No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ORBEX and LIGHT FX ?

In the table below, you can compare the features of ORBEX , LIGHT FX side by side to determine the best fit for your needs.

--

XAUUSD:41.2

EURUSD: -9.12 ~ 2.12

XAUUSD: -50.97 ~ 24.13

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of orbex, lightfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Mauritius |

| Founded Year | 5-10 years ago |

| Company Name | ORBEX Ltd |

| Regulation | Regulated in United Kingdom (FCA), Germany (BaFin), France (Banque de France), and Cyprus (CySEC) |

| Minimum Deposit | $100 for Starter account, $500 for Premium account, $25,000 for Ultimate account |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable spreads starting from 1.7 pips for Starter account |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, Orbex Mobile App |

| Tradable Assets | Forex, cryptocurrencies, commodities, stocks, indices |

| Account Types | Starter, Premium, Ultimate |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +44 2035198170 (English), +965 22968151 (English), +962 6 5622268 (English) |

| Payment Methods | Debit/Credit cards, eWallets (Skrill, Neteller), Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, Knet, Zotapay, Bank Transfers |

| Educational Tools | Trading Central, Free VPS, Calculator Tools, Economic Calendar |

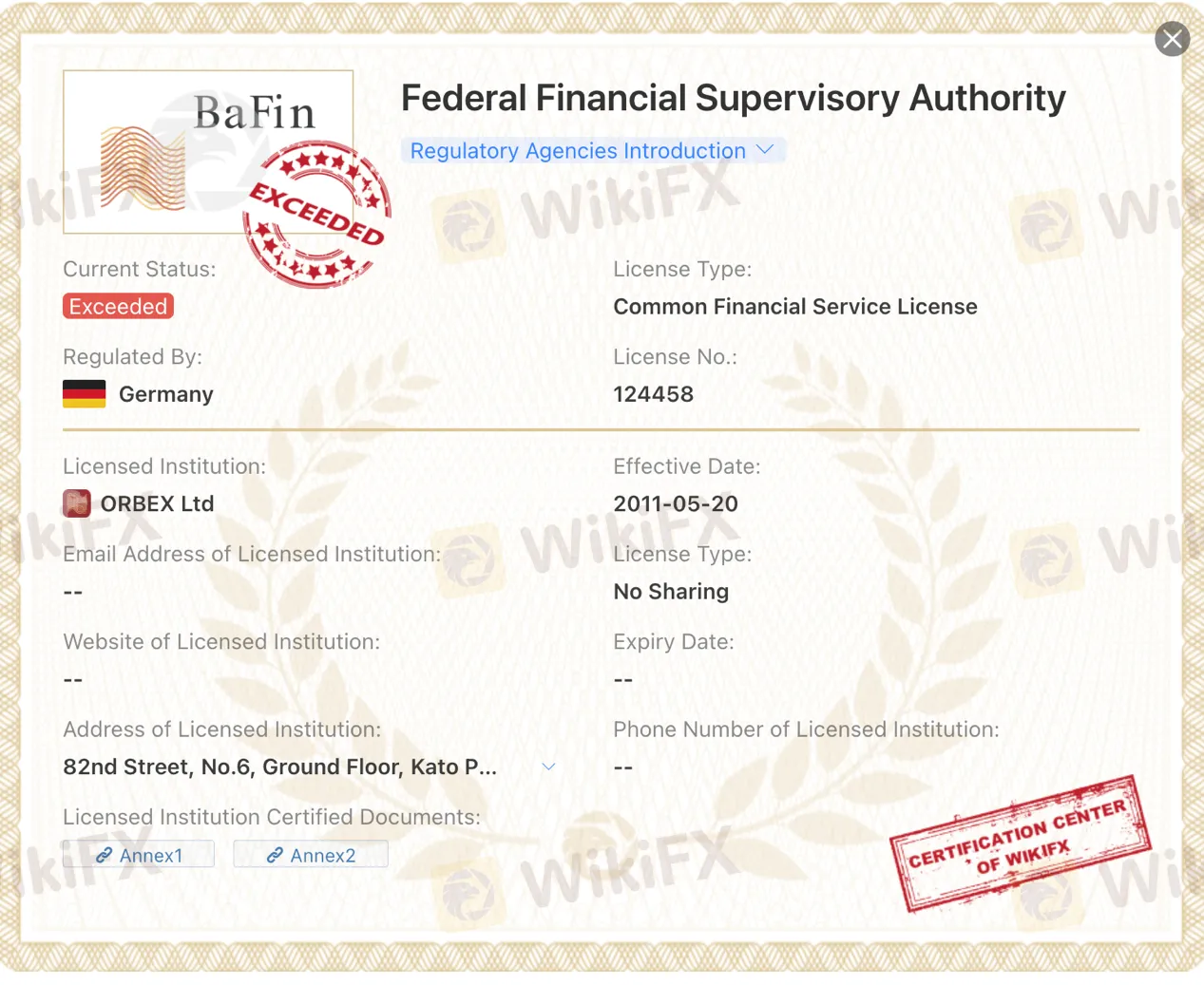

Orbex.com is owned by Orbex Group Limited and is operated by Orbex Global Limited and it is a financial institution operating in the financial services industry, offering a range of trading instruments such as forex, cryptocurrencies, commodities, stocks, and indices. While ORBEX is regulated by multiple authorities including the UK's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France, and the Cyprus Securities and Exchange Commission (CySEC), concerns have been raised about its regulatory status. The FCA has classified ORBEX as “Unsubscribed,” BaFin has stated that ORBEX exceeds their regulated business scope, and there are suspicions regarding the claimed CySEC regulation.

ORBEX provides various trading accounts to cater to different traders' needs, including Starter, Premium, and Ultimate accounts. Each account type offers different features and requires varying minimum investments. The accounts offer access to a range of trading instruments, variable spreads, and leverage of up to 1:500. However, it is important to exercise caution and consider the potential risks associated with ORBEX due to concerns about its regulatory status and suspicions raised by industry sources.

ORBEX offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, and a mobile app. These platforms provide traders with different features and functionalities, allowing them to trade across various markets. Additionally, ORBEX offers trading tools such as Trading Central for market analysis and insights, a free Virtual Private Server (VPS) for stable and secure trading, and calculator tools for risk management. Traders can also access an economic calendar to stay informed about upcoming market events.

Considering the concerns raised about ORBEX's regulatory status and suspicions in the industry, it is crucial for individuals to carefully assess the potential risks involved before engaging in any financial activities with ORBEX.

