No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ORBEX and S.A.M. Trade ?

In the table below, you can compare the features of ORBEX , S.A.M. Trade side by side to determine the best fit for your needs.

--

XAUUSD:41.2

EURUSD: -9.12 ~ 2.12

XAUUSD: -50.97 ~ 24.13

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of orbex, sam-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Mauritius |

| Founded Year | 5-10 years ago |

| Company Name | ORBEX Ltd |

| Regulation | Regulated in United Kingdom (FCA), Germany (BaFin), France (Banque de France), and Cyprus (CySEC) |

| Minimum Deposit | $100 for Starter account, $500 for Premium account, $25,000 for Ultimate account |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable spreads starting from 1.7 pips for Starter account |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, Orbex Mobile App |

| Tradable Assets | Forex, cryptocurrencies, commodities, stocks, indices |

| Account Types | Starter, Premium, Ultimate |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +44 2035198170 (English), +965 22968151 (English), +962 6 5622268 (English) |

| Payment Methods | Debit/Credit cards, eWallets (Skrill, Neteller), Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, Knet, Zotapay, Bank Transfers |

| Educational Tools | Trading Central, Free VPS, Calculator Tools, Economic Calendar |

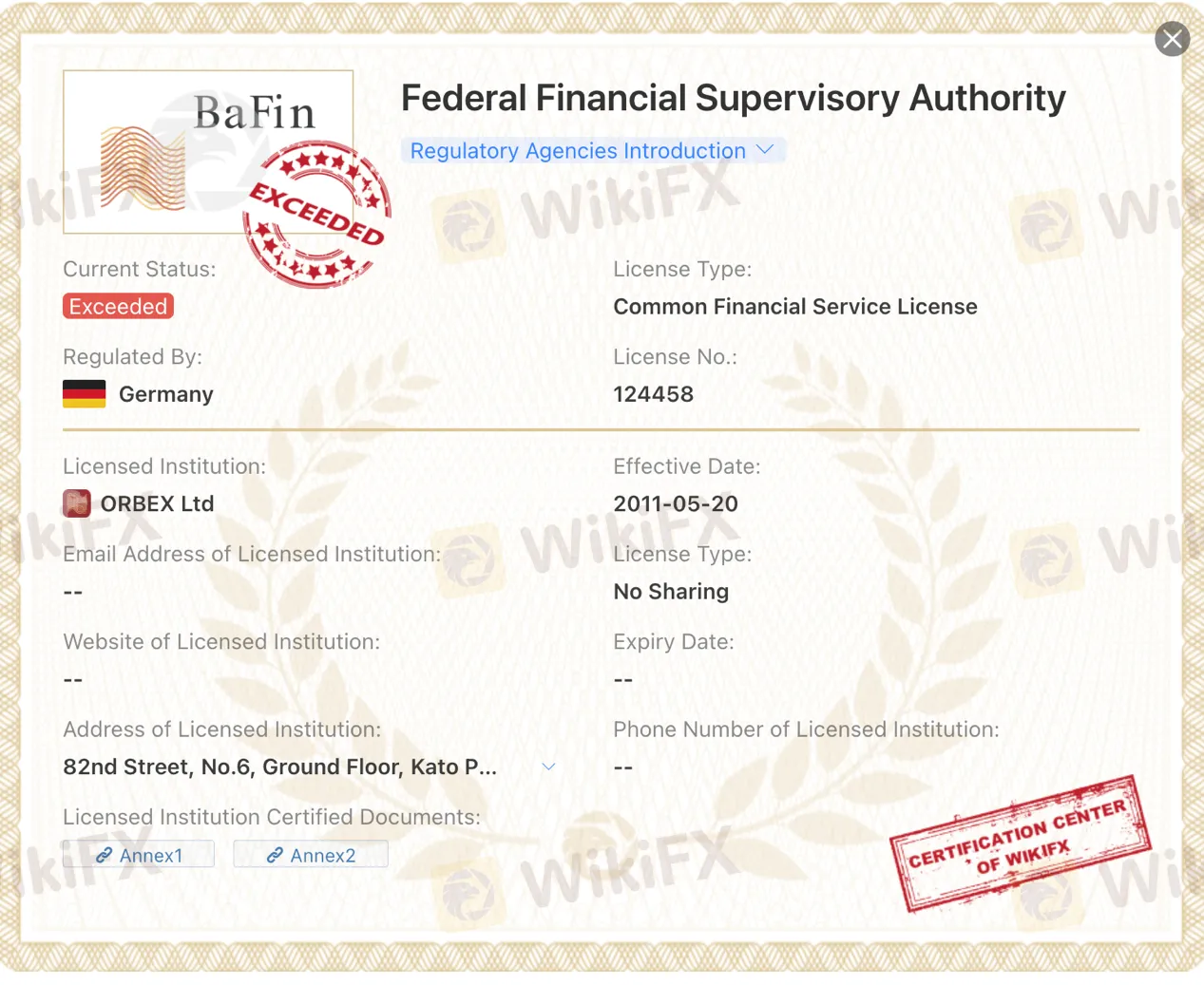

Orbex.com is owned by Orbex Group Limited and is operated by Orbex Global Limited and it is a financial institution operating in the financial services industry, offering a range of trading instruments such as forex, cryptocurrencies, commodities, stocks, and indices. While ORBEX is regulated by multiple authorities including the UK's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France, and the Cyprus Securities and Exchange Commission (CySEC), concerns have been raised about its regulatory status. The FCA has classified ORBEX as “Unsubscribed,” BaFin has stated that ORBEX exceeds their regulated business scope, and there are suspicions regarding the claimed CySEC regulation.

