No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ActivTrades and GKFX Prime ?

In the table below, you can compare the features of ActivTrades , GKFX Prime side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of activtrades, gkfx-prime lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

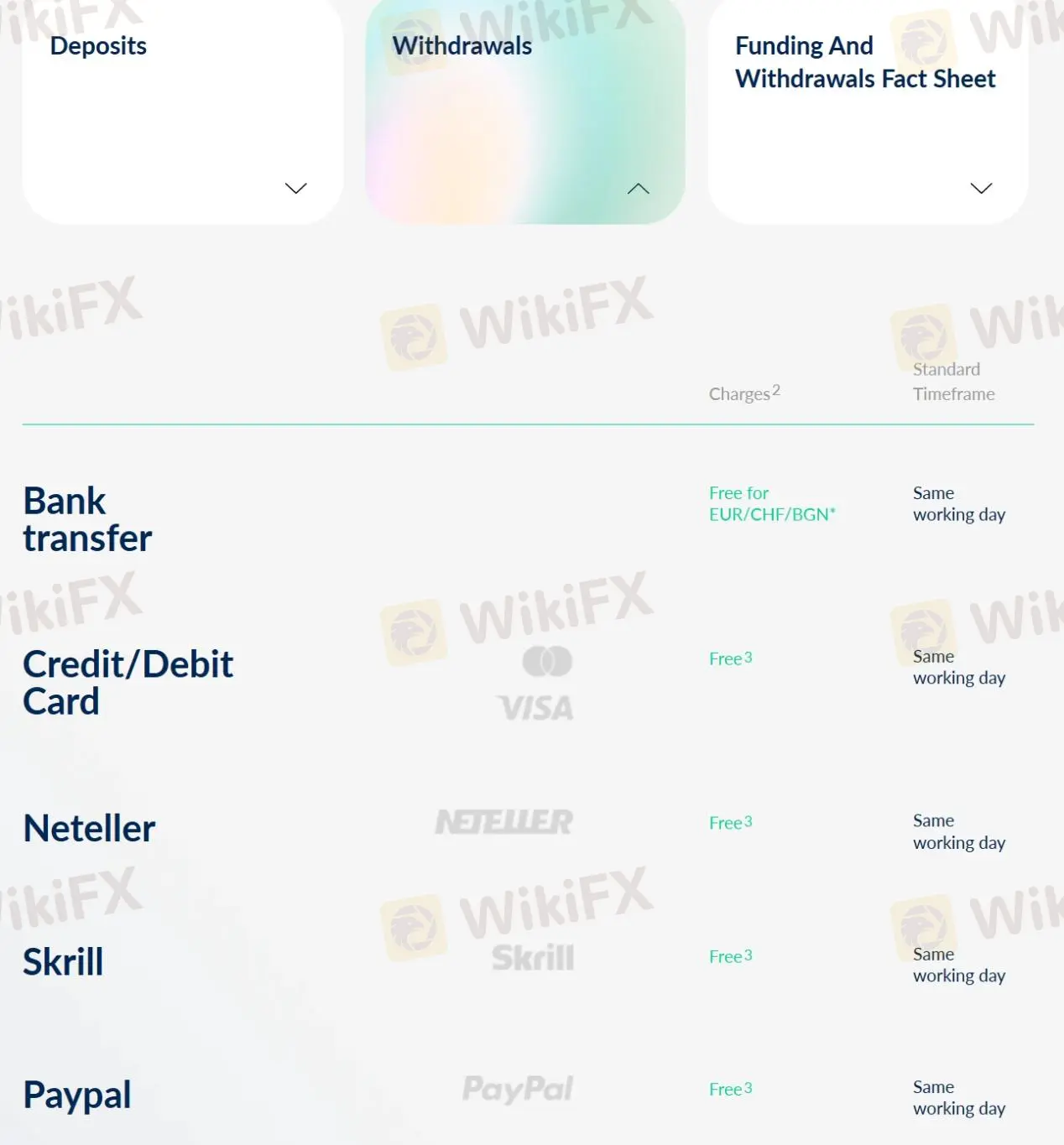

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

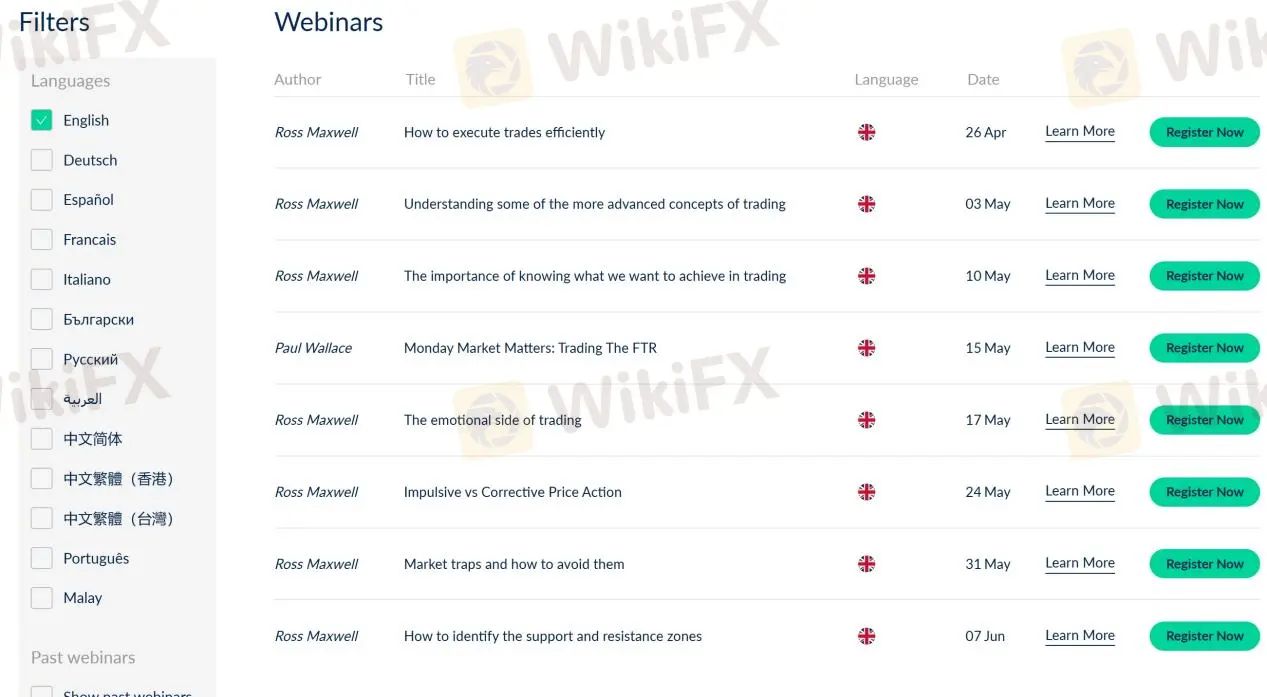

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| GKFX Prime Review Summary in 10 Points | |

| Founded | 2012 |

| Headquarters | UK |

| Regulation | FSC |

| Market Instruments | Forex, Commodities, Indices, Stocks, Cryptocurrency |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | 1.8 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $0 |

| Customer Support | 24/5 Live chat, phone, email |

GKFX Prime is an online forex and CFD broker that was established in 2012. The broker is based in the United Kingdom. GKFX Prime provides traders with a range of trading instruments, including forex, indices, commodities, and cryptocurrencies. They offer various account types and trading platforms, including the popular MetaTrader4 and MetaTrader5 platforms. GKFX Prime also provides educational resources and customer support in multiple languages.

GKFX Prime is a Straight Through Processing (STP) broker that offers clients direct access to interbank markets without the need for a dealing desk or human intervention. This means that trades are executed instantly and efficiently without any conflict of interest between the broker and the client.

GKFX Prime's main advantages are their competitive trading conditions, including tight spreads and low commissions, as well as their extensive range of trading instruments and educational resources.

However, their lack of regulatory oversight in major jurisdictions and too many complaints from users may be a concern for some traders.

Ultimately, it's important for traders to weigh these factors against their own priorities and preferences when choosing a broker.

| Pros | Cons |

| • Multiple account types and platforms | • No legitimate regulatory licenses |

| • Tight spreads and low commissions | • No US clients allowed |

| • No deposit or withdrawal fees | • Too many complaints |

| • extensive range of trading instruments and educational resources |

Some alternative brokers to GKFX Prime include:

IC Markets: An Australian-based broker that offers ECN trading with tight spreads and low commissions. They also have a wide range of trading instruments and multiple trading platforms.

Admiral Markets: A European-based broker with a strong focus on education and research. They offer a variety of account types and trading platforms, as well as a wide range of trading instruments.

FxPro: A UK-based broker with over 15 years of experience in the industry. They offer a range of trading platforms and account types, including ECN trading with tight spreads.

Pepperstone: An Australian-based broker that offers low spreads, fast execution, and a variety of trading platforms. They also offer a range of educational resources for traders.

