No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FIBO Group and ZFX ?

In the table below, you can compare the features of FIBO Group , ZFX side by side to determine the best fit for your needs.

--

--

EURUSD:-28.4

EURUSD:-0.8

EURUSD:13.42

XAUUSD:32.79

EURUSD: -6.23 ~ 2.32

XAUUSD: -33.47 ~ 15.94

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fibo-group, zfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | The Virgin Islands |

| Found | 1998 |

| Regulation | CYSEC & BaFin |

| Market Instrument | Forex CFDs, spot metals, cryptocurrencies |

| Account Type | MT5 NDD, cTrader NDD, MT4 NDD No Commission, MT4 NDD, MT4 Fixed, and MT4 Cent |

| Demo Account | yes |

| Maximum Leverage | 1:1000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4, MT5, cTrader |

| Minimum Deposit | $0 |

| Deposit & Withdrawal Method | Bank Wire Transfer, Bank Card or e-payment systems |

FIBO Group, a trading name of FIBO Group Holdings Limited, is an online financial dealer, established in 1998 with four offices worldwide in Shanghai, Alma-Ata, Limassol, and Munich.

FIBO Group, or International Financial Holding FIBO Group, is an international financial holding company that was established in 1998. It offers online trading services, primarily in the foreign exchange market, but also provides a platform for the trading of CFDs, commodities, and cryptocurrencies. Headquartered in Vienna, Austria, the company has a global presence with subsidiaries in the British Virgin Islands, Cyprus, Australia, Singapore, and Russia, as well as offices in several other countries. FIBO Group started as an investment consulting firm and evolved into a prominent player in the forex market, and in 2017 it expanded into cryptocurrency derivatives.

Here is the home page of this brokers official site:

FIBO Group is under the regulations of several regulation authorities, including CySEC in Crypus ( Regulatory license no. 182/11), BaFin in Germany (Regulatory license no.124031), a European Authorized Representative license from FCA (revoked) in the UK, with registration number 532885, and an offshore retail forex license from FSC in the Virgin Islands ( regulatory license number SIBA/L/14/1063).

Note: The screenshot date is January 30, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

FIBO Group presents a range of advantageous features for traders. Firstly, they offer multiple trading platforms, ensuring flexibility and choice. Competitive spreads are provided across various trading instruments, contributing to cost-efficiency. The availability of flexible leverage options allows traders to tailor their exposure according to their risk preferences. FIBO Group also caters to diverse trading needs through a variety of account types. In addition, they provide valuable trading tools, including market sentiment data, economic calendars, and trading signals, enhancing decision-making capabilities. Traders can further benefit from the educational resources offered by FIBO Group's Academy, which includes webinars and a comprehensive glossary. It's important to note that PAMM account availability may be limited on certain platforms, and customer support availability may primarily be on weekdays.

| Pros | Cons |

| Multiple Trading Platforms | Limited Availability of PAMM Accounts |

| Competitive Spreads | Limited Customer Support Availability |

| Flexible Leverage Options | |

| Diverse Account Types | |

| Additional Trading Tools | |

| Educational Resources |

FIBO Group offers mainstream and popular financial products in the global financial market for investors, including forex (60 currency pairs), precious metals (gold and silver), cryptocurrencies (Bitcoin, Ethereum, Litecoin, Zcash, Dash, Monroe), CFDs, etc.

CFD Trading:

CFD trading, which stands for Contract for Difference, allows traders to speculate on the price movements of various financial instruments, such as currencies, shares, commodities, and indices. Traders do not own the underlying asset but rather enter into a contract based on the price difference between the opening and closing of the trade.

Spot Metals:

FIBO Group provides access to spot metals trading, particularly gold and silver. Spot metals are traded based on the current market price and allow traders to take advantage of price movements in these precious metals.

Forex:

Forex, also known as foreign exchange, involves the trading of currencies. It is the largest and most liquid financial market globally, where traders aim to profit from fluctuations in currency exchange rates. FIBO Group offers a wide range of currency pairs for forex trading.

