No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between AGEA and S.A.M. Trade ?

In the table below, you can compare the features of AGEA , S.A.M. Trade side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of agea, sam-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Note: This company has been voluntarily dissolved.

| Aspect | Information |

| Company Name | AGEA |

| Registered Country/Area | Montenegro |

| Years | 5-10 years |

| Regulation | Unregulated |

| Market Instruments | CFD |

| Account Types | Standard and Cent |

| Minimum Deposit | USD 100 |

| Maximum Leverage | 1:100 |

| Trading Platforms | Streamster and MetaTrader 4 |

| Customer Support | Live Support, Phone: +382 (20)664-320 and +382(20)664-320, and Email: support@agea.com |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods (Sofort Banking (Germany) and iDEAL (Netherlands)) |

| Educational Resources | Latest News |

AGEA, a financial services company, has been operating in the trading industry for 5-10 years. Based in Montenegro, the company provides trading opportunities primarily through Contracts for Difference (CFDs). Despite its years in the industry, AGEA operates in an unregulated environment, meaning it may not be subject to oversight by financial regulatory authorities.

Traders can choose between two types of trading accounts: Standard and Cent. With a minimum deposit requirement of USD 100. The company offers a maximum leverage of 1:100.

AGEA provides traders with two trading platforms: Streamster and MetaTrader 4. Additionally, traders can access live support for real-time assistance with any inquiries or issues they may encounter.

In terms of funding options, AGEA supports various deposit and withdrawal methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

For educational resources, AGEA provides the latest news to keep traders informed about market developments and trends.

AGEA operates as an unregulated trading platform. Unregulated financial institutions are not bound by the rules and regulations designed to protect consumers' interests. This leaves customers vulnerable to various risks such as fraud, mismanagement of funds, and unfair treatment.

| Pros | Cons |

| Experienced Institution | Unregulated |

| Account Variety | Limited Educational Resources |

| Low Minimum Deposit | Higher Risk |

| Multiple Trading Platforms | Potential for Longer Dispute Resolution |

| Different Deposit/Withdrawal Options | Limited Market Instruments |

Pros:

Experienced Institution: With 5-10 years of industry experience, AGEA brings a solid foundation and understanding of the trading landscape.

Account Variety: AGEA offers a variety of account types, including Standard and Cent accounts.

Low Minimum Deposit: The minimum deposit requirement of USD 100 makes trading accessible to individuals with varying capital sizes.

Multiple Trading Platforms: AGEA provides traders with a choice of trading platforms, including Streamster and MetaTrader 4.

Different Deposit/Withdrawal Options: AGEA supports various deposit and withdrawal methods, including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods, providing flexibility and convenience to traders.

Cons:

Unregulated: One significant drawback of AGEA is its unregulated status, consumer protection and the security of funds may be concerning.

Limited Educational Resources: AGEA may lack comprehensive educational resources to help traders improve their skills and knowledge, potentially hindering traders' ability to make informed decisions.

Higher Risk: The unregulated nature of AGEA introduces a higher level of risk for traders, as there may be fewer safeguards in place to ensure the stability and security of the financial institution.

Potential for Longer Dispute Resolution: Resolving disputes with AGEA may be more challenging and time-consuming due to the lack of regulatory oversight, leading to delays and frustrations for traders seeking resolution.

Limited Market Instruments: While AGEA offers CFD trading across various asset classes, it may have fewer market instruments compared to some other brokers, limiting trading opportunities for certain traders.

AGEA offers Contract for Difference (CFD) instruments as part of its market offerings. CFDs are derivative financial products that allow traders to speculate on the price movements of various underlying assets, without actually owning the assets themselves.

With CFDs, traders can take positions on a wide range of financial instruments, including currencies, indices, commodities, and cryptocurrencies. This flexibility enables traders to diversify their portfolios and capitalize on market opportunities across different asset classes.

AGEA offers two distinct account types: Standard and Cent.

