Score

XENA EXCHANGE

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://xena.exchange/?_ga=2.221055448.1588504002.1605505189-332716193.1605505189

Website

Rating Index

Contact

Licenses

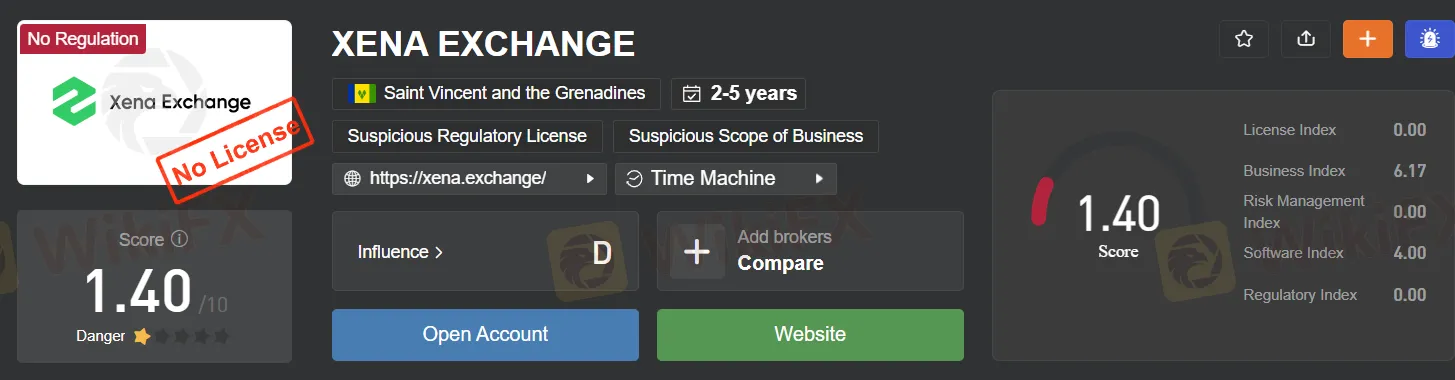

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Swiss Capital Ltd

XENA EXCHANGE

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed XENA EXCHANGE also viewed..

XM

Neex

MiTRADE

Decode Global

XENA EXCHANGE · Company Summary

| Aspect | Information |

| Company Name | Xena Exchange |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2017 |

| Regulatory Authority | Unregulated |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Tether USD (USDT), and more (as per platform updates) |

| Fees | Taker Fee: 0.03% Maker Rebate: -0.03% (Specific fees may vary by cryptocurrency) |

| Payment Methods | Cryptocurrency deposits and withdrawals |

| Customer Support |

What is XENA EXCHANGE?

Xena Exchange, a cryptocurrency platform founded in 2017 and based in Saint Vincent and the Grenadines, operates in an unregulated environment, which can be a source of concern for potential users. While it offers trading options for a variety of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), and Tether USD (USDT), the lack of regulatory oversight may raise questions about the safety and security of user funds and activities.

Furthermore, the fee structure at Xena Exchange may not be appealing to all users, with a 0.03% fee for takers and a -0.03% rebate for makers, and these fees can vary depending on the specific cryptocurrency being traded.