Cryptocurrencies:

FIBO Group also enables trading in cryptocurrencies, which are digital assets that utilize cryptographic technology. Traders can speculate on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and others. Cryptocurrency trading with FIBO Group is typically conducted through CFDs, allowing traders to benefit from price speculation without owning the actual digital tokens.

By offering these market instruments, FIBO Group provides traders with a diverse range of opportunities to participate in global financial markets and capitalize on price fluctuations across different asset classes.

MT4 Cent Account:

The MT4 Cent Account is designed for traders who want to start with smaller amounts. It operates on the market maker order execution technology. This account has a minimum deposit requirement of 0 cents, making it accessible to those with limited funds. The account uses the fifth decimal point, allowing for more precise pricing. The minimum lot and volume step are set at 0.01, providing flexibility in trade sizes. The spread starts from 0.6 pips, and there is no commission charged. The leverage offered is 1:1000, allowing traders to amplify their positions. The stop out level is set at 20%, meaning positions will be automatically closed if the account equity falls below this threshold. The account currency options include USD cent and GLD Cent1. CFD trading is not available in this account. Traders can access 32 currency pairs and can have a maximum of 50 open orders. The maximum order volume is set at 100 lots or 1 standard lot. Managed account (PAMM) feature is not available in this account.

MT4 Fixed Account:

The MT4 Fixed Account is suited for traders who prefer a fixed spread model. It also operates on the market maker order execution technology. The minimum deposit requirement for this account is $50. The account uses a standard four decimal point pricing system. The minimum lot and volume step are the same as the MT4 Cent Account, set at 0.01. The spread starts from 1 pip, and no commission is charged. The leverage offered is 1:200. The stop out level is set at 20%. The account currency options include EUR, USD, RUR, CHF, and GBP. CFD trading is available in this account. Traders can access 43 currency pairs, although information regarding the maximum open orders and maximum order volume is not provided. The account offers a managed account (PAMM) feature, allowing traders to invest in PAMM accounts and allocate funds to professional traders.

MT4 NDD Account:

The MT4 NDD Account operates on the No Dealing Desk (NDD) order execution technology, providing traders with direct market access. The minimum deposit requirement is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are set at 0.01, similar to the other MT4 accounts. The spread starts from 0 pips, but there is a commission of 0.003% charged based on the transaction amount. The leverage offered is 1:400, providing increased buying power. The stop out level is set at 50%, allowing for more flexibility in margin requirements. The account currency options include EUR, USD, and GLD2. CFD trading is available in this account. Traders can access 32 currency pairs, and the account offers a managed account (PAMM) feature.

cTrader NDD Account:

The cTrader NDD Account is designed for traders who prefer the cTrader platform and the benefits of No Dealing Desk (NDD) execution. The minimum deposit requirement for this account is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are the same as the other accounts, set at 0.01. The spread starts from 0.8 pips, and there is no commission charged. The leverage offered is 1:400. The stop out level is set at 50%. The account currency options include EUR, USD, GLD2, BTC3, and ETH4, providing additional flexibility. CFD trading is not available in this account. Traders can access 32 currency pairs, and the account offers a managed account (PAMM) feature.

MT5 NDD Account:

The MT5 NDD Account is designed for traders who prefer the MT5 platform and direct market access through No Dealing Desk (NDD) execution. The minimum deposit requirement for this account is $50. The account uses the fifth decimal point for precise pricing. The minimum lot and volume step are set at 0.01. The spread starts from 0 pips, and there is a commission of 0.005% charged based on the transaction amount. The leverage offered is 1:400. The stop out level is set at 50%. The account currency option is limited to USD. CFD trading is not available in this account. Traders can access 33 currency pairs, and information regarding the maximum open orders and maximum order volume is not provided. The account offers a managed account (PAMM) feature.

Demo Account: A demo account is a practice account that allows traders to simulate trading without using real money. It is useful for learning and testing trading strategies in a risk-free environment.

7. Managed Account:

The Managed Account option is available only for the MT4 Fixed and MT4 NDD account types. With a Managed Account, clients can have their trading account managed by a professional fund manager. The fund manager trades on behalf of the client, aiming to generate profits. However, the availability of Managed Accounts may be subject to certain conditions and requirements set by the broker.

