Score

ZERO

China|2-5 years|

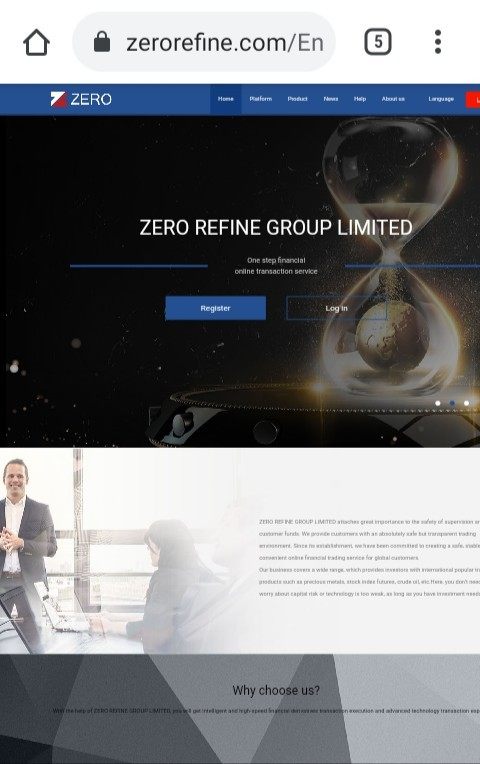

China|2-5 years| https://zerorefine.com/En

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed ZERO also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

zerorefine.com

Server Location

Hong Kong

Website Domain Name

zerorefine.com

Server IP

116.213.40.205

Company Summary

| Aspect | Information |

| Company Name | zero |

| Registered Country/Area | China |

| Founded Year | 2020 |

| Regulation | Unregulated |

| Minimum Deposit | 1000 yuan |

| Spreads | as low as 0 |

| Trading Platforms | MT4 |

| Tradable Assets | Forex,commodities,share stocks |

| Account Types | Personal account |

| Demo Account | Available |

| Customer Support | Phone, email |

| Deposit & Withdrawal | Credit/debit card,bank transfer |

Overview of Zero

Zero is a China-based company founded in 2020 that specializes in offering trading services. Though unregulated, the company demands a minimum deposit of 1000 yuan and boasts spreads as low as 0. They operate on the MT4 trading platform and provide options to trade Forex, commodities, and share stocks.

Zero offers a personal account type and also provides the option of a demo account for prospective traders to familiarize themselves with the platform. For assistance, customers can reach out via phone or email. Deposits and withdrawals can be made through credit/debit cards and bank transfers.

Is Zero Legit or a Scam?

Zero, a trading platform headquartered in China, is currently unregulated, implying that it doesn't adhere to any specific governmental or independent financial standards, which may expose traders to risks not typical of more conventional trading environments. Lacking this regulatory framework, Zero does not offer guarantees regarding security or compliance that many traders seek.

With this absence of regulation, both potential and existing traders are encouraged to approach with added vigilance. Prior to making any financial commitments, comprehensive research and due diligence are essential, especially considering the heightened uncertainties associated with unregulated platforms.

Those considering trading might benefit from exploring alternative platforms that provide a more secure, regulated trading experience to better safeguard their capital.

Pros and Cons

Pros of Zero Trading Platform:

Broad Asset Range: Zero offers a diverse range of tradable assets, including Forex, commodities, and share stocks, giving traders a wide variety of investment options.

Low Spreads: With spreads as low as 0, traders can potentially achieve better profitability due to reduced trading costs.

User-Friendly Platform: Using the MT4 trading platform, which is well-known for its user-friendly interface, makes it easier for both new and experienced traders to navigate and trade.

Demo Account Availability: Zero provides a demo account for prospective traders, allowing them to familiarize themselves with the platform before committing real money.

Multiple Deposit & Withdrawal Options: Traders have the convenience of using both credit/debit cards and bank transfers for their financial transactions.

Cons of Zero Trading Platform:

Lack of Regulation: Being unregulated, Zero doesn't adhere to any specific financial standards, which can expose traders to heightened risks.

Security Concerns: Without regulatory oversight, there might be concerns regarding the safety of funds, data protection, and transactional security.

Limited Account Types: Zero only offers a personal account type, which may not cater to the diverse needs of different traders, like institutional or high-frequency traders.

Potential Hidden Costs: Unregulated platforms might have hidden fees or charges that are not explicitly mentioned, leading to unexpected costs for traders.

