Score

Maxi-O

Malawi|2-5 years|

Malawi|2-5 years| https://maxi-o.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Malawi

MalawiUsers who viewed Maxi-O also viewed..

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

maxi-o.com

Server Location

Netherlands

Website Domain Name

maxi-o.com

Server IP

185.186.246.21

Company Summary

| Aspect | Information |

| Company Name | Maxi-O LLC |

| Registered Country/Area | Malawi |

| Founded year | 2009 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | 100:1 |

| Spreads | As low as 0.1 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Tradable assets | Forex, commodities, indices, stocks, cryptos |

| Account Types | Standard, ECN |

| Demo Account | Yes |

| Customer Support | 24/5 live chat, email, phone |

| Deposit & Withdrawal | Credit/debit cards, bank wire, PayPal |

| Educational Resources | Ebooks, webinars, video tutorials |

Overview of Maxi-O

Maxi-O is a forex and CFD broker that was founded in 2009 and is headquartered in Malawi. It is unregulated, but it offers a wide range of trading products and services, including forex, commodities, indices, stocks, and cryptos. The broker offers two types of trading accounts: Standard and ECN.

Maxi-O has a low minimum deposit of $100 and competitive spreads, starting from 0.1 pips. The broker also offers a demo account, which is a great way to practice trading without risking any real money. It provides 24/5 customer support via live chat, email, and phone. The broker also offers a variety of deposit and withdrawal methods, including credit/debit cards, bank wire, and PayPal. And it offers a range of educational resources, such as ebooks, webinars, and video tutorials. These resources can help traders of all levels learn more about trading and improve their skills.

Overall, Maxi-O is a forex and CFD broker that offers a wide range of trading products and services at competitive prices. However, it is important to note that the broker is unregulated, which means that there is less protection for traders in the event of a dispute.

Pros and Cons

| Pros | Cons |

| Wide range of trading products and services | Unregulated |

| Competitive prices | High-risk trading |

| Low minimum deposit | Limited customer support |

| Demo account | No negative balance protection |

| Educational resources |

Pros

Wide range of trading products and services: Maxi-O offers a wide range of trading products and services, including forex, commodities, indices, stocks, and cryptos. This gives traders a lot of flexibility in choosing what they want to trade.

Competitive prices: Maxi-O offers competitive prices, including low spreads and a low minimum deposit. This makes it a good option for traders who are looking for a cost-effective way to trade.

Demo account: Maxi-O offers a demo account, which is a great way to practice trading without risking any real money. The demo account is also a good way to learn more about the trading platforms and the different trading products.

Educational resources: Maxi-O offers a range of educational resources, such as ebooks, webinars, and video tutorials. These resources can help traders of all levels learn more about trading and improve their skills.

Cons

Unregulated: Maxi-O is unregulated, which means that it is not overseen by any financial regulator. This means that there is less protection for traders in the event of a dispute.

High-risk trading: Forex and CFD trading is a high-risk activity, and traders can lose all of their investment. It is important to understand the risks involved before trading with any forex or CFD broker.

Limited customer support: Maxi-O has limited customer support. The customer support team is only available during business hours, and they may not be able to resolve all issues quickly.

No negative balance protection: Maxi-O does not offer negative balance protection. This means that traders can lose more money than their initial deposit.

Regulatory Status

Maxi-O is an unregulated forex and CFD broker. This means that it is not overseen by any financial regulator. This is a major disadvantage, as it means that there is less protection for traders in the event of a dispute.

There are a number of reasons why a broker might be unregulated. One possibility is that the broker is new and has not yet had time to obtain a regulatory license. Another possibility is that the broker is located in a country with no financial regulation. Finally, it is also possible that the broker is simply not willing to comply with the regulations of a financial regulator.

Whatever the reason, traders should be aware that there are significant risks involved in trading with an unregulated broker. If the broker goes bankrupt or commits fraud, traders may have difficulty recovering their funds. Additionally, unregulated brokers may not be subject to the same rules and regulations as regulated brokers, which means that traders may have less protection against unfair practices.

If you are considering trading with Maxi-O, it is important to weigh the risks carefully. You should also consider trading with a regulated broker, as this will give you more protection in the event of a dispute.