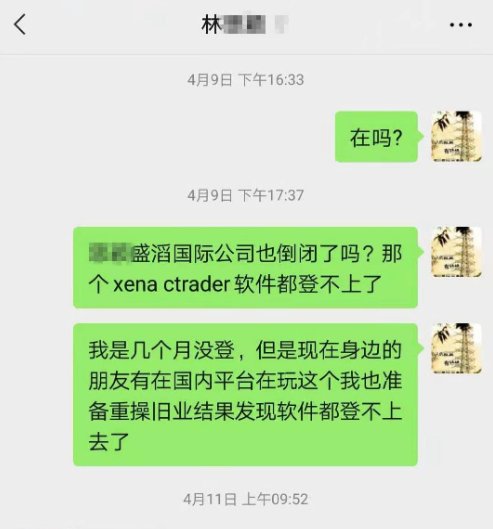

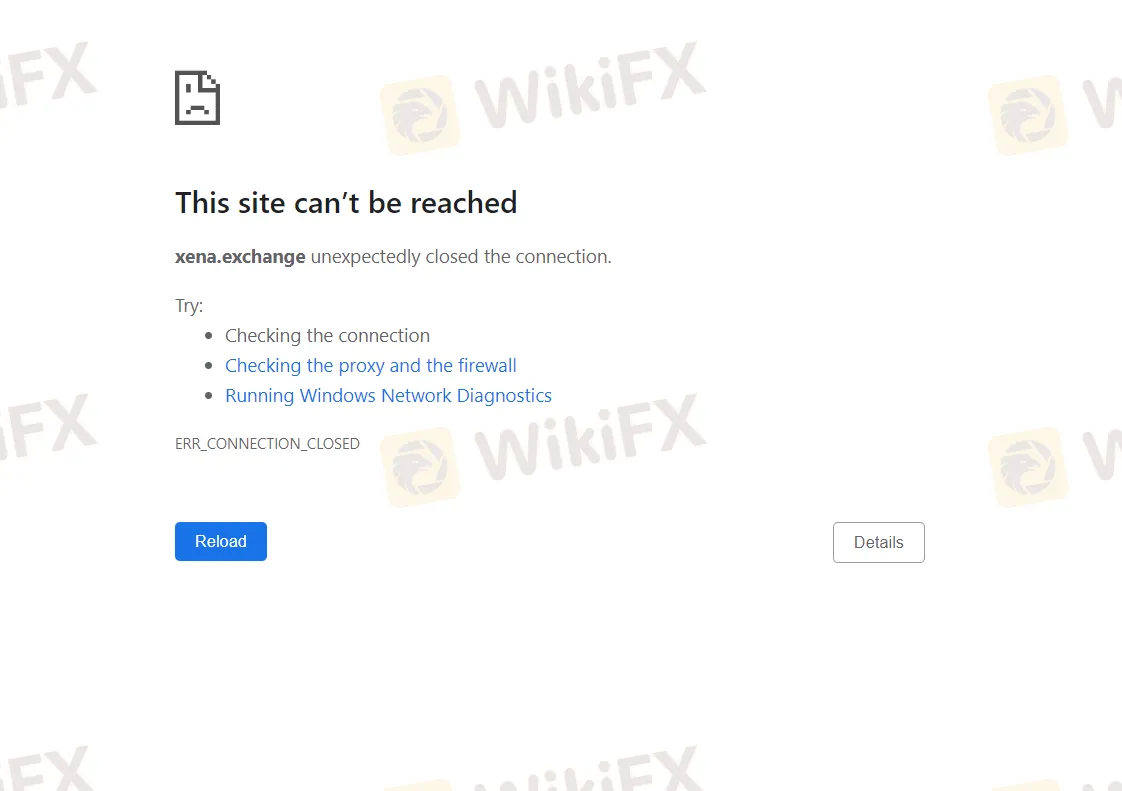

One significant drawback is the reported issue of the Xena Exchange website being down, which can severely hinder user access to the platform and essential information. Although customer support is available, the specific support channels may vary, leaving users potentially frustrated with limited options for assistance.

Considering these factors, potential users should exercise caution and conduct thorough research before choosing Xena Exchange as their cryptocurrency trading platform, taking into account the unregulated status, fee structure, and website reliability issues.

Regulation

XENA EXCHANGE is an unregulated cryptocurrency broker platform that operates without oversight or regulation from any governmental or financial authority, offering a range of services related to digital assets, including trading, investment, and asset management. In the rapidly evolving and decentralized world of cryptocurrencies, XENA EXCHANGE positions itself as an autonomous and independent entity, providing users with the freedom to engage in various crypto activities without the constraints of traditional financial regulations and compliance requirements. However, it's essential for individuals considering using the platform to exercise caution and conduct thorough due diligence, as the absence of regulatory oversight can entail higher risks associated with security, transparency, and investor protection in the crypto space.