It is important for clients to thoroughly understand the terms and conditions, fees, and risks associated with managed accounts before opting for this service.

FIBO Group provides leverage to traders, which is the capital offered by the broker to potentially amplify funds by using a ratio of the trader's capital to the broker's credit. While leverage presents an opportunity to increase funds, it's important for traders to understand that higher leverage also comes with higher risks. FIBO Group adheres to regulatory restrictions, offering leverage ratios of up to 1:30 for major currency pairs and 1:10 for commodities, while the MT4 Cents account offers leverage up to 1:1000 and NDD accounts offer leverage up to 1:400.

Spreads and Commissions

Forex brokers generate income through commissions and spreads. Commissions refer to the fees charged by brokers for facilitating trades, and they vary depending on the instrument and account type. FIBO Group does not charge commissions on its MT4 Cent and MT4 Fixed accounts.

On the other hand, spreads are the difference between the bid price (the price at which traders can sell) and the ask price (the price at which traders can buy). Spreads can be either variable or fixed, depending on market conditions such as interest rates. FIBO Group offers a range of spreads, with minimum spreads ranging from 0 pips to 2.0 pips, depending on the specific account type.

Additionally, some brokers impose rollover or swap fees for positions held open overnight. These fees are determined by the interest rate differential between the currency pairs involved in the open position.

For the MT4 NDD, cTrader NDD, and MT5 NDD accounts offered by FIBO Group, commissions are charged ranging from 0.003% to 0.005% of the transaction amount. It's important to note that the specific fees may vary depending on the account type and trading conditions.

Overall, understanding the fees involved in trading is essential for traders to manage their costs and make informed decisions when choosing a broker.

1. Sign up-Creating your Client Area. The first stage of registration with the company is creating your Client Area. To do this, you need to indicate your email address and phone number in the sign-up form on the site.

2. Verification of email, phone number and proof of identity. To verify your email, this broker will send you an email to the address you indicate while signing up. Click the link in the message to confirm your email address.

3. Depositing funds to your account and starting trading.

The minimum spread for MT4 Cent Accounts is 0.6 pips, with no commission. The minimum spread for MT4 Fixed Accounts is 2 pips, with no commission. The minimum spread for MT4 NDD Accounts is 0 pips, and the commission is 0.003% of the trading volume. MT4 NDD No-Commission Account has a minimum spread of 0.8 pips. cTrader NDD Accounts has a minimum spread of 0 pips, and the commission is 0.003% of the trading volume. MT5 NDD Account has a minimum spread of 0 pips, and the commission is 0.005% of the trading amount.

FIBO Group provides traders with a choice of three reliable and widely-used trading platforms. The cTrader platform offers direct trading with international banking institutions and features high-speed order execution, customizable indicators, and market depth display. The MetaTrader 4 platform is customizable and user-friendly, with a range of technical indicators, strategy tester, and one-click trading. The MetaTrader 5 platform offers multi-asset trading, advanced strategy tester, netting and hedging modes, and comprehensive analytical tools such as built-in indicators, financial news, and an economic calendar. All platforms are available on desktop, Android, and iOS devices, catering to traders' diverse needs and preferences.

cTrader Tools is a collection of features and functionalities available on the cTrader trading platform. Two notable features include:

cTrader Mirror: This feature enables social trading, allowing traders to become either strategy providers or investors. Strategy providers can share their trading strategies and allow other traders to copy their trades. Investors, on the other hand, can browse and select strategies to automatically replicate trades in their own accounts.

cAlgo: cAlgo is a platform within cTrader that allows users to create custom indicators, trading robots, and other software using the C# programming language. Traders can develop their own tools and automate their trading strategies based on their unique requirements.

PAMM Accounts:

PAMM (Percentage Allocation Management Module) Accounts are investment accounts offered by some brokers. Here are key points regarding PAMM accounts:

Manager and Investor Options: PAMM accounts allow clients to participate either as a manager or an investor. Managers are responsible for trading on behalf of investors, while investors provide the funds to be traded.

