简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RC Global

Resumo:RC Global, established in 2014 and based in the United States, operates as an unregulated entity in the loan sector, offering a variety of services tailored to meet diverse financial needs. Their portfolio includes purchase loans, FHA loans, VA loans, refinancing options, and reverse mortgages, attracting a wide range of borrowers looking for both residential and investment property financing solutions. Despite its unregulated status, RC Global aims to support its clients through tools such as a renting versus buying calculator, refinance analysis calculator, and a consolidation calculator, alongside a comprehensive glossary of mortgage terms to educate and guide borrowers. Customer support is readily accessible via phone at (877) 724-5622, ensuring personalized assistance for each client's unique financial situation.

| Aspect | Information |

| Company Name | RC Global |

| Registered Country/Area | United States |

| Founded Year | 2014 |

| Regulation | Unregulated |

| Services | Purchase loan,FHA loans,VA loans,Refinance,Reverse mortogage |

| Customer Support | Phone:(877)724-5622 |

| Tools | Renting versus buying calculator,Refinance analysis calculator,Consolidation calculator,Glossary of mortgage terms |

Overview of RC Global

RC Global, established in 2014 and based in the United States, operates as an unregulated entity in the loan sector, offering a variety of services tailored to meet diverse financial needs.

Their portfolio includes purchase loans, FHA loans, VA loans, refinancing options, and reverse mortgages, attracting a wide range of borrowers looking for both residential and investment property financing solutions. Despite its unregulated status, RC Global aims to support its clients through tools such as a renting versus buying calculator, refinance analysis calculator, and a consolidation calculator, alongside a comprehensive glossary of mortgage terms to educate and guide borrowers. Customer support is readily accessible via phone at (877) 724-5622, ensuring personalized assistance for each client's unique financial situation.

Is RC Global Limited Legit or a Scam?

RC Global operates within the loan industry as an unregulated entity, meaning it has not been formally authorized or overseen by any financial regulatory bodies.

This status indicates that while RC Global offers a range of loan services, including purchase loans and refinancing options, it does so without the regulatory safeguards typically enforced to protect consumers in the financial sector.

Pros and Cons

| Pros | Cons |

| Diverse Loan Services | Unregulated Entity |

| Educational Tools | Potential Risk for Consumers |

| Comprehensive Support | Limited Regulatory Recourse |

| Informative Resources | Uncertainty About Compliance |

| Established Presence | Reputational Concerns |

Pros of RC Global:

Diverse Loan Services: RC Global offers a wide array of loan options including purchase loans, FHA loans, VA loans, refinancing, and reverse mortgages,meeting various borrower needs and preferences.

Educational Tools: The company provides valuable tools such as renting versus buying calculators, refinance analysis calculators, and consolidation calculators, aiding clients in making informed financial decisions.

Comprehensive Support: With dedicated customer support available via phone, RC Global ensures that clients have access to personalized assistance for their queries and concerns.

Informative Resources: The inclusion of a glossary of mortgage terms helps demystify complex financial jargon, empowering clients with the knowledge needed to navigate the loan process more confidently.

Established Presence: Having been founded in 2014, RC Global has several years of experience in the loan industry, which could indicate a level of stability and accumulated expertise in providing loan services.

Cons of RC Global:

Unregulated Entity: The lack of regulatory oversight might raise concerns regarding consumer protection, operational transparency, and compliance with industry standards.

Potential Risk for Consumers: Without regulatory safeguards, clients might face higher risks related to the terms of their loans, dispute resolution, and data protection.

Limited Regulatory Recourse: In the absence of regulation, clients may have limited recourse in the event of disputes or dissatisfaction with the services provided.

Uncertainty About Compliance: Being unregulated may lead to questions about the company's adherence to best practices and ethical standards in the financial services industry.

Reputational Concerns: Potential clients might be wary of engaging with an unregulated firm due to perceived risks and the lack of a regulatory seal of approval, which could impact trust and credibility.

Products & Services

RC Global offers a diverse array of loan services tailored to address the unique financial needs and goals of various clients:

Purchase Loans: RC Global's purchase loans are designed to facilitate the home buying process for individuals and families. Whether clients are in the market for their first home, upgrading to a larger space, or investing in real estate, RC Global provides customized financing solutions. These loans are structured to meet the buyer's financial situation, offering competitive interest rates and terms that align with their long-term homeownership goals.

FHA Loans: Federal Housing Administration (FHA) loans are a cornerstone of RC Global's offerings, aimed at making homeownership more accessible. These government-backed loans are ideal for borrowers who may not qualify for conventional mortgages due to lower credit scores or limited savings for down payments. FHA loans come with the security of government backing, reduced down payment requirements, and more lenient lending standards, making them an attractive option for first-time homebuyers and those with modest incomes.