Here is the screenshot of Orbexs official website:

ORBEX is a financial institution that operates in the financial services industry. It is regulated by multiple authorities, including the United Kingdom's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France in France, and the Cyprus Securities and Exchange Commission (CySEC).

However, it is important to note that there are some concerns regarding ORBEX's regulatory status. According to WikiFX, a platform that collects and provides information about forex brokers, there have been complaints and suspicions raised about ORBEX. The FCA has classified its regulatory status as “Unsubscribed,” indicating an abnormality. BaFin has stated that ORBEX exceeds the business scope regulated by them. The regulatory status with Banque de France is also marked as “Exceeded,” suggesting potential issues. Additionally, the CySEC regulation claimed by ORBEX is suspected to be a clone.

Given these concerns and the information provided, it is advisable to exercise caution and carefully consider the potential risks associated with ORBEX before engaging in any financial activities with them.

Orbex is a trading broker that has both positive and negative aspects to consider. On the positive side, Orbex is regulated by multiple authorities, ensuring a level of oversight and security for traders. They also offer a variety of trading instruments, allowing traders to diversify their portfolios. Additionally, Orbex provides different account types to cater to the individual needs of traders. They offer multiple funding options as well. Orbex supports popular trading platforms like MetaTrader 4 and MetaTrader 5, which are widely used and trusted in the industry. Furthermore, Orbex provides educational resources for traders, allowing them to enhance their knowledge and skills. They also offer a free VPS service for all account types and provide access to the Trading Central research portal. On the downside, there have been concerns raised about Orbex's regulatory status, which may raise doubts among some traders. The FCA has classified Orbex as abnormal, leading to potential questions about their operations. Additionally, there are suspicions regarding Orbex exceeding its regulated business scope by regulatory bodies like BaFin and Banque de France. There have also been suspicions of clone regulation by CySEC. Despite these concerns, it is important for traders to carefully evaluate these factors before deciding to engage with Orbex.

| Pros | Cons |

| Regulated by multiple authorities | Concerns about regulatory status |

| Offers a variety of trading instruments | Abnormality classification by the FCA |

| Provides different account types to meet traders' needs | Suspicions of exceeding regulated business scope by BaFin and Banque de France |

| Multiple funding options available | Suspected clone regulation by CySEC |

| Offers popular trading platforms like MetaTrader 4 and MetaTrader 5 | - |

| Provides educational resources for traders | - |

| Free VPS service for all account types | - |

| Access to Trading Central research portal | - |

| Offers economic calendar and calculator tools | - |

Orbex provides traders with mainstream and popular financial products in the global financial market, including forex, spot indices, futures indices, precious metals, energies, stock CFDs, etc.

