No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between LIGHT FX and AvaTrade ?

In the table below, you can compare the features of LIGHT FX , AvaTrade side by side to determine the best fit for your needs.

--

--

EURUSD:-0.7

EURUSD:-2.8

EURUSD:7

XAUUSD:22.81

EURUSD: -2.53 ~ 0.34

XAUUSD: -5.82 ~ 1.95

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of lightfx, ava-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Company Name | Light FX |

| Registered In | Japan |

| Regulation Status | Regulated by the Financial Service Agency of Japan |

| Years of Establishment | 15-20 years |

| Trading Instruments | Around 20 currency pairs including major pairs |

| Account Types | Not specified |

| Minimum Initial Deposit | No minimum deposit requirement |

| Maximum Leverage | Up to 1:25 |

| Trading Platform | LIGHT FX app, Advanced Trader, Simple Trader |

| Deposit and Withdrawal | Direct deposit, wire transfer from bank counters or ATMs |

| Customer Service | Telephone support and contact form |

Light FX, a Japan-based forex broker, boasts a solid regulatory foundation as it operates under the supervision of the Financial Service Agency of Japan. With a track record spanning 15-20 years, Light FX offers traders access to around 20 currency pairs, including major ones, facilitating diverse trading opportunities. While specific account types remain unspecified, the broker stands out with its welcoming no minimum deposit requirement.

Leverage of up to 1:25 is available, albeit with due consideration of risk. Light FX provides traders with a choice of trading platforms, including the LIGHT FX app, Advanced Trader, and Simple Trader. Funding options encompass direct deposit and wire transfers from bank counters or ATMs, ensuring flexibility.

Given its regulation by the Financial Service Agency of Japan, LIGHT FX appears to be a legitimate and trustworthy broker.

Regulatory oversight is a fundamental factor in the forex industry, ensuring that traders' interests are protected, and trading practices adhere to industry standards. Nonetheless, it's always wise for traders to conduct their own due diligence and verify the broker's credentials.

| Pros | Cons |

| Regulatory Authorization | Limited Account Information |

| Competitive Spreads | Weekend Support Absence |

| Fee-Free Trading | Educational Resource Clarity |

| Flexible Trading Platforms | |

| Diverse Market Instruments |

Pros:

Regulatory Authorization: Light FX is regulated by the Financial Service Agency of Japan, providing traders with confidence in the broker's legitimacy and adherence to regulatory standards.

Competitive Spreads: The broker offers competitive spreads on major currency pairs, making it cost-effective for traders to engage in forex trading.

Fee-Free Trading: Light FX operates on a fee-free trading model, meaning traders can execute trades without incurring additional commission costs.

Flexible Trading Platforms: The broker provides a variety of trading platforms, including the LIGHT FX app, catering to traders of all experience levels. The inclusion of the “Trading View” tool enhances analysis capabilities.

Diverse Market Instruments: Light FX offers a selection of around 20 currency pairs, including major and minor pairs, allowing traders to diversify their trading portfolios.

Cons:

Limited Account Information: The available information does not provide details about the specific account types offered by Light FX. Traders may need to visit the official website or contact customer support for account-related details.

Weekend Support Absence: Customer support is not available on weekends, which may be inconvenient for traders who prefer weekend trading or have urgent inquiries during that time.

Educational Resource Clarity: While Light FX offers various educational resources and market information, the provided information lacks specific details about the educational materials available, requiring traders to seek further clarification.

Light FX offers traders access to around 20 currency pairs, encompassing both major and minor pairs.

This selection includes popular choices such as EUR/USD, USD/JPY, GBP/JPY, AUDJPY, and EURJPY, allowing traders to engage in a diverse range of forex trading opportunities.

Unfortunately, the available information does not provide details about the specific account types offered by Light FX. To gain a better understanding of the account options, it is recommended to visit the broker's official website or contact their customer support.

Different account types often come with varying features and benefits, catering to the diverse needs of traders, from beginners to advanced.

While the provided information does not outline the exact process for opening an account with Light FX, the standard procedure for most forex brokers typically involves the following steps:

Registration: Visit the broker's website and initiate the account registration process. You will be required to provide personal information and create login credentials.

Verification: Complete identity verification by submitting the necessary documents, which usually include a valid ID, proof of address, and possibly financial information.