VA Loans: Dedicated to serving the needs of veterans and active military personnel, VA loans offer significant benefits as a token of gratitude for their service to the country. With features like no down payment, no requirement for PMI, and lenient credit requirements, VA loans from RC Global provide a pathway to homeownership that acknowledges the sacrifices made by military members and their families. These loans also offer favorable terms for refinancing, further enhancing their appeal to eligible borrowers.

Refinance: For homeowners looking to optimize their existing mortgage, RC Global's refinancing services offer a solution. Whether the goal is to secure a lower interest rate, reduce monthly mortgage payments, switch from an adjustable-rate to a fixed-rate loan, or access home equity for major expenses, refinancing can provide financial relief and flexibility. RC Global works closely with clients to assess their current financial situation and long-term goals, offering refinancing options that best suit their needs.

Reverse Mortgages: Tailored specifically for seniors, reverse mortgages from RC Global offer a financial tool to enhance retirement planning. By allowing homeowners aged 62 and older to convert part of their home equity into cash without the need to sell their home, reverse mortgages provide a source of income that can supplement retirement funds, cover healthcare costs, or fund home improvements. RC Global ensures that clients fully understand the terms and potential implications of a reverse mortgage, guiding them through the process with expert advice and support.

How to Open an Account?

Opening an account with RC Global can be a straightforward process, typically involving the following steps:

Step 1: Provide Personal and Financial Information

Start by visiting the RC Global website or contacting their office directly. You'll need to provide personal details such as your name, address, and contact information, as well as financial information, including your income, employment history, and any existing debts. This information helps RC Global assess your loan eligibility and tailor their services to your specific needs.

Step 2: Select the Desired Loan Service

Choose the loan service that best suits your financial goals, whether it's a purchase loan for a new home, an FHA or VA loan, refinancing options, or a reverse mortgage. RC Global may provide guidance and advice to help you make an informed decision based on your eligibility, financial situation, and long-term objectives.

Step 3: Submit Application and Await Approval

Complete and submit your loan application along with any required documentation, such as proof of income, asset information, and identification. Once submitted, RC Global will process your application, conduct the necessary credit and financial checks, and inform you of their decision.

Customer Support

RC Global is dedicated to providing exceptional customer support to ensure a smooth and satisfactory experience for its clients.

For any inquiries, assistance, or support, clients can easily reach out to the RC Global team by calling (877) 724-5622, where knowledgeable representatives are available to offer personalized help.

Alternatively, for those who prefer written communication or need to send documents, emailing info@877rcglobal.com is a convenient option.

Additionally, for in-person consultations or services, clients can visit the RC Global office located at 3949 Clairemont Dr, Suite 15, San Diego, CA 92117, where the staff is prepared to assist with a wide range of loan-related needs.

Tools

RC Global provides its clients with a suite of financial tools designed to assist in making informed decisions about their loan options:

Renting versus Buying Calculator: This tool helps potential borrowers weigh the financial implications of renting against buying a home. By inputting their current rental expenses and comparing them with potential mortgage costs, users can better understand the long-term benefits and costs associated with homeownership versus continuing to rent.

