No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ActivTrades and Gaitame.Com ?

In the table below, you can compare the features of ActivTrades , Gaitame.Com side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of activtrades, gaitame-com lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

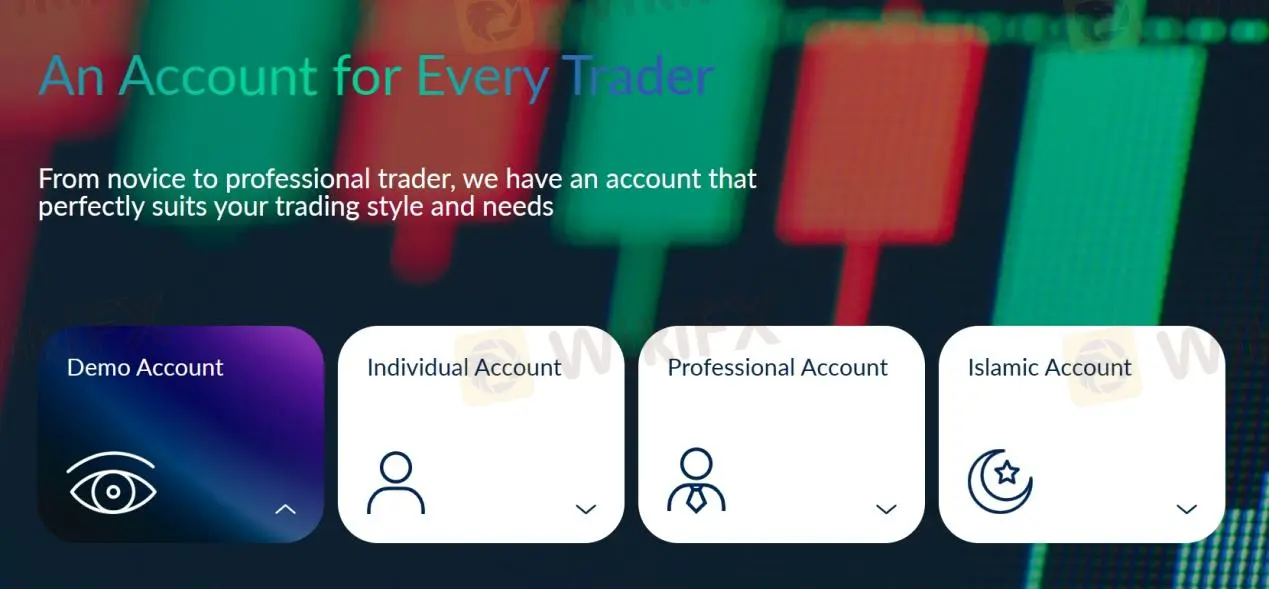

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

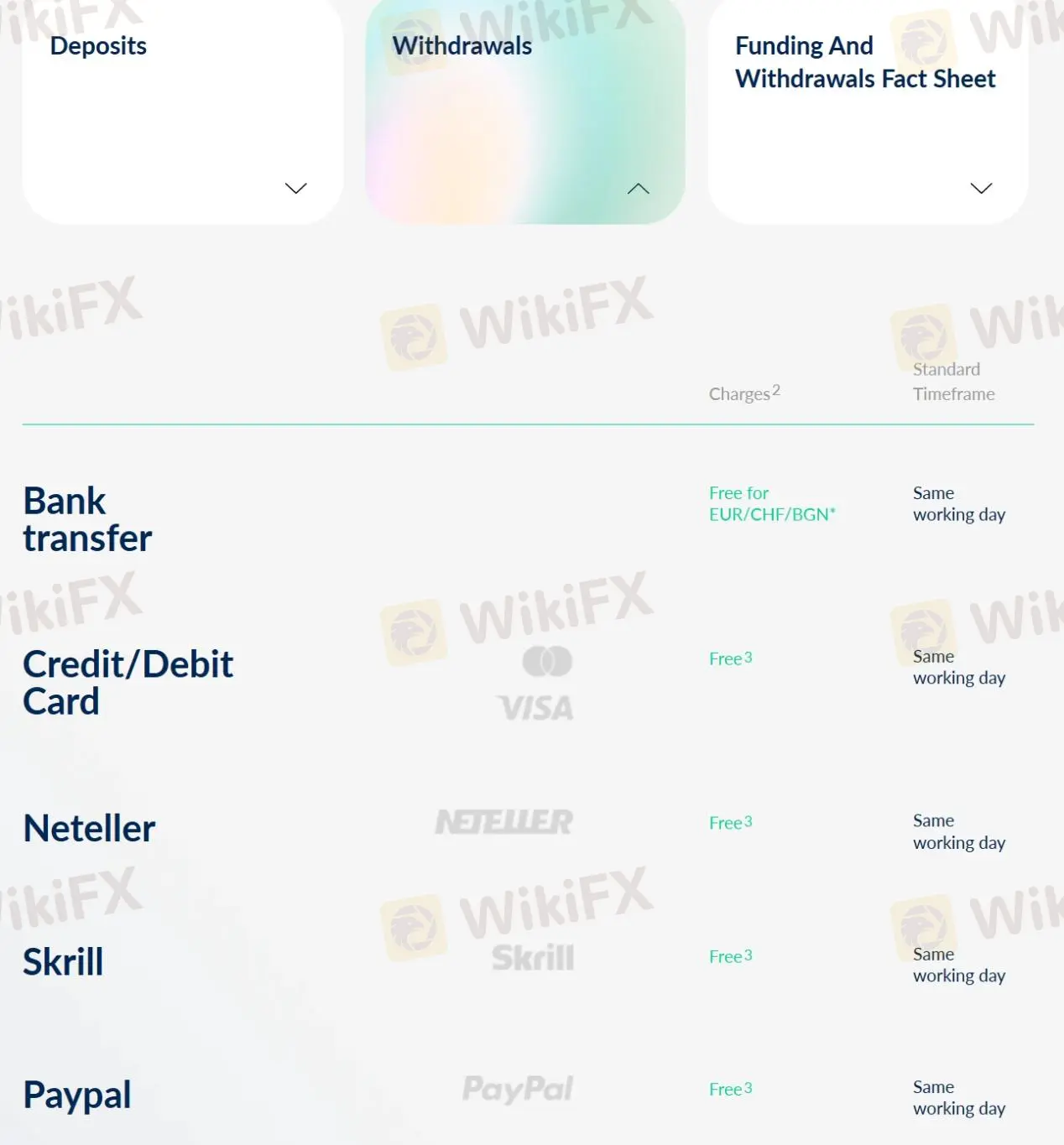

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

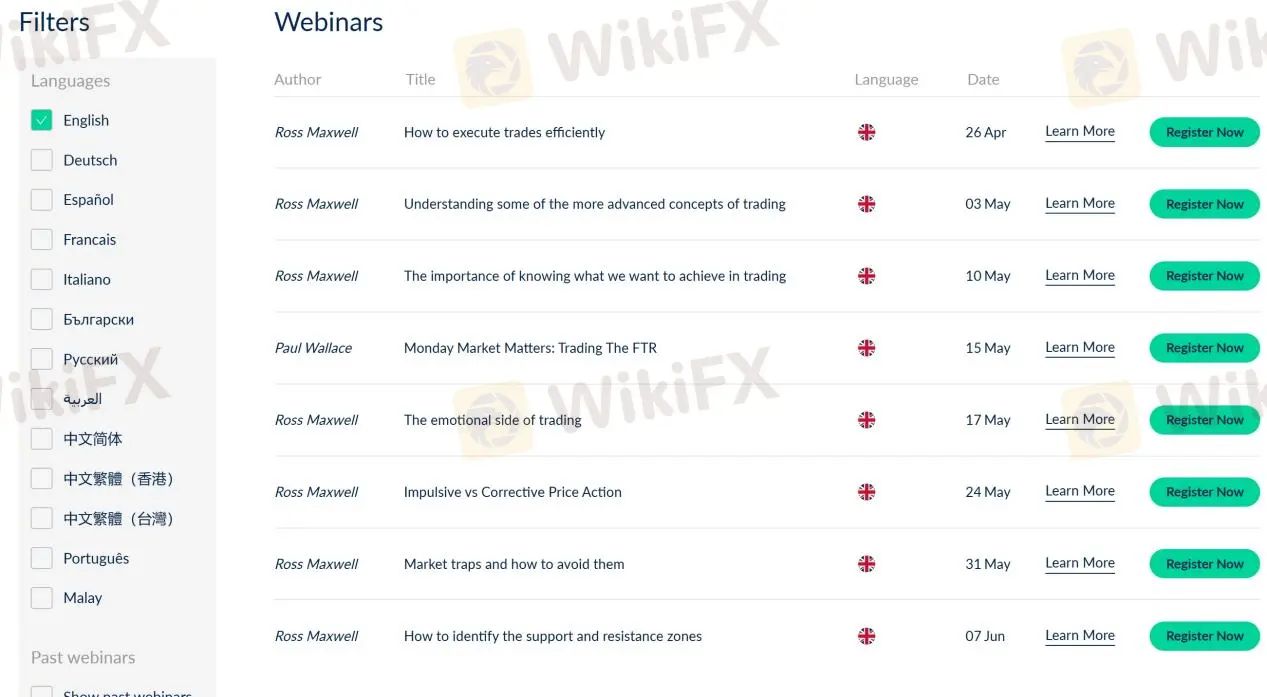

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Company Information | Details |

