No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ActivTrades and xChief ?

In the table below, you can compare the features of ActivTrades , xChief side by side to determine the best fit for your needs.

--

--

EURUSD:1.1

EURUSD:6.8

EURUSD:21.08

XAUUSD:41.42

EURUSD: -8.9 ~ 1.1

XAUUSD: -39.8 ~ 16.2

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of activtrades, forexchief lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

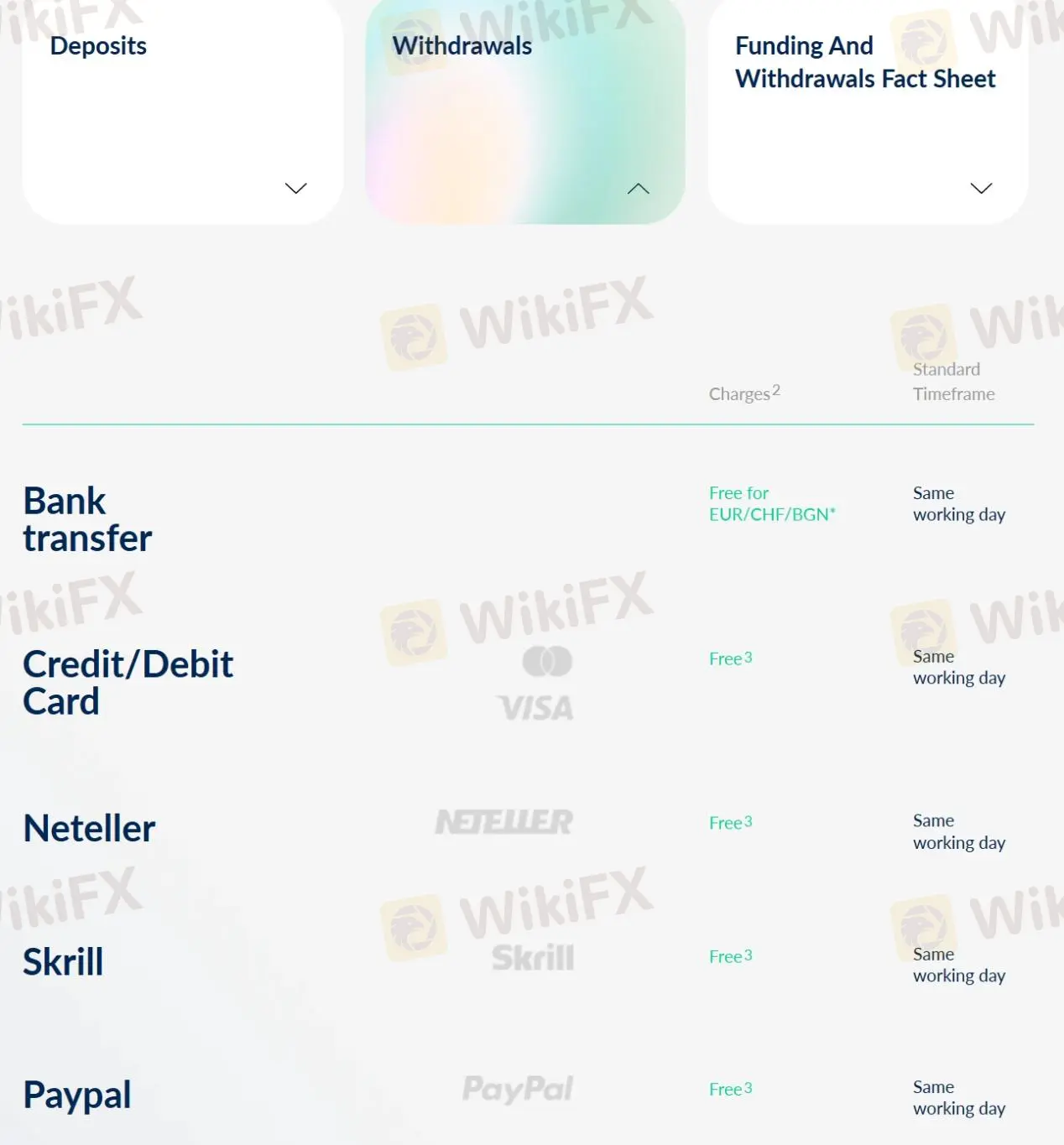

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

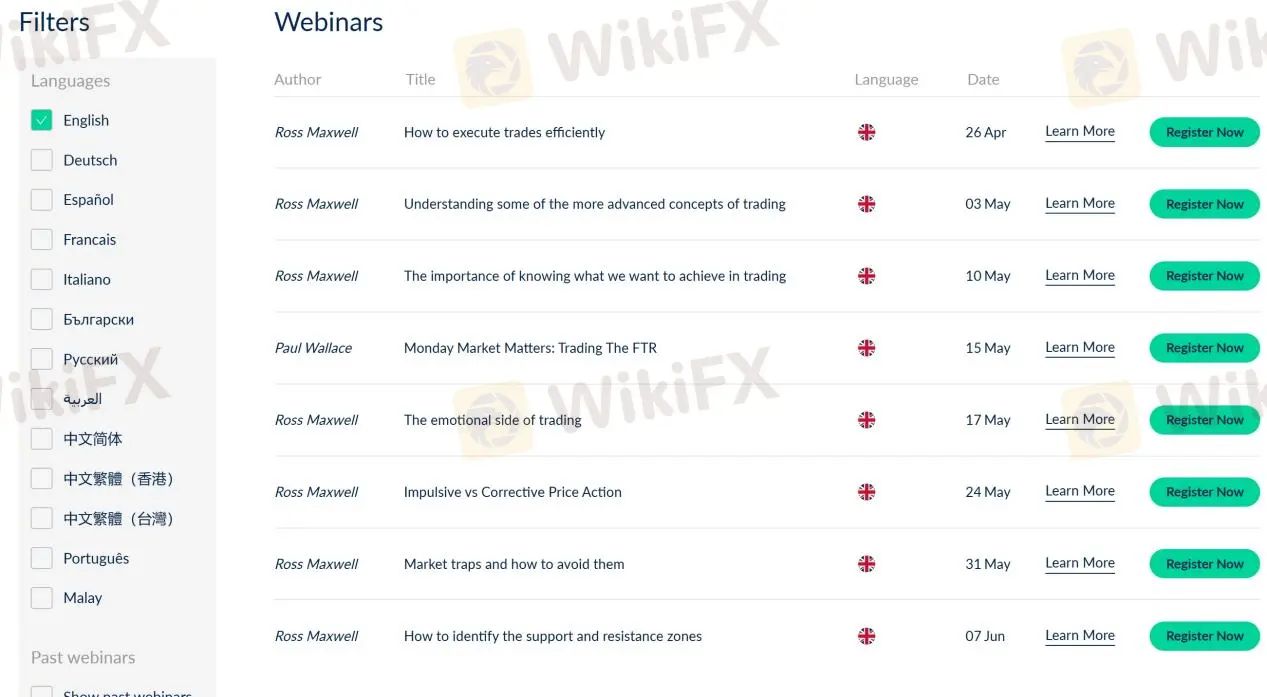

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| xChiefReview Summary | |

| Founded | 2014 |

| Registered Country/Region | Comoros |

| Regulation | MISA (Offshore) |

| Market Instruments | Forex, Metals, Commodities, Indexes, Stocks, Cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0 pips |

| Trading Platform | MT4, MT5, xChief App |

| Min Deposit | 0 |

| Customer Support | Live chat, phone, email |

xChief (formerly ForexChief) is an online Forex and CFD trading broker that offers multiple assets for trading online via the MetaTrader4/5 platforms. Founded in 2014, its head office is in Vanuatu while other representative offices are in Singapore and Nigeria. xChief Ltd is incorporated in the Republic of Comoros.

xChief Ltd is a retail forex broker offshore regulated by the Mwali International Services Authority (MISA) in Comoros with the license number T2023379. Besides, xChief prioritizies the safety of client funds. If there are any losses caused by technical faults, xChief will compensate for them. It also protects clients' funds by segregating them into separate bank accounts.

xChief has several pros and cons. It offers various trading instruments, multiple account types, and user-friendly trading platforms. Besides, it also highlights the safety of client funds, and manages to protect them. What's more, it is well regulated, and it is a mature broker. However, some reports have been exposed, which says that xChief has slippage.

