Score

FXPRIMUS

Cyprus|10-15 years| Benchmark A|

Cyprus|10-15 years| Benchmark A|https://www.fxprimus.com

Website

Rating Index

Benchmark

Benchmark

A

Average transaction speed (ms)

MT4/5

White Label

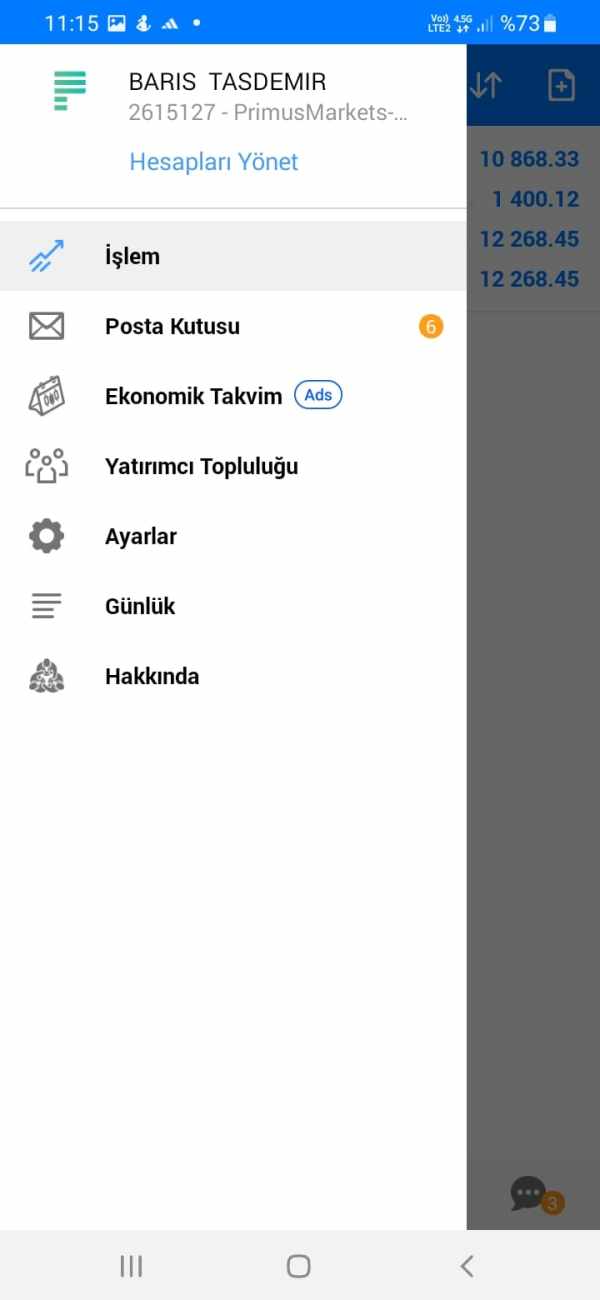

PrimusGlobal-Practice

Influence

A

Influence index NO.1

France 6.22

France 6.22Benchmark

Speed:C

Slippage:AA

Cost:AAA

Disconnected:A

Rollover:B

MT4/5 Identification

MT4/5 Identification

White Label

United States

United StatesInfluence

Influence

A

Influence index NO.1

France 6.22

France 6.22Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The WikiFX cloud system has verified this broker has way too many complaints, and it is in the WikiFX complaint blacklist. Please be aware of the risk!

Basic information

Cyprus

CyprusAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed FXPRIMUS also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

| 922*** | USDJPYx | 12-24 20:50:22 | |

Tokyo Tokyo | 494*** | USDJPYx | 12-16 14:40:06 |

Taipei Taipei | 333*** | USDJPYx | 12-13 09:50:52 |

Stop Out

1.43%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Botswana

Cambodia

Cyprus

fxprimus.eu

Server Location

United States

Website Domain Name

fxprimus.eu

Server IP

104.21.33.165

primusmarketscn.com

Server Location

United States

Website Domain Name

primusmarketscn.com

Website

WHOIS.VERISIGN-GRS.COM

Company

-

Server IP

104.31.67.222

integritas.asia

Server Location

United States

Website Domain Name

integritas.asia

Website

WHOIS.NIC.ASIA

Company

DOTASIA

Domain Effective Date

2013-02-12

Server IP

104.18.192.52

Genealogy

VIP is not activated.

VIP is not activated.FOREXOTODAY

primuscfd

Mega Trade Station

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| FXPRIMUS Review Summary in 10 Points | |

| Founded | 2009 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Market Instruments | Forex, Metals, Energies, Equities, Indices, Futures and CFD Cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0 pips |

| Trading Platforms | MT4, MT5, cTrader, WebTrader |

| Minimum deposit | $15 |

| Customer Support | 24/5 live chat, email |

What is FXPRIMUS?

FXPRIMUS is a CySEC-regulated retail forex and CFD broker, founded in 2009 and headquartered in Cyprus. FXPRIMUS offers trading on a range of financial instruments including Forex, Metals, Energies, Equities, and Indices, different account types with varying minimum deposits and leverages, and multiple trading platform choices of MT4, MT5, cTrader, and WebTrader.

Pros & Cons

| Pros | Cons |

| • Regulated by CYSEC | • Clients from Australia, Belgium, Iran, Japan, North Korea and USA are not accepted |

| • High-level protection measures for clients | • Higher minimum deposit for certain account types |

| • Wide range of market instruments | • Limited copy trading availability |

| • Low minimum deposit | |

| • No deposit or withdrawal fees | |

| • Competitive spreads and commissions | |

| • Various deposit and withdrawal methods | |

| • Strong customer service support | |

| • Comprehensive trading tools and educational resources |

Overall, FXPRIMUS appears to be a legitimate and reliable broker with strong regulatory oversight and high-level protection measures. They offer a wide range of trading instruments and account types, as well as various trading platforms and educational resources.

FXPRIMUS Alternative Brokers

FXCM - a well-established broker with a good reputation and comprehensive trading tools;

FxPro - offers competitive pricing and advanced trading platforms;

Exness - has a user-friendly platform and low minimum deposits.

