简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CWM Information Revealed

บทคัดย่อ:Class Wealth Management (CWM) is a financial institution based in the United Kingdom with a history of 2-5 years. The legitimacy of CWM is questionable, as it claims to be regulated by the United Kingdom Financial Conduct Authority (FCA) under license number 504915 but is suspected of being a clone and currently lacks valid regulation, potentially posing risks to investors. CWM offers a variety of market instruments, including currencies, stocks, commodities, indices, ETFs, CFDs, options, and futures. They provide different account types, such as individual, joint, trust, and custodial accounts. CWM offers leverage on forex, CFDs, and stocks, with variable spreads and commissions on different instruments. They support various deposit and withdrawal methods, with associated fees. CWM provides trading platforms including a classic web-based platform and a mobile app. User reviews raise concerns about abnormal trading behavior, delayed order execution, and questions about the authenticity

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | Not specified |

| Company Name | Class Wealth Management |

| Regulation | Suspected clone with no valid regulation |

| Minimum Deposit | $100 |

| Maximum Leverage | Forex: 200:1, CFDs: 100:1, Stocks: 50:1 |

| Spreads | Variable, depends on market and instrument |

| Trading Platforms | Classic Platform (web-based), Mobile Platform |

| Tradable Assets | Currencies, Stocks, Commodities, Indices, ETFs, CFDs, Options, Futures |

| Account Types | Individual, Joint, Trust, Custodial |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone: +44 (0)208 089 8740, Email: info@classwealth.com |

| Payment Methods | Bank transfer, Credit/Debit card, E-wallets |

Overview of CWM

CWM, officially known as Class Wealth Management, is a financial institution based in the United Kingdom with a reported existence of 2-5 years. However, it is important to note that the main website of CWM is currently unavailable and listed for sale, raising questions about its operational status and legitimacy. Furthermore, CWM claims to be regulated by the United Kingdom Financial Conduct Authority (FCA) under license number 504915, but there are suspicions that it may be a clone and lacks valid regulation, which can pose potential risks to investors. Caution is advised when considering any involvement with this institution.

CWM offers a range of market instruments for trading, including major and minor currencies, US and international stocks, various commodities, broad market indices, ETFs, CFDs across asset classes, options, and futures contracts. Traders can access leverage of up to 200:1 on forex, 100:1 on CFDs, and 50:1 on stocks, enabling them to amplify their trading positions. The broker provides variable spreads, and while it doesn't charge commissions on forex trades, there are commission fees for stock and CFD trades. CWM supports multiple deposit and withdrawal methods, with minimum deposit requirements and withdrawal limits in place.

The available account types include individual, joint, trust, and custodial accounts, catering to different investor needs. CWM offers trading through its Classic Platform, a web-based option with essential trading features, and a Mobile Platform in the form of a mobile app for on-the-go trading. However, user reviews of CWM express concerns about abnormal trading behavior, order execution delays, regulatory authenticity, and the quality of customer support, suggesting potential risks associated with this broker. Given these concerns, investors should exercise caution and consider alternative options when evaluating their investment choices.

Pros and Cons

CWM (Class Wealth Management) presents a mix of potential advantages and drawbacks. On the positive side, the company claims to be regulated by the FCA (Financial Conduct Authority), indicating a degree of oversight. CWM also offers a diverse range of market instruments and leverage options, catering to different trading preferences. Furthermore, it provides various account types and a variety of deposit and withdrawal methods. However, the legitimacy of CWM is marred by suspicions of being a clone and lacking valid regulation. User concerns about abnormal trading behavior, regulatory license authenticity, and customer service quality further raise doubts. Additionally, the unavailability of the main website, coupled with the presence of fees for credit/debit card transactions, adds to the list of potential disadvantages.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Is CWM Legit?

The broker mentioned in the provided information, which claims to be regulated by the United Kingdom Financial Conduct Authority (FCA) under license number 504915, is suspected of being a clone and currently lacks valid regulation. Therefore, caution is advised when dealing with this institution as it presents potential risks to investors.

Market Instruments

Currencies: CWM offers a range of major currencies including USD, EUR, GBP, JPY, and CHF. They also provide access to minor currencies like AUD, CAD, NZD, and SEK.

Stocks: CWM allows trading in both US and international stocks. US stock options include S&P 500, Nasdaq 100, and Dow Jones Industrial Average, while international options encompass FTSE 100, DAX, and CAC 40.

Commodities: CWM provides access to various commodities, including energy commodities like crude oil, natural gas, and gasoline. Precious metals such as gold and silver, as well as industrial metals like copper, are also available. Additionally, agricultural commodities like wheat, corn, and soybeans are offered.

