No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between TopFX and ZFX ?

In the table below, you can compare the features of TopFX , ZFX side by side to determine the best fit for your needs.

--

--

EURUSD:-28.4

EURUSD:-0.8

EURUSD:13.42

XAUUSD:32.79

EURUSD: -6.23 ~ 2.32

XAUUSD: -33.47 ~ 15.94

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of topfx, zfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Chipre |

| Regulated by | CYSEC, FCA |

| Year(s) of establishment | 10-15 years |

| Trading instruments | Forex (more than 60 currency pairs), indices, equities, metals (gold, silver, platinum, palladium), energy, cryptocurrencies, ETFs |

| Minimum Initial Deposit | Information not available |

| Maximum Leverage | 1:500 |

| Minimum spread | Float |

| Trading platform | MT4, cTrader |

| Deposit and withdrawal method | Bank wire transfer, credit card, google pay, apple pay, skrill, neteller |

| Customer Service | Email/phone number/address |

| Fraud Complaints Exposure | Yes |

Established in 2010, TopFX is an online Forex broker regulated by CYSEC, FCA and FSA at present.

TopFX is a reputable brokerage firm established in Cyprus. It caters to individual retail traders, institutional investors, and professional traders worldwide. They offer a wide range of financial services, including Forex, Indices, Shares, Metals, Energies, Cryptocurrencies, ETFs, and more. Traders can choose from multiple account types with spreads starting from 1.0. The maximum leverage is 1:1000, allowing traders to amplify their positions. TopFX provides a seamless trading experience through their advanced platforms, MetaTrader 4 (MT4), and cTrader, available on desktop, web, and mobile devices.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Yes, TopFX Global Ltd is a company registered under the Laws of Seychelles with registration number 8424819-1 and licensed by the Financial Services Authority (FSA) of Seychelles with a Securities Dealer License No: SD037.

Another regulated entity within the group: TopFX Ltd is registered as a Cyprus investment firm (CIF) and licensed by the Cyprus Securities and Exchange Commission (CySEC) under licence number 138/11 in accordance with the Markets in Financial instruments Directive (MiFID II).

TopFX offers several advantages to traders. Firstly, they provide a diverse range of market offerings, allowing traders to access various financial instruments. Additionally, TopFX offers competitive spreads, ensuring cost-effective trading. The platform is equipped with advanced trading platforms, offering advanced features and tools for enhanced trading experiences. Furthermore, TopFX is regulated, providing a secure and reliable trading environment. Traders can also choose from flexible account options to suit their individual needs. However, it's worth noting that TopFX has limited educational resources and no fixed spread accounts. Customer support channels are also limited, and there are no social trading features or guaranteed stop loss orders available.

| Pros | Cons |

| Diverse Market Offerings | Limited Educational Resources |

| Competitive Spreads | No Fixed Spread Accounts |

| Advanced Platforms | Limited Customer Support Channels |

| Regulatory Compliance | No Social Trading Features |

| Flexible Account Options | No Guaranteed Stop Loss Orders |

TopFX offers investors access to conventional and popular tradable financial instruments on global financial markets, mainly Forex (more than 60 currency pairs), indices, stocks, metals (gold, silver, platinum, palladium), energy, cryptocurrencies, ETFs, etc.

Forex: TopFX allows traders to participate in the foreign exchange market, offering a wide selection of currency pairs. Traders can speculate on the price movements between major, minor, and exotic currency pairs, taking advantage of the volatility and liquidity of the Forex market.

Indices: TopFX provides trading opportunities on major global stock indices, such as the S&P 500, NASDAQ, FTSE 100, and Nikkei 225. Traders can speculate on the overall performance of a specific stock market rather than individual stocks, based on their analysis and market insights.

Shares: TopFX offers access to a variety of shares from global markets. Traders can invest in individual company stocks, such as Apple, Google, or Amazon, and take advantage of the price movements of these shares.

Metals: TopFX allows trading in precious metals like gold, silver, platinum, and palladium. These metals are often considered safe-haven assets and can be used as a hedge against inflation or economic uncertainties. Traders can speculate on the price fluctuations of these metals.

Energies: TopFX provides trading opportunities in energy markets, including oil and natural gas. Traders can participate in the price movements of these energy commodities, which can be influenced by geopolitical events, supply and demand dynamics, and other market factors.

