简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NFP Hammers Dollar to 4 Months Low

Sommario:The aftermath of the Japanese yen's strengthening has manifested in significant dips across multiple markets, including equities, commodities, and various currencies. The yen has erased all its 2024 losses against the dollar, moving towards the 145.00 mark. The dollar index (DXY) has fallen to its lowest level since March, hovering above the $103 mark.

The strengthening of the Japanese Yen shattered the financial market.

The commodity market weighs on the deteriorating economic outlook.

BTC dropped below $55000 as the risk appetite in the crypto market was affected by the Macro uncertainty.

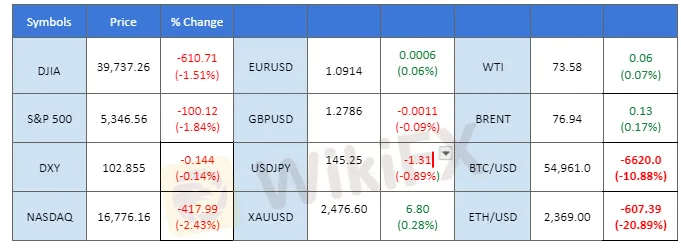

Market Summary

The aftermath of the Japanese yen's strengthening has manifested in significant dips across multiple markets, including equities, commodities, and various currencies. The yen has erased all its 2024 losses against the dollar, moving towards the 145.00 mark. The dollar index (DXY) has fallen to its lowest level since March, hovering above the $103 mark. Asian stock markets have plummeted at the start of the week, with the Nikkei leading the decline, dropping over 5% in Monday's Tokyo session.

The risk-off sentiment has failed to support safe-haven assets, with gold seesawing at its recent high level. Oil has slid to its 2-month low, weighed down by a deteriorating economic outlook. In the crypto market, Bitcoin tumbled below the $55,000 mark, marking the largest single-day drop since the collapse of FTX. The liquidity crunch, combined with heightened risk-off sentiment, has also negatively impacted the crypto market.

Market Overview

in

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which trades against a basket of six major currencies, extended its losses after weaker-than-expected employment reports for July raised expectations that the Federal Reserve will cut interest rates aggressively in September. According to the US Labor Department, US Nonfarm Payrolls dropped significantly from the previous 179K to 114K, far below market expectations of 176K. Additionally, the US Unemployment Rate increased sharply to 4.30%, worse than the market expectations of 4.10%. Market participants are now pricing in a 71% probability that the Fed will cut rates by 50 basis points in September, up from 31% before the data was released, according to the CME FedWatch Tool.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 32, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.05, 106.05

Support level: 102.70, 100.90

XAU/USD, H4

Gold prices tumbled after hitting a two-week high as market participants took profits and prepared for significant movement in an eventful and volatile week. After the downbeat US jobs report was released, gold prices initially rebounded sharply due to expectations that the Fed might consider cutting interest rates and the subsequent depreciation of the Greenback. However, global market volatilities rose significantly, causing several crucial asset classes, including cryptocurrencies, stocks, and oil, to tumble. This led some institutional investors to sell off gold to raise cash and prevent aggressive margin calls from banks.

Gold prices are consolidating in a range while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the commodity might enter overbought territory.

Resistance level: 2450.00, 2485.00

Support level: 2420.00, 2380.00

GBP/USD,H4

Pound Sterling has weakened following the first Bank of England (BoE) rate cut in the post-pandemic period. However, the U.S. dollar has also faced pressure, submerging after last Friday's Non-Farm Payroll (NFP) reading, which came in significantly lower than market expectations. This has heightened the likelihood of a September rate cut by the Federal Reserve, leading to significant selling pressure on the dollar, which is now trailing towards the $103 mark.

GBP/USD has recorded a technical rebound from its one-month low but remains trading on its downtrend trajectory. The RSI remains below the 50 level, while the MACD has a bullish cross below the zero line, suggesting the bearish momentum is easing.

Resistance level: 1.2855, 1.2940

Support level: 1.2760, 1.2705

EUR/USD,H4

The EUR/USD surged sharply by more than 1% in the last session as the euro capitalised on the softened U.S. dollar, erasing all its previous losses. The soft NFP reading released last Friday, in contrast with the upbeat eurozone CPI reading suggesting persistent inflation in the region, has pushed the pair to trade at recent high levels.

The EUR/USD pair showed a strong trend reversal signal and rebounded sharply from its recent low level to its recent high level. The RSI is breaking into the overbought zone, while the MACD has broken above the zero line and is diverging, suggesting strong bullish momentum.

Resistance level: 1.0940, 1.0985

Support level: 1.0895, 1.0850

USD/JPY, H4

The USD/JPY pair has traded to its lowest level in 2024, erasing all its gains for the entire year. The potential narrowing of the interest rate gap between the two currencies has led to the sharp decline of the pair. The Japanese yen strengthened following a 15 bps rate hike last week, and the market is anticipating another 25 bps rate hike by the end of this year. In contrast, the dollar was hammered down by the soft NFP reading released last Friday, suggesting the Fed is close to having its first rate cut in the post-pandemic era.

The pair is currently trading with extreme bearish momentum and is about to break its lowest level in 2024. The RSI has gotten into the oversold zone, while the MACD is edging lower at below the zero line, suggesting that the bearish momentum remains strong.

Resistance level: 146.80, 148.65

Support level: 143.20, 141.35

BTC/USD, H4

BTC has dropped below its downtrend channel, suggesting a bearish signal for the cryptocurrency. Macroeconomic uncertainty over the deteriorating economic outlook, as well as geopolitical uncertainty arising from heightened Middle East tensions, have affected risk appetite in the crypto market. This has led to massive selling pressure on BTC.

The BTC is currently trading on its strong bearish trend, having dropped below its downtrend channel. The RSI has gotten into the oversold zone, while the MACD is edging lower and diverging, suggesting that the bearish momentum is gaining.

Resistance level: 57060.00, 61250.00

Support level: 52530.00, 48000.00

NASDAQ (US100), H4

The US equity market tumbled as persistent concerns over an economic slowdown and extended profit-taking in technology stocks weighed on sentiment. A string of weak readings on business activity and the labor market ramped up concerns that the Federal Reserve's high interest rates had overstayed their welcome, diminishing hopes for a soft landing for the economy. Selling pressure remained largely focused on technology stocks, with the NASDAQ Composite falling 2.4%, the S&P 500 down by 1.8%, and the Dow Jones Industrial Average falling 1.5%.

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 34, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 18975.00, 20015.00

Support level: 18215.00, 17115.00

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

IC Markets Global

ATFX

Tickmill

VT Markets

Vantage

STARTRADER

IC Markets Global

ATFX

Tickmill

VT Markets

Vantage

STARTRADER

WikiFX Trader

IC Markets Global

ATFX

Tickmill

VT Markets

Vantage

STARTRADER

IC Markets Global

ATFX

Tickmill

VT Markets

Vantage

STARTRADER

Rate Calc