简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BullionStar--Overview of Minimum Deposit, Spreads & Leverage

Zusammenfassung:BullionStar, founded in 2012 in Singapore, provides a wide array of products and services tailored for precious metals enthusiasts and investors. These include bullion sales of gold, silver, platinum, and palladium in various forms such as bars, coins, and numismatics. Additionally, BullionStar offers secure vault storage in Singapore, the United States and New Zealand.

| ForexMart Review Summary | |

| Founded | 2012 |

| Region/Country | Singapore |

| Regulation | No regulation |

| Products & Services | Trading, shipping and storage of precious metals |

| Customer Support | Phone, address, email, social media, FAQ |

BullionStar Information

BullionStar, founded in 2012 in Singapore, provides a wide array of products and services tailored for precious metals enthusiasts and investors. These include bullion sales of gold, silver, platinum, and palladium in various forms such as bars, coins, and numismatics. Additionally, BullionStar offers secure vault storage in Singapore, the United States and New Zealand.

While it boasts robust security measures and comprehensive customer service options, it operates without regulatory oversight, which should be a consideration for interested investors seeking transparency and regulatory protection.

Pros & Cons

| Pros | Cons |

| Wide Range of Products | Lack of Regulation |

| Storage Options | |

| Safe Deposit Boxes | |

| Payment Flexibility | |

| No GST/VAT/Sales Tax in Singapore | |

| IRA Account Option |

Pros:

- Wide Range of Products: BullionStar offers a diverse selection of precious metals including gold, silver, platinum, and palladium in various forms such as bars, coins, and bullion jewelry.

- Storage Options: They provide secure vault storage in multiple jurisdictions including Singapore, the United States, and New Zealand.

- Safe Deposit Boxes: Affordable safe deposit boxes are available in different sizes at their Singapore location.

- Payment Flexibility: Accepts a wide range of payment methods including bank transfers, credit/debit cards, cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Litecoin), and local payment options like PayNow.

- No GST/VAT/Sales Tax in Singapore: BullionStar operates in a jurisdiction where there are no GST/VAT or sales taxes on precious metals

- IRA Account Option: BullionStar provides the option for investors to open IRA (Individual Retirement Account) accounts, allowing them to invest in precious metals within a tax-advantaged retirement framework in the United States.

Cons:

- Lack of Regulation: BullionStar is not regulated by financial authorities, which raises concerns about investor protection and recourse in case of disputes.

Is BullionStar Legit?

When considering the safety of a brokerage like BullionStar or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

- Regulatory sight: The broker's current operation without legitimate regulatory oversight only fuels concerns about its legitimacy and trustworthiness. These worries are compounded by the broker's inaccessible website.

- User feedback: For a deeper insight into the brokerage, traders should read reviews and feedback from existing clients. These valuable inputs from users, available on trustworthy websites and discussion forums, can provide firsthand information about the broker's operations.

- Security measures: BullionStar prioritizes the security of its clients' assets with robust measures. Below are some of them:

- All metals stored in BullionStar's vaults are fully insured at their replacement value up to SGD 150,000, sub-limited to SGD 15,000 for cash.

- The company employs stringent security protocols, including 24/7 monitoring, advanced alarm systems, and secure access controls to their storage facilities in Singapore, the United States, and New Zealand. Customers have the ability to audit their bullion holdings in person at BullionStar's locations.

- Additionally, BullionStar offers detailed online account management, allowing clients to track their stored bullion, view photographs of their holdings, and generate vault certificates.

In the end, choosing whether or not to engage in trading with BullionStar is an individual decision. We advise you carefully balance the risks and returns before committing to any actual trading activities.

Products & Services

BullionStar caters to investors interested in diversifying their portfolios with precious metals.

