No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FX Choice and Hirose-fx ?

In the table below, you can compare the features of FX Choice , Hirose-fx side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fx-choice, hirose-fx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Belize |

| Regulated by | FSC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, webtrader |

| Deposit and withdrawal method | cryptocurrencies, VISA, MasterCard, Perfectmoney, Skrill, Neteller, astropay and many other options |

| Customer Service | Email/phone number/address/live chat/call back |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Multiple account types with varying minimum deposits and commissions to suit traders with different needs and preferences.

The option to trade a wide range of financial instruments including Forex, metals, indices, cryptocurrencies, and shares.

Multiple platform options including the popular MetaTrader 4 and 5, as well as a WebTrader platform.

High leverage of up to 1:1000 for the Optimum account, providing the opportunity for potentially higher profits.

A variety of deposit and withdrawal methods, including popular e-wallets and cryptocurrencies, with a 15% deposit bonus available.

Comprehensive educational resources including autotrade, copy trading, and trading signals to help traders make informed decisions.

Multilingual customer support available 24/5 via phone, email, live chat, and call back.

Cons:

Limited options for those who prefer a low minimum deposit or zero commission account.

Pro account holders are charged a commission of USD 3.5 per side, which may be relatively high for some traders.

Limited to only a few trading platforms, which may not suit traders who prefer other platforms.

The maximum leverage available of up to 1:1000 for the Optimum account may be too high for some traders who prefer a lower level of risk.

The customer support service does not offer 24/7 assistance.

| Advantages | Disadvantages |

| FX Choice offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, FX Choice has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

FX Choice is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, FX Choice acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that FX Choice has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with FX Choice or any other MM broker.

With a history between 2 and 5 years, FX Choice is an online forex broker regulated by FSC and is dedicated to providing a series of common forex instruments.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of trading markets including currency pairs, indices, commodities, metals, energy, cryptocurrencies, and stocks | None found |

FX Choice offers a vast selection of tradable instruments, including forex, indices, commodities, metals, energy, cryptocurrencies, and stocks. This wide range of markets provides traders with numerous opportunities to diversify their trading portfolio and take advantage of different market conditions. For instance, traders can choose to trade the highly liquid forex market, take positions on the commodities market, or trade the popular cryptocurrency markets. Additionally, traders can access various indices, energy, and metal markets to take advantage of market opportunities. Overall, the broad range of trading instruments on FX Choice makes it a suitable broker for both new and experienced traders who want access to multiple markets. No disadvantages were found in this dimension.

| Advantages | Disadvantages |

| Competitive spreads | Pro account commission of USD 3.5 per side is relatively high |

| No commission on Classic and Optimum accounts | Optimum account has higher spreads compared to other accounts |

| Rebates available on Pro account |

FX Choice offers competitive spreads on all its account types. The Classic account has spreads starting from 0.5 pips, while the Optimum account has spreads starting from 1.5 pips. The Pro account has spreads starting from 0 pips but charges a commission of USD 3.5 per side, which is relatively high compared to other brokers. However, rebates of up to USD 2 per side are available for high-volume traders on the Pro account. There are no commissions charged on the Classic and Optimum accounts, making them suitable for traders who do not want to pay additional fees. Overall, FX Choice's spreads are competitive and can be considered an advantage for traders.

Demo Account: FX Choice provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live account: FX Choice offers three account types: Classic, Optimum, and Pro Accounts. The Classic Account has a minimum deposit of USD 100 and offers tight spreads starting from 0.5 pips. The Optimum Account, on the other hand, requires a minimum deposit of only USD 10 but has wider spreads starting from 1.5 pips. The Pro Account has a minimum deposit of USD 100 and offers the tightest spreads starting from 0 pips. However, it comes with a relatively high commission fee of USD 3.5 per side. All account types allow for a minimum lot size of 0.01 lots, and the leverage for forex and metals trading ranges from 1:200 to 1:1000. Moreover, the accounts support different markets, including forex, indices, metals and energies, cryptocurrencies, and stocks, among others.

| Classic Account | Optimum Account | Pro Account | |

| Minimum deposit | USD 100 | USD 10 | USD 100 |

| Tight spreads starting from | 0.5 pips | 1.5 pips | 0 pips |

| Minimum lot size | 0.01 lots | 0.01 lots | 0.01 lots |

| Commission charged Negative figure under ‘Commission’ in trade history | No | No | USD 3.5 per side (USD 1.5 for high-volume traders, see Pips+), per notional amount of USD 100,000 |

| Rebate added Above-zero figure under ‘Commission’ in trade history | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | No |

| Leverage | Forex, metals — up to 1:200; more markets. | Forex, metals — up to 1:1000; more markets. | Forex, metals — up to 1:200; more markets. |

| Margin level for hedge/lock positions | 50% | 50% | 50% |

| Execution | NDD, Market | NDD, Market | NDD, Market |

| Margin call / Stop out | 25/15 | 25/15 | 25/15 |

| Forex CFDs | 36 currency pairs | 36 currency pairs | 36 currency pairs |

| More CFDs | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares |

| Advantages | Disadvantages |

| MetaTrader 4 (MT4) platform available | No proprietary platform |

| MetaTrader 5 (MT5) platform available | No cTrader platform available |

| WebTrader platform available |

FX Choice offers three popular trading platforms to its clients: MT4, MT5, and WebTrader. The MetaTrader platforms are well-known for their advanced charting capabilities and algorithmic trading options, making them ideal for both novice and experienced traders. The WebTrader platform is a browser-based platform that allows traders to access their accounts from anywhere without the need for downloading any software. However, FX Choice does not have its own proprietary platform, which may be a disadvantage for traders who prefer a more customized trading experience. Additionally, the absence of the cTrader platform may be a drawback for traders who prefer this platform for its advanced charting and order execution features. Overall, the availability of the popular MetaTrader platforms and a browser-based WebTrader platform provides traders with flexibility and accessibility to trade from various devices.

| Advantages | Disadvantages |

| Allows for higher potential profits with smaller initial investment | Higher leverage increases risk of large losses |

| Greater flexibility in trading strategies and positions | Can lead to overtrading and poor risk management |

| Enables traders to access larger markets with limited capital | Inexperienced traders may be tempted to use high leverage without understanding the risks |

| Can increase trading volume and potential returns | Market volatility can quickly wipe out an account with high leverage |

FX Choice offers maximum leverage of up to 1:1000 for Optimum account and 1:200 for Classic and Pro account, which allows traders to open larger positions with a smaller amount of capital. This can be advantageous for traders who have a good understanding of risk management and use leverage wisely to maximize their trading opportunities. However, high leverage can also lead to large losses if traders do not use it responsibly. It is important for traders to understand the risks involved and have a solid trading plan in place when using high leverage. Additionally, traders should always consider the market conditions and volatility before using high leverage in their trades.

