No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FULLERTON and xChief ?

In the table below, you can compare the features of FULLERTON , xChief side by side to determine the best fit for your needs.

--

--

EURUSD:1.4

EURUSD:9

EURUSD:21.99

XAUUSD:41.19

EURUSD: -8.9 ~ 1.1

XAUUSD: -39.8 ~ 16.2

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fullerton-markets, forexchief lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Information | Details |

| Registration | Saint Vincent and the Grenadines |

| Regulated | Unregulated |

| Years of establishment | 5-10 years |

| Trading instruments | Forex, precious metals, indices, cryptocurrencies, stocks |

| Minimum Initial Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Minimum Spread | Variable, Raw, or PRO spreads |

| Trading Platform | MT5 |

| Deposit and Withdrawal | Credit cards, digital wallets, bank wire transfers, cryptocurrencies |

| Customer Service | Email, phone, messaging apps (Line, Telegram, Viber, Whatsapp) |

Fullerton is a financial institution that provides trading services in various financial markets. While it is important to note that Fullerton operates without a license and regulatory oversight, it offers a diverse range of market instruments, two types of accounts (LIVE and DEMO), leverage options up to 1:500, and the MT5 trading platform. Traders can access forex, precious metals, indices, cryptocurrencies, and stocks, while the platform provides advanced features and analytical tools. Deposits and withdrawals are facilitated through various methods, and customer support is available through multiple channels.

FULLERTON, as an unlicensed and unregulated financial institution, exposes investors and traders to significant risks.

Pros and Cons

| Pros | Cons |

| Diverse market instruments | Unregulated |

| LIVE and DEMO accounts | Security and protection uncertainty |

| Leverage options up to 1:500 | Limited transparency and accountability |

| Advanced MT5 trading platform | Potential financial losses and lack of recourse |

| Convenient deposit and withdrawal methods | |

| Multiple customer support channels |

Fullerton offers a diverse range of market instruments to cater to the needs of traders and investors. In the realm of forex, Fullerton provides a wide selection of currency pairs, enabling participants to engage in global currency trading and take advantage of fluctuations in exchange rates.

Additionally, Fullerton offers trading opportunities in precious metals such as gold, silver, platinum, and palladium, allowing individuals to diversify their portfolios and hedge against inflation or market volatility. Traders can also explore a variety of indices, including major global indices like the S&P 500, FTSE 100, and Nikkei 225, to speculate on the overall performance of specific markets. Fullerton extends its offerings to crude oil, providing access to one of the world's most important commodities, enabling traders to capitalize on price movements in the oil market.

Moreover, Fullerton recognizes the growing popularity of cryptocurrencies and offers a range of digital assets, including Bitcoin, Ethereum, and Litecoin, allowing traders to participate in this dynamic and evolving market.

Lastly, Fullerton facilitates trading in stocks, enabling individuals to invest in a wide range of publicly traded companies across various sectors and regions.

Fullerton offers two types of accounts: LIVE and DEMO.

The LIVE account is for real trading with actual money. It requires registration, verification, and funding. Traders can access various financial instruments and experience live market conditions. It involves real risks, and individuals should carefully consider their strategies and risk management.

The DEMO account is a practice account with virtual funds. It allows users to simulate trades and test strategies without risking real money. It helps beginners gain confidence and familiarity with the trading platform. Profits or losses in a DEMO account are simulated and do not have real financial consequences.