There are many alternative brokers to FXPRIMUS depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is FXPRIMUS Safe or Scam?

FXPRIMUS is a legitimate online broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC). It is also a member of the Investor Compensation Fund (ICF) in Cyprus, which provides protection to clients in the event of the company's insolvency. Overall, FXPRIMUS appears to be a reputable broker.

How are you protected?

FXPRIMUS places a strong emphasis on client protection measures. It offers Negative Balance Protection, which means that clients will never lose more than their account balance. Additionally, FXPRIMUS uses top-tier liquidity providers, ensuring fast and reliable execution of trades. The broker's funds are audited by a third-party auditor to ensure transparency, and client funds are held in segregated accounts, separate from the broker's operating funds. These measures help to ensure that FXPRIMUS clients are protected from financial fraud and malpractice.

Our Conclusion on FXPRIMUS Reliability:

Based on the information provided, FXPRIMUS appears to have strong protection measures in place for their clients, including regulation by CYSEC, negative balance protection, top-tier liquidity, and audit and segregated accounts. These measures provide a level of assurance that FXPRIMUS is committed to the security of its clients' funds. Therefore, it can be concluded that FXPRIMUS is a trustworthy broker for traders.

Market Instruments

FXPRIMUS offers a diverse range of market instruments for its clients to trade. In addition to forex pairs, clients can also trade metals such as gold and silver, as well as energies such as oil and natural gas. The broker also offers equities, indices, futures, and CFD cryptocurrencies. With such a wide range of market instruments available, clients can diversify their trading portfolios and take advantage of different market opportunities.

Accounts

FXPRIMUS offers three account types, Primus Classic, Primus Pro, and Primus Zero, with minimum deposits ranging from $15 to $1,000. Primus Classic accounts are the most accessible with a low minimum deposit requirement of $15, while Primus Pro and Primus Zero accounts require higher minimum deposits of $500 and $1,000, respectively. Copy trading is only available for Primus Classic accounts. FXPRIMUS also offers demo accounts for traders to practice their strategies before committing to a live account.

Leverage

FXPRIMUS provides varying leverage options depending on the account type and trading platform. For instance, for the Primus Classic account, clients can enjoy up to 1:1000 leverage. On the other hand, for the Primus Pro account, leverage is up to 1:500 on the MT4 platform and up to 1:1000 on the MT5 platform. For the Primus Zero account, the maximum leverage offered is up to 1:500. It is essential to note that high leverage levels carry a higher risk of potential losses, and traders should exercise caution when using high leverage levels.

Spreads & Commissions

FXPRIMUS offers competitive spreads and commissions across its account types. The spreads for the Primus Classic account start from 1.5 pips with no commission, which is suitable for beginners who are looking for a commission-free trading experience. For the Primus Pro account, the spreads are variable and start from as low as 0.3 pips, but the commissions are higher at $8 on the MT5 and $10 on the MT4. For experienced traders who prefer tighter spreads, the Primus Zero account offers spread from 0 pips with a commission of $5, making it suitable for high-frequency trading strategies.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| FXPRIMUS | From 0.0 pips | No commission on Primus Classic |

| FXCM | From 0.2 pips | No commission on Standard |

| FxPro | From 0.0 pips | From $4.5 on cTrader |

| Exness | From 0.3 pips | No commission on Standard |

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

FXPRIMUS offers a range of popular trading platforms to cater to the needs of different types of traders. The platform options include the widely used MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and WebTrader.

The MT4 and MT5 platforms are popular among traders due to their user-friendly interface, advanced charting capabilities, and customizable indicators.

The cTrader platform is preferred by traders who seek a more transparent trading environment with direct market access (DMA) and Level II pricing.

The WebTrader platform is a web-based platform that allows traders to access their accounts from any device with an internet connection, without the need to download or install any software.

Overall, FXPRIMUS' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| FXPRIMUS | MT4, MT5, cTrader, WebTrader |

| FXCM | Trading Station, MT4 |

| FxPro | MT4, MT5, cTrader |

| Exness | MT4, MT5, WebTerminal |

Trading tools

FXPRIMUS offers a variety of trading tools to assist its clients. The pip calculator helps traders calculate the value of a pip for a given currency pair and position size. The margin calculator allows traders to calculate the margin required to open and hold a position. The currency converter helps traders convert one currency to another at current exchange rates.

In addition, FXPRIMUS provides a market calendar that shows the schedule of economic events and their expected impact on the market, which can help traders make informed trading decisions. These tools can be accessed through the FXPRIMUS website or the trading platforms.

