简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SQUAREDFINANCIAL 3511893046

摘要:SquaredFinancial is a regulated online trading broker that offers access to trade multiple financial instruments, including forex, metals, stocks, indices, futures, energies, and cryptocurrencies. The company provides various account types, platforms, deposit and withdrawal options, educational resources, and customer support services to cater to the needs of different traders.

| Registered in | Cyprus |

| Regulated by | CYSEC, AMF, FSA, CNMV |

| Year(s) of establishment | 10-15 years |

| Trading instruments | Forex, metals, stocks, indices, futures, energies, cryptos |

| Minimum Initial Deposit | $0 |

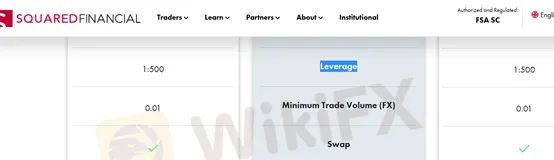

| Maximum Leverage | 1:500 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, own platform Squared WebTrader |

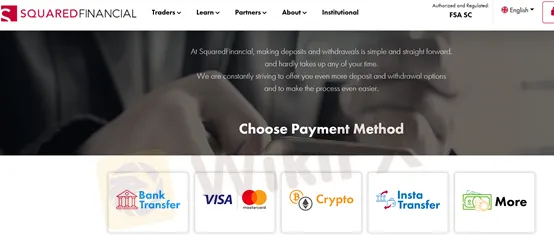

| Deposit and withdrawal method | Bank transfer, VISA, crypto, insta transfer, and more payment methods |

| Customer Service | Email, phone number, address |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and Cons of SQUAREDFINANCIAL

Pros:

Regulated by several reputable financial authorities, including CYSEC, BAFIN, BDF, FSA, and CNMV

Wide range of tradable instruments across seven different asset classes

Two types of trading accounts to choose from with different features and requirements

Competitive spreads and leverage up to 1:500

Multiple deposit and withdrawal methods with quick processing times

Variety of educational resources available for traders of all levels

Three trading platforms available, with proprietary platform

Multilingual customer support available 24/5

Cons:

Limited availability of account base currencies

Limited information on the website about the company's history and management team.

What type of broker is SQUAREDFINANCIAL?

| Advantages | Disadvantages |

| SQUAREDFINANCIAL offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, SQUAREDFINANCIAL has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

SQUAREDFINANCIAL is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, SQUAREDFINANCIAL acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that SQUAREDFINANCIAL has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with SQUAREDFINANCIAL or any other MM broker.

General information of SQUAREDFINANCIAL

SquaredFinancial is a regulated online trading broker that offers access to trade multiple financial instruments, including forex, metals, stocks, indices, futures, energies, and cryptocurrencies. The company provides various account types, platforms, deposit and withdrawal options, educational resources, and customer support services to cater to the needs of different traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Regulatory Status

SquaredFinancial is a globally regulated brokerage firm, adhering to the standards set by several prominent regulatory authorities:

Cyprus Securities and Exchange Commission (CySEC): SquaredFinancial is regulated under license number 329/17, which aligns with stringent EU regulatory frameworks, offering high levels of investor protection and financial transparency.

Autorité des Marchés Financiers (AMF): In France, SquaredFinancial operates under license number 71593, ensuring compliance with French financial regulations and providing a safe investment environment within the French market.

Seychelles Financial Services Authority: For its offshore operations, SquaredFinancial is regulated under license number SD024. This allows the firm to offer certain financial services with more flexible conditions, appealing to a broader range of international clients while still maintaining oversight.

Comisión Nacional del Mercado de Valores (CNMV): In Spain, the firm is regulated under license number 4421, ensuring adherence to Spanish regulations and enhancing security for Spanish traders.

Market instruments

| Advantages | Disadvantages |

| Diverse range of trading options | Potential for information overload |

| Ability to diversify investment | Difficulty in keeping up with all markets |

| Access to different asset classes | Requires thorough market research |

| Opportunity for higher returns | Increased risk with some assets |

| Flexible trading options | Complex trading strategies with some assets |

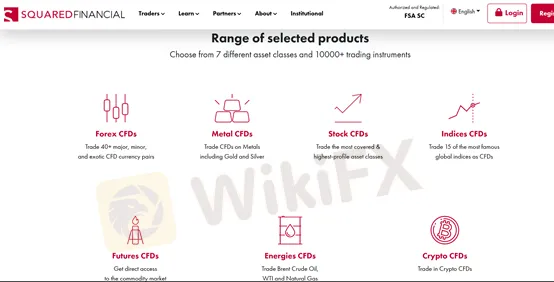

SqaredFinancial offers its clients a wide range of trading instruments, covering over 10,000 financial instruments across 7 asset classes. This allows traders to diversify their investments and have access to multiple markets to find trading opportunities. The asset classes available for trading include forex, metals, stocks, indices, futures, energies, and cryptocurrencies. While having access to a diverse range of trading options can provide numerous opportunities for profit, traders must conduct thorough market research and manage the increased risk associated with some asset classes. Additionally, traders must be able to keep up with all markets and may potentially experience information overload. Overall, the vast array of trading instruments offered by SquaredFinancial provides traders with a flexible and dynamic trading experience.