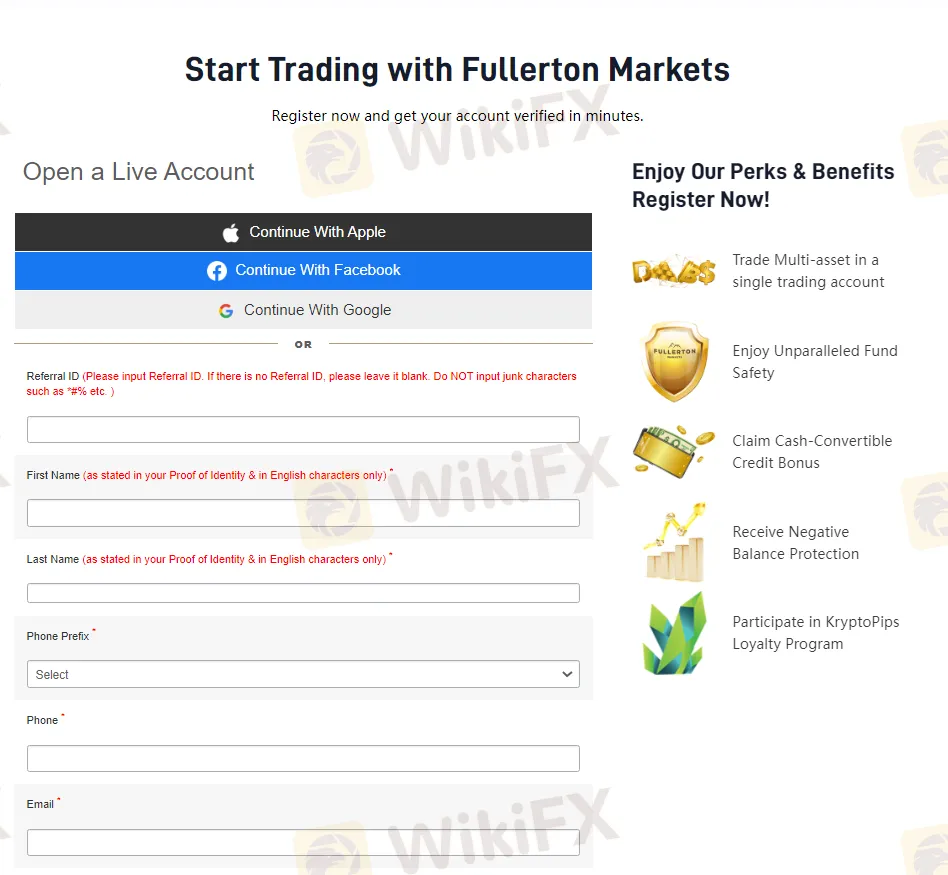

To open an account with Fullerton, follow these steps:

3. Choose the type of account you want to open, such as a LIVE or DEMO account.

4. Fill out the registration form with your accurate personal details.

Fullerton offers a maximum leverage of 1:500 to its clients. Leverage is a financial tool that allows traders to amplify their trading positions by borrowing funds from the broker. With a leverage ratio of 1:500, clients can control a position size up to 500 times larger than their actual account balance.

Fullerton Markets offers three types of spreads to its clients:

Fullerton Markets' MT5 platform offers traders enhanced flexibility and a wide range of trading functionalities that are not available on the older MT4 platform. With its advanced features, the MT5 platform provides traders with a more comprehensive and efficient trading experience. It offers 21 timeframes, allowing traders to analyze market trends across different intervals. Additionally, traders can choose from 6 pending order types, providing them with greater control over their trades and entry points.

The platform also boasts an extensive selection of technical indicators and analytical objects, empowering traders with in-depth market analysis capabilities. It includes a built-in economic calendar, providing real-time updates on important economic events and their potential impact on the markets. Traders can develop and utilize custom trading strategies using the MQL5 programming language, further enhancing their ability to implement personalized trading approaches.

Moreover, the MT5 platform provides real-time Depth of Market (DOM) data, enabling traders to access insights into market liquidity and the order book.

Deposit: Fullerton Markets offers a variety of convenient deposit methods to suit the needs of traders worldwide. Traders can choose to fund their accounts using credit cards, digital wallets, bank wire transfers, or cryptocurrencies. Credit card deposits are available in USD, EUR, and SGD currencies, with no minimum deposit amount required. Sticpay and digital wallet deposits are also available in USD, EUR, and SGD, with no minimum deposit requirement. For bank wire transfers, traders can deposit in USD, EUR, SGD, or NZD currencies, with a minimum deposit of USD 200 or equivalent value in other currencies.