Forex: ORBEX provides a wide range of Forex trading instruments. Forex trading involves the buying and selling of currencies, with traders speculating on the value of one currency against another. ORBEX offers low spreads and leverage of up to 1:500 in Forex trading. You can access various currency pairs such as AUDCAD, AUDCHF, AUDJPY, AUDNZD, and AUDUSD, among others.

2. Cryptocurrencies: ORBEX allows traders to trade cryptocurrencies, which are encrypted, digital, and decentralized forms of money based on blockchain technology. Cryptocurrencies are not regulated by any central authority. ORBEX offers leverage of 1:2 and a commission of 0.5% for trading popular cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), Litecoin (LTCUSD), Bitcoin Cash (BCHUSD), and Ripple (XRPUSD).

3. Commodities: ORBEX offers trading instruments for commodities, which are raw materials that can be bought or sold as physical assets. Traders can access commodities like metals, energies, agricultural products, and precious metals. ORBEX provides flexible leverage options and low spreads for commodity trading. Precious metals include XAUUSD (Gold), XAGUSD (Silver), XPDUSD (Palladium), and XPTUSD (Platinum).

4. Stocks: ORBEX provides trading instruments for stocks, allowing traders to buy and sell shares in various assets or companies. Stock trading involves owning shares and selling them based on market value. ORBEX offers a wide range of stock CFDs (Contracts for Difference) with commission starting from $0. Some of the available stocks include 3M, Abercrombie & Fitch Co, Activision Blizzard, Adobe Systems, AIG, and Airbnb Inc, among others.

5. Indices: ORBEX offers trading instruments for indices, which are collections of assets or securities used to track their performance. Indices can be used as benchmarks to assess general economic data. ORBEX provides leverage of 1:100 for indices trading and offers a selection of popular world indices. Some of the available indices include US30, NAS 100, Germany 40, UK 100, SPX500, Australia 200 Cash Index, and France 40 Cash Index, among others.

| Pros | Cons |

| Wide range of trading instruments | Concerns about regulatory status |

| Low spreads and leverage in Forex | Abnormality classification by the FCA |

| Availability of popular cryptocurrencies | Suspicions of exceeding regulated business scope by BaFin and Banque de France |

| Leverage options for commodities | Suspected clone regulation by CySEC |

| Access to a variety of stock CFDs |

To meet investors' various investment requirements and strategies, Orbex has set up three account types: Starter Accounts, Premium Accounts, and Ultimate Accounts. The minimum deposit for the starter account is US$200, the premium account US$500, and the ultimate account is US$25,000.

The Starter account is suitable for traders who are new to the market or prefer to start with a smaller investment. It requires a minimum investment of $100 and offers variable spreads reaching 1.7 pips. There are no commissions charged for trades on this account, making it a cost-effective option. Traders can leverage up to 1:500 and trade with a minimum size of 0.01 lots. The account features a 20% stop out level and a 100% margin call level. It operates on a Non-Dealing Desk (NDD) execution type. The Starter account also provides basic education materials to support traders in their learning journey.

The Premium account is designed for traders with a higher investment capacity. It requires a minimum investment of $500 and offers similar features as the Starter account, including variable spreads from 0.0 pips and leverage up to 1:500. However, there is a commission of $8 charged per trade on this account. The Premium account also provides advanced education materials to enhance traders' knowledge and skills. Traders on this account have access to exclusive monthly webinars and receive one-on-one training sessions.

The Ultimate account is tailored for experienced traders and those with a substantial investment capability. It requires a minimum investment of $25,000, offering the same features as the other accounts, including variable spreads from 0.0 pips and leverage up to 1:500. The commission charged on trades is lower compared to the Premium account, with a rate of $5 per trade. Similar to the Premium account, the Ultimate account provides advanced education materials, but traders on this account receive three one-on-one training sessions. The account also grants exclusive access to webinars.

| Pros | Cons |

| Multiple account options | Concerns about regulatory status |

| Varied investment requirements | Abnormality classification by the FCA |

| Variable spreads available | Higher commission charges on Premium and Ultimate accounts |

| Leverage up to 1:500 | Higher minimum investment requirement for Ultimate account |

To open an account with ORBEX, follow these steps:

Visit the ORBEX website and click on the “Register” button.

2. Fill out the registration form with the required information. This includes your first name, last name, email address, country, and phone number. Make sure to read and agree to the terms and conditions.