Deposit: Fund your trading account with the minimum required deposit or your chosen amount through the provided deposit methods.

Platform Access: After your account is verified and funded, you can access the trading platforms offered by Light FX and start trading.

Light FX offers competitive features related to leverage and spreads, which play a crucial role in the cost structure of trading:

Light FX provides leverage up to 1:25 for forex trading, in accordance with Japanese regulatory guidelines. Leverage allows traders to amplify their positions with a relatively smaller capital investment. However, it's important to note that higher leverage also involves increased risk, and traders should use it cautiously.

Spreads: The broker offers competitive spreads on major currency pairs. For instance, spreads for popular pairs like EUR/USD can be as low as 0.3 pips, while USD/JPY may have spreads as tight as 0.2 pips. GBP/JPY, AUD/JPY, and EUR/JPY also feature competitive spreads at 0.9 pips, 0.6 pips, and 0.4 pips, respectively. It's worth noting that spreads can vary depending on market conditions.

Commissions: The information provided does not mention any commission fees, suggesting that Light FX operates on a fee-free trading model. This can be advantageous for traders, as it means that you can execute trades without incurring additional commission costs.

| Currency Pair | Spread (in pips) | Commission |

| EUR/USD | 0.3 | None |

| USD/JPY | 0.2 | None |

| GBP/JPY | 0.9 | None |

| AUD/JPY | 0.6 | None |

| EUR/JPY | 0.4 | None |

Light FX offers a diverse range of trading platforms to cater to traders of all levels. The LIGHT FX app is a highly flexible and accessible platform with a user-friendly interface, making it suitable for traders on the go. It integrates the powerful “Trading View” tool for stress-free trade analysis, features intuitive navigation, and offers one-tap order placement. Traders can even execute chart orders while analyzing market data, ensuring a seamless and sophisticated trading experience.

For more experienced traders, the Advanced Trader platform provides extensive customization options. It also incorporates the “Trading View” tool for comprehensive chart analysis, allowing traders to arrange the trading screen to their liking and access abundant customization features. With a wealth of information tools and advanced chart analysis functions, Advanced Trader empowers traders to create a personalized trading environment that suits their unique needs.

In the case of direct deposit, Light FX offers traders a convenient and efficient way to fund their trading accounts. The 24-hour real-time reflection ensures that deposited funds are available for trading almost immediately, making it ideal for traders who want to seize opportunities in the forex market promptly. The fact that Light FX covers all transfer fees for deposits through this method further adds to its appeal, as it minimizes costs for traders.

For those who prefer wire transfers from bank counters or ATMs, Light FX accommodates this option as well. While this method incurs transfer fees, it offers an alternative for traders who may not have access to internet banking or prefer in-person transactions. The creation of a customer-specific margin deposit account for wire transfers streamlines the process, ensuring that the funds are directed to the appropriate trading account.

Light FX offers customer support through multiple channels to assist traders with their queries and concerns:

Telephone Support: Traders can reach the customer support team by phone at 0120 637 105. Support is available every day from 7:00 AM to 10:00 PM, excluding Saturdays and Sundays.

Contact Form: For written inquiries or support requests, traders can use the contact form provided on the broker's website. This offers a convenient way to seek assistance or information.

The availability of telephone support during extended hours on weekdays is a positive feature, ensuring that traders have access to assistance when they need it most. However, the absence of support on weekends may be a limitation for some traders who prefer weekend trading or have urgent inquiries during that time.

Light FX provides a comprehensive suite of educational resources and market information to empower traders. Their offerings include real-time exchange rates for all currency pairs, crypto asset rates, and exchange charts, allowing traders to stay up to date with market movements.

The economic indicators calendar aids in tracking important events, while the swap calendar helps traders understand swap points for currency pairs. The buy/sell ratio for LIGHT FX customers, currency strength/weakness through heatmaps, and TM sign for USD/JPY predictions using text mining technology offer valuable insights.

Traders can also utilize margin simulations, effective leverage calculations, and swap simulations to manage their risk and plan their trades effectively. Additionally, Light FX provides information on corporate account leverage and total customer swap receipts, enhancing traders' market awareness.

In conclusion, Light FX is a Japan-based forex broker that operates under the regulatory authority of the Financial Service Agency of Japan. It offers a range of currency pairs for trading and provides flexibility in deposit methods. While the broker offers competitive spreads and leverage options, there is limited information available regarding account types and educational resources.