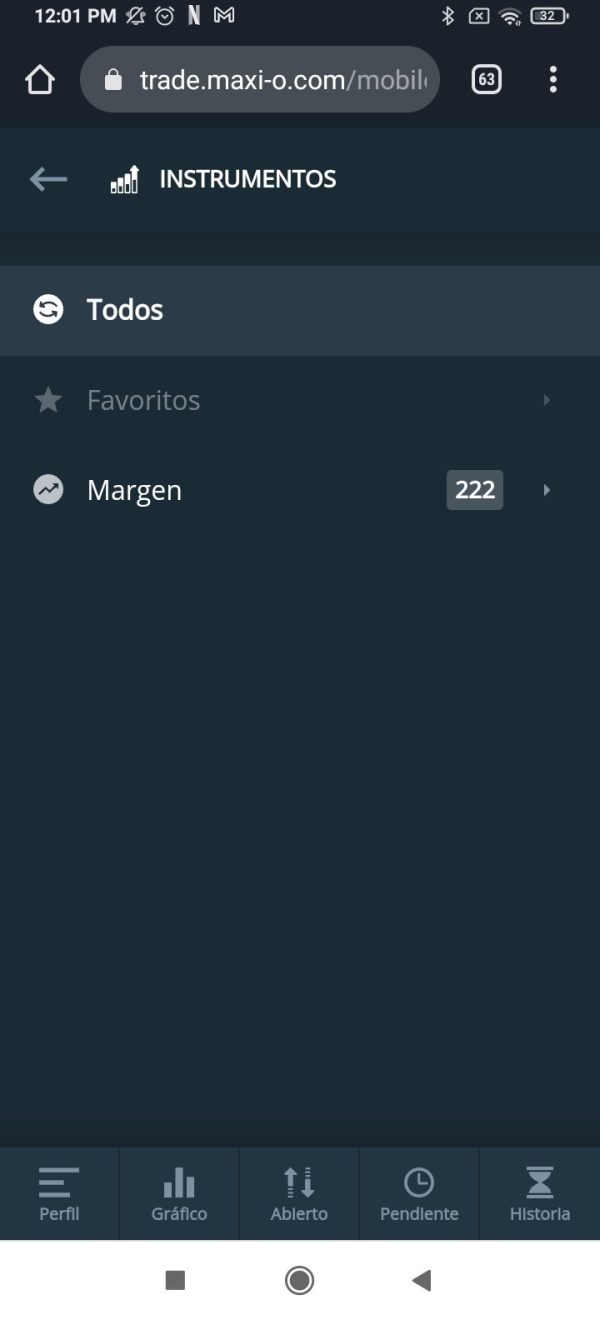

Market Instruments

Maxi-O offers a wide range of market instruments for trading, including:

Forex: Maxi-O offers over 60 currency pairs to trade, including major, minor, and exotic pairs.

Commodities: Maxi-O offers a range of commodities to trade, including gold, silver, oil, and natural gas.

Indices: Maxi-O offers a range of stock market indices to trade, including the S&P 500, the Dow Jones Industrial Average, and the Nasdaq 100.

Stocks: Maxi-O offers a range of stocks to trade, including US stocks, UK stocks, and European stocks.

Cryptos: Maxi-O offers a range of cryptocurrencies to trade, including Bitcoin, Ethereum, and Litecoin.

This wide range of market instruments gives traders a lot of flexibility in choosing what they want to trade. Maxi-O also offers a variety of trading accounts to suit the needs of different traders, including Standard and ECN accounts.

