简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Lex-Fct

Zusammenfassung:Lex-Fct is a New Zealand-based brokerage firm with an operational history of 5-10 years. Notably, it operates without regulatory oversight, rendering it unregulated. While it offers trading opportunities in a range of instruments, including forex, metals, cryptocurrencies, stock indexes, and crude oil, key details such as account types and minimum initial deposits remain unspecified. Traders may find appeal in the flexibility of leverage options, spanning from 1:1 to 1:100, and competitive spreads starting from 0.0 pips. The MetaTrader 5 platform is employed for trading, albeit the overall trading experience hinges on the broker's implementation and regulatory standing. Transparency regarding spreads, commissions, and deposit/withdrawal methods is notably lacking.

| Company Information | Details |

| Company Name | Lex-Fct |

| Registered in | New Zealand |

| Regulation Status | Unregulated |

| Years of Establishment | 5-10 years |

| Trading Instruments | Forex, Metals, Cryptocurrencies, Stock Indexes, Crude Oil |

| Maximum Leverage | 1:1 to 1:100 |

| Minimum Spread | Starting from 0.0 pips |

| Trading Platform | MetaTrader 5 |

| Customer Service |

Overview of Lex-Fct

Lex-Fct is a New Zealand-based brokerage firm with an operational history of 5-10 years. Notably, it operates without regulatory oversight, rendering it unregulated. While it offers trading opportunities in a range of instruments, including forex, metals, cryptocurrencies, stock indexes, and crude oil, key details such as account types and minimum initial deposits remain unspecified.

Traders may find appeal in the flexibility of leverage options, spanning from 1:1 to 1:100, and competitive spreads starting from 0.0 pips. The MetaTrader 5 platform is employed for trading, albeit the overall trading experience hinges on the broker's implementation and regulatory standing. Transparency regarding spreads, commissions, and deposit/withdrawal methods is notably lacking.

Is Lex-Fct legit or a scam?

