Score

ICM

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.icm.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

ICMCapitalVC-Demo

Influence

A

Influence index NO.1

Japan 6.90

Japan 6.90MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

A

Influence index NO.1

Japan 6.90

Japan 6.90Contact

Licenses

Licenses

Licensed Institution:ICM Capital (Labuan) Limited (formerly known as ICM Trader Limited)

License No.:MB/18/0029

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 14 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

United Kingdom

United KingdomAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed ICM also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Malaysia

Iran

icmcapital.uk

Server Location

United Kingdom

Website Domain Name

icmcapital.uk

Server IP

89.187.100.106

icmcapital.com

Server Location

United States

Most visited countries/areas

Iran

Website Domain Name

icmcapital.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

1999-05-04

Server IP

162.241.141.55

icm.com

Server Location

United States

Website Domain Name

icm.com

Website

WHOIS.UNIREGISTRAR.COM

Company

UNIREGISTRAR CORP

Domain Effective Date

1993-07-22

Server IP

162.241.141.55

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

Company Summary

Company profile

| ICM Review Summary in 10 Points | |

| Founded | 2009 |

| Headquarters | London, UK |

| Regulation | FCA, FSA, ARIF, FSC, LabuanFSA, QFC and CABs |

| Market Instruments | Forex, precious metals, stocks, futures, securities, cryptocurrencies CFD |

| Demo Account | Available |

| Leverage | 1:200 |

| EUR/USD Spread | 1.2 pips |

| Trading Platforms | MT4, MT5, cTrader |

| Minimum deposit | $200 |

| Customer Support | 24/5 live chat, phone, email, WhatsApp or send messages |

What is ICM?

ICM, or ICM Capital, is a UK-based online forex and CFD trading provider. It was established in 2009 and is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. The company offers trading services in a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. ICM also provides clients with access to the MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader trading platforms, and offers multiple account types to cater to the needs of different traders.

Pros & Cons

ICM offers several advantages for traders, including the provision of the popular MetaTrader platform and a wide range of tradable instruments across multiple asset classes. The broker is also regulated by reputable authorities.

However, there are some drawbacks, such as limited educational resources and research tools. Additionally, ICM is not available for clients in certain jurisdictions.

| Pros | Cons |

| • Regulated by multiple authorities | • Limited educational resources |

| • Commission-free trading | • No 24/7 customer support |

| • Islamic accounts offered | • Limited research tools |

| • Negative balance protection | |

| • MR4, MT5, cTrader supported |

Note: The above table is based on general observations and may not be comprehensive. Pros and cons may vary depending on individual preferences and requirements.

ICM Alternative Brokers

There are many alternative brokers to ICM, each with their own unique features and offerings. Some popular alternatives include:

eToro: eToro is a well-known broker that offers social trading, allowing traders to follow and copy the trades of other successful traders.

IG: IG is a broker that offers a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies.

XM: XM is a broker that offers low spreads and competitive pricing, as well as a range of educational resources for traders.

Plus500: Plus500 is a broker that offers commission-free trading and a range of trading instruments, including forex, stocks, and cryptocurrencies.

FXTM: FXTM is a broker that offers a range of trading platforms and a variety of trading instruments, including forex, stocks, and commodities.

It's important to do your own research and compare the features, fees, and offerings of different brokers before choosing one that best fits your trading needs and preferences.

Is ICM Safe or Scam?

ICM is a legitimate forex and CFD broker that is regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA), Financial Services Commission of Mauritius, etc. The company also uses advanced security measures to protect clients' funds and personal information.

However, as with any financial service provider, it is always important to do your own research and due diligence before opening an account and investing your money.

How are you protected?

ICM protect their clients with many different protection measures. Specific details can be found in the table below:

| Protection Measures | Description |

| Regulation | FCA, FSC, LabuanFSA, FSA, ARIF, CABs, QFC |

| Negative Balance Protection | Clients can not lose more than their account balance in the event of a market downturn |

| Segregated Accounts | Protect clients in the unlikely event of the broker's insolvency |

| SSL Encryption | ICM's website and trading platforms use SSL encryption to ensure that all client information and transactions are secure |

| Two-Factor Authentication | As an additional security measure to protect client accounts from unauthorized access |

It's worth noting that while these measures can help protect clients, no security measures can completely eliminate the risk of financial loss in trading. It's important for traders to understand the risks involved in trading and to only trade with funds they can afford to lose.