XM: A global broker that offers a wide range of trading instruments and multiple account types. They also offer a demo account for traders to practice trading strategies without risking real money.

It is important to thoroughly research and compare different brokers before choosing one that suits your trading needs and preferences.

As GKFX Prime is an unregulated broker, its reliability may be a concern for some traders. While the company has been operating for several years, the lack of regulatory oversight may make it less attractive to traders who prioritize safety and security. The worse is that there are too many complaints from their users.

Also, it's important to note that being unregulated doesn't necessarily mean that a broker is unreliable. However, it does mean that there is no external oversight of the broker's activities and no protection for clients in the event of financial difficulty or fraud. Clients should exercise caution when dealing with unregulated brokers and conduct thorough research before opening an account.

GKFX Prime offers 400+ financial instruments to trade, including forex, commodities, indices, stocks, and cryptocurrencies.

Forex: over 50 currency pairs, including major, minor, and exotic pairs.

Commodities: including gold, silver, oil, and natural gas.

Indices: over 20 global indices, including popular indices like the S&P 500, FTSE 100, and DAX 30.

Stocks: over 300 stocks from companies listed on exchanges in the US, UK, Germany, and France.

Cryptocurrency: including Bitcoin, Ethereum, and Litecoin.

Apart from free demo accounts, there is a large variety of live trading accounts available at GKFX Prime, and each one is tailored to the specific requirements of the clients.

A trader's risk appetite, the quantity of their initial investment, and the amount of free time they have daily to devote to trading the Forex market are all important considerations when deciding which account type will best suit their needs.

The account types include the following: Standard Fixed, Standard Variable, VIP Variable and ECN Zero. Additionally, Islamic accounts are available for clients who follow Sharia laws. There is no minimum deposit requirement for Standard Fixed, Standard Variable and ECN Zero accounts, while $5,000 for VIP Variable accounts.

To open a new forex trading account with GKFX Prime, you must first pass a simple “know your customer” test. Because of this, GKFX Prime can verify your identity, your account information, and the security of your cash.

Login information for the trading platform that is best suited to the type of account you opened will typically be emailed to you after the initial registration.

Step 1 – Register an account

Open your Live Trading Account.

Step 2 – Fill out the 5-page form

Supply personal detail, financial information, trade knowledge and experience, etc.

The maximum leverage offered by GKFX Prime is 1:400. However, the leverage available to you may vary depending on your location and the regulatory restrictions in place.

Different account types have different trading conditions. Specifically, Standard Fixed accounts have spread from 1.8 pips and no commissions; Standard Variable accounts have spread from 1.2 pips and no commissions; VIP Variable accounts have spread from 0.6 pips and no commissions; ECN Zero accounts have spread as low as 0.0 pips but have to pay a commission of 10/lot.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| GKFX Prime | 1.8 pips | No (except for ECN Zero account) |

| IC Markets | 0.1 pips | $7 per standard lot |

| Admiral Markets | 0.5 pips | No (except for Zero.MT4) |

| FxPro | 1.4 pips | No |

| Pepperstone | 0.16 pips | No (except for Razor account) |

| XM | 0.8 pips | No |

Note: The above information is subject to change and may vary based on account types and market conditions.

GKFX Prime offers the MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms, which are popular and widely used platforms among traders. They provide access to a range of tools and features, including advanced charting, technical analysis tools, automated trading capabilities, and the ability to customize and use third-party indicators and trading algorithms.

They are both available for desktop, web, and mobile devices, making it convenient for traders to access their accounts and trade from anywhere at any time. Additionally, GKFX Prime offers a VPS (Virtual Private Server) service to clients who require faster and more reliable connection to the MT4 and MT5 platforms.

Overall, GKFX Prime's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| GKFX Prime | MT4, MT5 |

| IC Markets | MT4, MT5, cTrader |

| Admiral Markets | MT4, MT5 |

| FxPro | MT4, MT5, cTrader |

| Pepperstone | MT4, MT5, cTrader |

| XM | MT4, MT5, WebTrader |

While there is no minimum deposit requirement with GKFX Prime, we advise putting up at least five dollars so that you have more flexibility and a higher chance of building positions large enough to make a difference in the markets. The company offers quick deposit and withdrawal alternatives to GKFX Prime traders so that regular traders can have more faith in the platform and gain more market access.

Credit cards (Visa, MasterCard and Maestro), bank transfers and e-wallets such as Neteller and Skrill are all acceptable methods of payment, so long as the buyer has provided the necessary “know your customer” papers to comply with AML regulations. The most common of them is a photocopy of your passport and some form of the recent bill showing your current address.

