No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FirewoodFX and LMAX Group ?

In the table below, you can compare the features of FirewoodFX , LMAX Group side by side to determine the best fit for your needs.

EURUSD:0.3

EURUSD:0.4

EURUSD:14.52

XAUUSD:34.85

EURUSD: -8.59 ~ 2.38

XAUUSD: -26.34 ~ 11.57

--

XAUUSD:22.05

XAUUSD: -48.16 ~ 27.94

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of firewoodfx, lmax-global lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Firewood FX Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex, Gold, Cryptos, Oil, etc. |

| Demo Account | ✅ |

| Leverage | Up to 1:3000 |

| Spread | From 2 pips (Standard account) |

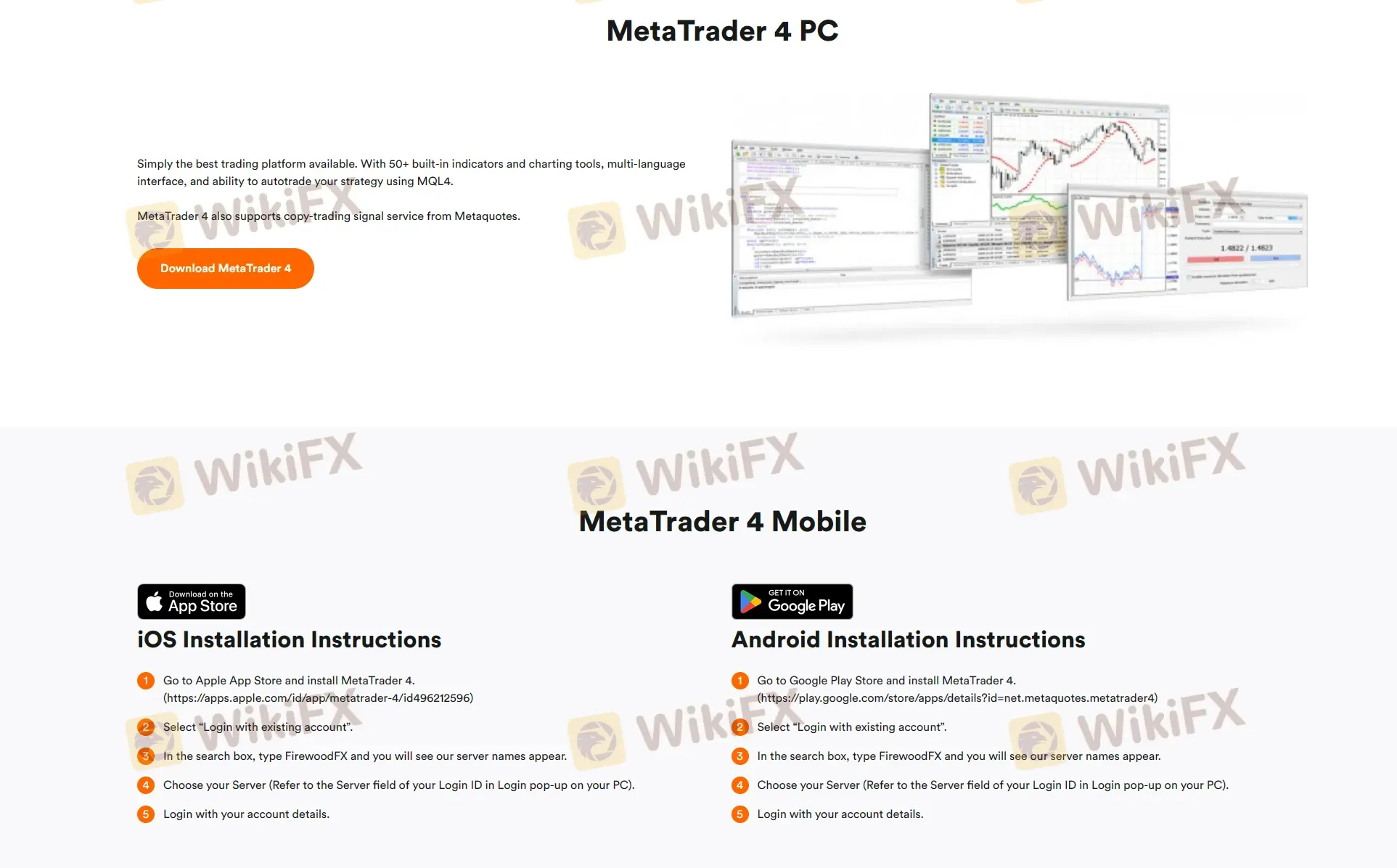

| Trading Platform | MT4 |

| Min Deposit | $10 |

| Customer Support | Live chat, contact form |

| Tel: +442036083558 | |

| Email: support@firewoodfx.com | |

| Address: Suite 305, Griffith Corporate Centre, Beachmont. St. Vincent and the Grenadines | |

| Regional Restrictions | The United States, North Korea, Iraq, Iran, Saint Lucia and Saint Vincent and the Grenadines |

