简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG USOUSD Market Report January 13, 2025

Sommario:USOUSD has broken through Support 1 at 74.936 and is currently traded around 76.662, indicating a bullish momentum. However, the stochastic indicator is approaching overbought levels near 80, suggesti

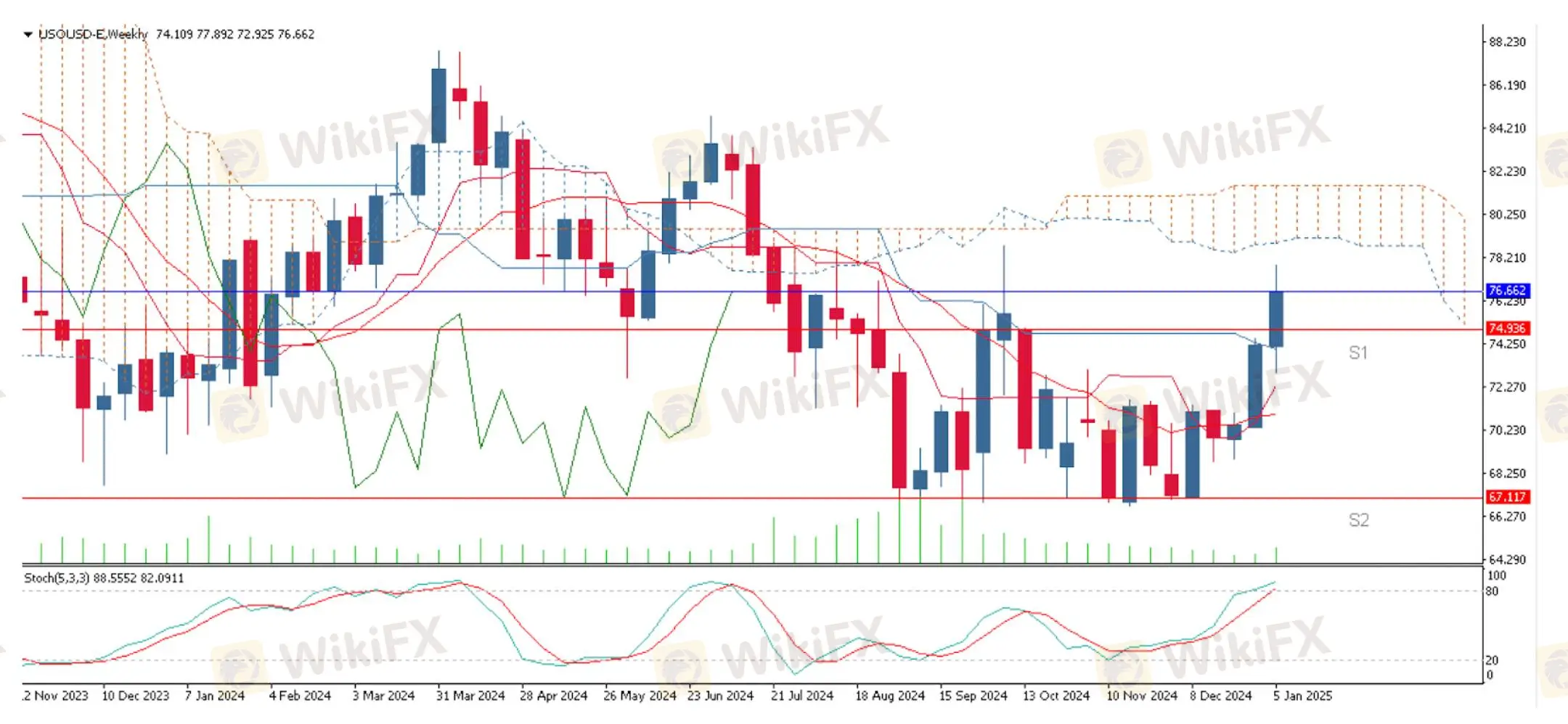

USOUSD has broken through Support 1 at 74.936 and is currently traded around 76.662, indicating a bullish momentum. However, the stochastic indicator is approaching overbought levels near 80, suggesting a potential trend reversal if buying pressure diminishes.

USOUSD has successfully breached the first support level at 74.936 and is now attempting to penetrate the Kumo cloud, signaling a potential continuation of the bullish trend. The current price is approximately 76.662, reflecting strong upward momentum. However, the stochastic oscillator is nearing the overbought threshold of 80, indicating that the asset may be overextended. If buying interest remains robust, the bullish trend could persist; otherwise, a trend reversal may occur due to overbought conditions.

Market Observation & Strategy Advice:

1. Monitor Resistance Levels: Keep an eye on the next resistance levels at 77.500 and 78.800, which could act as potential barriers to further price increases.

2. Watch for Overbought Signals: Given the stochastic indicator's proximity to overbought territory, be cautious of potential trend reversals.

3. Set Stop-Loss Orders: To manage risk, consider placing stop-loss orders below the breached support level at 74.936.

4. Assess Buying Pressure: Evaluate the strength of buying pressure to determine the sustainability of the current bullish momentum.

5. Consider Partial Profit-Taking: If in a long position, think about taking partial profits as the price approaches key resistance levels to secure gains.

Market Performance:

Commodities Last Price % Change

XAUUSD 2,710.80 +0.08%

Today's Key Economic Calendar:

CN: Balance of Trade

CN: Exports and Imports (YoY)

EU: ECB Lane Speech

Risk Disclaimer This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IB

EC Markets

TMGM

VT Markets

Neex

IC Markets Global

IB

EC Markets

TMGM

VT Markets

Neex

IC Markets Global

WikiFX Trader

IB

EC Markets

TMGM

VT Markets

Neex

IC Markets Global

IB

EC Markets

TMGM

VT Markets

Neex

IC Markets Global

Rate Calc