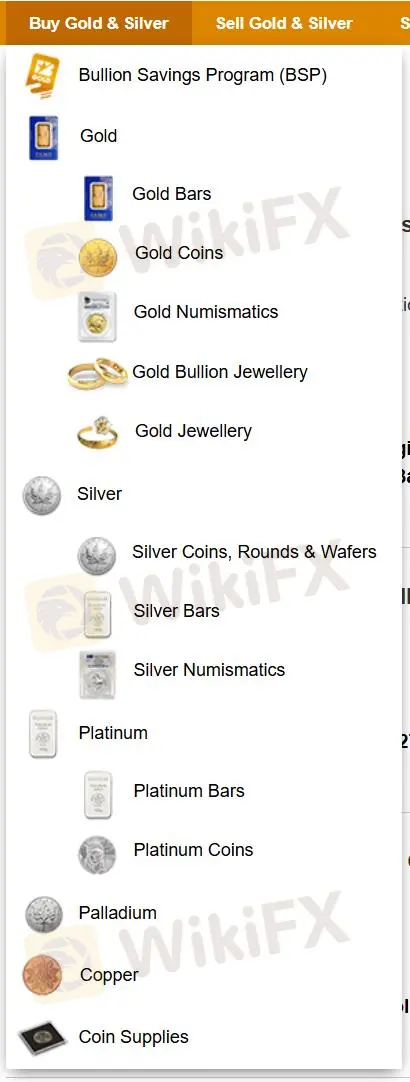

BullionStar caters to a comprehensive range of precious metals needs, offering investors and collectors a wealth of options. Their core business centers on buying and selling gold, silver, platinum, and even palladium. This encompasses various product formats, including bars and coins ideal for investment, along with numismatic collectibles for those seeking valuable historical artifacts.

For those seeking to build their holdings gradually, the Bullion Savings Program facilitates regular, smaller purchases. BullionStar doesn't limit itself to new metals; they also buy and sell gold, silver, and platinum scrap, transforming unwanted jewelry into fresh investment opportunities.

Furthermore, BullionStar offers secure shipping and vault storage solutions for precious metals in Singapore, the United States, and New Zealand. They even provide coin supplies to safeguard your collection.