For the Standard account, the minimum balance requirement is set at USD 100, ensuring accessibility for traders with varying capital levels. On the other hand, the Cent account presents a lower entry point with balances ranging from USD 6 to 5,000, ideal for those starting with smaller amounts.

Both account types share identical leverage options, ranging from 1:1 to 1:100, initially set at 1:100. This flexibility allows traders to adjust their positions relative to their capital, amplifying their potential gains or losses accordingly.

Neither account type imposes commissions, providing traders with a cost-effective trading environment. Additionally, trade sizes are consistent across both accounts, ranging from 1,000 to 100,000 units, enabling traders to execute trades according to their strategies and risk preferences.

| Account Type | Standard | Cent |

| Balance Limits | Minimum USD 100 | USD 6 - 5,000 |

| Leverage | 1:1 - 1:100 (initially 1:100) | 1:1 - 1:100 (initially 1:100) |

| Commissions | None | None |

| Trade Sizes | 1,000 - 100,000 | 1,000 - 100,000 |

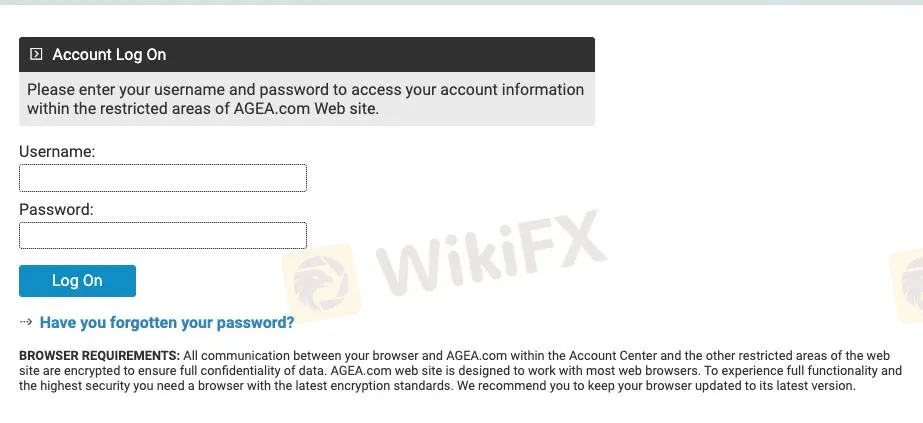

Opening an account with AGEA is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the AGEA website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: AGEA offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the AGEA trading platform and start making trades.

Withdrawal by Wire Fee - $10.00: This fee is applicable when you make a withdrawal transaction through bank wire transfer. We charge $10.00 for each withdrawal processed via wire transfer.

Withdrawal by Electronic Money Fee - $7.00: For withdrawals processed through non-wire processors, such as electronic money services, we charge a fee of $7.00 per transaction.

Inactivity Fee (SUSPENDED) - $30.00 per Month: Please note that the Inactivity Fee of $30.00 per month, which applies for each 1-month period without account activity, is currently suspended. We'll notify you in advance if there are any changes to this policy.

Streamster: Streamster is a user-friendly trading platform suitable for traders of all levels. Streamster stands out with its unique international multi-channel chat, allowing traders to discuss market trends and receive real-time customer support. It also seamlessly integrates live and virtual trading desks within a single account, ensuring consistency between demo and live trading experiences. With no balance limits or commissions, Streamster covers Crypto, Currency, Index, and Commodity CFDs, operating from Sunday 22:15 to Friday 21:00 GMT, and offers leverage ranging from 1:10 to 1:100.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is a customizable trading platform designed for proficient traders. It provides tools for price analysis, trade execution, and automated trading through Expert Advisors (EAs). MT4 offers various chart timeframes and built-in indicators for technical analysis. With its proprietary programming language, MQL4, traders can develop custom EAs tailored to their strategies. Supporting currency, index, and commodity CFDs, MT4 operates within the same trading hours as Streamster. Margin interest, execution types, and position limits vary between standard and cent accounts on MT4, providing flexibility for traders with different risk levels. Additionally, MT4 supports multiple account currencies, enhancing accessibility for global traders.

