简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Powell’s Jackson Hole Speech: Is the Federal Reserve’s Monetary Policy Entering a Phase of Adjustment?

Sommario:At the 2024 Jackson Hole Global Central Bank Annual Meeting, Federal Reserve Chairman Jerome Powell's speech provided the market with important clues about the future direction of U.S. monetary policy, emphasizing that the current moment is an appropriate time for monetary policy adjustments and expressing confidence in the return of inflation to the 2% target. Although he remains optimistic about the stability of the job market and the resilience of the economy, he also cautioned the market tha

On August 23, 2024, Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Global Central Bank Annual Meeting provided important clues about the future direction of U.S. monetary policy for the global financial market. In this highly anticipated speech, Powell not only reviewed the changes in the U.S. economy following the impact of the COVID-19 pandemic but also conducted an in-depth analysis of the current inflation and job market conditions, hinting at upcoming adjustments in monetary policy.

Powell's remarks can be summarized in four points:

- Powell clearly stated that the current time is appropriate for adjusting monetary policy, directly declaring, “The time for policy adjustment has come.”

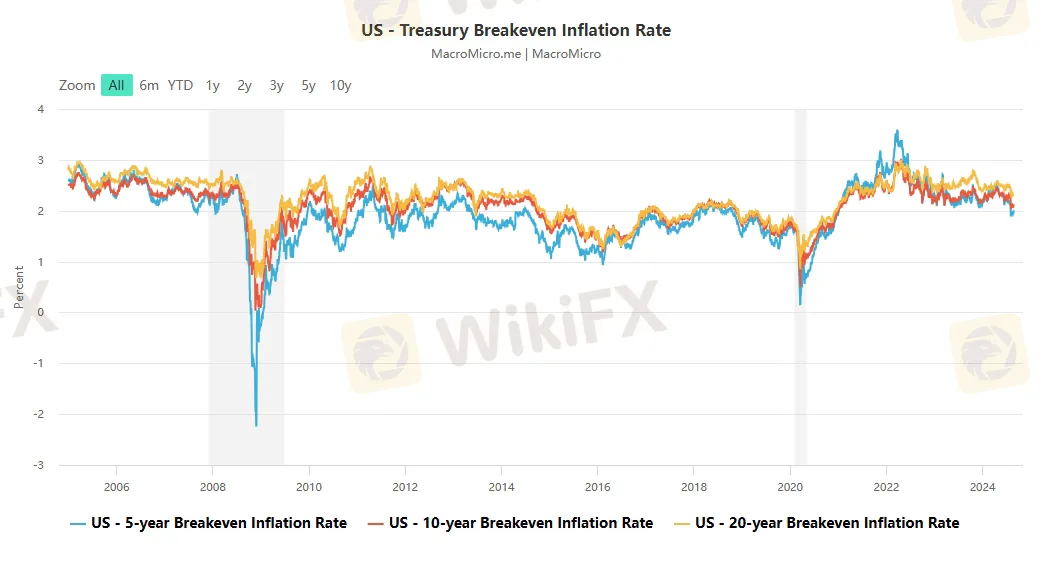

- He emphasized that the inflation rate is now very close to the targeted 2% goal, and he has an enhanced confidence that the inflation rate will continue to steadily fall back to this target level.