ORBEX provides various trading accounts to cater to different traders' needs, including Starter, Premium, and Ultimate accounts. Each account type offers different features and requires varying minimum investments. The accounts offer access to a range of trading instruments, variable spreads, and leverage of up to 1:500. However, it is important to exercise caution and consider the potential risks associated with ORBEX due to concerns about its regulatory status and suspicions raised by industry sources.

ORBEX offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, and a mobile app. These platforms provide traders with different features and functionalities, allowing them to trade across various markets. Additionally, ORBEX offers trading tools such as Trading Central for market analysis and insights, a free Virtual Private Server (VPS) for stable and secure trading, and calculator tools for risk management. Traders can also access an economic calendar to stay informed about upcoming market events.

Considering the concerns raised about ORBEX's regulatory status and suspicions in the industry, it is crucial for individuals to carefully assess the potential risks involved before engaging in any financial activities with ORBEX.

Here is the screenshot of Orbexs official website:

ORBEX is a financial institution that operates in the financial services industry. It is regulated by multiple authorities, including the United Kingdom's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France in France, and the Cyprus Securities and Exchange Commission (CySEC).

However, it is important to note that there are some concerns regarding ORBEX's regulatory status. According to WikiFX, a platform that collects and provides information about forex brokers, there have been complaints and suspicions raised about ORBEX. The FCA has classified its regulatory status as “Unsubscribed,” indicating an abnormality. BaFin has stated that ORBEX exceeds the business scope regulated by them. The regulatory status with Banque de France is also marked as “Exceeded,” suggesting potential issues. Additionally, the CySEC regulation claimed by ORBEX is suspected to be a clone.

Given these concerns and the information provided, it is advisable to exercise caution and carefully consider the potential risks associated with ORBEX before engaging in any financial activities with them.

Orbex is a trading broker that has both positive and negative aspects to consider. On the positive side, Orbex is regulated by multiple authorities, ensuring a level of oversight and security for traders. They also offer a variety of trading instruments, allowing traders to diversify their portfolios. Additionally, Orbex provides different account types to cater to the individual needs of traders. They offer multiple funding options as well. Orbex supports popular trading platforms like MetaTrader 4 and MetaTrader 5, which are widely used and trusted in the industry. Furthermore, Orbex provides educational resources for traders, allowing them to enhance their knowledge and skills. They also offer a free VPS service for all account types and provide access to the Trading Central research portal. On the downside, there have been concerns raised about Orbex's regulatory status, which may raise doubts among some traders. The FCA has classified Orbex as abnormal, leading to potential questions about their operations. Additionally, there are suspicions regarding Orbex exceeding its regulated business scope by regulatory bodies like BaFin and Banque de France. There have also been suspicions of clone regulation by CySEC. Despite these concerns, it is important for traders to carefully evaluate these factors before deciding to engage with Orbex.

| Pros | Cons |

| Regulated by multiple authorities | Concerns about regulatory status |

| Offers a variety of trading instruments | Abnormality classification by the FCA |

| Provides different account types to meet traders' needs | Suspicions of exceeding regulated business scope by BaFin and Banque de France |

| Multiple funding options available | Suspected clone regulation by CySEC |

| Offers popular trading platforms like MetaTrader 4 and MetaTrader 5 | - |

| Provides educational resources for traders | - |

| Free VPS service for all account types | - |

| Access to Trading Central research portal | - |

| Offers economic calendar and calculator tools | - |

Orbex provides traders with mainstream and popular financial products in the global financial market, including forex, spot indices, futures indices, precious metals, energies, stock CFDs, etc.

Forex: ORBEX provides a wide range of Forex trading instruments. Forex trading involves the buying and selling of currencies, with traders speculating on the value of one currency against another. ORBEX offers low spreads and leverage of up to 1:500 in Forex trading. You can access various currency pairs such as AUDCAD, AUDCHF, AUDJPY, AUDNZD, and AUDUSD, among others.

2. Cryptocurrencies: ORBEX allows traders to trade cryptocurrencies, which are encrypted, digital, and decentralized forms of money based on blockchain technology. Cryptocurrencies are not regulated by any central authority. ORBEX offers leverage of 1:2 and a commission of 0.5% for trading popular cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), Litecoin (LTCUSD), Bitcoin Cash (BCHUSD), and Ripple (XRPUSD).

3. Commodities: ORBEX offers trading instruments for commodities, which are raw materials that can be bought or sold as physical assets. Traders can access commodities like metals, energies, agricultural products, and precious metals. ORBEX provides flexible leverage options and low spreads for commodity trading. Precious metals include XAUUSD (Gold), XAGUSD (Silver), XPDUSD (Palladium), and XPTUSD (Platinum).

4. Stocks: ORBEX provides trading instruments for stocks, allowing traders to buy and sell shares in various assets or companies. Stock trading involves owning shares and selling them based on market value. ORBEX offers a wide range of stock CFDs (Contracts for Difference) with commission starting from $0. Some of the available stocks include 3M, Abercrombie & Fitch Co, Activision Blizzard, Adobe Systems, AIG, and Airbnb Inc, among others.

5. Indices: ORBEX offers trading instruments for indices, which are collections of assets or securities used to track their performance. Indices can be used as benchmarks to assess general economic data. ORBEX provides leverage of 1:100 for indices trading and offers a selection of popular world indices. Some of the available indices include US30, NAS 100, Germany 40, UK 100, SPX500, Australia 200 Cash Index, and France 40 Cash Index, among others.

| Pros | Cons |

| Wide range of trading instruments | Concerns about regulatory status |

| Low spreads and leverage in Forex | Abnormality classification by the FCA |

| Availability of popular cryptocurrencies | Suspicions of exceeding regulated business scope by BaFin and Banque de France |

| Leverage options for commodities | Suspected clone regulation by CySEC |

| Access to a variety of stock CFDs |

To meet investors' various investment requirements and strategies, Orbex has set up three account types: Starter Accounts, Premium Accounts, and Ultimate Accounts. The minimum deposit for the starter account is US$200, the premium account US$500, and the ultimate account is US$25,000.