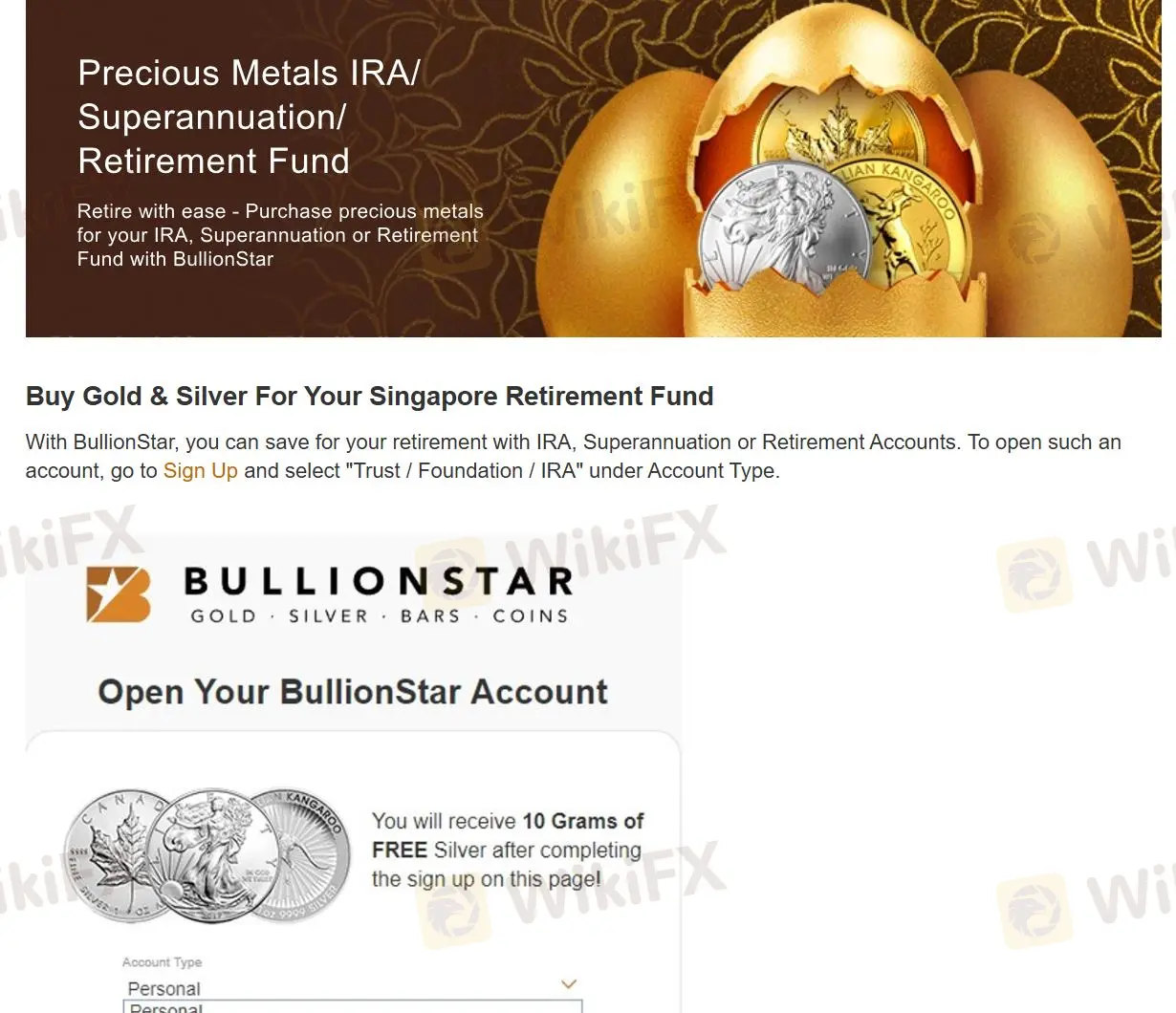

Beyond direct purchases, BullionStar can facilitate the setup of a Precious Metals IRA. This allows you to invest in retirement savings using gold, silver, platinum, or palladium bullion or IRA-approved coins. If you're new to this type of IRA, BullionStar provides guidance on finding a custodian to manage your account and ensure compliance with IRS regulations.

Safe Deposit Box

BullionStar offers secure safe deposit boxes in Singapore, conveniently located within their premises at 45 New Bridge Road near the CBD.

| Size | Dimensions (Depth x Width x Height) | Maximum Weight | 1 Year Price (SGD) | 2 Years Price (SGD) | 5 Years Price (SGD) | 10 Years Price (SGD) |

| Small | 50.5 cm x 22.5 cm x 7.5 cm | 10 kg | 399 | 389 | 359 | 288 |

| Large | 50.5 cm x 22.5 cm x 11.5 cm | 25 kg | 599 | 589 | 549 | 488 |

| Extra Large | 50.5 cm x 22.5 cm x 37.5 cm | 100 kg | 1,279.00 | 1,259.00 | 1,199.00 | 1,088.00 |

Available in three sizes—small, large, and extra large—these robust boxes can accommodate items such as bullion, numismatics, jewellery, collectibles, and important documents. Each box is housed in a vault and accessed via self-service entry using an access card, PIN code, and personal box key. Clients enjoy unlimited access during operating hours, with private viewing rooms available for discreet handling of contents.

Pricing options are flexible, ranging from SGD 399.00 to SGD 1,279.00 per year, depending on the box size and lease duration.

Account Types

BullionStar offers two primary account types: Cash & Bullion Accounts and Precious Metals IRA Accounts.

The Cash & Bullion Account is available for both individual and business customers, allowing them to hold both bullion and cash simultaneously, simplifying the process of buying, selling, and storing precious metals. With multiple jurisdiction options, account holders can manage their investments across locations in Singapore, the United States, and New Zealand, and maintain balances in Singapore dollars, U.S. dollars, and euros.

The Precious Metals IRA Account provides a tax-advantaged structure under U.S. law for saving for retirement.

Self-directed IRAs facilitate investment in a wide variety of assets, including precious metals. BullionStar collaborates with preferred IRA custodians, enabling customers to set up self-directed custodial IRAs and invest in precious metals while retaining tax benefits.

The IRA account can be funded through contributions, transfers from other IRAs, or rollovers from pension plans such as a 401k. Once set up, customers can purchase precious metals from BullionStar and store them securely in BullionStar vaults, with the flexibility to sell, audit, or physically withdraw their assets at any time.

