简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Global central banks increase gold reserves: Eastern European countries' trends and mar

Sommario: Earlier this year, Czech Central Bank Governor Ales Michl visited London to view Czech gold reserves stored in the Bank of England's vaults. The move was part of his announced plan to double Czech

Earlier this year, Czech Central Bank Governor Ales Michl visited London to view Czech gold reserves stored in the Bank of England's vaults. The move was part of his announced plan to double Czech gold reserves to 100 tons over the next three years. Since Michel took office in 2022, Czech gold reserves have increased fivefold with the aim of diversifying the central bank's reserves. Michel stressed that "we need to reduce volatility, we need an asset with zero correlation with stocks, and this asset is gold." This trend is particularly evident in Eastern European countries, and central bank governors in Poland, Serbia and other countries have also joined the action to increase gold reserves as a way to diversify investments and bet on future gold price increases.

Central banks around the world are stockpiling gold to protect against external shocks, such as potential trade wars and geopolitical tensions. Eastern European central banks are particularly prominent in increasing their gold reserves. For example, Adam Glapinski, governor of the Polish central bank, said that gold and hard currency reserves are essential to protect the economy from catastrophic events. Serbia has repatriated its gold stocks stored abroad to ensure their safety and reduce storage costs.

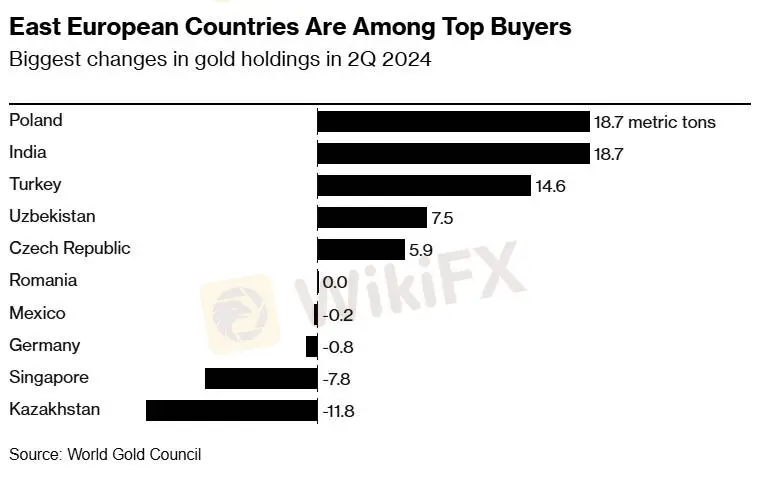

According to the latest data from the World Gold Council, Poland is one of the world's largest gold buyers in the second quarter of 2024. Polish Central Bank Governor Grabinski said that they are entering the exclusive club of the world's largest gold holders and plan to increase the proportion of gold reserves to 20%. The Czech Central Bank is also expected to become a member of this "exclusive club". The central bank has about $150 billion in foreign exchange reserves, which is almost half of its GDP.

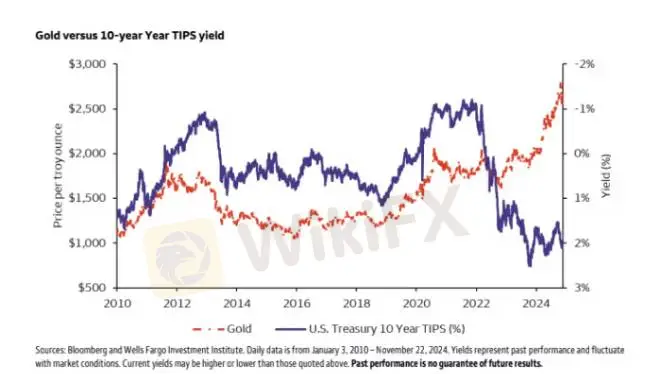

Strong demand for gold from global central banks has led to gold prices no longer being driven by rising real interest rates as usual. Instead of falling as real interest rates rise, gold prices have risen nearly 30% in the year ending Monday, making it one of the best performing assets this year, according to FactSet. Mason Mendez and John LaForge, strategists at Wells Fargo Investment Institute, said the change has more to do with gold than real interest rates, adding that gold has been "particularly sensitive to geopolitical tensions in Ukraine and the Middle East" in recent years.

Central bank purchases already accounted for 23% of total gold demand last year, up from 10% in 2021. Rick Rule, a veteran investor and president and CEO of Rule Investment Media, said the only way for the United States to escape its current debt crisis is to undermine the real value of its debt through inflation, a dynamic that creates a bullish case for gold, copper and energy resources under the next U.S. government.

Gold is seen as a safe haven and a political selling point for Eastern European leaders, who often need to maintain a complex balance between the West, Russia and China. Hungary's central bank has increased its gold reserves by more than a tenth to 110 tons this year. Serbian President Aleksandar Vucic repatriated the country's stockpiles stored abroad in 2021. This year, he pledged to buy gold with "every surplus money" left in the treasury "to keep it safe in difficult times."

Gold's value and importance are increasing during times of global turmoil, especially during geopolitical conflicts and high inflation. Goldman Sachs Group Inc. ranked gold as one of the most important commodities to trade in 2025, saying that gold prices could continue to rise during Trump's presidency and reach $3,000 an ounce by December next year.

The increase in gold reserves by central banks in Eastern Europe and the strong demand for gold from central banks around the world are changing the dynamics of the gold market. Gold is becoming increasingly important as a safe haven against the backdrop of geopolitical tensions and inflation expectations. Investors and policymakers need to pay close attention to these trends to seize investment opportunities in the gold market.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

ATFX

FxPro

FXTM

STARTRADER

OANDA

IC Markets Global

ATFX

FxPro

FXTM

STARTRADER

OANDA

IC Markets Global

WikiFX Trader

ATFX

FxPro

FXTM

STARTRADER

OANDA

IC Markets Global

ATFX

FxPro

FXTM

STARTRADER

OANDA

IC Markets Global

Rate Calc