The Starter account is suitable for traders who are new to the market or prefer to start with a smaller investment. It requires a minimum investment of $100 and offers variable spreads reaching 1.7 pips. There are no commissions charged for trades on this account, making it a cost-effective option. Traders can leverage up to 1:500 and trade with a minimum size of 0.01 lots. The account features a 20% stop out level and a 100% margin call level. It operates on a Non-Dealing Desk (NDD) execution type. The Starter account also provides basic education materials to support traders in their learning journey.

The Premium account is designed for traders with a higher investment capacity. It requires a minimum investment of $500 and offers similar features as the Starter account, including variable spreads from 0.0 pips and leverage up to 1:500. However, there is a commission of $8 charged per trade on this account. The Premium account also provides advanced education materials to enhance traders' knowledge and skills. Traders on this account have access to exclusive monthly webinars and receive one-on-one training sessions.

The Ultimate account is tailored for experienced traders and those with a substantial investment capability. It requires a minimum investment of $25,000, offering the same features as the other accounts, including variable spreads from 0.0 pips and leverage up to 1:500. The commission charged on trades is lower compared to the Premium account, with a rate of $5 per trade. Similar to the Premium account, the Ultimate account provides advanced education materials, but traders on this account receive three one-on-one training sessions. The account also grants exclusive access to webinars.

| Pros | Cons |

| Multiple account options | Concerns about regulatory status |

| Varied investment requirements | Abnormality classification by the FCA |

| Variable spreads available | Higher commission charges on Premium and Ultimate accounts |

| Leverage up to 1:500 | Higher minimum investment requirement for Ultimate account |

To open an account with ORBEX, follow these steps:

Visit the ORBEX website and click on the “Register” button.

2. Fill out the registration form with the required information. This includes your first name, last name, email address, country, and phone number. Make sure to read and agree to the terms and conditions.

3.Once you have completed the form, submit it. By doing so, you acknowledge the risks associated with Forex and Contract for Differences (CFD) trading.

4. After submitting the form, you will receive a confirmation email with instructions on how to log in to the client portal.

5. Log in to the client portal using the provided credentials.

6. Fund your account to start trading. ORBEX offers various funding options to deposit funds into your trading account.

7. Once your account is funded, you can begin trading forex, indices, commodities, or stock CFDs, depending on the available options.

Leverage rates at Orbex are quite high, reaching 1:500 for forex pairs on all accounts. However, to mitigate the risks of margin trading, leverage rates are capped at 1:100 if trading in volumes of over 40 lots. The maximum leverage rates provided for indices are 1:100, though Chinese indices are capped at 1:20. Commodities can be leveraged at either 1:100 or 1:50 and stock CFDs are limited to 1:5.For EU retail traders, leverage is capped at 1:30.

ORBEX offers different trading accounts with varying spreads and commissions. The Starter account features variable spreads, with minimum spreads starting from 1.7 pips. On the other hand, the Premium and Ultimate accounts provide spreads that start from 0 pips. When it comes to commissions, the Starter account does not impose any additional charges. However, the Premium account requires a commission of $8, and the Ultimate account incurs a commission of $5. These account types allow traders to choose the option that aligns with their specific trading preferences and cost considerations.

ORBEX offers several trading platforms to cater to the needs of different traders.

MetaTrader 4 (MT4)

Firstly, Orbex uses the world's most popular MT4 trading platform, allowing traders to explore the forex, precious metals, indices, commodities, and energy markets in depth. Orbex MT4 has such advantages as responding to all customer inquiries within 1 hour, trading ECN on MT4, making fund withdrawals more convenient and faster, 10 language & 24-hour customer support. The platform supports 23 languages, automated trading, and is customized using an intelligent trading system exclusive own strategy, trailing stop loss function. The platform can be applied to Windows client-side, multi-accounts client-side, Android, and Apple iOS client-side.

MetaTrader 5 (MT5)

Another platform offered by ORBEX is MetaTrader 5 (MT5). It is a powerful platform suitable for traders of all levels. MT5 includes all the features of MT4 and provides additional trading functions like advanced orders and trading automation tools. It offers improved speed, functionality, and algorithmic efficiency. Traders can access over 300 CFDs, including forex pairs, stocks, indices, commodities, and cryptocurrencies. The platform also provides 38+ preinstalled technical indicators, 44 analytical charting tools, and options for different types of orders, execution modes, and market depth. Traders can automate their trades using trading robots, Expert Advisors, and scripts. Additionally, MT5 integrates tools like Orbex's Trading Central, Elliott Wave indicator, and VPS service. Traders can track their performance, join a community of traders and developers, and even develop and back test their own indicators and EAs.

FIX API

ORBEX also offers the FIX API, which stands for Financial Information Exchange. FIX API is a technology used by institutional players in the financial markets. It allows for real-time exchange of a large amount of financial information and offers direct connections between traders and tier-1 liquidity providers. This ensures trades are executed with no latency and with high precision. FIX API provides ultra-fast and precise execution for accessing global markets.

Orbex Mobile App

For traders who prefer mobile trading, ORBEX has the Orbex Mobile App. The app allows traders to register, set up, and manage their trading accounts on the go. It is available on both the App Store and Google Play. Traders can perform various actions through the app, such as registering and verifying their accounts, creating and funding their wallets, depositing, transferring, and withdrawing funds, accessing daily market analysis, and getting live support from the expert team via live chat in English or Arabic.

| Pros | Cons |

| Offers MetaTrader 4 (MT4), known for speed and execution | Concerns about regulatory status |

| Provides MetaTrader 5 (MT5) with advanced features | Potential compatibility issues with certain operating systems or devices |

| Orbex Mobile App for mobile trading | Reliance on stable internet connection for seamless trading experience |

| Offers FIX API for ultra-fast and precise execution |

Trading Central: Orbex provides its active clients with access to Trading Central, an acclaimed research portal. This platform offers a range of market-scanning tools designed to assist traders in understanding the markets, identifying potential trading opportunities, and enhancing their strategies. Trading Central allows users to access expert insights, algorithmic setups, financial summaries, historical data, market buzz, technical views, and economic insights.