Traders interested in Light FX should consider conducting further research and verifying specific details on the broker's official website. As with any financial endeavor, it's essential to trade responsibly and be aware of the potential risks associated with forex trading.

Q: Is Light FX a regulated forex broker?

A: Yes, Light FX is regulated by the Financial Service Agency of Japan, ensuring it meets regulatory standards.

Q: What currency pairs can I trade on Light FX?

A: Light FX offers approximately 20 currency pairs, including major pairs like EUR/USD, USD/JPY, and GBP/JPY.

Q: Does Light FX charge commissions for trading?

A: No, Light FX operates on a fee-free trading model, meaning there are no commission fees for trading.

Q: What is the maximum leverage offered by Light FX?

A: Light FX offers leverage up to 1:25 for forex trading, in compliance with Japanese regulations.

Q: How can I deposit funds into my Light FX trading account?

A: You can deposit funds through direct deposit or wire transfer from bank counters or ATMs, with direct deposit offering real-time reflection.

Q: What trading platforms does Light FX provide?

A: Light FX offers a range of trading platforms, including the LIGHT FX app, Advanced Trader, and Simple Trader, catering to traders of all levels.

Q: Are there educational resources available for traders on Light FX?

A: Yes, Light FX provides educational resources such as real-time market information, economic indicators calendars, and margin simulations to support traders in making informed decisions.

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA, KNF |

| Tradable Assets | Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, options |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