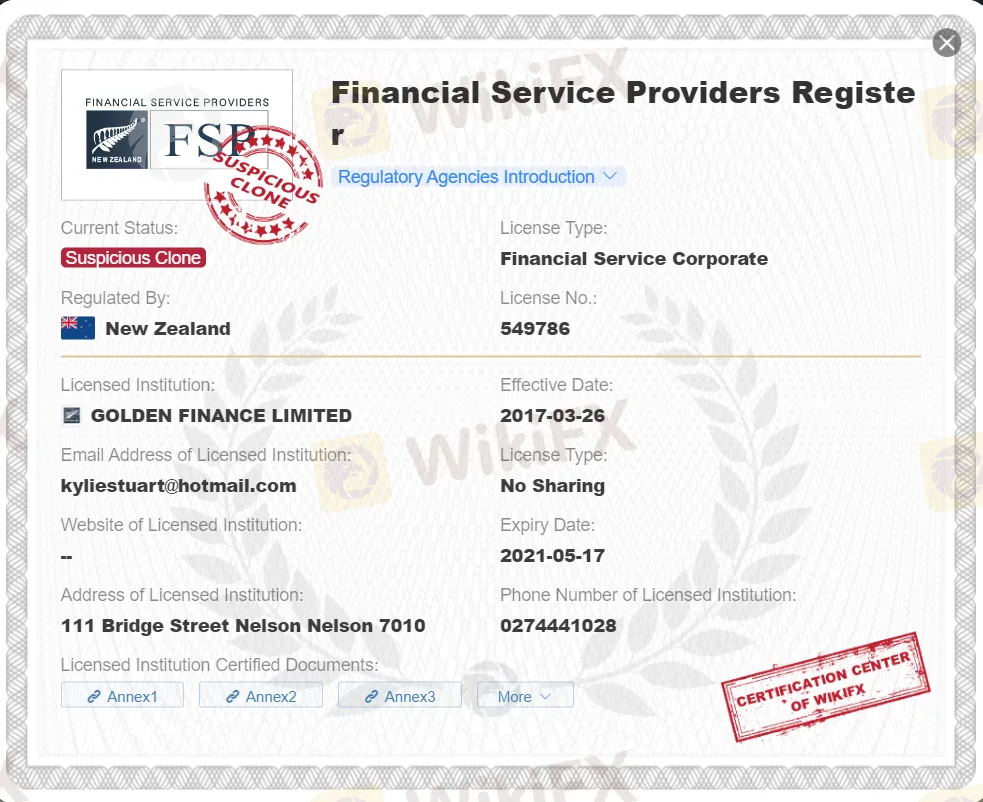

The claim of New Zealand Financial Service Providers Register (FSPR) regulation with license number 549786 by this broker raises suspicions of potential cloning or misrepresentation. The broker operates without oversight or scrutiny from an official financial regulatory authority. This lack of regulation can result in a significant absence of safeguards and protective mechanisms for traders, leaving them potentially vulnerable to risks associated with unverified financial activities.

Traders are advised to exercise extreme caution when considering an unregulated broker, as the absence of regulatory supervision may compromise the safety of their funds and overall reliability of the broker's operations.

Pros and Cons

| Pros | Cons |

| Versatile Leverage Options | Unregulated |

| Competitive Spread Rates | Opacity in Account Offerings |

| MetaTrader 5 Platform | Unclear Spreads & Commissions |

| Mobile Trading | Customer Support Concerns |

Pros:

Versatile Leverage Options: Lex-Fct provides traders with the flexibility to choose leverage ratios ranging from 1:1 to 1:100, empowering them to tailor their trading strategies according to their risk tolerance.

Competitive Spread Rates: The broker offers competitive spreads, commencing from as low as 0.0 pips, which can potentially lead to lower overall trading expenses.