Free VPS: Orbex offers a free Virtual Private Server (VPS) to all types of trading accounts. A VPS is a virtual computer hosted within a parent server. It acts as a fully functional computer that remains connected to your trading account 24/5, regardless of your personal device's status or internet connectivity. This feature ensures a stable trading experience, safeguarding trading strategy from threats like computer viruses or internet disruptions. It allows your trades to continue uninterrupted.

Calculator Tools: Orbex provides various calculator tools to assist traders in their decision-making process. These tools include a currency converter, which allows users to convert between different currencies. Traders can select the desired currencies and obtain the conversion value instantly. Another useful tool is the pip value calculator, which helps determine the monetary value of each pip movement in a particular currency pair. These calculators aid traders in managing risk and understanding the potential profit or loss associated with their trades.

Economic Calendar: Orbex offers an economic calendar that provides essential information about upcoming economic events, such as economic indicators, central bank announcements, and geopolitical developments. The economic calendar helps traders stay informed about significant market-moving events and plan their trading activities accordingly. By being aware of these events, traders can make more informed decisions and adapt their strategies to capitalize on potential market opportunities.

| Feature | Pros | Cons |

| Trading Central | Access to expert insights, algorithmic setups, financial summaries, historical data, market buzz, technical views, and economic insights. | Can be overwhelming for beginners. |

| Free VPS | Stable trading experience, safeguarding your trading strategy from threats like computer viruses or internet disruptions. | Requires some technical knowledge to set up. |

| Calculator tools | Help traders in managing risk and understanding the potential profit or loss associated with their trades. | Can be complex for beginners. |

| Economic calendar | Provides essential information about upcoming economic events, such as economic indicators, central bank announcements, and geopolitical developments. | Can be difficult to keep up with all of the events. |

When it comes to depositing funds, ORBEX supports different payment methods, including debit/credit cards such as Visa and Mastercard. The available currencies for these cards are USD, PLN, EUR, and GBP. There are no fees associated with these card deposits, and the processing time is typically up to 2 hours. It's important to note that ORBEX is regulated under the Central Bank of Cyprus for these transactions.

ORBEX also accepts eWallets for funding and withdrawal. Skrill and Neteller are two popular eWallet options available for users, supporting the same currencies as the cards. Similar to card deposits, there are no fees for using these eWallets, and the processing time is up to 2 hours. ORBEX is regulated under the Financial Conduct Authority (FCA) in the UK for these transactions.

Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, Knet, and Zotapay are additional funding and withdrawal options provided by ORBEX. These methods support various currencies and have their own unique regulations and processing times.

For users interested in cryptocurrency payments, ORBEX accepts USDT (Tether). Deposits and withdrawals using USDT have no fees and typically take up to 2 hours to process. It's important to note that cryptocurrency transactions are not regulated.

Lastly, ORBEX supports bank transfers for funding and withdrawal. Bank wire transfers are available in currencies such as USD, EUR, GBP, AED, and KWD. There are no fees associated with bank wire transfers, and the processing time is 3-5 business days. Similar to other transactions, ORBEX is regulated under the Central Banks of Incorporation Countries for bank transfers.

| Pros | Cons |

| Supports various payment methods | Processing time may take up to 5 business days for bank transfers |

| No fees for card deposits and eWallets | Cryptocurrency transactions are not regulated |

| Multiple currencies available | Different regulations and processing times for various funding options |

| Regulated under reputable authorities | Limited cryptocurrency options (only USDT accepted) |

| Bank wire transfers available for large transactions |

Forex Educational Hub:

ORBEX offers a comprehensive Forex Educational Hub that provides market research and educational content for traders of all experience levels. The hub includes a variety of resources such as articles, tutorials, infographics, trading education, videos, and eBooks. These resources cover topics ranging from understanding forex trading platforms like MT4 to exploring the history of gold and learning about different trading strategies. The educational content is tailored to suit the needs of traders at various skill levels.

Webinars:

ORBEX conducts live FX webinars to help traders sharpen their skills and enhance their market understanding. These webinars are hosted by leading industry experts and cover a wide range of topics. Traders can participate in these free webinars to gain insights into market trends, trading strategies, and economic events. Additionally, past webinars are available for reference, allowing traders to access valuable educational material and enhance their trading knowledge.

Seminars:

ORBEX organizes informative and educational seminars to empower traders in making informed trading decisions. These seminars cover various aspects of trading, including fundamental and technical analysis, forex basics, and strategy-building support. Traders can attend these seminars to expand their knowledge, learn new trading techniques, and gain insights from industry professionals. ORBEX has conducted seminars in different locations, such as the MENA Seminar Tour in Egypt and Kuwait.

ORBEX offers a comprehensive range of customer support services to address your needs and provide assistance throughout your trading journey. Our experienced team is available 24/5 to address any queries or concerns you may have. You can reach the Customer Support team via email at support@orbex.com.

In addition, specialized departments are in place to handle specific areas of focus. The Back Office team can be contacted at backoffice@orbex.com, while the Dealing Desk is available at dealing@orbex.com. For sales inquiries, you can get in touch with the Sales team through sales@orbex.com.

ORBEX has departments for specific requirements, including White Label services, Introducers Brokers, Complaints, Human Resources, Marketing, Turkish Support, Arabic Sales, and Financial matters. The contact details for each department can be found on the official website. To provide immediate assistance, a live chat option is also available to connect with knowledgeable agents.