No Guarantee of Practices: The lack of regulation means there's no guarantee of fair trading practices, which might lead to issues like price manipulation or delayed withdrawals.

| Pros | Cons |

| Broad Asset Range | Lack of Regulation |

| Low Spreads | Security Concerns |

| User-Friendly Platform | Limited Account Types |

| Demo Account Availability | Potential Hidden Costs |

| Multiple Deposit & Withdrawal Options | No Guarantee of Practices |

Market Instruments

Zero provides traders with an array of market instruments, furnishing them with the adaptability to dive into various trading horizons and curate a comprehensive investment approach spanning multiple asset domains. Here's a detailed examination of Zero's market instruments:

Forex (Foreign Exchange):

Currencies: Zero empowers traders with access to the expansive forex market. This allows them to participate in trading a diverse set of currency pairs, which could range from major and minor pairs to potentially exotic ones, offering avenues to capitalize on global currency market dynamics.

Commodities:

Raw Materials: Traders using Zero can venture into the commodities market, enabling them to speculate on the price movements of primary goods like metals, energies, and agricultural products. This ensures opportunities to profit from global supply-demand imbalances and geopolitical developments impacting commodity prices.

Share Stocks:

Equity Market: Zero provides the platform for traders to immerse themselves in the stock market, granting them the capability to trade shares of public corporations. This opens doors to leverage company-specific trends, benefit from dividend distributions, and navigate the general shifts in the equity market.

By presenting this spectrum of financial instruments, Zero ensures that its traders are equipped to tap into a wide range of financial markets, thereby enabling the deployment of versatile trading strategies.

Account Types

Zero offers a “Personal account” type to its users. The exact features and specifics of this account type haven't been elaborated upon, but in the trading world, a personal account generally serves the individual retail trader. It offers them access to a multitude of trading instruments and global financial markets, spanning from Forex to commodities and share stocks, typically through an intuitive and streamlined platform.

Within Zero's personal account, traders can navigate a plethora of market instruments using the renowned MT4 trading platform. They also have the luxury of reaching out to customer support services, available through phone and email, ensuring that their questions and issues are aptly addressed. The platform might also bestow traders with additional tools and resources designed to boost their trading acumen and methodologies.

However, it remains crucial for aspiring traders to proceed with vigilance and undertake comprehensive research before diving in.

How to Open an Account?

Opening an account with Zero can be a straightforward process. Here's a suggested five-step guide based on typical account registration processes on trading platforms:

Visit the Website: Navigate to the official Zero trading platform's website. Look for the “Sign Up” or “Register” button, typically found on the homepage.

Fill in Personal Details: Once you click on the registration option, you'll be prompted to provide personal information. This usually includes your full name, email address, phone number, and sometimes a chosen username and password. Ensure all details are accurate to prevent future issues.

Submit Identification Documents: For security and verification purposes, Zero may require you to upload specific identification documents. This can include a passport, driver's license, or a utility bill to confirm your address. Ensure the scans or photos are clear and legible.

Choose Your Account Type: Since Zero offers a “Personal account” type, this step might be straightforward. However, ensure you've reviewed all account features and benefits before proceeding.

Make an Initial Deposit: Once your account is verified, you'll be prompted to make your initial deposit. With Zero, the minimum deposit is 1000 yuan. Utilize the available payment methods like credit/debit cards or bank transfers to fund your account.

Spreads & Commissions

Zero purports to offer spreads “as low as 0,” though it's unclear if this is a standard rate for all its trading instruments or if it's specific to certain asset categories. Spreads, representing the differential between the bid and asking prices of a trading instrument, form a significant part of trading expenses for investors.

Having a spread “as low as 0” suggests that, in specific market situations, traders might have the chance to execute trades without this immediate expense, which might appeal particularly to those adopting high-frequency or scalping trading methods. However, the exact circumstances or instruments that this spread applies to are not detailed.

Furthermore, Zero hasn't provided explicit details about its commission structure. This information is crucial for traders to completely understand so they can accurately calculate overall trading costs and design an effective trading strategy accordingly.

Trading Platform

Zero leverages the MetaTrader 4 (MT4) as its chief trading platform, a decision that likely aligns with many traders' preferences given MT4's well-established reputation for reliability, intuitive interface, and its comprehensive suite of tools suitable for both beginners and advanced traders.

Within the framework of Zero's offerings, MT4 fosters an adaptable trading environment, permitting traders to navigate through a wide array of market instruments, bolstered by a selection of tools engineered to amplify trading success. Traders on Zero's MT4 platform benefit from advanced charting functionalities and a vast selection of technical analysis tools. Additionally, they can harness the power of algorithmic trading by utilizing Expert Advisors (EAs).