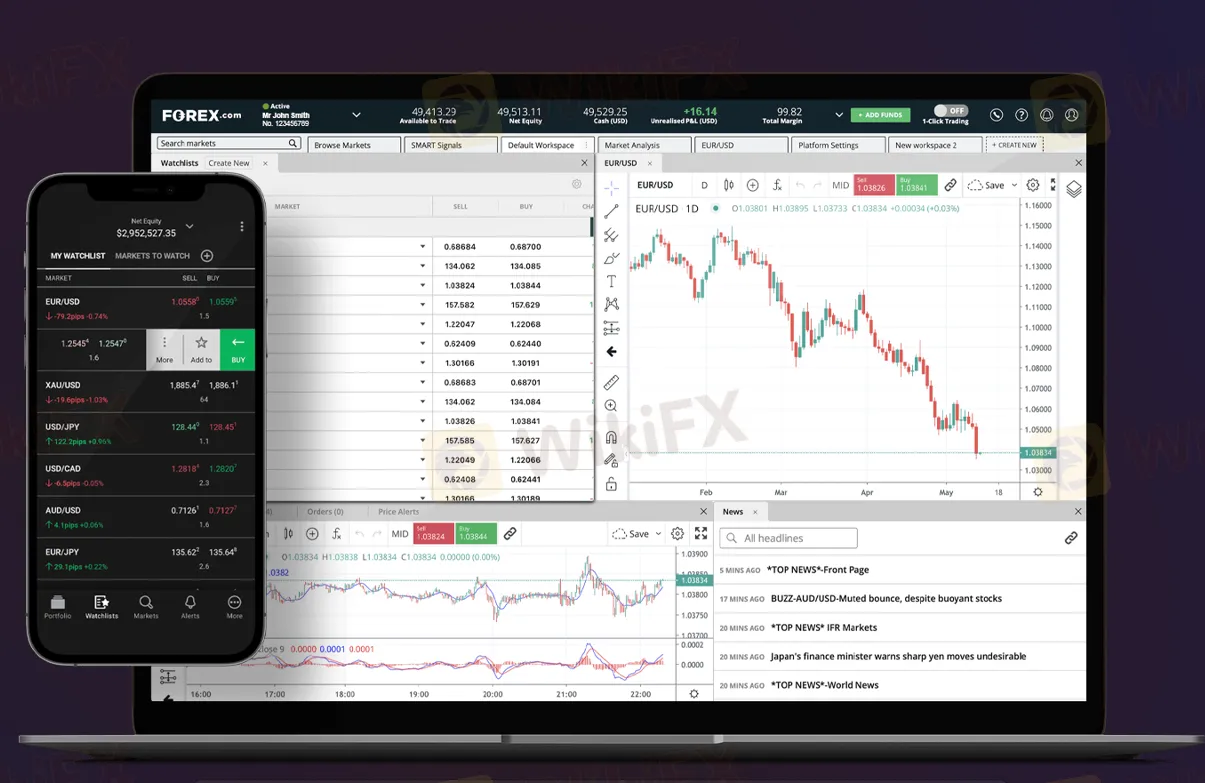

MetaTrader 5 Platform: Lex-Fct leverages the renowned MetaTrader 5 trading platform, celebrated for its advanced features, real-time trading capabilities, and dynamic quotation analysis.

Mobile Trading: Clients can access their accounts and execute trades on the go via dedicated Android and iOS applications, providing convenience and flexibility.

Cons:

Unregulated: The broker operates without oversight or scrutiny from an official financial regulatory authority.

Opacity in Account Offerings: The dearth of detailed information pertaining to distinct account types can complicate the process for traders to select the most suitable option that aligns with their requirements.

Unclear Spreads & Commissions: Lex-Fct does not furnish specific details regarding the application of spreads and commissions across various currency pairs, trading conditions, or time frames, thereby introducing uncertainty in terms of trading costs.

Customer Support Concerns: Reviews suggest that the responsiveness of Lex-Fct's customer support, which is conducted via email, may not meet expected standards.

Market Instruments

Lex-Fct offers an array of trading opportunities to its clients, encompassing:

Forex Market: Traders can engage in speculation across 62 diverse currency pairs, benefiting from ultra-low spreads.

Metals Trading: Lex-Fct extends access to precious metals like gold and silver, tradable against the USD.

Cryptocurrency Options: Clients intrigued by digital currencies can participate in the trading of assets such as Bitcoin, Ethereum, and other prominent cryptocurrencies.

Stock Indexes and Crude Oil: Lex-Fct further broadens its portfolio by facilitating trading opportunities in stock indexes and crude oil.

How to Open an Account?

The procedure for opening an account with Lex-Fct seems straightforward on the surface. Prospective clients are typically required to furnish personal details, designate their geographical location, input their residential address, and submit scans of their identification cards. However, it is imperative to underscore that the absence of comprehensive account details in the provided information can leave traders uncertain about the specifics of their chosen account type and trading conditions. Clarity and assurance are pivotal considerations for traders in the competitive trading environment.

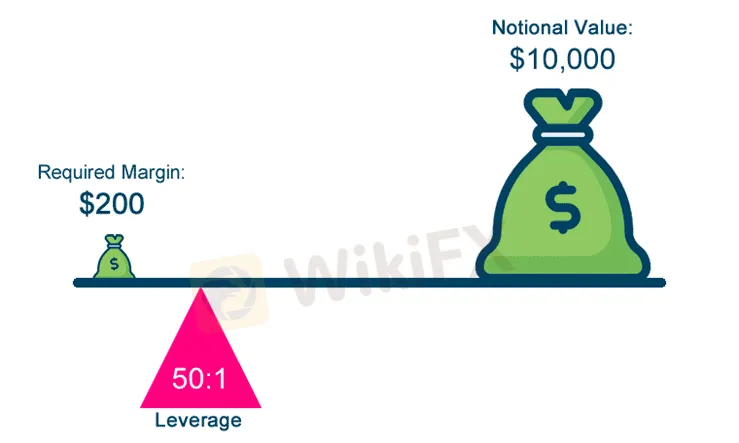

Leverage

Lex-Fct extends leverage options spanning from 1:1 to 1:100. While this adaptability may be enticing for traders seeking to amplify potential gains, it is crucial to grasp that heightened leverage also escalates the associated risks in trading. The absence of explicit regulatory oversight for Lex-Fct amplifies the significance of these risk factors, as there may be fewer protective measures in place in comparison to regulated brokers.