Cryptocurrencies: TopFX offers trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Traders can take advantage of the high volatility and liquidity of the cryptocurrency market, speculating on the price movements of these digital assets.

ETFs (Exchange-Traded Funds): TopFX allows traders to invest in ETFs, which are investment funds traded on stock exchanges. These funds are composed of a basket of assets, such as stocks, bonds, or commodities. Traders can gain exposure to a diversified portfolio of assets by trading ETFs.

Range of Markets: In addition to the above instruments, TopFX provides access to a wide range of other markets, allowing traders to explore various trading opportunities. These markets may include commodities, bonds, options, futures, and more.

TopFX offers competitive spreads and commissions across its three account types: Zero Account, Raw Account, and VIP Account. The Zero Account features spreads starting from 1.0, while the Raw Account offers incredibly tight spreads starting from 0.0. For the VIP Account, spreads start from 0.2. Both the Zero Account and the VIP Account come with zero commissions, allowing traders to focus solely on the spreads. On the other hand, the Raw Account charges a commission of $2.75 per lot traded. These flexible options cater to traders of various strategies and preferences, ensuring cost-effective trading conditions at TopFX.

Demo Account: TopFX does not provide a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: TopFX provides three distinct types of trading accounts to cater to the diverse needs of traders: Zero Account, Raw Account, and VIP Account.

The Zero Account is an ideal choice for traders looking for competitive spreads without any commission charges. With spreads starting from 1.0 pip and zero commission, this account offers a cost-effective trading solution. The minimum deposit requirement of $500 ensures accessibility for traders at different levels, while the maximum leverage of 1000:1 provides flexibility in managing trading positions.

For traders seeking the tightest spreads and direct market access, the Raw Account is a suitable option. With spreads starting from 0.0 pip and a commission of $2.75 per lot traded, this account offers ultra-low-cost trading. The minimum deposit of $5000 reflects a higher commitment level, attracting more experienced traders. Additionally, the account provides a maximum leverage of 1000:1, allowing traders to amplify their trading potential.

The VIP Account is designed for high-volume and high-net-worth traders who require personalized support and exclusive features. With spreads starting from 0.2 pip and zero commission, this account offers competitive trading conditions. The minimum deposit requirement of $50,000 ensures that only elite traders can access the VIP Account, providing a tailored trading experience. The maximum leverage of 1000:1 enables traders to maximize their capital efficiency.

The account opening process with TopFX is straightforward and can be completed in a few simple steps:

Registration: Visit the TopFX website and click on the “Open Account” or “Register” button. You will be directed to a registration form where you need to provide your personal details such as name, email address, and phone number. Create a username and password for your account.

2. Verification: After submitting the registration form, you will need to go through a verification process to comply with regulatory requirements. This typically involves submitting identification documents such as a passport or driver's license, as well as proof of address such as a utility bill or bank statement. TopFX will review and verify your documents.

3. Account Selection: Once your account is verified, you can choose the type of trading account that best suits your needs. Select from the Zero Account, Raw Account, or VIP Account, considering factors such as spreads, commissions, minimum deposit, and leverage. Take the time to review and understand the features and conditions of each account type before making a decision.

4. Funding Your Account: After selecting your desired account type, it's time to fund your trading account. TopFX offers multiple convenient payment methods, including bank wire transfer, credit/debit card, and online payment systems. Follow the instructions provided on the website to deposit the minimum required amount or any additional funds you wish to allocate for trading.

5. Start Trading: Once your account is funded, you can log into the TopFX trading platform using your credentials. Familiarize yourself with the platform's features and tools, and you're ready to start trading. Choose from a wide range of market instruments, analyze the market, place trades, and manage your positions.

It's important to note that the account opening process may vary slightly based on individual circumstances and regulatory requirements. TopFX strives to make the process as efficient and user-friendly as possible, providing support and guidance throughout the journey to ensure a smooth account opening experience.

TopFX offers traders two high-performance trading platforms in the retail sector, MT4 and cTrader. Both support automated trading solutions, occupying the top two places in this sub-sector. The trading platform options at TopFX are excellent and show that the management understands traders' needs. Traders can opt for an enhanced MT4 trading platform or cTrader as an alternative.

