WikiFX, являясь независимой сторонней информационной платформой, стремится предоставлять пользователям комплексные и объективные услуги по поиску нормативной информации о дилерах. WikiFX не участвует напрямую в какой-либо торговой деятельности на валютном рынке и не предоставляет никаких рекомендаций по торговым каналам или инвестиционных советов. Рейтинг трейдеров WikiFX основан на объективной информации из общедоступных каналов и полностью учитывает различия регуляторной политики в разных странах и регионах. Рейтинги трейдеров являются основным продуктом WikiFX. Мы решительно выступаем против любой деловой практики, которая может нанести ущерб его объективности и беспристрастности, и приветствуем контроль и предложения пользователей со всего мира. Горячая линия для жалоб: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

Поиск брокера

Pусский

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gamma Squeezer

0123456789

0123456789

0123456789

0123456789

KOL

ID: 2111991648

Гонконг

до 1 года

Подписка

Life is long gamma

Gamma Squeezer

Market Wrap(11.12)

USD rises to 4-month peak vs major peers.

Key factors:

Investors betting on Trump administration policies

Euro at 7-month low, yuan at 3-month low

Potential Trump tariffs targeting Europe and China

Trump's crypto stance:

Vows to make US "crypto capital of the planet"

Analyst Gautam Chhugani: "regulatory tailwind zone"

Expectations of crypto-friendly SEC under Trump

Dollar index up 0.38% to 105.83 (highest since July). Drivers:

US equities, interest rates, and dollar pushing higher

Reports of hawkish China policy team (Rubio, Waltz)

Republican control of Congress

Currency movements:

Onshore yuan at 7.2378 (lowest since Aug 1)

AUD down 0.45% to $0.6545

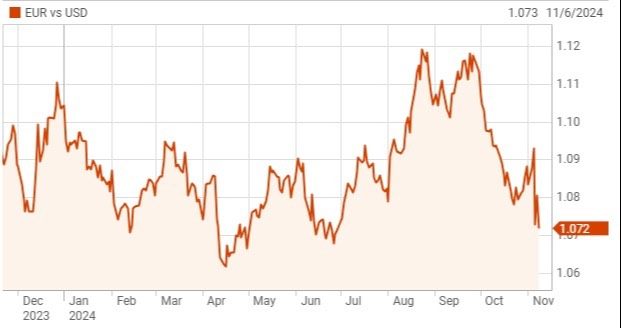

EUR at $1.0611 (lowest since late April)

GBP down 0.36% to $1.2824

JPY at 154.04 per dollar

Market expectations:

Reduced likelihood of Dec Fed rate cut (69% vs 80% week ago)

Inflationary tariffs and immigration policies

German political uncertainty (Feb 23 elections)

UK wage growth slowing, unemployment rising

#ForexMarkets #TrumpEffect #BitcoinRally #DollarStrength #GlobalEconomics

2024-11-12 22:03

Gamma Squeezer

Bitcoin Nears $90K as Trump Win Fuels Crypto Rally

Bitcoin's record-breaking rally approaches $90,000, pushing overall crypto market value above pandemic-era peak. BTC hit all-time high of $89,599, up 32% since US election. Current price: $87,063 as of 7:02 a.m. New York time.

Trump's pro-crypto stance driving surge:

Promises friendlier regulations

Plans for strategic Bitcoin stockpile

Aims to boost domestic mining

Goal: Make US the global crypto capital

Sharp contrast to SEC crackdown under Biden administration.