AGEA offers a range of deposit and withdrawal options including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Bank Wire Transfer: Traders can securely transfer funds to and from their AGEA accounts using bank wire transfers, providing a traditional and reliable method for depositing and withdrawing funds.

Credit/Debit Cards: AGEA accepts major credit and debit cards, offering a convenient and widely used method for instant deposits and withdrawals, facilitating seamless transactions for traders.

E-wallets: Traders can utilize various e-wallet services to deposit and withdraw funds from their AGEA accounts, providing a fast, secure, and convenient payment solution for managing their trading accounts.

Local Payment Methods (Sofort Banking and iDEAL): AGEA supports local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Customer support at AGEA is comprehensive and easily accessible, ensuring traders receive assistance whenever needed.

Live Support: Traders can engage with AGEA's support team in real-time through the Live Support feature, allowing for immediate assistance with any inquiries or issues.

Phone Support: AGEA provides phone support through two contact numbers: +382 (20)664-320 and +382(20)664-320. Traders can directly reach out to speak with a representative for personalized assistance.

Email Support: For non-urgent inquiries or detailed requests, traders can contact AGEA's support team via email at support@agea.com. This allows for thorough communication and resolution of queries.

AGEA offers valuable educational resources through its Latest News section, keeping traders informed about important developments and events. This section provides updates on various company announcements and actions, including notices to shareholders, invitations to general meetings, updates on voluntary dissolution procedures, and more.

By staying updated with the Latest News, traders can gain insights into the company's operations, corporate decisions, and regulatory compliance. This information can help traders make informed decisions and stay ahead of market trends.

Here are some examples of educational resources provided by AGEA through its Latest News section:

Notice to Shareholders on the Payment of Dividends: Traders can learn about dividend payments and their impact on the company's financial performance.

Invitation to General Meetings: Traders can stay informed about upcoming general meetings and participate in discussions regarding company matters.

Update on Voluntary Dissolution: Traders can understand the implications of voluntary dissolution procedures and how they may affect the company's future operations.

In conclusion, AGEA has its ups and downs:

On the positive side, AGEA has solid experience in trading, offering various account types and a low minimum deposit of USD 100, making it accessible to traders.

But there are drawbacks to consider. AGEA operates without regulation, which might worry some traders about the safety of their funds. Plus, their educational resources are limited, which could affect traders' success. The lack of regulation also means there's more risk involved, and resolving disputes may take longer.

Question: What documents do I need to provide to verify my account?

Answer: To verify your account, you'll need to provide a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

Question: What trading platforms does AGEA offer?

Answer: AGEA offers two main trading platforms: Streamster and MetaTrader 4 (MT4). Streamster is user-friendly and suitable for traders of all levels, while MT4 is more advanced and customizable, ideal for experienced traders.

Question: How can I deposit funds into my AGEA account?

Answer: You can deposit funds into your AGEA account using various methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking and iDEAL.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit required to open an account with AGEA is USD 100. This ensures accessibility for traders with varying capital levels.

Question: Does AGEA offer educational resources for traders?

Answer: Yes, AGEA provides educational resources to help traders improve their skills and knowledge. These resources include articles, tutorials, webinars, and market analysis tools.

Question: How can I contact AGEA's customer support?

Answer: You can contact AGEA's customer support team through live chat, phone (+382 (20)664-320), or email (support@agea.com). Our support team is available to assist you with any inquiries or issues you may have.