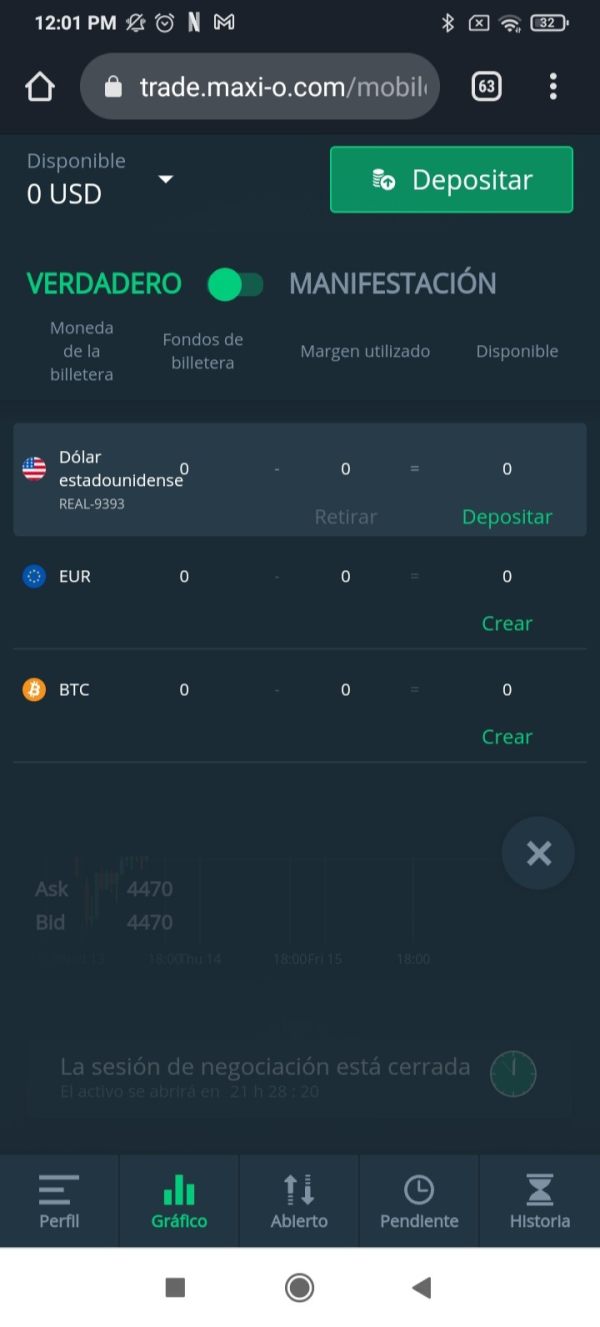

Account Types

Maxi-O offers two types of trading accounts: Standard and ECN.

Standard account: The Standard account is a good option for beginners and traders who are looking for a simple account type. The Standard account offers a variety of features, including low spreads, a low minimum deposit, and a demo account.

ECN account: The ECN account is a good option for more experienced traders who want tighter spreads and faster execution. The ECN account offers a commission per trade, but the spreads are generally much tighter than on the Standard account.

Which account type is right for you depends on your trading style and experience level. If you are a beginner, the Standard account is a good option. If you are a more experienced trader who wants tighter spreads and faster execution, the ECN account is a good option.

Here is a table comparing the two account types:

| Feature | Standard account | ECN account |

| Spreads | Floating | Floating |

| Commission | None | Yes |

| Minimum deposit | $100 | $500 |

| Demo account | Yes | Yes |

Which account type is right for you depends on your trading style and experience level. If you are a beginner, the Standard account is a good option. If you are a more experienced trader who wants tighter spreads and faster execution, the ECN account is a good option.

How to Open an Account?

To open an account with Maxi-O, follow these steps:

Go to the Maxi-O website and click on the “Open Account” button.

Fill out the online application form. This will include your name, email address, and phone number.

Choose the type of account you want to open (Standard or ECN).

Deposit your initial deposit. The minimum deposit for a Standard account is $100 and the minimum deposit for an ECN account is $500.

Verify your account. This will involve submitting a copy of your ID and proof of residence.

Once your account is verified, you can start trading.

Leverage

Maxi-O offers a maximum leverage of 100:1. This means that traders can control a position that is 100 times larger than their initial deposit. For example, if a trader deposits $100, they can control a position worth $10,000.

High leverage can magnify both profits and losses. For example, if a trader makes a 1% profit on a 100:1 leveraged position, they will make a profit of 100%. However, if the trader makes a 1% loss on a 100:1 leveraged position, they will lose their entire deposit.

It is important to use leverage carefully and to understand the risks involved. Traders should only use leverage that they can afford to lose.

Spreads & Commissions

Maxi-O offers competitive spreads and commissions. The spreads on the Standard account start at 1 pip and the spreads on the ECN account start at 0.1 pips. The commission on the ECN account is $0.5 per lot per side.

Here is a table comparing the spreads and commissions of the two account types:

| Feature | Standard account | ECN account |

| Spreads | Starting from 1 pip | Starting from 0.1 pip |

| Commission | None | $0.5 per lot per side |

The spreads and commissions charged by Maxi-O are in line with the industry standard. However, it is important to note that spreads and commissions can vary depending on the market conditions.

Trading Platform

Maxi-O offers two trading platforms: MetaTrader 4 and MetaTrader 5. MetaTrader 4 and MetaTrader 5 are two of the most popular trading platforms in the world. They are both user-friendly and offer a wide range of features.