Based in Saint Vincent and the Grenadines, FirewoodFX is an unregulated forex broker that was established in 2014. FirewoodFX provides various financial products to trade via the MT4 platform, including Forex, Gold, Cryptos, Oil and more. Demo accounts are available and the minimum deposit requirement to open a live account is only $10.

| Pros | Cons |

| Various trading options | Unregulated |

| Demo accounts | Regional restrictions |

| Cent account offered | |

| Multiple account types | |

| Commission-freefor most accounts | |

| Low minimum deposit | |

| Multiple payment options | |

| Live chat support |

No, FirewoodFX is not regulated by any reputable financial body. Please be aware of the risk!

| Tradable Instruments | Supported |

| Forex | ✔ |

| Gold | ✔ |

| Cryptos | ✔ |

| Oil | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

FirewoodFX offers five accounts to choose from, including Cent, Micro,Standard, Premium and ECN accounts. Besides, it also sets up demo accounts for traders to practice trading with virtual credit. Islamic swap free accounts are available.

| Account Type | Min Deposit | Max Trade Size | Min Trade Size |

| Cent | $10 | 100 cent lot (100,000) | 0.01 cent lot (1,000) |

| Micro | 200 micro lot (200,000) | 0.01 micro lot (100) | |

| Standard | 30 lot (3,000,000) | 0.01 lot (1,000) | |

| Premium | 50 lot (3,000,000) | ||

| ECN | $200 |

FirewoodFX provides leverage up to 1:3000 for Cent account and up to 1:1000 for other accounts. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Account Type | Max Leverage |

| Cent | 1:3000 |

| Micro | 1:1000 |

| Standard | |

| Premium | |

| ECN |

FirewoodFX offers different spreads for different accounts. The broker charged $7/lot for ECN account and commission-free on other accounts.

| Account Type | Spread | Commission |

| Cent | Floating from 1 pip | ❌ |

| Micro | Fixing from 3 pips | ❌ |

| Standard | Fixing from 2 pips | ❌ |

| Premium | Floating from 0.3 pip | ❌ |

| ECN | Floating from 0 pips | $7/lot |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, PC, Mac, mobile and tablet | Beginners |

| MT5 | ❌ | / | Experienced traders |

| Payment Options | Accepted Currencies | Min Deposit | Fees | Processing Time |

| Bank Transfer | USD | $100 | Bank fees may apply | 24 hours |

| QRIS | IDR | IDR 100,000 | ❌ | Few minutes |

| Internet Banking (Indonesian Local Bank) | $10 | |||

| Virtual Account (E-Wallet) | ||||

| USD Tether TRC20/BEP20 | USTD | $1 | ||

| USD Coin BEP20 | ||||

| IDRX BEP20 | IDRX | |||

| Credit Card | USD | $50 | $0.5+ 5% | Instant deposit |

| Perfect Money | $1 | ❌ | ||

| Fasapay | USD, IDR | |||

| Thai QR Payment | THB | $10 | Few minutes |

| LMAX Group Review Summary in 10 Points | |

| Founded | 2010 |

| Headquarters | London, UK |

| Regulation | FCA, CYSEC |

| Market Instruments | Forex, precious metals, stock indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:100 (forex), 1:50 (metals and commodities) |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | LMAX Global, MetaTrader4 |

| Minimum deposit | $1,000 |

| Customer Support | 24/7 phone, email, and live chat |

LMAX Group is a UK-based multilateral trading facility (MTF) that offers forex and cryptocurrency trading to retail and institutional clients. It was founded in 2010 and is regulated by the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CYSEC). LMAX is known for its transparent and fair execution model, as well as its low latency and high-speed trading technology. The company's headquarters are located in London, and it has additional offices in New York, Tokyo, and Hong Kong.

LMAX is an electronic communication network (ECN) broker that operates a multilateral trading facility (MTF) for forex and cryptocurrency trading. It is a pure agency broker, which means it does not take positions against its clients and earns revenue solely from commissions and fees. LMAX provides institutional and retail traders with deep liquidity, fast execution, and transparent pricing through its proprietary trading platform, LMAX Global.

LMAX has several advantages, such as being a regulated broker, offering transparent and direct market access, providing a range of trading instruments, and offering a professional trading platform.

On the other hand, LMAX has some drawbacks, including limited account types and high minimum deposit requirements.

| Pros | Cons |

| • Regulated by FCA and CySEC | • High minimum deposit requirement |

| • Offers DMA (Direct Market Access) | •High commission fees |

| • Low latency and fast trade execution | • No social trading or copy trading features |

| • Transparent pricing and deep liquidity | |

| • Advanced trading technology and tools | |

| • Professional and institutional grade services | |

| • Segregated client funds and investor protection |

As a regulated broker by reputable financial authorities such as FCA and CySEC, LMAX is considered a reliable broker. The company also prioritizes the security of its clients' funds by keeping them in segregated accounts and offering negative balance protection.

| Protection Measures | Detail |

| Regulation | FCA, CySEC |

| Segregated client funds | To protect them in case of any financial difficulties or insolvency |

| Financial Services Compensation Scheme (FSCS) | A member of the FSCS, which provides eligible clients with protection up to £85,000 per person in the event of the broker's insolvency |

| Negative balance protection | Ensures that clients can never lose more than their account balance |

| Two-factor authentication | Adds an extra layer of security to clients' accounts |

| SSL encryption | To protect clients' personal and financial information from unauthorized access |

LMAX is a highly regulated and reputable broker that takes the security of its clients' funds seriously. It is regulated by the FCA and CYSEC, and it implements various measures to ensure the safety of its clients' funds, such as holding them in segregated accounts and offering negative balance protection. Overall, LMAX appears to be a reliable and trustworthy broker.