Our Conclusion on ICM Reliability:

Based on the regulatory oversight, client fund protection, and risk management policies of ICM, it can be considered a relatively reliable broker. It is regulated by several reputable financial authorities, and it implements measures to ensure the security of its clients' funds.

However, like any other broker, there are still risks associated with trading, such as market volatility and price fluctuations, which should be taken into consideration. Though these measures can help protect clients, no security measures can completely eliminate the risk of financial loss in trading. It's important for traders to understand the risks involved in trading and to only trade with funds they can afford to lose

Market Instruments

ICM offers a variety of trading instruments across different asset classes, including:

Forex: ICM offers over 60 major, minor, and exotic currency pairs, including EUR/USD, GBP/USD, USD/JPY, AUD/USD, and many more.

Precious metals: ICM provides trading opportunities for precious metals, including gold and silver, which are traded as CFDs.

Stocks: ICM allows clients to trade stocks from some of the world's most popular stock exchanges, including the NYSE and NASDAQ.

Futures: ICM provides access to futures contracts from various markets, including indices, commodities, and currencies.

Securities: ICM offers trading in bonds, bills, and notes issued by governments and corporations.

Cryptocurrencies CFDs: ICM also offers trading in cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple, as CFDs.

It's worth noting that the availability of trading instruments may vary depending on the jurisdiction of the client.

Accounts

ICM offers two account types: ICM Direct (ECN) and ICM ZERO.

The ICM Direct (ECN) account has variable spreads starting from 1.2 pips and requires a minimum deposit of $200. It also offers a maximum leverage of 1:200.

The ICM ZERO account has spreads starting from 0.0 pips with a commission of $7 per lot traded and requires a minimum deposit of $1,000. It also offers a maximum leverage of 1:200. Both accounts offer access to the MT4, MT5 and cTrader trading platforms.

Leverage

ICM offers leverage up to 1:200 for forex trading. However, the maximum leverage available for other instruments such as indices, commodities, and cryptocurrencies may vary depending on the instrument and market conditions.

It is important to note that while leverage can increase potential profits, it also amplifies potential losses, and traders should use it with caution and employ appropriate risk management strategies.

Spreads & Commissions

ICM offers variable spreads, which means that the spread can fluctuate depending on market conditions. The spread for EUR/USD can start from as low as 1.2 pips on the ICM Direct account, while on the ICM ZERO account the spread can be as low as 0.0 pips, but with a commission of $7 per lot.

It's important to note that the spreads and commissions may vary depending on the account type, trading instrument, and market conditions. It's always recommended to check the latest information on the ICM website or trading platform.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| ICM | 1.2 pips | 0 ($7 per lot on ICM ZERO account) |

| eToro | 1.0 pips | 0 |

| IG | 0.75 pips | 0 |

| XM | 0.9 pips | 0 |

| Plus500 | 0.6 pips | 0 |

| FXTM | 1.3 pips | 0 |

Note: Spreads and commissions are subject to change and may vary depending on the account type and trading platform used.

Trading Platforms

ICM offers MetaTrader4 (MT4), MetaTrader5 (MT5), and cTrader as trading platforms.

MetaTrader4 is a widely used platform among traders and offers a range of features such as automated trading and advanced charting tools.

MetaTrader5 is the successor to MT4 and includes additional features such as more advanced trading tools and indicators.

cTrader is a popular platform among ECN traders and offers advanced charting tools, level 2 pricing, and other advanced features.

Overall, ICM's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| ICM | MT4, MT5, cTrader |

| eToro | eToro Platform |

| IG | IG Platform |

| XM | MT4, MT5 |

| Plus500 | Plus500 Platform |

| FXTM | MT4, MT5 |

Deposits & Withdrawals

ICM offers several deposit and withdrawal options for its clients.