Market dynamics:

Total crypto market cap reaches $3.1 trillion

Bitcoin options traders betting on $100K by year-end

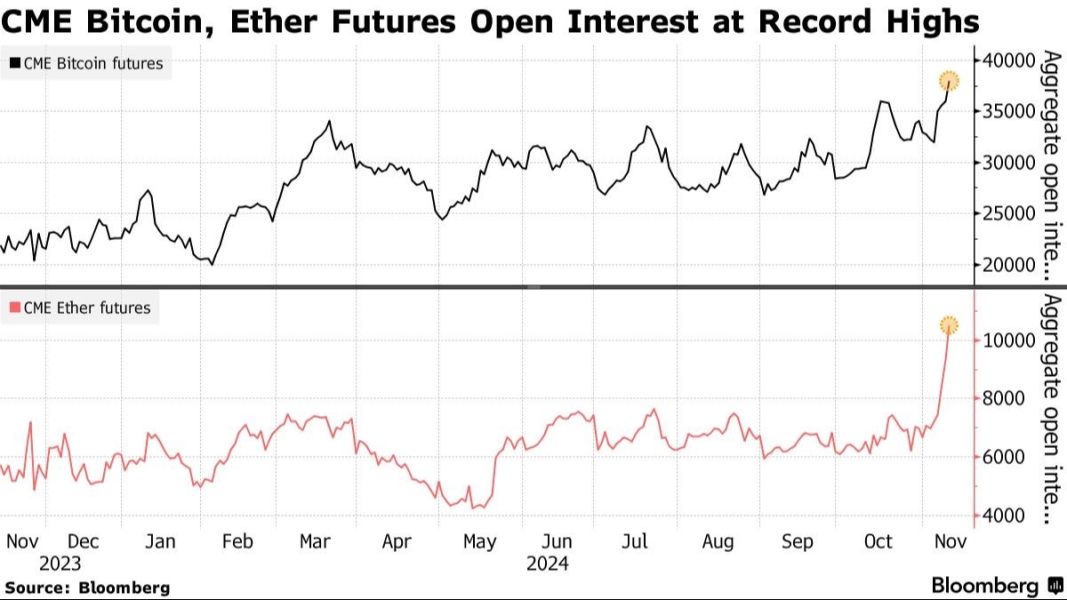

CME futures for BTC and ETH hit record open interest

MicroStrategy purchased 27,200 BTC ($2B) in early November

2024 performance:

Bitcoin up 110% YTD

Outperforming global stocks and gold

BlackRock's iShares Bitcoin Trust sees record turnover

Analysts warn of potential "digestion" period after steep rise

Political landscape:

Crypto companies heavily invested in pro-industry candidates

Trump's crypto support marks significant policy shift

Bitcoin joins other "Trump trades" (US stocks, USD)

Focus on economic growth, tax cuts, and protectionist policies

#Bitcoin #TrumpEffect #CryptoMarkets #BTC

2024-11-12 22:02

Gamma Squeezer

Euro Hits 6-Month Low Amid U.S. Tariff Fears

Euro just hit a 6.5-month low against the dollar as fears of U.S. tariffs mount. Investors are spooked by potential moves from President-elect Trump, who might tap trade hawk Robert Lighthizer for his team. The euro is down 0.6%, trading at $1.0657 – the lowest since May. Dollar bulls are charging ahead.

German politics also added fuel to the fire. Olaf Scholz paving the way for snap elections means more uncertainty around Germany's fiscal future. Meanwhile, mixed views about the Fed's next move are keeping traders on their toes. ING is bullish, betting that tariffs and easing Fed policy will support the greenback, while others aren't so sure.

Bottom line: A clean U.S. election result has strengthened the dollar, but global uncertainty is on the rise. The market's now waiting for clarity on U.S. trade policy and Fed direction. Buckle up, this ride isn't over yet.

2024-11-11 21:38

Gamma Squeezer

MarketWrap(11.11)