At TopFX, leverage allows traders to amplify their trading positions. With a maximum leverage of 1000:1, offered across all three account types - Zero Account, Raw Account, and VIP Account - traders can control larger positions in the market with a smaller initial capital investment. This high leverage enables potential for increased profits, but it is important to remember that it also carries a higher level of risk. Traders should exercise caution and employ proper risk management strategies when utilizing leverage to maximize their trading opportunities at TopFX.

TopFX offers a wide range of options for Deposit & Withdrawal, making it convenient and flexible for traders. Users can choose from various methods including Credit/debit cards, Bank Wire Transfer, E-wallets, and Cryptocurrency, such as PayPal, Skrill, Neteller, China UnionPay, mPay, FasaPay, Webmoney, among others. Each method may have different minimum deposit requirements, but the overall minimum deposit is $50. Whether you prefer traditional banking methods, digital wallets, or even cryptocurrencies, TopFX ensures that you have plenty of options to fund your trading account and make withdrawals. This diverse range of options allows traders to choose the method that suits them best and provides a seamless and hassle-free experience when it comes to managing their funds.

A series of educational resources is available at TopFX, such as trading signals, news, trading central, market analysis, etcetera.

The customer support, offered by TopFX, is moderate. That is, it has the basics like email, phone number, address, social networks, multilingual service. These are necessary, but it will be better if it could offer more like live chat, callback, Q&A, and so on.

Here are more details about the customer support service

Languages: English, Spanish, Arabic, Chinese, French, Portuguese and so on.

Address: CT House, Unit 8, Office No 8H, Providence Mahe Seychelles

Phone: +248 4374705

Email: support@topfx.com.sc

Social media: Facebook, Instagram, LinkedIn

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

TopFX provides excellent customer support through multiple channels, ensuring that traders receive timely assistance whenever they need it. Users can reach out to their customer support team via phone, email, and live chat. With the phone option, traders can directly speak with a representative who can address their queries and provide real-time assistance. Email support allows traders to send detailed inquiries or requests, and the TopFX team strives to respond promptly with helpful solutions. Live chat is another convenient option, enabling traders to have instant conversations with support agents, allowing for quick resolutions to their concerns. Whether you prefer the convenience of live chat, the personal touch of a phone call, or the detailed communication of an email, TopFX's customer support team is dedicated to delivering efficient and effective assistance to ensure a smooth trading experience for all users.

TopFX offers a range of educational resources to help traders enhance their knowledge and improve their trading skills. They provide webinars where experts share valuable insights and strategies. Traders can access informative articles that cover various trading topics and market trends. Tutorials are available to guide users through different aspects of trading, from basic concepts to advanced techniques. Additionally, TopFX provides comprehensive market analysis, including technical and fundamental analysis, to assist traders in making informed decisions. With these educational resources, traders can stay updated, learn new strategies, and develop a better understanding of the financial markets, ultimately improving their trading performance.

In summary, TopFX is a reputable brokerage firm based in Cyprus, offering a diverse range of financial services to individual retail traders, institutional investors, and professional traders worldwide. With a wide range of market instruments, competitive spreads, and advanced trading platforms like MetaTrader 4 and cTrader, TopFX provides traders with a comprehensive and reliable trading experience. The company is regulated by the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure and trustworthy trading environment. Traders can choose from flexible account options, including the Zero Account, Raw Account, and VIP Account, with varying spreads, commissions, and leverage options. While TopFX offers excellent customer support, it has limited educational resources and lacks certain features like fixed spread accounts, social trading, and guaranteed stop loss orders. Overall, TopFX offers a solid trading platform with competitive conditions, suitable for traders of all levels.

Q: Is TopFX a regulated broker?

A: Yes, TopFX is a regulated broker. It is authorized and regulated by several top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

Q: What trading instruments are available at TopFX?

A: TopFX offers a wide range of trading instruments, including Forex, Indices, Shares, Metals, Energies, Cryptocurrencies, ETFs, Range of Markets

Q: What trading platforms does TopFX offer?

A: TopFX offers several trading platforms, including MetaTrader 4 and cTrader.

Q: What is the minimum deposit required to open an account with TopFX?

A: The minimum deposit required to open an account with TopFX is $50.

Q: What is the maximum leverage offered by TopFX?