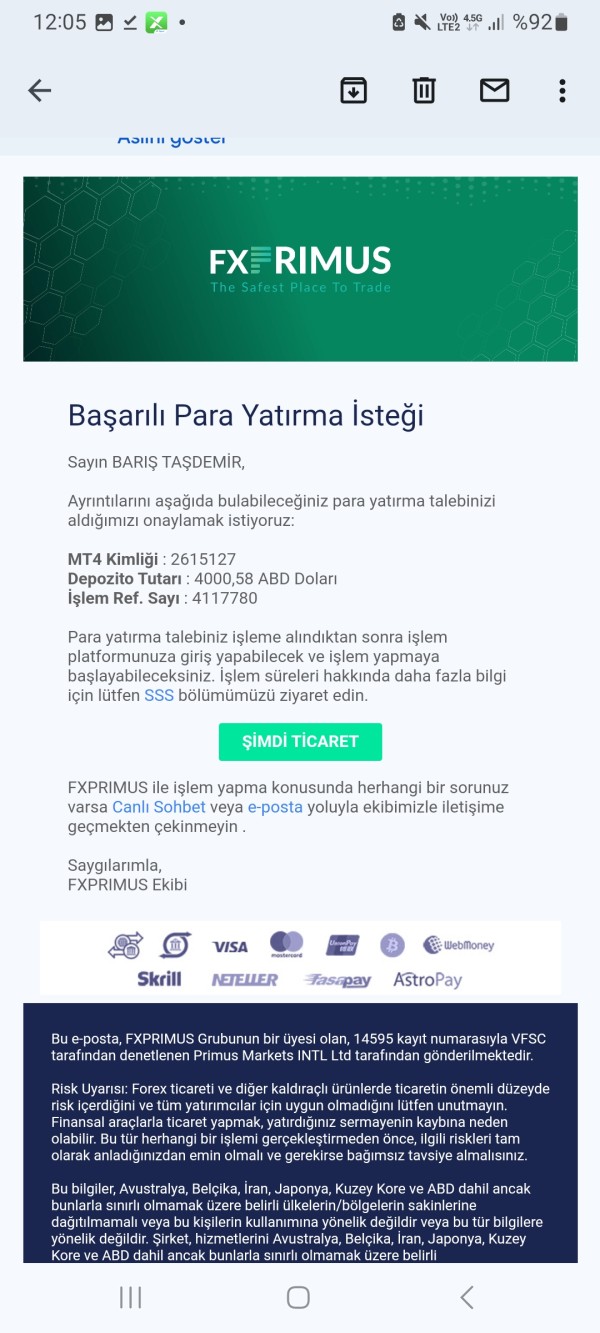

Deposits & Withdrawals

FXPRIMUS offers various deposit and withdrawal methods, including Bank Wire, Local Transfer, Credit Cards, and e-Wallets.

The minimum deposit is relatively low at $15. There are no deposit or withdrawal fees charged by FXPRIMUS, but your payment provider may charge a fee. However, it is worth noting that the minimum withdrawal amount is $100, which may be higher than some traders would prefer.

FXPRIMUS minimum deposit vs other brokers

| FXPRIMUS | Most other | |

| Minimum Deposit | $15 | $100 |

The processing time for withdrawals varies depending on the payment method chosen, with Bank Wire taking 2-5 working days, Local Transfer taking 1-5 working days, and Credit Cards and e-Wallets taking up to 5 minutes.

FXPRIMUS Money Withdrawal

To withdraw funds from FXPRIMUS, you can follow these steps:

Step 1: Log in to your FXPRIMUS account and click on the “Withdrawals” option in the main menu.

Step 2: Select the payment method you want to use for the withdrawal.

Step 3: Enter the amount you want to withdraw and click on the “Submit” button.

Step 4: Follow the instructions provided by the payment method you selected to complete the withdrawal process.

Fees

FXPRIMUS does not charge any deposit or withdrawal fees; however, payment provider fees may apply.

The broker charges an inactivity fee of $10 per month for accounts that have been inactive for 180 days or more. This fee is charged to cover the costs of maintaining the account and providing access to trading services, educational resources, and customer support. However, the inactivity fee can be avoided by simply logging into the trading account at least once every 180 days. It's important to note that the inactivity fee is only charged on the balance of the account and not on the deposited amount.

It also charges swap fees for holding positions overnight, and these fees vary depending on the instrument being traded.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| FXPRIMUS | Free | Free | $10 per month after 180 consecutive days of inactivity |

| FXCM | Free | Free | $50 per year after 12 months of inactivity |

| FxPro | Free | Free | $0 after 12 months of inactivity |

| Exness | Free | Varies by payment method | No |

It is important to note that fees and charges are subject to change, and clients should refer to the brokers websites for up-to-date information.

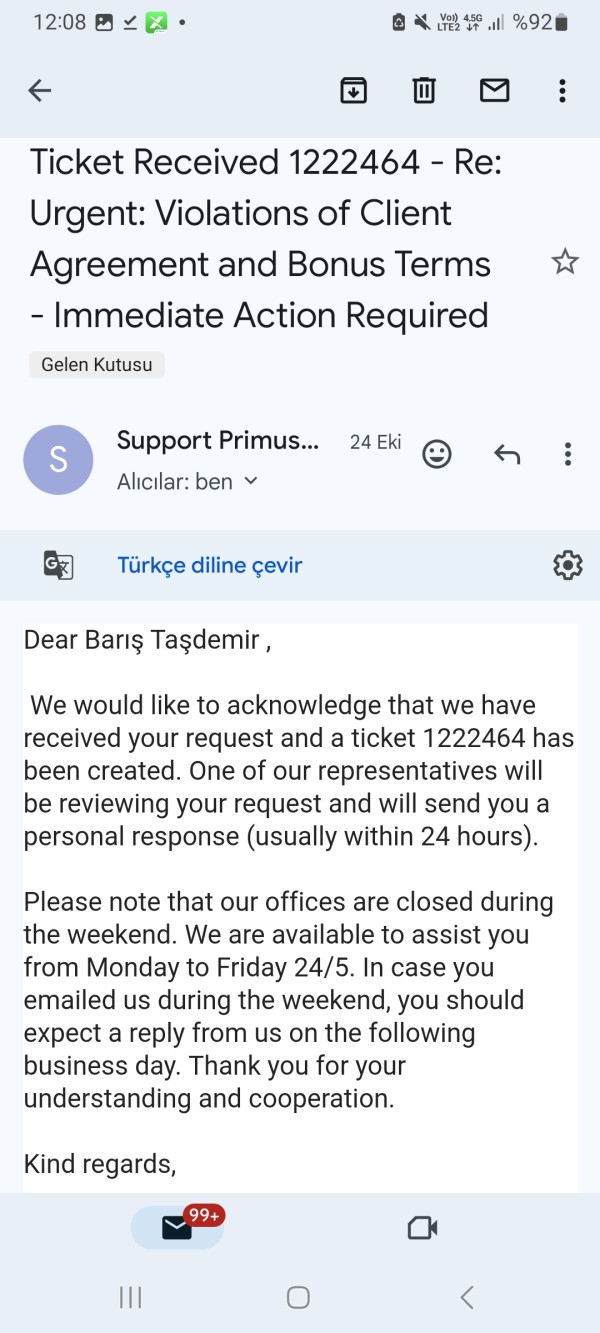

Customer Service

FXPRIMUS customer service offers various channels for clients to reach out for support. Clients can access 24/5 live chat, email, and online messaging to get in touch with customer support representatives. In addition, the broker provides support via messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram. This allows clients to contact customer support representatives in a convenient and accessible way.