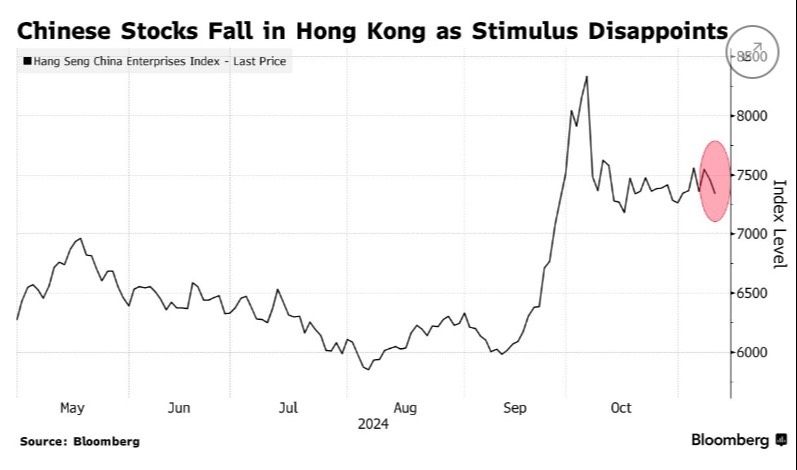

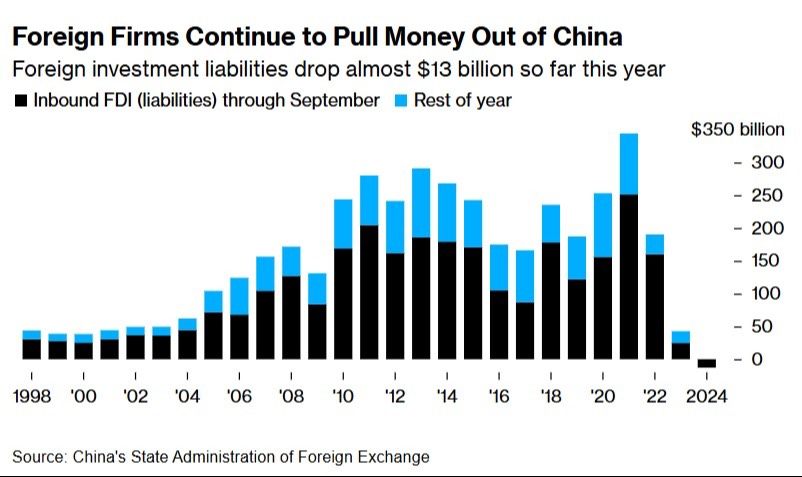

European shares poised for gains, following Wall Street's Friday rally. Euro Stoxx 50 futures up 0.5%. Hong Kong's Chinese stock index down 1.7%, CSI 300 recovers to close with slight gains.

Bitcoin surges past $81,000, boosted by Trump's pro-crypto stance and supportive lawmakers. Dollar and euro steady, yen slips as BOJ hints at caution on rate hikes. Japan PM Ishiba leads in party vote despite election setback.

Fed's Kashkari suggests less easing than expected, citing strong US economy. Key data ahead: AU jobs, CN retail/industrial, US/EU inflation, UK/JP growth. Multiple Fed speakers to provide post-election policy insights.

2024-11-11 16:40

Gamma Squeezer

Yen Bears at Peak Pre-US Vote: What's Next?