A: The maximum leverage offered by TopFX is 1:1000.

| Company Name | ZFX |

| Registered Country/Region | London, UK |

| Founded in | 2010 |

| Regulation | FCA, FSA (Offshore) |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Max. Leverage | 1:2000 |

| Spread | From 1.3 pips (Standard account) |

| Trading Platforms | ZFX mobile app, MT4 Web Trader, MT4 for Windows, Mac and Android & ios |

| Minimum Deposit | $50 |

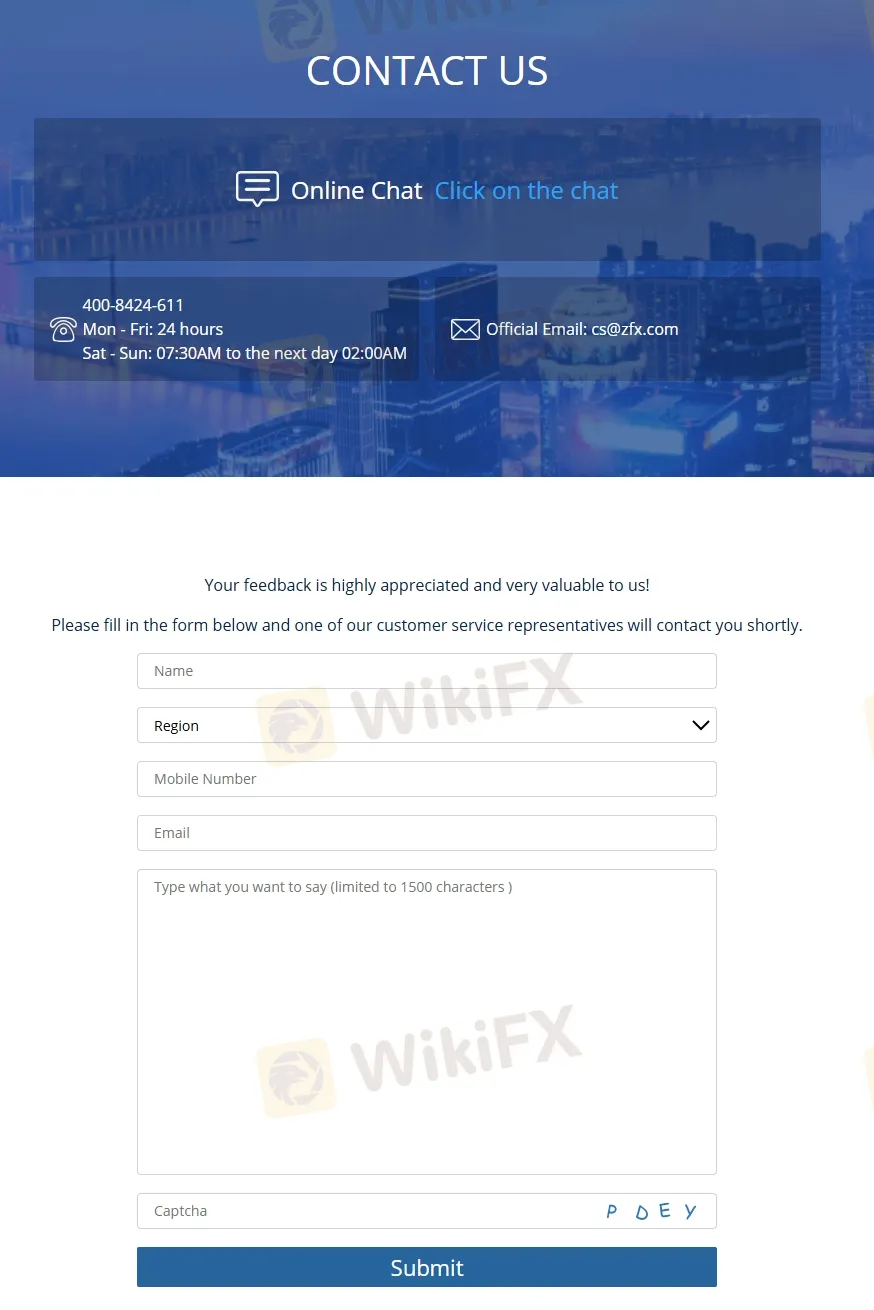

| Customer Support | Mon - Fri: 24 hours, Sat - Sun: 07:30 AM to the next day 02:00 A |

| Online chat, contact form | |

| Phone: 400-8424-611 | |

| Email: cs@zfx.com | |

| Social media: Facebook, Instagram, LinkedIn, Twitter | |

| Regional Restrictions | Residents of the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries are not allowed. |

Zeal Group of Companies, often referred to collectively as the Zeal Group, is a conglomerate of fintech corporations and regulated financial institutions that trade under the name ZFX. The group specializes in providing liquidity solutions for various types of assets in regulated markets and is backed by exclusive technology. Furthermore, the Zeal Group operates globally, combining with their multi-asset specializations and regulatory frameworks, solidifies their position as a competitive player in the financial industry.