Pros and Cons

Xena Exchange is a cryptocurrency platform that offers a range of trading options, but it operates in an unregulated environment, which may raise concerns about user safety and security. The fee structure can be a drawback for some traders, and the reported website downtime can hinder access to the platform. However, the exchange provides multiple trading platforms and security measures to protect user funds.

| Pros | Cons |

| Offers a variety of cryptocurrency trading pairs to cater to different trading strategies and preferences. | Operates in an unregulated environment, which may raise concerns about user protection and oversight. |

| Implements security measures, including cold wallet storage and regular security testing, to protect user funds. | The fee structure, with a 0.03% fee for takers and a -0.03% rebate for makers, may not be appealing to all users. |

| Provides multiple trading platforms, including a user-friendly Portfolio Page and an advanced Trading Terminal. | The reported issue of website downtime can severely hinder user access to the platform and information. |

| Welcomes both novice traders and experienced professionals, offering a versatile cryptocurrency trading experience. | Limited information is available about the regulatory status and compliance of the exchange. |

| Active monitoring to detect and prevent market manipulation, promoting a fair and transparent trading environment. | Customer support channels may vary, potentially limiting users' options for assistance. |

Cryptocurrencies Accepted

Xena Exchange offers a selection of cryptocurrency trading pairs for users to engage in the dynamic world of digital asset trading. At the time of writing this review, the available trading pairs on Xena Exchange include:

BTC/USDT: This pair allows users to trade Bitcoin (BTC) against Tether (USDT), a stablecoin pegged to the US dollar. It provides a gateway for investors to capitalize on Bitcoin's price movements while hedging against the volatility of the crypto market through USDT.

ETH/USDT: Ethereum (ETH) can be traded against Tether (USDT) on this pair. It enables traders to speculate on Ethereum's price fluctuations and potentially benefit from the liquidity and stability offered by USDT.

ETH/BTC: This trading pair facilitates the exchange of Ethereum (ETH) for Bitcoin (BTC). It appeals to traders looking to diversify their crypto holdings or take advantage of price disparities between these two prominent cryptocurrencies.

ETC/BTC: Ethereum Classic (ETC) can be traded against Bitcoin (BTC) in this pair. It provides an avenue for investors interested in Ethereum Classic to enter or exit the market while leveraging the volatility of Bitcoin.

LTC/BTC: Litecoin (LTC) is tradable against Bitcoin (BTC) on this pair. It allows users to engage in Litecoin trading activities and potentially benefit from the price movements of these two popular cryptocurrencies.

These trading pairs offer various opportunities for crypto enthusiasts to speculate, diversify their portfolios, or actively manage their cryptocurrency holdings. The availability of these pairs reflects the platform's commitment to providing a range of options to cater to different trading strategies and preferences within the cryptocurrency market. Users can monitor market trends, execute trades, and explore potential profit opportunities across these diverse pairs on Xena Exchange.

Security

Xena Exchange places a strong emphasis on the safety and security of user funds. Here's a description of the safety measures in place:

Cold Wallet Storage: User funds are stored in cold wallets, which means they are not connected to the internet. These wallets are geographically distributed in secured locations, enhancing the security of the stored assets. By keeping funds offline, Xena Exchange reduces the risk of unauthorized access or cyberattacks.

Hot Wallet Security: In cases where hot wallets are utilized, they only contain the minimum necessary amount of funds for operational purposes. Additionally, the private keys associated with these wallets are distributed across containers in the Google Cloud, ensuring that they are detached from any specific server or physical location. This setup adds an extra layer of protection against potential security breaches.

Cryptographic Multi-Factor Verification: To further enhance security, Xena Exchange implements cryptographic multi-factor verification processes for both deposits and withdrawals. This multi-factor approach adds an additional level of authentication, making it more difficult for unauthorized individuals to access and manipulate user accounts.