Furthermore, FXPRIMUS has a presence on social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. This enables clients to stay up-to-date with the latest news and updates from the broker.

| Pros | Cons |

| • 24/5 live chat | • No phone support |

| • Multiple language support for live chat and email | • No support on Weekends |

| • Active on social media channels for customer engagement | • Live chat can be slow to respond during busy periods |

Note: These pros and cons are subjective and may vary depending on the individual's experience with FXPRIMUS' customer service.

Education

FXPRIMUS offers a variety of educational resources for traders of all levels. These resources include video tutorials, educational materials, live webinars, and articles.

The video tutorials cover a range of topics, from basic concepts such as trading terminology and chart analysis to more advanced topics such as risk management and trading strategies.

The educational materials include e-books, trading guides, and other resources to help traders improve their skills and knowledge.

The live webinars are led by experienced traders and cover a variety of topics, including market analysis, trading psychology, and risk management.

The articles on FXPRIMUS' website cover current market news and analysis, trading strategies, and other relevant topics.

Conclusion

In conclusion, FXPRIMUS is a regulated and reliable broker that offers a range of account types with competitive spreads and commissions. The broker provides a variety of trading platforms and trading tools to enhance clients' trading experience. Additionally, the broker offers excellent customer service and educational resources to support traders.

Frequently Asked Questions (FAQs)

| Q 1: | Is FXPRIMUS regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At FXPRIMUS, are there any regional restrictions for traders? |

| A 2: | Yes. FXPRIMUS does not offer its services to residents of certain countries/jurisdictions including, but not limited to, Australia, Belgium, Iran, Japan, North Korea and USA. |

| Q 3: | Does FXPRIMUS offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does FXPRIMUS offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, cTrader, and WebTrader. |

| Q 5: | What is the minimum deposit for FXPRIMUS? |

| A 5: | The minimum initial deposit to open an account is $15. |

| Q 6: | Is FXPRIMUS a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Keywords

- 10-15 years

- Regulated in Cyprus

- Regulated in Vanuatu

- Market Making(MM)