| Year Founded | 2002 |

| Head Office | Tokyo, Japan |

| Financial Regulatory Bodies | Financial Futures Association of Japan |

| Managed Accounts | No |

| Institutional Accounts | No |

| Islamic Account | No |

| Minimum Deposit | None |

| Demo Trading Account available | Yes |

| Countries not accepted for trade | All countries accepted |

| Withdrawal options | Bank Wire, Credit/Debit Card |

| Deposit options | Bank Wire, Credit/Debit Card |

| Platform(s) provided | NextNeo |

| OS compatibility | Mac, Microsoft Windows, Mobile, Web, iPhone |

| Tradable assets | Forex |

| Languages supported on the website | English, Japanese |

| Customer support languages | English, Japanese |

| Customer service hours | 8 hours, five days a week |

| Maximum Leverage | 1:100 |

| Overall Rating | 4.6/5 |

| Recommended FX Brokers Rank | #416 |

| Safety and Regulation | Regulated by FFAJ, Financial Supervision Authority |

| Trading Fees | Low |

| Account Activation Time | 24 Hours |

| Cryptocurrency Trading | Yes |

| Total Pairs | 18 |

| Visit Broker | Gaitame.com |

| Minimum Deposit | USD 1 |

GAITAME is an online forex broker based in Japan. Founded in 2002, the company provides a range of trading services and tools to investors. It is regulated by the Financial Futures Association of Japan, ensuring a safe and secure trading environment. GAITAME offers a proprietary trading platform called NextNeo, which is available for desktop, mobile, and web. The broker supports trading in forex with a maximum leverage of 1:100. It offers demo accounts for practice trading and has low trading fees. GAITAME accepts clients from all countries and provides customer support in English and Japanese. Withdrawals and deposits can be made through bank wire and credit/debit card options. Overall, GAITAME has a good reputation and is a popular choice among traders in Japan.

GAITAME is currently regulated by the Financial Futures Association of Japan (FFAJ). The FFAJ is a recognized regulatory body that oversees financial institutions in Japan. Being regulated by the FFAJ means that GAITAME operates in accordance with the regulatory guidelines and standards set by the association. The broker is subject to regular audits and inspections to ensure compliance with these regulations. Client funds are held in segregated accounts with reputable banks, ensuring that they are kept separate from the broker's operational funds. This regulatory oversight provides traders with a level of confidence in the safety and security of their funds while trading with GAITAME.

GAITAME offers a variety of market instruments for trading, with a focus on forex. Forex, also known as currency or FX trading, involves the exchange of currencies in the global market. GAITAME allows traders to trade in 30 currency pairs, which include major, minor, and exotic pairs. This provides traders with ample opportunities to participate in the foreign exchange market and take advantage of currency price fluctuations.

While GAITAME primarily focuses on forex, it does not offer a wide range of other market instruments such as commodities, indices, or precious metals. Traders who are specifically looking to trade in these instruments may find the options limited with GAITAME.

Here's a detailed table summarizing the available market instruments on GAITAME:

| Market Instruments | Available |

| Forex | Yes |

| Commodities | No |

| Indices | No |

| Precious Metals | No |

| Energy | No |

Please note that GAITAME's primary offering is forex trading, and traders should consider their specific trading preferences and requirements when choosing a broker.

GAITAME offers three tiered trading account options to cater to the diverse needs of traders. The account types available are Individual Account, Corporate Account, and Demo Account.

Individual Account: This account type is designed for individual traders who wish to engage in forex trading. It provides access to all the features and functionalities offered by GAITAME, allowing individual traders to trade in the forex market with ease. The Individual Account is suitable for both beginners and experienced traders.

Corporate Account: The Corporate Account is specifically tailored for corporate entities that want to participate in forex trading. It allows businesses to manage their forex trading activities and access the various tools and resources provided by GAITAME. This account type offers features that are relevant to corporate trading needs.

Demo Account: GAITAME also offers a Demo Account, which is an excellent option for traders who want to practice their trading strategies or familiarize themselves with the platform before trading with real money. The Demo Account provides a simulated trading environment where traders can explore the platform's features and test their trading skills using virtual funds.