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | Some deposit/withdrawal methods may not be available in certain countries |

| 15% deposit bonus available | Withdrawal fees may apply |

| Cryptocurrency deposits and withdrawals available | Bonus terms and conditions may apply |

| Fast processing time for most payment methods |

FX Choice offers clients a wide range of deposit and withdrawal options, including cryptocurrencies, Visa, Mastercard, Skrill, Neteller, and many more. The 15% deposit bonus is also an attractive feature for new clients. However, some payment methods may not be available in certain countries and withdrawal fees may apply. It's also important to note that bonus terms and conditions may apply. In general, FX Choice aims to process payments quickly, which is a positive aspect for clients looking for a fast and efficient payment system.

| Advantages | Disadvantages |

| A wide range of educational resources including market signals, autotrade, copy trading, VPS, news, trading signals, and EA | Limited educational materials for beginners |

| Access to professional trading tools | Some resources may require additional fees or commissions |

| Customizable tools to meet individual needs and preferences | |

| Opportunity to learn from experienced traders |

FX Choice offers a variety of educational resources that cater to the needs of traders at different levels of experience. The platform provides a range of professional trading tools that traders can use to improve their skills and knowledge. The educational resources available include market signals, autotrade, copy trading, VPS, news, trading signals, and EA. These resources are customizable, allowing traders to tailor them to their individual needs and preferences. Additionally, traders can learn from experienced traders by using the platform's copy trading features. While FX Choice offers a wide range of educational resources, there may be limited materials for beginners, and some resources may require additional fees or commissions. Overall, the platform offers a strong set of educational resources for traders looking to improve their trading skills and knowledge.

| Advantages | Disadvantages |

| 24/5 customer service available | No 24/7 customer service available |

| Support in multiple languages | No local phone numbers for some countries |

| Various contact methods available | No physical office for some regions |

| Quick response time through live chat and phone | Limited information on the website about customer service protocols |

| Call back service available |

FX Choice offers 24/5 customer service to its clients, providing support in multiple languages through various channels such as email, phone, live chat and call back service. The quick response time through live chat and phone is an advantage, ensuring that clients can get their issues resolved promptly. However, the lack of 24/7 customer service and local phone numbers for some countries could be a disadvantage for clients in those regions. While FX Choice has a physical office, it may not be accessible to some clients. The website could also provide more information about the customer service protocols in place to manage clients' issues. Overall, FX Choice's customer care dimension provides a good level of support to its clients.

FX Choice is a well-established online trading platform that provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies. The platform offers multiple account types, educational resources, and 24/5 customer support in various languages. It also provides various deposit and withdrawal options, making it easy for traders to manage their funds. One of the most significant advantages of FX Choice is the availability of the MetaTrader platform, which is a popular and user-friendly platform used by many traders worldwide. While there are some disadvantages, such as the limited availability of some services, FX Choice remains a reputable and reliable platform for both beginner and experienced traders looking to trade various financial instruments. Overall, with its comprehensive trading features, customer support, and user-friendly platform, FX Choice is an attractive choice for traders looking for a reliable online trading platform.

Question: What is FX Choice?

Answer: FX Choice is an online forex and CFD broker that offers trading services to retail and institutional clients.

Question: What types of accounts does FX Choice offer?

Answer: FX Choice offers three types of accounts: Classic, Optimum, and Pro.

Question: What is the minimum deposit to open an account with FX Choice?

Answer: The minimum deposit to open a Classic account is USD 100, while the minimum deposit for an Optimum account is USD 10, and for a Pro account, it is USD 100.

Question: What is the maximum leverage offered by FX Choice?

Answer: FX Choice offers leverage up to 1:1000 for Optimum account and 1:200 for Classic and Pro accounts.

Question: What trading platforms are available at FX Choice?

Answer: FX Choice offers the popular trading platforms MT4, MT5, and WebTrader.

Question: What are the deposit and withdrawal methods available at FX Choice?

Answer: FX Choice offers various deposit and withdrawal methods, including credit cards, e-wallets, bank transfers, and cryptocurrencies.

Question: Does FX Choice offer educational resources for traders?

Answer: Yes, FX Choice provides educational resources such as market signals, autotrade, copy trading, VPS, news, trading signals, and EA.

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded Year | 15-20 years ago |

| Company Name | Hirose Tusyo Co., Ltd. |

| Regulation | Regulated in Japan |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Fixed spreads on certain currency pairs |

| Trading Platforms | NET4 (installed version), LION FX C2 (installed version), LION FX Mobile App, HTML5 version, Flash version, Mobile app/portable version |

| Tradable Assets | 51 currency pairs, including major currencies and large currency pairs |

| Account Types | FX accounts, LION CFD accounts |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone, email, fax, website |

| Payment Methods | Quick deposit, quick deposit at ATM, transfer deposit |

| Educational Tools | LION FX easy operation video seminar, FX MARKET INFORMATION SEMINAR, seminars on campaign product cooking, resources on website |

Established in 2004, Hirose Tusyo Inc. is a Japan-based company mainly engaged in foreign exchange margin trading business, and was listed on the JASDAQ market of the Tokyo Stock Exchange on March 18, 2016.The Company is mainly engaged in foreign exchange margin trading business, which provides investors with foreign exchange margin trading and binary options trading through the Internet; provision of trading systems for group companies; provision of white label services for financial instruments traders, as well as covering transaction business as a counterparty of financial instruments traders, among others. Hirose Tusyo Inc. is authorized and regulated by Financial Services Agency, with regulatory license number 9120001106932.

The broker provides fixed spreads on several currency pairs, although these spreads may vary based on market conditions. Hirose-fx does not charge any commissions on trades, reducing the overall cost of trading. They offer deposit and withdrawal options and provide customer support through various channels, including phone, fax, and an online inquiry form.

Overall, Hirose-fx is a regulated broker with a range of trading instruments, account types, and trading platforms. Traders can benefit from their fixed spreads, commission-free trading, and accessible customer support.