- Retail Forex License

- White label MT4

- White label MT5

- Regional Brokers

- South Africa Financial Service Corporate Expired

- Suspicious Overrun

- High potential risk

- Offshore Regulated

News

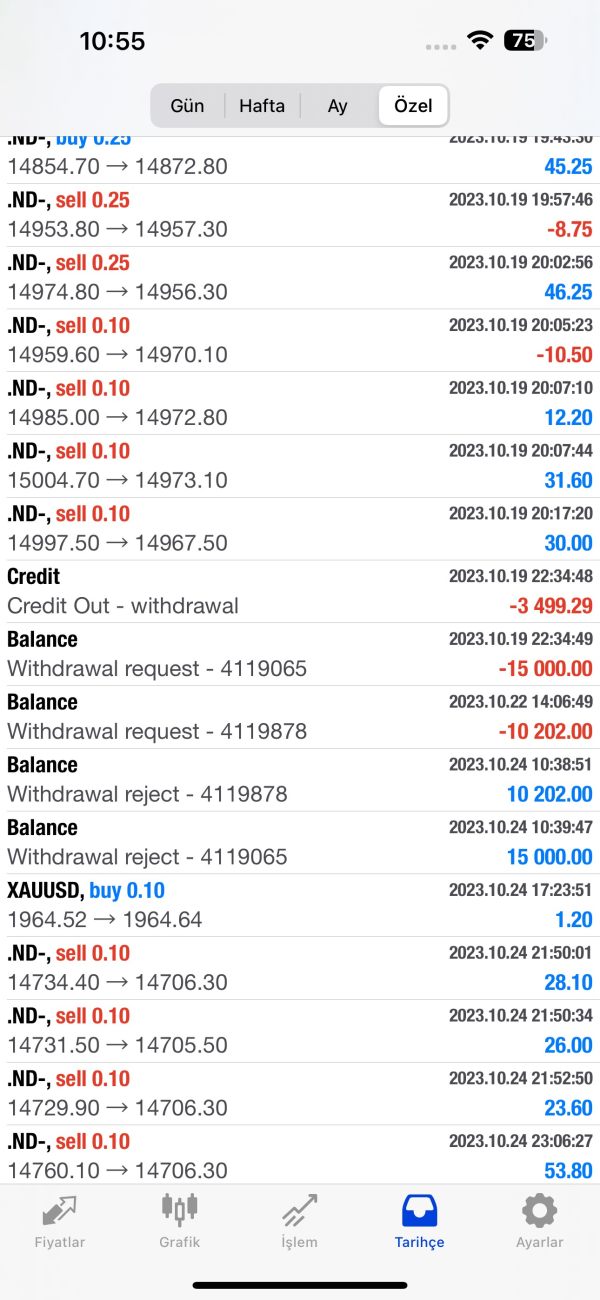

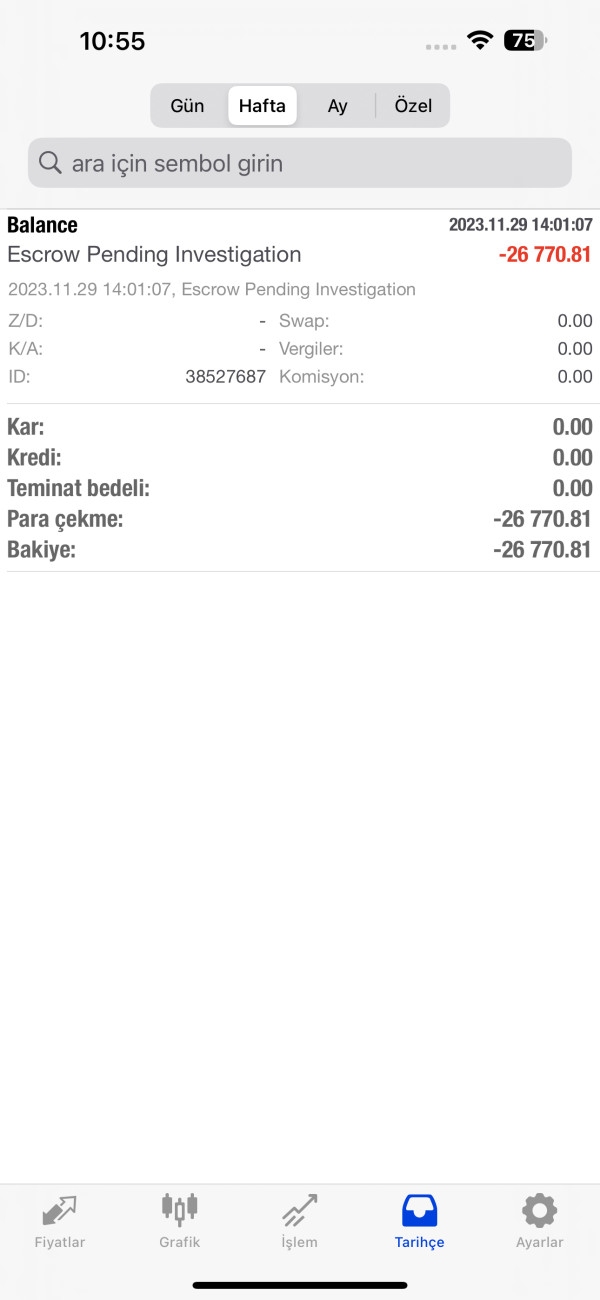

Exposure FXPRIMUS's Withdrawal Woes Strike Again

Amidst the labyrinth of online trading, a troubling tale unfolds, echoing the struggles of an investor entangled in a tumultuous relationship with FXPRIMUS, drawn in by the promise of financial growth via Telegram ads.

2023-11-30 17:03

Exposure Alert: FXPrimus Withdrawal Issues Increasing

Alert: Rising FXPrimus withdrawal issues reported by traders. Learn about the risks and trader experiences with this online trading platform.

2023-11-30 10:25

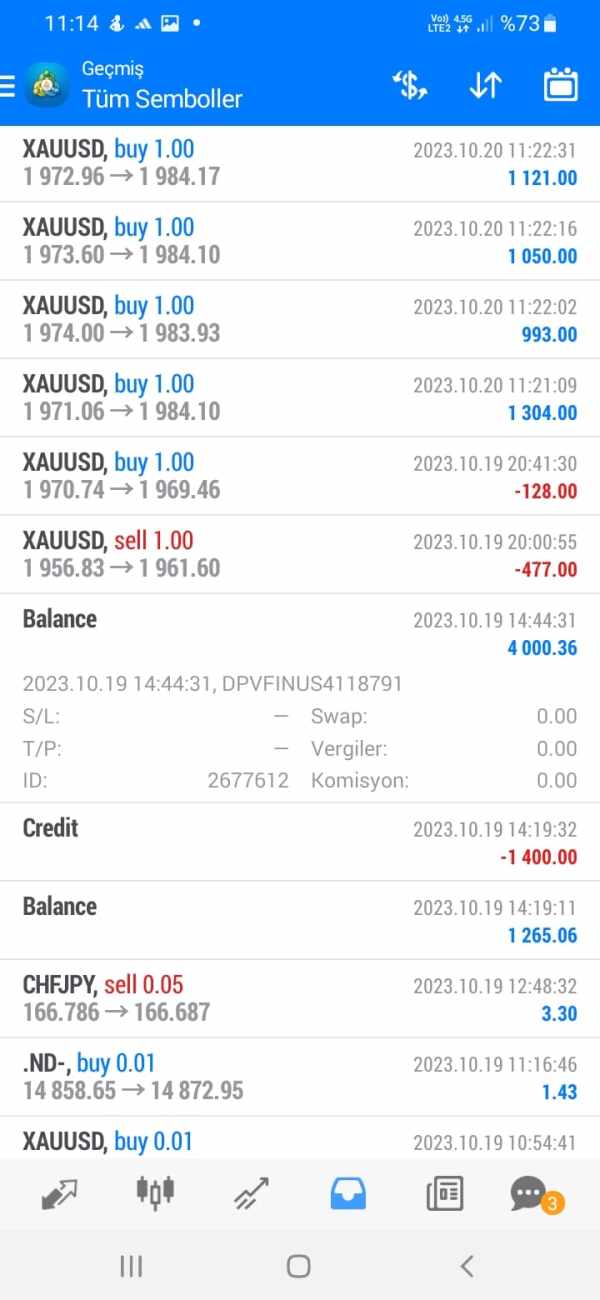

Exposure One more user complaints against Fxprimus

A user filed complaint against FXPrimus and wrote in his complaint that “I wanted to buy gold due to the war because many brokers I followed were saying that gold would rise, then I closed my transactions by taking profit and continued trading”.

2023-11-08 15:24

News WIKIFX REPORT: Forex & CFDs broker FXPRIMUS announces rebrand

FXPRIMUS has revealed the launch of its new brand as well as multiple enhancing features for its clients.

2022-07-01 14:16

News WikiFX Review: Is FXPRIMUS a solid Broker or just another scam?

FXPRIMUS is an online forex brokerage company offering financial services to its clients. Recently, WikiFX has received many feedback from investors within three months. We wonder if FXPRIMUS is really trustworthy. WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyse the reliability of this broker from specific information, regulation, exposure and etc. And you should never miss it.

2022-06-06 15:24

News Exclusive: FXPRIMUS Rebrands after 12 Years of Its Operations

The rebranding better showcases its “greater speed, faster loading and quicker execution.” It is a part of the its broader 2022 mission to bolster its digital and mobile presence.

2022-04-11 14:45

Review 71

Content you want to comment

Please enter...

Review 71

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Nil223

Turkey

This fraudulent company has not paid my money in any way for 2 months. If you look at the complaints, they stole the money of many investors and finally deleted the money from the commodity, there is no ongoing investigation, they just slander and do not give any feedback.

