No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between AGEA and WeTrade ?

In the table below, you can compare the features of AGEA , WeTrade side by side to determine the best fit for your needs.

--

--

EURUSD:-0.2

EURUSD:-3

EURUSD:15.33

XAUUSD:30.25

EURUSD: -8 ~ 0.51

XAUUSD: -37.65 ~ 14.44

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of agea, wetrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Note: This company has been voluntarily dissolved.

| Aspect | Information |

| Company Name | AGEA |

| Registered Country/Area | Montenegro |

| Years | 5-10 years |

| Regulation | Unregulated |

| Market Instruments | CFD |

| Account Types | Standard and Cent |

| Minimum Deposit | USD 100 |

| Maximum Leverage | 1:100 |

| Trading Platforms | Streamster and MetaTrader 4 |

| Customer Support | Live Support, Phone: +382 (20)664-320 and +382(20)664-320, and Email: support@agea.com |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods (Sofort Banking (Germany) and iDEAL (Netherlands)) |

| Educational Resources | Latest News |

AGEA, a financial services company, has been operating in the trading industry for 5-10 years. Based in Montenegro, the company provides trading opportunities primarily through Contracts for Difference (CFDs). Despite its years in the industry, AGEA operates in an unregulated environment, meaning it may not be subject to oversight by financial regulatory authorities.

Traders can choose between two types of trading accounts: Standard and Cent. With a minimum deposit requirement of USD 100. The company offers a maximum leverage of 1:100.

AGEA provides traders with two trading platforms: Streamster and MetaTrader 4. Additionally, traders can access live support for real-time assistance with any inquiries or issues they may encounter.

In terms of funding options, AGEA supports various deposit and withdrawal methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

For educational resources, AGEA provides the latest news to keep traders informed about market developments and trends.

AGEA operates as an unregulated trading platform. Unregulated financial institutions are not bound by the rules and regulations designed to protect consumers' interests. This leaves customers vulnerable to various risks such as fraud, mismanagement of funds, and unfair treatment.

| Pros | Cons |

| Experienced Institution | Unregulated |

| Account Variety | Limited Educational Resources |

| Low Minimum Deposit | Higher Risk |

| Multiple Trading Platforms | Potential for Longer Dispute Resolution |

| Different Deposit/Withdrawal Options | Limited Market Instruments |

Pros:

Experienced Institution: With 5-10 years of industry experience, AGEA brings a solid foundation and understanding of the trading landscape.

Account Variety: AGEA offers a variety of account types, including Standard and Cent accounts.

Low Minimum Deposit: The minimum deposit requirement of USD 100 makes trading accessible to individuals with varying capital sizes.

Multiple Trading Platforms: AGEA provides traders with a choice of trading platforms, including Streamster and MetaTrader 4.

Different Deposit/Withdrawal Options: AGEA supports various deposit and withdrawal methods, including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods, providing flexibility and convenience to traders.

Cons:

Unregulated: One significant drawback of AGEA is its unregulated status, consumer protection and the security of funds may be concerning.

Limited Educational Resources: AGEA may lack comprehensive educational resources to help traders improve their skills and knowledge, potentially hindering traders' ability to make informed decisions.

Higher Risk: The unregulated nature of AGEA introduces a higher level of risk for traders, as there may be fewer safeguards in place to ensure the stability and security of the financial institution.

Potential for Longer Dispute Resolution: Resolving disputes with AGEA may be more challenging and time-consuming due to the lack of regulatory oversight, leading to delays and frustrations for traders seeking resolution.

Limited Market Instruments: While AGEA offers CFD trading across various asset classes, it may have fewer market instruments compared to some other brokers, limiting trading opportunities for certain traders.

AGEA offers Contract for Difference (CFD) instruments as part of its market offerings. CFDs are derivative financial products that allow traders to speculate on the price movements of various underlying assets, without actually owning the assets themselves.

With CFDs, traders can take positions on a wide range of financial instruments, including currencies, indices, commodities, and cryptocurrencies. This flexibility enables traders to diversify their portfolios and capitalize on market opportunities across different asset classes.

AGEA offers two distinct account types: Standard and Cent.