| S.A.M. Trade | Basic Information |

| Company Name | S.A.M. Trade |

| Founded | 2015 |

| Headquarters | Australia |

| Regulations | Unlicensed broker |

| Tradable Assets | Forex, Indices, Commodities, Futures, Cryptocurrencies |

| Account Types | Standard Account, VIP Account, ECN Account, Islamic Account |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Spreads | Varies depending on account type and instrument |

| Commission | No commission for most account types; $5 commission per round lot turn for ECN Account |

| Deposit Methods | Tether (USDT), Bank Wire Transfer, Visa/Mastercard Credit & Debit Cards |

| Trading Platforms | MetaTrader 4 (MT4), CopySam™ |

| Customer Support | Contact form, Email |

| Education Resources | Educational guides, Membership program |

| Bonus Offerings | Not specified |

S.A.M. Trade is an unlicensed broker based in Australia that offers a range of tradable assets including Forex, Indices, Commodities, Futures, and Cryptocurrencies. They provide different account types such as Standard, VIP, ECN, and Islamic accounts, with minimum deposits starting at $10. The broker offers leverage of up to 1:1000 and varying spreads depending on the account type and instrument. Traders have access to the MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. S.A.M. Trade also provides educational resources, membership programs, and accessible customer support channels.

However, it's important to note that S.A.M. Trade operates as an unlicensed broker. This raises concerns about regulatory oversight and accountability, as well as potential issues with fund safety and unfair trading practices. Traders should exercise caution when considering trading with an unlicensed broker, as there may be limited avenues for dispute resolution and challenges in recovering funds in case of disputes or financial issues.

While S.A.M. Trade offers a wide range of tradable assets, account types with varying leverage options, and access to popular trading platforms, the lack of regulatory oversight and accountability is a significant drawback. Traders should carefully evaluate the risks and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

S.A.M. Trade is an unlicensed broker, and it is risky trading with it. Caution is advised when considering trading with S.A.M. Trade, as this broker operates without a license. Trading with an unlicensed broker carries inherent risks and raises concerns regarding the safety and security of funds. Regulatory authorities play a crucial role in overseeing and regulating the operations of brokers, ensuring compliance with industry standards and protecting the interests of traders.

Choosing to trade with an unlicensed broker such as S.A.M. Trade means there is a lack of regulatory oversight and accountability. This absence of oversight can result in potential issues such as inadequate client fund protection, unfair trading practices, and limited avenues for dispute resolution. In the event of any disputes or financial issues, traders may face challenges in seeking recourse or recovering their funds.

S.A.M. Trade offers a wide range of tradable assets and provides different account types with varying leverage options and spreads. Traders have access to the popular MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. The broker also provides educational resources and a membership program. Additionally, they offer accessible customer support channels. However, it's important to note that S.A.M. Trade is an unlicensed broker, which raises concerns about regulatory oversight and accountability. There may be potential issues with fund safety and unfair trading practices. Furthermore, the limited avenues for dispute resolution can be a disadvantage for traders.

| Pros | Cons |

| Wide range of tradable assets | Unlicensed broker |

| Different account types with varying leverage options and spreads | Lack of regulatory oversight and accountability |

| Availability of MetaTrader 4 (MT4) and CopySam™ platform | Potential issues with fund safety and unfair trading practices |

| Educational resources and membership program | Limited avenues for dispute resolution |

| Accessible customer support channels |

S.A.M. Trade offers a variety of trading instruments to its clients, including Forex, Indices, Commodities, Futures, and Cryptocurrencies. Here's a breakdown of each category:

1. Forex:

S.A.M. Trade provides trading services for over 30+ currency pairs. Each currency pair is offered with a standard contract size of 100,000 units of the first-named currency. The company operates 24/5 trading, allowing traders to participate in the forex market throughout the week. It's important to note that there may be fluctuations in spreads during opening, closing, and between market sessions. These fluctuations can be attributed to routine settlements conducted by major financial institutions, which can affect prices. S.A.M. Trade offers a range of major and minor currency pairs, each with its own value per pip, contract size, minimum lot size, and typical spread.

2. Indices:

S.A.M. Trade provides investors with the opportunity to trade on derivatives of various indices. Trading indices offers a way to diversify risk compared to single stock trading. The company offers a selection of popular indices such as ASX 200, FTSE CHINA A50, Germany DAX 30, Euro Stoxx 50, Hang Seng, KOSPI 200, and more. Each index contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

3. Commodities:

S.A.M. Trade allows investors to expand their investment portfolios by trading derivatives on spot metals and energies. The company offers contracts for gold, silver, WTI crude oil, Brent crude oil, and natural gas. Each commodity contract has a specific value per contract, quote digits, contract size per lot, minimum lot size, and average spread.

