简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

D24FX Defrauded Saudi Arabian Investor of a Fortune

Абстракт:As with many industries, the fast growing forex industry also has plenty of predators, who look to take advantage of newcomers. These illegal brokers target the typical mindset of investors to make money quickly and induce investors to engage in unregulated or high-risk investments, causing them heavy losses. Recently, an investor from Saudi Arabia told WikiFX about how he was defrauded by the illegal forex broker D24FX, as well as his difficult experience in trying to recover the lost fund.

As with many industries, the fast growing forex industry also has plenty of predators, who look to take advantage of newcomers. These illegal brokers target the typical mindset of investors to make money quickly and induce investors to engage in unregulated or high-risk investments, causing them heavy losses. Recently, an investor from Saudi Arabia told WikiFX about how he was defrauded by the illegal forex broker D24FX, as well as his difficult experience in trying to recover the lost fund.

Victim: anonymous investor

Country: Saudi Arabia

Exposed broker: D24FX

Victims story:

It happened like this. Many “agents” of D24FX, had fake identities and contact number from multiple countries, and they kept telling me that “the bonus is very, very high”, and I‘d get “as much as 3000%” from the investment. They had also registered several fake forex trading websites. For the past 2 years, I’ve been trying to get my money back from the broker who blocked my trading account and those agents who never answered my requests, but had no luck so far.

I also contacted a Danish company named Forex Scam Agency (a legal aid service provider) in the hope that they‘ll help me recover my lost fund, and even paid them a whole year’s service fees. But eventually the company told me that they couldnt get my money back because D24FX had gone bankrupted! This seems to suggest that the Danish company had defrauded me as well.

Now, Im trying to contact a law firm, Al-Hakim (website Alhakeem-lawfirm.com), and ask for their assistance in taking legal actions against D24FX, but I found their London address to be a fake one.

Unfortunately, these companies had all let me down, but I do hope that WikiFX can help me out.

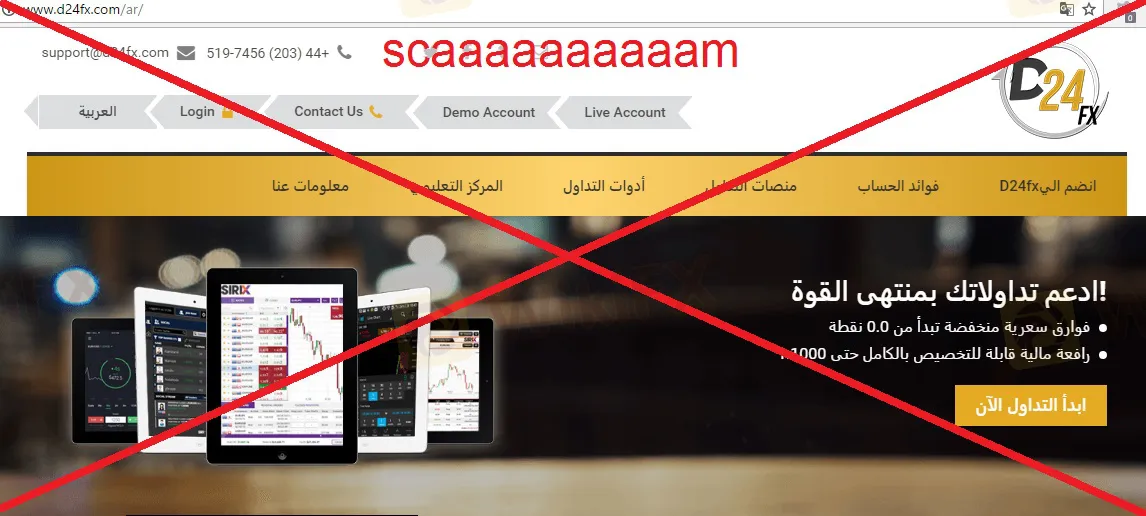

Website of D24FX

Register information of D24FX

Per checking WikiFX App, we found that the VFSC(Vanuatu) license that D24FX claims to hold doesnt exist, and the broker is currently unregulated, please stay away from it!

Here WikiFX would like to remind investors that the forex market, as well as the opportunity to make profits, will not disappear with time. So investors need to carefully check the broker‘s profile before investing, and don’t hastily decide to make deposit before you do a thorough research on the broker. If you have been defrauded, dont easily trust some unreliable “law firms” that claim they can recover your funds. Instead, keep the relevant evidences and seek legal assistance through credible and verified sources.

Отказ от ответственности:

Мнения в этой статье отражают только личное мнение автора и не являются советом по инвестированию для этой платформы. Эта платформа не гарантирует точность, полноту и актуальность информации о статье, а также не несет ответственности за любые убытки, вызванные использованием или надежностью информации о статье.

Подробнее

Эпидемия разорила Баффета на $46,5 млрд

Согласно документам, опубликованным Комиссией США по ценным бумагам и биржам (SEC), во вторник и среду Баффет Беркшир Хэтэуэй продал акции Bank of New York Mellon стоимостью более 30 миллионов долларов США. В начале марта когда американские акции упали Баффет увеличил свою долю в Bank of New York Mellon до 359 млн. долл. США.

WPP сообщает, что чистые продажи в марте снизились на 7,9% из-за пандемии

WPP (L: WPP), крупнейшая в мире рекламная компания, заявила, что чистый объем продаж упал на 3,3% в первом квартале, из-за воздействия пандемии COVID-19, всего за март снизившись на 7,9%, что привело к сокращению дополнительных расходов.

Ожидается крупный обвал на рынке страхования в России - почти на треть из-за кризиса

Аналитики рейтингового агентства «Эксперт РА» пессимистичны относительно рынка страхования, вместо роста на 6-8%, они ждут падения рынка по итогам года в лучшем случае на 17%, а в худшем — почти на треть. Уже в марте компании зафиксировали снижение спроса со стороны клиентов.

Экспорт Германии вырос в феврале, но торговля в Китае замедлилась из-за вируса

Экспорт в Германии вырос в феврале, но торговля с Китаем резко замедлилась, поскольку крупнейшая экономика Европы испытывает последствия пандемии коронавируса, сообщило Федеральное статистическое управление в четверг.

WikiFX брокеры

Подсчет курса