Deposit methods include bank wire transfer, credit/debit card, Skrill, Neteller, FasaPay, and China Union Pay. Withdrawal methods include bank wire transfer, Skrill, Neteller, FasaPay, and China Union Pay.

ICM does not charge any deposit or withdrawal fees, but fees may be charged by the payment provider. Withdrawals are usually processed within 24 hours, but may take longer depending on the payment method.

The minimum deposit amount for ICM Direct account is $200 and for ICM Zero account is $1,000.

ICM minimum deposit vs other brokers

| ICM | Most other | |

| Minimum Deposit | $200 | $100 |

ICM Money Withdrawal

To withdraw funds from your ICM trading account, you need to follow these steps:

Step 1: Log in to your ICM client portal.

Step 2: Click on the “Withdrawal” button.

Step 3: Select the payment method you want to use.

Step 4: Enter the amount you want to withdraw and fill in any required details.

Step 5: Submit your withdrawal request.

ICM will then process your withdrawal request and send the funds to the payment method you selected. The processing time can vary depending on the payment method and your bank's processing times. It is recommended to check with your payment provider for more information.

Fees

ICM charges various fees that traders should be aware of. Apart from spreads and commissions, there are also some other fees that will be charged.

Inactivity fee: If an account is inactive for 180 days, ICM charges an inactivity fee of $50 per month.

Overnight swap fees: ICM charges overnight swap fees on positions held open overnight, which can be either positive or negative, depending on the trading instrument.

Conversion fees: If traders deposit or withdraw funds in a currency different from their account currency, ICM charges a conversion fee of 2%.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| ICM | Free for most methods, bank wire may incur a fee | Free for most methods, bank wire may incur a fee | $5/month after 180 days of inactivity |

| eToro | Free | $5 | $10/month after 12 months of inactivity |

| IG | Free for most methods, bank wire may incur a fee | $1.20 per withdrawal | £12/month after 24 months of inactivity |

| XM | Free for most methods, bank wire may incur a fee | Free for most methods, bank wire may incur a fee | $5/month after 90 days of inactivity |

| Plus500 | Free | $1.3 - $39 depending on the withdrawal method used | $10/month after 3 months of inactivity |

| FXTM | Free for most methods, bank wire may incur a fee | Free for most methods, bank wire may incur a fee | $5/month after 6 months of inactivity |

It is important to note that fees may vary depending on the account type, trading instrument, and market conditions. Traders should always check the latest fee schedule on ICM's website before trading.

Customer Service

ICM offers customer support 24/5 via live chat, phone, email, WhatsApp or send messages online to get in touch.

You can also follow some social networks such as LinkedIn, YouTube, Instagram, Facebook and Twitter.

| Pros | Cons |

| • 24/5 customer support via phone, email, and live chat | • No 24/7 customer support |

| • Personal account managers for certain account types | • No in-person customer support |

| • Multilingual customer support | • Limited educational resources on customer support page |

| • Quick response times to customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with ICM's customer service.

Overall, ICM's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Conclusion

In conclusion, ICM is a regulated broker that offers a range of trading instruments and account types. The broker has a strong emphasis on customer protection and provides negative balance protection to its clients. Additionally, the broker offers a demo account for traders to practice their trading strategies before investing real money.

ICM offers two account types with different spreads and commissions, and clients can choose between MT4, MT5, and cTrader as their trading platforms. The broker offers multiple deposit and withdrawal options, and fees are relatively competitive compared to other brokers in the industry.

In terms of customer service, ICM has a knowledgeable support team that can be reached through email, phone, or live chat. However, the broker's educational resources could be more extensive to cater to novice traders.