Spreads & Commissions

Lex-Fct asserts the provision of spreads commencing from as low as 0.0 pips. However, the absence of precise information regarding the application of these spreads to distinct currency pairs, trading conditions, or time periods can give rise to unforeseen expenses for traders.

Transparent disclosure of commission structures and spread of information is indispensable for traders to effectively manage their trading costs.

Trading Platform

A notable asset for Lex-Fct is its utilization of the MetaTrader 5 trading platform. MetaTrader 5 is renowned for its robust feature set, encompassing real-time trading capabilities, dynamic quotation analysis, and support for algorithmic trading. Nonetheless, the quality of the trading experience on this platform is contingent upon the broker's implementation, customer support, and regulatory adherence, elements that may not be explicitly elucidated in this case.

Deposit & Withdrawal

Lex-Fct proclaims to facilitate instant deposits and expedited payouts; however, comprehensive details regarding accepted payment methods, associated fees, and processing timelines are conspicuously absent. The dearth of transparency in this regard, coupled with potential customer grievances concerning withdrawal difficulties, engenders concerns pertaining to the broker's liquidity and reliability.

Customer Support

Lex-Fct delivers customer support primarily via email at info@lexinfx.com Reviews intimate that the responsiveness of this support system may fall short of expectations. In the contemporary trading arena, efficient customer support is indispensable for addressing issues promptly and averting potential disruptions for traders.

Conclusion

In summation, Lex-Fct presents a mixed bag of advantages and disadvantages for prospective traders. While it proffers certain benefits, such as versatile leverage options and competitive spreads, concerns regarding its regulatory status, transparency, and customer support could introduce risks for traders. Individuals contemplating Lex-Fct as their broker should undertake comprehensive research and exercise prudence when engaging with this brokerage.

FAQs

Q: What is Lex-Fct's regulatory status?

A: Lex-Fct operates without regulatory oversight, making it an unregulated brokerage firm.

Q: Can you provide information on the available account types?

A: Lex-Fct does not specify the types of trading accounts it offers, which may pose challenges for traders seeking tailored account options.

Q: What is the minimum initial deposit required to open an account with Lex-Fct?

A: Lex-Fct has not provided specific details regarding the minimum initial deposit, making it challenging for traders to plan their investments.

Q: What are the leverage options available at Lex-Fct?

A: Lex-Fct offers leverage options ranging from 1:1 to 1:100, providing traders with flexibility in managing risk and potential rewards.

Q: Are there any details about the broker's spreads and commissions?

A: Lex-Fct claims to offer competitive spreads starting from 0.0 pips, but lacks specific information on how these apply to different trading conditions or currency pairs.

Q: Which trading platform does Lex-Fct utilize?

A: Lex-Fct utilizes the MetaTrader 5 platform, known for its advanced features and real-time trading capabilities, although the quality of the trading experience may depend on the broker's implementation.

Q: What deposit and withdrawal methods are supported by Lex-Fct?

A: Lex-Fct has not provided information about the specific deposit and withdrawal methods it supports, leaving traders uncertain about transaction options.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Ripple: XRP stabil über 0,5100 US-Dollar – Analysten blicken auf regulatorische Entwicklungen

Schlechte Nachrichten bei VW vor Tarifverhandlungen: Gewinne brechen um 40 Prozent ein

MicroStrategy will über 3 Jahre 42 Milliarden Dollar für den Kauf von Bitcoin aufbringen

Saudi-Arabiens Staatsfonds reduziert seine weltweiten Investments – und fokussiert sich auf inländische Projekte

Grund für Optimismus? Umsätze im Handel und Kauflaune steigen an

Solana: Vier-Tage-Rally gestoppt – Trendwende oder Erholung?

Shiba Inu Preis-Prognose: Nähert sich absteigender Trendlinie, bullischer Ausbruch möglich

Bitcoin nimmt neues Allzeithoch ins Visier, nachdem er kurzzeitig die Marke von $73.000 überschritten hat

Uniswap-Preis-Prognose: Technische Aussichten deuten auf einen bullischen Ausbruch hin

Probleme in den USA: Opel-Mutterkonzern Stellantis verzeichnet Umsatzeinbruch

Wechselkursberechnung