Indices: CWM offers trading in broad market indices like S&P 500, Nasdaq 100, and Dow Jones Industrial Average. They also provide access to sector-specific indices such as technology, healthcare, and financials, as well as geographic indices like MSCI World Index and MSCI Emerging Markets Index.

ETFs: CWM offers a range of ETFs, including index ETFs that track specific market indices like the S&P 500 or Nasdaq 100. They also provide sector ETFs for investing in specific sectors of the economy, such as technology or healthcare, and thematic ETFs focused on specific themes like clean energy or artificial intelligence.

CFDs: CWM offers CFDs (Contracts for Difference) across various asset classes. These include Forex CFDs for trading currencies on margin, Stock CFDs for trading stocks on margin, Commodity CFDs for trading commodities on margin, and Index CFDs for trading indices on margin.

Options: CWM provides options trading, including call options that grant the right to buy a security at a specific price on or before a specific date, and put options that grant the right to sell a security at a specific price on or before a specific date.

Futures: CWM offers futures contracts for different asset types. This includes stock futures, allowing users to buy or sell a stock at a predetermined price on a specific date, commodity futures for trading commodities at specified prices and dates, and index futures for trading indices at predetermined prices and dates.

| Pros | Cons |

| Offers a wide range of market instruments, including major and minor currencies, stocks, commodities, indices, ETFs, CFDs, options, and futures | Limited information on trading volume and market depth |

| Provides access to both US and international stocks, as well as a variety of commodities and indices | Lack of transparency regarding pricing and liquidity |

| Offers diverse investment options with ETFs, CFDs, options, and futures |

Account Types

Individual Account:

This account type is designed for individuals seeking opportunities to invest and grow their wealth. Examples of individual accounts include retirement accounts such as 401(k)s and IRAs, college savings accounts like 529 plans, and non-retirement investment accounts.

Joint Account:

A joint account is suitable for multiple individuals who wish to collectively invest their funds. Examples encompass married couples, business partners, and friends or family members pooling their resources for investment purposes.

Trust Account:

Trust accounts are intended for legal entities that hold assets on behalf of others. Examples consist of living trusts, testamentary trusts, revocable trusts, and irrevocable trusts, all established to benefit specific individuals or entities.

Custodial Account:

Custodial accounts are designated for minors who lack the legal capacity to own investment accounts in their own names. Examples encompass UTMA (Uniform Transfers to Minors Act) accounts and UGMA (Uniform Gift to Minors Act) accounts, which allow assets to be managed on behalf of minors until they reach adulthood.

| Pros | Cons |

| Diverse range of account types for various needs | No demo account available |

| Options available for both individuals and groups |

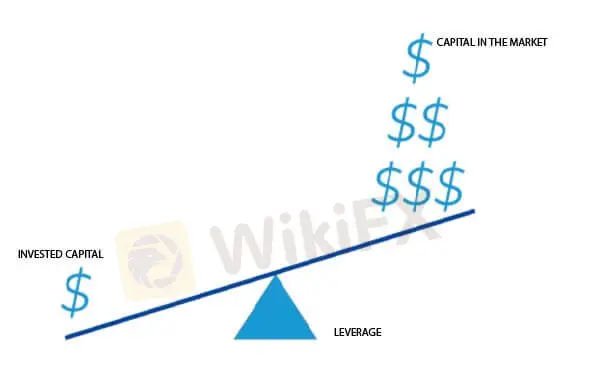

Leverage

CWM offers a leverage of up to 200:1 on forex, 100:1 on CFDs, and 50:1 on stocks. This means that traders can borrow money from CWM to increase their trading positions. For example, a trader with a $1,000 account can use 200:1 leverage to control a $200,000 position.

Spreads & Commissions

CWM offers variable spreads on all instruments. The spreads vary depending on the market conditions and the instrument being traded. For example, the spread on the EUR/USD currency pair may be 0.1 pips, while the spread on the gold CFD may be $0.50 per ounce. CWM does not charge any commissions on forex trades. However, there is a commission of $0.01 per share on stock trades and $0.02 per contract on CFD trades.

Deposit & Withdrawal

CWM offers a variety of deposit and withdrawal methods, including bank transfer, credit/debit card, and e-wallets. The minimum deposit amount is $100 and the maximum withdrawal amount is $100,000 per day. Bank transfers are typically free, but may take up to 5 business days to process. Credit/debit card deposits and withdrawals are processed immediately, but there is a 2.5% fee on all deposits and withdrawals. E-wallets are also processed immediately, but there may be a small fee. Please note that these fees are subject to change.

| Pros | Cons |

| Variety of deposit and withdrawal methods | 2.5% fee on credit/debit card deposits and withdrawals |

| Credit/debit card deposits and withdrawals are processed immediately | E-wallets may have small fees |

| Bank transfers are typically free | Bank transfers may take up to 5 business days to process |

| Minimum deposit amount of $100 | Maximum withdrawal amount of $100,000 per day |

Trading Platforms

Classic Platform: The Classic Platform provided by CWM is a web-based trading platform offering essential trading features such as real-time quotes, charting, and technical indicators. It caters to a broad range of traders, regardless of their experience level. Some common examples of similar platforms include MetaTrader 4, NinjaTrader, and Thinkorswim.