Frequently Asked Questions (FAQs)

| Q 1: | Is ICM regulated? |

| A 1: | Yes. It is regulated by FCA, FSA, ARIF, FSC, LabuanFSA, QFC and CABs. |

| Q 2: | At ICM, are there any regional restrictions for traders? |

| A 2: | Yes. ICM does not provide services to residents of the USA, North Korea and a few other countries. |

| Q 3: | Does ICM offer industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available. It also supports cTrader. |

| Q 4: | What is the minimum deposit for ICM? |

| A 4: | The minimum deposit requirement at ICM is $200. |

| Q 5: | Is ICM a good broker for beginners? |

| A 5: | Yes. ICM is a good choice for beginners because it is regulated well and offers various trading instruments with no minimum deposit requirement on the leading MT4 and MT5 platforms. |

Keywords

- 5-10 years

- Regulated in Malaysia

- Straight Through Processing(STP)

- MT4 Full License

- MT5 Full License

- High potential risk

News

Exposure ICM.com Seeks to Cancel UK Subsidiary's FCA License

ICM.com has filed to cancel the FCA license for its UK branch, ICM Capital Limited, amidst financial struggles.

2024-05-17 16:39

News WIKIFX REPORT: ICM Capital grows client assets 2x to £6.1M in 2020

ICM Capital Ltd, an FCA-regulated retail forex broker, has released its 2020 financials, which indicate relatively flat activity for the year but steady long-term increase in client deposits.

2022-06-21 14:42

News WIKIFX REPORT: ICM Capital Releases Financial Results In Fy20 With A Net Profit Of £177,000

ICM Capital Limited, a forex and CFDs broker, has released its financial reports for the fiscal year ending December 31, 2021. After a disappointing profit performance the previous financial year, the FCA-regulated broker reported a net profit of £177,015 this year.

2022-06-17 14:50

News ICM Capital Offers £1,000,000 Insurance for FX and CFD Traders

ICM Capital today announces it has enhanced its client-fund protection to cover £1,000,000. This new insurance is available to all ICM Capital live account holders at no additional cost and is underwritten by QBE Underwriting Limited and other participating syndicates at Lloyd’s of London.

2022-06-17 14:39

News ICM Partners Signs ‘Not Going Quietly’ Director Nicholas Bruckman (EXCLUSIVE)

ICM Partners has signed Nicholas Bruckman, director of the SXSW award-winning and IDA-nominated documentary “Not Going Quietly,” for representation.

2021-12-16 18:04

Review 19

Content you want to comment

Please enter...