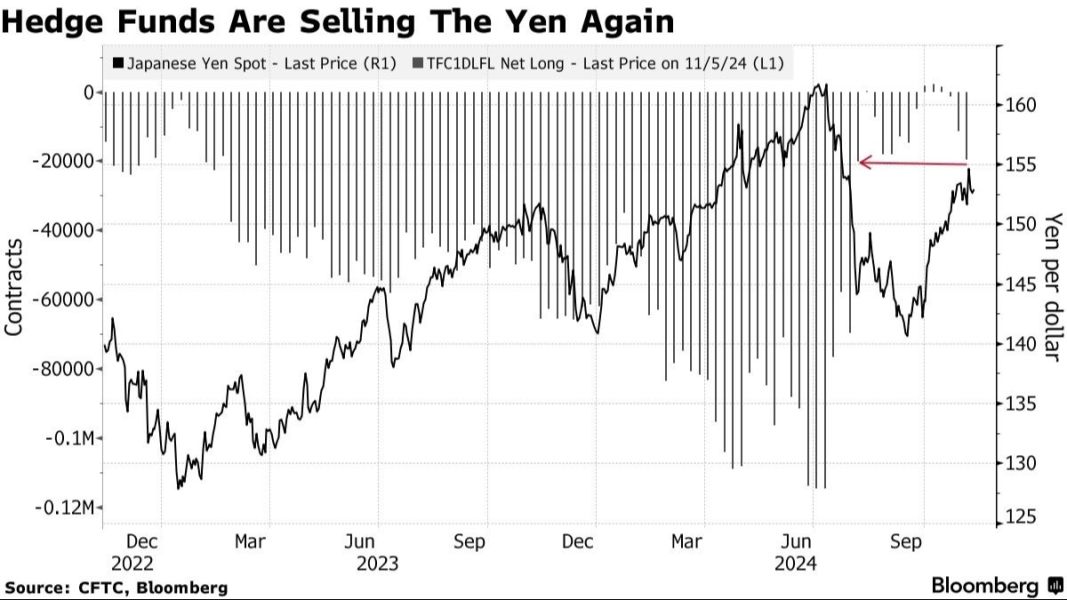

Hedge funds were most bearish on yen since August before US election. CFTC data shows yen shorts increased for 4 straight weeks. Post-Trump win, USD/JPY saw initial surge, then retreat.

Yen outlook:

Potential for continued carry trade appeal

But beware of potential reversals

BOJ rate hike expectations add uncertainty

Watch US-Japan yield spreads for direction

USD drivers post-election:

Trump's fiscal policies (tax cuts, tariffs)

Inflation expectations

Treasury yield projections

Upcoming CPI data crucial for Fed policy

Market sentiment:

"Trump trade" initially favors USD

Long-term trends may differ from knee-jerk reactions

Volatility expected across major pairs

Stay alert for economic data and policy signals

#JPY #USD#ForexStrategy #TrumpEffect

2024-11-11 16:29

Gamma Squeezer

Bitcoin Soars to Record High

Bitcoin reached a new all-time high of $81,899, more than doubling from its yearly low of $38,505.

The surge is attributed to expectations of a favorable regulatory environment under President-elect Donald Trump and newly elected pro-crypto Congress members.

Key factors driving the rally: Trump's promise to make the U.S. the "crypto capital of the planet"

Anticipation of Gary Gensler's removal as SEC Chair

Success of pro-crypto candidates in congressional elections

Trump's personal involvement in the crypto sector with World Liberty Financial

Market Impact

Broad gains across cryptocurrencies (Ether above $3,200, Dogecoin at 3-year high)

'Trump trades' in other markets losing steam, while crypto momentum continues

Crypto industry's $119 million investment in pro-crypto candidates paying off

Outlook

Potential for deregulation and more crypto-friendly policies

Increased institutional interest and mainstream adoption

Volatility expected as market adjusts to new political landscape

Caution: Despite positive sentiment, regulatory changes and policy implementations may take time. Investors should remain vigilant and consider potential risks in this rapidly evolving market.

2024-11-11 15:00

Gamma Squeezer

Fed's Kashkari: No Clash with Trump on Inflation

Kashkari downplays Fed-Trump tension, citing bipartisan inflation concerns. This alignment could support continued Fed independence in policy decisions. Markets may react positively to reduced political interference risk in monetary policy.

Strong economic resilience surprises Kashkari, hinting at potentially higher rates. This outlook suggests the Fed may maintain a more hawkish stance than previously expected. Investors should prepare for possible upward pressure on yields and USD strength.

Outlook: Cautiously hawkish. Fed likely to maintain focus on inflation fight despite political shifts. Watch for signals of extended high-rate environment in upcoming Fed communications.

Trading analysis: Kashkari's comments suggest potential USD strength. Consider bullish USD positions against major pairs like EUR/USD, USD/JPY, and GBP/USD. Rate-sensitive pairs such as USD/CHF and USD/CAD may also benefit from Fed's hawkish stance. Monitor economic data and Fed speeches closely to confirm this trend.