Mobile Platform: CWM offers a Mobile Platform in the form of a mobile app, enabling traders to access their accounts and execute trades from anywhere worldwide. While it offers a more limited set of features compared to the classic platform, it serves as an option for traders who prefer to trade on the go. Notable examples of similar mobile trading platforms include MetaTrader 5, NinjaTrader Mobile, and Thinkorswim Mobile.

| Pros | Cons |

| Classic Platform offers real-time quotes, charting, and technical indicators | Limited features on the Mobile Platform compared to the Classic Platform |

| Catering to a broad range of traders | |

| Mobile Platform for trading on the go |

Customer Support

Customer Support at CWM can be reached at +44 (0)208 089 8740 for phone inquiries, and their customer service email address is info@classwealth.com.

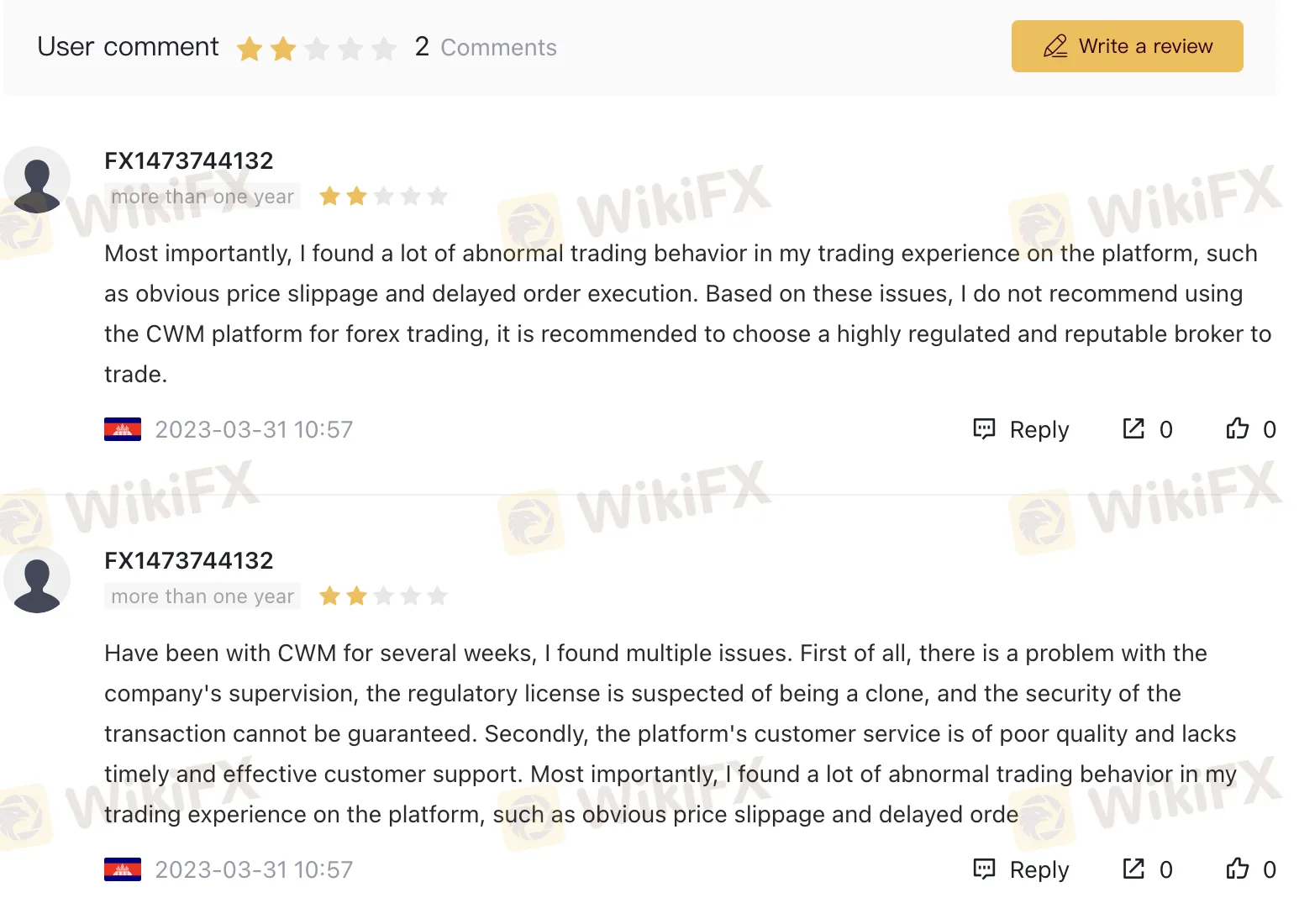

Reviews

User reviews of CWM on WikiFX highlight several concerns. Users have reported encountering abnormal trading behavior on the platform, including significant price slippage and delayed order execution. They express reservations about using the CWM platform for forex trading and recommend choosing a highly regulated and reputable broker instead. Additionally, there are concerns about the company's supervision, with suspicions raised about the authenticity of its regulatory license, which may impact the security of transactions. Users also note issues with the platform's customer service, describing it as lacking in quality and timely support.

Conclusion

In conclusion, CWM, or Class Wealth Management, presents a complex landscape with both advantages and disadvantages. On the positive side, CWM offers a diverse range of market instruments, including currencies, stocks, commodities, indices, ETFs, CFDs, options, and futures. They also provide various account types to cater to individual, joint, trust, and custodial needs. However, it is crucial to exercise caution when considering CWM as a potential broker. The legitimacy of its regulatory claims is suspect, raising concerns about investor security. User reviews further highlight issues related to trading behavior, order execution, and customer support quality. Therefore, potential investors should approach CWM with caution and consider alternatives with more established regulatory credentials and better reputations in the industry.