Exposure

2023-12-06

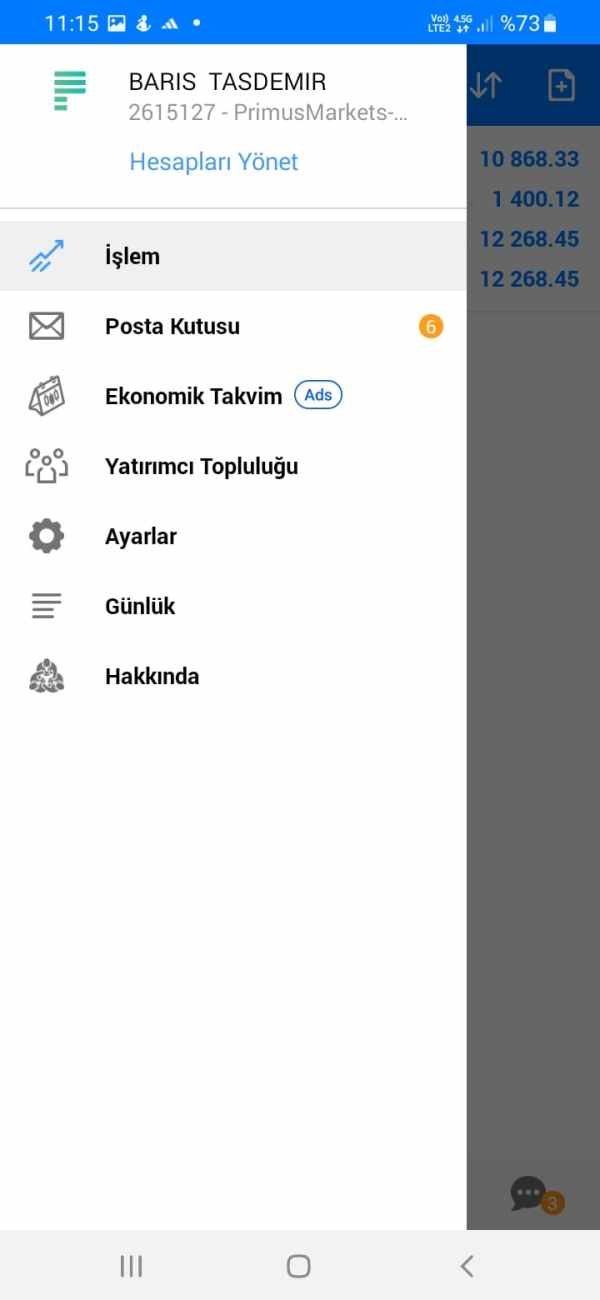

barış

Turkey

fxprimus does not pay my money and I cannot reach any official. They have taken the money from my account. Do not trust this institution. Do not invest at all.

Exposure

2023-12-06

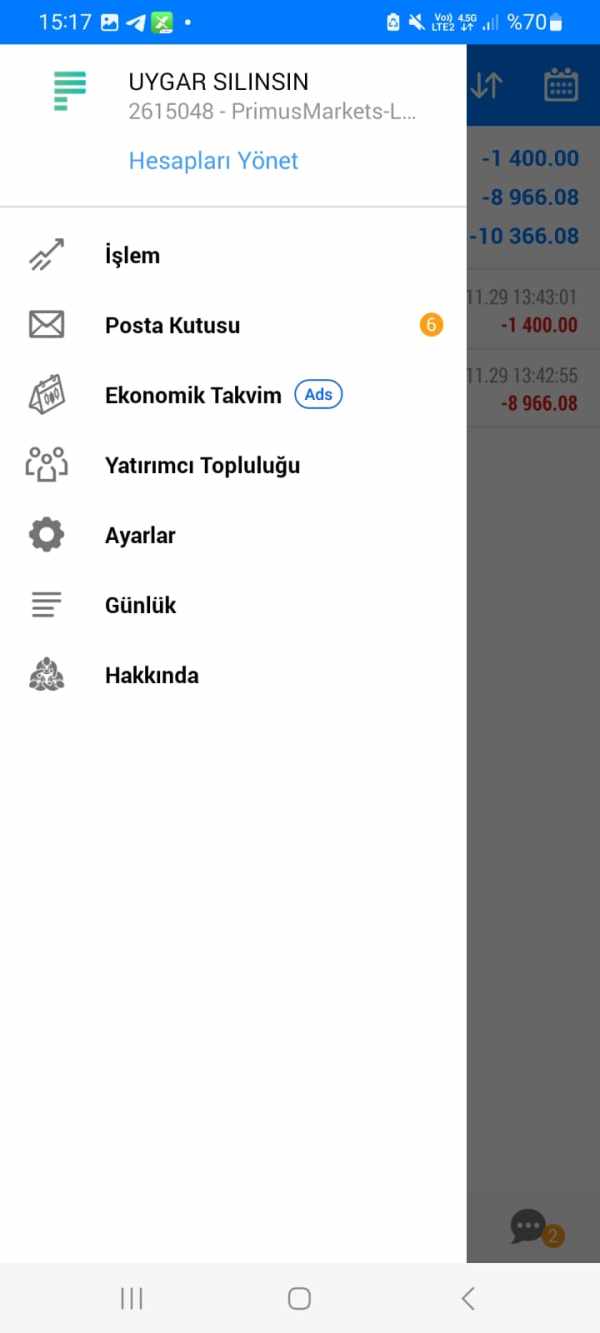

uygar

Turkey

Primus did not pay my money, they deducted my money from Met4 and added it to their own safe. They do not pay my money and I cannot reach any official.

