简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

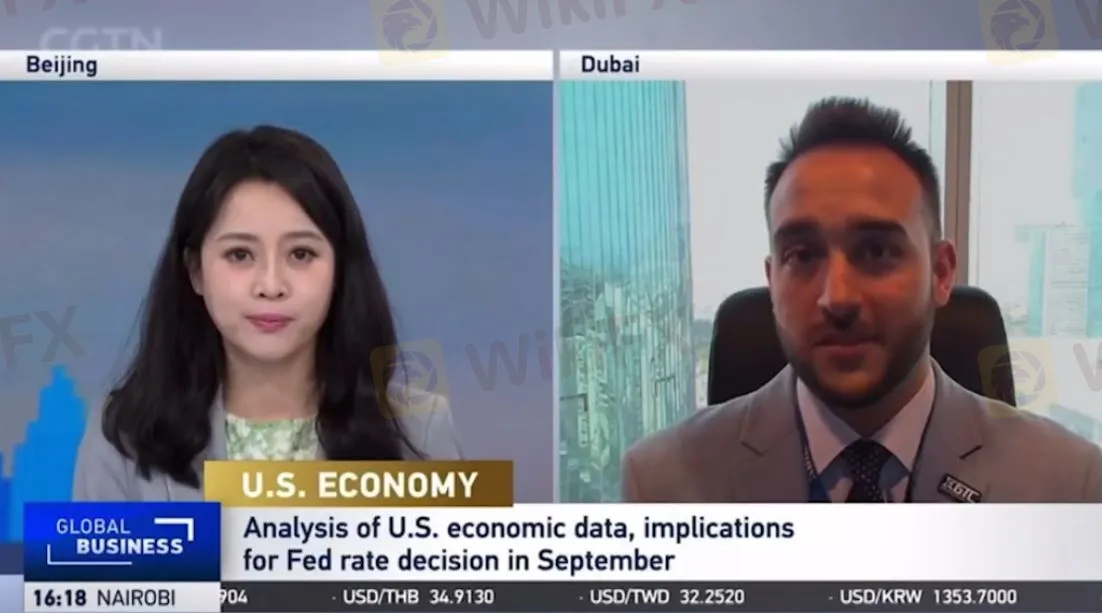

GTCFX Chief Analyst Featured on CGTN: Rising Expectations of Federal Reserve Rate Cuts and Renewed Debate on Real Estate Bubble

Sommario:U.S. Inflation Drops to Lowest Level in Over Two Years, Strengthening Expectations of a September Federal Reserve Rate Cut; Real Estate Market Hits Record High, Renewed Bubble Debate

Recently, the U.S. released data on the Consumer Price Index (CPI) for July, showing that the inflation rate has dropped to its lowest level in over two years, approaching a two-and-a-half-year historical low. This positive signal has heightened expectations of a rate cut in the Federal Reserve's upcoming September meeting. GTC Chief Analyst Jameel Ahmad noted that as the CPI continues to move closer to the Federal Reserve's 2% target, the Fed's resolve to lower interest rates in September has been further strengthened. This development has not only increased market expectations for more rate cuts within the year but also boosted investor confidence, with the gold market responding positively. Gold prices are nearing historical highs, and they are expected to maintain a strong trend in the short term.

At the same time, shocking news emerged from the U.S. real estate market. According to the latest research from Zillow, the price of typical entry-level homes in more than 200 cities across the U.S. has surpassed the one million dollar mark, setting a new historical high. This data has sparked widespread discussion and concern about a potential real estate bubble. Jameel Ahmad commented that although the term “bubble” is frequently mentioned, the global real estate market, including the U.S., has shown resilience and an ability to adapt to a high-interest-rate environment over the past year.

He further analyzed that the core challenge facing the current real estate market is the rapid rise in home prices and living costs, which has not been accompanied by corresponding wage growth, squeezing disposable income for residents. Particularly in the U.S., where mortgage terms are relatively long (typically 20 to 25 years), compared to the short-term fluctuations in the European market, this has provided a certain level of stability. However, he also acknowledged that for first-time homebuyers, the high prices have become an unavoidable obstacle, and he called for wage growth to better align with the actual needs of homebuyers.

In conclusion, the significant decline in the U.S. inflation rate provides strong support for a Federal Reserve rate cut, while the continued boom in the real estate market also brings with it discussions of bubble risks. Going forward, the market will closely monitor the Federal Reserve's policy actions and the subsequent developments in the real estate market to assess their impact on the global economic environment.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Pepperstone

XM

Octa

Tickmill

TMGM

Vantage

Pepperstone

XM

Octa

Tickmill

TMGM

Vantage

WikiFX Trader

Pepperstone

XM

Octa

Tickmill

TMGM

Vantage

Pepperstone

XM

Octa

Tickmill

TMGM

Vantage

Rate Calc