3.Once you have completed the form, submit it. By doing so, you acknowledge the risks associated with Forex and Contract for Differences (CFD) trading.

4. After submitting the form, you will receive a confirmation email with instructions on how to log in to the client portal.

5. Log in to the client portal using the provided credentials.

6. Fund your account to start trading. ORBEX offers various funding options to deposit funds into your trading account.

7. Once your account is funded, you can begin trading forex, indices, commodities, or stock CFDs, depending on the available options.

Leverage rates at Orbex are quite high, reaching 1:500 for forex pairs on all accounts. However, to mitigate the risks of margin trading, leverage rates are capped at 1:100 if trading in volumes of over 40 lots. The maximum leverage rates provided for indices are 1:100, though Chinese indices are capped at 1:20. Commodities can be leveraged at either 1:100 or 1:50 and stock CFDs are limited to 1:5.For EU retail traders, leverage is capped at 1:30.

ORBEX offers different trading accounts with varying spreads and commissions. The Starter account features variable spreads, with minimum spreads starting from 1.7 pips. On the other hand, the Premium and Ultimate accounts provide spreads that start from 0 pips. When it comes to commissions, the Starter account does not impose any additional charges. However, the Premium account requires a commission of $8, and the Ultimate account incurs a commission of $5. These account types allow traders to choose the option that aligns with their specific trading preferences and cost considerations.

ORBEX offers several trading platforms to cater to the needs of different traders.

MetaTrader 4 (MT4)

Firstly, Orbex uses the world's most popular MT4 trading platform, allowing traders to explore the forex, precious metals, indices, commodities, and energy markets in depth. Orbex MT4 has such advantages as responding to all customer inquiries within 1 hour, trading ECN on MT4, making fund withdrawals more convenient and faster, 10 language & 24-hour customer support. The platform supports 23 languages, automated trading, and is customized using an intelligent trading system exclusive own strategy, trailing stop loss function. The platform can be applied to Windows client-side, multi-accounts client-side, Android, and Apple iOS client-side.

MetaTrader 5 (MT5)

Another platform offered by ORBEX is MetaTrader 5 (MT5). It is a powerful platform suitable for traders of all levels. MT5 includes all the features of MT4 and provides additional trading functions like advanced orders and trading automation tools. It offers improved speed, functionality, and algorithmic efficiency. Traders can access over 300 CFDs, including forex pairs, stocks, indices, commodities, and cryptocurrencies. The platform also provides 38+ preinstalled technical indicators, 44 analytical charting tools, and options for different types of orders, execution modes, and market depth. Traders can automate their trades using trading robots, Expert Advisors, and scripts. Additionally, MT5 integrates tools like Orbex's Trading Central, Elliott Wave indicator, and VPS service. Traders can track their performance, join a community of traders and developers, and even develop and back test their own indicators and EAs.

FIX API

ORBEX also offers the FIX API, which stands for Financial Information Exchange. FIX API is a technology used by institutional players in the financial markets. It allows for real-time exchange of a large amount of financial information and offers direct connections between traders and tier-1 liquidity providers. This ensures trades are executed with no latency and with high precision. FIX API provides ultra-fast and precise execution for accessing global markets.

Orbex Mobile App

For traders who prefer mobile trading, ORBEX has the Orbex Mobile App. The app allows traders to register, set up, and manage their trading accounts on the go. It is available on both the App Store and Google Play. Traders can perform various actions through the app, such as registering and verifying their accounts, creating and funding their wallets, depositing, transferring, and withdrawing funds, accessing daily market analysis, and getting live support from the expert team via live chat in English or Arabic.

| Pros | Cons |

| Offers MetaTrader 4 (MT4), known for speed and execution | Concerns about regulatory status |

| Provides MetaTrader 5 (MT5) with advanced features | Potential compatibility issues with certain operating systems or devices |

| Orbex Mobile App for mobile trading | Reliance on stable internet connection for seamless trading experience |

| Offers FIX API for ultra-fast and precise execution |

Trading Central: Orbex provides its active clients with access to Trading Central, an acclaimed research portal. This platform offers a range of market-scanning tools designed to assist traders in understanding the markets, identifying potential trading opportunities, and enhancing their strategies. Trading Central allows users to access expert insights, algorithmic setups, financial summaries, historical data, market buzz, technical views, and economic insights.

Free VPS: Orbex offers a free Virtual Private Server (VPS) to all types of trading accounts. A VPS is a virtual computer hosted within a parent server. It acts as a fully functional computer that remains connected to your trading account 24/5, regardless of your personal device's status or internet connectivity. This feature ensures a stable trading experience, safeguarding trading strategy from threats like computer viruses or internet disruptions. It allows your trades to continue uninterrupted.