Feedback is highly valued. To submit your query, please complete the contact form on the official website. The form requires your name, email address, country, phone number, ORBEX account number (if applicable), and your message. The customer support experts will respond to your inquiry promptly.

Several negative reviews have been reported about ORBEX on WikiFX. Traders have expressed concerns about their inability to withdraw funds, accusing the broker of fraudulent activities and scams. Clients have claimed that ORBEX manipulates trades, keeps orders open after stop-loss, and exhibits slippage. Some reviewers have also stated that ORBEX fails to have a physical office in Mauritius as claimed. Overall, the reviews indicate dissatisfaction with ORBEX's withdrawal process and suspicions of fraudulent behavior.

In conclusion, ORBEX is a financial institution operating in the financial services industry. It is regulated by multiple authorities, including the United Kingdom's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France in France, and the Cyprus Securities and Exchange Commission (CySEC). However, there are concerns regarding ORBEX's regulatory status, with abnormal classifications and potential issues raised by regulatory bodies. It is advisable to exercise caution and carefully consider the potential risks associated with ORBEX before engaging in any financial activities with them.

Q: Is ORBEX a legitimate financial institution?

A: ORBEX is regulated by authorities such as the FCA, BaFin, Banque de France, and CySEC. However, there are concerns and suspicions raised about its regulatory status, indicating potential issues. Caution is advised before engaging in any financial activities with ORBEX.

Q: What trading instruments are available on ORBEX?

A: ORBEX offers Forex, cryptocurrencies, commodities, stocks, and indices for trading.

Q: What types of trading accounts does ORBEX offer?

A: ORBEX offers Starter, Premium, and Ultimate trading accounts to cater to different trader preferences and needs.

Q: How can I open an account with ORBEX?

A: To open an account with ORBEX, visit their website, fill out the registration form, receive a confirmation email, log in to the client portal, fund your account, and start trading.

Q: What leverage options are available on ORBEX?

A: ORBEX offers leverage rates up to 1:500 for forex trading. Leverage rates for other instruments vary.

Q: What are the spreads and commissions on ORBEX?

A: ORBEX offers variable spreads starting from 1.7 pips for the Starter account, while the Premium and Ultimate accounts start from 0 pips. Commissions range from $0 to $8 per trade, depending on the account type.

Q: What are the deposit and withdrawal options on ORBEX?

A: ORBEX supports various payment methods, including debit/credit cards, eWallets, bank transfers, and cryptocurrency payments.

Q: What trading platforms does ORBEX offer?

A: ORBEX offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, and the Orbex Mobile App for trading.

Q: What trading tools are available on ORBEX?

A: ORBEX provides access to Trading Central, a free VPS, calculator tools, and an economic calendar to assist traders in their decision-making process.

Q: What educational resources does ORBEX offer?

A: ORBEX provides a Forex Educational Hub with market research, articles, tutorials, videos, and eBooks for traders of all experience levels.

| S.A.M. Trade | Basic Information |

| Company Name | S.A.M. Trade |

| Founded | 2015 |

| Headquarters | Australia |

| Regulations | Unlicensed broker |

| Tradable Assets | Forex, Indices, Commodities, Futures, Cryptocurrencies |

| Account Types | Standard Account, VIP Account, ECN Account, Islamic Account |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Spreads | Varies depending on account type and instrument |

| Commission | No commission for most account types; $5 commission per round lot turn for ECN Account |

| Deposit Methods | Tether (USDT), Bank Wire Transfer, Visa/Mastercard Credit & Debit Cards |

| Trading Platforms | MetaTrader 4 (MT4), CopySam™ |

| Customer Support | Contact form, Email |

| Education Resources | Educational guides, Membership program |

| Bonus Offerings | Not specified |

S.A.M. Trade is an unlicensed broker based in Australia that offers a range of tradable assets including Forex, Indices, Commodities, Futures, and Cryptocurrencies. They provide different account types such as Standard, VIP, ECN, and Islamic accounts, with minimum deposits starting at $10. The broker offers leverage of up to 1:1000 and varying spreads depending on the account type and instrument. Traders have access to the MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. S.A.M. Trade also provides educational resources, membership programs, and accessible customer support channels.

However, it's important to note that S.A.M. Trade operates as an unlicensed broker. This raises concerns about regulatory oversight and accountability, as well as potential issues with fund safety and unfair trading practices. Traders should exercise caution when considering trading with an unlicensed broker, as there may be limited avenues for dispute resolution and challenges in recovering funds in case of disputes or financial issues.

While S.A.M. Trade offers a wide range of tradable assets, account types with varying leverage options, and access to popular trading platforms, the lack of regulatory oversight and accountability is a significant drawback. Traders should carefully evaluate the risks and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

S.A.M. Trade is an unlicensed broker, and it is risky trading with it. Caution is advised when considering trading with S.A.M. Trade, as this broker operates without a license. Trading with an unlicensed broker carries inherent risks and raises concerns regarding the safety and security of funds. Regulatory authorities play a crucial role in overseeing and regulating the operations of brokers, ensuring compliance with industry standards and protecting the interests of traders.

Choosing to trade with an unlicensed broker such as S.A.M. Trade means there is a lack of regulatory oversight and accountability. This absence of oversight can result in potential issues such as inadequate client fund protection, unfair trading practices, and limited avenues for dispute resolution. In the event of any disputes or financial issues, traders may face challenges in seeking recourse or recovering their funds.