4. Futures:

Trading futures enables investors to diversify their portfolios and explore various trading opportunities. S.A.M. Trade offers futures contracts for the volatility index, Hang Seng China Enterprises, India Nifty 50, KOSPI 200, Russell 2000 Mini, Dollar Index, 10-year US Bond, DAX 30, Mini-sized DJIA, and US Oil. Each futures contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

5. Cryptocurrencies:

S.A.M. Trade allows clients to trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. The company offers a range of cryptocurrency pairs, each with its own value per contract, quote digits, contract size per lot, and minimum lot size. It's important to note that leverage on cryptocurrency CFDs is capped at 1:5, and trading hours are available 24/7.

By offering these diverse trading instruments, S.A.M. Trade aims to provide its clients with a wide range of options to suit their investment preferences and strategies.

Here is a comparison table of trading instruments offered by different brokers:

| Trading Instruments | S.A.M Trade | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | No | Yes | No | No |

| Options | No | Yes | Yes | Yes |

S.A.M. Trade offers a range of account types tailored to meet the specific needs and expertise levels of traders. The account types differ based on factors such as minimum funding requirements, spreads, leverage options, commissions, and additional features.

For the Australia region, S.A.M. Trade provides the following account types:

1. Standard Account: This account offers standard spreads, leverage of up to 1:30, no commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:30, no commissions, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account offers the best available spreads, priority customer support, leverage of up to 1:30, USD 5 commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 100.

For the St Vincent and the Grenadines region, S.A.M. Trade provides the following account types:

1. Standard Account: This account type offers standard spreads, leverage of up to 1:1000, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:1000, no commissions, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account provides the best available spreads, priority customer support, leverage of up to 1:200, USD 5 commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 100.

4. Islamic Account: S.A.M. Trade also offers an Islamic account with standard spreads, swap-free trading, leverage of up to 1:500, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

Traders should note that the maximum leverage differs between the two regions, with the Australia region offering a maximum leverage of 1:30, while the St Vincent and the Grenadines region offers higher maximum leverage options, ranging from 1:1000 to 1:200 depending on the account type. It is crucial for traders to consider their risk tolerance and trading strategies when selecting the appropriate account type.

To open an account on S.A.M. Trade, follow these steps:

Visit the S.A.M. Trade website: Go to the official website of S.A.M. Trade and locate the “Open Live Account” button on the homepage. Click on it to initiate the account opening process.

2. Choose your account type: On the registration page, you will be presented with different account types to choose from, including Individual, Joint and Corporate.

3. Complete the registration process: Fill in the required information, including your personal details, contact information, and any additional information requested. Ensure that all the provided information is accurate and up to date.

4. Receive your account login details: After submitting the registration form, you will receive an automated email containing your personal account login information. Keep this information secure as it will be used to access your trading account.

5. Log in to your account: Using the provided login details, access your S.A.M. Trade account by logging in through the website's login portal. Make sure to use the correct username and password to gain access successfully.

6. Deposit funds: Once logged in, proceed to deposit funds into your trading account. S.A.M. Trade typically provides multiple payment methods, including Bank Transfers, Visa / Master and Tether (USDT). Choose the most convenient option for you and follow the instructions to deposit the desired amount.

7. Download the trading platform: To start trading, you will need to download the trading platform provided by S.A.M. Trade. Follow the instructions on the website to download and install the trading platform.

Once the trading platform is installed, you can log in using your account credentials and begin trading in the financial markets offered by S.A.M. Trade. It is recommended to familiarize yourself with the platform's features and tools before placing any trades.

S.A.M. Trade provides different leverage options based on the account types and the regions in which they operate. In the Australia region, the maximum leverage offered is 1:30 for all the account types available, including the Standard, VIP, and ECN accounts. This means that traders can access a leverage ratio of up to 1:30 for their trades.