Calculator Tools: Orbex provides various calculator tools to assist traders in their decision-making process. These tools include a currency converter, which allows users to convert between different currencies. Traders can select the desired currencies and obtain the conversion value instantly. Another useful tool is the pip value calculator, which helps determine the monetary value of each pip movement in a particular currency pair. These calculators aid traders in managing risk and understanding the potential profit or loss associated with their trades.

Economic Calendar: Orbex offers an economic calendar that provides essential information about upcoming economic events, such as economic indicators, central bank announcements, and geopolitical developments. The economic calendar helps traders stay informed about significant market-moving events and plan their trading activities accordingly. By being aware of these events, traders can make more informed decisions and adapt their strategies to capitalize on potential market opportunities.

| Feature | Pros | Cons |

| Trading Central | Access to expert insights, algorithmic setups, financial summaries, historical data, market buzz, technical views, and economic insights. | Can be overwhelming for beginners. |

| Free VPS | Stable trading experience, safeguarding your trading strategy from threats like computer viruses or internet disruptions. | Requires some technical knowledge to set up. |

| Calculator tools | Help traders in managing risk and understanding the potential profit or loss associated with their trades. | Can be complex for beginners. |

| Economic calendar | Provides essential information about upcoming economic events, such as economic indicators, central bank announcements, and geopolitical developments. | Can be difficult to keep up with all of the events. |

When it comes to depositing funds, ORBEX supports different payment methods, including debit/credit cards such as Visa and Mastercard. The available currencies for these cards are USD, PLN, EUR, and GBP. There are no fees associated with these card deposits, and the processing time is typically up to 2 hours. It's important to note that ORBEX is regulated under the Central Bank of Cyprus for these transactions.

ORBEX also accepts eWallets for funding and withdrawal. Skrill and Neteller are two popular eWallet options available for users, supporting the same currencies as the cards. Similar to card deposits, there are no fees for using these eWallets, and the processing time is up to 2 hours. ORBEX is regulated under the Financial Conduct Authority (FCA) in the UK for these transactions.

Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, Knet, and Zotapay are additional funding and withdrawal options provided by ORBEX. These methods support various currencies and have their own unique regulations and processing times.

For users interested in cryptocurrency payments, ORBEX accepts USDT (Tether). Deposits and withdrawals using USDT have no fees and typically take up to 2 hours to process. It's important to note that cryptocurrency transactions are not regulated.

Lastly, ORBEX supports bank transfers for funding and withdrawal. Bank wire transfers are available in currencies such as USD, EUR, GBP, AED, and KWD. There are no fees associated with bank wire transfers, and the processing time is 3-5 business days. Similar to other transactions, ORBEX is regulated under the Central Banks of Incorporation Countries for bank transfers.

| Pros | Cons |

| Supports various payment methods | Processing time may take up to 5 business days for bank transfers |

| No fees for card deposits and eWallets | Cryptocurrency transactions are not regulated |

| Multiple currencies available | Different regulations and processing times for various funding options |

| Regulated under reputable authorities | Limited cryptocurrency options (only USDT accepted) |

| Bank wire transfers available for large transactions |

Forex Educational Hub:

ORBEX offers a comprehensive Forex Educational Hub that provides market research and educational content for traders of all experience levels. The hub includes a variety of resources such as articles, tutorials, infographics, trading education, videos, and eBooks. These resources cover topics ranging from understanding forex trading platforms like MT4 to exploring the history of gold and learning about different trading strategies. The educational content is tailored to suit the needs of traders at various skill levels.

Webinars:

ORBEX conducts live FX webinars to help traders sharpen their skills and enhance their market understanding. These webinars are hosted by leading industry experts and cover a wide range of topics. Traders can participate in these free webinars to gain insights into market trends, trading strategies, and economic events. Additionally, past webinars are available for reference, allowing traders to access valuable educational material and enhance their trading knowledge.

Seminars:

ORBEX organizes informative and educational seminars to empower traders in making informed trading decisions. These seminars cover various aspects of trading, including fundamental and technical analysis, forex basics, and strategy-building support. Traders can attend these seminars to expand their knowledge, learn new trading techniques, and gain insights from industry professionals. ORBEX has conducted seminars in different locations, such as the MENA Seminar Tour in Egypt and Kuwait.

ORBEX offers a comprehensive range of customer support services to address your needs and provide assistance throughout your trading journey. Our experienced team is available 24/5 to address any queries or concerns you may have. You can reach the Customer Support team via email at support@orbex.com.