Spreads and commissions for trading with SQUAREDFINANCIAL

| Advantages | Disadvantages |

| Low spreads on Squared Elite | Commission charges on Squared Elite |

| No commissions on Squared Pro | Higher spreads on Squared Pro |

| Transparent pricing structure | |

| Competitive overall costs |

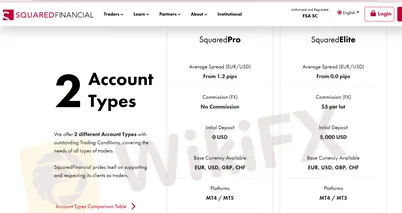

Squared Financial offers two types of accounts with varying spreads, commissions, and costs. The Squared Pro account has average spreads of EURUSD from 1.2 pips and does not charge any commission. On the other hand, the Squared Elite account offers lower spreads, starting from 0.0 pips, but charges a $5 commission per trade. Both accounts have a choice of four base currencies - EUR, USD, GBP, and CHF. The pricing structure is transparent and offers competitive overall costs for trading. However, it is important to note that while Squared Elite offers lower spreads, it charges a commission, which may not be suitable for traders who prefer zero-commission accounts. Meanwhile, Squared Pro offers no commissions, but its spreads are relatively higher.

Trading accounts available in SQUAREDFINANCIAL

| Disadvantages | |

| No initial deposit requirement for Squared Pro account | High initial deposit requirement of $5000 for Squared Elite account |

| Competitive average spreads of EURUSD from 1.2 pips for Squared Pro account | $5 commission per lot traded for Squared Elite account |

| No commissions for Squared Pro account | Squared Pro account may have higher spreads compared to other brokers |

| Four base currency options available for both account types (EUR, USD, GBP, CHF) |

SquaredFinancial offers two main account types - Squared Pro and Squared Elite. The Squared Pro account requires no initial deposit and has average spreads of EURUSD from 1.2 pips with no commissions. This account also offers four base currency options (EUR, USD, GBP, and CHF). On the other hand, the Squared Elite account requires an initial deposit of $5000 and has average spreads of EURUSD from 0.0 pips, but comes with a $5 commission per lot traded. Like the Squared Pro account, the Squared Elite account also offers four base currency options. While the Squared Pro account may have higher spreads compared to other brokers, the absence of commissions and no initial deposit requirement may be attractive to some traders. However, the high initial deposit requirement for the Squared Elite account may not be feasible for all traders.

Trading platform(s) that SQUAREDFINANCIAL offers

| Advantages | Disadvantages |

| Wide range of platforms including MT4, MT5, and Squared WebTrader | No proprietary trading platform |

| MT4 and MT5 are highly customizable and user-friendly | No mobile app for Squared WebTrader |

| MT4 and MT5 offer advanced charting and trading tools | |

| Access to automated trading with expert advisors and custom indicators |

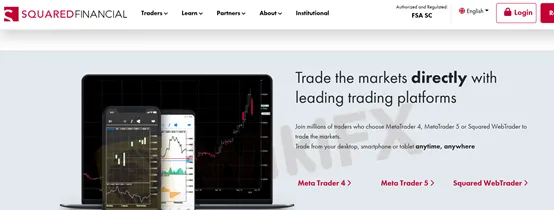

Squared Financial offers a variety of trading platforms including the popular MetaTrader 4 and MetaTrader 5 platforms as well as their own Squared WebTrader. Both MT4 and MT5 are highly customizable and user-friendly, offering advanced charting and trading tools, access to automated trading with expert advisors and custom indicators. Squared WebTrader offers traders the ability to trade from any browser with no download required. However, there is no proprietary trading platform offered by Squared Financial, and there is no mobile app available for the Squared WebTrader platform. Overall, the platform dimension offers a wide range of options and user-friendly features for traders.

Maximum leverage of SQUAREDFINANCIAL

| Advantages | Disadvantages |

| Enables traders to potentially increase profits | Increases the potential risk of losses |

| Allows traders to control larger positions with a smaller amount of capital | May lead to overleveraging and larger losses than the account balance |

| Gives traders more trading flexibility and opportunities | Can cause emotional trading due to the potential for large profits or losses |

| Can enhance the efficiency of trading strategies | May result in margin calls and forced liquidations of positions |