The platform facilitates various order types, including market, limit, stop, and trailing stop orders, thereby providing traders with the versatility to implement diverse trading strategies with precision.

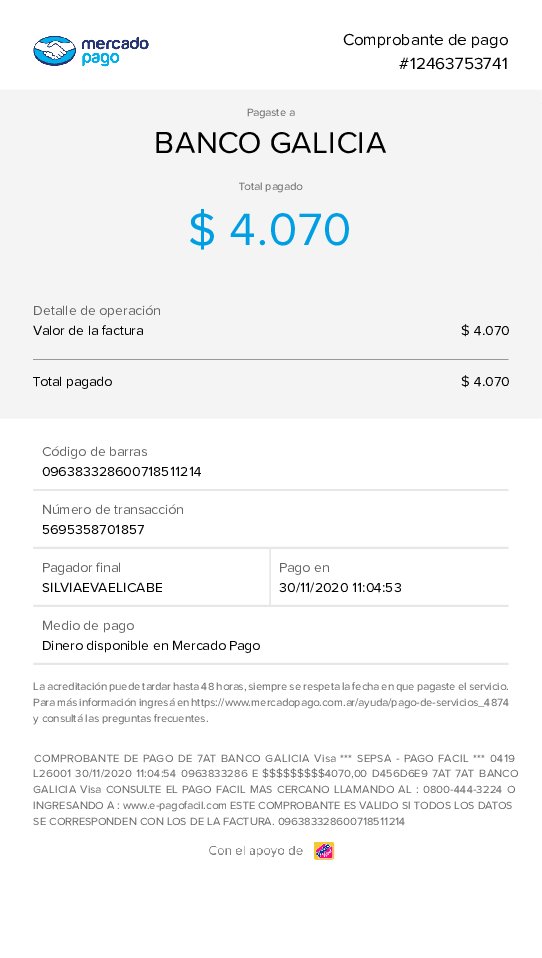

Deposit & Withdrawal

Zero prioritizes the fluidity of its users' financial activities by offering several channels for deposit and withdrawal, simplifying the task of managing assets on their platform. Users can resort to credit/debit card transactions or employ bank transfers for their monetary dealings with Zero. There's a clear-cut minimum deposit guideline set at 1000 yuan, establishing Zero as a feasible option for traders even if they're venturing with a conservative initial investment budget.

For those eyeing to venture with Zero or current users aiming for a seamless trading journey, it's imperative to gain a thorough understanding of Zeros financial procedures. A visit to Zero's official website or reaching out to their customer service can offer in-depth details on the transaction steps, potential associated charges, and the usual timeframes for processing.

Customer Support

Zero Refine Group Limited, commonly known as Zero, is dedicated to offering customer support to address the needs and concerns of its clientele. While details about various communication methods such as phone, social media, or instant messaging remain unspecified, Zero does provide an email avenue for client communications and assistance. Those seeking to get in touch with Zero or have inquiries can channel their questions and concerns to the given email address: info@zerorefine.com.

For a more extensive understanding of Zero, its offerings, and other relevant particulars, individuals are encouraged to navigate the official company website at https://zerorefine.com/En.

Conclusion

Zero Refine Group Limited, abbreviated as Zero, is a China-based trading platform established in 2020. Utilizing the popular MT4 platform, Zero offers traders a diverse range of market instruments, from Forex to share stocks, with notably low spreads.

While the platform provides a streamlined process for deposits and withdrawals, and an accessible email-based customer support system, it's crucial to note that Zero operates in an unregulated environment. Prospective and current traders should exercise caution, performing thorough due diligence before engaging with the platform to ensure they're making informed decisions in their trading endeavors.

FAQs

Q: Is Zero a regulated trading platform?

A: No, Zero operates in an unregulated environment. Traders should exercise caution and conduct due diligence before using the platform.

Q: What trading instruments are available on Zero?

A: Zero offers a variety of market instruments, including Forex, commodities, and share stocks.

Q: Which trading platform does Zero use?

A: Zero employs the MetaTrader 4 (MT4) platform, renowned for its user-friendly interface and a comprehensive suite of trading tools.

Q: How can I contact Zero's customer support?

A: Zero offers an email support system. Queries and concerns can be directed to the email address:info@zerorefine.com.

Q: Are there any demo accounts available for beginners on Zero?

A: Yes, Zero provides a demo account option for potential traders, allowing them to familiarize themselves with the platform and test trading strategies without risking real funds.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now