Diversification and Risk Preferences: Investors can choose from various PAMM accounts based on their risk preferences. Each account may have different trading strategies and risk levels, providing options for diversification and accommodating different investor profiles.

Performance and Risk: It's important to note that while PAMM accounts offer potential profitability, there is no guarantee of returns. Past performance of PAMM managers is not indicative of future results, and investors should carefully consider the risks involved.

Assets Management:

Assets Management is a service offered by the FIBO Group that allows clients to invest in portfolios managed by experienced asset managers. Here are some key points about this service:

Portfolio Options: FIBO Group offers various portfolios to suit different risk preferences and financial goals. Clients can choose from a range of portfolios that align with their investment objectives.

Performance-based Fees: Asset managers charge performance-based fees, meaning their compensation is tied to the performance of the portfolio. If the portfolio performs well, the manager receives a higher fee, incentivizing them to strive for positive returns.

Market Sentiment:

Market Sentiment is a feature that provides real-time trade statistics to assist traders in gauging market sentiment. Here are some details:

Real-time Trade Statistics: Market Sentiment offers traders access to real-time trade statistics. These statistics are derived from aggregated data obtained from clients' accounts, providing insights into the prevailing market sentiment.

Market Analysis:

FIBO Group's analyst team regularly provides updates on news, events, and fundamental factors that impact the financial markets. Key points about Market Analysis include:

Expert Insights: FIBO Group's analyst team shares their analysis and commentary on various financial markets, helping traders stay informed about significant market developments.

Economic Calendar:

The Economic Calendar is a customizable tool that displays important economic events, analysts' forecasts, and historical data. Here's what you should know about it:

Event Tracking: The Economic Calendar tracks significant economic events, such as interest rate decisions, GDP releases, and employment reports. It also includes forecasts and historical data for reference.

Trading Signals:

Trading Signals are available on the MT4 and MT5 trading platforms. Here's an overview of this feature:

Signal Services: Clients can search for and subscribe to signal services provided by other traders. These signals can be used to receive trade recommendations, helping traders make informed trading decisions.

The deposit method supports SWIFT ( deposit accepting EUR & USD, the commission generally 35 to 50 US dollars, and the transfer time takes 2-5 working days; the withdrawal accepting EUR, USD, BGP & CHF, and the withdrawal fee usually 35 to 50 US dollars.), UnionPay (accepting RMB, no commission, credited immediately after payment is successful), VISA/MASTERCARD (deposit accepting EUR & USD, no commission, credited immediately after payment is successful; withdrawal accepting EUR & USD, and the commission 2.5%+1.5 Euros), RegularPay (accepting EUR and USD, no commissions, through the RegularPay system processing centre to use bank cards to inject funds; withdrawal accepting EUR &USD, with a withdrawal fee of 10 dollars or other equivalent amounts), ZOTAPAY (supporting RMB, no commission for deposits, the payment is processed immediately when the invoice is paid, and the withdrawal with 2.2% commission), Neteller (supporting EUR &USD, no commission), WebMoney (deposits and withdrawals both supporting EUR &USD, a commission of 0.8% is charged, and it will be credited automatically after successful payment). The company also supports a series of cryptocurrency deposits and withdrawals.

The customer support team at FIBO Group operates from multiple office locations and is available from Monday to Friday. They offer support in up to 12 languages, which is advantageous for non-English speakers. You can easily reach the support team through online instant web chat, email, and dedicated phone lines for different regions. Additionally, the website provides a helpful FAQ section for quick answers to common queries. FIBO Group is also active on various social media platforms, providing additional channels for communication.

FIBO Group offers a comprehensive educational resource called the FIBO Group Academy, which caters to both beginner and experienced traders. This shows their commitment to providing traders with the knowledge they need to make informed decisions. The Academy brings together experienced teachers and practicing traders who aim to help participants understand the fundamental principles of financial markets and apply their knowledge effectively.

One of the educational resources provided by FIBO Group is webinars. These video courses are conducted by experienced traders who cover topics such as the basics of forex trading, terminology, and trading instruments in the forex market. The webinars can be accessed online and are available for on-demand viewing in case participants are unable to attend the live sessions.