Hirose-fx is a regulated Forex broker that offers a range of trading instruments, including 51 currency pairs. The company holds a Retail Forex License and is regulated by the Financial Services Agency (FSA) of Japan. Hirose-fx provides two types of accounts, FX accounts, and LION CFD accounts. They offer various order types to meet different trading needs and have both fixed and variable spreads, depending on market conditions. Hirose-fx does not charge any commissions on trades, which can be advantageous for traders. They offer multiple deposit and withdrawal options, as well as a variety of trading platforms to cater to different preferences and devices. The broker also provides trading tools, educational resources, and customer support through various channels. Overall, Hirose-fx has its strengths and weaknesses, and traders should carefully consider their options before choosing this broker.

| Pros | Cons |

| Regulated by the Financial Services Agency (FSA) of Japan | Medium potential risk |

| Offers a variety of trading instruments, including 51 currency pairs | Limited account types (FX accounts and LION CFD accounts) |

| Provides a range of trading platforms for different preferences and devices | Spreads may widen or contract based on market conditions |

| Offers a selection of order types to meet different trading needs | Variable spreads based on market conditions |

| Does not charge commissions on trades | Withdrawal requests have specific request and reflection times |

| Deposit options with various payment methods available | Limited customer support channels |

| Provides trading tools for market analysis and economic news updates | Maintenance periods during trading hours |

| Offers educational resources to improve trading knowledge and skills | Limited availability during rollover time |

Based on the information provided, Hirose-fx, also known as Hirose Financial UK Ltd, is regulated by the Financial Services Agency (FSA) of Japan. It holds a Retail Forex License and is regulated under the supervision of the Kinki Local Finance Bureau (近畿財務局長(金商)第41号). The licensing institution is Hirose Tsusho Kaisya Limited (ヒロセ通商株式会社).

The effective date of the license is September 30, 2007. The company's address is located at MG Building, 1-3-19 Shimmachi, Nishi-ku, Osaka, Japan. The phone number provided for the licensed institution is 06-6534-0708.

Hirose-fx offers a variety of trading instruments, including 51 currency pairs. These currency pairs encompass major currencies from around the world and provide opportunities for traders to engage in foreign exchange (Forex) trading. Some of the currency pairs offered include AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, CNH/JPY, EUR/AUD, EUR/CAD, and others.

Additionally, Hirose-fx offers a selection of large currency pairs, which are often traded frequently and have high liquidity. These large currency pairs include Large USD/JPY, Large EUR/USD, Large EUR/JPY, Large GBP/USD, Large GBP/JPY, and Large AUD/JPY.

| Pros | Cons |

| Offers a variety of trading instruments, including 51 currency pairs | Medium potential risk |

| Provides opportunities for Forex trading with major currencies worldwide | Limited account types (FX accounts and LION CFD accounts) |

| Includes large currency pairs with high liquidity for frequent trading | Spreads may widen or contract based on market conditions |

| Access to popular currency pairs like AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, CNH/JPY, EUR/AUD, EUR/CAD, and others | Variable spreads based on market conditions |

| Allows trading of Large USD/JPY, Large EUR/USD, Large EUR/JPY, Large GBP/USD, Large GBP/JPY, and Large AUD/JPY | Withdrawal requests have specific request and reflection times |

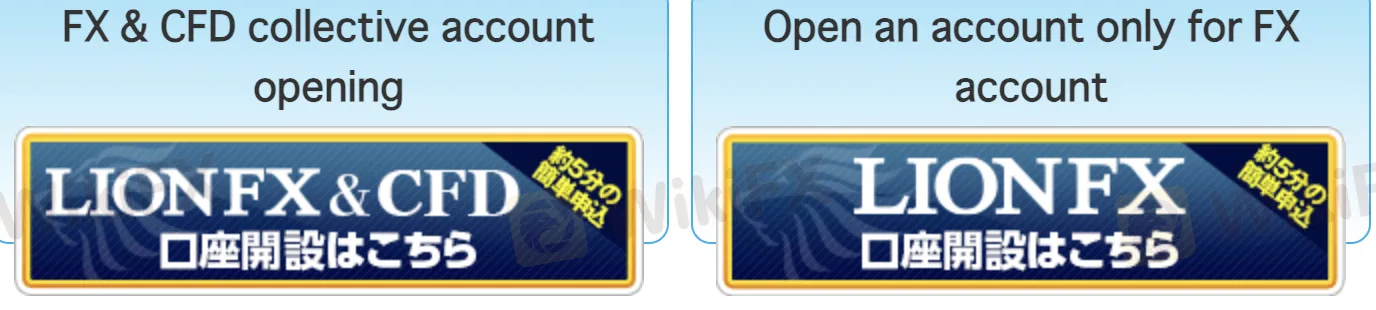

Hirose-fx offers two types of accounts: FX accounts and LION CFD accounts. Customers residing overseas are unable to open a LION CFD account. If a customer already has a LION FX account and wishes to open a LION CFD account, they can do so from the trading screen after the next business day following the completion of the FX account opening procedure. For more information on how to apply for a LION CFD account, customers can refer to the provided guidelines.

| Pros | Cons |

| Provides options for different trading preferences and strategies | Limited availability of LION CFD accounts for customers residing overseas |

| Allows customers to choose the account type that suits their needs | Additional procedures required to open a LION CFD account if already holding a LION FX account |

| Supports different trading platforms for each account type | Customers need to refer to guidelines for information on applying for a LION CFD account |

To open an account with Hirose-fx, follow these steps:

Access the main website of Hirose-fx and click on “新規口座開設” (Open a new account) or a similar option.