For the Standard account, the minimum balance requirement is set at USD 100, ensuring accessibility for traders with varying capital levels. On the other hand, the Cent account presents a lower entry point with balances ranging from USD 6 to 5,000, ideal for those starting with smaller amounts.

Both account types share identical leverage options, ranging from 1:1 to 1:100, initially set at 1:100. This flexibility allows traders to adjust their positions relative to their capital, amplifying their potential gains or losses accordingly.

Neither account type imposes commissions, providing traders with a cost-effective trading environment. Additionally, trade sizes are consistent across both accounts, ranging from 1,000 to 100,000 units, enabling traders to execute trades according to their strategies and risk preferences.

| Account Type | Standard | Cent |

| Balance Limits | Minimum USD 100 | USD 6 - 5,000 |

| Leverage | 1:1 - 1:100 (initially 1:100) | 1:1 - 1:100 (initially 1:100) |

| Commissions | None | None |

| Trade Sizes | 1,000 - 100,000 | 1,000 - 100,000 |

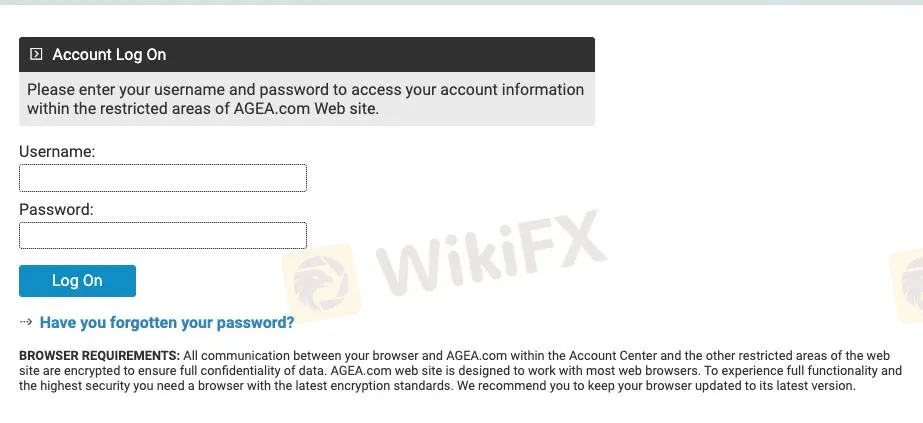

Opening an account with AGEA is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the AGEA website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: AGEA offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the AGEA trading platform and start making trades.

Withdrawal by Wire Fee - $10.00: This fee is applicable when you make a withdrawal transaction through bank wire transfer. We charge $10.00 for each withdrawal processed via wire transfer.

Withdrawal by Electronic Money Fee - $7.00: For withdrawals processed through non-wire processors, such as electronic money services, we charge a fee of $7.00 per transaction.

Inactivity Fee (SUSPENDED) - $30.00 per Month: Please note that the Inactivity Fee of $30.00 per month, which applies for each 1-month period without account activity, is currently suspended. We'll notify you in advance if there are any changes to this policy.

Streamster: Streamster is a user-friendly trading platform suitable for traders of all levels. Streamster stands out with its unique international multi-channel chat, allowing traders to discuss market trends and receive real-time customer support. It also seamlessly integrates live and virtual trading desks within a single account, ensuring consistency between demo and live trading experiences. With no balance limits or commissions, Streamster covers Crypto, Currency, Index, and Commodity CFDs, operating from Sunday 22:15 to Friday 21:00 GMT, and offers leverage ranging from 1:10 to 1:100.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is a customizable trading platform designed for proficient traders. It provides tools for price analysis, trade execution, and automated trading through Expert Advisors (EAs). MT4 offers various chart timeframes and built-in indicators for technical analysis. With its proprietary programming language, MQL4, traders can develop custom EAs tailored to their strategies. Supporting currency, index, and commodity CFDs, MT4 operates within the same trading hours as Streamster. Margin interest, execution types, and position limits vary between standard and cent accounts on MT4, providing flexibility for traders with different risk levels. Additionally, MT4 supports multiple account currencies, enhancing accessibility for global traders.