MetaTrader 4 is a good option for beginners and traders who are looking for a simple trading platform. MetaTrader 5 is a good option for more experienced traders who want a more powerful trading platform with more features.

Both MetaTrader 4 and MetaTrader 5 are available for download from the Maxi-O website. Traders can also access MetaTrader 4 and MetaTrader 5 through a web browser.

Deposit & Withdrawal

Maxi-O accepts deposits and withdrawals via the following methods:

Credit/debit cards (Visa, Mastercard, American Express)

Bank wire transfer

PayPal

There are no fees for deposits or withdrawals made via credit/debit cards or PayPal. However, there is a $25 fee for bank wire withdrawals.

| Transaction Type | Fee |

| Deposits (Credit/Debit Card) | $0 |

| Withdrawals (Credit/Debit Card) | $0 |

| Deposits (PayPal) | $0 |

| Withdrawals (PayPal) | $0 |

| Bank Wire Withdrawals | $25 |

Customer Support

Maxi-O offers 24/5 customer support via live chat, email, and phone. The customer support team is available to answer any questions you have about trading or broker's services.

Here is a summary of the customer support options offered by Maxi-O:

Live chat: Live chat is the fastest way to get in touch with Maxi-O customer support. Live chat is available 24/5.

Email: You can also contact Maxi-O customer support via email. The customer support team will respond to your email as soon as possible.

Phone: Maxi-O customer support is also available by phone. The customer support team is available to answer your call 24/5.

Overall, Maxi-O provides commendable customer support, with a friendly and helpful team ready to address trading-related inquiries and broker services. It's crucial to bear in mind that Maxi-O operates as an unregulated broker, offering less protection in case of disputes. Traders should exercise caution and thoroughly assess the associated risks before engaging in trading activities with Maxi-O.

Educational Resources

Maxi-O offers a range of educational resources to help traders of all levels learn more about trading and improve their skills. These resources include:

Ebooks: Maxi-O offers a variety of ebooks on topics such as forex trading, CFD trading, and technical analysis. The ebooks are well-written and informative, and they provide a good overview of the topics covered.

Webinars: Maxi-O offers regular webinars on a variety of trading topics. The webinars are hosted by experienced traders and analysts, and they provide valuable insights into the markets and trading strategies.

Video tutorials: Maxi-O offers a variety of video tutorials on topics such as how to use the MetaTrader 4 and MetaTrader 5 trading platforms, how to place trades, and how to use risk management tools. The video tutorials are well-made and easy to follow.

Maxi-O provides a comprehensive set of free educational resources on its website, catering to traders of all skill levels. The well-structured ebooks, webinars, and video tutorials offer valuable insights into markets and trading strategies, enhancing the learning experience for users.

Conclusion

In summary, Maxi-O offers a comprehensive suite of trading products and services at attractive prices, with amenities like a demo account, round-the-clock customer service during weekdays, educational resources, and a low minimum deposit making it appealing to many traders.

However, the unregulated status of the broker should give potential clients pause for thought; this lacuna increases risk, limits customer support options, and means a lack of negative balance protection. Therefore, while Maxi-O does possess quite a number of benefits, it's essential to weigh those against the potential risks posed by its lack of oversight from any financial regulatory body.

FAQs

Q: Is Maxi-O regulated?

A: No, Maxi-O is not regulated. This means that it is not overseen by any financial regulator, which means that there is less protection for traders in the event of a dispute.

Q: What is the minimum deposit at Maxi-O?

A: The minimum deposit at Maxi-O is $100. This makes it a good option for traders who are just starting out and do not want to risk a lot of money.

Q: What is the maximum leverage at Maxi-O?

A: The maximum leverage at Maxi-O is 100:1. This means that traders can control a position that is 100 times larger than their initial deposit. It is important to note that high leverage can amplify both profits and losses.

Q: What trading platforms does Maxi-O offer?

A: Maxi-O offers two trading platforms: MetaTrader 4 and MetaTrader 5. These are two of the most popular trading platforms in the world, and they offer a wide range of features and tools.

Q: What payment methods does Maxi-O accept?

A: Maxi-O accepts a variety of payment methods, including credit/debit cards, bank wire, and PayPal.

Q: Does Maxi-O offer customer support?

A: Yes, Maxi-O offers 24/5 customer support via live chat, email, and phone.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now