ZFX is a broker that offers several advantages and disadvantages to traders.

| Pros | Cons |

| • Regulated by the FCA | • No MT5 platform available |

| • Multiple account types available | • No Islamic account option for Muslim traders |

| • Demo accounts available | • Lack of info on deposits and withdrawals |

| • Low minimum deposit requirement for the Mini Trading Account | • Regional restrictions |

| • Wide range of funding options | |

| • MT4 and proprietary trading platform supported | |

| • Copy trading available | |

| • Multi-channel support |

On the positive side, ZFX is a regulated broker, providing traders with demo accounts option, which is beneficial for beginner traders who want to practice their trading strategies before trading with real money. In addition, ZFX offers competitive trading conditions and low minimum deposit requirement through the popular MetaTrader4 trading platform.

On the negative side, no MT5 platform and no Islamic account option for Muslim traders. And ZFX doesn't reveal any info on deposits and withdrawals. Additionally, the broker does not provide services for residents of certain countries such as the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries.

ZFX is a regulated broker. Its company name is Zeal Capital Market (UK) Limited, and it is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration No. 768451. The FCA is one of the most reputable regulatory bodies in the world, and its strict regulations ensure that ZFX adheres to high standards of transparency and fairness.

ZFX's other entity, Zeal Capital Market (Seychelles) Limited, is authorized and offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number: SD027.

Additionally, ZFX ensures the safety of its clients' funds by keeping them fully segregated in a designated client bank account. This means that the clients' funds are kept separate from ZFX's operating funds. In the event that the company faces financial difficulties or becomes insolvent, the funds in these client accounts cannot be used to meet the liabilities of the company. This measure provides an added layer of security for ZFX clients, ensuring their capital cannot be used for any other purposes aside from their trading activities.

ZFX provides a comprehensive range of market instruments, catering to diverse trading preferences and strategies. This includes major asset classes such as forex, where traders can engage in currency trading across major, minor, and exotic pairs. For those interested in the stock market, ZFX offers the ability to trade stocks from leading global companies, allowing traders to tap into corporate performance and stock market trends.

Additionally, ZFX includes indices trading, which aggregates the performance of a number of stocks representing a segment of the stock market, providing a broader market exposure. Commodities are also available, offering opportunities to trade in essential goods such as oil and gold, which are often used as hedge investments against inflation or currency devaluation.

Furthermore, ZFX has embraced the growing interest in digital currencies by including cryptocurrencies in their offerings, thus allowing traders to speculate on the highly volatile crypto markets. Overall, ZFX's diverse selection of trading instruments ensures that traders have ample opportunities to diversify their portfolios and explore various market dynamics.

Apart from demo accounts, ZFX offers three types of trading accounts, namely Mini Trading, Standard Trading, and ECN Trading accounts. Each account has its own unique features and advantages, catering to different levels of traders with varying trading styles and preferences.

| Account Type | Minimum Deposit |

| Mini | $50 |

| Standard STP | $200 |

| ECN | $1000 |

| Pros | Cons |

| • Variety of account types to choose from | • Limited features in the Mini account |

| • Low minimum deposit requirement for the Mini account | • High minimum deposit requirement for the ECN account |

| • Access to high leverage for all account types | • No Islamic account option available |

Opening an account with ZFX is a simple and straightforward process that can be completed in just a few steps.

The maximum leverage offered by ZFX is up to 1:2000 and the leverage amount may vary depending on the account type and trading instrument. Additionally, ZFX operates on a tiered margin system, where the leverage is determined based on account equity. For accounts with equity between $0 and $3,000, the maximum leverage is 1:2000. For equity between $3,001 and $10,000, the maximum leverage is 1:1000. More detailed info on leverage can be found in the screenshot below:

ZFX says it offers competitive spreads and commissions on its trading instruments.

| Account Type | Spreads | Commissions |

| Mini Trading | From 1.5 pips | N/A |

| Standard Trading | From 1.3 pips | |

| ECN Trading | From 0.2 pips |

For the Mini Trading account, the minimum spread for forex pairs is 1.5 pips. The Standard Trading account has a minimum spread of 1.3 pips for forex pairs. The ECN Trading account has a minimum spread of 0.2 pips for forex pairs. However, no specific info on commissions is revealed openly.