Additionally, FIBO Group's website features a glossary that contains over 230 trading-related terms and their explanations. This searchable glossary allows traders to familiarize themselves with important trading terms that they may encounter in their trading journey.

Overall, FIBO Group's educational resources serve as valuable tools for traders to enhance their understanding of the financial markets and improve their trading skills.

FIBO Group is a well-established brokerage firm with a strong reputation in the industry. They provide access to multiple trading platforms, including cTrader, MetaTrader 4, and MetaTrader 5, offering a wide range of trading instruments such as forex, CFDs, and futures. The company offers competitive spreads, flexible leverage options, and various account types to suit different trading preferences. Traders have access to a range of tools and resources, including market analysis, economic calendars, and trading signals, which can help them make informed trading decisions. FIBO Group also offers educational resources through their Academy, including webinars and a comprehensive glossary, to enhance traders' knowledge and skills.

Overall, FIBO Group offers a comprehensive trading experience with its diverse range of platforms, competitive trading conditions, and additional trading tools. The provision of educational resources demonstrates their commitment to supporting traders in their journey.

Q1: What trading platforms does FIBO Group offer?

A1: FIBO Group offers cTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) as trading platforms.

Q2: What is the minimum deposit requirement for opening an account with FIBO Group?

A2: The minimum deposit requirement to open an account with FIBO Group is $100.

Q3: What is the maximum leverage available for trading with FIBO Group?

A3: FIBO Group offers leverage of up to 500:1, allowing traders to control larger positions with a smaller initial investment.

Q4: Does FIBO Group charge commissions on all account types?

A4: No, FIBO Group does not charge commissions on the MT4 Cent and MT4 Fixed account types. However, commissions are charged on the MT4 NDD, cTrader NDD, and MT5 NDD accounts.

Q5: What customer support options are available at FIBO Group?

A5: FIBO Group provides customer support through online live chat, email, and dedicated phone lines. Their support team operates from Monday to Friday and offers assistance in multiple languages.

| Q 1: | At FIBO Group, are there any regional restrictions for traders? |

| A 1: | Yes. The services of FIBO Group are not provided to residents of the United Kingdom, North Korea and the USA. |

| Q 2: | Can I have more than one account? |

| A 2: | Yes, you may open more than one account with FIBO Group. To open an additional account you should log in to your client area and click “Open a new trading account.” It is not necessary to submit your ID and Utility bill again (Unless the details have changed). |

| Q 3: | Can I trade with an EA (Expert Advisor or robot)? |

| A 3: | Yes, you may trade with any forex Expert Advisors you like. |

| Q 4: | What is the minimum deposit for FIBO Group? |

| A 4: | There is no minimum initial deposit requirement. |

| Q 5: | Is FIBO Group a good broker for beginners? |

| A 5: | Yes. FIBO Group is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

| Company Name | ZFX |

| Registered Country/Region | London, UK |

| Founded in | 2010 |

| Regulation | FCA, FSA (Offshore) |

| Tradable Assets | Forex, stocks, indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Max. Leverage | 1:2000 |

| Spread | From 1.3 pips (Standard account) |

| Trading Platforms | ZFX mobile app, MT4 Web Trader, MT4 for Windows, Mac and Android & ios |