Credit cards and bank transfers are both acceptable withdrawal methods. Transfers made with a credit card take three to five business days to process, while wire transfers can take anywhere from one to five days. Withdrawal is free of charge.

Please note that some deposit and withdrawal methods may not be available in certain regions/countries, and fees and processing times may vary depending on the chosen method.

| GKFX Prime | Most other | |

| Minimum Deposit | 0 | $100 |

To withdraw funds, clients need to log in to their account, go to the “Withdrawal” section, select the preferred withdrawal method, and follow the instructions provided. It's worth noting that GKFX Prime may require additional documentation for verification purposes before processing the withdrawal request.

GKFX Prime claims to offer a 100% welcome bonus and a 50% re-deposit bonus. In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task.

Apart from commission fees on the ECN Zero account, there are no other fees charged.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| GKFX Prime | Free | Free | No |

| IC Markets | Free | $0-$20 depending on method | AUD$10 per month after 6 months of inactivity |

| Admiral Markets | Free | Free | €10 per month after 24 months of inactivity |

| FxPro | Free | Free | $5 per month after 12 months of inactivity |

| Pepperstone | Free | Free | AUD$15 per month after 12 months of inactivity |

| XM | Free (may vary depending on method and country) | Free (may vary depending on method and country) | $5 per month after 90 days of inactivity |

Please note that these fees are subject to change and may vary depending on the country of residence and the payment method used.

GKFX Prime offers customer support in multiple languages through various channels including live chat, phone, and email. Their customer support is available 24/5, which means that traders can get assistance during the trading week. Additionally, GKFX Prime provides support through social media platforms such as Facebook, Twitter, LinkedIn, Instagram and YouTube.

The broker also provides an FAQ section and educational resources on its website to assist traders. Overall, GKFX Prime has a good reputation for customer support.

| Pros | Cons |

| • Multiple channels for customer support including email, phone, and live chat | • No 24/7 customer support available |

| • Dedicated account manager for VIP clients | |

| • Multilingual customer support | |

| • Quick response time to customer inquiries | |

| • Availability of customer support during market hours |

Note: These pros and cons are subjective and may vary depending on the individual's experience with GKFX Prime's customer service.

Those interested in opening an account with GKFX Prime should familiarize themselves thoroughly with the ins and outs of forex and commodity trading before placing any trades. If a trader needs more information than is available on the GKFX Prime website, they should look elsewhere.

GKFX Prime offers a range of educational resources for traders of all levels, including video tutorials, articles, ebooks, webinars, seminars.

Webinars: GKFX Prime provides free webinars to its clients, covering various trading topics, such as market analysis, risk management, and trading strategies.

Video tutorials: The broker offers a collection of video tutorials covering a range of trading topics, including technical analysis, trading psychology, and risk management.

Based on the information provided, GKFX Prime is an unregulated broker with a wide range of trading instruments and account types. While their trading conditions are relatively competitive, the lack of regulation raises concerns about the safety of client funds. Their customer support and educational resources are adequate but not exceptional. Overall, traders should approach GKFX Prime with caution and consider alternative brokers that are regulated and offer more comprehensive services.

| Q 1: | Is GKFX Prime regulated? |

| A 1: | Yes. It is regulated by FSC. |

| Q 2: | At GKFX Prime, are there any regional restrictions for traders? |

| A 2: | Yes. GKFX Prime does not provide services for the residents of certain countries, such as the United States of America, Canada, Japan, Indonesia, Turkey, Israel and the Islamic Republic of Iran. |

| Q 3: | Does GKFX Prime offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does GKFX Prime offer the industry-standard MT4 & MT5? |

| A 4: | Yes. Both MT4 and MT5 are available. |

| Q 5: | What is the minimum deposit for GKFX Prime? |

| A 5: | There is no minimum initial deposit requirement. |

| Q 6: | Is GKFX Prime a good broker for beginners? |

| A 6: | Yes. GKFX Prime is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive activtrades and gkfx-prime are, we first considered common fees for standard accounts. On activtrades, the average spread for the EUR/USD currency pair is -- pips, while on gkfx-prime the spread is as low as 0.0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

activtrades is regulated by FCA,SCB,DFSA. gkfx-prime is regulated by MFSA,BaFin,FSC,CNMV,CNB,CNMV,SERC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

activtrades provides trading platform including -- and trading variety including --. gkfx-prime provides trading platform including ECN 0,STANDARD,VIP and trading variety including Forex, Metals, Indices, Energies etc..