To open an account with GAITAME, follow these simple steps:

Visit the GAITAME Website: Start by visiting the official website of GAITAME.

2. Click on the “Open an Account” Tab: On the website's menu, locate and click on the “Open an Account” tab. This will initiate the account opening process.

3. Fill out the Registration Form: You will be directed to a registration form. Fill in all the required details, including your personal information such as name, address, and contact information. Follow the instructions carefully and provide accurate information.

Completing these steps will initiate the account opening process with GAITAME. It's important to ensure that you provide all the necessary information accurately to avoid any delays in the account activation process. Once your account is approved, you can proceed to fund your account and start trading.

Com offers spreads on currency pairs for two time periods: 1:00 am to 4:00 pm, and 4:00 pm to 1:00 am. During the former time period, the spread is 0.2 pips on USD/JPY, 0.5 pips on EUR/JPY, 0.4 pips on EUR/USD, 0.7 pips on AUD/JPY, 1.0 pips on GBP/JPY, 1.2 pips on NZD/JPY, and 1.7 pips on CAD/JPY. CAD / JPY at 1.7 pips. During the period from 4:00 pm to 1:00 am, the USD/JPY spread is 0.1 pips, EUR/JPY 0.3 pips, EUR/USD 0.3 pips, AUD/JPY 0.4 pips, GBP/JPY at 0.6 pips, and NZD/JPY at 0.9 pips.

GAITAME offers its clients the NextNeo trading platform, which serves as the primary trading software for desktop and mobile applications. NextNeo is a proprietary platform developed by GAITAME, designed to provide traders with a user-friendly and feature-rich trading experience. The platform is compatible with both Windows and Mac operating systems. Additionally, GAITAME offers a mobile version of the NextNeo platform for Android and iPhone devices. Traders can download the mobile app using a QR code and enjoy intuitive and smooth transactions, along with a suite of charting tools for comprehensive market analysis. The NextNeo trading platform is available in English and Japanese, providing traders with a customizable and intuitive interface, charting tools, and access to news, analysis reports, and financial calendars.

Here's a table summarizing the trading platform offered by GAITAME:

| Trading Platform | NextNeo (proprietary platform) |

| Platform Types | Desktop (Windows, Mac), Mobile (Android, iPhone) |

| Language Support | English, Japanese |

| Key Features | User-friendly interface, Charting tools, News and analysis reports |

| Customization | Customizable trading strategies, Intuitive and customizable charting tools |

GAITAME offers convenient options for depositing and withdrawing funds. When it comes to deposits, clients can fund their trading accounts using bank wire transfers or credit/debit cards. The broker accepts deposits in both Japanese Yen (JPY) and US Dollars (USD). Additionally, GAITAME provides a “Quick Deposit” service in partnership with certain banks, allowing clients to make instant deposits without any transfer fees.

For withdrawals, clients can choose between bank wire transfers and credit/debit cards. GAITAME ensures that withdrawals are processed promptly and free of charge. It's worth noting that withdrawals are generally made using the same method used for deposits.

It's essential for traders to review GAITAME's website for detailed information and instructions on how to deposit and withdraw funds. By following the outlined procedures, traders can easily manage their funds and engage in seamless deposit and withdrawal processes with GAITAME.

| Deposit Options | Bank Wire Transfers, Credit/Debit Cards |

| Accepted Currencies | Japanese Yen (JPY), US Dollars (USD) |

| Quick Deposit | Instant deposits available with affiliated financial institutions |

| on weekdays, weekends, and holidays 24 hours | |

| Withdrawal Options | Bank Wire Transfers, Credit/Debit Cards |

| Withdrawal Fees | Free of charge |

| Withdrawal Process | Generally processed using the same method as the deposit |

GAITAME provides customer support to assist traders with their inquiries and concerns. The broker can be reached through telephone and email. Traders can contact the customer support team by calling the provided phone numbers, which include a dedicated number for international calls. The professional support team is available from Monday to Friday, during specified hours, to provide assistance in both English and Japanese. Additionally, traders can submit their inquiries through the broker's website using the provided contact form, and GAITAME will respond via email. While live chat support is not available, the broker offers comprehensive FAQ sections on its website, covering various topics related to features and trading conditions. By utilizing these support channels, traders can receive the necessary assistance and guidance from GAITAME's customer support team.