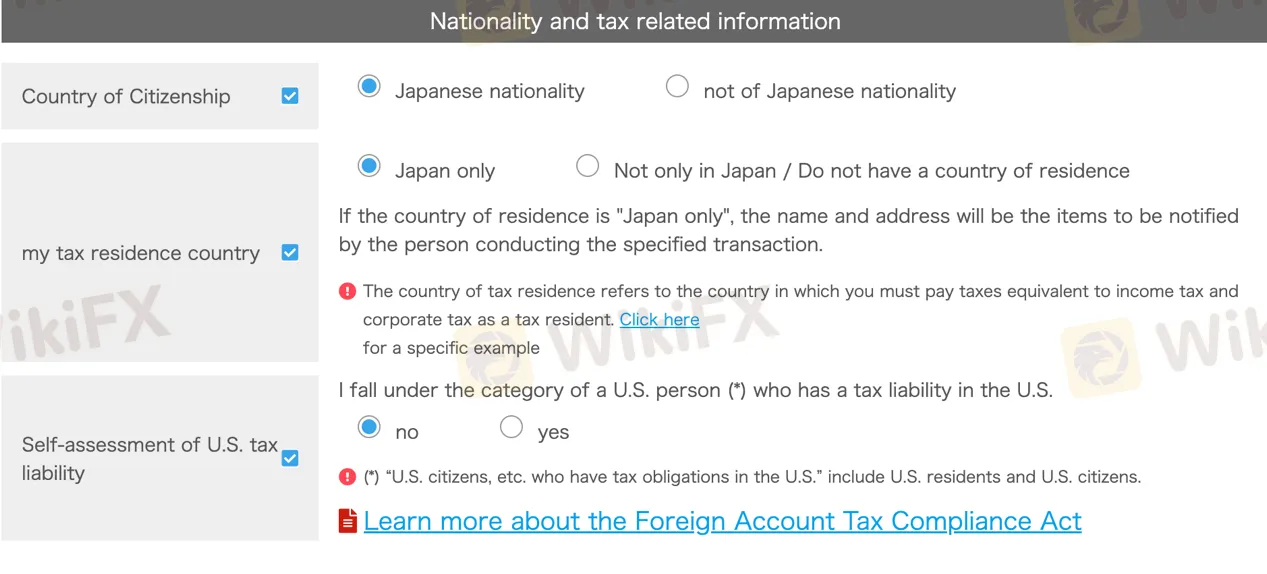

The account opening process may vary depending on the required identity verification documents and delivery method. Choose the appropriate option and proceed.

Fill in the necessary information and review the required documents. Note that using Internet Explorer (IE) is. not recommended; it's advisable to use another browser.

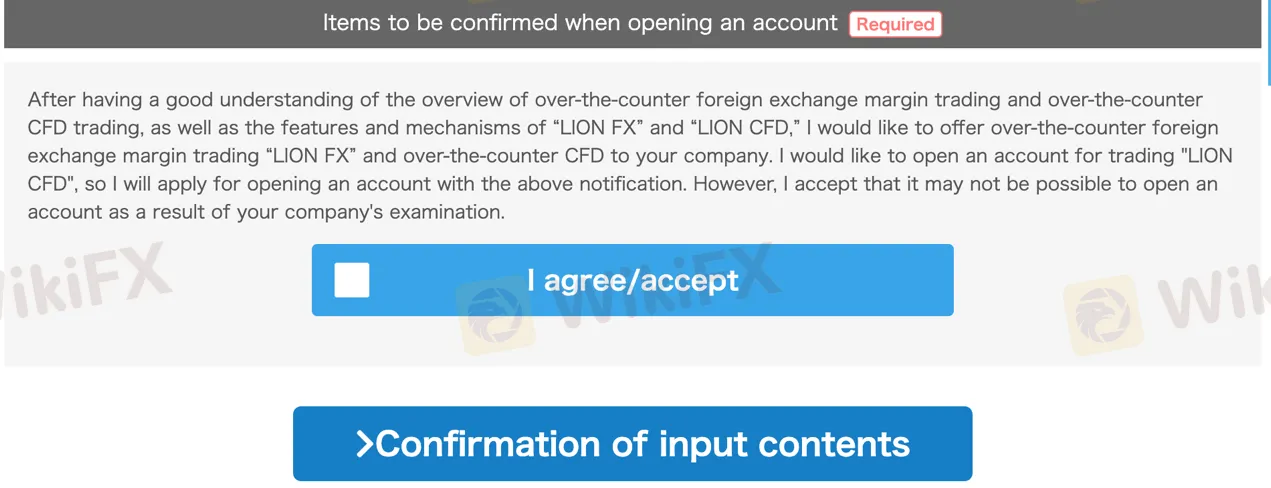

Submit your identity verification documents and My Number verification documents. You can choose from various sending methods, including simple identity verification with a smartphone, easy identity verification with Internet banking, upload, email, fax, or mail.

5. Once all the necessary documents are received, Hirose-fx will begin the screening and account opening process. Normally, it takes 1-2 business days after the arrival of the verification documents.

6. You will receive your user ID and password via email. The method of sending the user ID and password depends on the method used to send the identification documents.

7. Deposit funds into your trading account. Once the funds are deposited, you can log in and start trading.

FIXED SPREADS: Hirose-fx provides fixed spreads on several currency pairs. For example, USD/JPY has a fixed spread of 0.2 pips, AUD/JPY has a fixed spread of 0.6 pips, GBP/JPY has a fixed spread of 1.0 pip, AUD/USD has a fixed spread of 0.4 pips, EUR/USD has a fixed spread of 0.3 pips, NZD/JPY has a fixed spread of 0.8 pips, and MXN/JPY has a fixed spread of 0.2 pips. These fixed spreads indicate that the difference between the buying and selling prices of these currency pairs remains constant under normal market conditions.

VARIABLE SPREADS: It should be noted that while Hirose-fx provides fixed spreads, these spreads are not completely fixed. The spreads may widen or contract based on market conditions and exceptional events such as low liquidity times. This means that during times of increased volatility or reduced market liquidity, the spreads may change from their fixed values. As a result, the actual spreads experienced by traders may differ from the ones mentioned above.

COMMISSIONS: Hirose-fx does not charge any commissions on its trades. This means that traders can execute their trades without incurring any additional fees in the form of commissions. The absence of commissions can be advantageous for traders.

There are 27 order types, including Market Order, Limit Order, Stop Order, OCO order, IF-DONE order, IF-OCO order, Trail Order, Streaming order, Timed Market order, Timed Limit ( stop) order, one-click order, Quick Order, One-click payment order, Bulk Settlement Order, Bulk Purchase Settlement order, Bulk Sale Settlement order, All Settlement Order by currency, All settlements Orders, Pip difference Settlement order, Doten Order, Bulk Order, Amount specified all settlement, trigger order, Timed All Settlement order, BID Judgment Buy (ASK Judgment Sell) Stop Order, Trigger orders in other currencies, Repeat time specified market order.