Withdrawal: Fullerton Markets provides hassle-free withdrawal options for traders to access their funds. The minimum withdrawal amounts vary depending on the chosen method. For credit card, digital wallet, and cryptocurrency withdrawals, there is no minimum withdrawal amount. However, for Bitcoin withdrawals, a minimum withdrawal of USD 100 is required. Bank wire transfers have a minimum withdrawal amount of USD 200 or equivalent in other currencies. Additionally, Fullerton Markets covers all withdrawal fees, ensuring that traders can access their funds without any additional charges.

Customer Support at Fullerton Markets is dedicated to providing prompt and reliable assistance to traders. Traders can reach out to Fullerton Markets through various channels, including email, phone, and messaging apps like Line, Telegram, Viber, and Whatsapp. This multi-channel approach ensures that traders have multiple options to connect with the support team based on their preferred communication method.

Additionally, Fullerton Markets provides a comprehensive Help Center and FAQ section on their website, where traders can find instant answers to common questions about services, trading, and their accounts. This resourceful repository of information serves as a valuable self-help tool, empowering traders to find solutions and make informed decisions.

Furthermore, Fullerton Markets offers tutorials in the form of videos and blog posts to help traders master the A-Z of trading.

Fullerton Markets offers a range of educational resources to support traders in their journey towards successful trading. These resources are designed to provide valuable market insights, enhance trading knowledge, and help traders stay updated with the latest developments.

The blog section on Fullerton Markets' website is a valuable resource for traders. It features weekly market research that provides in-depth analysis and updates on market trends, economic news, and trading opportunities. Traders can leverage this information to make informed trading decisions and stay ahead of the market.

The video library is another valuable educational resource offered by Fullerton Markets. It covers a wide range of topics, including Forex, MetaTrader 4, MetaTrader 5, indicators, and key trading concepts.

These videos provide detailed explanations, step-by-step tutorials, and practical tips to help traders improve their trading skills and understanding of the market.

No, Fullerton operates without a license and regulatory oversight.

Trading with an unregulated entity exposes traders to potential financial losses and limited recourse in case of disputes or grievances.

Fullerton offers two types of accounts: LIVE accounts for real trading with actual money and DEMO accounts for practice trading with virtual funds.

Fullerton offers a maximum leverage of 1:500 to its clients.

You can reach out to Fullerton's customer support through email, phone, or messaging apps like Line, Telegram, Viber, and Whatsapp.

| xChiefReview Summary | |

| Founded | 2014 |

| Registered Country/Region | Comoros |

| Regulation | MISA (Offshore) |

| Market Instruments | Forex, Metals, Commodities, Indexes, Stocks, Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pips |

| Trading Platform | MT4, MT5, xChief App |

| Min Deposit | 0 |

| Customer Support | Live chat, phone, email |

xChief (formerly ForexChief) is an online Forex and CFD trading broker that offers multiple assets for trading online via the MetaTrader4/5 platforms. Founded in 2014, its head office is in Vanuatu while other representative offices are in Singapore and Nigeria. xChief Ltd is incorporated in the Republic of Comoros.

xChief Ltd is a retail forex broker offshore regulated by the Mwali International Services Authority (MISA) in Comoros with the license number T2023379. Besides, xChief prioritizies the safety of client funds. If there are any losses caused by technical faults, xChief will compensate for them. It also protects clients' funds by segregating them into separate bank accounts.

xChief has several pros and cons. It offers various trading instruments, multiple account types, and user-friendly trading platforms. Besides, it also highlights the safety of client funds, and manages to protect them. What's more, it is well regulated, and it is a mature broker. However, some reports have been exposed, which says that xChief has slippage.