Please note that the specific contact hours and phone numbers may be subject to change, and it is recommended to visit GAITAME's website for the most up-to-date information regarding customer support availability.

| Customer Support Channels | Telephone, Email |

| Telephone Support | From inside Japan: 0120 430 225 |

| International calls: +81 3 5733 3065 | |

| IP phones: 03 5733 3065 | |

| Email Support | Contact form available on the website |

| Customer Service Hours | Monday to Friday, specific hours (local time) |

| Languages | English, Japanese |

| Live Chat | Not available |

| Additional Resources | Comprehensive FAQ sections on the website |

GAITAME offers a range of educational resources to support traders in their journey through the forex market. While the specific details of these resources are not provided, it can be inferred that GAITAME is committed to providing valuable educational materials to its clients.

The broker likely offers educational resources such as tutorials, webinars, articles, and videos. These materials are designed to cater to both beginner and advanced traders, covering various aspects of forex trading. Topics may include fundamental and technical analysis, risk management strategies, trading psychology, and market insights.

GAITAME may also provide a comprehensive educational section on its website, where traders can access a wealth of information to enhance their understanding of the forex market. This section might include guides, glossaries, and FAQs to address common questions and provide clarity on key concepts.

Furthermore, GAITAME may organize webinars or training sessions conducted by experienced traders or market experts. These interactive sessions can offer valuable insights, practical tips, and real-time analysis to help traders refine their skills and stay updated with market trends.

The educational resources provided by GAITAME aim to empower traders with the knowledge and tools they need to make informed trading decisions. By investing in their clients' education, GAITAME demonstrates a commitment to fostering a supportive trading environment.

Please note that the specific educational resources offered by GAITAME are not explicitly mentioned in the available information. Traders are advised to visit GAITAME's website or contact their customer support for detailed and up-to-date information on the educational materials they provide.

Here's a table summarizing the potential educational resources that GAITAME may offer:

| Educational Resources | Description |

| Tutorials | Step-by-step guides and instructional materials |

| Webinars | Interactive sessions with market experts |

| Articles | Informative articles on various forex trading topics |

| Videos | Visual content covering trading strategies and more |

| Website Section | Comprehensive educational section with guides and FAQs |

GAITAME is an established forex broker based in Japan, offering a range of trading services and features. The broker has a long-standing presence in the industry since its founding in 2002 and is regulated by the Financial Futures Association of Japan. GAITAME provides a proprietary trading platform called NextNeo, available for desktop and mobile devices. The platform offers user-friendly features, charting tools, and access to news and analysis reports. The broker supports a variety of deposit and withdrawal options, including bank wire transfers and credit/debit cards. GAITAME's educational resources, although not explicitly specified, are expected to cater to both beginner and advanced traders. The broker's maximum leverage is 1:100, and it aims to offer competitive spreads and low trading fees.

Pros:

Established and regulated broker with a long history in the industry.

NextNeo trading platform provides a user-friendly experience and access to market analysis tools.

Variety of deposit and withdrawal options for convenience.

Expected range of educational resources to support traders' knowledge and skills.

Competitive spreads and low trading fees.

Cons:

Specific details about educational resources are not provided in the available information.

Limited information about available trading instruments.

Customer support availability and options are not explicitly stated.

No information on additional features such as bonuses or promotions.

Traders interested in GAITAME should conduct further research and review the broker's website or contact their customer support for more detailed and up-to-date information on specific offerings and features.

What is GAITAME?

GAITAME is an established forex broker based in Japan that offers trading services and features to clients. It provides a proprietary trading platform, NextNeo, and is regulated by the Financial Futures Association of Japan.

What trading platform does GAITAME offer?

GAITAME offers the NextNeo trading platform, which is available for both desktop (Windows, Mac) and mobile (Android, iPhone) devices. It provides a user-friendly interface, charting tools, and access to news and analysis reports.

Is GAITAME regulated?

Yes, GAITAME is regulated by the Financial Futures Association of Japan (FFAJ) under License No. 1544. It adheres to strict oversight by the Japanese government to ensure a safe and secure trading environment.

What are the deposit and withdrawal options with GAITAME?

GAITAME offers deposit and withdrawal options that include bank wire transfers, credit cards, and debit cards. These options provide convenience and flexibility for clients to manage their funds.

Does GAITAME provide educational resources?

While specific details are not mentioned, GAITAME is expected to offer educational resources to support traders. These resources may include tutorials, webinars, articles, and videos to enhance traders' knowledge and skills in forex trading.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive activtrades and gaitame-com are, we first considered common fees for standard accounts. On activtrades, the average spread for the EUR/USD currency pair is -- pips, while on gaitame-com the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

activtrades is regulated by FCA,SCB,DFSA. gaitame-com is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

activtrades provides trading platform including -- and trading variety including --. gaitame-com provides trading platform including -- and trading variety including --.