When US standard time is applied, Japan time Monday 7:00 am to Saturday 6:30 am Japan time. When summertime is applied, Japan time Monday 6:30 am to Saturday 5:30 am. Rollover time (6:59 am Japan time) Minutes, 5:59 am when US summer time is applied), communication will be disconnected, and day closing work and maintenance will be performed. (It takes about 15 minutes for the day closing work and maintenance, but it may take up to 30 minutes.)

Hirose-fx offers a range of trading platforms designed to cater to the diverse needs of traders. These platforms provide access to the financial markets and offer various tools and features to facilitate trading activities.

NET4 (installed version): This trading platform is available for Windows and Mac operating systems. It offers customizability, easy-to-see screens, and the ability to view charts and execute orders. It supports various order types and provides access to account information and news.

LION FX C2 (installed version): This platform is recommended for beginners and offers versatile functionality. It allows for simultaneous ordering and payment, displays order and position execution history, and supports collective payment. It provides a simple and comfortable user experience.

LION FX Mobile App (iPad, iPhone, Android): Hirose-fx offers mobile apps for iPad, iPhone, and Android devices. These apps provide access to essential functions and information. Traders can check rates, view charts, place orders, monitor positions, and manage their accounts using these mobile apps.

HTML5 version, Flash version: Hirose-fx also offers web-based trading platforms compatible with various web browsers. The HTML5 version provides access to charting tools, order placement, and account information. The Flash version may have similar functionality but requires Flash support.

Mobile app/portable version: Hirose-fx provides a mobile version of its trading platform that is compatible with mobile phones from different carriers such as docomo, au, and SoftBank. This version allows traders to conduct transactions and access various features on their mobile devices.

The trading platforms offered by Hirose-fx provide traders with the ability to view real-time rates, analyze charts, place different types of orders, manage positions, and access account information. Each platform has its own set of features and compatibility options to cater to traders' preferences and device capabilities.

| Pros | Cons |

| Multiple platform options (NET4, LION FX C2, LION FX Mobile App, HTML5 version, Flash version, Mobile app/portable version) | May require separate platform downloads for different devices |

| Customizability and easy-to-use interfaces | Flash version requires Flash support |

| Real-time rate viewing and chart analysis | Limited platform availability for certain carriers or operating systems |

| Support for various order types | Mobile app/portable version may have limited features compared to other platforms |

| Access to account information and news updates | Web-based platforms may have performance limitations compared to installed versions |

| Mobile apps for iPad, iPhone, and Android devices available |

There are three types of deposit options available with Hirose-fx: quick deposit, quick deposit at ATM, and transfer deposit. Payments can be made 24 hours a day, 365 days a year. Quick deposits support approximately 380 lines and are free of charge, except for PayPay, Mizuho, and Sumitomo Mitsui Banking Corporation, which may charge a fee. Quick deposit at ATMs allows fee-free deposits and supports various banks, including Japan Post Bank, Mizuho, Mitsubishi UFJ, Mitsui Sumitomo, Resona, Saitama Resona, Aomori, Shonai, Gunma, Chiba, Yokohama, Kansai Mirai, Nanto, Hyakujushi, Fukuoka, Juhachi Shinwa, Towa, Keiyo, and Kumamoto. Some agricultural cooperatives and Shinren also support this option. There is also a general transfer deposit available for users.

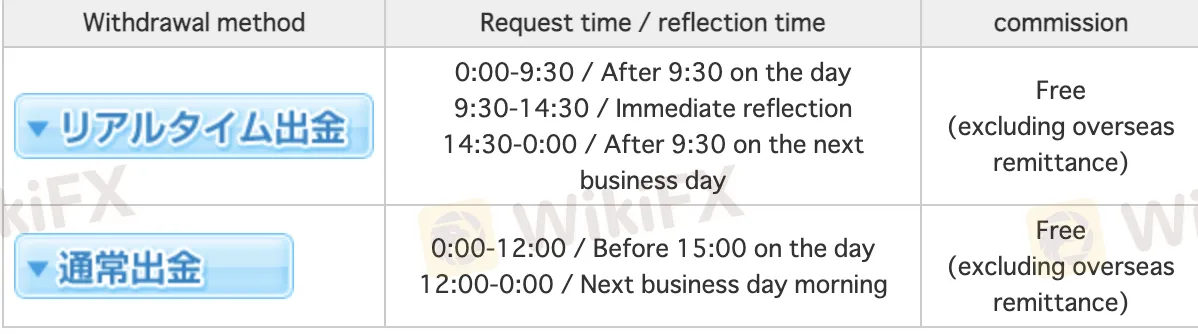

Hirose-fx offers two types of withdrawals: real-time withdrawals and regular withdrawals. Real-time withdrawals allow for immediate reflection of funds and can be requested within specific timeframes. There are no commissions for real-time withdrawals, except for overseas remittances. Normal withdrawals have specific request and reflection times and are also commission-free, excluding overseas remittances. Withdrawals can be requested once a day, either for real-time withdrawals or regular withdrawals. However, on Saturdays, Sundays, and Mondays, withdrawals can only be made once every three days. It's important to note that real-time withdrawals cannot be canceled once the procedure is completed. Withdrawal requests require authentication with a PIN code set by the customer in advance.

Hirose-fx offers several trading tools to assist users in their investment activities. These tools include:

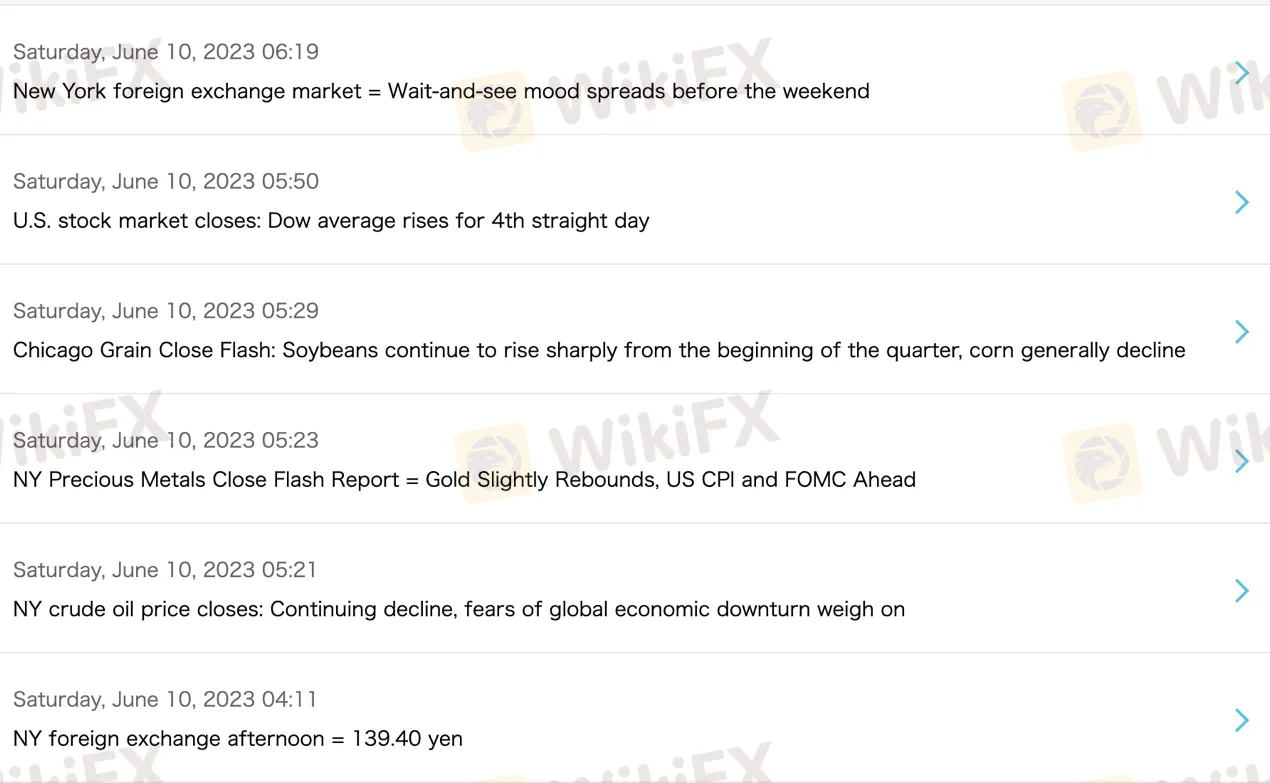

1. Economic News: The platform provides real-time updates on economic bulletins. Users can stay informed about the latest economic developments that may impact their trading decisions.

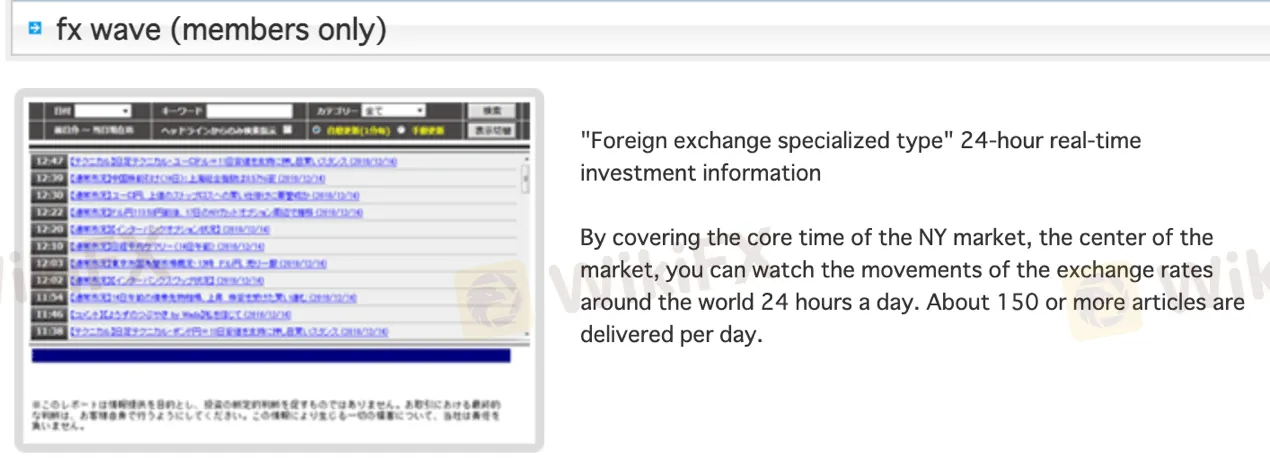

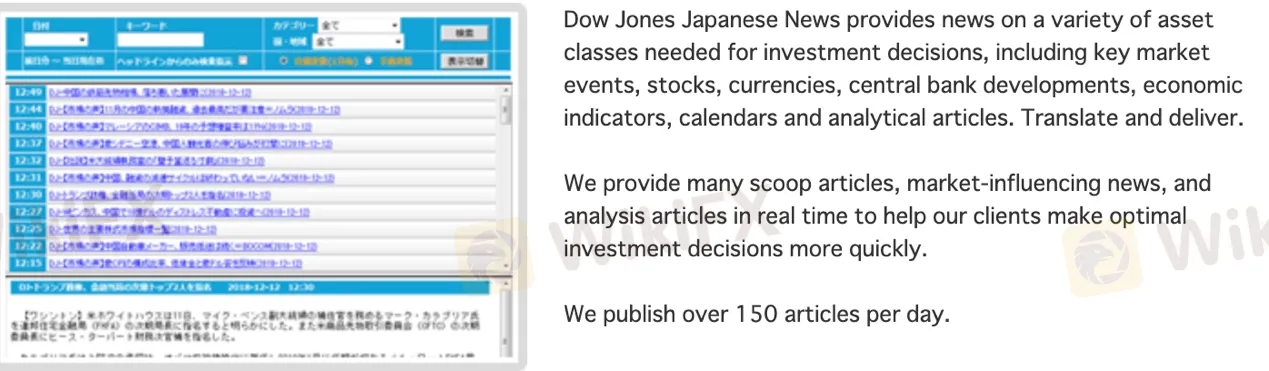

2. FX Wave: This feature delivers 24-hour real-time investment information focused on foreign exchange. Users can access over 150 articles per day, providing insights and analysis to help them make informed trading choices.