FAQs

Q: Is CWM a legitimate company?

A: CWM, which claims to be regulated by the United Kingdom Financial Conduct Authority (FCA), is currently suspected of being a clone and lacks valid regulation. Caution is advised when dealing with this institution.

Q: What market instruments can I trade with CWM?

A: CWM offers trading in currencies, stocks, commodities, indices, ETFs, CFDs, options, and futures, providing a wide range of investment options.

Q: What types of accounts does CWM offer?

A: CWM offers individual, joint, trust, and custodial accounts, catering to various investor needs and preferences.

Q: What leverage does CWM provide?

A: CWM offers leverage of up to 200:1 on forex, 100:1 on CFDs, and 50:1 on stocks, allowing traders to amplify their trading positions.

Q: How can I contact CWM's customer support?

A: You can reach CWM's customer support by phone at +44 (0)208 089 8740 or via email at info@classwealth.com.

Q: What are some concerns raised by users about CWM?

A: User reviews highlight concerns such as abnormal trading behavior, delayed order execution, doubts about regulatory authenticity, and issues with customer service quality when using CWM's platform for trading.

ข้อจำกัดความรับผิดชอบ:

มุมมองในบทความนี้แสดงถึงมุมมองส่วนตัวของผู้เขียนเท่านั้นและไม่ถือเป็นคำแนะนำในการลงทุน สำหรับแพลตฟอร์มนี้ไม่รับประกันความถูกต้องครบถ้วนและทันเวลาของข้อมูลบทความ และไม่รับผิดชอบต่อการสูญเสียใด ๆ ที่เกิดจากการใช้ข้อมูลในบทความ

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

WikiFX โบรกเกอร์

IC Markets Global

Pepperstone

VT Markets

Vantage

TMGM

OANDA

IC Markets Global

Pepperstone

VT Markets

Vantage

TMGM

OANDA

WikiFX โบรกเกอร์

IC Markets Global

Pepperstone

VT Markets

Vantage

TMGM

OANDA

IC Markets Global

Pepperstone

VT Markets

Vantage

TMGM

OANDA

ข่าวล่าสุด

รวมวิธีการเป็น “Day trader ” ประสบความสำเร็จ

“พาวเวล” ส่งสัญญาณเฟดไม่รีบลดดอกเบี้ย เหตุเศรษฐกิจ-ตลาดแรงงานยังแกร่ง

ข้อคิดดีๆ จากหนังสือ "วิธีบริหารเวลาให้คุ้มค่าที่สุดในแต่ละวัน"

บิตคอยน์ทุบ All Time High ทะลุ $93,000 กูรูฟันธง $100,000 ก็แค่ปากซอย!

กฎสำคัญของการเทรดแบบ Scalping

เพราะอะไร? นักเทรดที่มีประสบการณ์จึงใส่ใจสเปรด

กว่าจะมาเป็นผู้ร่วมก่อตั้ง Ethereum เรื่องราวของ Vitalik Buterin เป็นมาอย่างไร?

คำนวณอัตราแลกเปลี่ยน