In addition, specialized departments are in place to handle specific areas of focus. The Back Office team can be contacted at backoffice@orbex.com, while the Dealing Desk is available at dealing@orbex.com. For sales inquiries, you can get in touch with the Sales team through sales@orbex.com.

ORBEX has departments for specific requirements, including White Label services, Introducers Brokers, Complaints, Human Resources, Marketing, Turkish Support, Arabic Sales, and Financial matters. The contact details for each department can be found on the official website. To provide immediate assistance, a live chat option is also available to connect with knowledgeable agents.

Feedback is highly valued. To submit your query, please complete the contact form on the official website. The form requires your name, email address, country, phone number, ORBEX account number (if applicable), and your message. The customer support experts will respond to your inquiry promptly.

Several negative reviews have been reported about ORBEX on WikiFX. Traders have expressed concerns about their inability to withdraw funds, accusing the broker of fraudulent activities and scams. Clients have claimed that ORBEX manipulates trades, keeps orders open after stop-loss, and exhibits slippage. Some reviewers have also stated that ORBEX fails to have a physical office in Mauritius as claimed. Overall, the reviews indicate dissatisfaction with ORBEX's withdrawal process and suspicions of fraudulent behavior.

In conclusion, ORBEX is a financial institution operating in the financial services industry. It is regulated by multiple authorities, including the United Kingdom's Financial Conduct Authority (FCA), the Federal Financial Supervisory Authority in Germany (BaFin), Banque de France in France, and the Cyprus Securities and Exchange Commission (CySEC). However, there are concerns regarding ORBEX's regulatory status, with abnormal classifications and potential issues raised by regulatory bodies. It is advisable to exercise caution and carefully consider the potential risks associated with ORBEX before engaging in any financial activities with them.

Q: Is ORBEX a legitimate financial institution?

A: ORBEX is regulated by authorities such as the FCA, BaFin, Banque de France, and CySEC. However, there are concerns and suspicions raised about its regulatory status, indicating potential issues. Caution is advised before engaging in any financial activities with ORBEX.

Q: What trading instruments are available on ORBEX?

A: ORBEX offers Forex, cryptocurrencies, commodities, stocks, and indices for trading.

Q: What types of trading accounts does ORBEX offer?

A: ORBEX offers Starter, Premium, and Ultimate trading accounts to cater to different trader preferences and needs.

Q: How can I open an account with ORBEX?

A: To open an account with ORBEX, visit their website, fill out the registration form, receive a confirmation email, log in to the client portal, fund your account, and start trading.

Q: What leverage options are available on ORBEX?

A: ORBEX offers leverage rates up to 1:500 for forex trading. Leverage rates for other instruments vary.

Q: What are the spreads and commissions on ORBEX?

A: ORBEX offers variable spreads starting from 1.7 pips for the Starter account, while the Premium and Ultimate accounts start from 0 pips. Commissions range from $0 to $8 per trade, depending on the account type.

Q: What are the deposit and withdrawal options on ORBEX?

A: ORBEX supports various payment methods, including debit/credit cards, eWallets, bank transfers, and cryptocurrency payments.

Q: What trading platforms does ORBEX offer?

A: ORBEX offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), FIX API, and the Orbex Mobile App for trading.

Q: What trading tools are available on ORBEX?

A: ORBEX provides access to Trading Central, a free VPS, calculator tools, and an economic calendar to assist traders in their decision-making process.

Q: What educational resources does ORBEX offer?

A: ORBEX provides a Forex Educational Hub with market research, articles, tutorials, videos, and eBooks for traders of all experience levels.

| Company Name | Light FX |

| Registered In | Japan |

| Regulation Status | Regulated by the Financial Service Agency of Japan |

| Years of Establishment | 15-20 years |

| Trading Instruments | Around 20 currency pairs including major pairs |

| Account Types | Not specified |

| Minimum Initial Deposit | No minimum deposit requirement |

| Maximum Leverage | Up to 1:25 |

| Trading Platform | LIGHT FX app, Advanced Trader, Simple Trader |

| Deposit and Withdrawal | Direct deposit, wire transfer from bank counters or ATMs |

| Customer Service | Telephone support and contact form |

Light FX, a Japan-based forex broker, boasts a solid regulatory foundation as it operates under the supervision of the Financial Service Agency of Japan. With a track record spanning 15-20 years, Light FX offers traders access to around 20 currency pairs, including major ones, facilitating diverse trading opportunities. While specific account types remain unspecified, the broker stands out with its welcoming no minimum deposit requirement.