| Minimum Deposit | $50 |

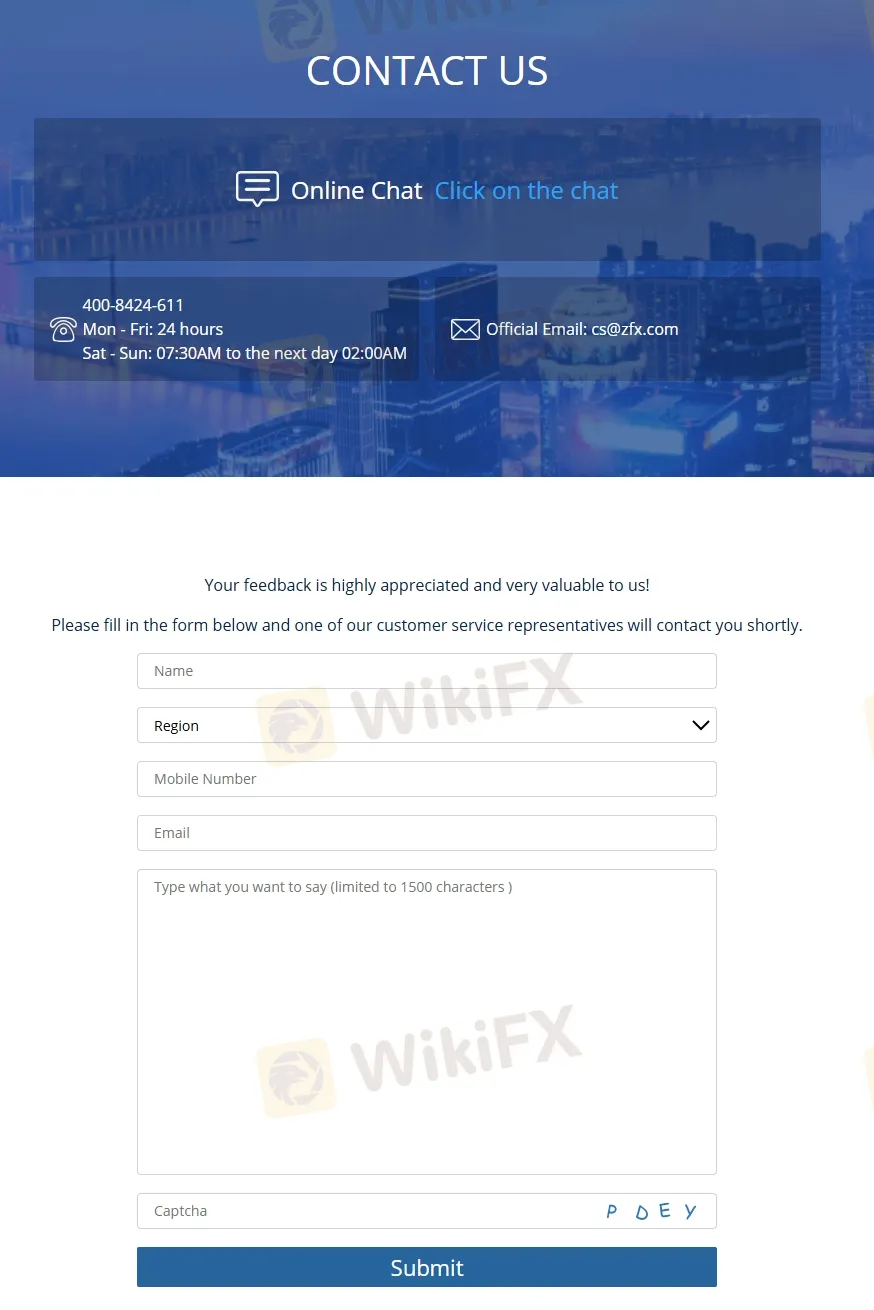

| Customer Support | Mon - Fri: 24 hours, Sat - Sun: 07:30 AM to the next day 02:00 A |

| Online chat, contact form | |

| Phone: 400-8424-611 | |

| Email: cs@zfx.com | |

| Social media: Facebook, Instagram, LinkedIn, Twitter | |

| Regional Restrictions | Residents of the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries are not allowed. |

Zeal Group of Companies, often referred to collectively as the Zeal Group, is a conglomerate of fintech corporations and regulated financial institutions that trade under the name ZFX. The group specializes in providing liquidity solutions for various types of assets in regulated markets and is backed by exclusive technology. Furthermore, the Zeal Group operates globally, combining with their multi-asset specializations and regulatory frameworks, solidifies their position as a competitive player in the financial industry.