Fees

BullionStar offers competitive fees for storing physically allocated and insured bullion. They provide storage options in Singapore, the United States, and New Zealand, each with distinct charges.

| Service | Singapore Fees | US Fees (free for the first year) | New Zealand Fees |

| Gold Bullion Products | 0.39% per annum | 0.39% per annum | 0.59% per annum |

| Silver & Platinum Bullion Products | 0.59% per annum | 0.49% per annum | 0.88% per annum |

| BSP Grams Gold | 0.09% per annum | 0.09% per annum | 0.09% per annum |

| BSP Grams Silver & Platinum | 0.19% per annum | 0.19% per annum | 0.19% per annum |

| Daily Minimum Storage Fee | SGD 0.19 per jurisdiction | USD 0.19 | SGD 0.19 per jurisdiction |

| BSP Conversion/Withdrawal | FREE | FREE | FREE |

| Vault Withdrawal of Bullion Products | SGD 129 per instance | USD 129 per instance | SGD 129 per instance |

| Customer Audit of Physical Bullion | SGD 99 per instance | USD 249 per instance | SGD 199 per instance |

| Late Payment Fee for Storage Charges | SGD 49 per reminder + 2% monthly interest | USD 49 per reminder + 2% monthly interest | SGD 49 per reminder + 2% monthly interest |

| Fee Calculation Basis | Mid-spot price at 00:01 SGT | Spot price at 11:01 CST | Mid-spot price at 00:01 SGT |

| Invoicing Frequency | 1 March annually or upon sale/withdrawal | 1 March annually or upon sale/withdrawal | 1 March annually or upon sale/withdrawal |

Payment Methods

Customers can choose from several options including bank transfers in multiple currencies such as Singapore Dollar (SGD), US Dollar (USD), Euro (EUR), British Pound (GBP), Australian Dollar (AUD), New Zealand Dollar (NZD), Swedish Krona (SEK), and Japanese Yen (JPY).

Additionally, they accept payments through major credit and debit cards (Mastercard, VISA, JCB, UnionPay),PayNow (for SGD payments up to SGD 200,000), and cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Litecoin).

More details can be found as below:

| Payment Method | Remark |

| Cash Payment | Accepted in Singapore Dollar (SGD) for amounts up to SGD 200,000. |

| Bank Transfer | Available in various currencies including SGD, USD, EUR, GBP, AUD, NZD, SEK, and JPY. Bank charges are borne by the remitter. |

| Cheque | Accepted in SGD issued by a Singaporean bank. Subject to clearance before delivery initiation. |

| International Bank Transfer | Includes SWIFT (international) and SEPA (European Union) transfers. |

| PayNow | Singapore Dollar payments up to SGD 200,000 using PayNow with BullionStar's Unique Entity Number (UEN). Funds are received immediately with no transfer costs. |

| Credit/Debit Card | Online payments accepted in SGD (Mastercard, VISA, JCB, UnionPay) and USD (Mastercard, VISA). In-shop payments accepted in SGD (Mastercard, VISA, UnionPay). |

| Cryptocurrency | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC). Payment must be initiated within 20 minutes of placing the order. |