Exposure

2023-12-06

Dilvin

Turkey

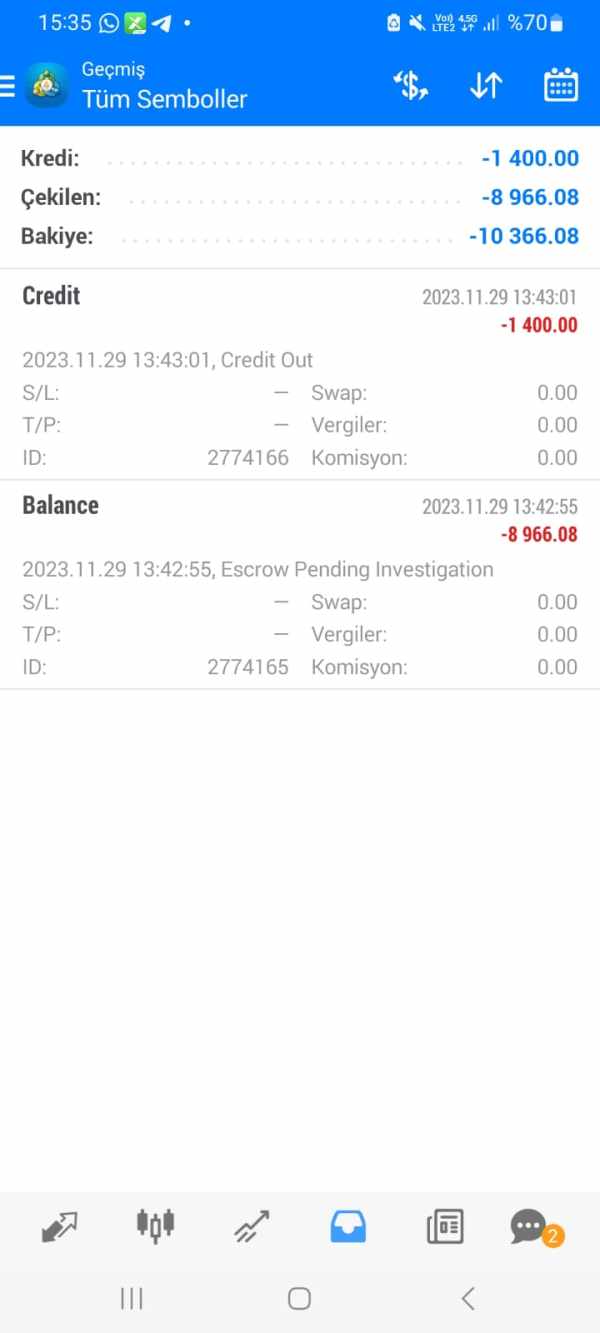

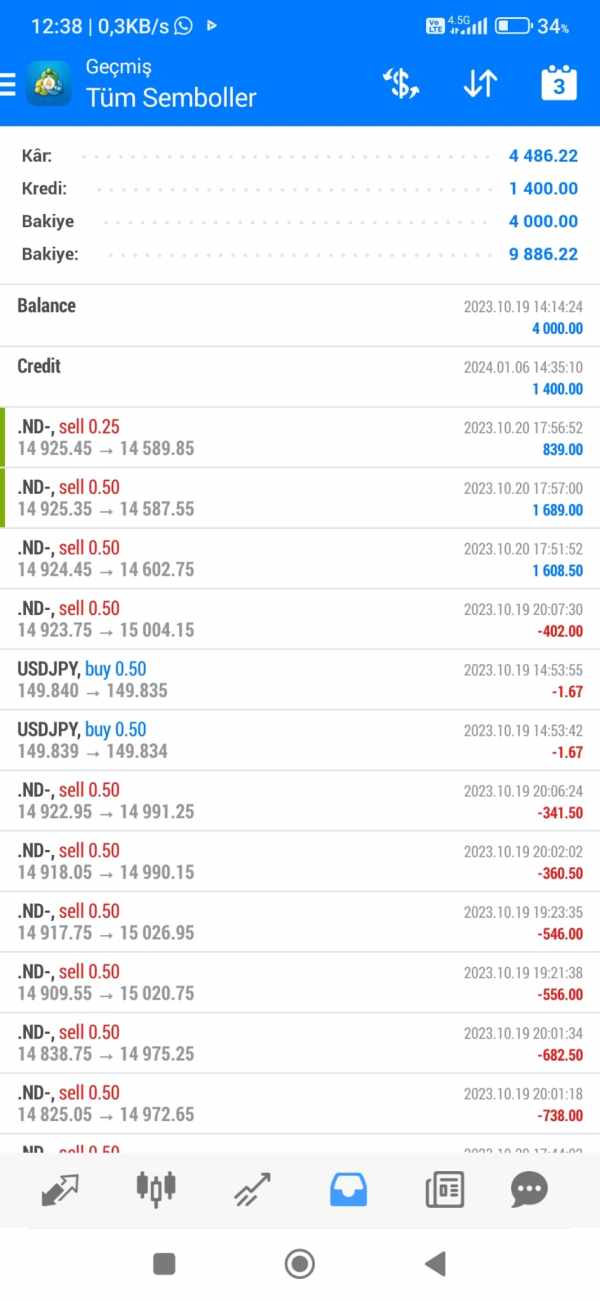

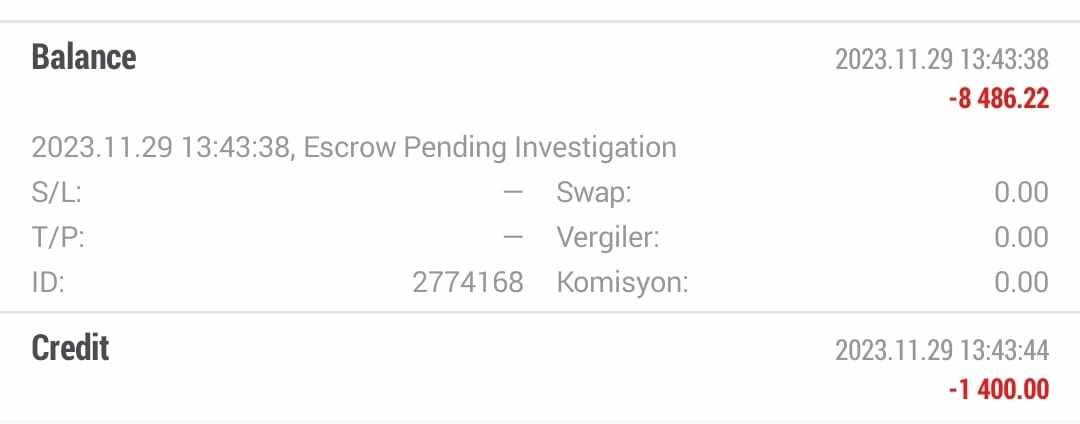

Hello,Company on the subject: Primus Markets INTL LtdI first created my account on October 18, 2023.I secured funding and started trading on October 19, 2023.I tried to withdraw my money after October 20, 2023, but the company says it will not pay my money.I don't even understand what I'm accused of.They constantly send me an e-mail and say it is based on this.I am an individual trading normally.I request you to help me get my money from the company.They deleted my money from the Metatrader application. It's starting to get very annoying now.Thanks.