On the other hand, in the St Vincent and the Grenadines region, S.A.M. Trade offers higher maximum leverage options. The Standard and VIP accounts in this region allow traders to utilize leverage of up to 1:1000, providing greater potential for amplifying trading positions. The ECN account, however, offers a maximum leverage of 1:200.

It's important for traders to understand that leverage magnifies both potential profits and losses. Higher leverage can increase potential gains but also increases the risk of significant losses. Therefore, it is crucial for traders to carefully assess their risk tolerance, trading strategies, and market conditions when deciding on the appropriate leverage level.

Here is a comparison table of maximum leverage offered by different brokers:

| S.A.M Trade | IG Group | Just2Trade | Forex.com | |

| Maximum Leverage | 1:1000 | 1:30 | 1:20 | 1:200 |

S.A.M. Trade offers a variety of account types with different spreads and commissions to suit the needs of different traders. For most account types, including the standard ones, there are no commissions charged for investing. This means that traders can execute trades without incurring additional fees beyond the spreads.

While S.A.M. Trade does not provide specific spreads for each account or instrument, they do offer average prices for certain popular trading pairs and assets. For example, the EUR/USD currency pair typically has a spread ranging from 1.7 to 2 pips, indicating the difference between the buying and selling prices. The GBP/USD pair, on the other hand, has an average spread of 2.4 to 2.6 pips. Commodity trades like Crude Oil and Natural Gas have an average spread of 5.0 cents.

For traders looking for the tightest spreads, S.A.M. Trade offers an ECN account type. With this account, traders can access the market through an STP/ECN model, which provides direct access to liquidity providers. However, there is a $5 commission per round lot turn for trades executed through the ECN account. This commission covers the cost of accessing the competitive spreads and liquidity offered by the ECN model.

In summary, S.A.M. Trade offers commission-free investing for most account types, allowing traders to trade without additional fees beyond the spreads. While specific spreads are not provided for all instruments, average prices are available for popular trading pairs and commodities. Traders seeking the tightest spreads can opt for the ECN account, but should be aware of the $5 commission per round lot turn.

S.A.M. Trade imposes swap charges for positions held overnight. They offer a profit-sharing plan called CopySam™, where users may share a portion of the profits generated from copied trades. Opening a live trading account with S.A.M. Trade is free, and there are no account management fees.

S.A.M. Trade offers different trading platforms for traders in Australia and St Vincent and the Grenadines.

In Australia, S.A.M. Trade provides the popular MetaTrader 4 (MT4) trading platform. MT4 is widely recognized as a leading trading platform in the world. Traders can download MT4 for free and enjoy its user-friendly interface, extensive tools, and indicators. It supports various financial instruments such as forex, commodities, indices, and cryptocurrencies, providing a seamless trading experience.

For traders in St Vincent and the Grenadines, S.A.M. Trade introduces CopySam™, an innovative trade copying technology. CopySam™ allows traders to follow and trade like expert traders by automatically copying their trades with precision. It offers beginners the opportunity to replicate winning traders' trades and experienced traders the convenience of minimal time involvement while diversifying their portfolios. CopySam™ has received the Collective Investment Platform Certification, ensuring transparency and fair trading practices.

By offering both MT4 and CopySam™, S.A.M Trade caters to the needs of different types of traders. MT4 provides a robust and versatile trading platform for those who prefer to analyze the markets and execute their own trades, while CopySam™ offers a convenient way to follow and copy the trades of successful traders, making it suitable for traders who prefer a more hands-off approach to trading.

S.A.M. Trade offers customer service support through different channels, including a contact form on their website and dedicated email addresses for media/partnership inquiries and general support. Traders can fill out the contact form with their details to receive a prompt response. Media and partnership inquiries can be sent to marketing@samtradefx.com, while general support inquiries can be directed to support@samtradefx.com. Additionally, customers can follow S.A.M. Trade on Facebook and YouTube for updates. While phone support may not be mentioned, the broker is committed to providing accessible customer service through these available channels.