Leverage of up to 1:25 is available, albeit with due consideration of risk. Light FX provides traders with a choice of trading platforms, including the LIGHT FX app, Advanced Trader, and Simple Trader. Funding options encompass direct deposit and wire transfers from bank counters or ATMs, ensuring flexibility.

Given its regulation by the Financial Service Agency of Japan, LIGHT FX appears to be a legitimate and trustworthy broker.

Regulatory oversight is a fundamental factor in the forex industry, ensuring that traders' interests are protected, and trading practices adhere to industry standards. Nonetheless, it's always wise for traders to conduct their own due diligence and verify the broker's credentials.

| Pros | Cons |

| Regulatory Authorization | Limited Account Information |

| Competitive Spreads | Weekend Support Absence |

| Fee-Free Trading | Educational Resource Clarity |

| Flexible Trading Platforms | |

| Diverse Market Instruments |

Pros:

Regulatory Authorization: Light FX is regulated by the Financial Service Agency of Japan, providing traders with confidence in the broker's legitimacy and adherence to regulatory standards.

Competitive Spreads: The broker offers competitive spreads on major currency pairs, making it cost-effective for traders to engage in forex trading.

Fee-Free Trading: Light FX operates on a fee-free trading model, meaning traders can execute trades without incurring additional commission costs.

Flexible Trading Platforms: The broker provides a variety of trading platforms, including the LIGHT FX app, catering to traders of all experience levels. The inclusion of the “Trading View” tool enhances analysis capabilities.

Diverse Market Instruments: Light FX offers a selection of around 20 currency pairs, including major and minor pairs, allowing traders to diversify their trading portfolios.

Cons:

Limited Account Information: The available information does not provide details about the specific account types offered by Light FX. Traders may need to visit the official website or contact customer support for account-related details.

Weekend Support Absence: Customer support is not available on weekends, which may be inconvenient for traders who prefer weekend trading or have urgent inquiries during that time.

Educational Resource Clarity: While Light FX offers various educational resources and market information, the provided information lacks specific details about the educational materials available, requiring traders to seek further clarification.

Light FX offers traders access to around 20 currency pairs, encompassing both major and minor pairs.

This selection includes popular choices such as EUR/USD, USD/JPY, GBP/JPY, AUDJPY, and EURJPY, allowing traders to engage in a diverse range of forex trading opportunities.

Unfortunately, the available information does not provide details about the specific account types offered by Light FX. To gain a better understanding of the account options, it is recommended to visit the broker's official website or contact their customer support.

Different account types often come with varying features and benefits, catering to the diverse needs of traders, from beginners to advanced.

While the provided information does not outline the exact process for opening an account with Light FX, the standard procedure for most forex brokers typically involves the following steps:

Registration: Visit the broker's website and initiate the account registration process. You will be required to provide personal information and create login credentials.

Verification: Complete identity verification by submitting the necessary documents, which usually include a valid ID, proof of address, and possibly financial information.

Deposit: Fund your trading account with the minimum required deposit or your chosen amount through the provided deposit methods.

Platform Access: After your account is verified and funded, you can access the trading platforms offered by Light FX and start trading.

Light FX offers competitive features related to leverage and spreads, which play a crucial role in the cost structure of trading:

Light FX provides leverage up to 1:25 for forex trading, in accordance with Japanese regulatory guidelines. Leverage allows traders to amplify their positions with a relatively smaller capital investment. However, it's important to note that higher leverage also involves increased risk, and traders should use it cautiously.

Spreads: The broker offers competitive spreads on major currency pairs. For instance, spreads for popular pairs like EUR/USD can be as low as 0.3 pips, while USD/JPY may have spreads as tight as 0.2 pips. GBP/JPY, AUD/JPY, and EUR/JPY also feature competitive spreads at 0.9 pips, 0.6 pips, and 0.4 pips, respectively. It's worth noting that spreads can vary depending on market conditions.

Commissions: The information provided does not mention any commission fees, suggesting that Light FX operates on a fee-free trading model. This can be advantageous for traders, as it means that you can execute trades without incurring additional commission costs.

| Currency Pair | Spread (in pips) | Commission |

| EUR/USD | 0.3 | None |

| USD/JPY | 0.2 | None |

| GBP/JPY | 0.9 | None |

| AUD/JPY | 0.6 | None |

| EUR/JPY | 0.4 | None |

Light FX offers a diverse range of trading platforms to cater to traders of all levels. The LIGHT FX app is a highly flexible and accessible platform with a user-friendly interface, making it suitable for traders on the go. It integrates the powerful “Trading View” tool for stress-free trade analysis, features intuitive navigation, and offers one-tap order placement. Traders can even execute chart orders while analyzing market data, ensuring a seamless and sophisticated trading experience.