ZFX is a broker that offers several advantages and disadvantages to traders.

| Pros | Cons |

| • Regulated by the FCA | • No MT5 platform available |

| • Multiple account types available | • No Islamic account option for Muslim traders |

| • Demo accounts available | • Lack of info on deposits and withdrawals |

| • Low minimum deposit requirement for the Mini Trading Account | • Regional restrictions |

| • Wide range of funding options | |

| • MT4 and proprietary trading platform supported | |

| • Copy trading available | |

| • Multi-channel support |

On the positive side, ZFX is a regulated broker, providing traders with demo accounts option, which is beneficial for beginner traders who want to practice their trading strategies before trading with real money. In addition, ZFX offers competitive trading conditions and low minimum deposit requirement through the popular MetaTrader4 trading platform.

On the negative side, no MT5 platform and no Islamic account option for Muslim traders. And ZFX doesn't reveal any info on deposits and withdrawals. Additionally, the broker does not provide services for residents of certain countries such as the United States of America, Brazil, Canada, Egypt, Iran, North Korea (Democratic People's Republic of Korea), and EU countries.

ZFX is a regulated broker. Its company name is Zeal Capital Market (UK) Limited, and it is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under the registration No. 768451. The FCA is one of the most reputable regulatory bodies in the world, and its strict regulations ensure that ZFX adheres to high standards of transparency and fairness.

ZFX's other entity, Zeal Capital Market (Seychelles) Limited, is authorized and offshore regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number: SD027.

Additionally, ZFX ensures the safety of its clients' funds by keeping them fully segregated in a designated client bank account. This means that the clients' funds are kept separate from ZFX's operating funds. In the event that the company faces financial difficulties or becomes insolvent, the funds in these client accounts cannot be used to meet the liabilities of the company. This measure provides an added layer of security for ZFX clients, ensuring their capital cannot be used for any other purposes aside from their trading activities.

ZFX provides a comprehensive range of market instruments, catering to diverse trading preferences and strategies. This includes major asset classes such as forex, where traders can engage in currency trading across major, minor, and exotic pairs. For those interested in the stock market, ZFX offers the ability to trade stocks from leading global companies, allowing traders to tap into corporate performance and stock market trends.

Additionally, ZFX includes indices trading, which aggregates the performance of a number of stocks representing a segment of the stock market, providing a broader market exposure. Commodities are also available, offering opportunities to trade in essential goods such as oil and gold, which are often used as hedge investments against inflation or currency devaluation.

Furthermore, ZFX has embraced the growing interest in digital currencies by including cryptocurrencies in their offerings, thus allowing traders to speculate on the highly volatile crypto markets. Overall, ZFX's diverse selection of trading instruments ensures that traders have ample opportunities to diversify their portfolios and explore various market dynamics.

Apart from demo accounts, ZFX offers three types of trading accounts, namely Mini Trading, Standard Trading, and ECN Trading accounts. Each account has its own unique features and advantages, catering to different levels of traders with varying trading styles and preferences.

| Account Type | Minimum Deposit |

| Mini | $50 |

| Standard STP | $200 |

| ECN | $1000 |

| Pros | Cons |

| • Variety of account types to choose from | • Limited features in the Mini account |

| • Low minimum deposit requirement for the Mini account | • High minimum deposit requirement for the ECN account |

| • Access to high leverage for all account types | • No Islamic account option available |

Opening an account with ZFX is a simple and straightforward process that can be completed in just a few steps.

The maximum leverage offered by ZFX is up to 1:2000 and the leverage amount may vary depending on the account type and trading instrument. Additionally, ZFX operates on a tiered margin system, where the leverage is determined based on account equity. For accounts with equity between $0 and $3,000, the maximum leverage is 1:2000. For equity between $3,001 and $10,000, the maximum leverage is 1:1000. More detailed info on leverage can be found in the screenshot below:

ZFX says it offers competitive spreads and commissions on its trading instruments.

| Account Type | Spreads | Commissions |

| Mini Trading | From 1.5 pips | N/A |

| Standard Trading | From 1.3 pips | |

| ECN Trading | From 0.2 pips |

For the Mini Trading account, the minimum spread for forex pairs is 1.5 pips. The Standard Trading account has a minimum spread of 1.3 pips for forex pairs. The ECN Trading account has a minimum spread of 0.2 pips for forex pairs. However, no specific info on commissions is revealed openly.