S.A.M. Trade offers a wide range of tradable assets and provides different account types with varying leverage options and spreads. Traders have access to the popular MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. The broker also provides educational resources and a membership program. Additionally, they offer accessible customer support channels. However, it's important to note that S.A.M. Trade is an unlicensed broker, which raises concerns about regulatory oversight and accountability. There may be potential issues with fund safety and unfair trading practices. Furthermore, the limited avenues for dispute resolution can be a disadvantage for traders.

| Pros | Cons |

| Wide range of tradable assets | Unlicensed broker |

| Different account types with varying leverage options and spreads | Lack of regulatory oversight and accountability |

| Availability of MetaTrader 4 (MT4) and CopySam™ platform | Potential issues with fund safety and unfair trading practices |

| Educational resources and membership program | Limited avenues for dispute resolution |

| Accessible customer support channels |

S.A.M. Trade offers a variety of trading instruments to its clients, including Forex, Indices, Commodities, Futures, and Cryptocurrencies. Here's a breakdown of each category:

1. Forex:

S.A.M. Trade provides trading services for over 30+ currency pairs. Each currency pair is offered with a standard contract size of 100,000 units of the first-named currency. The company operates 24/5 trading, allowing traders to participate in the forex market throughout the week. It's important to note that there may be fluctuations in spreads during opening, closing, and between market sessions. These fluctuations can be attributed to routine settlements conducted by major financial institutions, which can affect prices. S.A.M. Trade offers a range of major and minor currency pairs, each with its own value per pip, contract size, minimum lot size, and typical spread.

2. Indices:

S.A.M. Trade provides investors with the opportunity to trade on derivatives of various indices. Trading indices offers a way to diversify risk compared to single stock trading. The company offers a selection of popular indices such as ASX 200, FTSE CHINA A50, Germany DAX 30, Euro Stoxx 50, Hang Seng, KOSPI 200, and more. Each index contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

3. Commodities:

S.A.M. Trade allows investors to expand their investment portfolios by trading derivatives on spot metals and energies. The company offers contracts for gold, silver, WTI crude oil, Brent crude oil, and natural gas. Each commodity contract has a specific value per contract, quote digits, contract size per lot, minimum lot size, and average spread.

4. Futures:

Trading futures enables investors to diversify their portfolios and explore various trading opportunities. S.A.M. Trade offers futures contracts for the volatility index, Hang Seng China Enterprises, India Nifty 50, KOSPI 200, Russell 2000 Mini, Dollar Index, 10-year US Bond, DAX 30, Mini-sized DJIA, and US Oil. Each futures contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

5. Cryptocurrencies:

S.A.M. Trade allows clients to trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. The company offers a range of cryptocurrency pairs, each with its own value per contract, quote digits, contract size per lot, and minimum lot size. It's important to note that leverage on cryptocurrency CFDs is capped at 1:5, and trading hours are available 24/7.

By offering these diverse trading instruments, S.A.M. Trade aims to provide its clients with a wide range of options to suit their investment preferences and strategies.

Here is a comparison table of trading instruments offered by different brokers:

| Trading Instruments | S.A.M Trade | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | No | Yes | No | No |

| Options | No | Yes | Yes | Yes |

S.A.M. Trade offers a range of account types tailored to meet the specific needs and expertise levels of traders. The account types differ based on factors such as minimum funding requirements, spreads, leverage options, commissions, and additional features.

For the Australia region, S.A.M. Trade provides the following account types:

1. Standard Account: This account offers standard spreads, leverage of up to 1:30, no commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:30, no commissions, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account offers the best available spreads, priority customer support, leverage of up to 1:30, USD 5 commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 100.

For the St Vincent and the Grenadines region, S.A.M. Trade provides the following account types:

1. Standard Account: This account type offers standard spreads, leverage of up to 1:1000, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:1000, no commissions, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account provides the best available spreads, priority customer support, leverage of up to 1:200, USD 5 commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 100.

4. Islamic Account: S.A.M. Trade also offers an Islamic account with standard spreads, swap-free trading, leverage of up to 1:500, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

Traders should note that the maximum leverage differs between the two regions, with the Australia region offering a maximum leverage of 1:30, while the St Vincent and the Grenadines region offers higher maximum leverage options, ranging from 1:1000 to 1:200 depending on the account type. It is crucial for traders to consider their risk tolerance and trading strategies when selecting the appropriate account type.

To open an account on S.A.M. Trade, follow these steps:

Visit the S.A.M. Trade website: Go to the official website of S.A.M. Trade and locate the “Open Live Account” button on the homepage. Click on it to initiate the account opening process.

2. Choose your account type: On the registration page, you will be presented with different account types to choose from, including Individual, Joint and Corporate.

3. Complete the registration process: Fill in the required information, including your personal details, contact information, and any additional information requested. Ensure that all the provided information is accurate and up to date.

4. Receive your account login details: After submitting the registration form, you will receive an automated email containing your personal account login information. Keep this information secure as it will be used to access your trading account.

5. Log in to your account: Using the provided login details, access your S.A.M. Trade account by logging in through the website's login portal. Make sure to use the correct username and password to gain access successfully.

6. Deposit funds: Once logged in, proceed to deposit funds into your trading account. S.A.M. Trade typically provides multiple payment methods, including Bank Transfers, Visa / Master and Tether (USDT). Choose the most convenient option for you and follow the instructions to deposit the desired amount.

7. Download the trading platform: To start trading, you will need to download the trading platform provided by S.A.M. Trade. Follow the instructions on the website to download and install the trading platform.

Once the trading platform is installed, you can log in using your account credentials and begin trading in the financial markets offered by S.A.M. Trade. It is recommended to familiarize yourself with the platform's features and tools before placing any trades.

S.A.M. Trade provides different leverage options based on the account types and the regions in which they operate. In the Australia region, the maximum leverage offered is 1:30 for all the account types available, including the Standard, VIP, and ECN accounts. This means that traders can access a leverage ratio of up to 1:30 for their trades.

On the other hand, in the St Vincent and the Grenadines region, S.A.M. Trade offers higher maximum leverage options. The Standard and VIP accounts in this region allow traders to utilize leverage of up to 1:1000, providing greater potential for amplifying trading positions. The ECN account, however, offers a maximum leverage of 1:200.