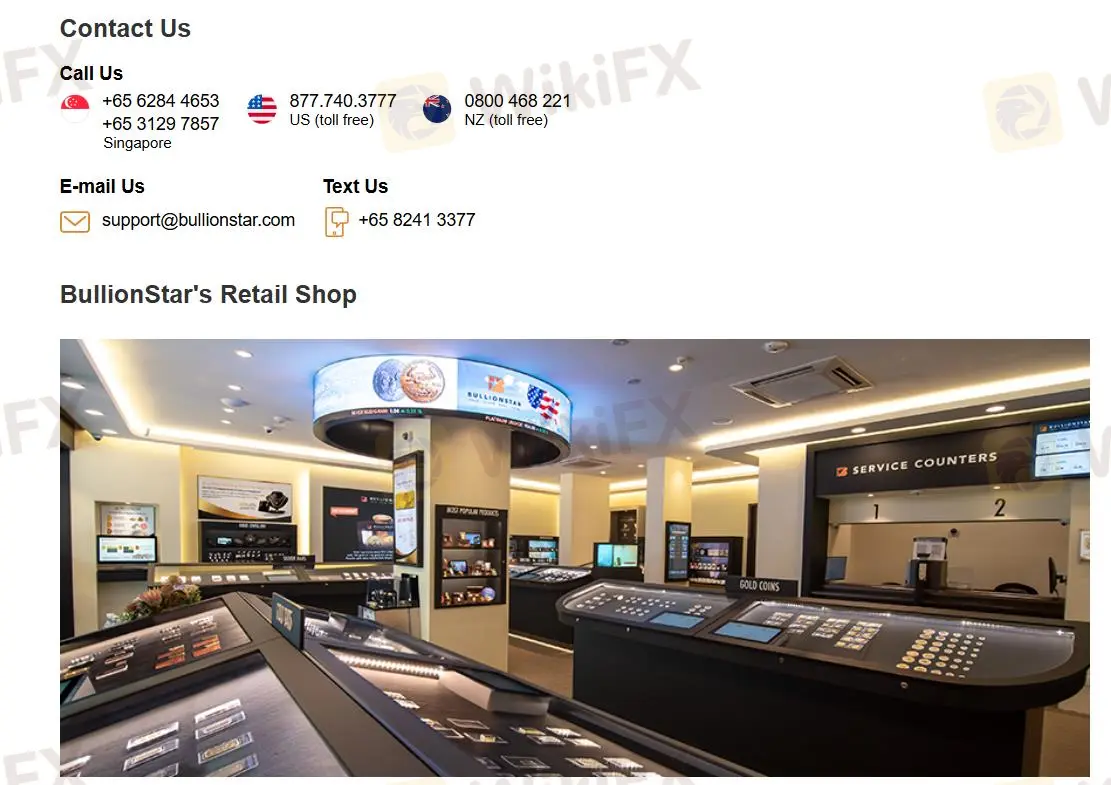

Customer Service

BullionStar offers customer support primarily through phone and email channels, with a physical office for in-person assistance. Their website hosts a comprehensive FAQ section to address common queries, while social media engagement on Telegram, Twitter, Instagram, Facebook and YouTube allows for community interactive.

- Address: 45 New Bridge RoadSingapore 059398

- Email: support@bullionstar.com

- Tel: +65 6284 4653, +65 3129 7857, +65 8241 3377(Singapore); 877.740.3777 (US toll free); 0800 468 221 (NZ toll free)

Conclusion

BullionStar is a Singapore-based company who provides a wide range of products and services, including bullion sales, shipping and storage as well as safe deposit boxes. However, it operates without regulatory oversight.

While offering strong security measures and comprehensive customer service through phone, address, email, and a detailed FAQ, the absence of regulation raises concerns about investor protection and transparency. Interested investors should consider these factors carefully when deciding whether to engage with BullionStar or not.

Q&A

- Is BullionStar regulated?

No. The broker is currently under no valid regulation.

- Is BullionStar a good broker for beginners?

No, though the company offers multiple security measures, it is not ideal for beginners due to its lack of regulatory oversight and may not offer the same protections as regulated brokers.

- What types of precious metals does BullionStar offer?

BullionStar offers gold, silver, platinum, and palladium. These are available in various forms such as bars, coins, and numismatics, etc.

- What payment methods does BullionStar accept?

Bank transfers, credit/debit cards, cryptocurrencies (Bitcoin, Bitcoin Cash, Ethereum, Litecoin), and PayNow for Singapore customers, etc.

- How long do I have to make payment after placing an order with BullionStar?

Payment must be initiated by the next business day following the order placement.

- Are there any taxes on bullion purchased from BullionStar?

Singapore does not impose GST/VAT/sales tax on bullion purchases.

- Is there insurance coverage for precious metals stored with BullionStar?

Yes, all precious metals stored with BullionStar are insured against theft and damage, providing peace of mind to customers.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

Verbundener Broker

WikiFX-Broker

Aktuelle Nachrichten

MicroStrategy will über 3 Jahre 42 Milliarden Dollar für den Kauf von Bitcoin aufbringen

Saudi-Arabiens Staatsfonds reduziert seine weltweiten Investments – und fokussiert sich auf inländische Projekte

Grund für Optimismus? Umsätze im Handel und Kauflaune steigen an

Solana: Vier-Tage-Rally gestoppt – Trendwende oder Erholung?

XRP und XRP Ledger: Ripple-CTO David Schwartz räumt mit Missverständnissen auf

Uniswap-Preis-Prognose: Technische Aussichten deuten auf einen bullischen Ausbruch hin

Probleme in den USA: Opel-Mutterkonzern Stellantis verzeichnet Umsatzeinbruch

Reddit steigert Gewinne um 42 Prozent — diese Rolle spielt KI dabei

Ethereum: DeFi-König trotz starker Konkurrenz – Chancen und Risiken im Überblick

Bitcoin, Ethereum, Ripple: BTC fällt - Widerstand in der Nähe des Allzeithochs

Wechselkursberechnung