ZFX offers the popular trading platform MetaTrader 4 (MT4), which is widely recognized in the forex industry for its user-friendly interface and advanced trading tools. MT4 provides access to various order types, technical analysis tools, and customization options, making it suitable for both novice and experienced traders. In addition, ZFX offers mobile versions of the MT4 platform for both iOS and Android devices, enabling traders to access the markets from anywhere, at any time.

ZFX also provides a mobile application for its clients, ensuring they can trade on the go. This ZFX Mobile App offers access to all the major features of the trading platform and enables clients to manage their portfolio, place trades, and monitor the markets from their mobile device.

The mobile app can be a valuable tool for traders who need the flexibility to trade anywhere and anytime, while still having access to key functionalities of the platform. Before using the app, make sure it is downloaded from an official source like the App Store or Google Play to ensure security and authenticity.

ZFX offers a Copy Trade feature, which is great news for both beginner and busy traders. Copy trading, also known as social trading, allows traders to automatically copy the trades of experienced and successful traders. This can help beginners to learn trading strategies from experienced traders, and help busy traders to automate their trading. By using the Copy Trade feature, you can potentially increase your chances of making profitable trades.

ZFX is committed to providing an extensive educational framework to support both novice and experienced traders through their A-to-Z Academy, which offers comprehensive learning resources designed to master trading from the basics to advanced strategies. This initiative underscores ZFX's dedication to empowering its clients with the knowledge needed to navigate the financial markets confidently.

Additionally, ZFX enhances trader support with a 24/7 Help Center, serving as a constant trading support hub where traders can obtain assistance at any time.

The platform also features a detailed Glossary, which acts as a valuable dictionary for demystifying complex trading terminology, making the trading language more accessible to everyone.

Moreover, their FAQ section addresses common queries related to trading mechanics, account management, funding procedures, withdrawals, and specific product details.

Collectively, these educational resources equip ZFX traders with a solid foundation of knowledge and continuous support, facilitating a well-rounded and informed trading experience.

ZFX provides robust customer support with extensive availability and multiple communication channels to ensure that traders can receive assistance whenever needed. Operating hours extend throughout the week, with round-the-clock support from Monday to Friday and extended hours over the weekend from 07:30 AM to 02:00 AM the next day, accommodating traders across different time zones.

Traders can reach out via online chat for immediate responses, use the contact form for less urgent inquiries, or call directly through the phone number 400-8424-611 for personalized assistance. Additionally, ZFX can be contacted through email at cs@zfx.com for comprehensive support.

The broker also maintains a strong presence on several social media platforms including Facebook, Instagram, LinkedIn, and Twitter. This multi-faceted approach ensures that ZFX's clients receive timely and effective support, enhancing their trading experience.

Overall, ZFX is a reputable option for traders looking to access the financial markets. The broker's maximum trading leverage of 1:2000, based on account equity, is one of the highest in the industry and can provide traders with significant opportunities for profit. Additionally, competitive spreads and a choice of popular MT4 trading platforms further strengthen ZFX's position as a reliable broker.

| Is ZFX regulated? |

| Yes. It is regulated by FCA and FSA (Offshore). |

| At ZFX, are there any regional restrictions for traders? |

| Yes. It does not provide services for residents of certain countries such as the United States of America, Canada, Egypt, Iran and North Korea (Democratic People's Republic of Korea). |

| Does ZFX demo accounts? |

| Yes. |

| Does ZFX offer industry leading MT4 & MT5? |

| Yes. It supports MT4 and ZFX Mobile App. |

| What is the minimum deposit for ZFX? |

| $50 for the Mini Trading account, while higher for other account types. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive topfx and zfx are, we first considered common fees for standard accounts. On topfx, the average spread for the EUR/USD currency pair is 0.5 pips pips, while on zfx the spread is From 0.2.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

topfx is regulated by CYSEC,BaFin,AMF. zfx is regulated by FCA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

topfx provides trading platform including ZERO,RAW and trading variety including --. zfx provides trading platform including ECN,Standard STP,Mini and trading variety including --.