It's important for traders to understand that leverage magnifies both potential profits and losses. Higher leverage can increase potential gains but also increases the risk of significant losses. Therefore, it is crucial for traders to carefully assess their risk tolerance, trading strategies, and market conditions when deciding on the appropriate leverage level.

Here is a comparison table of maximum leverage offered by different brokers:

| S.A.M Trade | IG Group | Just2Trade | Forex.com | |

| Maximum Leverage | 1:1000 | 1:30 | 1:20 | 1:200 |

S.A.M. Trade offers a variety of account types with different spreads and commissions to suit the needs of different traders. For most account types, including the standard ones, there are no commissions charged for investing. This means that traders can execute trades without incurring additional fees beyond the spreads.

While S.A.M. Trade does not provide specific spreads for each account or instrument, they do offer average prices for certain popular trading pairs and assets. For example, the EUR/USD currency pair typically has a spread ranging from 1.7 to 2 pips, indicating the difference between the buying and selling prices. The GBP/USD pair, on the other hand, has an average spread of 2.4 to 2.6 pips. Commodity trades like Crude Oil and Natural Gas have an average spread of 5.0 cents.

For traders looking for the tightest spreads, S.A.M. Trade offers an ECN account type. With this account, traders can access the market through an STP/ECN model, which provides direct access to liquidity providers. However, there is a $5 commission per round lot turn for trades executed through the ECN account. This commission covers the cost of accessing the competitive spreads and liquidity offered by the ECN model.

In summary, S.A.M. Trade offers commission-free investing for most account types, allowing traders to trade without additional fees beyond the spreads. While specific spreads are not provided for all instruments, average prices are available for popular trading pairs and commodities. Traders seeking the tightest spreads can opt for the ECN account, but should be aware of the $5 commission per round lot turn.

S.A.M. Trade imposes swap charges for positions held overnight. They offer a profit-sharing plan called CopySam™, where users may share a portion of the profits generated from copied trades. Opening a live trading account with S.A.M. Trade is free, and there are no account management fees.

S.A.M. Trade offers different trading platforms for traders in Australia and St Vincent and the Grenadines.

In Australia, S.A.M. Trade provides the popular MetaTrader 4 (MT4) trading platform. MT4 is widely recognized as a leading trading platform in the world. Traders can download MT4 for free and enjoy its user-friendly interface, extensive tools, and indicators. It supports various financial instruments such as forex, commodities, indices, and cryptocurrencies, providing a seamless trading experience.

For traders in St Vincent and the Grenadines, S.A.M. Trade introduces CopySam™, an innovative trade copying technology. CopySam™ allows traders to follow and trade like expert traders by automatically copying their trades with precision. It offers beginners the opportunity to replicate winning traders' trades and experienced traders the convenience of minimal time involvement while diversifying their portfolios. CopySam™ has received the Collective Investment Platform Certification, ensuring transparency and fair trading practices.

By offering both MT4 and CopySam™, S.A.M Trade caters to the needs of different types of traders. MT4 provides a robust and versatile trading platform for those who prefer to analyze the markets and execute their own trades, while CopySam™ offers a convenient way to follow and copy the trades of successful traders, making it suitable for traders who prefer a more hands-off approach to trading.

S.A.M. Trade offers customer service support through different channels, including a contact form on their website and dedicated email addresses for media/partnership inquiries and general support. Traders can fill out the contact form with their details to receive a prompt response. Media and partnership inquiries can be sent to marketing@samtradefx.com, while general support inquiries can be directed to support@samtradefx.com. Additionally, customers can follow S.A.M. Trade on Facebook and YouTube for updates. While phone support may not be mentioned, the broker is committed to providing accessible customer service through these available channels.

S.A.M. Trade recognizes the importance of education and provides a range of resources to help clients gain knowledge and skills in forex and commodity trading. They offer educational guides and articles that cover various topics such as forex trading basics, CFDs and commodities, leverage and margin, and important concepts like Overnight Funding and Margin Call Policy. These resources aim to equip traders with the necessary understanding to navigate the trading world effectively.

In addition to educational materials, S.A.M. Trade offers an exclusive membership program that provides valuable guidance and market analysis. Led by expert trainers, registered clients gain access to the latest market news, fundamental research, and a results-driven approach to trading. The membership program includes eight sessions held every Friday evening for eight weeks, as well as a Bootcamp consisting of 10 sessions spread over three weekends. While there is a one-time membership fee of $10,000 associated with this program, clients can benefit from the expertise and insights shared during these sessions to enhance their trading strategies.

S.A.M. Trade offers trading tools to enhance the trading experience and ensure the security of funds. One of these tools is SamTracks™, a Portfolio Monitoring System that helps traders track their account and trading performance. It provides an overview of the account, allows performance tracking, monitors asset allocation, and displays traded volume.

S.A.M. Trade also prioritizes fund security through their Six Pillars of Secured Fund Coverage, known as SamAide™. These pillars include measures such as segregating clients' funds, professional indemnity insurance, third-party insurance protection, membership in the Financial Commission, and Negative Balance Protection. They also provide real-time deposit and withdrawal notifications to keep clients informed about their account activity.

S.A.M. Trade provides promotional offers to its clients, including the SamRewards™ program. This program rewards retail investors based on their trading volumes. By meeting certain criteria such as making a first deposit of $500, trading 1 standard FX lot, or referring new clients, investors can earn 'points'. These points can then be exchanged for luxury prizes, including electronics.