S.A.M. Trade recognizes the importance of education and provides a range of resources to help clients gain knowledge and skills in forex and commodity trading. They offer educational guides and articles that cover various topics such as forex trading basics, CFDs and commodities, leverage and margin, and important concepts like Overnight Funding and Margin Call Policy. These resources aim to equip traders with the necessary understanding to navigate the trading world effectively.

In addition to educational materials, S.A.M. Trade offers an exclusive membership program that provides valuable guidance and market analysis. Led by expert trainers, registered clients gain access to the latest market news, fundamental research, and a results-driven approach to trading. The membership program includes eight sessions held every Friday evening for eight weeks, as well as a Bootcamp consisting of 10 sessions spread over three weekends. While there is a one-time membership fee of $10,000 associated with this program, clients can benefit from the expertise and insights shared during these sessions to enhance their trading strategies.

S.A.M. Trade offers trading tools to enhance the trading experience and ensure the security of funds. One of these tools is SamTracks™, a Portfolio Monitoring System that helps traders track their account and trading performance. It provides an overview of the account, allows performance tracking, monitors asset allocation, and displays traded volume.

S.A.M. Trade also prioritizes fund security through their Six Pillars of Secured Fund Coverage, known as SamAide™. These pillars include measures such as segregating clients' funds, professional indemnity insurance, third-party insurance protection, membership in the Financial Commission, and Negative Balance Protection. They also provide real-time deposit and withdrawal notifications to keep clients informed about their account activity.

S.A.M. Trade provides promotional offers to its clients, including the SamRewards™ program. This program rewards retail investors based on their trading volumes. By meeting certain criteria such as making a first deposit of $500, trading 1 standard FX lot, or referring new clients, investors can earn 'points'. These points can then be exchanged for luxury prizes, including electronics.