| Pros | Cons |

| Various trading instruments | Withdrawal issues and slippage |

| Tight spreads | Offshore regulated |

| Demo accounts | |

| MT4/5 supported | |

| No minimum deposit requirement | |

| Live chat |

xChief offers 4 types of trading accounts: CENT account, Classic+ account, DirectFX account, and xPRIME account. Demo accounts are also available for traders.

| Account Type | Account Curency | Minimum Deposit | No-Deposit Bonus $100 | Welcome Bonus $500 |

| CENT | USD, EUR | 0 | ❌ | ❌ |

| Classic+ | USD, EUR, GBP | $10 (or equivalent) | ✔ | ✔ |

| DirectFX | USD, EUR, GBP | $50 (or equivalent) | ✔ | ✔ |

| xPRIME | USD, EUR, GBP, CHF, JPY | $2000 (or equivalent) | ❌ | ✔ |

The leverage is relatively high, and for some types of accounts, it can be up to 1:1000, which means risks may also be high.

| Account Type | Max Leverage | Spreads | Commissions |

| CENT | 1:500 | From 0.9 pips | ❌ |

| Classic+ | 1:1000 | From 0.6 pips | ❌ |

| DirectFX | 1:1000 | From 0.3 pips | $/€/£2.5 |

| xPRIME | 1:1000 | From 0 pips | $/€/£/₣3/¥500 |

| Trading Platform | Available Devices | Suitable for |

| MetaTrader5 | Desktop, iOS, Android, MacOS, Web | Beginners |

| MetaTrader4 | Desktop, iOS, Android, MacOS, Web | Skilled and professional traders |

| xChief Mobile App | Mobile | All types of traders |

TxChief supports different kinds of deposit and withdrawal methods. Take the UK for example.

| Deposit Methods | Fees | Time | Currency |

| SWIFT | 0% | Up to 5 days | EUR, GBP |

| Crypto | 0% | Up to 8 hours | BTC, ETH, LTC, XRP, USDT, USDC |

| Perfect Money | 1.99% | Instantly | USD, EUR |

| Withdrawal M ethods | Fees | Time | Currency |

| SWIFT | 1%, min.€50/£50 | Up to 5 business days | EUR, GBP |

| SEPA | €25 | Up to 3 business days | EUR |

| Debit/Credit Card | 2%, min.$5/€5 | Up to 7 business days | USD, EUR |

| Crypto | 0% | 1 business day | BTC, ETH, LTC, XRP, USDT, USDC |

| Perfect Money | 0.5% | 1 business day | USD, EUR |

xChief provides customer services to its clients, and it has unique contact options in the headquarter as well as representative offices.

| Vanuatu Contact Info | |

| Phone | +65 31593652 |

| info@xchief.com | |

| marketing@xchief.com | |

| partnership@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | 1st Floor, CNM Building, Port Vila, Vanuatu |

| Singapore Contact Info | |

| Phone | +65 31593652 |

| asia@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | 2 Venture Dr, #24-01 Vision Exchange, Singapore, 608526 |

| Nigeria Contact Info | |

| Contact Options | Details |

| Phone | +234 9030795364 |

| nigeria@xchief.com | |

| Support Ticket System | ✔ |

| Online Chat | 24/7 |

| Website Language | English |

| Company Address | Suite 319 Rock of Ages Mall Jabi, Abuja, Nigeria |

Is xChief regulated?

Yes, it is regulated by the MISA.

Does xChief offer demo accounts?

Yes.

What trading platforms does xChief have?

It supports MT4, MT5, and xChief APP.

What is the minimum deposit for xChief?

The minimum deposit is 0.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive activtrades and forexchief are, we first considered common fees for standard accounts. On activtrades, the average spread for the EUR/USD currency pair is -- pips, while on forexchief the spread is From 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

activtrades is regulated by FCA,SCB,DFSA. forexchief is regulated by MISA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

activtrades provides trading platform including -- and trading variety including --. forexchief provides trading platform including xPRIME,DirectFX,Classic+,CENT and trading variety including 150+ Forex, Metals, Commodities, Indexes, Stocks, Crypto.