primus is a trading platform based in the United Kingdom and operates as an unregulated broker. It has been in operation for less than a year and offers a wide range of tradable assets, including forex, indices, cryptocurrencies, commodities, shares, and treasuries. Traders have the option to choose between two account types, the New Trader Account and the Experienced Trader Account, to suit their trading needs.

For forex trading, the maximum leverage available is 1:30. The platform's trading conditions vary depending on the instrument being traded. Primus Next Generation is the trading platform offered, providing advanced charting tools and analysis capabilities. Traders can deposit funds using credit/debit cards, bank transfers, and electronic payment options. Customer support is available via phone and email, providing assistance 24/5 to address any queries or concerns traders may have.

Is Primus legit or a scam?

Primus has been verified to operate as an unregulated broker, meaning it lacks oversight from reputable financial regulatory authorities.Regulated brokers are subjected to stringent guidelines and supervision by regulatory bodies, providing traders with a level of assurance in terms of fair trading practices, segregation of client funds, and proper dispute resolution mechanisms.

Trading with an unregulated broker poses inherent risks, as there may be no recourse or protection for traders in case of any issues, such as fund security, transparency, or potential fraudulent activities. Traders are exposed to higher vulnerabilities, and there may be uncertainties surrounding the safety and legitimacy of their investments.

Given Primus' unregulated status, it is crucial for traders to exercise extreme caution and conduct thorough research before considering this broker or any unregulated broker for that matter. It is highly advisable to opt for regulated brokers that are authorized and overseen by reputable financial regulatory authorities.

Pros and Cons

Primus offers a range of advantages to traders, including diverse market instruments that cater to different trading preferences. Their user-friendly platform is especially beneficial for new traders, providing a seamless onboarding experience. For experienced traders, Primus boasts a feature-rich environment, with advanced charting and analysis tools, enhancing their technical analysis capabilities.

Traders also have access to comprehensive educational resources, empowering them with valuable knowledge about cryptocurrencies and financial markets. Additionally, the convenience of mobile trading allows traders to stay connected and make informed decisions on the go.

Despite these benefits, it is crucial to acknowledge the risks associated with Primus being an unregulated broker. The lack of regulatory oversight raises potential higher risks for traders, as there may be limited protection for their investments. Moreover, the absence of segregated client funds poses concerns about fund security.

Traders may also face limited customer support options, potentially impacting the efficiency of addressing queries or concerns. Lastly, the absence of a guarantee for fair trading practices may lead to uncertainties regarding the overall integrity of the platform.

| Pros | Cons |

| Diverse market instruments | Unregulated |

| User-friendly for new traders | Potential higher risks for traders |

| Feature-rich for experienced traders | Lack of segregated client funds |

| Comprehensive educational resources | Limited customer support options |

| Advanced charting and analysis tools | No guarantee of fair trading practices |

| Mobile trading convenience |

Market Instruments

Primus offers a diverse array of market instruments that empower traders with a wide range of opportunities to participate in financial markets. Forex pairs are available for those seeking to trade on the strength of one currency against another in the largest and most liquid market globally. Indices trading allows investors to take positions on baskets of top shares, reflecting the performance of a country's economy.

Cryptocurrencies provide the chance to speculate on popular digital assets' price movements. Commodity trading covers a selection of highly traded commodities, including gold, silver, oil, and natural gas. Shares and ETFs enable traders to capitalize on the performance of some of the world's largest companies like Apple, Amazon, and Rio Tinto.

Additionally, Primus allows users to take views on government bonds, gilts, and treasury notes, offering exposure to specific regions' economies through Treasuries trading. This comprehensive range of market instruments caters to diverse trading preferences, making Primus a versatile and attractive platform for traders worldwide.

Account Types

For new traders, Primus offers a user-friendly account that provides a solid foundation for their trading journey. As an established industry leader with extensive trading experience, Primus support and educate new traders by providing access to comprehensive trader education resources. The platform also emphasizes risk management, offering advanced tools to help safeguard capital and make informed decisions. Additionally, the option for tax-free spread betting profits is available, providing an attractive opportunity for potential returns. Primus ensures accessibility by eliminating any minimum deposit requirements, making it open to traders with varying initial investments.

For experienced traders, Primus offers a feature-rich account designed to meet their sophisticated trading requirements. The platform provides a trading environment, equipped with a wide range of charting tools for effective market analysis and precise strategy execution. Fast and automated execution ensures timely trade implementation. Expert news and analysis are readily available to keep traders informed of market developments. Competitive spreads and advanced trading tools allow experienced traders to optimize their performance. Like the new trader account, the experienced trader account also offers tax-free spread betting profits, providing a tax-efficient way to realize trading gains.

How to Open an Account?

Opening an account with Primus is a straightforward process that can be completed in five simple steps:

Step 1: Visit the Website

Go to the official Primus website at https://primus-ltd.net/en/index.php using your web browser.

Step 2: Click on “Open Account”

Once on the website's homepage, look for the “Open Account” or “Sign Up” button and click on it.

Step 3: Fill in the Registration Form

You will be directed to the account registration page. Fill in the required information accurately, which may include your name, email address, phone number, and any other necessary details.