#FedPolicy #ForexOutlook #USDTrend

2024-11-10 20:14

Gamma Squeezer

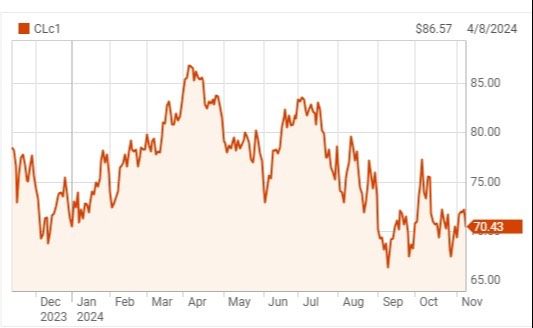

Gulf Oil Output Drops 25% Post-Hurricane

Hurricane Rafael's impact: 25%+ crude, 17% gas offline in US Gulf. Potential for extended production cuts as storm lingers. Expect short-term price spikes in oil and natural gas markets, particularly if outages persist beyond initial forecasts.

Market implications: Supply disruptions could support higher energy prices near-term. Watch for ripple effects on US inflation data and Fed policy expectations. Energy sector stocks may see increased volatility as production recovery timeline unfolds.

Outlook: Bullish for energy prices short-term. Monitor weather forecasts for production restart estimates. Consider hedging strategies for energy-intensive portfolios. Long-term impact likely limited unless storm damage proves extensive. Keep eye on inventory reports for supply shock duration.

#Oil #WTI

2024-11-10 19:54

Gamma Squeezer

CAD Pressured as BoC Cut Odds Rise

CAD weakens as markets price 60% chance of 50bps BoC cut in December. Record-high 112bps US-Canada yield spread fuels USD strength. This policy divergence likely to drive further CAD depreciation, impacting cross-border trade and investment flows.

Trump victory adds trade uncertainty for Canada's export-heavy economy. Oil's 3% drop compounds CAD pressure. Investors should brace for volatility in CAD pairs, particularly USD/CAD. Watch for potential shifts in Canada's trade-sensitive sectors.

Outlook: Bearish CAD, bullish USD short-term. Flattening Canadian yield curve signals economic worries. Consider increasing USD exposure, hedging CAD risks. Monitor BoC communications for policy clues. US assets may outperform as capital seeks higher yields and safety.

#CADOutlook #ForexTrends #MonetaryPolicy

2024-11-10 17:37

Gamma Squeezer

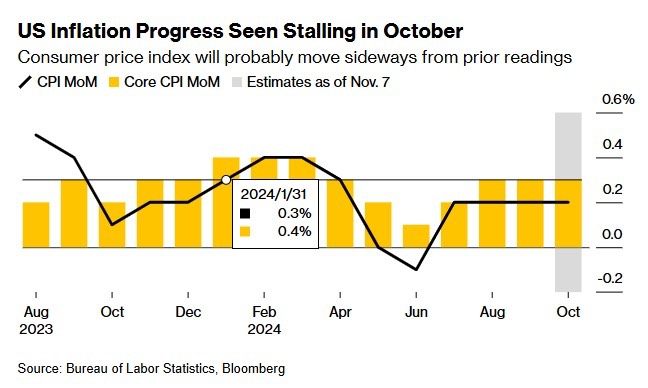

Markets Brace for Potential Fed Hawkish Shift

October US inflation data suggests stalled progress, potentially forcing Fed to reconsider its dovish stance. This unexpected inflation persistence could lead to a stronger dollar as markets price in delayed rate cuts. Investors should prepare for increased volatility in currency and bond markets.

Core CPI holding steady signals stubborn inflationary pressures. If this trend continues, Fed may need to maintain higher rates for longer, supporting USD strength. Watch for Treasury yields to potentially rise, impacting global capital flows and emerging market currencies.

Short-term market outlook: Cautious. Dollar likely to strengthen against major currencies if inflation remains elevated. Equity markets may face headwinds as higher rates could pressure valuations. Investors should consider defensive positions and reassess exposure to rate-sensitive sectors.

#FX #FedPolicy #DXY

2024-11-10 17:22

Смотреть еще

Люди, которые могут вам понравиться

Изменять

TMGM客户代表 高效率+找ib65800

Подписка

AXI顶级外汇=代理

Подписка

jkea113事件驱动 诚招贤士

十年量化管理经验团队·Аналитик

Подписка

RealTradingMaster

Подписка

盈利锁定EA赢技巧 搜ib65800

十年量化管理经验团队·Продажа

Подписка