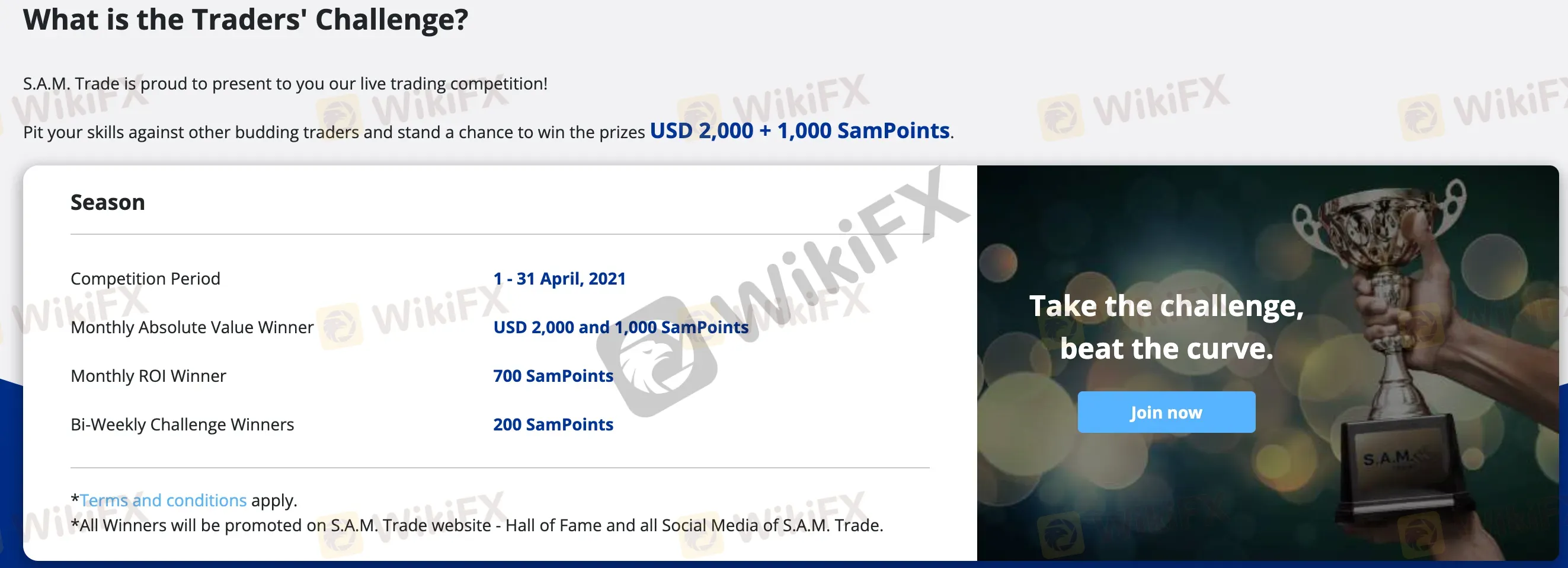

In addition, S.A.M. Trade occasionally organizes a 'Traders' Challenge'. This challenge allows clients to compete based on their performance during a specific month. Participants have the opportunity to win up to $2000 and earn 1,000 SamPoints, providing an added incentive for traders to excel in their trading activities.

At S.A.M. Trade, there are several deposit methods available for clients. These include Tether (USDT), which typically takes up to one working day to process, Bank Wire Transfer, which takes one to four working days, and Visa & Mastercard Credit & Debit Cards, which are processed within one hour during weekdays. While most S.A.M. Trade live accounts have a minimum deposit of $10, the accepted payment methods require a minimum deposit of $20 or its equivalent currency (or USDT 50). The broker itself does not charge any fees for deposits, but investors may be responsible for any third-party charges.

When it comes to withdrawals, S.A.M. Trade accepts withdrawals through the same deposit methods. A minimum withdrawal amount of $20 or USDT 50 applies. Withdrawal processing times typically range from one to four working days for bank transfers and credit/debit cards. However, all withdrawals are processed by the broker within 72 hours. Tether payments, on the other hand, can be processed in one working day. Just like with deposits, S.A.M. Trade does not charge any withdrawal fees, but investors may need to bear any applicable third-party charges.

In conclusion, S.A.M. Trade is an unlicensed broker based in Australia that offers a variety of tradable assets and account types with attractive features such as low minimum deposits, high leverage, and access to popular trading platforms. However, the lack of regulatory oversight and accountability is a significant disadvantage. Trading with an unlicensed broker raises concerns about fund safety, unfair trading practices, and limited avenues for dispute resolution. Traders should carefully evaluate the risks involved and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

Q: Is S.A.M. Trade a regulated broker?

A: No, S.A.M. Trade currently operates without valid regulation.

Q: What trading instruments are available on S.A.M. Trade?

A: S.A.M. Trade offers Forex, Indices, Commodities, Futures, and Cryptocurrencies as trading instruments. Each category has a variety of assets available for trading.

Q: What leverage options does S.A.M. Trade offer?

A: S.A.M. Trade offers leverage options of up to 1:1000 for Standard and VIP accounts, up to 1:200 for ECN accounts, and up to 1:500 for Islamic accounts.

Q: What trading platforms are available at S.A.M. Trade?

A: S.A.M. Trade offers MetaTrader 4 (MT4) and their proprietary copy trading platform, CopySam™.

Q: What are the deposit and withdrawal methods offered by S.A.M. Trade?

A: S.A.M. Trade accepts deposits through Tether (USDT), Bank Wire Transfer, and Visa/Mastercard Credit & Debit Cards. Withdrawals can be made using the same methods.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive agea and sam-trade are, we first considered common fees for standard accounts. On agea, the average spread for the EUR/USD currency pair is -- pips, while on sam-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

agea is regulated by --. sam-trade is regulated by ASIC,FCA,ASIC,VFSC,FCA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

agea provides trading platform including -- and trading variety including --. sam-trade provides trading platform including ECN,Islamic,Standard,VIP and trading variety including --.