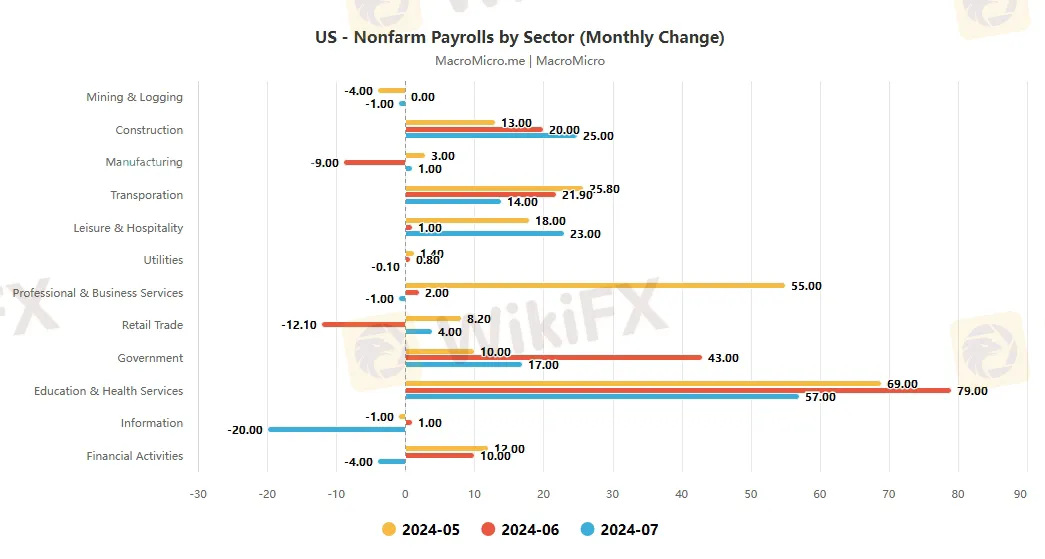

- Powell indicated that the Federal Reserve does not wish to see further cooling in the job market, suggesting that in the hierarchy of policy objectives, the stability of the job market may be prioritized over controlling inflation. He clearly stated, “We do not seek nor welcome further cooling in labor market conditions,” and pledged to “do everything we can to support a strong labor market while further achieving price stability.”

- His speech mainly focused on an in-depth analysis of inflation, clearly conveying the Federal Reserve's confidence that the inflation issue will be effectively controlled, with a tone that almost declared success in combating inflation.

His speech mainly consisted of two core parts. First, he provided a prospect for recent monetary policy, clearly stating that “the time for policy adjustment has come,” and expressed more confidence in inflation falling back to the 2% target. Second, he detailed the ups and downs of U.S. inflation after the pandemic and concluded that the reversal of the pandemic, the Federal Reserve's suppression of aggregate demand, and stable inflation expectations have jointly promoted the decline in inflation.