Regular Security Testing: Xena Exchange has a proactive approach to security. They conduct regular security testing for each software release to identify and address vulnerabilities. This ongoing assessment helps ensure the platform remains robust and resilient against potential threats.

Market Manipulation Prevention: Xena Exchange actively monitors trading operations to detect and prevent market manipulation, such as wash trading and other toxic activities. This commitment to maintaining a fair and transparent trading environment benefits all users by promoting market integrity.

In summary, Xena Exchange takes comprehensive measures to safeguard user funds and maintain the security of its platform. These measures include a combination of cold wallet storage, secure hot wallet practices, multi-factor verification, regular security testing, and efforts to prevent market manipulation. These initiatives collectively contribute to a secure and reliable trading experience for users.

Cryptocurrency Trading Fees

The fee structure you provided, 0.03% for takers and -0.03% for makers, represents a common fee model found in cryptocurrency exchanges and is often referred to as a “maker-taker fee” schedule. Here's a breakdown of what these fees mean:

Taker Fee (0.03%): This fee applies to users who place orders that are immediately matched with existing orders on the exchange's order book. In other words, takers are traders who remove liquidity from the market by executing orders at the current market price. They pay a fee of 0.03% for each trade they make. Taker fees are typically higher because they contribute to price volatility and liquidity provision on the exchange.

Maker Rebate (-0.03%): Makers, on the other hand, are traders who place limit orders that do not immediately execute but instead add liquidity to the order book. In return for providing liquidity to the market, makers receive a rebate of -0.03% for each trade. This means that makers are effectively rewarded with a discount on their trading fees, which can incentivize them to place orders that enhance the overall liquidity of the exchange.

In summary, this fee structure encourages traders to contribute to the liquidity of the exchange by placing limit orders (makers), as they receive a fee rebate, while traders who execute market orders (takers) pay a fee for the convenience of immediate execution. It's a common practice in the cryptocurrency industry to promote market depth and trading activity on the exchange. The specific fee rates may vary between exchanges, but the maker-taker fee model is widely adopted in the industry.

Trading Platforms

Xena Exchange offers three distinct trading platforms to cater to a diverse range of traders and investors in the cryptocurrency market. Here's a description of these platforms:

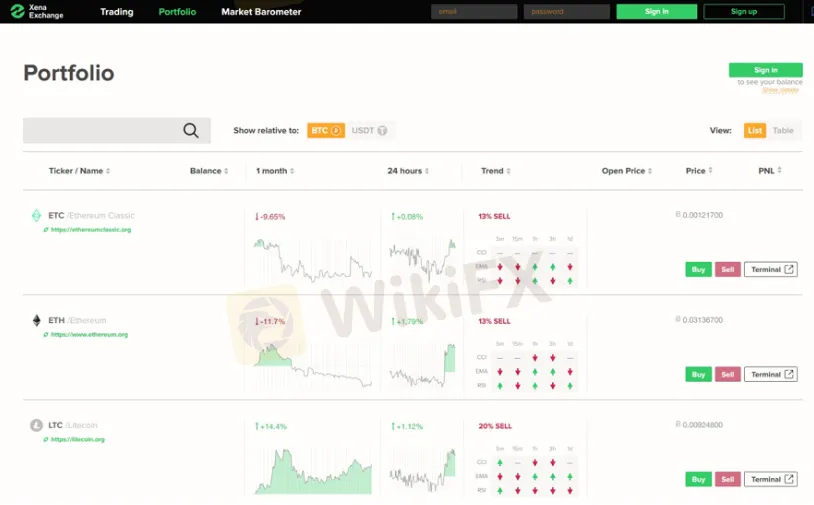

Portfolio Page:

Target Audience: Designed for crypto investors and novice traders.

Interface: Clean and user-friendly interface.

Features: Allows users to view essential information about their portfolios at a glance.

Trading: Users can quickly buy and sell cryptocurrencies.