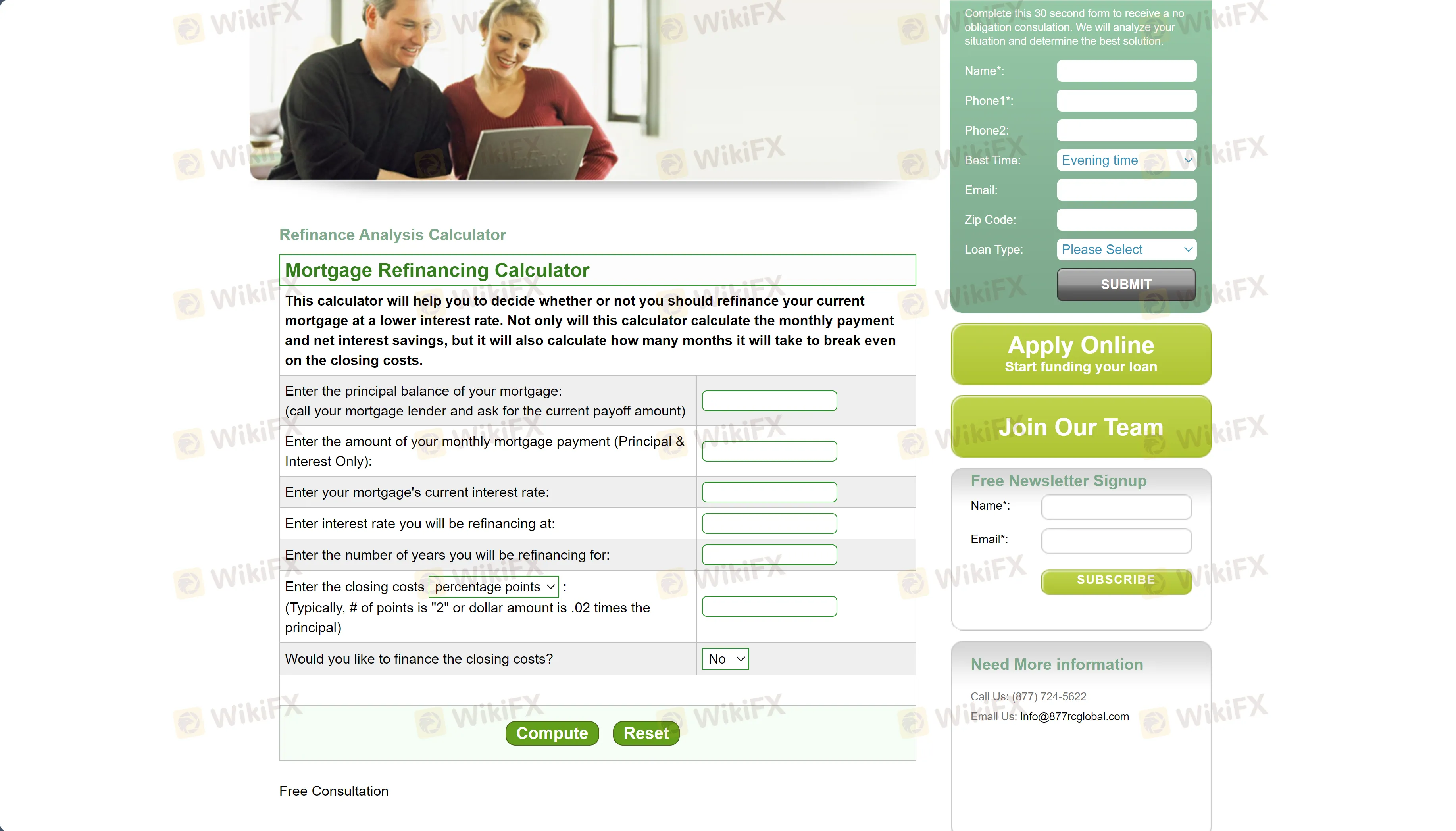

Refinance Analysis Calculator: For those considering refinancing their existing mortgage, this calculator offers insights into how refinancing might affect their monthly payments, interest costs, and overall loan term. It helps users evaluate whether refinancing is a financially beneficial move based on their current loan terms and the prevailing interest rates.

Consolidation Calculator: This tool is designed for individuals looking to consolidate their debts, including multiple loans or credit card balances, into a single loan, potentially with a lower interest rate. By inputting their existing debts, interest rates, and monthly payments, users can assess the potential savings and simplification benefits of consolidation.

Glossary of Mortgage Terms: Understanding mortgage terminology can be challenging for many borrowers. RC Global offers a comprehensive glossary of mortgage-related terms, providing clear and concise definitions to help clients navigate the complex language of the loan industry, enhancing their understanding and confidence in making loan-related decisions.

Conclusion

In conclusion, RC Global, established in 2014 in the United States, is an unregulated loan service provider that offers a range of loan options including purchase loans, FHA loans, VA loans, refinancing, and reverse mortgages.

Despite its unregulated status, RC Global aims to assist clients with dedicated customer support and a suite of tools like renting versus buying calculators and refinance analysis calculators to make informed financial decisions.

The company's commitment to personalized service and comprehensive financial solutions makes it a noteworthy option for those seeking loan services.

FAQs

Q: What types of loans does RC Global offer?

A: RC Global provides various loan services including purchase loans, FHA loans, VA loans, refinancing options, and reverse mortgages.

Q: Is RC Global a regulated entity?

A: No, RC Global operates as an unregulated loan service provider.

Q: How can I contact RC Global for support?

A: You can reach RC Global's customer support by calling (877) 724-5622 or via email at info@877rcglobal.com.

Q: Can RC Global help me decide between renting and buying?

A: Yes, RC Global offers a renting versus buying calculator to help you evaluate the financial implications of both options.

Q: Does RC Global provide tools for analyzing refinancing options?

A: Yes, they offer a refinance analysis calculator to assess the potential benefits of refinancing your mortgage.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora relacionada

Corretora WikiFX

Corretora WikiFX

Últimas notícias

Alerta: Saques Bloqueados e Falta de Resposta da Capivo

Quotex em Crise? Usuários Relatam Saques Atrasados e Suporte Ineficiente

Eleições EUA 2024: Impacto no Ouro e Forex

Admiral Markets: A Broker Ideal para Investir!

Escolha do Broker Ideal para Iniciantes

Impacto Eleitoral dos EUA em Ações

Eleições dos EUA 2024: Impactos no Mercado

BrokerTradeEU Global: Avaliação e Alertas Importantes

Por Que as Eleições Americanas São em Terça de Novembro?

Cálculo da taxa de câmbio