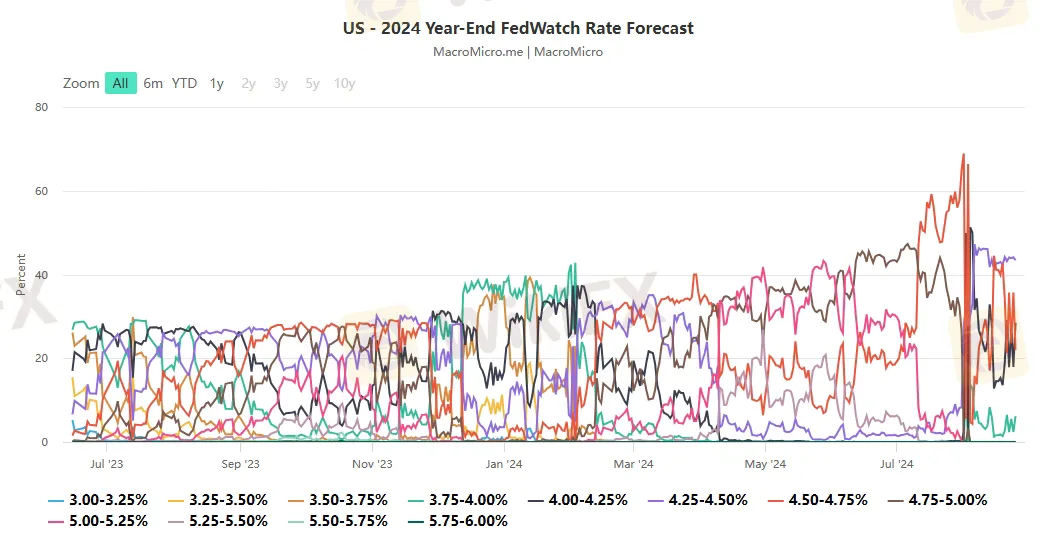

Market participants reacted swiftly to Powell's speech. Bond traders began to bet on the magnitude of the first rate cut and the future easing path, while stock market investors welcomed the rise in U.S. stocks. The decline in the U.S. dollar index and the drop in U.S. Treasury yields reflected the market's enhanced expectations for a rate cut by the Federal Reserve. The three major U.S. stock indices rose in response, with the Nasdaq, S&P 500, and Dow Jones Industrial Average closing up by 1.47%, 1.15%, and 1.14%, respectively. In addition, gold prices were also boosted, with a daily increase of 1.1%, regaining the important psychological threshold of $2,500 per ounce.

Despite Powell's optimistic view on the decline of inflation, the market remains vigilant about the risks of rising inflation. The reversal space of supply disruptions and demand factors may become obstacles to the decline in inflation. Currently, the pressure on the U.S. supply side has improved to some extent, but some key indicators, such as CPI transportation services and motor vehicle insurance, still show the impact of supply disruptions on inflation. Demand factors may also become a “stumbling block” for the decline in inflation, as the rebound in U.S. inflation in the first quarter of this year was mainly driven by the demand side.

Powell emphasized that the future path of policy will depend on upcoming economic data and evolving risk assessments. This indicates that the Federal Reserve will maintain flexibility in policy-making to address potential economic fluctuations. He did not specify the exact timing and magnitude of rate cuts, but the market anticipates that the Fed is more likely to cut rates by 25 basis points (BP) rather than 50BP in September, thereby conveying confidence in a “soft landing” for the U.S. economy.

In the current global economic environment, the Fed's policies are influenced not only by domestic economic conditions but also by international events. Conflicts in the Middle East may increase the market's demand for safe-haven assets, thereby affecting the performance of the U.S. dollar and Treasury bonds. Additionally, policy movements of other central banks around the world, such as the Bank of Japan's rate hikes, may also indirectly affect the Fed's decision-making. In the current economic climate, risks facing the U.S. economy include an unexpected economic downturn and the resurgence of liquidity risk events. These risks could influence the Fed's policy choices and have a cascading effect on global financial markets.

Powell's speech provided the market with important information about the direction of the Fed's future monetary policy. Although the specific path of rate cuts remains uncertain, the market generally expects the Fed to adopt a more accommodative policy stance. Investors and policymakers need to closely monitor upcoming economic data and changes in the global economic environment to better understand the Fed's policy direction and potential market reactions. The Fed may adjust its monetary policy based on future economic data while maintaining a focus on “two-way risks.”

At the 2024 Jackson Hole Global Central Bank Annual Meeting, Federal Reserve Chairman Jerome Powell's speech provided the market with important clues about the future direction of U.S. monetary policy, emphasizing that the current moment is an appropriate time for monetary policy adjustments and expressing confidence in the return of inflation to the 2% target. Although he remains optimistic about the stability of the job market and the resilience of the economy, he also cautioned the market that the Fed's policies will remain flexible based on upcoming economic data and risk assessments. Powell's speech led to an increased expectation in the market for a 25 basis point rate cut in September, and his dovish stance boosted U.S. stock and gold prices, while the U.S. dollar index and Treasury yields fell accordingly. Market participants need to closely monitor future economic indicators and changes in the global economic environment to predict the Fed's policy direction.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Tickmill

EC Markets

Vantage

HFM

VT Markets

STARTRADER

Tickmill

EC Markets

Vantage

HFM

VT Markets

STARTRADER

WikiFX Trader

Tickmill

EC Markets

Vantage

HFM

VT Markets

STARTRADER

Tickmill

EC Markets

Vantage

HFM

VT Markets

STARTRADER

Rate Calc