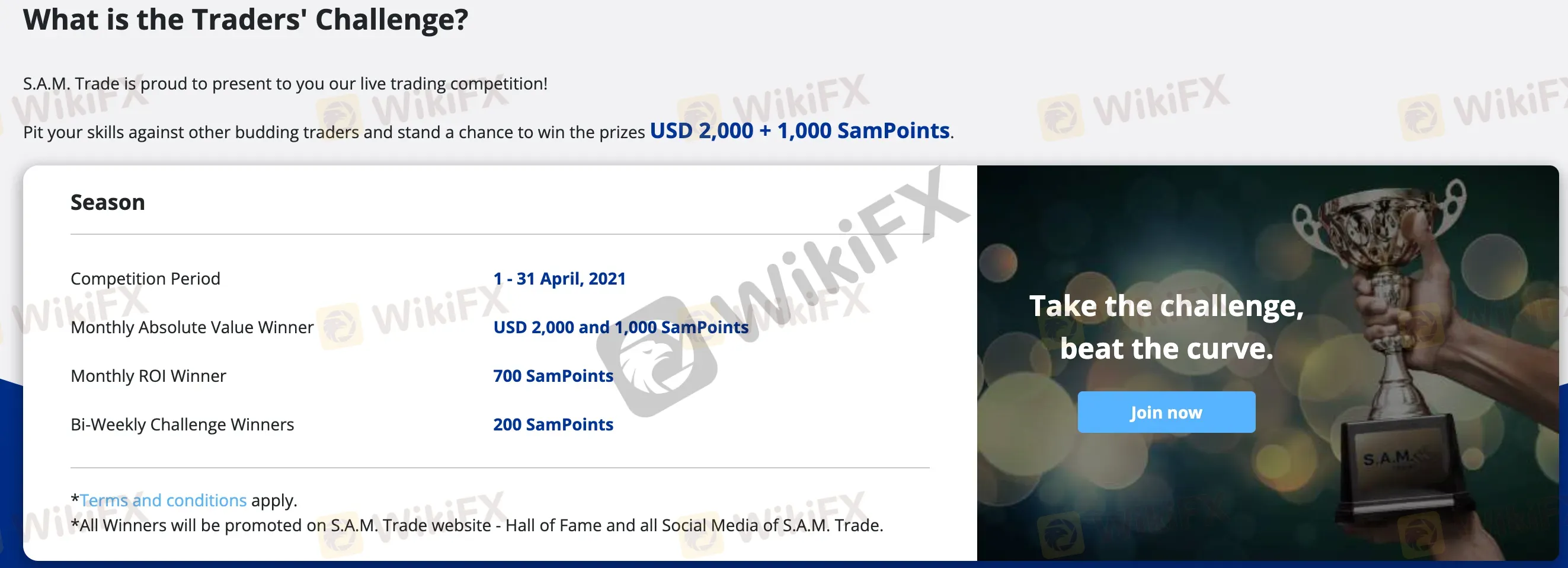

In addition, S.A.M. Trade occasionally organizes a 'Traders' Challenge'. This challenge allows clients to compete based on their performance during a specific month. Participants have the opportunity to win up to $2000 and earn 1,000 SamPoints, providing an added incentive for traders to excel in their trading activities.

At S.A.M. Trade, there are several deposit methods available for clients. These include Tether (USDT), which typically takes up to one working day to process, Bank Wire Transfer, which takes one to four working days, and Visa & Mastercard Credit & Debit Cards, which are processed within one hour during weekdays. While most S.A.M. Trade live accounts have a minimum deposit of $10, the accepted payment methods require a minimum deposit of $20 or its equivalent currency (or USDT 50). The broker itself does not charge any fees for deposits, but investors may be responsible for any third-party charges.

When it comes to withdrawals, S.A.M. Trade accepts withdrawals through the same deposit methods. A minimum withdrawal amount of $20 or USDT 50 applies. Withdrawal processing times typically range from one to four working days for bank transfers and credit/debit cards. However, all withdrawals are processed by the broker within 72 hours. Tether payments, on the other hand, can be processed in one working day. Just like with deposits, S.A.M. Trade does not charge any withdrawal fees, but investors may need to bear any applicable third-party charges.

In conclusion, S.A.M. Trade is an unlicensed broker based in Australia that offers a variety of tradable assets and account types with attractive features such as low minimum deposits, high leverage, and access to popular trading platforms. However, the lack of regulatory oversight and accountability is a significant disadvantage. Trading with an unlicensed broker raises concerns about fund safety, unfair trading practices, and limited avenues for dispute resolution. Traders should carefully evaluate the risks involved and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

Q: Is S.A.M. Trade a regulated broker?

A: No, S.A.M. Trade currently operates without valid regulation.

Q: What trading instruments are available on S.A.M. Trade?

A: S.A.M. Trade offers Forex, Indices, Commodities, Futures, and Cryptocurrencies as trading instruments. Each category has a variety of assets available for trading.

Q: What leverage options does S.A.M. Trade offer?

A: S.A.M. Trade offers leverage options of up to 1:1000 for Standard and VIP accounts, up to 1:200 for ECN accounts, and up to 1:500 for Islamic accounts.

Q: What trading platforms are available at S.A.M. Trade?

A: S.A.M. Trade offers MetaTrader 4 (MT4) and their proprietary copy trading platform, CopySam™.

Q: What are the deposit and withdrawal methods offered by S.A.M. Trade?

A: S.A.M. Trade accepts deposits through Tether (USDT), Bank Wire Transfer, and Visa/Mastercard Credit & Debit Cards. Withdrawals can be made using the same methods.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive orbex and sam-trade are, we first considered common fees for standard accounts. On orbex, the average spread for the EUR/USD currency pair is From 0.0 pips, while on sam-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

orbex is regulated by CYSEC,FCA. sam-trade is regulated by ASIC,FCA,ASIC,VFSC,FCA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

orbex provides trading platform including ULTIMATE,PREMIUM,STARTER and trading variety including --. sam-trade provides trading platform including ECN,Islamic,Standard,VIP and trading variety including --.