简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 3 Oct: EUR/USD Slides Amid Middle East Tensions & Strong U.S. Employment Data

Sommario:Product: EUR/USDPrediction: DecreaseFundamental Analysis:EUR/USD continued its downward trend on Wednesday, pushing bids lower as markets contend with uncertainty in the Middle East and fading expecta

Product: EUR/USD

Prediction: Decrease

Fundamental Analysis:

EUR/USD continued its downward trend on Wednesday, pushing bids lower as markets contend with uncertainty in the Middle East and fading expectations for a significant rate cut from the Federal Reserve in November.

The pair recovered slightly from a weekly low of 1.1045 reached on Tuesday, but traders remain cautious ahead of important U.S. macroeconomic data. This week focuses on employment figures, with several reports leading up to Friday's Nonfarm Payrolls.

The JOLTS Job Openings report showed an unexpected increase of 329K, raising openings from 7.711 million in July to 8.040 million in August, which provided short-term support for the U.S. Dollar. The ADP survey also revealed a private sector job gain of 143K in September, outperforming expectations.

Earlier, the Eurozone reported the August unemployment rate held steady at 6.4%. The USD gained from a risk-averse environment due to escalating tensions between Israel and Lebanon, with rising oil prices driving investors away from high-yield assets.

Technical Analysis:

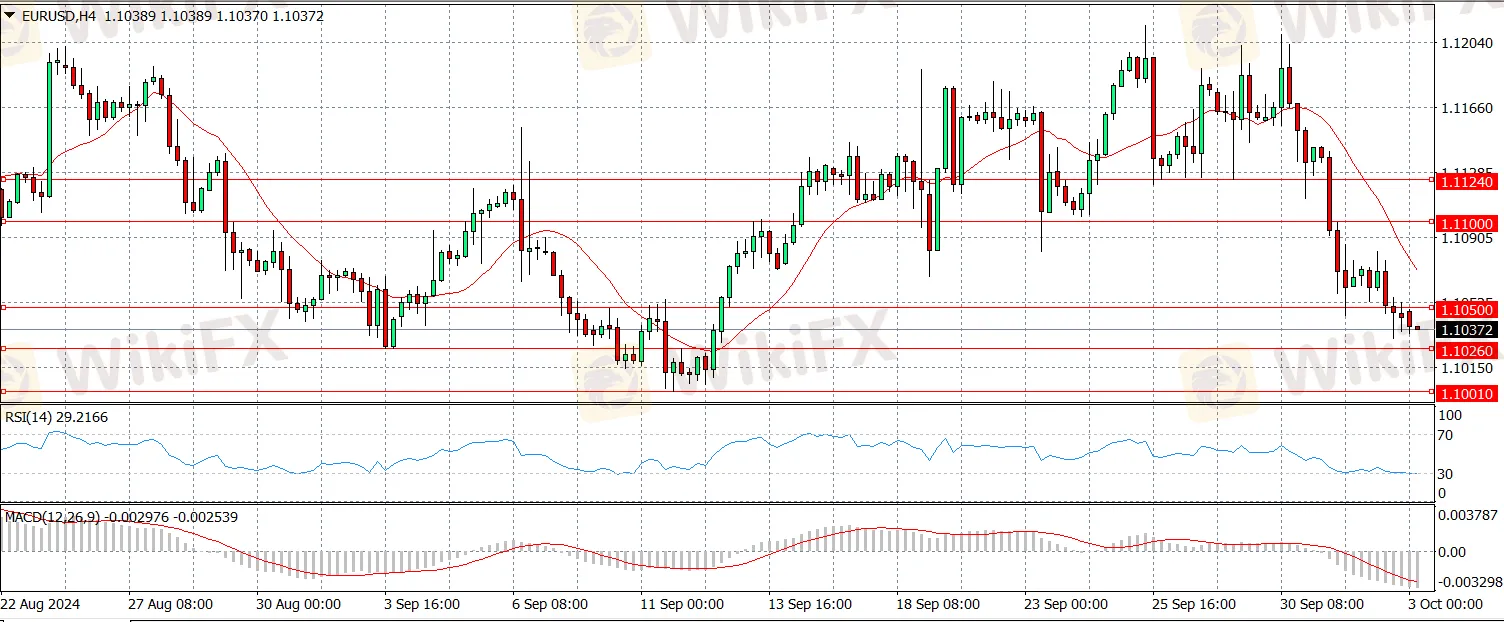

From a technical perspective, the EUR/USD pair appears bearish, currently trading at the lower end of Tuesdays range. The daily chart shows the pair below a flat 20 Simple Moving Average, which is acting as resistance around the 1.1100 level. Meanwhile, the 100 and 200 SMAs have lost their upward momentum but remain well below the current price. Technical indicators also show bearish trends, indicating potential further losses.

In the short term, the 4-hour chart suggests a downside bias. A bearish 20 SMA is nearing a downward cross with the directionless 100 and 200 SMAs, signalling strong selling pressure. Additionally, technical indicators are trending lower after a consolidation phase, suggesting another downward move may be coming.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices are struggling to gain momentum on Thursday but remain near last week's highs, supported by escalating Middle East tensions. Spot Gold is trading around $2,650 per ounce, benefiting from safe-haven demand amid a pessimistic market mood and rising crude oil prices.

While Asian and European stocks are mixed, U.S. employment data, including 143,000 new jobs in September from the ADP report, is boosting the U.S. Dollar. Traders are watching for Friday's Nonfarm Payrolls, with concerns about employment possibly influencing future Federal Reserve rate cuts.

Technical Analysis:

The daily chart for XAU/USD shows that it has recovered from early losses and is hovering around its opening price. Moving averages are trending upward, remaining well below the current price, which supports a long-term bullish trend. Technical indicators have dipped but are still above their midlines, indicating limited downward momentum and not suggesting a sharp decline.

In the short term, the 4-hour chart indicates that XAU/USD is poised to continue its upward movement. The pair is trading just above a flat 20 SMA, while the 100 and 200 SMAs are rising below it, supporting a bullish extension. Additionally, technical indicators are moving into positive territory, signalling increased buying interest.

Product: GBP/USD

Prediction: Decrease

Fundamental Analysis:

The GBP/USD pair has dropped to around 1.3265 during the early Asian session on Thursday. Increased demand for the U.S. dollar, fueled by rising geopolitical tensions in the Middle East, is supporting the pair.

GBP/USD fell nearly 0.7% on Tuesday and edged closer to 1.3300 in the European session on Wednesday, but the technical outlook still lacks strong recovery momentum. After a bullish start to the week, the U.S. Dollar continued to strengthen on Tuesday, pushing GBP/USD lower as the risk-averse market favoured the USD.

The U.S. Bureau of Labor Statistics reported job openings rose to 8.04 million in August, above expectations. The Automatic Data Processing will release its private sector employment report later today, with expectations for a 120,000 job increase. A disappointing figure could negatively impact the USD, while a stronger reading might help it hold its ground. Investors are also focused on the Middle East crisis, where Israel has vowed to retaliate after Iran launched around 200 missiles, increasing safe-haven demand for the USD.

Technical Analysis:

The Relative Strength Index on the 4-hour chart remains well below 50, indicating that the recent recovery may be just a technical correction rather than a true reversal. On the downside, interim support is at 1.3275, followed by 1.3250, where the 100-period Simple Moving Average is. A daily close below this level could attract sellers and lead to a further decline toward 1.3180. If GBP/USD stabilises above 1.3300, it may encounter resistance at 1.3340-1.3350, ahead of 1.3400.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FOREX.com

EC Markets

IQ Option

Pepperstone

HFM

IC Markets Global

FOREX.com

EC Markets

IQ Option

Pepperstone

HFM

IC Markets Global

WikiFX Trader

FOREX.com

EC Markets

IQ Option

Pepperstone

HFM

IC Markets Global

FOREX.com

EC Markets

IQ Option

Pepperstone

HFM

IC Markets Global

Rate Calc