LMAX provides access to a range of financial instruments across various asset classes, including:

LMAX offers different account types, each with different features and benefits:

All of these accounts have different minimum deposit requirements and fee structures.

The maximum leverage offered by LMAX varies based on the account type and the asset being traded. For example, the maximum leverage for forex trading is up to 1:100, while for metals and commodities, it is up to 1:50.

It's important to note that leverage can increase both potential profits and losses, so it should be used with caution.

LMAX offers a variable spread on EUR/USD, which can start from as low as 0.2 pips during peak trading hours. However, the average spread is usually around 0.5-1 pip. It's worth noting that the spread can widen during periods of low liquidity or high market volatility.

The commission fee varies depending on the account type and the trading volume of the client. Here is a breakdown of the commission fees for LMAX:

LMAX Global: The commission for forex pairs ranges from $2.5 to $4.5 per $100,000 traded, depending on the trading volume. For indices, the commission ranges from $1.25 to $5 per lot traded, depending on the instrument and the trading volume.

LMAX Professional: The commission for forex pairs ranges from $2 to $3 per $100,000 traded, depending on the trading volume. For indices, the commission ranges from $1 to $3 per lot traded, depending on the instrument and the trading volume.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| LMAX | 0.2 pips | $2-$4.5 per lot/trade |

| IG | 0.6 pips | None |

| Saxo Bank | 0.9 pips | None |

| CMC Markets | 0.7 pips | None |

| Admiral Markets | 0.5 pips | $6 per lot/trade |

| Pepperstone | 0.16 pips | $3.76 per lot/trade |

Note that the above information may vary depending on the account type, trading platform, and other factors. It's always a good idea to check with the broker directly for the most up-to-date and accurate information.

LMAX offers its proprietary trading platform called LMAX Global, which is a web-based platform accessible from any device with an internet connection. It also offers connectivity through industry-standard APIs, allowing clients to connect directly to LMAX Global's liquidity pool through third-party platforms.

Additionally, LMAX offers the MetaTrader 4 platform for traders who prefer using a familiar interface.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| LMAX | LMAX Global, MT4 |

| IG | IG Trading, MT4 |

| Saxo Bank | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor, MT4 |

| CMC Markets | MT4, proprietary mobile trading platform |

| Admiral Markets | MT4, MT5, proprietary Supreme platform |

| Pepperstone | MT4, MT5, cTrader |

Deposits & Withdrawals

LMAX offers a variety of deposit and withdrawal methods, including:

LMAX does not charge any deposit or withdrawal fees. However, fees may be charged by the payment provider or bank involved in the transaction.

To withdraw funds from LMAX, you need to follow these steps:

Step 1: Log in to your LMAX account and go to the “My Account” section.

Step 2: Click on the “Withdraw Funds” button.

Step 3: Select the account you want to withdraw from and enter the amount you wish to withdraw.

Step 4: Choose your preferred withdrawal method and fill out the necessary information.

Step 5: Submit your withdrawal request.

LMAX processes withdrawal requests within one business day, and the time it takes for the funds to reach your account will depend on the withdrawal method you choose.

LMAX charges various fees for trading and account maintenance. Here is an overview of some of the fees charged by LMAX:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| LMAX | Free | Free | Free |

| IG | Free | Free (over $100) | $18/month after 2 years |

| Saxo Bank | Free | Free | €100/year after 2 years |

| CMC Markets | Free | Free | £10/month after 12 months |

| Admiral Markets | Free (except bank transfer) | Free (over $150) | Free |

| Pepperstone | Free (except bank transfer) | Free (over $100) | Free |

LMAX provides 24/7 customer service through phone, email, and live chat. You can also follow LMAX on some social networks such as LinkedIn, Facebook and YouTube.

Conclusion

In conclusion, LMAX is a highly-regulated broker that offers institutional-level trading services to retail clients. The broker offers a wide range of trading instruments and a powerful trading platform. LMAX's low-latency trading environment, deep liquidity pool, and transparent pricing model make it an ideal choice for traders who demand high-quality execution and a fair trading environment.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive firewoodfx and lmax-global are, we first considered common fees for standard accounts. On firewoodfx, the average spread for the EUR/USD currency pair is From 0 pips, while on lmax-global the spread is EURUSD 0.3 GBPUSD 0.8 .

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

firewoodfx is regulated by --. lmax-global is regulated by FCA,CYSEC,FCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

firewoodfx provides trading platform including ECN,Micro,Standard,Premium,Cent and trading variety including --. lmax-global provides trading platform including Professional account and trading variety including Foreign exchange, precious metals, stock indexes and commodities.