Review 19

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

曾经心痛

Hong Kong

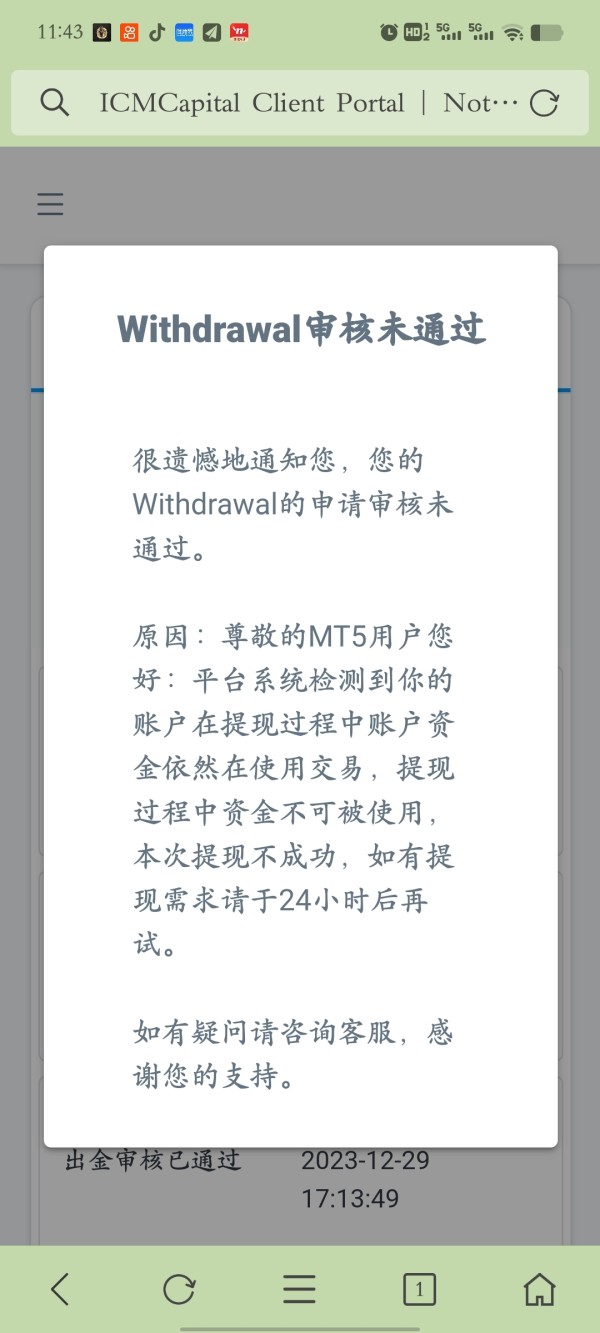

Every withdrawal is rejected! Every withdrawal is rejected!

Exposure

01-05

FX2181623852

Hong Kong

1. The reason for rejection is too far-fetched. The position closing operation was already done during the review, but the withdrawal was refused because of transactions made on that day! No withdrawal requests may be submitted during New Year's Day, but there are no restrictions on deposits. There is also an unreasonable request: no further withdrawals are allowed for 24 hours! This reason for refusing to withdraw money is too weird!! ! At 20:15 on January 2, 2024, the ICM platform suddenly dropped by 10,000 pips, causing many customers to liquidate their positions. However, when I checked the international Bitcoin market, this wave of market prices did not appear! 2. Shouldn’t the withdrawal exchange rate be the real-time exchange rate? The deposit rate is 7.2, but the platform informed that the withdrawal rate is 6.8.