For more experienced traders, the Advanced Trader platform provides extensive customization options. It also incorporates the “Trading View” tool for comprehensive chart analysis, allowing traders to arrange the trading screen to their liking and access abundant customization features. With a wealth of information tools and advanced chart analysis functions, Advanced Trader empowers traders to create a personalized trading environment that suits their unique needs.

In the case of direct deposit, Light FX offers traders a convenient and efficient way to fund their trading accounts. The 24-hour real-time reflection ensures that deposited funds are available for trading almost immediately, making it ideal for traders who want to seize opportunities in the forex market promptly. The fact that Light FX covers all transfer fees for deposits through this method further adds to its appeal, as it minimizes costs for traders.

For those who prefer wire transfers from bank counters or ATMs, Light FX accommodates this option as well. While this method incurs transfer fees, it offers an alternative for traders who may not have access to internet banking or prefer in-person transactions. The creation of a customer-specific margin deposit account for wire transfers streamlines the process, ensuring that the funds are directed to the appropriate trading account.

Light FX offers customer support through multiple channels to assist traders with their queries and concerns:

Telephone Support: Traders can reach the customer support team by phone at 0120 637 105. Support is available every day from 7:00 AM to 10:00 PM, excluding Saturdays and Sundays.

Contact Form: For written inquiries or support requests, traders can use the contact form provided on the broker's website. This offers a convenient way to seek assistance or information.

The availability of telephone support during extended hours on weekdays is a positive feature, ensuring that traders have access to assistance when they need it most. However, the absence of support on weekends may be a limitation for some traders who prefer weekend trading or have urgent inquiries during that time.

Light FX provides a comprehensive suite of educational resources and market information to empower traders. Their offerings include real-time exchange rates for all currency pairs, crypto asset rates, and exchange charts, allowing traders to stay up to date with market movements.

The economic indicators calendar aids in tracking important events, while the swap calendar helps traders understand swap points for currency pairs. The buy/sell ratio for LIGHT FX customers, currency strength/weakness through heatmaps, and TM sign for USD/JPY predictions using text mining technology offer valuable insights.

Traders can also utilize margin simulations, effective leverage calculations, and swap simulations to manage their risk and plan their trades effectively. Additionally, Light FX provides information on corporate account leverage and total customer swap receipts, enhancing traders' market awareness.

In conclusion, Light FX is a Japan-based forex broker that operates under the regulatory authority of the Financial Service Agency of Japan. It offers a range of currency pairs for trading and provides flexibility in deposit methods. While the broker offers competitive spreads and leverage options, there is limited information available regarding account types and educational resources.

Traders interested in Light FX should consider conducting further research and verifying specific details on the broker's official website. As with any financial endeavor, it's essential to trade responsibly and be aware of the potential risks associated with forex trading.

Q: Is Light FX a regulated forex broker?

A: Yes, Light FX is regulated by the Financial Service Agency of Japan, ensuring it meets regulatory standards.

Q: What currency pairs can I trade on Light FX?

A: Light FX offers approximately 20 currency pairs, including major pairs like EUR/USD, USD/JPY, and GBP/JPY.

Q: Does Light FX charge commissions for trading?

A: No, Light FX operates on a fee-free trading model, meaning there are no commission fees for trading.

Q: What is the maximum leverage offered by Light FX?

A: Light FX offers leverage up to 1:25 for forex trading, in compliance with Japanese regulations.

Q: How can I deposit funds into my Light FX trading account?

A: You can deposit funds through direct deposit or wire transfer from bank counters or ATMs, with direct deposit offering real-time reflection.

Q: What trading platforms does Light FX provide?

A: Light FX offers a range of trading platforms, including the LIGHT FX app, Advanced Trader, and Simple Trader, catering to traders of all levels.

Q: Are there educational resources available for traders on Light FX?

A: Yes, Light FX provides educational resources such as real-time market information, economic indicators calendars, and margin simulations to support traders in making informed decisions.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive orbex and lightfx are, we first considered common fees for standard accounts. On orbex, the average spread for the EUR/USD currency pair is From 0.0 pips, while on lightfx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

orbex is regulated by CYSEC,FCA. lightfx is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

orbex provides trading platform including ULTIMATE,PREMIUM,STARTER and trading variety including --. lightfx provides trading platform including -- and trading variety including --.