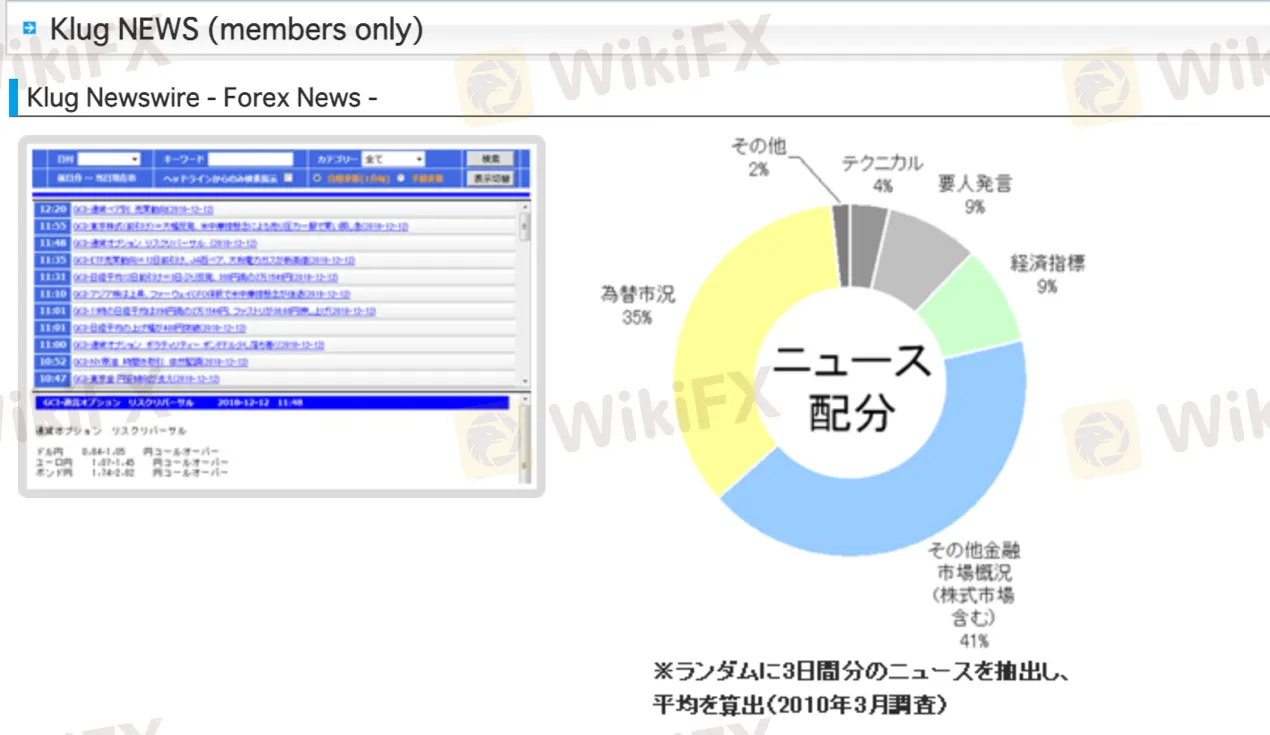

3. Klug NEWS: Klug NEWS offers a continuous feed of Forex news, available 24 hours a day. Users can access more than 180 news deliveries daily, ensuring they stay updated on the latest developments in the Forex market.

4. Dow Jones: Hirose-fx translates and delivers news on various asset classes, providing users with information necessary for making investment decisions. Users can expect around 150 news articles per day, covering a range of relevant topics.

These trading tools aim to keep users informed about market trends, economic news, and relevant investment information, enabling them to make well-informed trading decisions.

| Pros | Cons |

| Real-time updates on economic bulletins | Some tools may require additional fees or subscriptions |

| Access to over 150 articles per day for foreign exchange insights | Language translation may not be perfect for all news sources |

| Continuous feed of Forex news available 24/7 | Information overload may be overwhelming for some users |

| Delivery of news on various asset classes for comprehensive investment information | Limited customization options for news delivery |

| Helps users stay informed about market trends and economic news | Dependency on external news sources for analysis and decision-making |

| Provides insights and analysis to support informed trading choices | Potential delays or lag in news delivery |

Hirose-fx offers a variety of educational resources to assist users in improving their trading knowledge and skills. One of their resources is the LION FX easy operation video seminar, which provides step-by-step guidance on using their trading platform. The seminar covers topics such as installing the app, navigating the transaction screen, understanding different order types, making payments, and managing orders.

Additionally, they offer the FX MARKET INFORMATION SEMINAR, which provides valuable insights into the market and strategies to enhance trading performance. The seminar includes various equations and formulas aimed at helping traders achieve success in their trades. They also offer a special equation designed specifically for winning trades.

Moreover, Hirose-fx provides resources on topics like quick deposit methods, changing currency pairs and order display, order preferences setup, chart analysis techniques, saving chart settings, using technical indicators and trend lines, and accessing execution history. They also cover features such as signal functions, measurement tools, and customizing the transaction screen.

Furthermore, Hirose-fx offers seminars on campaign product cooking, which may provide additional information or strategies related to specific trading promotions or offerings.

| Pros | Cons |

| Provides step-by-step guidance on using the trading platform | Limited variety of educational resources |

| Offers insights into the market and strategies to enhance trading performance | Limited coverage of advanced trading topics |

| Includes equations and formulas for successful trades | May not cater to all trading styles or preferences |

| Covers a wide range of topics, including deposit methods, chart analysis, and execution history | Availability of seminars may vary |

| Offers information on campaign product offerings | Limited interactivity or hands-on learning opportunities |

- When US standard time applies, Hirose-fx operates from Monday 7:00 am to Saturday 6:30 am Japan time.

- When daylight saving time applies in Japan, the trading hours shift to Monday 6:30 am to Saturday 5:30 am Japan time.

During Rollover time, which is at 6:59 am Japan time (or 5:59 am when US daylight saving time is applied), certain activities occur. Communication will be temporarily cut off, and date closing work as well as maintenance will be performed. This process usually takes around 15 minutes, but it could extend up to 30 minutes. Additionally, a maintenance pop-up may appear, potentially affecting the ability to trade during this period.

Hirose-fx provides various channels for customer support. You can reach their customer support team via telephone using the toll-free number 0120-63-0727 or the representative number 06-6534-0708. Additionally, you can contact them through fax using the toll-free number 0120-34-0709 or the number 06-6534-0709. Visiting their head office or branches is also an option.