Step 4: Verify Your Identity

As part of the registration process, Primus may require you to verify your identity. This typically involves submitting some identification documents, such as a passport or driver's license, to comply with regulatory requirements.

Step 5: Fund Your Account

After completing the registration and identity verification, you can proceed to fund your account. Primus provides various deposit methods, such as credit/debit cards, bank transfers, or electronic payment options. Choose the preferred payment method and follow the instructions to deposit funds into your trading account.

Leverage

Primus offers a maximum leverage of 1:30 for forex trading, which means that for every $100 you deposit, you can trade up to $3000 worth of currency pairs. The maximum leverage for other asset classes is as follows: 1:20 for indices, 1:10 for commodities, 1:5 for shares, and 1:2 for treasuries. It is important to note that leverage is a double-edged sword, as it can magnify your profits but also your losses. If you are not careful, you could lose more money than you have deposited.

Spreads & Commissions

For Forex trading, Primus offers tight spreads, starting from as low as 0.7 points on popular currency pairs like EUR/USD. This enables traders to take advantage of favorable exchange rates without incurring significant costs.

Indices trading on Primus comes with competitive spreads as well, with key indices like the UK 100 and Germany 40 having spreads as low as 1 point. This allows investors to access major market indices with minimal price gaps between buying and selling.

When it comes to commodities, Primus offers attractive spreads, with Gold having a spread as low as 0.3 points. This gives traders the opportunity to speculate on the price of Gold with reduced trading costs.

Regarding margin rates, Primus ensures traders have access to flexible leverage. Forex trading starts from a margin rate of 3.3%, while indices and commodities have a margin rate of 5%. For those interested in trading shares and treasuries, the margin rate starts from 20%, providing the required exposure to these markets with a reasonable level of capital.

Trading Platform

Primus offers Next Generation trading platform that caters to traders of all levels, from beginners to experts. The platform is equipped with advanced web and mobile trading capabilities. Additionally, Primus provides a price projection tool to automatically identify visible patterns and offer price projection targets, highlighting potential trading opportunities.

With mobile charting capabilities, traders can access live streaming prices and manage trades directly from charts using over 40 popular technical indicators and drawing tools. The ability to trade directly from charts enables greater control over execution, facilitating better-informed entry and risk management decisions.

Innovative trading tools, such as the client sentiment tool, market calendar, and pattern recognition scanner, provide unique insights into traders' behavior and help identify possible trading opportunities. Primus' Next Generation trading platform stands as a robust and comprehensive solution, equipped with features and tools designed to enhance trading experiences for both new and experienced traders.

Deposit & Withdrawal

Primus offers a variety of deposit and withdrawal methods, including credit/debit cards, bank transfers, and electronic payment options. The minimum deposit requirement is $100.

For deposits, Primus charges a processing fee of 2.5% for credit/debit card deposits and 0.5% for bank transfers. Withdrawals are processed within 24 hours and there is no fee for withdrawals made to bank accounts.

Primus's deposit and withdrawal methods are convenient and reliable. However, it is important to note that Primus is an unregulated broker, which means there is no guarantee that your funds will be safe. It is advisable to only deposit funds that you can afford to lose.

Customer Support

Primus offers an accessible customer support system to assist traders throughout their trading journey. Traders can reach out to Primus' customer support team through various channels, including a 24/5 phone line at +44 (0)20 7170 8200, ensuring timely assistance during trading hours from Monday to Friday. Additionally, traders can seek help via email:info@primusltd.net, allowing them to address their queries and concerns conveniently.

Educational Resources

Primus offers a comprehensive range of educational resources to help traders gain a deeper understanding of cryptocurrencies like Bitcoin and Ethereum, as well as the risks associated with trading in this market. These resources cover essential topics such as the fundamentals of Bitcoin and Ethereum, their underlying technologies, and how they function in the digital economy.

Primus' educational materials also delve into the broader concept of cryptocurrencies, providing insights into the rapidly evolving landscape of digital assets and their role in the financial world. With easy access to these educational resources, traders can stay updated with the latest trends, developments, and regulatory changes in the crypto space, empowering them to navigate this exciting and dynamic market more confidently.

Conclusion

Primus is an unregulated broker that offers a diverse range of market instruments, including forex, indices, cryptocurrencies, commodities, shares, and treasuries. The platform caters to traders of all levels, from beginners to experts, and offers a variety of features and tools to enhance trading experiences. Primus also provides educational resources to help traders gain a deeper understanding of cryptocurrencies and the risks associated with trading in this market.

However, it is important to note that Primus is an unregulated broker, which means it lacks oversight from reputable financial regulatory authorities.

FAQs

Q: Is Primus a regulated broker?

A: No, Primus is currently an unregulated broker.

Q: What market instruments can I trade with Primus?

A: Forex, indices, cryptocurrencies, commodities, shares, and treasuries.

Q: Are there educational resources for new traders?

A: Yes, Primus offers comprehensive educational materials for new traders.

Q: Does Primus provide advanced charting tools?

A: Yes, Primus offers advanced charting and analysis tools.

Q: Is customer support available 24/5?

A: Yes, Primus provides customer support from Monday to Friday.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now