ZFX offers the popular trading platform MetaTrader 4 (MT4), which is widely recognized in the forex industry for its user-friendly interface and advanced trading tools. MT4 provides access to various order types, technical analysis tools, and customization options, making it suitable for both novice and experienced traders. In addition, ZFX offers mobile versions of the MT4 platform for both iOS and Android devices, enabling traders to access the markets from anywhere, at any time.

ZFX also provides a mobile application for its clients, ensuring they can trade on the go. This ZFX Mobile App offers access to all the major features of the trading platform and enables clients to manage their portfolio, place trades, and monitor the markets from their mobile device.

The mobile app can be a valuable tool for traders who need the flexibility to trade anywhere and anytime, while still having access to key functionalities of the platform. Before using the app, make sure it is downloaded from an official source like the App Store or Google Play to ensure security and authenticity.

ZFX offers a Copy Trade feature, which is great news for both beginner and busy traders. Copy trading, also known as social trading, allows traders to automatically copy the trades of experienced and successful traders. This can help beginners to learn trading strategies from experienced traders, and help busy traders to automate their trading. By using the Copy Trade feature, you can potentially increase your chances of making profitable trades.

ZFX is committed to providing an extensive educational framework to support both novice and experienced traders through their A-to-Z Academy, which offers comprehensive learning resources designed to master trading from the basics to advanced strategies. This initiative underscores ZFX's dedication to empowering its clients with the knowledge needed to navigate the financial markets confidently.

Additionally, ZFX enhances trader support with a 24/7 Help Center, serving as a constant trading support hub where traders can obtain assistance at any time.

The platform also features a detailed Glossary, which acts as a valuable dictionary for demystifying complex trading terminology, making the trading language more accessible to everyone.

Moreover, their FAQ section addresses common queries related to trading mechanics, account management, funding procedures, withdrawals, and specific product details.

Collectively, these educational resources equip ZFX traders with a solid foundation of knowledge and continuous support, facilitating a well-rounded and informed trading experience.

ZFX provides robust customer support with extensive availability and multiple communication channels to ensure that traders can receive assistance whenever needed. Operating hours extend throughout the week, with round-the-clock support from Monday to Friday and extended hours over the weekend from 07:30 AM to 02:00 AM the next day, accommodating traders across different time zones.

Traders can reach out via online chat for immediate responses, use the contact form for less urgent inquiries, or call directly through the phone number 400-8424-611 for personalized assistance. Additionally, ZFX can be contacted through email at cs@zfx.com for comprehensive support.

The broker also maintains a strong presence on several social media platforms including Facebook, Instagram, LinkedIn, and Twitter. This multi-faceted approach ensures that ZFX's clients receive timely and effective support, enhancing their trading experience.

Overall, ZFX is a reputable option for traders looking to access the financial markets. The broker's maximum trading leverage of 1:2000, based on account equity, is one of the highest in the industry and can provide traders with significant opportunities for profit. Additionally, competitive spreads and a choice of popular MT4 trading platforms further strengthen ZFX's position as a reliable broker.

| Is ZFX regulated? |

| Yes. It is regulated by FCA and FSA (Offshore). |

| At ZFX, are there any regional restrictions for traders? |

| Yes. It does not provide services for residents of certain countries such as the United States of America, Canada, Egypt, Iran and North Korea (Democratic People's Republic of Korea). |

| Does ZFX demo accounts? |

| Yes. |

| Does ZFX offer industry leading MT4 & MT5? |

| Yes. It supports MT4 and ZFX Mobile App. |

| What is the minimum deposit for ZFX? |

| $50 for the Mini Trading account, while higher for other account types. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fibo-group and zfx are, we first considered common fees for standard accounts. On fibo-group, the average spread for the EUR/USD currency pair is from 0 pips, while on zfx the spread is From 0.2.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fibo-group is regulated by FCA,CYSEC,FSC. zfx is regulated by FCA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fibo-group provides trading platform including MT5 NDD,cTrader NDD ,MT4 NDD No Commission,MT4 NDD,MT4 Fixed,MT4 Cent and trading variety including --. zfx provides trading platform including ECN,Standard STP,Mini and trading variety including --.