Technical Information: Provides useful technical information for different timeframes, aiding in decision-making.

Trading Terminal:

Target Audience: Geared towards experienced traders.

Interface: Advanced and feature-rich, reminiscent of the Binance trading interface.

Charting: Utilizes TradingView charts, offering access to powerful indicators and studies.

Trend Power Tool: Includes a proprietary tool that generates signals based on common technical indicators (CCI, EMA, RSI) across various timeframes.

Templates: Offers four predefined templates (Planimetry, Trends, Corrected Average, and Ribbons) for quick chart customization.

Upcoming Features: The platform has a roadmap with plans to introduce more studies and signals, multi-leg trades, fast orders from the Market Depth widget, and the ability to create arbitrage strategies.

Xena API:

Target Audience: Aimed at algorithmic traders and developers.

API Endpoints: Provides three different API endpoints: Web-Socket Market Data, Web-Socket Trading, and REST Transfers.

Future Enhancements: The company has plans to offer additional features, including connection via the FIX protocol and the ability to create advanced trading strategies using neural networks, making it a robust option for those looking to automate and customize their trading strategies.

In summary, Xena Exchange offers a diverse set of trading platforms, ranging from a simple and user-friendly Portfolio Page for beginners to an advanced Trading Terminal equipped with powerful charting and analysis tools for experienced traders. Additionally, the availability of multiple API endpoints caters to algorithmic traders and developers, with plans for further enhancements to support advanced trading strategies. This variety of platforms and features makes Xena Exchange a versatile choice for cryptocurrency trading.

Account Opening

Opening an account at Xena Exchange is a straightforward process designed to make it accessible for users. Here's how to get started:

Email Registration: Begin by entering your email address. This initial step initiates the account creation process.

Email Verification: After providing your email address, you will need to verify it. This typically involves receiving an email with a verification link and following the provided instructions to confirm your email address. Verification helps ensure the security and validity of your account.

Basic Information: Provide some essential personal information as part of the registration process. This information may include details like your name and contact information.

Optional Verification: While not mandatory, it's advisable to complete the verification process. Verification can offer several benefits, such as higher withdrawal limits and additional security features. This step often involves providing more comprehensive identification documents to confirm your identity.

By following these steps, users can quickly and easily create an account on Xena Exchange. Verifying the account can enhance both security and functionality, making it a recommended option for those looking to maximize their experience on the platform.

Deposit & Withdrawal

Xena Exchange exclusively facilitates deposits and withdrawals using a range of cryptocurrencies. Currently, the following cryptocurrencies are accepted for deposits and withdrawals on the platform:

Bitcoin (BTC): Users can deposit and withdraw Bitcoin (BTC) on Xena Exchange.

Ethereum (ETH): Ethereum (ETH) deposits and withdrawals are supported on the platform.

Ethereum Classic (ETC): Xena Exchange accepts Ethereum Classic (ETC) for both deposits and withdrawals.

Litecoin (LTC): Users can deposit and withdraw Litecoin (LTC) on the platform.

Tether USD (USDT): Xena Exchange allows deposits and withdrawals in Tether USD (USDT), a stablecoin pegged to the US dollar.

It's important to note that Xena Exchange currently does not accept traditional fiat currencies for deposits or withdrawals. Therefore, users looking to engage with the platform must use one or more of the aforementioned cryptocurrencies to fund their accounts or withdraw funds.

For specific details on the deposit and withdrawal processes, including any associated fees or additional requirements, users should refer to Xena Exchange's official website or platform documentation, as these details may be subject to change or may vary depending on the cryptocurrency being deposited or withdrawn.