Exposure

2023-12-06

barış

Turkey

This institution is not paying the money I invested, it is making me a victim. It has been a month and still no solution has been found and it does not provide any response, I need you to help me.

Exposure

2023-11-25

uygar

Turkey

This company does not pay my money, it says that it cannot pay for ridiculous reasons, it has been 2 months and it has confiscated my money and now there is no response.

Exposure

2023-11-25

Aziz3152

Turkey

I have made a deposit to fx primus company 2 times And although my account is below the amount I deposited, it does not send my money, I have been scammed very badly, I cannot withdraw my money, The company has cut off communication with me And is not responding, This is a big fraud case, I hear that many investors in Turkey have been scammed by the same method.

Exposure

2023-11-25

uygar

Turkey

I cannot get my money in this institution. I expect you to intervene in this. I have full faith that this fraud disturbs you as well.

Exposure

2023-11-24

uygar

Turkey

This institution does not withdraw my money and is fraudulent.

Exposure

2023-11-08

Nil223

Turkey

I INVESTED 10,000 DOLLARS IN THIS COMPANY ON 10.12.2023 AND ABOUT A WEEK LATER I REQUESTED THE FIRST WITHDRAWAL AND MY MONEY DID NOT ARRIVE. THEN I WANTED TO WITHDRAW MY WHOLE BALANCE. I WAS TOLD THERE IS A TECHNICAL PROBLEM. MAKE YOUR WITHDRAWAL MANUALLY. MONEY HAS BEEN TRANSFERRED AGAIN TO META REQUIRED DOCUMENTS FOR MANUAL WITHDRAWAL REQUEST I CONDUCTED IT, AND I UNDERSTANDED IT AS IT WAS A TECHNICAL PROBLEM AND MY CHECKS DID NOT REACH ME. THE COMPANY DOES NOT RESPOND IN ANY WAY. IF YOU LOOK AT THE OTHER COMPLAINTS, YOU WILL UNDERSTAND THAT THEY FRAUD MANY INVESTORS. THE NECESSARY EVIDENCE IS ATTACHED.

Exposure

2023-11-02

Bahar6657

Turkey

I received a withdrawal request from fxprimus company 5 days ago, they still haven't sent my money, they created different activities as I tried to communicate.

Exposure

2023-10-26

Alyaz

Turkey

HelloI funded the account number 4614629 on Friday, and although I did not make any transactions, the company rejects the withdrawal request. Even though I haven't made any transactions, I haven't been able to withdraw money for a week because of the company, my e-mails are not answered, and I cannot contact anyone from the company.

Exposure

2023-10-26

muhittin

Turkey

They withheld my money for 4 days, the fraudulent company intervened in my transactions and closed all transactions, interrupted mail response. They do not respond. Be careful, do not lose your money.

Exposure

2023-10-26

Burock

Turkey

This company is a fraud. Hasn't it sent money for a week? First he deducted my money from the meta app and added it back 4 days later. He doesn't pay my money, he makes us suffer.

Exposure

2023-10-26

MendE

Turkey

I deposited 5000 dollars to the company and wanted to withdraw it without making any trade transactions. However, they have not paid my money for 2 days. The support team is not responding. I think I have been scammed. If the payment is not made in a few days, I will file a formal complaint to all licensing agencies. For now, no one should deposit money my acc no: 4613947

Exposure

2023-10-26

metin cengiz

Turkey

Hello, this institution persistently does not provide my payment. For 7 days I have not been able to withdraw my money. I have opened countless tickets but they still do not send money. I advise you not to make your investments in this institution. I have never experienced this situation in any global institution, I have been victimized, not those who read this article.

Exposure

2023-10-25

FX3622982718

Turkey

Hello, fxprimus company does not pay the 8870 USD profit I earned after the investment I made to my account with login number 4614490. I would be glad if you can help me withdraw my money by saying there is a problem in the customer panel.

Exposure

2023-10-25

alex7827

Vietnam

Server Slippage on cTrader. I havent place 8 Orders opened at the same price

Exposure

2022-10-29

Rey

Philippines

I am sharing my bad experience on FXPRIMUS, headquarter in Cyprus, Africa and many Countries. I hope to receive your support to solve the issue. I was requested to provide them my PLE & POA as last step to finish open-process. Right after that I got the email FXPRIMUS Completion of Live Account open. Then I normally deposited fund to account and traded, got daily trading report via the email My account was suddenly deducted by FXPRIMUS $ 16 500 (sixteen thousand and five hundred dollars) .Right after that, I have complainted to FXPRIMUS, but They did not feedback for me. I didn’t know what happened to my account following days. I did contact them via email, Live chat and even call them to support me resolve the issue. I made profitable trade, FXPRIMUS deducted my money for no reason. FXPRIMUS couldn’t show evidence and robbed customers' fund.

Exposure

2021-09-17

FX2983670864

Nigeria

FXPRIMUS IS VERY DANGEROUS AND NOT SECURE THEY SCAM ME 100K NAIRA FROM ESCROW AND LIES TO REGULATION VANUATU AND CYSEC THERE GROUP OF PROPLE THAT INVEST AND NO ONE WITHDRAW HIS OR HER MONEY SO DONT BE A VICTIM STAY AWAY FROM THEM

Exposure

2021-09-10