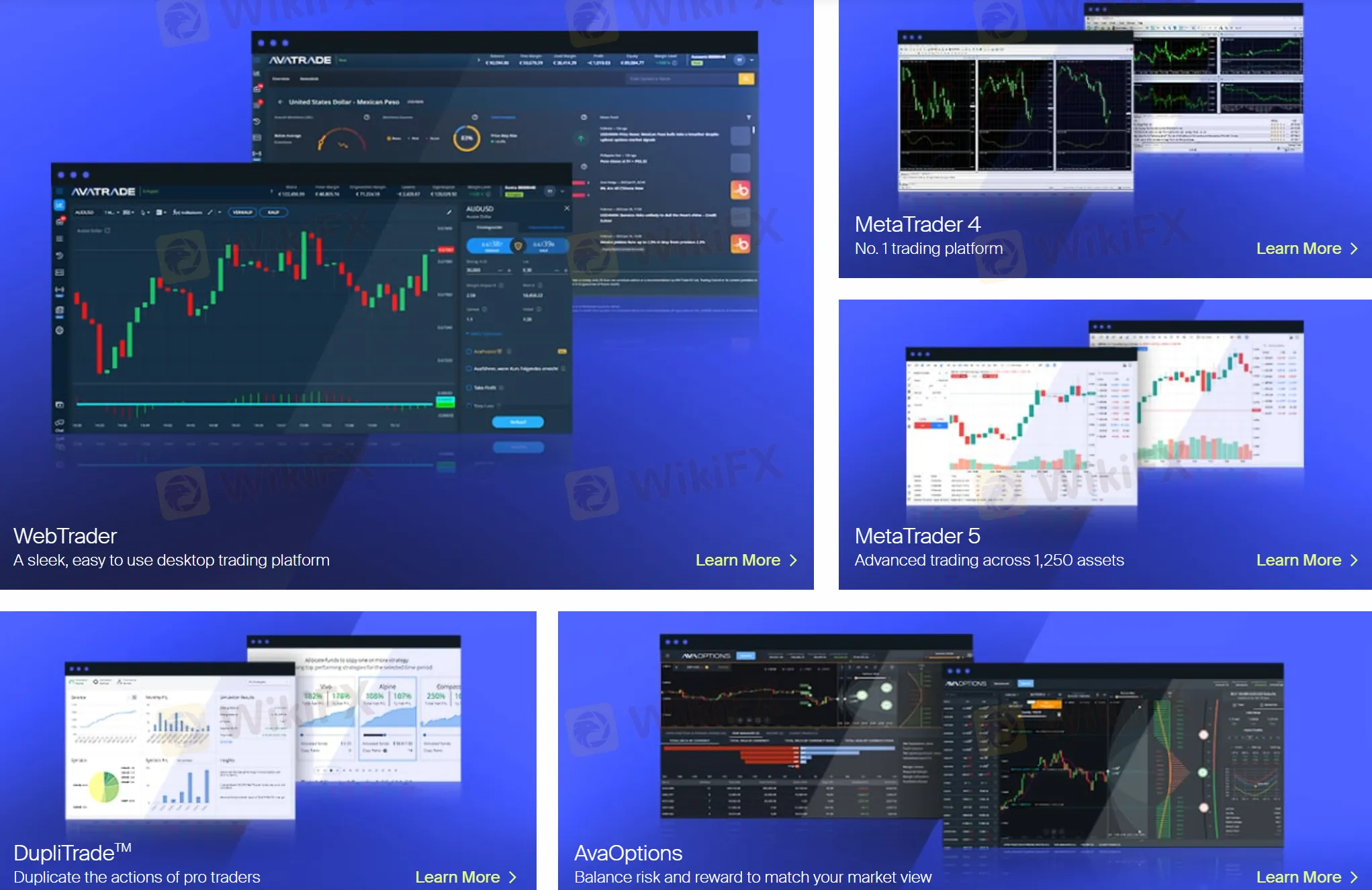

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Minimum Deposit | $100 |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | 24/7 - live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

| Educational Resources | Academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, FSCA, and KNF.

As a market maker broker, Avatrade offers a range of tradable assets including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

Avatrade requires a minimum deposit of $100 to open an account, and clients can choose from a variety of payment methods including MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto.

Customer support is available via live chat, phone, email, and a knowledge base. The broker also provides a range of educational resources for traders, including academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars.

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), the Financial Sector Conduct Authority of South Africa (FSCA), and the Polish Financial Supervision Authority of Poland (KNF). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you. Some potential advantages of a broker may include competitive spreads, user-friendly trading platforms, and rich educational resources. Additionally, a regulated broker can provide peace of mind knowing that your funds are protected.

| Pros | Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | |

| Multiple trading platforms | |

| Rich and Free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Avatrade offers a wide range of trading instruments across various markets, including Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options.

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

The standard account provides access to all of Avatrade's trading instruments, including forex, stocks, commodities, and cryptocurrencies. This means that traders can diversify their portfolio and take advantage of different market conditions, all within the same account.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, Pepperstone and XM have a minimum deposit requirement of $0 and $5, respectively.

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

Non-trading fees are the fees that a broker charges for activities other than trading. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker. Avatrade charges inactivity fee and administration fee. You can find detailed info in the table below:

| Fee Type | Amount | Detail |

| Inactivity Fee | $/€/£50 | Charged after 3 consecutive months of non-use (“Inactivity Period”) |

| Administration Fee | $/€/£100 | Charged fter 12 consecutive months of non -use (“Annual Inactivity Period”) |

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

Avatrade accepts MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, and Boleto. The minimum deposit requirement is 100 USD, EUR, GBP or AUD. Deposit and withdrawal processing time very by the method you choose. You can find more detailed info in the screenshot below or directly visit this link: https://www.avatrade.com/about-avatrade/avatrade-withdrawals-deposits.

Avatrade offers customer support 24/7 through multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and a demo account for traders to practice their strategies. However, there are some downsides to consider, such as higher inactivity fees and limited account options.

Is Avatrade regulated?

Yes, Avatrade is regulated by multiple reputable authorities, including ASIC (Australia), FSA (Japan), FFAJ (Japan), ADGM (UAE), CBI (Ireland), FSCA (South Africa), and KNF (Poland).

Does Avatrade offer a demo account?

Yes, Avatrade offers a free demo account for traders to practice and test their strategies before trading with real money.

What is the minimum deposit requirement for Avatrade?

The minimum deposit requirement for Avatrade is $100.

What is the maximum leverage offered by Avatrade?

The maximum leverage offered by Avatrade is 1:400.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive lightfx and ava-trade are, we first considered common fees for standard accounts. On lightfx, the average spread for the EUR/USD currency pair is -- pips, while on ava-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

lightfx is regulated by FSA. ava-trade is regulated by ASIC,FSA,FFAJ,ADGM,CBI,FSCA,KNF.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

lightfx provides trading platform including -- and trading variety including --. ava-trade provides trading platform including -- and trading variety including --.