Compare with other exchanges

| Aspect | Xena Exchange | Bitcoiniacs | Exscudo |

| Company Name | Xena Exchange | Bitcoiniacs | Exscudo |

| Registered Country/Area | United Kingdom | Canada | Lithuania |

| Founded Year | 2017 | 2013 | 2016 |

| Regulatory Authority | Unregulated | FINTRAC (Exceeded) | Regulated |

| Cryptocurrencies | BTC, ETH, ETC, LTC, USDT, and more | 4 | 30+ |

| Fees | Taker Fee: 0.03% Maker Rebate: -0.03% | 0.5%-1.5% per trade | Maker: 0.2% Taker: 0.2% |

| Payment Methods | Cryptocurrency deposits and withdrawals | Bank transfer, Flexepin, Bitcoin ATM | Bank transfer, cryptocurrency transfers |

| Customer Support | Email, Phone | Email, phone |

Customer Support

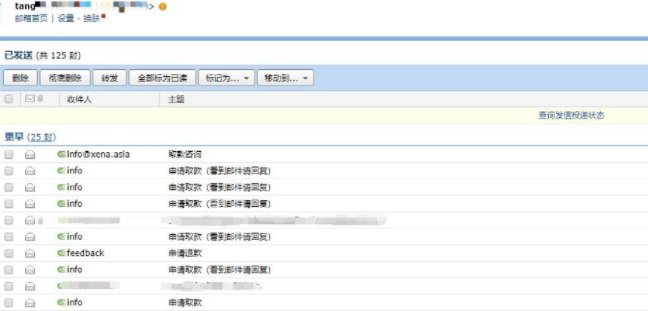

Xena Exchange's customer support, while available, presents certain drawbacks that warrant a negative assessment. Users may find the support experience less than ideal for several reasons:

Limited Information: The provided email addresses, support@xena.exchange and partners@xena.exchange, are the only contact options mentioned. This limited choice in support channels can be frustrating for users who prefer different means of communication, such as live chat or phone support.

Lack of Specifics: The description does not offer any additional details about the responsiveness, availability hours, or expected response times of the support team. This lack of information can leave users uncertain about when and how they can expect assistance.

Dependence on Email: Relying solely on email communication can be perceived as less efficient and potentially slow, especially in urgent situations where users may require immediate assistance or resolution to their issues.

Potential for Delay: Email-based support can lead to delays in issue resolution, as it typically involves back-and-forth email exchanges. Users might experience frustration due to the inability to resolve their concerns swiftly.

In summary, Xena Exchange's customer support may fall short of user expectations due to its limited contact options, lack of detailed information, and reliance on email as the primary communication channel. This could leave users feeling dissatisfied and inconvenienced, particularly in situations that require prompt assistance.

Summary

Xena Exchange, while offering a range of cryptocurrency trading options, presents notable concerns for potential users. Operating in an unregulated environment raises questions about the safety of user funds and activities. Moreover, the fee structure, with a 0.03% fee for takers and a -0.03% rebate for makers, may not be attractive to all traders. The reported issue of website downtime further hinders user access, and the limited customer support options, primarily relying on email, can be frustrating and slow. These factors collectively indicate that users should exercise caution and thoroughly research before considering Xena Exchange as their cryptocurrency trading platform, given the unregulated status, fee structure, and support limitations.

FAQs

Q1: Is Xena Exchange a regulated cryptocurrency platform?

A1: No, Xena Exchange operates in an unregulated environment, lacking oversight from governmental or financial authorities.

Q2: What cryptocurrencies can I trade on Xena Exchange?

A2: You can trade cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), and Tether USD (USDT), among others, subject to platform updates.

Q3: How does Xena Exchange ensure the security of user funds?

A3: Xena Exchange employs cold wallet storage, hot wallet security measures, cryptographic multi-factor verification, regular security testing, and market manipulation prevention to safeguard user funds.

Q4: What are the trading fees on Xena Exchange?

A4: Xena Exchange employs a maker-taker fee model, with takers paying a 0.03% fee for immediate order execution and makers receiving a -0.03% rebate for adding liquidity to the order book.

Q5: What trading platforms does Xena Exchange offer?

A5: Xena Exchange provides a Portfolio Page for investors, an advanced Trading Terminal for experienced traders, and an API for algorithmic traders and developers.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now