| Pros | Cons |

| Various trading instruments | Withdrawal issues and slippage |

| Tight spreads | Offshore regulated |

| Demo accounts | |

| MT4/5 supported | |

| No minimum deposit requirement | |

| Live chat |

xChief offers 4 types of trading accounts: CENT account, Classic+ account, DirectFX account, and xPRIME account. Demo accounts are also available for traders.

| Account Type | Account Curency | Minimum Deposit | No-Deposit Bonus $100 | Welcome Bonus $500 |

| CENT | USD, EUR | 0 | ❌ | ❌ |

| Classic+ | USD, EUR, GBP | $10 (or equivalent) | ✔ | ✔ |

| DirectFX | USD, EUR, GBP | $50 (or equivalent) | ✔ | ✔ |

| xPRIME | USD, EUR, GBP, CHF, JPY | $2000 (or equivalent) | ❌ | ✔ |

The leverage is relatively high, and for some types of accounts, it can be up to 1:1000, which means risks may also be high.

| Account Type | Max Leverage | Spreads | Commissions |

| CENT | 1:500 | From 0.9 pips | ❌ |

| Classic+ | 1:1000 | From 0.6 pips | ❌ |

| DirectFX | 1:1000 | From 0.3 pips | $/€/£2.5 |

| xPRIME | 1:1000 | From 0 pips | $/€/£/₣3/¥500 |

| Trading Platform | Available Devices | Suitable for |

| MetaTrader5 | Desktop, iOS, Android, MacOS, Web | Beginners |

| MetaTrader4 | Desktop, iOS, Android, MacOS, Web | Skilled and professional traders |

| xChief Mobile App | Mobile | All types of traders |

TxChief supports different kinds of deposit and withdrawal methods. Take the UK for example.

| Deposit Methods | Fees | Time | Currency |

| SWIFT | 0% | Up to 5 days | EUR, GBP |

| Crypto | 0% | Up to 8 hours | BTC, ETH, LTC, XRP, USDT, USDC |

| Perfect Money | 1.99% | Instantly | USD, EUR |

| Withdrawal M ethods | Fees | Time | Currency |

| SWIFT | 1%, min.€50/£50 | Up to 5 business days | EUR, GBP |

| SEPA | €25 | Up to 3 business days | EUR |

| Debit/Credit Card | 2%, min.$5/€5 | Up to 7 business days | USD, EUR |

| Crypto | 0% | 1 business day | BTC, ETH, LTC, XRP, USDT, USDC |

| Perfect Money | 0.5% | 1 business day | USD, EUR |

xChief provides customer services to its clients, and it has unique contact options in the headquarter as well as representative offices.

| Vanuatu Contact Info | |

| Phone | +65 31593652 |

| info@xchief.com | |

| marketing@xchief.com | |

| partnership@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | 1st Floor, CNM Building, Port Vila, Vanuatu |

| Singapore Contact Info | |

| Phone | +65 31593652 |

| asia@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | 2 Venture Dr, #24-01 Vision Exchange, Singapore, 608526 |

| Nigeria Contact Info | |

| Contact Options | Details |

| Phone | +234 9030795364 |

| nigeria@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | Suite 319 Rock of Ages Mall Jabi, Abuja, Nigeria |

Is xChief regulated?

Yes, it is regulated by the MISA.

Does xChief offer demo accounts?

Yes.

What trading platforms does xChief have?

It supports MT4, MT5, and xChief APP.

What is the minimum deposit for xChief?

The minimum deposit is 0.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fullerton-markets and forexchief are, we first considered common fees for standard accounts. On fullerton-markets, the average spread for the EUR/USD currency pair is -- pips, while on forexchief the spread is From 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fullerton-markets is regulated by --. forexchief is regulated by MISA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fullerton-markets provides trading platform including -- and trading variety including --. forexchief provides trading platform including xPRIME,DirectFX,Classic+,CENT and trading variety including 150+ Forex, Metals, Commodities, Indexes, Stocks, Crypto.