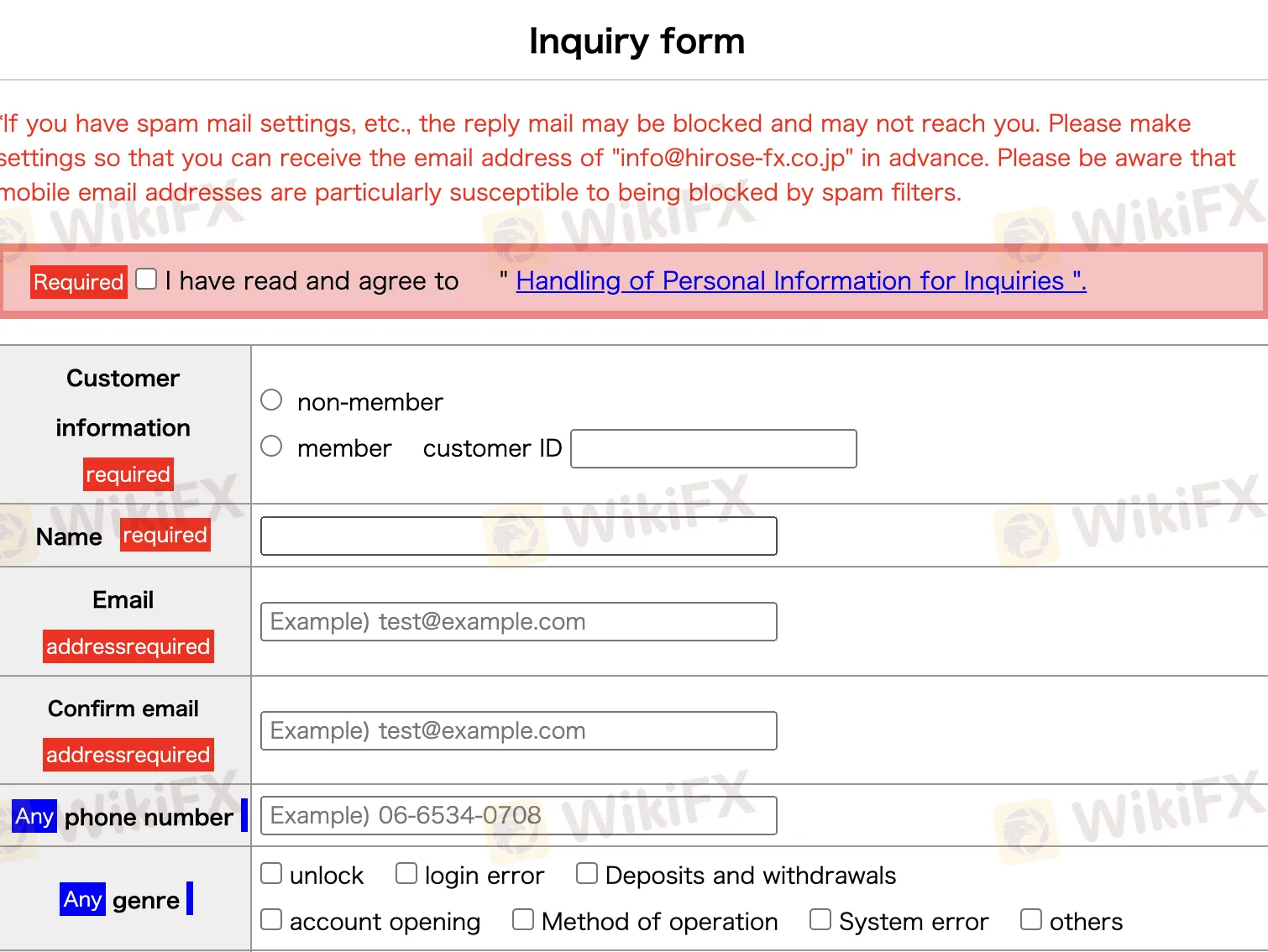

They offer an inquiry form on their website where you can submit your opinions, questions, or requests directly. They also provide a FAQ section where you can find answers to frequently asked questions.

For specific information on deposits, withdrawals, and changing registration information, they provide detailed information on their website. They have a complaint consultation desk for addressing any complaints, and you can contact them for information about the final tax return.

There is an opinion box where you can share your feedback and impressions about their website, trading system, and various services. They offer an operation manual for LION FX, and you can access information to better understand Forex, including country information and technical analysis.

You can contact their customer support team via phone using the toll-free number 0120-63-0727 or the direct dial number 06-6534-0708. They also provide an email address, info@hirose-fx.co.jp, for inquiries if you are unable to use the inquiry form on their website.

Hirose-FX is a forex trading platform that offers several advantages to traders. It provides a user-friendly interface with various tools and features to facilitate trading activities. Hirose-FX also offers a range of trading instruments, allowing users to diversify their portfolios. However, there are some disadvantages worth considering. The platform may lack in-depth educational resources and research materials, which could limit the learning opportunities for traders. Additionally, customer support may not always be readily available or responsive, potentially leading to delays in issue resolution. Traders should carefully assess these factors before deciding to engage with Hirose-FX.

Q: Is Hirose-fx a regulated broker?

A: Yes, Hirose-fx is regulated by the Financial Services Agency (FSA) of Japan and holds a Retail Forex License.

Q: What is the address of Hirose-fx?

A: Hirose-fx is located at MG Building, 1-3-19 Shimmachi, Nishi-ku, Osaka, Japan.

Q: What trading instruments does Hirose-fx offer?

A: Hirose-fx offers 51 currency pairs for trading, including major currency pairs like AUD/USD, EUR/USD, GBP/JPY, and more.

Q: What types of accounts does Hirose-fx offer?

A: Hirose-fx offers two types of accounts: FX accounts and LION CFD accounts. Overseas customers can only open FX accounts.

Q: How can I open an account with Hirose-fx?

A: To open an account with Hirose-fx, you need to visit their website and follow the account opening process, which involves providing necessary information and submitting verification documents.

Q: What order types are available on Hirose-fx?

A: Hirose-fx offers various order types, including Market Order, Limit Order, Stop Order, OCO order, Trail Order, and more, to meet different trading needs.

Q: Does Hirose-fx charge commissions on trades?

A: No, Hirose-fx does not charge any commissions on trades.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fx-choice and hirose-fx are, we first considered common fees for standard accounts. On fx-choice, the average spread for the EUR/USD currency pair is from 0 pips, while on hirose-fx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fx-choice is regulated by FSC. hirose-fx is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fx-choice provides trading platform including Pro,Classic,Optimum and trading variety including 36 currency pairs; Indices, Metals, Commodities, Energies, Cryptocurrencies. hirose-fx provides trading platform including -- and trading variety including --.