Exposure

01-05

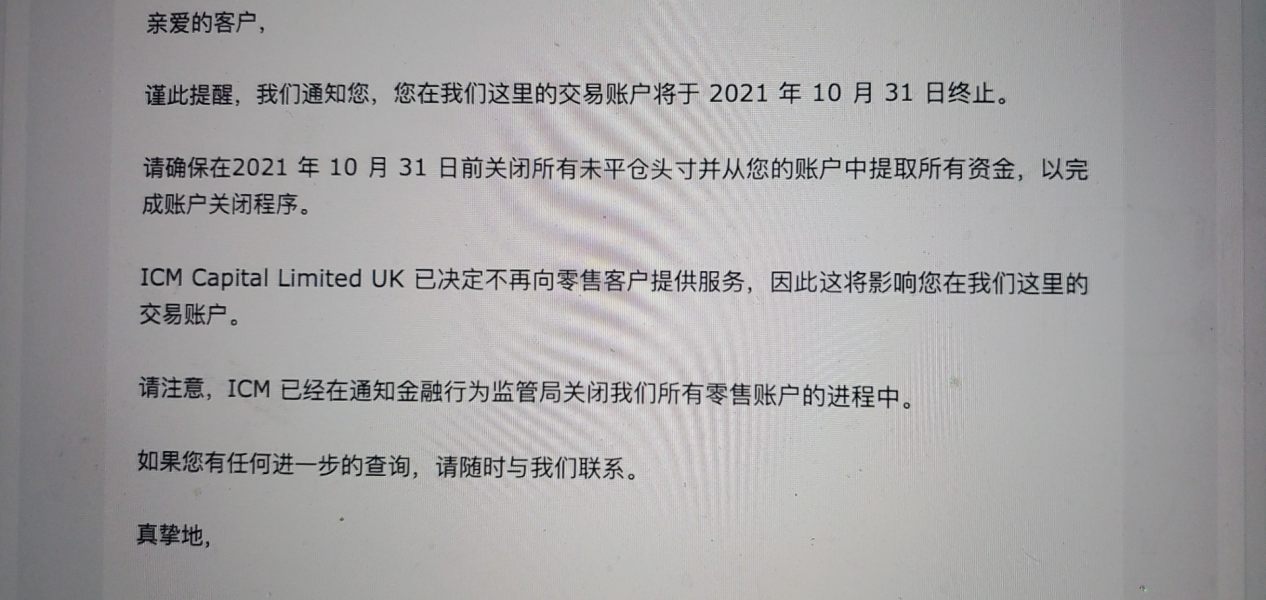

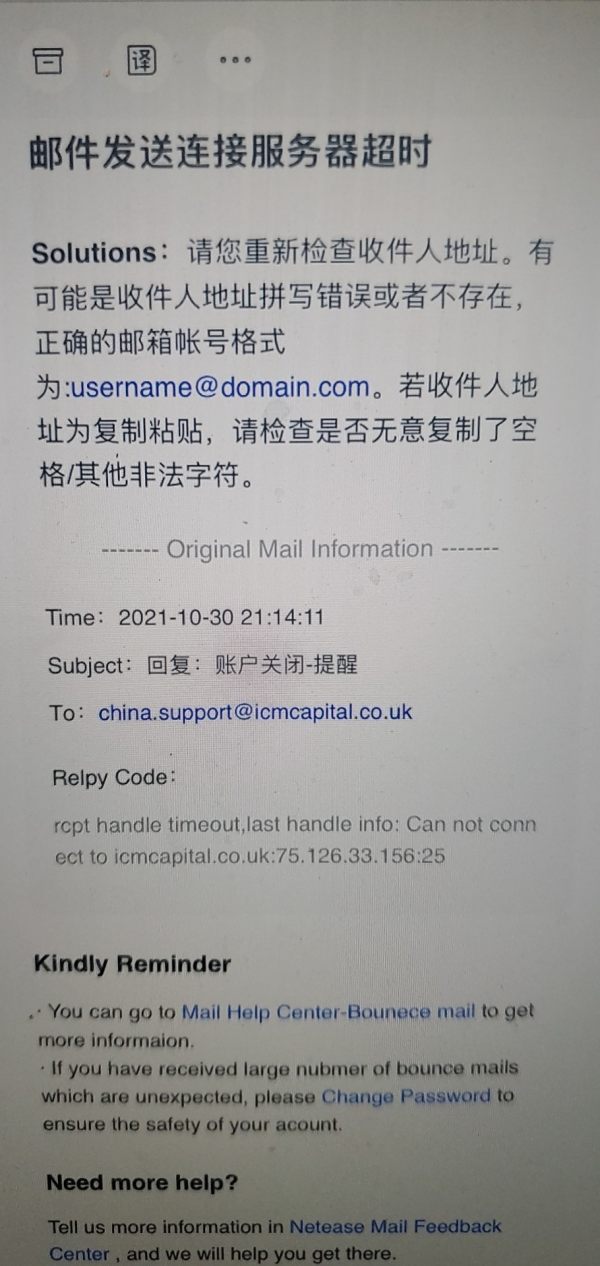

小总统

Hong Kong

I received an email and could not log in the website. It did not reply and my withdrawal was still not done.