AGEA offers a range of deposit and withdrawal options including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Bank Wire Transfer: Traders can securely transfer funds to and from their AGEA accounts using bank wire transfers, providing a traditional and reliable method for depositing and withdrawing funds.

Credit/Debit Cards: AGEA accepts major credit and debit cards, offering a convenient and widely used method for instant deposits and withdrawals, facilitating seamless transactions for traders.

E-wallets: Traders can utilize various e-wallet services to deposit and withdraw funds from their AGEA accounts, providing a fast, secure, and convenient payment solution for managing their trading accounts.

Local Payment Methods (Sofort Banking and iDEAL): AGEA supports local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Customer support at AGEA is comprehensive and easily accessible, ensuring traders receive assistance whenever needed.

Live Support: Traders can engage with AGEA's support team in real-time through the Live Support feature, allowing for immediate assistance with any inquiries or issues.

Phone Support: AGEA provides phone support through two contact numbers: +382 (20)664-320 and +382(20)664-320. Traders can directly reach out to speak with a representative for personalized assistance.

Email Support: For non-urgent inquiries or detailed requests, traders can contact AGEA's support team via email at support@agea.com. This allows for thorough communication and resolution of queries.

AGEA offers valuable educational resources through its Latest News section, keeping traders informed about important developments and events. This section provides updates on various company announcements and actions, including notices to shareholders, invitations to general meetings, updates on voluntary dissolution procedures, and more.

By staying updated with the Latest News, traders can gain insights into the company's operations, corporate decisions, and regulatory compliance. This information can help traders make informed decisions and stay ahead of market trends.

Here are some examples of educational resources provided by AGEA through its Latest News section:

Notice to Shareholders on the Payment of Dividends: Traders can learn about dividend payments and their impact on the company's financial performance.

Invitation to General Meetings: Traders can stay informed about upcoming general meetings and participate in discussions regarding company matters.

Update on Voluntary Dissolution: Traders can understand the implications of voluntary dissolution procedures and how they may affect the company's future operations.

In conclusion, AGEA has its ups and downs:

On the positive side, AGEA has solid experience in trading, offering various account types and a low minimum deposit of USD 100, making it accessible to traders.

But there are drawbacks to consider. AGEA operates without regulation, which might worry some traders about the safety of their funds. Plus, their educational resources are limited, which could affect traders' success. The lack of regulation also means there's more risk involved, and resolving disputes may take longer.

Question: What documents do I need to provide to verify my account?

Answer: To verify your account, you'll need to provide a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

Question: What trading platforms does AGEA offer?

Answer: AGEA offers two main trading platforms: Streamster and MetaTrader 4 (MT4). Streamster is user-friendly and suitable for traders of all levels, while MT4 is more advanced and customizable, ideal for experienced traders.

Question: How can I deposit funds into my AGEA account?

Answer: You can deposit funds into your AGEA account using various methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking and iDEAL.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit required to open an account with AGEA is USD 100. This ensures accessibility for traders with varying capital levels.

Question: Does AGEA offer educational resources for traders?

Answer: Yes, AGEA provides educational resources to help traders improve their skills and knowledge. These resources include articles, tutorials, webinars, and market analysis tools.

Question: How can I contact AGEA's customer support?

Answer: You can contact AGEA's customer support team through live chat, phone (+382 (20)664-320), or email (support@agea.com). Our support team is available to assist you with any inquiries or issues you may have.

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

Cons:

| Pros | Cons |

| Regulated by FSA and LFSA | Limited deposit/withdrawal options |

| Wide range of instruments | Customer support limited to email and social media |

| Multiple account types, including demo | Limited company background information |

| Competitive spreads; high leverage up to 1:2000 | ECN account: $1000 minimum deposit, $7/lot commission |