The maximum leverage offered by SQUAREDFINANCIAL is up to 1:500, which means that traders can control a position size up to 500 times larger than their account balance. While this may increase potential profits, it also increases the potential risk of losses. Traders should be aware of the risks associated with high leverage and use it carefully to avoid overleveraging and margin calls. However, the high leverage offered by SQUAREDFINANCIAL can provide traders with more trading flexibility and opportunities, allowing them to potentially enhance the efficiency of their trading strategies. It is important to note that high leverage can also cause emotional trading due to the potential for large profits or losses.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| Multiple payment options available | Withdrawals may take several days to be processed |

| Deposit and withdrawal processes are simple and straightforward | Withdrawals can only be made via the same method used for deposits |

| Fast processing time for withdrawal requests | Some payment methods may have fees associated with them |

| Back Office team processes withdrawal requests within 2 working days | |

| Bank transfers are typically processed within 24 working hours |

SquaredFinancial offers a range of payment options for deposit and withdrawal, including bank transfer, VISA, crypto, and insta transfer, making it easy for traders to manage their funds. The deposit and withdrawal processes are straightforward, and the Back Office team processes withdrawal requests within 2 working days. However, it is important to note that withdrawals can only be made via the same method used for deposits, and some payment methods may have fees associated with them. Additionally, while withdrawal requests are processed quickly, it may take several days for the funds to be credited to your account depending on the payment method used. Overall, SquaredFinancial provides a convenient and efficient payment system for traders.

Educational resources in SQUAREDFINANCIAL

SQUAREDFINANCIAL offers a variety of educational resources to help traders improve their skills and knowledge. The trading guides and articles provide clear explanations on trading concepts and strategies, while market insights and analysis can help traders make informed trading decisions. Access to trading FAQs can also provide quick answers to common trading questions. However, some educational resources may not be comprehensive enough for advanced traders, and may require a significant time commitment to fully utilize and understand. Additionally, some educational resources may be generic and not specific to individual trading needs, and may become outdated quickly in a rapidly changing market.

Customer service of SQUAREDFINANCIAL

| Advantages | Disadvantages |

| 24/5 customer support via telephone and email | No 24/7 customer support |

| Limited social media support | No live chat support |

| Headquarters located in Seychelles |

SQUAREDFINANCIAL offers customer support through telephone and email, available 24/5. The company's headquarters is also located in Seychelles, which may offer local customers a sense of security. However, the lack of 24/7 customer support may not be ideal for traders who need assistance outside of regular business hours. In addition, there is no live chat support available and the company's social media support is limited. Overall, the customer care dimension of SQUAREDFINANCIAL is satisfactory, but there is room for improvement in terms of expanding customer support channels and increasing availability.

Conclusion

In conclusion, SQUAREDFINANCIAL is a well-regulated forex broker that offers a wide range of trading instruments and account types with competitive spreads and commissions. The company provides several trading platforms, including the popular MetaTrader 4 and MetaTrader 5, and offers a maximum leverage of up to 1:500. The deposit and withdrawal process is simple and straightforward, with a variety of payment methods available. The educational resources provided by SQUAREDFINANCIAL are also a great benefit for both new and experienced traders. Additionally, the company's customer care is available through multiple channels, including phone and email support. Overall, SQUAREDFINANCIAL appears to be a reputable forex broker, offering a comprehensive trading experience for traders of all levels.

Frequently asked questions about SQUAREDFINANCIAL

Question: Is SquaredFinancial a regulated forex broker?

Answer: Yes, SquaredFinancial is a regulated forex broker. The company is registered in Cyprus and is regulated by several financial regulatory bodies, including CYSEC, BAFIN, BDF, FSA, and CNMV.

Question: What are the trading platforms offered by SquaredFinancial?

Answer: SquaredFinancial offers its clients the MetaTrader 4, MetaTrader 5, and Squared WebTrader trading platforms.

Question: What are the account types available at SquaredFinancial?

Answer: SquaredFinancial offers two account types: the Squared Pro account and the Squared Elite account. The Squared Pro account has no minimum deposit requirement, while the Squared Elite account requires an initial deposit of $5,000.

Question: What is the maximum leverage offered by SquaredFinancial?

Answer: SquaredFinancial offers a maximum leverage of up to 1:500.

Question: What are the deposit and withdrawal methods available at SquaredFinancial?

Answer: SquaredFinancial offers several deposit and withdrawal methods, including bank transfer, VISA, crypto, insta transfer, and more. Withdrawal requests are processed within 2 working days by the Back Office Team.

Question: Does SquaredFinancial offer educational resources for traders?

Answer: Yes, SquaredFinancial offers a series of educational resources, such as trading guides, educational articles, market insights, and trading FAQs.

Question: Where is SquaredFinancial's headquarters located?

Answer: SquaredFinancial's headquarters are located at Commercial House 1, Office no 4, Eden Island, Mahe, Seychelles.

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

2024美國大選如何改變外匯市場?價差與流動性的深度解析

2024美國總統選舉對黃金和外匯價格的影響

如何在MT4中安裝EA的基本步驟

大選交易錦囊:在2024美國大選期間千萬別犯的7個錯誤

詐騙平台曝光!仿冒GO MARKETS高匯釣魚網站行騙中,註冊前請比對官方網址

慎防詐騙黑平台Aden Markets!誤信飆股群組假投資話術,投資100萬無法出金還被爆倉

詐騙警報!外匯券商Saxo盛寶金融遭黒平台假冒,投資前請比對官方網址

AUS Global 鞏固中東版圖:獲得阿聯酋新牌照

FOREX.com嘉盛集團與 Kalshi 合作推出美國大選交易

香港交易商HKJP驚傳交易糾紛!假網友邀請加群做投資,黑平台拒絕出金已潛逃

匯率計算