Exposure

2021-11-01

痞痞侠

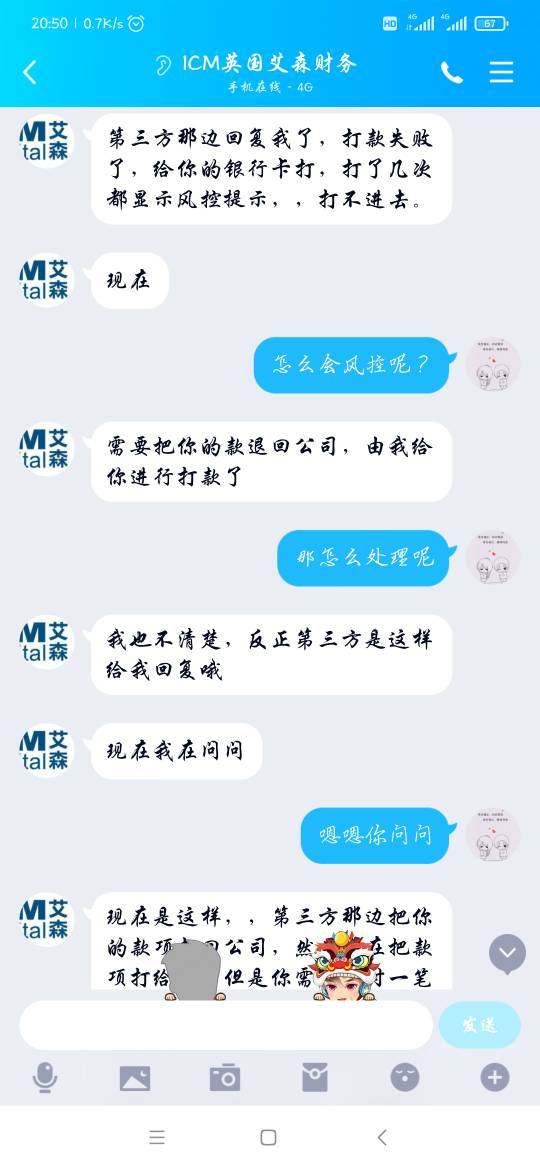

Hong Kong

I have submitted the withdrawal request for one month, while ICM kept fending off with the excuse of risk-management by third party, asking for an extra custody fee.

Exposure

2020-06-13

痞痞侠

Hong Kong

The withdrawal applied on 18th is yet to be received. The service is out of contact, as well as the so-called financial consultant. Now the website is disabled.

Exposure

2020-06-05

痞痞侠

Hong Kong

ICM gave no access to withdrawal and asked for 20% margin. After that, it continued to ask for 10%.

Exposure

2020-05-14

FX4132770937

Hong Kong

Having appealed for 2 days, I still couldn’t unfreeze my fund. The customer service didn’t reply to me. Stay away from the scam platform.

Exposure

2020-04-25

FX3399440842

Hong Kong

The scam platform even blocked me.

Exposure

2019-12-19

FX3399440842

Hong Kong

Their routine was the so-called wrong bank information, which might be rigged by them. You will be told to pay 100000 RMB to modify. After that, it will low the credit score to deliberately and ask you to pay 200000 RMB, then tax fee... It’s a rip-off.

Exposure

2019-12-13

小三和弦

Hong Kong

There is no free lunch in the world! Don’t be too greedy! The routine of the scam platform are similar. Be careful!!!

Exposure

2019-12-09

FX3399440842

Hong Kong

In November, I failed to withdraw in ICM . I was told to pay 93230 RMB margin to modify my bank account. Then, with the excuse of raising credit score, they required me to pay another 200000 RMB. It was a simply routine.

Exposure

2019-12-06

一念洒脱

Hong Kong

I was asked to perfect information again.The customer service told me that my bank card number was wrong, which would affect my credit score, leading to unavailable withdrawal.I need to make up 20 score, with 15000 RMB for per score.I was forced to add 300000 RMB before the end of the month.Otherwise, they threatened that my account would be canceled.

Exposure

2019-11-29

一念洒脱

Hong Kong

While I typed the bank number wrongly, the platform asked me to raise the credit score.Otherwise, it won’t return the fund.Scam platform!

Exposure

2019-11-29

FX3399440842

Hong Kong

I was asked to pay 9320 yuan to modify the password and 20 margin for the credit score.What’s the relation between them?Is the platform legit?

Exposure

2019-11-20

FX2780757310

Hong Kong

The candlestick was different,thus the imprecise analysis caused losses.I am seriously suspicious of the reliability of the platform!The left one is the candlestick of ICM’s MT4,the right one was the candlestick in Huitong Finance.I send this to warn you!

Exposure

2019-10-23

zhao juan

Malaysia

It's good to have Login in both Web & mobile, which many brokers don't allow. They use single login/instance only. For improvement on mobile app/ Web, if there is an option to save the previous traded quantity it will be much useful, instead of entering the quantity again. Also the favourites tab is not available in the Web. Please consider this.

Neutral

04-30

净芳

Hong Kong

Are there any trusted brokers out now? Many brokers I just opened a demo account with but did not conduct real trading. ICM is different, I see no deposit threshold, so I invested a little casually, and I didn't expect to earn! So I applied for a withdrawal, but no one processed it...

Neutral

2023-02-13

kamahak

United States

ICM is an broker that you use it very very easy

Neutral

2022-12-08

Joker5026

United Kingdom

This is a very good broker that I have used. The K-line is clear, smooth to use, and withdrawals are convenient and fast.

Positive

2023-12-10