| Educational resources available |

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

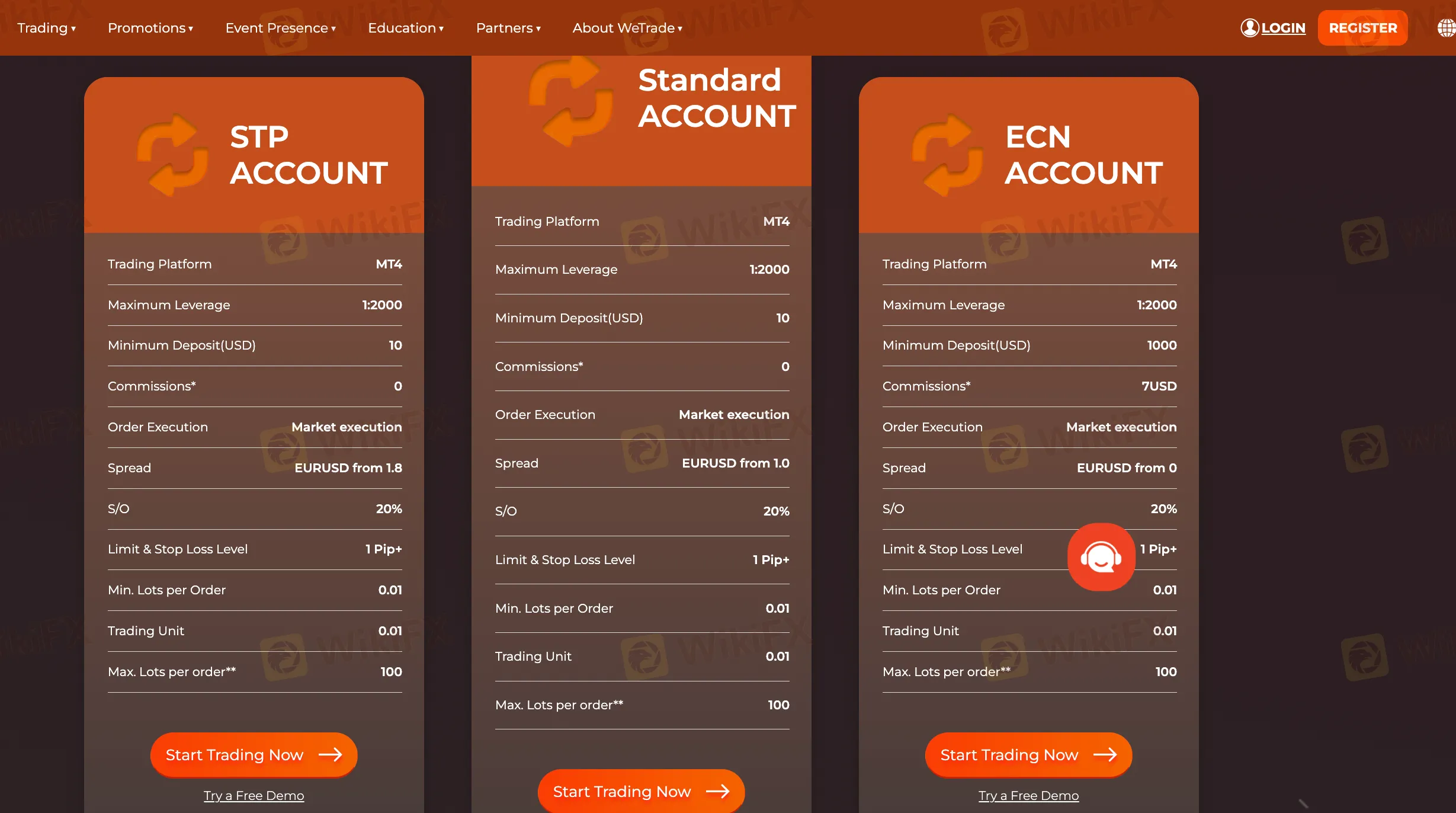

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive agea and wetrade are, we first considered common fees for standard accounts. On agea, the average spread for the EUR/USD currency pair is -- pips, while on wetrade the spread is As low as 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

agea is regulated by --. wetrade is regulated by LFSA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

agea provides trading platform including -- and trading variety including --. wetrade provides trading platform including Islamic Account,ECN ACCOUNT,Standard ACCOUNT,STP ACCOUNT and trading variety including Forex,Metals,Energies,Indices, Stocks,Cryptocurrencies.